Looking for deals in Los Angeles: Real estate sales slogging along while marginal areas take a hit. Deals in Watts for $100k if you don’t mind 669 square feet of living space.

According to some, every single piece of livable space in Los Angeles is gentrifying at a glorious pace. Crap shacks are now mansions in their Kool-Aid colored glasses. Many try to disguise their deeply speculative ways as being conservative but in reality, they might as well be speculating in oil futures. Some feel that they missed out and shed tears but this only makes sense if you bought, and then actually sold the place. Unless you sell, that equity is locked in. Of course we have tons of Friskies eating boomers who just can’t cash in their housing lottery ticket and instead are house rich and cash poor because they would rather die in L.A. living like a pauper versus going elsewhere and leveraging their winnings. If you truly were buying to stay put for 30 years then what does one or two years of price fluctuations matter? Unfortunately in SoCal we have financial amnesia and people actually forgot what happened in 2007 through 2010. Many buyers are property ladder wannabe climbers so they want to use their first home as a “starter†home before ending up in their dream mansion. Since every area is perfection, let us look at some deals in Los Angeles. According to some folks these are the important metrics: be in L.A., be close to “actionâ€, make sure the sun is shining on you, and remember that every area is gentrifying. So today we’ll take a trip to Watts.

Great deals for you

There are some crap shacks that are priced at $700,000 and then there are places that realize what they should be selling for. Incredibly, these are homes that are competing within the same timeframe and only miles apart.

Today we take a trip to Watts where you can actually buy a place in the $100k range. Say what? That is impossible! In fact, these homes are only 18 minutes away from Downtown assuming no traffic (which realistically is never or at 2am). So according to the logic of some, these places should be selling for close to a million dollars. Fortunately for you, these are priced to move with a ton of L.A. love:

10725 Kalmia St, Los Angeles, CA 90059

1 bed, 1 bath, 669 square feet

I love this place. In many ways, this place is indistinguishable from other crap shacks. The big difference is that the current listing price is $155,650. I love the ad because it pretty much rattles off every SoCal housing cliché you can think of:

“**HUD HOME IN LOS ANGELES 90059** This is the property you have been waiting for at a price worth waiting for! Centrally located in one of LA?s most sought after zip codes, this expanded home is ready for the creative and handy homeowner. Features include an expanded bedroom a remodeled kitchen & bath room and a cozy living room and dining room. Gleaming tile throughout! Super low maintenance concrete side and backyard and a finished out single detached garage. Enjoy all the neighborhood has to offer. Very close to public transportation shopping and entertainment centers! This property is available to owner occupants for 15 days! Buy now and beat the investors!â€

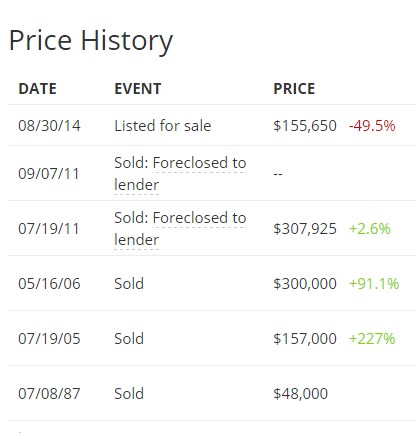

Centrally located? Most sought after zip code? Ready for the creative and handy homeowner? Super low maintenance? Well of course! This place is 669 square feet. A wet napkin should be enough to clean this place. You have one bedroom after all. This place is priced to move however. Oh, and this is selling for 50 percent off from the last sale:

All the reasons for crap shacks being expensive apply here as well but somehow, this lower price will be justified away. It is also ironic that those justifying current prices are not putting their money down on those crap shacks. They are merely hoping other lemmings keep the gig going for many more years.

Let us look at our next home:

1954 E 112th St, Los Angeles, CA 90059

2 beds, 2 baths, 665 square feet

The ad on this place gets down to the point:

“perfect family for a first time home buyer, cheaper than paying rent. this a great opportunity at a very affordable price.â€

Who has time to capitalize letters when you have a screaming deal! Although I’m not too sure if we are buying a family or a home here? Cheaper than paying rent. In this case, that actually might be true. This place is priced at $193,500. It sold for $165,000 in 2004 and $65,000 back in 1999. Go for it and make this place your home.

Both of these places have: central location to Los Angeles, near all awesome restaurants, activities, museums, freeways, beaches, and you get the great weather as well. You’ll be paying under $1k per month on PITI with a 20 percent down payment here. What is not to like?

Those whining about not being able to buy now have their chance to plunk down some cash here and not a lot either. Obviously there is more to buying a home then simply locking up a place in L.A. County. What people don’t want to admit however is that thanks to current housing policies, we’ve all turned into a bunch of mega speculators and real estate in SoCal is incredibly speculative.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

99 Responses to “Looking for deals in Los Angeles: Real estate sales slogging along while marginal areas take a hit. Deals in Watts for $100k if you don’t mind 669 square feet of living space.”

Now this is just depressing. If you buy one of these places, you’d better get an M-1 Garand and 1000 rounds of 30-06 Garand ammo (it’s still available). Put a lot of sandbags in the windows and maybe a foxhole in the front yard.

Freeway close to the action Downtown! Oh, and if you’re not of the underrepresented minority groups, you probably don’t want to make yourself known to the locals. Just buy the place as an “investment”.

I wouldn’t want to live there either, but I wonder what you could rent that house for. This could be a good a good cash flow money machine.

I live and invest in Oxnard, AKA Gangland-by-the-Sea, and if this was in my hood, I would swing by and kick the tires.

Three important things that I have learned about houses like this;

1 Pay cash

2 Hire a Property Manager to collect rents and screen tenants (very important)

3 Do as much maintenance and rehab on these houses as you can yourself, labor is expensive.

Not even close–these POS homes won’t rent for anything. You can get a nice two bedroom apartment in Alhambra/SG Valley for $1200-1400. Which is about a 2000% better location in terms of everything.

What is the PITI on this $150,000 crap shack? All your profit (if any) goes out the door with the property manager. And it will NEVER be worth anything because it’s a postage stamp size house and lot.

This is the definition of insanity.

Live in Watts instead of Alhambra? Are you kidding me?!

