Real County of Genius – Ventura County meets the housing correction. A mid-tier market with a median home price of $370,000 down from the $627,000 peak of 2006. Thousand Oaks and Newbury Park. Prime mid-tier examples of the correction.

Today I wanted to focus some attention on Ventura County. This is one of the smaller counties in Southern California with a population of approximately 800,000. Ventura County is located north of Los Angeles County and most of our attention has focused on Los Angeles. After all 10,000,000 of the people that call Southern California their home live in L.A. Yet there seems to be an interest in Ventura County and why not focus a little light on it? It is simply another overpriced region in SoCal. Like a small brother looking up to an older sibling, they have followed in the footsteps of Los Angeles. Some of the nicer areas in Ventura like Oak Park carry price tags of millions but this is only one tiny segment of the market. But Ventura is the quintessential mid-tier county. Most other areas are still overpriced simply because of the income of families made in those areas. You have cities like Simi Valley, Moorpark, and Camarillo that really are still inflated. Today we salute Ventura County with our Real County of Genius.

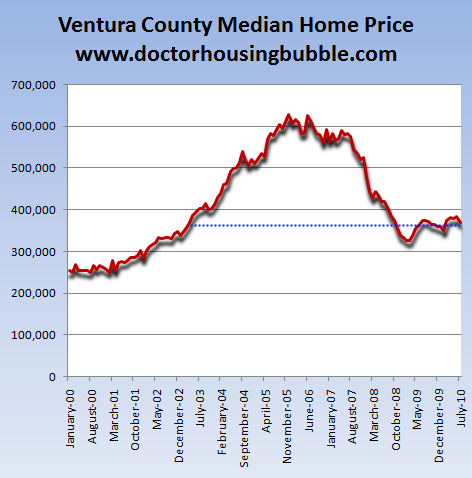

First, let us examine the median price of housing for the county over the decade:

Housing in Ventura County reached a peak in June of 2006. At that time, the median home price hit $627,000. Interestingly enough, the median household income at that time was roughly $70,000. Yet this metric seems to be common throughout California. Many of the bubble areas reached a crescendo bubble price point at a ratio of 10 times annual household income. As the bubble popped, median home prices have fallen 40 percent. The current median home price is $370,000. Like most places in California many home purchases were done via toxic mortgage financing. This county is not immune to the bubble bursting. If you would have told someone back in the summer of 2006 that Ventura home prices would fall by 40 percent they would have thought you crazy. Well here we are and guess what? Prices are still inflated.

Ventura is situated as follows:

The reason so little attention is given to the area is the relative population size in comparison to L.A. But all California counties had massive housing bubbles and all will correct. It is a matter of timing. If we look at Riverside and San Bernardino median home prices are off by 50 or even 60 percent. Ventura is down by 40 percent. L.A. and Orange Counties are off by 30 percent. In the end, an equilibrium will be reached no matter how much government stimulus and bailouts are funneled into these markets unless incomes can magically inflate.

Let us take a look at the housing numbers for the area:

MLS listings:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3,251

MLS listed distressed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 65

MLS listed short sales:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 211

Distressed inventory (REOs, NODs, Auctions):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 4,659

The above tells the entire story. The MLS lists 3,251 homes for sale. Of those, only 65 are foreclosures! Yet if we look at the shadow inventory you will find a stunning 4,659 homes. Now you can interpret that how you like but there is no denying that a large amount of people are unable or unwilling to pay their mortgage. Those exotic mortgages don’t look so exotic when they are sucking the life blood out of your family’s monthly budget.

You can see the entire story when you look at pricing history. Let us look at a home in Thousand Oaks:

786 CALLE CONTENTO, Thousand Oaks, CA 91360

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2009

Square feet:Â Â Â Â Â Â 2,311

Listing price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $599,000

The home is listed as a foreclosure. But if you really want to see the action take a look at this:

8/21/2010Â Â Â Â Â Â Â Â Â Â Â Price change *Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $599,900Â Â Â Â Â Â Â Â Â Â Â Â -24.8%

08/12/2010Â Â Â Â Â Â Â Â Price change *Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $798,000Â Â Â Â Â Â Â Â Â Â Â Â Â -1.3%

07/14/2010Â Â Â Â Â Â Â Â Listed for sale *Â Â Â Â Â Â Â Â Â Â Â Â Â Â $808,500Â Â Â Â Â Â Â Â Â Â Â Â -18.7%

07/18/2009Â Â Â Â Â Â Â Â Listing removed *

11/09/2008Â Â Â Â Â Â Â Â Listed for sale *Â Â Â Â Â Â Â Â Â Â Â Â Â Â $995,000

Someone tried to sell this home for $1 million back in 2008! This makes no sense. They were two years too late. The current median price for this zip code in Thousand Oaks is $459,000. Is this a good deal? You tell me but dropping the price by 40% ($400,000) from the peak listing price of 2008 is a big change in my opinion. The market is still in the process of correcting. Any bottom talk is nonsense especially for California. It doesn’t help that the underemployment rate for the state is 23 percent and we still have no freaking budget!

