Finding the True Unemployment Rate: Is the Government Listening to Financial Bloggers? Bureau of Labor and Statistics now has Annual U-6 Data for Individual States. California U-6 Rate for 2008? 13.4 Percent.

Many long time readers know that I have had issues in how the media and government report the unemployment numbers. It is sugarcoated, put in a silky dress, and has lipstick before it is dished out for everyone to eat at the happy days buffet. The good news is that recently the media has been catching on and using the wider measure of unemployment (not always), normally recognized as the U-6 data in the Bureau of Labor Statistics releases since this provides a more accurate assessment of the unemployment situation for the average person and family. That isn’t necessarily the big news. One of the main data points that I have been searching for is the U-6 data for individual states. The BLS as of March 16, 2009 now has the annual data for states including U-6.

As you are aware, the national employment figures are calculated via the Current Population Survey (CPS) that samples 60,500 eligible households. However, for state sub-samples the data can range from 600 to 4,000 households depending on what state is being surveyed. We still don’t have monthly data at the BLS regarding individual states but having the annualized data does help us arrive at a more accurate level for unemployment. What we are finding is that we are approaching Great Depression levels of unemployment.

Before going on, let me add a couple of caveats since everyone thinks that simply uttering the Great Depression means we are flying off some kind of economic cliff. People anchor on to the dismal 25 percent unemployment peak but fail to realize that in some years, unemployment was hovering around 15 percent. The Great Depression lasted an entire decade with major fluctuations in employment and also saw the stock market bounce off record lows. GDP also increased. It was not all doom and gloom. In addition, we have much more of a safety net today including unemployment insurance which provides a minor buffer to employment shocks. Yet this hasn’t stopped tent cities from popping up including one in Sacramento that is being shut down. The purpose of looking at the data is to get a more accurate assessment of what is going on in our economy. 8.1 percent unemployment does not warrant trillions in bailouts, printing money, and virtually throwing every piece of monetary and fiscal stimulus at it as the Federal Reserve and U.S. Treasury have. Yet a 20 percent unemployment rate may warrant massive action like during the Great Depression.

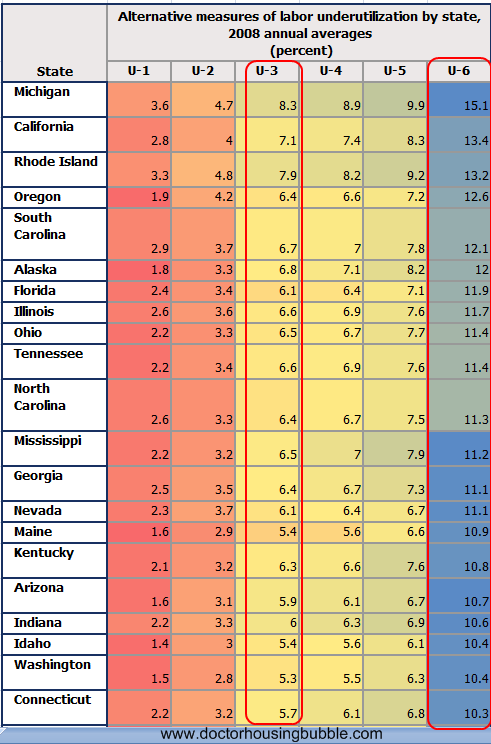

Let us now look at the 2008 annualized data for a few states. As we have suspected and argued, the real unemployment number is much worse:

I sorted out this data in Excel to paint a clearer picture. Let us spend some time on this chart because it is really important. First, the widely reported mainstream unemployment data is the U-3 column. Most have taken this at face value. Yet the broader and more accurate number in my opinion is the U-6 data because it includes part-time workers looking for full-time work and those looking for work, but have given up. I think it is fair to say that those people should not be calculated as fully employed. If anything, they are underemployed but we do not have a column for that so we need to draw our own conclusions where the data is missing.

