Wall Street and Housing Neurosis: The Real Cost of California Homeownership. Extreme Foreclosures, Option ARMs, Renting Utility Costs, and Breaking the Financially Twisted Psychology.

The housing bubble psychology in California is still very strong. I’ve been talking with a few people trying to examine why the housing market, with obviously overpriced values was able to entice many otherwise rational people to take on toxic mortgages like option ARMs and Alt-As. As we have discussed many times, much of the economic crisis stems from greed by the crony banking oligarchs on Wall Street but also the foot soldiers who pushed the product out on the street. In the last decade most buyers and sellers were willing or unwilling participants in speculation. Housing since World War II on a national level has rarely been seen as a “hot†investment aside from a few pockets across the country. It is an otherwise dry and slow moving forced savings account.

This was the crux of how housing was viewed. But in California, the gold rush mentality with the glitter of housing fixation shows made buying and flipping homes mainstream. Take for example the well meaning Extreme Home Makeover show:

“(WaPo) Symbolic to our era like a sledgehammer to drywall, the biggest house that ABC’s “Extreme Makeover: Home Edition” ever made over — a sprawling, four-bedroom starter castle, a three-car garage mahal with a turret and all — has gone into foreclosure, in the ‘burbs south of Atlanta.

In that particular episode of the hyper-benevolent reality show, which first aired in February 2005, it took 1,800 volunteers a week to demolish the house with the overflowing septic tank that belonged to Milton and Patricia Harper of Lake City, Ga., and then entirely rebuild a new, larger house, while the Harpers and their three children went away to Disneyland. When they returned, they had the biggest house on Ahyoka Drive, with all the appliances and furnishings, plus enough money to pay taxes on it for decades, plus a fund to send their children to college.â€

There have also been extreme foreclosures in Arizona and California. Why? Because people forget the true cost of ownership. The new mega monster homes get assessed at higher tax levels, energy costs jump, and you have more rooms to furnish. Does the extreme make over come with a boost in your W-2 income? The show is symbolic of how we view things. Let us do things big, fast, and crazy! Who cares about the longer term situation. Ironically the families on the show would be better off if the cost of the upgrades were given to them in cash directly. But not much production value in that.

The Wall Street premise was that everyone else would build, manufacture, get dirty, and otherwise do the work while you were able to get easy money simply by arranging a few papers to get pushed around. Now for the average man and woman, this is largely a tougher game. Yet Wall Street is still partaking in this casino environment. In a poetic irony of the entire mess, corrupt toxic banks are now trying to move on the public relation front by “paying back†billions to the government. This idea is such a preposterous notion. This is like a gambler who is down $20,000 but asks for $40,000 no strings attached, then makes a bet and wins. He gives you back the $40,000 and walks away with $20,000. The banks are rivaling the corruption of those in the Great Depression. How are banks making their profits?

“(NY Times) Despite continuing problems with its loans to struggling homeowners and consumers, Bank of America plans to return the $45 billion in aid that it received at the height of the financial panic — a step that, only months ago, would have been almost unimaginable.

But like many other big banks, Bank of America is once again making money, in large part through Wall Street businesses like trading stocks and bonds, rather than by making loans. Its recovery, while many ordinary Americans are still struggling, is an important milestone in the government’s yearlong effort to stabilize the nation’s financial industry.â€

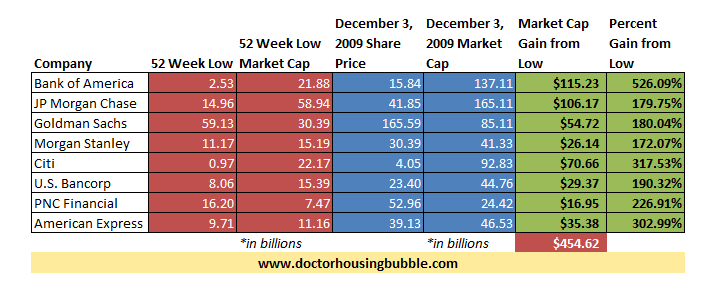

This should be obvious. Wall Street is no longer a reflection of the U.S. economy but of the gambling crony world of Wall Street. You might have noticed that home foreclosures are still near their peaks. Job growth? We are going for 23 straight months of job losses, the longest streak of this kind since the Great Depression. But let us check in on how Wall Street is doing:

That is correct. The 8 institutions listed above have made up nearly half a trillion in market cap since the lows reached in March. Some are up by 100, 300, and even 500 percent! While these banks made close to $500 billion back in market cap (this is only 8 so if we include the entire sector we are talking trillions) we will find that not one net job was added and the foreclosure rate is still seeing 300,000 filings per month. Glad we’re helping out the American public! If you had any doubts where this money is going, the above should put that assumption to rest. So what has the bailout accomplished? It allowed banks not to lend money to the public as it was sold to the American people, but to use the taxpayer money to gamble on Wall Street and suddenly recover their lost market cap by pure speculation. The down gambler has made a few winning bets. Was that really the purpose? Many American people seem oblivious or even worse, complacent to this since the crony banking system is robbing the country blind.

Yet this kind of thinking is what infected the population like a financial bubonic plague. People thought that instead of working, they would be able to buy into this paper pushing culture and suddenly they too would be on a get rich quick path. People didn’t deserve a nice home but a home with granite countertops and flat screens in every room. It wasn’t enough to have a good car but a V-10 tank that hauled your kids to soccer practice when it was designed to speed away from lions in the African desert. The 10 percent automatic stock market, dollar cost average, grow your way slowly to millionaire status without working culture is what allowed this to happen. It was a charlatan experiment and people were entertained by their ringmasters on Wall Street as long as they got a whiff of the scraps. Yet as we now are finding out, the ringmaster let the alligators out on the public while they pick up all the droped wallets and forgotten purses while people panic.

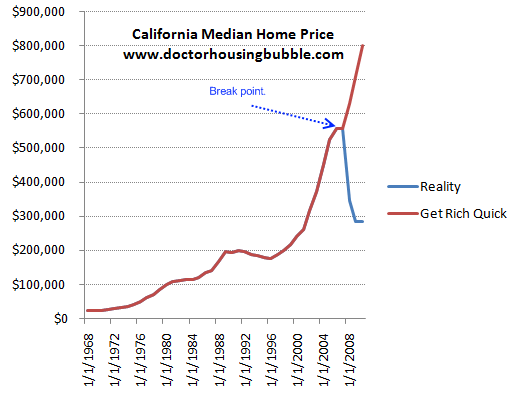

California was the ultimate shark tank because Wall Street found a willing participant. How else can we explain an absolutely idiotic product like option ARMs having such wild success? Option ARMs are zombie spawn of the get rich infomercial commercials. This loan converted housing into a speculative commodity. Forget about paying principal (or even all of your interest) these were short term products that prayed at the altar of perpetual housing appreciation. It is absolute nonsense. Let us use the peak price in 2007 and take housing prices to their triumphant and stupidly beautiful conclusion:

From 2000 to 2007 California housing increased at an annual average rate of approximately 12 percent. This is just flat out nuts given that incomes remained stagnant over the same time period. The above chart shows the trend if it would have continued. At this point, we would be getting close to a median home price of $800,000! In reality, the median home price in the state is now closer to $250,000. But this is the kind of logic that permeated through the market. A simple chart like this would have highlighted the error but people wanted to believe in the free lunch philosophy.

The option ARM catered to this mentality. Why do you need to make a full payment when you will sell your home in 3 to 5 years for double the price? Plus, that extra cash flow per month can be used to lease a Mercedes so you can go splurge on fancy restaurants with your credit card since you can’t even afford it with real money. That was the culture. This arrogance to long-term sustainability. People wanted to live it all up in a mega financial orgy and wake up exhausted from economic drunkenness. Well today the cold water is being splashed on the public.

The psychology is resisting any significant change. There is a group that have adapted and realize things are now different. Another group, I would venture to say most of the readers to this site were already cautious and didn’t buy into this perma-bull housing nonsense. But another group disdains this new austerity and is still patiently waiting for the next turnaround so they can once again ride high on the housing hog. Yet that boat has long sailed. This was a once in a lifetime bubble like Florida real estate in the 1920s. These people were used to the good life even though it was debt induced and will have to adjust but many are swallowing this jagged pill with bitterness.