The problem with rentals in those areas are the tenants. Screening ghetto tenants is an art and I wouldn’t trust a property manager to do that. And then there’s the collecting rent part. On a rental in a halfway decent area, you could just rely on electronic collection methods, but with this thing, you might be forced to accept a cash payer, so then you’re having to drive to the ghetto every month. Then again, you’d want to keep a close eye on the place, so in-person rent collection is probably a good idea. That’s also another reason I don’t want a property manager involved, they’ll never do as good a job as I will.

Also, if I’m doing maintenance and repairs myself, WTF do I want a property manager in the mix skimming off the top? I’m already there and dealing with the tenant at that point.

Being a slumlord doesn’t sound very appealing to anyone who highly values their time and sanity.

@zzy, M1 Garand?! House #1 has barbed wire at the top of the fence. This is a beautiful selling point for people who like to say that all of SoCal is prime real estate (Dfresh, Lord Blankfein, et al), and will soon be gentrified.

Having barbed wire at the top of an 8 foot high chain link fence makes one feel special. This is an amenity that should make those with 2 feet high wood picket fences feel jealous and envious about.

E-blo, put down the pipe buddy. Nobody is confusing Watts with anything remotely close to prime RE in socal. There are many better bets if you want to play the gentrification game, Watts is not on the hipster radar just yet. 🙂

Read what Falconator wrote below. Investing in housing is a long term deal. Nobody is going to get rich quick. Having a steady stream of income from free and clear investment properties is a great way to diversify your portfolio. I won’t even bother responding if anybody claims otherwise.

You might like the neighborhood where those two houses are located if you had recently moved up from the worst barrios of Tijuana and were used to gang violence.

If you buy either of these places make sure you save enough money after closing for a firearm.

@Hunan, No firearm needed. The first house has two metal fences, and barbed wire. All of SoCal is prime world class real estate according to some. Add a couple of pit bulls in the yard, and string some razor wire in the yard and you are looking at a house that will attract world class money.

some people don’t care where they live. I know quite a few white people who live in the hood, just because they want to be here, live close to the water, and the job centers. you think I’m kidding, but I know people who would rather live underneath a free way out here then have a house anywhere else. California is that cool

You’re beyond obnoxious. Say something relevant to the post at least.

Wouldn’t touch these areas of California for anything. I’d sooner move across the country than buy these places. Literally…I’d uproot my family, switch careers…whatever. Those homes being in California literally is meaningless.

Is that you What?

I think it’s guy from Seattle

Nope…

Apartment glut may tame rising rents:

http://www.marketwatch.com/story/apartment-glut-may-tame-rising-rents-2015-01-06

“With a veritable deluge of new supply set to come online over the next few years, vacancy is headed higher. The supply pipeline swells larger and larger on a weekly basis and presents the greatest risk to the apartment market’s health,â€

I grew up near these houses in the 80-90s, and I can tell you that the area has definitely improved since then, but it still has a long way to go before I consider buying a home there. I predict that one day soon the housing projects will be torn down and houses will be built on that land because others are willing to pay money for the central location and good weather.

Between the looser lending standards, and the down-tick in rates, 2015 is going to be a bullish year for housing whether you like it or not

http://www.marketwatch.com/story/30-year-fixed-rate-mortgage-falls-to-lowest-level-since-may-2013-2015-01-08

Not unless prices come down it won’t.

How did they squeeze 2 beds, 2 baths into 665 square feet?

That place is smaller than my 1 bed, 1 bath condo.

The square footage is listings is often from county assessor records and does not account for additions, especially illegal ones done without permits…that might be the case here.

There are many 2 bedroom apartments in SoCal that are 675 square feet and smaller. I saw a number of them in Culver City on Jefferson, Washington and Culver. So 675 sq ft for a 2 bedroom house is not out of the question, particular for housing built during the double recessions after WW2 (1945 and 1949).

Two bedrooms AND two baths in 675 square feet?

@son of a landlord, the first home I bought was a 2 bedroom 1 bathroom 650 square foot crap shack in the city of Paramount in the early 1990s. The washer and dryer was in a toolshed in the backyard and there was sink in the toolshed. If I had added a shower and a toilet to the toolshed then voila! 2 bedroom 2 bathroom 650 square foot Paramount crap shack.

The Gateway Cities of L.A. (i.e. area from DTLA, along the 110/710 freeways down to the port of Long Beach), has many of these sub-800 square foot “doll houses” that were built during the recessions of 1945 and 1949.

However, since I enjoy life and living, and don’t desire to wear Kevlar and body armor, I have long since left the Gateway Cities region.

Two 10×10 bedrooms (minimum size to be legal bedrooms) have 200 sf. You have to fit the rest in 400 sf. My garage is double than that house.

we’ve been looking to a house, with a pool, in the West Hollywood / Mid-Wilshire / EVEN the Valley! -and there’s nothing out there! Unless we want to pay 1.2mil for a shack!

THIS HAS TO STOP!

It’s EASY to stop this insanity–just don’t buy an overpriced crap shack. You’ll thank me for this sage advice way in the future.

People are so gullible and chumps–greed is SO predictable. Real whores run around saying ridiculous things and people believe them, even after these shills have been proven wrong a million times in the past.

Real estate values are falling world wide and with every sign that a hard crash has already started, people here seem to be holding out hope just like the Titanic passengers who were ordering dinner as the stern of the ship was rising up.

Just ask yourself a simple question–how much is your 1.2 MILLION dollar crap shack going to have to sell for in the future when you decide to dump it because of (1) retirement (2) you want to move up (3) you have to sell because you’re moving/lost job/whatever?

And who is going to buy it? According to some delusional folks, UCLA grads will be making $250,000/yr. Yeah right….

How quickly everyone forgot the last crash.

The zestimate forecast is -0.2% on my parents house so I agree we’ve hit a top on non-prime areas. Crash or plateau is anyone’s guess

What is mortgage demand like? It’s slipped to 2008 crisis lows in the UK, in spite of falling mortgage rates. I will continue to wait the housing market out.

_____

James Montier remains skeptical. The value investor and member of the asset allocation team at Boston-based asset manager GMO: «To think that central banks will always be there to bail out equity investors is incredibly dangerous» , says the outspoken Brit. His source of wisdom in current markets comes from none other than Winnie the Pooh: «Never underestimate the value of doing nothing.»

The house will be a millstone around your neck. All those numbers and spreadsheets showing residential single family homes will be static in the background. You will hate the house and the power it has over your shitty life.