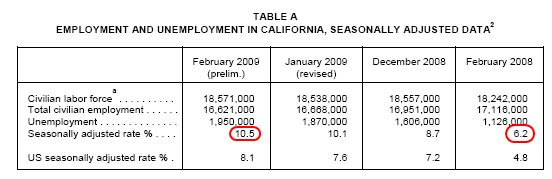

On an annualized basis for 2008, both Michigan and California have the highest unemployment rates. Michigan is at 15.1 percent (depression level) and California is at 13.4 percent. Keep in mind that this data is annualized and is skewed to include the first 8 months of the year before job losses really accelerated. In fact, this data has California unemployment via the U-3 at 7.1 percent on an annualized basis. On Friday state level data was released for February of 2009 and the unemployment rate for California now stands at 10.5 percent via the U-3 measure.

So why is this annualized state data important? Because it gives us a deeper view of what states are taking the brunt of this economic downturn. The BLS states that it does not give monthly data on all the U-1 through U-6 measures because state sample sizes fluctuate too much and don’t provide a good statistical sample. Yet things are quickly changing since the last few months have seen drastic jumps in unemployment. What this means is we will have to wait until 2010 to get an overall picture of the real unemployment feel for states but we don’t have to wait since we can arrive at a relatively accurate number on our own. There is enough data out there that we can triangulate various sources and arrive at an accurate assessment of the unemployment situation without waiting a full year for the final verdict.

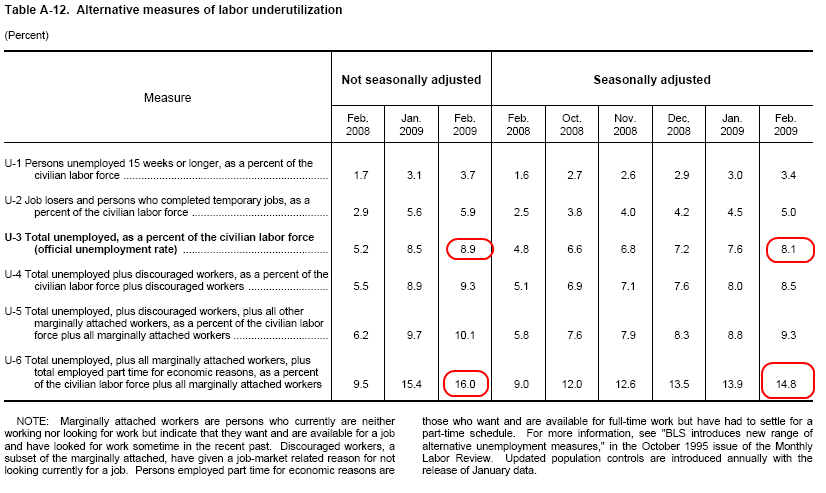

First, let us grab the pulse of the overall national employment picture:

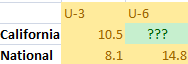

The current unemployment rate is 8.1 percent but if you look at U-6, nationally we are already at 14.8 percent. This is a very big difference. And as I had suspected when we look at the above annualized data for each state, U-6 data is much higher than the headline number (of course). U-3 and U-6 should have a positive correlation so we can try to assess the unemployment ratio for each state. Let us take California for example and measure it to the national breakdown:

So we’re really trying to solve for the U-6 here for California. If anything, we can arrive at a really generic ratio:

8.1 / 14.8 = .54 (national data for February of 2009)

7.1 / 13.4 = .52 (annualized U-3 vs U-6 California data for 2008)

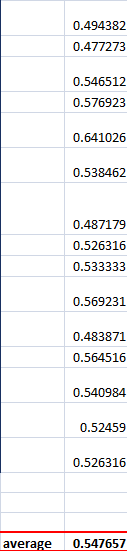

In fact, I ran a quick analysis for each state dividing U-3 and U-6 data for the entire 2008 year and the ratio is rather similar:

The ratio is extremely tight. It falls within a range of .47 to .66. So now you understand why the entire 2008 U-6 annualized data is so important because it now allows us to project U-6 estimates for each state. Let us use that .47 to .66 range and also, look at the average for California:

10.5% / ??? = 54%

??? = 19.1% for California U-6 using a .54 ratio

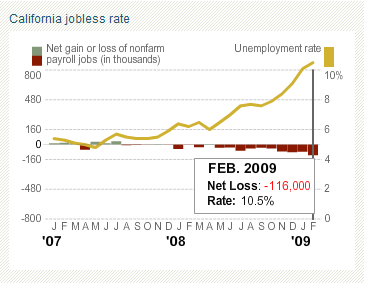

If we used the .47 ratio you are looking at 22 percent unemployment via the U-6 data or the higher ratio of .66 which gives us 16 percent. This is actually giving us a more accurate picture and why things are so dire including the fiscal problems that the state is facing. And these numbers make sense. If an annualized rate of 7.1 percent U-3 for the state rate gave us a U-6 of 13.4 percent, then is it hard to believe that a 10.5 percent U-3 rate would give us a 16 to 19 percent U-6 rate? That is why things are feeling much worse for the state. In fact, the job losses have accelerated in the last few months:

Source: L.A. Times

The reason this exercise is so important is that we have government official using U-3 measures to project out earnings and revenues and are falling drastically short. That is why we had an $8 billion budget short fall only three weeks after the budget had passed. Why did this occur? They were projecting 9.1 percent statewide unemployment for 2009 and a peak of 9.4 percent for 2010. We’re already at 10.5 percent with the headline number! As they say, garbage in and garbage out. Unless you are using proper assumptions your projections will be false and that is why the majority failed to see the housing bubble when it was expanding. Many now fail to realize that we will not see a housing bottom until 2011 for the state and this rising unemployment is a direct reason. People are fixated on prices now. Well who is going to buy when virtually 2 out of every 10 people are out of work if we use better measures of unemployment?

MarketWatch has an article looking at the fact that many Americans are one or two paychecks away from financial ruin:

“A MetLife study released last week found that 50% of Americans said they have only a one-month cushion — roughly two paychecks — or less before they would be unable to fully meet their financial obligations if they were to lose their jobs. More disturbing is that 28% said they could not make ends meet for longer than two weeks without their jobs.

And it’s not just low-income earners who would find themselves financially challenged. Twenty-nine percent of those making $100,000 or more a year said they would have trouble paying the bills after more than a month of unemployment.

Meanwhile, more than four in 10 respondents told pollsters in a recent Pew Research Center study that job-related issues were the nation’s most important economic problem.

“Since October, mentions of other major economic issues have declined, as the public is increasingly focused on the job situation,” according to the Pew study.

Since July, the study noted, there was been a striking spike in the numbers of families making $100,000 or more who said it was difficult to find local jobs — 73% compared with 40% eight months ago.”

Read the above carefully. 1 in 2 Americans are 2 paychecks away from massive financial trouble. 1 in 4 would be on the financial edge after 2 weeks only. These are fully employed people. This is what I talked about in the silent depression that many are facing. If you look at the 8.1 percent headline unemployment number things don’t look so bad. But when you dig deeper into the data, you realize something is amiss. In fact, the study above highlights what many are feeling. Things are much worse than we are being led to believe. Why else would the Fed be printing money to the tune of trillions of dollars? You will also see in the survey that those with relatively good incomes are also worried about the economy. Over 1 in 4 with incomes of $100,000 said they would have trouble paying their bills after one-month of unemployment.  How can that be you say? Well think about the bubble homes here in California. Say you bought a $500,000 home in California and make $100,000. You went no money down on some toxic mortgage that is now recasting. What does your balance sheet look like?

Monthly Net Pay:Â Â Â Â Â Â Â Â Â Â Â $6,022 (Married with no kids)

PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $3,000 to $3,500 depending on interest rate

Let us assume each person makes $50,000 a year. What if one person loses their job? That is it. You are now in the negative with only your PITI! What about your car payment? Food? Health insurance? Utility bills? You get the picture. And now that we know the bigger picture of the California employment situation, you can see why prices will now be falling because of more historical measures like the health of the economy instead of low interest rates.