30 Year Fixed the new and only Standard

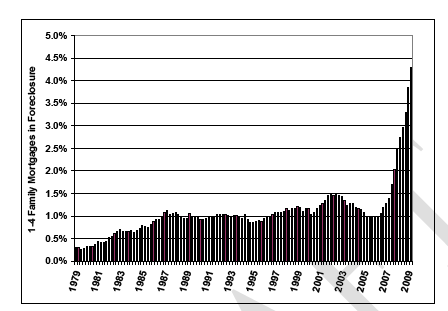

Since for all practical purposes the government is now mortgage lender of first, middle, and last resort let us break down the financials of a 30 year fixed mortgage. One thing I still hear from people is, “well if you are renting, you are throwing your money away!â€Â This is a faulty way of looking at things. Most people need to live somewhere so renting provides a service. You eat at a restaurant but after the meal, there is no future value. It provides a limited term utility. Housing serves this purpose. But the pressure of being a homeowner by the Madison Avenue marketing machine is deeply ingrained in the psyche of most Americans. Homeownership is a privilege, not a right. In the past, you earned this right by proving at the very minimum that you were able to save some money. This helped keep the foreclosure rate rather steady over decades:

As you can see, from 1979 to 2007 the foreclosure rate never went over 1.5 percent. We are now over 4.5 percent. In California the rate is even higher with 1 out 10 mortgage holders in distress. Why did this occur? Over this time the introduction of the adjustable rate mortgage was the financial daddy of the option ARM:

The Garn–St. Germain Depository Institutions Act of 1982

“The bill, whose full title was “An Act to revitalize the housing industry by strengthening the financial stability of home mortgage lending institutions and ensuring the availability of home mortgage loans,” was a Reagan Administration initiative

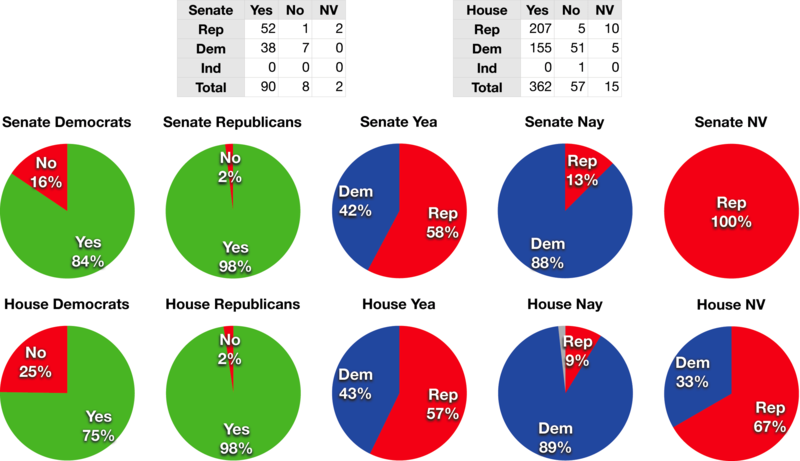

The bill is named after its sponsors, Congressman Fernand St. Germain, Democrat of Rhode Island, and Senator Jake Garn, Republican of Utah. The bill had broad support in Congress, with co-sponsors including Charles Schumer and Steny Hoyer. The bill passed overwhelmingly, by a margin of 272-91 in the House.

Title VIII, Alternative Mortgage Transactions, allowed Adjustable rate mortgagesâ€

Then we have the 1999 Gramm-Leach-Bliley Act that passed with flying colors and gutted the Glass Steagall legislation put in during the Great Depression:

This was a bi-partisan screw over of the American people. Option ARMs were merely the logical conclusion of moronic lending and short sighted political policy. But now, people actually have to look at the actual cost of taking on a 30 year fixed loan. Yes, those boring old school loans. Since many people are looking to buy something in prime areas of SoCal, good homes are still selling for $500,000 or higher. Let us run the math:

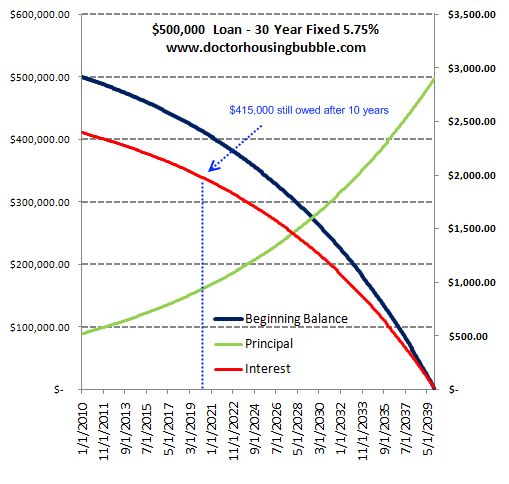

We should spend time on the above chart since this is so important. At the beginning of any fixed mortgage, a large portion of your payment goes to interest. Even with the above example of a cheap loan at 5.75 percent, the bulk of your payment is interest. Your principal and interest payment is $2,917 but it breaks down as follows:

Principal: Â Â Â Â Â Â Â Â Â Â Â $522

Interest:Â Â Â Â Â Â Â Â Â Â Â Â Â $2,395

Interest at a very simplistic level is the amount of money you pay to “rent†money. So the notion that renting is throwing money away is wrong on many levels. Also, if you paid for an asset that has fallen by 30, 40, or even 50 percent you are now paying “rent†on a home that isn’t even worth the initial balance. With option ARMs and Alt-As, many went zero down so they are massively underwater. Assuming you take out a $500,000 mortgage, a large percentage of your payment (82 percent) is going to interest. So you are slowly chopping away at your balance. In fact, after 10 years that $500,000 mortgage goes down to $415,000. The mortgage balance doesn’t start taking major hits until the last 15 to 20 years. But in California, everything was twisted. People didn’t rely on the slow savings of a home but believed in the perpetual appreciation factor. Without this factor in the equation, we need to rely on more traditional metrics. Of course some shills think we’re going back to the heyday but that will be challenging with a 23 percent unemployment and underemployment rate and $20 billion annual budget deficits until 2015.

Also, we aren’t including taxes and insurance above. On a $500,000 mortgage this will be roughly $520 to $700 a month depending on your local tax structure. So your total net payment is:

$2,971 (PI) + $520 (TI) = $3,491

But what about the tax benefits? Ah yes, another major selling point for the housing clown parade. That above payment is a net payment. In other words, you need to pay that out of current income. The after tax benefit comes at the end of the year (or after you adjust your monthly withholdings).

One thing people forget about renting is that it is a true reflection of real market price. Rent is paid from monthly income with no tax subsidies. It is a good indicator of economic market health. The fact that in SoCal rents are falling is an indicator that reality based budgets are getting hit. The current housing numbers are juiced on the following steroids:

>Home buyer tax credit (gift)

>Fed buying mortgage backed securities keeping interest rates artificially low (40 year average at 9%)

>Crashing prices

>Pent up fence sitters that can no longer wait and must jump into the shark tank to party

Why drive this point home? Because next year is the big wildcard for California. The option ARMs come home to roost in fashion. If anything, why not pull a chair and watch the action for a year to see how things play out? If you think you are going to miss out on another boom then you have been brainwashed by the Wall Street sucker parade. The trend and mean reversion are always present in many economic forces. Housing is not immune to that. Plus, our economy is in the toilet! The nation has gotten it’s priorities twisted. Don’t you think that it would have been more prudent to bail out the employment and manufacturing sectors first before bailing out banks and then the housing industry? If we follow the money, you would think that the government would be happy with all of us sitting unemployed in subsidized $500,000 homes.

But take the above example as well. Many $500,000 homes can be rented for $2,000 per month. So on a net basis you have $1,491 more in cash flow per month. Forget about the tax breaks for the moment because you can dump this into a 401k and lower your tax rate as well. So on a yearly basis you have $17,892 more per month. Even with zero percent, after 10 years if you saved the difference you would have $178,920. Your $500,000 mortgage balance went down by $85,000. But the major speculative point is where will housing prices be in 2020? If we bust a Japan it can move sideways for a decade. There is no guarantee that housing will always go up (the California median home price is now back to 2002 levels).

This is the new reality. We’ll have another jobs report tomorrow and it is highly doubtful that jobs will be added. But in this current economic structure that is somehow positive news for Wall Street.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

26 Responses to “Wall Street and Housing Neurosis: The Real Cost of California Homeownership. Extreme Foreclosures, Option ARMs, Renting Utility Costs, and Breaking the Financially Twisted Psychology.”

Another good one Dr. I enjoy reading all of your posts. Repealing Glass-Steagall was big mistake. I remember that as a child in Illinois, my father told me that branch banking was prohibited in the state. This resulted in many small banks, and each posted the interest rate that they paid on deposits, in the window. This made no sense, since all banks paid the same rate, which was set by law.