Markar …The problem Markar what is the price point for folks to get excited again. Maybe a 650k house comes down to 500k fine but most still can’t afford 500k. So does it have to be 50% off 3235k, do you really think that is going to happen?

Yes many overpaid but it appears most can afford to wait it out so a major decrease not likely.

Whether I believe 50% off will happen or not isn’t the point. 3% FHA loans are not going to goose this market at these insane valuations. WolfStreet did an interesting story recently that RE is rolling over not because of lack of supply, but because of lack of perceived value.

I read that Wolf Richter piece myself, syndicated at Stockman’s website, and at Richter’s own website. WR is a San Fran native as I remember it. Volume dropping into higher prices, as more buyers say NO to these prices.

____

December 18, 2014. [..]The peak of the prior housing bubble in San Francisco occurred in November 2007, based on the same DataQuick series, with a median price of $814,750. After it imploded so spectacularly, everyone acknowledged that it had been an out-of-whack bubble phenomenon. Everyone had anecdotes of craziness. Sanity would henceforth reign in San Francisco, they said. Now, exactly seven years later, the San Francisco median home costs 32% more than it did during that crazy bubble peak.

Only this time, it’s neither a bubble nor a peak. It’s just an insufficiently recovering housing market, according to Yellen. And so she’s surprised that, after six years of free money for certain folks, it hasn’t “recovered†even more.

What is wrong with being a “property ladder wannabe climber”?? I could barely afford my first condo but I rented out a room to a friend and saved that money and 5 years later I bought a townhouse and rented out 2 rooms and lived in the 3rd, while keeping the old condo. It wasn’t until my 3rd property that I actually lived alone before moving my wife-to-be in. Now I own my original 2 condos outright. It took awhile but it was worth it. I think there must be a lot of younger spoiled brats on this board who are not willing to sacrifice enough to get a foothold in real estate.

As for prices coming way down in the future, good luck waiting that one out. When I moved to San Diego there were 2.5 mil people in the County and about 950K housing units. Since that time we have added 700K to the resident population but only about 150K housing units. There has been nowhere near enough construction to satisfy the demand. On top of the additional 700K residents, non-resident ownership has definitely grown immensely over the past 20 years. Major resident and non-resident demand in San Diego.

The adage buy now or be priced out forever is just a bubble catch-phrase but there is some truth in there. If you did not buy in the early 2000s or during the dip in 2008-2011 then you will find yourself competing with owners with hundreds of thousands of dollars of equity when you are looking for a property. You can and will be outbid. And before long you will be competing not only with me but my kids, who will be the beneficiaries of my “property ladder wannabe” strategy when I provide them with a big chunk of money to get into properties.

Good luck to all lifetime renters, you are going to need it.

I have many college friends who bought a house in the late 80s and 90s and immediately rented out one or two of the bedrooms. Lifestyle wise it was no worse then their multiple roommate lifestyle of the college days. Like you said, over a span of time that was not unbearable they booted out their tenants and were full fledged homeowners (with the help of former renters). I wish I had done that at the time, but suffered from poverty-mentality, fearful of leveraging myself to any extent.

I own my house, you’re making a faulty assumption that the posters here that have an ounce of common sense are renters.

I’m glad that you’ve made out like a bandit as a RE tycoon. Making statements like yours on a blog featuring the biggest (or smallest) crap shacks in L.A. County make me think that you’re nothing but a RE shill.

The amount of helium holding this market up is astounding. This would be a bad joke on SNL except that it appears that some idiots are actually trying to sell these POS homes for real money.

The neighborhood WILL NEVER be desirable. IT’S WATTS as in the Watts Riot and the place has gone downhill since then and that was 50 years ago!

What a freakin joke….

California real estate is in a constant state of boom/bust cycles. What you said about buying now is the same thing my neighbors said in the late 70s. They were wrong then just like you are wrong now. This time it shot up like a bullet and it is going to drop the same way. Then it will go up again a few years later and we will all be having the same discussion, again.

“What is wrong with being a “property ladder wannabe climberâ€??”

What’s wrong with it is that it sets up an environment which requires new entrants to the market willing to pay higher prices on a real basis in order to sustain it. You collected rents from the real productive assets of others based on a land deed and that’s supposed to be admirable? I collect rents thanks to my position within the system but I’m not looking a gift horse in the mouth.

“I think there must be a lot of younger spoiled brats on this board who are not willing to sacrifice enough to get a foothold in real estate.”

You’re basically saying that others should accept the current status quo because of what worked for you in your particular circumstances some number of years ago. It’s not about “sacrifice” as that is a scarecrow you’re putting up, it’s about not getting screwed by a situation which through the actions of folks such as yourself has led us to this point.

“The adage buy now or be priced out forever is just a bubble catch-phrase but there is some truth in there. If you did not buy in the early 2000s or during the dip in 2008-2011 then you will find yourself competing with owners with hundreds of thousands of dollars of equity when you are looking for a property. You can and will be outbid. And before long you will be competing not only with me but my kids, who will be the beneficiaries of my “property ladder wannabe†strategy when I provide them with a big chunk of money to get into properties.”

I don’t believe you. Someone who is confident enough about that statement would be confident enough to not even bother commenting on a housing skeptic blog, much less even seek it out for reading. But at least your willing to admit to espousing buy now or be priced out forever mantra.

“when I provide them with a big chunk of money to get into properties.”

So the message here is “Be rich like me”.

Idea of competing with rich people for artificially scare/expensive resources while pumping the value of said resource up is somewhat stupid, why would anyone do that?

Not only hurting themselves but their neighbours too while doing it.

If no-one buys your property is more or less worthless: You can live in it but that’s that.

Non-liquid property isn’t really property, it’s an investment and a house doesn’t provide much returns for said investment.

The first shack has dual fencing to keep the neighbors out. That type of security is priceless.. Put me on the waiting list.

“Unfortunately in SoCal we have financial amnesia…”

Which is good for you, Doc. It’s kinda like job security for you and this blog.

If the down payment rule change is the bulls last best hope, they will be extremely disappointed in 2015. You can already get 5% down loans with reasonable credir and the PMI is not horrible. Lowering that 1.5% and extending to risky borrowers sounds bullish until you look at the facts on the ground. Lower income people are shacking up roommates and/or multi-gen to spread the cost and rent larger homes. Those same homes asking prices put the monthly nut far ahead of the rent. Not to mention needing to show 5 peoples incomes to get the mortgage!