Let us take a quick glance at the current situation:

February 2009 California employment data:

116,000 jobs lost in month (biggest number in 19 years)

1,950,000 million unemployed (up 824,000 from 1 year ago)

768,762 collecting unemployment insurance (up from 480,504 from 1 year ago)

You tell me how this is good for the housing market? The government through bailouts, fiscal stimulus, monetary programs, and every other imaginable bailout has committed over $9 trillion to the cause. You know how many $50,000 a year jobs we can buy with that for one year? 180,000,000. Even with the $1.2 trillion committed by the Fed with the TALF and buying treasuries to lower the interest rate, we could have literally bought 24,000,000 jobs at $50,000 for one year. We could have put everyone back to work for the price of making mortgages go back down to 4% and giving Wall Street another crony capitalist present. Money well spent right?

What are your thoughts on these above measures for employment? Am I too pessimistic? Optimistic? How would you calculate the U-6 for each state on a monthly basis?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

22 Responses to “Finding the True Unemployment Rate: Is the Government Listening to Financial Bloggers? Bureau of Labor and Statistics now has Annual U-6 Data for Individual States. California U-6 Rate for 2008? 13.4 Percent.”

Doc, I think you are right on, not pessimistic but realistic. It’s awful.

If the state stats department came out with hey 18% unemployment using previous statistical models for measurement, they would be soon joining the unemployment ranks! It’s like asking for an honest and realistic corporate sales press release. What without FIRE, what’s left? entertainment and tech both outsource heavily….

Can you calculate the amount of people in the U-6 that have multiple part time jobs or just one part time job, because they then might be making equivalent pay minus the benefits of health insurance and things of that nature? That would then give us a better picture of how many people are mis-employed compared to not employed at all.

From the last peak of unemployment in the early 80s (in Canada) we have far more self-employed people. From homebuilding to massage therapists, people are independant contractors who are not eligible for unemployment insurance. For the most part these people will still have some income but many will probably have trouble covering their expenses.

Doc, thank you as always for the info. One comment, California is an “at will” state, meaning companies can and do terminate people instead of laying them off. They thereby avoid having to pay any severance or unemployment benefits. I’ve heard this is rampant in the bay area. These number do not show up as layoffs as far as I know. I wonder what a “U-7” number would be that includes these terminations that are illegal in other states but legal in CA due to past lobbying in Sacramento.

Yes, it looks like the Greatest Depression is happening right before our eyes. We gotta be vigilant and PAY ATTENTION and do something about it. The ‘powers that be’ will not help us.

As I posted before many neighborhoods show few signs of Depression era unemployment in the San Francisco Bay Area. For example I-680 corridor– Walnut Creek, Alamo, Danville, San Ramon, Pleasanton still has real estate priced at 6 times median income. Just recently a smallish house went on sale in my neighborhood at 7 times median income (since lowed by 9%). But according to Zillow, houses have sold in the last few months in my neighborhood at 6 times median. The mall parking lots are full, and I don’t see closed up store fronts in any of the malls. Tradesmen still get top dollar for their services– go ahead try and get a plumber for less than $90 per hour. Car dealers insist on way over invoice price. Go ahead get Internet bids on a Honda or Toyota from East Bay dealer, and you will be astounded at how little they discount. I see no drop in prices at the grocery store from July 2008. I-680 and I-580 are still choked with traffic after 3 pm. Hard to believe that 1 in 5 people in this area are unemployed or under employed. There continues to be a disconnect between officia statistics and common experience at least in certain areas.

Being an “at will” state means you can terminate someone for any reason.

It does NOT mean that you can avoid paying unemployment. The State of CA. decides who gets unemployment, NOT the employer.

I ran a business for many years, and 2 people that I terminated collected unemployment, despite the circumstances.