So that is one example of a nice newly built home that has corrected. Sometimes folks say that the Real Homes of Genius target lower priced tiny homes. This is a newly built home in Thousand Oaks and is rather large. Then again, it is hard to convince someone that they are living in the bubble if their net worth is directly tied to bubble assets.

How about we look at a place out in Newbury Park?

624 VIA VISTA, Newbury Park, CA 91320

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 5

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2/1

Square feet:Â Â Â Â Â Â 2,672

Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1999

Listing Price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $724,900

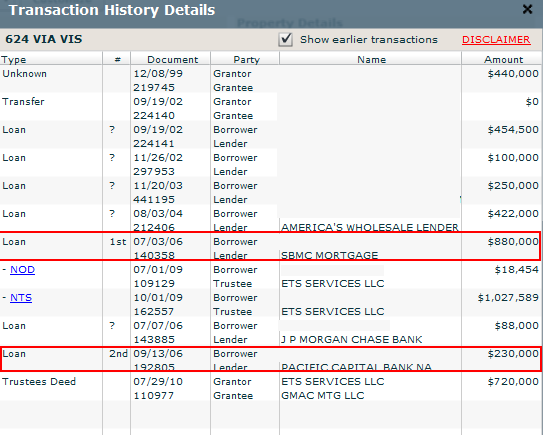

Now this is an interesting home. It is a bank owned home. A large place in a good area of Ventura County. But what happened here is really the more interesting part:

Someone bought this place in 1999 for $440,000. Not bad. But then it was home equity party time. By 2006, this place had $1,110,000 in mortgages attached. You know the exotic mortgage story and now this place is bank owned selling for $724,900 (a 34% decline from peak mortgage debt). Get used to this story. The mid-tier market is going to get a taste of the correction in the next few years.

Today we salute you Ventura with our Real County of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

30 Responses to “Real County of Genius – Ventura County meets the housing correction. A mid-tier market with a median home price of $370,000 down from the $627,000 peak of 2006. Thousand Oaks and Newbury Park. Prime mid-tier examples of the correction.”

(Please delete previous version of this comment)

DHB,

Thank you for addressing Ventura County – and in particular the bubble-icious East County (where portion where most of the interest from your readers seems to lie). I have owned a home in East VC for 20 years and watched it drop in “value” to under $200K in the mid-90s and peak at a ridiculous $600K+ in ~2006. Now it sits at ~$450K based on comps, but realistically still has a good $50-100K to fall.

The problem in East VC is that most folks here have too damn much money. Sure a few have lost their jobs, but unemployment among the professional classes is much less than the overall rate and most here are still raking in money. This is white-bread suburbia at its finest and most here can just delay any potential home sale for years if necessary. As a result MLS inventory is severely limited and this provides some price support. I fear it will be a long waiting game – possibly until the latter portion of this decade – until housing prices finish correcting out here.

In any case, thanks for looking our way and keep up the good work.

I agree with you that many of the established, entrenched communities can ride this bubble out for years and years to come. Anybody who bought in these communities (like Thousand Oaks, Irvine, Cerritos, etc) in the 1990s or earlier is sitting on a mountain of equity…assuming they didn’t do anything stupid with cash out refis. And if they refiance their mortgage at today’s 4% rates, their housing payments will probably be lower than a 1 bedroom apartment rental. That’s why this segment of the population has tons of disposable income and is keeping the economy going, not to mention these owners are in their prime earning years (40s and 50s). I see prices correcting another 10 to 15% in these communities, but not much more. The above factors I spoke about will probably limit the downside.

most here can just delay any potential home sale for years if necessary…but not market forces.

I believe the perception of value in real estate has turned and will add to home values falling below the mean. In Ventura it is happening at a slight to slightly more pace. Too many people are turning to rent than buy and the consequence to home price down side should escalate and mirror adjacent communities. Ventura County is not a island.