Mortgage guidelines and rates are an albatross. They cannot mask the fact that affordability is in the toilet and Housing Bubble 2.0 has run out of greater fools. Sales volume is the most prevalent indicator to market health and it is at mulch-decade lows. All while our economy is supposedly on the rebound. Math is going to be quite cruel to the specuvestors and REITs over the next 2 years.

Beware the ides of April and the FED rate rise…

What are the ides of April?

April 15th, I guess.

I highly doubt the Fed will raise rates, they are painted into a corner. They can not service the debt at higher rates. If rates go up at all, they will soon drop back forever.

DO NOT fight the Fed or Gov. They have proven, as security to social fabric, they are and will be the economy. If they have to, they will buy everyone’s home at a high market value just to hold it up.

Now you “highly doubt” what you were before so confidently claiming would absolutely not ever happen.

I’m inclined to agree with people like Kyle Bass when he states that the Fed is not going to raise rates, except maybe a ceremonial 25 or 50 basis points. Raising rates risks contracting the money supply. As Flyover has noted in response to my last comment, every dollar in the economy is created through borrowing/debt. Since we need to pay interest on those debts, the money supply must keep growing to make the payments possible. The two recent crashes in the US (dot com and housing) were preceded by a rise in interest rates, and thus a reduction in money supply growth. There are those like John Hussman who like to say QE does not prevent crashes and points to the aggressive easing by the Fed following the dot com bubble and the housing bubble. What he doesn’t say or say clearly enough is that before the Fed started easing, they were tightening. Those who have been looking for an imminent crash over the last 5 years now like to use the excuse that no one can say when the bubble finally pops. I think it’s a good bet that it will finally pop when the Fed decides to tighten. It’s not a sure thing because if the Fed never tightens and everyone believes that they will never tighten, then eventually all that will be priced into the market. Betting on further increases in market value in any asset class is therefore never a sure thing (except maybe in nominal terms in a hyperinflationary scenario).

I’m betting that the Fed will raise rates by no more than 50bps, if at all, before they are forced to start easing again to rescue us all from the next crash. I know people who earn good money who have no debts and no mortgages. If I could talk sense into them, I’d tell them to buy 4 investment properties each, when the 30 year mortgage interest rates goes below 2.5%, as long as the rent payments are enough to cover mortgage payments. (Forget first-time homebuyers, they are not needed anymore.) I do believe that over the next 10-30 years, houses will become worth much much less, as robots begin to extract commodities and build structures for less and less. The only smart way to invest in housing will be to have someone else pay for it.

Good info on the debt. Right now money velocity is falling as people have been deleveraging. That has meant a huge spike in money supply by the Central Banks. Like the U.S. Feds injection of $4 trillion dollars. BTW….that is how much the total value of housing feel from 2007 to 2011. Hmmmm.

Here is another thought though. All central banks want inflation. Deflation can wreck a debt driven economy…..which is 80% of all countries. Bad for lendors and with debt but good for saves. So if CBs can keep inducing inflation now matter how small then the price of almost all hard assets should go up at least the rate of inflation. Technology for some things can counter that trend in the building of the house but the land and raw material should rise with inflation?

If a company in 1900 made a widgets at a cost per widget of .90 cents. They always sell the widgets for 10 percents overcoat (material and labor). That means if they sell 100 widgets a year their profit is $10 dollars. The company is listed on the stock market and has a float of 100 shares. Thus they have EPS of 10 cents. They pay a 10% divy. The stock sells for $1 per share and the company has a market cap of $100 and a PE of 10.

Income Statement:

Sales = $100

Expenses = $90

Income = $10

EPS = .10

Dividend = .01 cent

So with that .01 cent dividend the stockholder can go buy one piece of bubble gum.

Fast forward to the year 2000. Inflation has increased at 2.33% a year. Roughly what the FED wants. The company still only makes 100 widgets a year. But now raw material and labor cost have been inflated at the 2.33% a year and the cost to produce a widget is now 9 dollars per unit. The company still sells the widget for a 10 percent profit that is equal to $1. At the end of the day this company still makes and sells 100 widgets for a 10% profit but what has changed is inflation.

In 2000

Income Statement:

Sales = 1000

Expenses = 900

Income = $100

EPS = $1

Dividend = .10 cents

So lets say the stock still sells at a PE of 10. That means the stock price is 10. The market cap is now 1000.

This company can claim it has grown sales by 900%, EPS by 900%, an the dividend by 900% but they have never increased production or lowered cost via technology. From a quick glance the company’s looks more valuable and has tremendous growth. It looks as if the stock holders are richer and the company is more valuable but in reality all the gains were equal to inflation. The stock holder can take his .10 dividend and can only buy 1 piece of bubble gum.

But at the end of the day it was only inflation that led to increases in the perceived value of this company. The company owners and the stockholders are not any richer as they value of the company increased at the same rate of inflation. But they are much better off than holding cash lost its value. $1 dollar in 1990 would buy 100 pieces of bubble gum. Now it only buys 10.

So I guess what i am getting at is that in a long term inflationary environment is housing a good or bad idea. It may be a great inflation hedge. For a homeowner…maybe. For a landlord….yes. Why a landlord. They can deduct and write of maintenance cost, property taxes, and insurance of an inflation price adjusted asset. For a home owner maintenance cost is something you hope is less than the appreciation of your house.

Just thinking out loud. I may not be right.

The saddest part of all is that many Living the Dream, Surf N Ski, luxury car driving, latest electronic gadget wielding, designer handbag carrying Cali Special People probably couldn’t qualify to buy these Watts houses with their low credit scores and real life incomes.

Of course, Mother and Daddy could helicopter in with a suitcase of cash. Carry on, people.

The advertisement for the Watts property is intended for foreign buyers, such as the Chinese, people who are not familiar with Los Angeles. It is like what people use to do in buying a ranch in some God forsaken part of America. They would even throw in a cow. People would buy property without even visiting the place(e.g. Florida beach front property). Same goes for this lovely piece of vintage, and so authentic Watts property, with a Blood or a Crip thrown in for genuine authenticity, or may be a low rider as the neighborhood changes. Whatever it takes to sell the property.

I will believe a rate hike when I see it.

Obviously the seller is cashing out to buy 4 houses in comparable Detroit… live in one, rent the others out.

“In fact, these homes are only 18 minutes away from Downtown assuming no traffic (which realistically is never or at 2am).”