Obama and others are fond of saying that credit is the “lifeblood” of the economy, but it seems to me that savings are the lifeblood of the economy. If people save, the credit follows. Our nation’s problem is that we have had credit without it being based on our savings. And that is why so many people are one month, or two weeks, from disaster. They talk about the need for credit for businesses to make payroll. I thought you were supposed to make payroll from profits saved from the past. Our problem is not, fundamentally, too little credit. It’s too little savings and too much debt. We do not have a credit crisis, we have a debt crisis

Bubba, I’m no expert, but I am a California resident. As far as I know, if you terminate an employee (other than for specific causes such as theft, insubordination, etc.) they are eligible for unemployment. I think you have some bad information there.

great post…i think you took the conservative calc on u6 and that clearly is why it feels so painful with only “10% ish” unemployment….next year’s budget deficit for California will only protract the recovery as services and jobs continue to get cut

Dr.H, Great idea, publishing a monthly State U-6 unemployment rate. Why?

1. Federal gov’t too big

2. Federal gov’t no longer represents the citizens.

3. USA debt a black hole

4. USA growth and profit sucked into this debt hole @ an acelerated rate.

5. Debt will have to be repudiated at some point in time.

6. States most likely will try to seperate themselves from the federal gov’t to save themselves.

7. States/Tribes can best represent its constituents in times of hardship and chaos.

R HB, Thanks again for the dose of reality among all the government spin and media hype. It is obvious to the public, things are much worse than we are led to believe. What strikes me the most is, with 2 income families, the chance of financial catastrophe is twice as great in this downturn. My guess is many are barely making their bills and worried sick about losing 1 or even 2 jobs. We are in the next phase of this recession which is job loss. All the damage so far has been by toxic mortgages. With job loss getting into full swing, ALT-A and Option Arms getting ready to explode, and a state budget teetering, California is ready to take a huge hit in real estate prices. Why else would the govt be resorting to such drastic measures as they are now. They are hawking our future by printing gobs of money with hyperinflation, in HOPES of soving problems now. Their record speaks for itself.

Very few houses now moving on the Westside. Santa Monica had a total of 5 houses sell last month. Other areas are in the single digits now, as the real estate market grinds to a halt.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

I agree with A. Zarkov. I cross the whole city every work day and I’m not seeing any signs of economic despair. Instead, I’m seeing the opposite. I’m seeing more fancy cars with paper plates on the road, and increasing traffic levels. When I go out on weekends the stores are still packed and people are buying. The housing prices along the Santa Monica Mountains and the coast have not yet “appeared” to drop by any significant amounts, and the cool-aid drinking is in full effect. I’m not even sure at this point it the coming Alt-A mess is really going to effect much. Maybe we just have to wait longer to see the wheels in motion, or maybe the bailouts will work (I doubt it based on every ounce of reason I have), but gravity seems to be broken.

I’d say this is just one of the last “hold-outs”, but I was in central NJ recently and saw the same thing. I feel that there is a disconnect somewhere. Maybe it’s all in my individual perception, but things don’t “feel” like what the good Dr. and the better news outlets keep reporting. On paper it all makes sense, but on the streets it’s not visible, or maybe just not “yet”.

Either way, this site has been a Godsend and I love the work you do here. Keep it up!

@Comrade Stan,

I totally agree with your point on credit. It is the crack drug of our modern economy. When pols say that we need to get the banks lending again, what they are really saying is we desperately need that next hit of crack. Oh and by the way, what does it say about our economic situation when every bazooka (thanks Hanky) has been fired and people are still not lending or borrowing, it might occur to us that we are in an Oh $hit moment. We have directed trillions of dollars to find that last hit of crack and it is not to be. I would differ from you in one small but significant way, we are not in a credit or debt crisis, we are in a solvency crisis. Pumping more dollars into the system will make getting out of this more difficult and every day that passes without understanding this is a day getting deeper in the hole. No Democrat or Republican in Washington (other than Ron Paul) gets this. Does it strike anyone else besides me as hypocritical that the pols are blaming Wall St. for reckless financial management when they are doing the same thing themselves but on a scale never before seen in history? It’s enough to make our Chinese lenders ask serious questions in public. Imagine what they are saying behind closed doors. The final act of this Greek Tragedy will be pretty.