If Bank of America returns all the money it got from the government, then it will not have to participate in the government mandated refinancing of mortgages. Since B of A holds a large percentage of troubled mortgages, there will be fewer reworked mortgages. Am I right?

I live in Santa Monica. Driving home at night I see many completely pitch black houses in the nicest areas of the city. There isn’t so much as a nightlight on in these homes. It looks like the power has been shut off. I’m guess the banks that own these homes are keeping them as long term hold assets. But with the current outlook, how many years can they hold a depreciating asset before they have to take the loss and sell or get swallowed up by a bigger bank and continue to hold? Will the bank lobby have enough power next year to squeeze another bailout from the Government? From the rise of the banking stock prices, it looks like it is going to happen.

In my honest opinion I believe the government and banks will do everything in their power to postpone the inevitable. I have a feeling all those homes worth 500k+ sitting in the shadows will remaing in darkness for at least a decade. When will the civil unrest begin? Maybe when the bread at the breadlines runs out.

Your math reminds me of why I decided to rent instead of buy a few years ago. Under conservative assumptions, I figured it would take 18 years for me to pay down a mortgage and own the house clear. But if I rented a similar house and saved the money that would’ve gone to PITI, I could buy the house with cash in 9 years. Wasn’t a hard decision.

I did my own calculations, and the tax benefits goes from savings $1491 – (tax benefits=875) = $616/month. Over 10 years, this equals $73,920 saved which is less than what you would have paid off of capital. However, your total interest and capital paid would be roughly $200,000. The main flaw with this thinking is taking into consideration inflation/discounting you are assuming is close to 0. I think it is fair for the next year, but over a 10 year period may not hold. BTW- I am looking to be a home buyer myself when I can afford it. Thanks for the calculations, and your contributions to the blog, and to helping all of us.

When will we demand squatters rights?

Talk of principal reductions and principal forbearance is increasing. Thanks to Sheila Bair for doing everything she can to keep housing prices up, and with them, bank asset sheets. If they start actually reducting the principal on mortgages held by people who bought more than they could ever afford, and are now just sitting in “their” houses, waiting for the government to bail them out, I will be far beyond upset.

I think that these entities have realized what this blog has been illuminating for quite a while now: that there is no way that the people in many of these houses can possibly afford to make the mortgage payments. Of course, they never could, except in the first couple of years of nothing down and teaser rates. But they are determined to not let the natural course of foreclosures, lower prices, and more solvent buyers, take place. I think that they would rather give the present “owners” the houses they are in, just to avoid the flood of empty houses and declining prices. In other words, they would rather make the liar’s loan people the winners, and the prudent and honest waiters the losers. I wish I could feel otherwise about this. I wish millions of people would write and call and complain to their elected officials to try to stop this transfer of wealth from frugal taxpayers to irresponsible wastrels.

Hey Doc, check this out: http://www.bloomberg.com/apps/news?pid=20601103&sid=aW0UJVi0Xnfs& I thought it would take a little longer, but Ms Blair in her never ending struggle with the old boy’s club and to stay in the spotlight is actually considering principal reductions. On your dime.

I got divorced in 06 and the Ex and I sold our house about a month past the peak in our area (September 2006). We actually lived within our means while married ( no $60k Giant SUV, $70k kitchen make overs or $15k vacations) so we did very well. After the divorce settlement and everything else I still walked away with $200k.

I just got lucky with the timing but I did have the sense to rent for the last 3.5 years. My Ex did not and bought in the spring of 2007. I know the neighborhood where she bought her house, the values are down close to $200k and she is stuck. Not my problem but I still feel bad for her.

I just closed on a REO-bank owned home and will qualify for the tax credit, got the home for less than half of what it went for in 2006, and when the appraisal came in $10K under what I offered, the bank re-wrote the contact at the lower price. Granted…its a fixer and I have budgeted $20k to make the house nice, and I will be doing most of the work myself, but having a home that I can afford with a normal 20% down, 30 year fixed @ 5.00 loan in a decent area is what I wanted.

I subscribe to 15 different real estate and mortage sites/blogs read tons more, and by every indicator out there the prices my area have bottomed. Right now your basic 3 bed 2 bath, decent neighborhood, decent condition house is priced at about 3.4 times the average income. In 2006 it was closer to 9x income. Right now my house payment with insurance and prop tax is less than the average rent for the same home.