I like this statement. It sounds as if Realist wrote it (“realistically”). With “good planning” and the right applications (tools) you can actually get there in 18 minutes and 3 seconds. The culture, weather and entertainment are just the bonus. The realtor forgot about those.

While “Friskies eating boomers” seems to have replaced hipsters as the target du jour around here I’m afraid that it represents our ill wishes for those more fortunate than us more than it does reality. Most boomers I know in the Southland actually have a decent nest egg in addition to home equity and an embarrassingly low Prop 13 provided tax bill. No Friskies there – just a good life based on prudent choices made over the long haul. I know this will be unpopular here, but that’s the reality I see.

Sure we would all love for everyone who has a nicer house than we do in SoCal to proven to be idiots in the long run. Then we could finally all be rich geniuses rather than simply those who bet on the wrong side in the local real estate game.

“No Friskies there – just a good life based on prudent choices made over the long haul. I know this will be unpopular here, but that’s the reality I see.”

Being born at a certain time and becoming of age during a certain period has nothing to do with prudence.

“Sure we would all love for everyone who has a nicer house than we do in SoCal to proven to be idiots in the long run. Then we could finally all be rich geniuses rather than simply those who bet on the wrong side in the local real estate game.”

It’s not about anyone being proven an idiot. It’s about what’s sustainable.

Nonsense…for example many who came of age during the Great Depression were profoundly affected by the experience and became frugal and financially conservative as adults as a result. Children growing up now and maybe witnessing a foreclosure, joblessness, and downward mobility in their family will very likely be strongly affected by that too (and yes plenty of adults bring these things upon themselves but the shrinking of the middle class and the decline in real income for middle/working class people is very real)

http://en.wikipedia.org/wiki/Middle-class_squeeze

“Being born at a certain time and becoming of age during a certain period has nothing to do with prudence.”

False. There are three factors which dictate what kind of person you shall be: One is you, your mind and body, one is the parents, family and education you have and third part is the society you live in.

It’s painfully obvious that parents, education and society are tightly tied to a certain time (or era) and that means that 2/3 of “you” is tied to that time, no matter what: “you” are not asked and mostly you were too young to change anything anyway.

Very, very visible today when the “ME!”-generation is in power, stealing anything they can, a quarter of an year at the time.

Absolute greedyness that didn’t exist a generation earlier and is abhorred only a generation later: “WTF these thieves are doing to this country?”

It’s perfect sense and the furthest thing from nonsense. Timing counts and if you’re not around to take advantage of the timing, you don’t get to take advantage. Drop the generational warfare garbage already.

Well said. I don’t understand the animosity toward those who put their money at risk and bought a place rather than rented. Perhaps they actually like the house they have. They’re certainly not “squatting” just to keep someone else out and refusing to leave. They worked hard for a long time to be able to pay for what everyone now calls a “crapshack”.

Many boomers lost their jobs and houses during the crash during their peak earning years. That should give the resentful some satisfaction, right?

The generational resentment I’ve seen here isn’t productive.

Nor are the unrealistic expectations people have when buying a first house. “Desirable areas”? If one can’t afford to buy there, you rent. No one did anything to you.

If you’re like those ninnies on “House Hunters” and won’t consider anything less than 5000 square feet with all the HGTV cliches like granite and stainless steel acceptable, then your choices will be limited. God forbid there’s only one bathroom. That’s like having an outhouse in the backyard.

Massive college and credit card debt? Who did that to you ? None of us on this site. Still living at home at 35? A result of your priorities, no one else’s.

People make choices. There’s nothing wrong with renting. And if someone is able to buy, ask them how they did it instead of heaping scorn on them. If you don’t find value for the money you’d pay to buy, then rent. That would be a sensible reaction.

Every generation has it’s own challenges and life events to deal with. Resenting those that came before or after you is simply a toxic way to go through life.

“The generational resentment I’ve seen here isn’t productive. ”

Says the generation who got it all, typically. They always have these nice weasel words for covering up the thievery.

Obviously it not productive when thievery victims whine about thieves: No-one earns money for it, therefore, not productive. How could it be, tell us?

Why something like that is measured by dollars anyway? Only a ultra-greedy person would do so.

Also it’s quite obvious that the people who already got what they wanted don’t want anyone to change anything, no matter what the cost is to other people. “Sharing” is something that doesn’t exist in their world: The ME!-generation: “I’ve legally taken this, this is mine to the grave” is the motto.

I’m quite sure no-one in my generation would care about “being productive” when the money transfer from young people to old people is painfully obvious, leaving only bones to young ones, not matter how “productive” they are.

“Every generation has it’s own challenges and life events to deal with.”

Except some generations have more than some others. And very few generations have most of those problems caused directly by absolute greedyness of previous generation.

Like now: No major wars, high technology everywhere and yet ordinary worker is much worse off than in 1950s and 1960s.

Era, when people now in power, were kids. This not a coindicence.

It is all a personal choice. I chose to cash out and leave So. Cal. It seemed a better bet to take advantage of the sellers market, and have a nice bank account. I can live comfortably and still spend as much time as I want in Hawaii, or the Caribbean, without having to worry about the escalating maintenance of an aging house, the traffic, the next tax increase in spend happy California, etc.

> the next tax increase in spend happy California…

I’ve lived in Ventura County for over 25 years. The max state income tax was 9.3% when I moved here and remains that unless you make more than $254K/yr. The sales tax was 7.25% and is now 7.5%. Property tax is 1.26% just like it was back then (though the gift of Prop 13 to longtime residents becomes ever more significant over time).

Anyway, “spend happy California” like “Governor Moonbeam” is one of those ideas that have just taken hold, but where the reality is much less extreme than the epithet.

Today we take a trip to Watts where you can actually buy a place in the $100k range. Say what? That is impossible! In fact, these homes are only 18 minutes away from Downtown assuming no traffic (which realistically is never or at 2am).

_____

I have had a good look around the areas of each house on Streetview. Without wanting to offend anyone, I think I am too soft, too rangey and handsome, to live in such areas, and such houses. Would prefer to rent and wait for better value in low-mid-high prime.

I should not use the peak year prices as any real guide to current values (one of them, according to Doc’s entry, sold at $300,000 in 2006 yikes) so maybe they could be value for some tougher private buyer as a home.