Doc, thanks for giving Ventura County some attention. I know we are a small number compared to L.A., O.C., … But we seem to have fewer well built simple homes with “Good Bones” to choose from. We have many poorly designed stick built junk with horrible floor plans and uninspired designs and folks think they are sitting on Gold. Realtors don’t help much as they have no clue, allways pushing for higher comps and spewing the false notion that the bottom has allready passed.

I Do appreciate your fine indepth coverage. Thank you again!

For the house on 786 CALLE CONTENTO, Thousand Oaks, CA 91360, I find it interesting that the house was for sale before it was built. This suggests that it was never occupied and was offered for sale probably before the slab was poured. Foreclosure was on the developer/owner correct?

I’m glad you looked (briefly) at VC. Right now I’m looking at homes in Simi Valley for the $275K to $325K price range. Most of what we’ve seen are short sales in decent neighborhoods, but they need work. Almost all need new flooring, most new kitchens, and some new landscaping. So an additional $5k to $20k could be needed. The closest one to a turn-key was VERY close to the train tracks.

The smartest move may be to wait 12+ months, but we are ready to get out of our apartment and into a decent neighborhood before we add baby #3. We’re ready for another child, just waiting on a bigger place. The San Fernando Valley just doesn’t offer that in our price range.

We plan to be in this house at least 5yrs. That should give us enough time to ride out any further decline in the market. Ideally we’ll be in this house MUCH longer.

BTW, if you could do a follow up on the Simi Valley area of VC, it would be much appreciated.

Thanks for your always great posts!

Underemployed only 23%? I bet it’s higher…

Everything is relative. If you think that a high school dropout making $300,000 a year selling toxic mortgages to people who could not afford them is properly employed, than almost all of us are underemployed.

Well, I was thinking of my boyfriend, a p/t art teacher, unable to find f/t work…

Most people can’t tell where LA county ends and where Ventura county begins, unless they see the small green sign on the freeway. Counties are just political divisions, and do not affect housing prices very much. Much more relevant is whether or not a house is in a sub-prime area, a middle class area, or a rich area; if it is near the coast, or inland.

The middle class areas of Ventura seem to be correcting at about the same rate as all other middle class areas in California. It is nice to see examples from all areas of Southern California.

Dear Nick Handle.

With all due respect, I strongly disagree with you regarding county lines. I know people who look on a map and specifically rule out looking for homes in L.A. County. Having a Ventura County address is more prestigious and allows better resale value than L.A. County.

Personally, I will take the worst home in Oak Park over the best home in Calabasas. I have a problem supporting L.A. County’s wasteful tax programs.

Hi, Thanks for reporting on Thousand Oaks, and this area. Could you tell me about Goleta, we are going to open houses there, and wonder if you think those will fall too, or is it such a small area, that the homes will not drop much more? thanks.

Goleta is Santa Barbara County, specifically South Coast SB County. This is still grossly, grossly overpriced. I make a good living here, and the most I can afford is a small condo. Buy if you want to see your property decline in value. Enjoy!

Doc, that for addresssing Ventura County. People are still asking crazy prices here in Camarillo. Hopefully, some of those foreclosures will come on to the market and bring prices down.

Doc,

Thanks for including VC, we’ve been neglected for too long. I have some comments regarding the listing at: 624 VIA VISTA, Newbury Park, CA 91320. Even though the total mortgage debt is $1.1 million, this house would never have sold for that much even at the peak. At the peak, this house would have sold in the $900s. Considering this is an REO, this only represents a drop from peak pricing of about 20-25%, and this is not even a prime home in this tract/community. It’ll be interesting to see what this house sells for, it’s actually one of the better priced homes currently in this particular neighborhood, and will probably sell for above list price. Follow up on the sales price on this home as I think it help with price discovery in this area. At this price, it will probably sell quickly. This particular neighborhood has a price premium due to a good local elementary school, close proximity to Amgen, and it’s one of the few newer developments in VC. I’ve been watching this neighborhood closely, and the prices have remained stubbornly high, some recent sales are only 10-15% off peak pricing. Pricing is coming down extremely slow, and the nicer homes (view, nice yard, +/- pool) in this tract seem to have no problem selling.

Spoken like a true realtor…..