BTW the banks are much harder to work with since the meltdown….I have an 800 credit score but since I have not owned a home for the 3.5 years I still had to provide everything except a DNA sample to get closed! They even required a signed letter from my landlords stating I paid my rent on time. Talk about closing the barn door after the horse has gotten out…

Anyway keep up the good info.

The one thing you overlook, is that buying a house is a forced savings plan for most people. I know many people in the 60 to 70 age range that have NO savings, but own their house free and clear, with a value of $400,000. to $600,000,cold, hard,cash.

If you “save” $1,500. a month by renting, very few (read “none”) people will have the discipline to actually put that money away in savings.They will take fancy vacations, buy new cars every 3 years, and wonder why they are broke at age 65.

For most people, buying a house and paying it off is still a logical choice, if you view it from a 25 or 30 year perspective.

By my calendar Japan is entering it’s 3rd decade of sideways to down movements in asset prices. Don’t fall into using the “lost decade” claptrap just because the MSM likes unthinking catch phrases. Maybe when it gets to be 90 years they’ll at least change to the “lost century”.

People have been so brainwashed into the cult of the monthly payment amount with credit cards, cars, etc. that they were easily hoodwinked into using it on the largest debt of their lifetimes. Decades of “you’re worth it” self esteem marketing has made people’s entire self image dependent on the stuff they have and any attempt to dissuade them from financial suicide is seen as an attack on their worth as a human being…..and over the cliff they go!

Here’s a good calculator for quickly working out the cost of buying vs. renting:

http://www.nytimes.com/2007/04/10/business/2007_BUYRENT_GRAPHIC.html

Love the blog I’ve learned so much keep up the great work.

Robert Cramer–

You are right, provided the eventual value of the house be significantly more than the combined sum of its initial cost, interest, depreciation, and inflation. Some estimates suggest housing in California may not markedly appreciate beyond the “break even” point until 2030–hardly a prudent long-term investment. Moreover, historical data indicates a return of between 2-3% on most owner occupied properties over the course of a characteristic 30-year mortgage. Even an under performing, sub par mutual fund managed by a bungling day trader with the I.Q. of a doorknob will see greater returns. So, were a home purchased prior to the bubble (including what has now become an insidious government sanctioned secondary bubble), your point is well taken; if not, prepare to watch much hard-earned money circle the drain.

In Ca in particular where you can have your house wiped away at a moments notice by an event not covered by conventional insurance such as earthquakes and landslides, owning seems problematical. Consider that the gov views home ownership (and almost says this) as a societal stability program. If you own a home you have something to loose if you rent you do not. If you have nothing to loose you will be more willing to join a revolt. (Recall the Red Slogan “Workers of the world unite you have nothing to loose but your chains” If you are a homeowner this is not true.) Excuse my cynicism here but one could see home ownership being pushed by the rich so they could keep their heads (ala paris 1787).

The problem with that calculator is it is showing me buying is never better than renting over 30 years in SoCal 🙂

Let me add another comment inspired by the graph. California is a state founded on get rich quick. (in the sense of being american, the spanish did not come completely as a get rich quick scheme) But what is a gold rush but a get rich quick scheme, and has been pointed out we had a gold rush in housing in CA without having to dig anything up or stand in cold water. Gold Rushes always collapse sooner or later. See Ca highway 49 for examples, or for a place that drove the northern CA economy for years Virgina City Nevada. So in one sense get rich quick could be said to be in California’s societal DNA.

I just don’t see the jubulation in the job report. Two million first-time unemployment in the month, 11,000 non-farm lost, but the rate drops? That can only be discouraged workers falling off the count and the many temps hired for Christmas, so the figure for now is useless. No doubt Wall Street is raking in the bonuses, and no doubt defense contractors are jacked up about another surge, but I don’t know anyone else doing well. Didn’t take long to get a good parking place at Walmarx on a Friday in December. That is a valid corollary regarding the little people. Things rebounding? Everyone I know is scared to death (I don’t know any TV reporters or investment bankers). I hope it gets better, but I’m not holding my breath.

Yes, it is never profitable to buy a bubble asset in a declining market. I had a friend who bought a house and rented an apartment off of it. That was a good way to own, maybe. Some of these McMansions could be a whole apartment complex.