A look on streetview (car directions)…

16.4 miles from shack 1 to the Lucerne Ave shack in Culver City

15.7 miles from shack 2 to the Lucerne Ave shack in Culver City

I have been to this neighborhood, even considered buying property there. Instead I bought in a not so great, but what I thought was better part of LA. I learned my lesson though. Before investing again in a questionable part of LA I would rather look into buying in Baghdad, Detroit, or maybe Ferguson. It wasn’t about the money (I did well with the property) but I don’t think it was worth the endless headaches and drama that comes along with owning in these neighborhoods. There is a blight in these parts of LA that is inescapable. Even if you build a moat around your property and install guard towers, the surrounding environment will creep in eventually.

Don’t forget that 20 years ago Venice was considered a blighted hood that was unwise to enter at any time without the aforementioned Garand.

The trick, of course, is figuring out which hood will become the next Venice.

It might be Oxnard but it’s definitely not Echo Park or Watts. Nevermind the magical 20 minute commute.

Great article doc

Check out what the fools are saying…more interesting than the article itself is the other commenters cynical responses. Can’t say I disagree with being skeptical…

http://www.fool.com/how-to-invest/personal-finance/credit/2015/01/10/this-could-be-the-biggest-mortgage-mistake-of-your.aspx

Just like old times, Doc.

From your archives in 2007:

http://www.doctorhousingbubble.com/real-homes-of-genius-675-square-foot-home-in-lynwood-california-at-425000/

$100K just for living in a Lynwood dream home a year? How about $100K just for living in one for six months:

https://www.redfin.com/CA/Lynwood/3606-Agnes-Ave-90262/home/7359240#property-history

You have to pay to play, and live in L.A.

That’s how it is in the weather and entertainment capital of the world.

Maybe if you live in Malibu, Santa Monica, West Hollywood, etc., but you’re kidding yourself if you think that places like the IE, Watts or most of the Valley qualify for either of those credentials. It’s like spending all of your money to eat at a lunch table near the popular kids’ table. You’re not really eating with them, and they don’t notice you, so no reason to pretend.

Hubris.

The people I know, are well aware their living standards can be “improved” in certain fields or two if they move. Larger house, shorter commute, etc. But it’s pick-n-choose, and what you gain in one you lose too much in another.

There are over 100 uniquely areas in SoCal, from The Grove to South Coast Plaza to Downtown Redlands. Catch my drift?

There is NO WHERE else in America that you will have access to what you do here, in one place. This is the land of the big dogs and this board is the land of the haters. I dare you to talk like this on the street, there are people who die for streets in this town, why do you think your malarkey holds any weight? Donald Trump owns part of SoCal. Chinese flock here for greener pastures. The proof is in the pudding, not your hater-ade. Deny it to yourselves all you want but it all boils down to YOU CANT HANG

My wife grew up in LA, and I lived there for 15 years. Plus, our entire family on both sides lives in LA. This isn’t about being a hater. It’s about getting out of a mental bubble, and your vibe is exactly the reason that we’re glad we left last month. I’d rather live in the Northwest if it was the same price. The fact that it’s a little cheaper is icing on the cake.

We just flew in to LA today, because we’re going to have to unfortunately come back quite a bit because of business and family, and, after being in Portland for a month, it’s amazing just how bad LA looks to us, now. You’d have to buy me a house right on the water in LA to convince me to move back.

It’s obvious that The Realist has never left LA, if he had he would know that when you compare LA to parts of San Diego county, the Bay area, and Northern Cali, LA starts to look like a 3rd world country.

I have lived in LA for over 20 years, and have seen it go straight down the toilet over that time.

Home listed two days ago 2,558ft, small lot , 2000 year built, at 955k, AVG PRICE THIS NEIGHBORHOO 715K. I call agent to find out the skinny, she floors me, says it sold first day, she says I can’t tell you the price but very near asking and for cash!

Well folks , this tells me many buyers still do no homework, do you remember I told you about a beautiful 4,000ft custom home 2011 built that never sold yet, now reduced to 950k, this house is 1.5 miles from it.

What are buyers doing and thinking, no wonder the old saying beauty is in the eyes of the beholder, no beauty at all in this house but it sold?

I have a question that I would like to pose to you folks out there, as you seem very educated on these matters.

The wife and I live near Palm Desert and are seeking to purchase our first home. If a home has been sitting on the market for over 30 days, what is a fair value.

The house I like, in particular, has been on the market for 100 days.

Is there a guideline to go by? Like offer -10% if sitting for over 30 days; -11% if sitting for over 60 days; -12% if sitting for over 90 days?

See, when I talk to RE agents, they don’t want to low ball and I want a deal. There adamant that the wife and I can afford xx payment, so I don’t need to low ball…but I want a deal. I don’t want the market to plunge and then I’m sitting there like an idiot because my agent told me to, lol.

I’m a RSO and my wife is employed with a local school district, so we aren’t nearly as educated as you folks out there.

For instance, I like this home (below); what would you offer?

https://www.redfin.com/CA/Indio/82372-Padova-Dr-92203/home/12503660

if it has been sitting for a long time, either —

the house is way overpriced

or the sellers aren’t ‘motivated’ to sell

imo throw out a low offer – you’re going to get more information which is always helpful in a negotitation

being ‘respectful’ doesn’t earn you any more or less ‘respect’ from the seller or the real estate agent(s) involved – once you finish this transaction, you may never hear from him/her/them again

it’s your hard earned $

Cheap Cop, that Indio house you have spotted looks like a very attractive, well-kept little home, especially for the money. The house looks great and the pool is beautiful. You couldn’t do nearly so well here in Chicago.

However, I don’t know the area at all, and doing a little research on the place, I discover that it is in Riverside, in an area classified as “desert”. I’m a little confused, as I thought that Riverside had reasonable access to water. Is water a problem there right now, and is it extremely expensive?

What do the rest of you think of this house, and the area it is in?

Indio is near Palm Desert, where I work. If you’re not familiar with Palm Desert, we’re also near Palm Springs. I guess Indio is about 25 minutes of Palm Springs.

This particular location is near some popular golf courses and shopping areas.

Laura,

Indio doesn’t have any water propblem. It has more water rights than the rest of SoCal. In terms of water it is the best positioned city.