Santa Barbara County might be a wee bit too north for your interests, but it’s becoming an interesting area to glean. Prices in mega-bucks Montecito for instance have been slached by as much as 50%. In Santa Barbara City a house I looked up on Zillows valued at less than $950,000 was down from a high of $2.6 million. At the height of the bubble you couldn’t get anything in Santa Barbara for under a million unless it was a condo. Another 30% and you could almost imagine riots in what they call ‘Paradise’.

Doc can you do a write up on Orange County, specifically Irvine?

I am a renter in LA and appreciate all the info on the area. Your blog is primarily responsible for my getting educated about the housing market and avoiding becoming another foreclosure statistic. Thanks!!! But I really enjoyed the analysis of Ventura county, too. I’d love to see more about Santa Barbara as well. I looked at the price to income ratio there and it is way off still, as far as I can tell. The supply of housing is limited there, and I’m not sure how that will affect the rate of price decline. So far there have been big reductions in SB as there have been everywhere else. My brother is looking to buy in Goleta where he works and currently rents with his family. I keep telling him it’s too soon, but he argues its a niche market so the standard formulas may not apply. I’ll echo the comment above and say I’d love to see one of your thorough analyses on the SB/ Goleta area, Dr. HB.

There is already a blog deciated to Irvine: http://www.irvinehousingblog.com

Doc, I think that it is time for a mid course correction on when we will hit bottom. Do you forsee it as 2012?

Hey Doc, can you do an article on Laguna Niguel? On another note, today I got to thinking why do I hear all the time that short sales are soo hard to make an offer on? That they take forever blah blah blah. I know at least 4 co-workers that have successfully purchased a short sale within the last year. As a renter with a fat down payment, I have nothing but time. I’m beginning to think that all of the discouragement is because realtors either don’t make much of a profit on them, or it’s a pain in the arse for the realtors.

This is a bit off topic but I was wondering if someone could explain the how the history of building and development in SoCal evolved such that lots are so tiny.

It’s astounding to me to see fairly expensive homes on tiny lots. I’m a civil engineer in central Mass. and the City of Worcester allows some lots as small as 7,000 square feet but that’s a bizarre exception among all the surrounding towns. Most towns will not let you build a single family home on a lot less than 20,000 square feet.

I’ve done google maps searches of some of the addresses listed in the case studies on this site and it blows my mind to see houses that went for $900,000 or $1 million or more from which one could spit and hit the neighbor’s house.

Are there older subdivisions in which the lots are bigger? Or was this density the norm right from the start?

Wow, must be a “cultural thing” between the west and east coasts. For the most part the lots are pretty standard for up and down the west coast. 50X100 is very standard and in many newer areas you can expect even less.

Even in Phoenix where land is literally wasted youraverage lot is only around 15000 sq feet although some are a .25 acre and some as small as 40X100.

There’s some variation in the older, pre 1970 subdivisions. Some have larger lots, some more like the Cali size but not quite that small. But things have coalesced around a 20,000 s.f. standard, for the most part with 100 or 125 feet of frontage the typical standard.

Hi Doc, thanks for educating us. Could you please make a study for North Orange County? Thanks.

I grew up (to the extent that I grew up) in Thousand Oaks. It was quite a shocker when I saw that my early childhood home was listing for $500K. This was the little place my folks bought for around 15K. Sure, the lot was big but much of it was at a 45 degree incline, leaving the portion that was the real lot no bigger than average.

Utter insanity. Nobody who can genuinely afford $500K should want to live in that house.

We live in Thousand Oaks now, and I admit the prices here are way too much for what you get, even if it is in California. We are renting, and are going to just continue to rent for a while, just because the prices are way too much.

We are going to open houses to see if we would want to buy, but are always disappointed in what you get for the price, might as well rent and be happy 🙂

Thanks DHB for all the information on Southern, Ca. Do you every do price

study in other state like Sheridan, Wy. Which is now starting to see a decline in their house markets. Thanks….MAC

10/1/10 786 Calle Contento was reduced to 550,000. Did a drive by. What you don’t see in the picture is the two other spec homes next to the one pictured. They all have lock boxes on them. These homes are built on a hillside at the end of a 1970’s syle street. (For you T.O. readers, it’s near Sunset Hills) I thought about our So. CA rain or shakers and wondered if the “Hill” the homes were built on would hold. Note the drive way in the picture. The driveway was is narrow and you would be unable to make a turn into the garage, which by the way is blocked by narrow pillars. No front yard , min. backyard, no landscaping. Don’t know who would pay to finish the long driveway and wall leading up to these three homes. Seems like way to much trouble.

Leave a Reply to Jeff C