Be brave Comrades!

Update on the retail economy of the CA I-680 Corridor.

I noticed that the house with an asking price of 6 x median area income has a “sale pend sign.” If the sale goes through it will have sold after about a month on the market. The 9% price reduction caused it sell. But it’s still over priced considering the cost of renting and the price to income measures. There is nothing special about this house– 2000 square foot, small lot. The interior has been updated but the sellers about a 1/3 or what they are asking. They bought in 2002.

Today I went to the Hacienda shopping mall off I-580 near Pleasanton. Parking lot was at least 90% full. The clerk at Bed, Bath and Beyond said business was very good. They have been extremely busy and no sales decline since July 2008. None of the stores in the mall are closed. The Starbucks coffee ship is full of customers.

Again my personal experiences belie the official statistics. Either this area is exceptional, or there is something misleading about a U6= 19.1%– a Great Depression era rate of unemployment. BTW I can’t get a better deal on a new car in the Mendocino County area of CA either. In fact their prices are way above the Bay Area.

If someone tells you that the Black Plague has swept through town, then you should be able to see some bodies.

Very interesting… Where can I find the U-6 for my state UTAH? I would love to see the real numbers, as you pointed out that will give the realistic perspective. I think the underlying problem we are all facing is in your last couple paragraphs. If people don’t have jobs, and can’t pay their bills, or if they are one pay check away from financial devastation… How in the world do we think the housing industry will turn around without fixing this problem first? Do I think you are too pessimistic? I am a believer in positive news where it is due. I don’t think it does us any good to be doom and gloom all the time, however to fix a problem we need to be able to acknowledge that it is a problem first. The goal is to recover and move forward and not make the same pitfalls as we have in the past…..

I agree, in Coronado CA you would never know there are signs of a depression. Prices for houses are still way over the top. Stores are packed, people are eating out. Boats are out on the bay. It would be nice to see housing prices drop, we were the few who held out and rented.

The Bay area is in a different world. 25% of the venture capital in the US usually ended/ends up there. The same with LA, different world. Is there a Hollywood in any other town? Cars: My friend just bought a 2006 Mercedes 430 CLK convertible, great shape, clean title for $13K from a car broker. It blue books at $37K. Call a car broker in San Diego, they need to work. Try Dixon.

U-3 vs U-6: We have to use U-6 if we want to compare where we are to The Great Depression. Isn’t that what we are all concerned about? The Greatest Depression fueled by the greatest credit accellerant in history? Where are the jobs that are going to change this situation, this continuing downward situation?

Where are the jobs created with $700BB and then $800BB thefts? Hoover Dam? Solar panels on every building that wants one in America? New manufacturing and construction jobs?

The US government cannot pay its bills. The lender to the government is buying its own debt back so the US government can “function” and owe more debt. “Quantitative Easing” they are calling it. In real terms it is the devaluation of the currency. Debt to borrow more debt. “Hyperinflation” because the dollar is worth less, or worthless depending on how far.

Interesting numbers out today on home sales from NAR. As I predicted in my post on the March 19th blog, this prime sales season (spring-summer) is looking to be a bit stronger than last driven mostly by significant drops in price. However, I predict sales will still lag the last 8 years making it the 2nd worst sales year this decade. The bottom callers will ignore this fact and tell us the end is in sight. Stick with the good doctor to shine the light on this mirage. Remember that bear market rallies are common and that complete capitulation doesn’t come on the first try (ala 1929 vs. 1934). In this case, patience will pay off big time.

Be brave Comrades!

I think the explanation for the overpriced houses, expensive car-buying, and mall shopping that still is prevalent is all the crazy money that was made by people attached to real estate in the last 8 years. It’s going to take a while for all that money to work its way through the system. Acquaintances who made money in real estate (either on the loan side or the sales side, plus the housing flippers) were making pretty big money like 300K+. All those folks still have a lot of money to spend, and they’re spending (flaunting?) it. Nevertheless, I think gradually it will wind down, because there won’t be the same big money coming in to replace it. Eventually the tight-lending standards will force house prices down because the regular middle-class couples making combined salaries of 80K won’t be able to buy the half-mill houses, and slowly-but-surely it’ll force the higher-priced ones down too.