It is in the desert – Coachella Valley. It doesn’t have too much employment; mainly retirees and welfare receipients. For that reason, the rents are very low. Given the low rents, if I have to live there, I would rent. The MeloRose (kind of a city bond for capital improvements which last for about 40 years) is very high. Add on top of that the HOA dues, property taxes and maintenance and it is a very good chance that you buy the house in cash and continue to pay rent like everybody else instead of investing those money. I looked at houses in that area in 2011 and they were around $100k. Given the money you spend monthly I could not justify the investment even at that low price – it would have been negative.

Otherwise, for those who like the desert heat, the newer parts of Indio, around golf course, are nice. The older parts are gang ridden. Indio spreads on a large area. It is about 15 minutes to Palm Springs.

Laura, you also couldn’t do nearly so well here in Los Angeles. It would be akin to comparing homes around Rockford or Kankakee to Chicago. Water is not the issue. It’s the jobs.

I’m sure that house was around 100k two years back. You already overpay.

Let’s assume you buy it in cash. Did you add the MeloRoose, the HOA dues, property taxes and maintenance? It is probably the same or more than the rent. The rents in Indio are not as much as San Francisco – they are low. Why would you want to sink $285k in a hole with no return and pay the rent on top of it???!!!…Just my 2c.

Want to talk reality? Why are The Hacienda Hotel, Sizzler, and Stick n Stein all empty for long periods on Sepulveda? And next door Boeing and Raytheon bleeding jobs (albeit for different reasons).

I consider L.A. a ‘key player’ economy, with everyone else trying to survive. kinda like a banana republic I guess.

At the same time there’s an $80 million dollar retail complex opening up a couple blocks away. It’s still 7 months away from being open but is almost already fully leased.

Forgot to mention.. Hacienda Hotel is still open albeit catering to tour groups and unsuspecting travelers.

The old Sizzler’s building will be torn down soon to put in a famous CA burger staple. Ironically it’s slow to get done because there are concerns the drive through will be TOO popular.

Reality? Hamburger Habit, Five Guys and Chipotle opened up on those blocks in the past 18 months, and the mega-rich-peoples’ mall just north of Rosecrans and Sepulveda opened up about a mile south of those locations. On Rosecrans between Sepulveda and Aviation, a bunch of higher-end restaurants (e.g., Romano’s Macaroni Grill and Lido) have opened up in the past few years, and Marvel Studios moved right into the middle of that stretch.

Stick and Stein’s days were numbered starting some time in the late 90s, possibly because surf and turf lunches and drinking your way through lunch is no longer popular. Aerospace manufacturing has moved out, but aerospace engineering (radar and satellites) are still there, and the entertainment industry (e.g., Marvel and the new mega-theater complex) has moved in to be closer to the airport and to the industry people living in the south bay. Also, the LA Kings’ practice rink moved into that area about ten years ago.

Thank you!

This isn’t the blue collar south bay of yesteryear, it’s getting gentrified at an alarming rate. As others have said, most of the new businesses that have opened in the past few years cater to the high end. Sizzler and Stick n’ Stein clearly don’t fit that role and their days were rightfully numbered. The Manhattan Village Mall is supposed to get a big time makeover and the Redondo waterfront powerplant will likely get removed in the near future and be replaced by a mega entertainment/shopping complex.

As was mentioned, the aerospace manufacturing jobs have been and will continue to disappear. The engineering is still here and from what I understand, all these companies are in massive hiring modes. I would not bet against south bay RE in the future.

i live in gardena but i play in torrance RB MB and El Segundo

Honestly, I don’t understand the appeal of Los Angeles. Traffic sucks, cost of living is extremely high, property values are outrageous, it’s dirty, crime ridden, full of illegals, and has the largest population of welfare recipients in the US. Unless one works in the entertainment industry, I don’t understand the appeal. There are much nicer places to live in California.

Take a look at Google Earth (the satellite image) of the westside, just north of San Vicente. Pacific Palisades and Brentwood. Or look at some of the homes in the hills. It’s the land of $10 million plus mansions. Huge estates with pools AND tennis courts.

The wealthy areas aren’t dirty and crime ridden. If you have real money, L.A. is one of the best places to live.

I didn’t get the impression that Hunan was coming from an uber wealthy person’s perspective. While arguably hyperbolic, Hunan’s raises valid points, and it’s a little more than obvious that responses that boil down to ‘but look at how the rich live’ don’t really help the average person looking to buy a house.

Oh put a sock in it! The truly wealthy have multiple homes in different places and they spend their time NOT just in dumpy old L.A. L.A. isn’t Vienna or the south of France.

If you’re so ignorant to think that L.A. culture compares with world class cities like Tokyo, Vienna or Monte Carlo, then you really need to get out more.

Besides, anyone who has the bucks to live like the wealthy isn’t reading this website! This site is for the 98%!!!!!

Who gives a flying @#%@ what people with $250,000,000 do with their money.

Agreed!!! Even the ultra-rich get stuck on the San Diego Freeway in traffic (only out-of towners call it the 405). Even if you have a helicopter you’ll get stuck in westside traffic on Friday rush hours.

And you’ll never be be able to avoid the homeless, the thugs and crap shack streets no matter how rich you are.

L.A. is a pathetic city when compared to cities with culture and history in Europe like Vienna where you can have coffee in REAL coffee houses, not the phony ones like we have in L.A.

EVERYTHING in L.A. is phony, it was a standard line of Johnny Carson. Every shopping mall is just like every other one–the same shops, trendy boutiques and bad parking. The Grove is just a prime example. Phony architecture and commercial marketing pretending to be “classy”. And in 20 years it will be out of fashion and dated.

Hint, the definition of culture is that it’s older than 20 years! People in L.A. don’t know what culture is–it could hit them in the face and they still wouldn’t recognize it.

The entire city is just one big sprawling suburb with trendy restaurants and malls, none of which are older than a few years. You have to drive on cogested streets and freeways to get everywhere and when you get there, it looks just like the place you just left.

We have two mediocre symphony orchestras that have even worse conductors and they play the same stuff over and over. And the tickets cost an arm and a leg. And don’t even mention opera!

Besides, the typical L.A. snob doesn’t know the difference between a Mozart and Mahler symphony and is equally as ignorant about food.

L.A. is, and has always been, a place where people came to get their cheap house and live in the endless suburb. The only “real” culture we have here consists of third-world-status Mexican stuff from south of the border or more recent imports from China or Asia.

Funny, if you go to a REAL Chinese restaurant in the S.G Valley that Chinese people frequent (you know, the places where then menu is in Chinese), you don’t find any white or trendy people there.