We haven’t got the CA unemployment figures yet. And when we do I expect it to show unemployment rising in the golden state even while national unemployment falls.

Three times I tried to post – maybe my comment was too long. In any case, I believe that the evidence, when all put together, points to indefinate support of their cronies on Wall Street. With this we are likely to experience a repeat of Japan’s lost decade(s), and see housing prices relatively stagnant over a long period of time. They may go down a bit more, but not all that much. If the government allows both (a. banks to stand or fail on their merits, and (b. investors to absorb the loss of their bad loans, only then will housing prices drop (as they should).

What will happen is anyones guess. It seems to me that considering interest rates and the likelihood of continued government bailout support, now is as good a time to buy as any.

As to the November employment report, Calculated Risk makes a good case that the decline is just statistical noise and it is possible that real unemployment rose slightly. The opposite is also true but the numbers are not a perfect metric of the labor markets.

It’s hard to argue that the efforts of the Fed, the Obama administration and shadow inventory managers have not had a real effect on stabilizing the housing market and providing some economic stimulous. Those of us on the side-lines waiting to buy a house are being forced to wait longer than hoped. But, hasn’t this orchestrated “soft landing” been better for all concerned than a precipitous market correction would have been? I’m frustrated sitting on the sidelines, seeing HELOC addicts who stole thousands, tens of thousands or hundreds of thousands of dollars walk away with temporary slaps on the wrists. But, again, we didn’t slip into a depression, which was a very real possibility had not strong and swift intervention, along with market manipulation, wouldn’t have occurred. It’s frustrating because the most concientious, careful, and prudent are being ignored. Greed, indeed was good for the greedy.

Certainly the impact of housing bubble burst has been reduced, but at what cost? Would it be better to endure a more severe, but shorter impact to the economy? Or is it better to soften the blow, but greatly extend the impact?

Also, the approach to softening the impact is of course through introducing outside influence (the bailout). There is nothing wrong with this in principle, but any external influence will of course have winners & losers. In this case, the selected winners are mostly the finance sector. By failing to let the market punish those who bear the greatest responsibility for running the system, don’t we encourage future shenanigans? While the home-owners are certainly at fault for engaging in risky behaviour, would it not be better to bail them out, and punish the people running the system so they do not make such foolish loans in the future? An interesting fact – if the bailout were applied to pay off mortgage balances, it would completely wipe out all mortgage debt.

Robert Cramer wrote:

“The one thing you overlook, is that buying a house is a forced savings plan for most people. I know many people in the 60 to 70 age range that have NO savings, but own their house free and clear, with a value of $400,000. to $600,000,cold, hard,cash.”

I don’t get that. Cold hard cash for the kids in the will if the kids can even sell the thing in today’s market, but for the elderly couple, it’s a liability, right? They can’t extract the “cash” if they don’t want to move, like most oldsters, and rising property taxes and maintenance and energy costs are just going to kill them. Figuratively speaking, of course. heh.

Where are people getting the idea that “ir-responsible” homeowners are getting money handed to them? People like William spout off ignorant statements, and STILL miss who is getting their money. Dude….wake up, it’s the BANKS that got “your” (don’t forget, it’s MY money as well) money, and they are NOT lending it out. They are NOT giving principal reductions, and they are NOT giving spectacular deals. Sure, some homeowners are getting a super low rate, but they are thousands and hundreds of thousands underwater.

What should be done is all banks that were speculators should fail. Everyone that cannot afford their house should be foreclosed upon. The market should be allowed to drop 50% or more ACROSS THE BOARD, and those people who lsot their homes should re-purchase them for 50% less, get a standard 30 year amortizing loan, and continue with life.

It will never happen that way, because you voted in your favorite republican/democrat, and their masters are not the public, their masters are the banksters on Wall St. Mammon, a very old god indeed.

@ dfresh “It’s hard to argue that the efforts of the Fed, the Obama administration and shadow inventory managers have not had a real effect on stabilizing the housing market and providing some economic stimulous.”

No, it’s not hard to argue the fact. Uncle Tom simply paid out Wall St. and the banksters at the expense of us all. The shadow inventory is waiting to crash upon the heads of every homeowner in the country, and the FED. Do you even realize that the FED is a private banking institution that is no more “federal” than federal express?

Is it any wonder we are a nation of debt slaves?

Leave a Reply