(DOW up ~500)

I guess when your inner tube is going over the falls, you might has well give it the best ride that you can. Evidently the investment community doesn’t want to miss the bear-market rally. I suppose that just making infinite amounts of federal reserve phantom notes is the answer to all problems and that there will be no repercussions. We have forced the world’s hand, and the world knows that we are too big to fail. En Espanol: Muy MAL (Mutually Assured Lunacy). Everyone knows not a dime of this will ever be paid back–we must keep printing and borrowing from now on. It’s just the greatest Ponzi scheme of all time: Buy new 10 & 30 years or the crap you’re holding now will fail. The can seems to have been successfully kicked down the road another few months. Sublime, Optical-Illusion Arms and Alt-Ape mortgages along with Mark-to-Mirage coming back? Is there really another option at this point? Maybe this is the only way to play this hand…

Comment by Bubba

March 21st, 2009 at 5:17 pm

Doc, thank you as always for the info. One comment, California is an “at will†state, meaning companies can and do terminate people instead of laying them off. They thereby avoid having to pay any severance or unemployment benefits. I’ve heard this is rampant in the bay area. These number do not show up as layoffs as far as I know. I wonder what a “U-7″ number would be that includes these terminations that are illegal in other states but legal in CA due to past lobbying in Sacramento.

___

Oh dear ….where to start….so much of this is simply DEAD WRONG!

(1) At will employment is NOT ILLEGAL in any state in the US. Without a written employment contract, under Federal law an employer can fire any employee for any reason they want so long as it is not because of the employee’s race, age, religion, sex, national origin, physical or mental handicap unrelated to the ability to perform the job, or union activity or use of FMLA. A few states add things like marital status or weight. BTW, a written employment contract can be an individual contract or collective bargaining contract (unions) or, in some states under certain conditions, an employee handbook issued by the employer.

>>>>

(2) NO state or federal law requires the payment of severance.

>>>>

(3) If a person is an employee -as opposed to an independent contractor or leased employee – 99.99999% of the time their employer has to pay into unemployment, If the “employee” is discharged – and not discharged for ’cause’ such as theft or tardiness or performance- they will qualify for unemployment if they have worked enough time.

>>>>

(4) The phrase ‘layoff” in employment law and labor economics means that the employer ceased the employee’s work activities temporarily and the both the employer and employee expect that the employee will be recalled to his job when work picks up. Layoff is a cessation of employment with the expectation of recall.

>>>

The phrase “termination” in employment law and labor economics means to end the employment relationship and there is NO expectation of recall.

>>

(5) In the unemployment data the unemployed are classified by the reason for the unemployment. The classes are :

(a) Job loser – Terminated (see definition above)

(b) Job Loser – Laid off (see definition above)

(c) Job leaver – those who quit a job before finding a new one and who are weeking work

(d) Re-entrant – those who have been out of the workforce and had an interruption in their job seeking acitivites.

(e) New entrant – first-time job seeker.

>>>

>>>>

(6) Neither the U-3, nor U-6 or other similar data from the BLS is based solely upon the filings for unemployment.

>>

(And I practiced labor and employment law for over 25 years……)

Those who are still enjoying the tickle from the bubble in the I-680 corridor, Santa Monica, etc. will soon understand what the rest of us of do. This sinkhole is growing.

I had a lawyer friend from Sarajevo. She said when they heard about the massacres in the suburbs, they could´not believe it. They thought it was an exaggeration or because those country people were soooo unsophisticated. No one prepared for what they could not believe was happening. Until the shootings were on their streets and educated sophisticated people were running for their lives as refugees.

The strongest economy in the world collapsing. Impossible. Those people losing their homes must have been “subprime”.

Leave a Reply to latesummer2009