If you go up to PV, all they have up there is an empty mall. One of the most popular restaurants is a fast food Peruvian place. I actually like PV because it’s not pretentious–it’s like a time capsule (my brother lives up there). For most things you have to drive down to Torrance which is just fine.

So if you think that you’re buying into world class culture and environment when you buy your inflated crap shack house in Mar Vista, Santa Monica or Manhatten Beach, I hate to break the news to you that you’re really buying a 1950’s house that’s sold for between $12,000 and $20,000. It’s a stucco box in a plain middle class neighborhood and will never be anything else.

But you’ll be a poor SOB paying Chamgagne prices for Gallo five gallon jug wine.

Yet all this you mentioned…is more than you have.

zzy,… Monte Carlo? Culture??? It’s Vegas with a dress code. not much more. Get real.

And, L.A. Symphony is hardly a mediocre symphony and Dudamel a bad conductor – On the contrary, it’ one of the great orchestras, he is sought the world over.

What’s the level of your concert going? Hollywood bowl in the summer? Go to Disney Hall and you’ll hear not just the old war horses, but many new works – and in one of the most acoustically perfect halls in the world.

I have been in most major cities in the world and the U.S. L.A is far from perfect but it is also absolutely a great city and if you can’t find the culture as well as some of the best food anywhere — the problem is you.

Wait just a minute. All those 1950’s era crapshacks are over 20 years old. And there’s plenty of them, so there must be plenty of culture here. 🙂

The haters will continue to hate!

eden, in your world the “L.A. Symphony Orchestra” is one of the great orchestras just like it existed in “High Anxiety” with Mel Brooks! It’s no wonder you think that the entertainer/actor conductor Dudamel is a great conductor! LOL!

I’ve heard Karajan and the Berlin Philharmonic perform Mahler’s 9th Symphony when they came to the Ambassador Auditorium. I’ve heard Bernstein and the Vienna Philharmonic perform Shostakovich 5th in Vienna. 30 years ago I was at the Hollywood Bowl when Bernstein and the Vienna Philharmonic did Mahler’s 5th. (I don’t go to the Bowl very often, but for Bernstein and VPO, I made an exception).

I’ve seen Bernard Haitink and the Concertgebouw Orchestra of Amersterdam do Mahler’s 7th and another concert (don’t remember, but I think it was also a Mahler symphony). I’ve heard the New York Philharmonic, the Philadelphia Orchestra, the Cleveland Symphony, the Chicago Symphony and a bunch more that I’d don’t have space for here.

They don’t make orchestras or conductors like they used to. The L.A. PHIL was never a very good orchestra–today they are just entertainment with a joke of a conductor. Dudamel doesn’t even have any formal conservatory training in Europe and like so many conductors today, his sole attribute is that he ACTS like a conductor.

He’s no Haitink, Walter, Karajan or even Bernstein. You probably haven’t even heard Mahler’s 5th by any orchestra, live or recorded. But don’t fret, you’re just like most of the cultured folks in L.A.

I was born and raised in L.A. I’ve been here all my life which is almost 60 years. My parents were born and raised here, too. And I’m the “problem”?! No, the problem is all the people who have turned this once nice place to live into a parody of suburbia where people run around saying dumb things like “This house in West L.A. is worth a MILLION dollars because it’s down the street from Playa Vista!”

Or where houses that have essentially no value (as the one here in Watts) are put up for sale for $150,000. The problem is people like YOU and the other Kool Aid drinkers who actually believe the crap that is said about the RE Bubble.

I’m just pointing out that this lunacy is just that, insanity and congratulate all of you idiots who have mortgaged your futures for crap shacks!

Cheap Cop… first thanks for you and your wife both serving the public as police officer and teacher.

Looks like ths home was bought for 188k about 2.5 years ago. Seems in good shape. Look all offers must be presented , but I feel a offer on a house 100 days means very little the market is slow. That said they want to sell it of course, offer 250k and if they counter go up to 262k and that is it. The seller makes some money and you get a nice home. Good luck

You really have to wonder why RE Shills come to a website called “doctorhousinbubble” and try to convince everyone that it’s a great idea to buy in a bubble market.

Then you have to wonder why people who have obvious bought into this nonsense and try to convince everyone that spending $900,000 on a 1950’s $15,000 crapshack is a great idea.

And then these same folks try like idiots to tell us that L.A. is so SPECIAL because we have places like Venice Beach and The Grove. And a shit*y symphony orchestra. Or parking lots otherwise known as “freeways”. And that the millions of illegal aliens, section 8 housing residents, welfare recipients, gangbangers and their compatriots who inhabit L.A. aren’t real and of no concerned to those who live in the “desirable” hoods.

So tell me, PLEASE, what is so special about L.A.? And please leave out the Sunset Magazine and AAA tourist guide crap.

I know this topic is a few weeks old, but I’ll share my opinion of what makes L.A. so special.

Both my wife and I have jobs that are based here. I have a ton of flexibility and could work just about anywhere, but my wife is limited to a few major cities. Of all the major cities, LA has much to offer us, therefore we chose to make this place home. We both live 5 miles from our jobs, which ends up being a 25 minute commute on the worst traffic days. The price we pay for this convenience is that we’ve been renting for what feels like way too long. We’re both in our mid 30s now with two kids and we’re stuffed in a tiny house. The good news is that our rent is dirt cheap and the public schools are nothing short of awesome. We’ve hit the point where we’ve both started to earn some decent money and with little kids not being so little anymore, it’s time to save up as much as we can and hope that we can find a home to live in. That means buying into this ridiculously overpriced bubble. The only hurdle is the downpayment; we have nowhere near 20%, however 3-5% is manageable. I know I can rent, and despite the ridiculous home prices in the South Bay, the monthly cost of owning an overpriced shack is very close to a comparable rental (with the interest deduction factored into my taxes).

I’ve been a CA housing bear for over 10 years and despite the little dip in 2010, I lost hope of any ‘correction’. I’m getting old. I’ve accepted the fact that I’ll have to put half of my take home pay toward a mortgage/taxes/interest, becoming another house poor LA resident.

I’ve been following housing blogs for the past decade, and I keep coming here to read exactly what I believe and want to hear – that LA real estate is jacked up and overpriced – and I keep holding out hope for a drop where I’ll feel comfortable buying, but I’ve given up.

Leave a Reply