U.S. Dollar Index and Real Estate: Foreigners Buy Commercial Real Estate not run down Residential Properties. The March S&P 500 and USD Correlation. Phase Two of the Crisis.

You wouldn’t know it by listening to current headlines but the economy in March was inching closer and closer to its own zero bound. Since that time the market has put together one of the fiercest rallies in U.S. history. We would have to go back to the Great Depression to find a similar rally. There are wildcard factors at play right now. The U.S. dollar is inching closer to the lows of 2008. The stock market is getting closer to the pre-Lehman Brothers days. The U.S. Treasury and Federal Reserve have put together a ragtag package of bailouts that have no historical precedent. We should expect the unexpected in the path ahead.

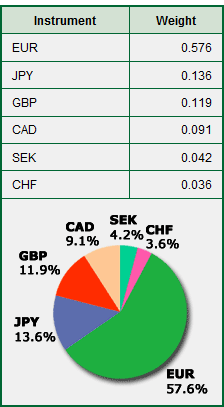

One issue rarely talked about is how the weak dollar is going to impact foreigners buying real estate. For the most part, I’m not sure how much of an impact this will have on residential real estate.  With commercial real estate we may see a good amount of buying if the dollar continues to get pounded. Yet it is important to look at what currencies make up the U.S. dollar index:

Source:Â Akmos

By far the largest weighted currency is the Euro. Yet many of the countries within the basket that make up the U.S. dollar index are facing their own demons. That is why I am hesitant to think the dollar will simply fly off a cliff while every other currency goes up and foreigners suddenly get an urge to buy up every Real Home of Genius on every corner of America.

What is fascinating is how connected the U.S. dollar and stock market have become. I was unable to find charts that overlay the S&P 500 and the U.S. dollar index so I matched them up to give you a clear perspective of what is occurring:

As the chart above highlights, the dollar had been falling hard for all of 2007. When the market peaked late in 2007, both the dollar and stock market fell in the U.S. This was the brief period of decoupling or belief in this misguided notion. This lasted until the dollar bottomed out at 70 in early 2008. But after that, the world re-coupled and the U.S. dollar soared up until the March 2009 stock market low. For this period, the stock market was tanking but the U.S dollar was going up. To twist your mind further, since the March low the stock market has moved lockstep in opposite directions from the dollar. It is a near perfect match!

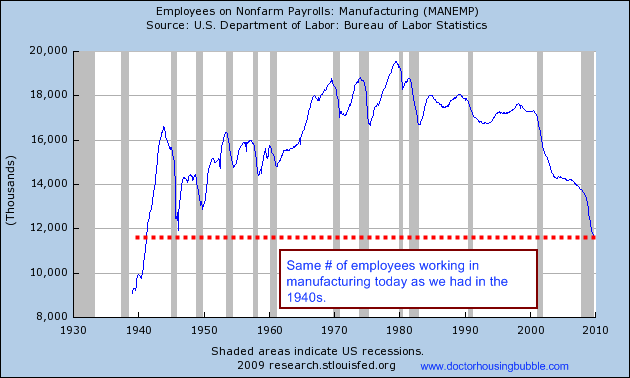

Unfortunately the U.S. Treasury and Federal Reserve are doing everything they can to damage the dollar. In fact, the only reason real estate isn’t correcting faster is because of the artificial money being pumped into the system. Forget about jobs (26 million Americans are unemployed or underemployed). Ignore manufacturing:

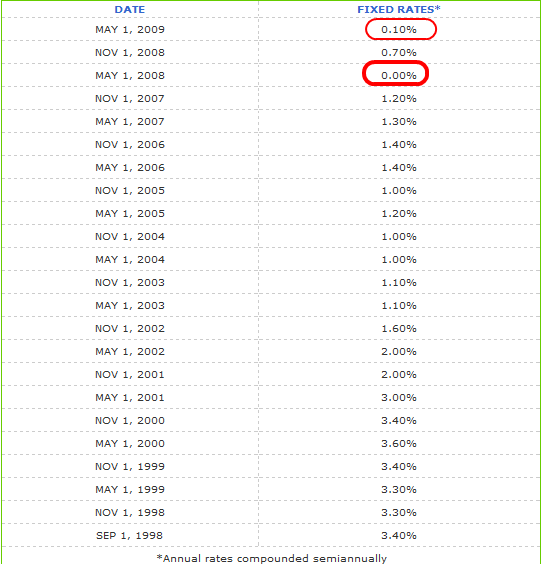

Right now the market is one giant easy money casino. In fact, saving money is now on par to stuffing it into your mattress. For example, let me tell you about U.S. Saving I-Bonds. I’ve bought a few of these in the past as additional diversification to my investment portfolio. The idea with I-bonds is they will keep up with inflation and pay a fixed rate. Well over time, that fixed rate has slowly disappeared:

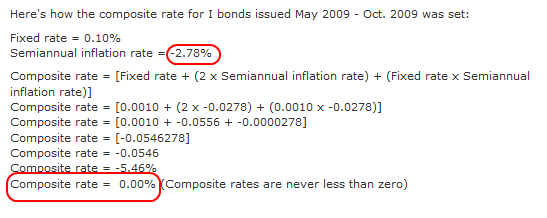

Okay, well at least we have the compounded inflation rate right?

That’s right! The CPI had deflation. So for the first time ever the I-bonds are now paying the awesome rate of 0.00%. Bwahahaha! The U.S. Treasury issues these products. If they really wanted Americans to save they could up the fixed rate. Instead, they cut the amount of these you can buy to $5,000 a year from the previous $30,000 a year and then make the rate so unattractive that putting money in your shoes seems like a wise investment move. Get the hint? They don’t want you to save. They want you to blow every penny you have on cars, homes, and every other consumer hamster gimmick you can think of. Only problem, the consumer hamster is reaching retirement and is loaded up with Prozac and Red Bull and is about to collapse.

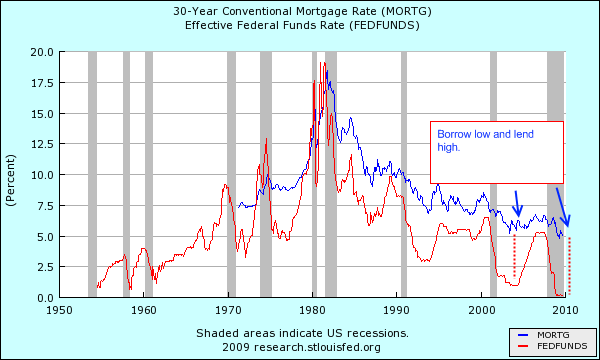

I would show you the big bank savings rate but suffice it to say they are offering basically 0 percent. However, banks are now making good dough on the difference between what they borrow and what they lend even with historically low mortgage rates:

Thanks to the trillions in taxpayer subsidies, banks are able to borrow for virtually zero and lend out at much higher rates. So any rate above zero is a gain. And since banks can now be picky regarding customers, they are experiencing some crazy yields. If you want an idea why banks made enormous profits this decade just look at the Fed funds rate. Yet this is now all coming at a cost. The U.S. dollar has lost over 40 percent of its value since 2002. How this will play out in housing will be interesting to see.

The U.S. Treasury and Federal Reserve seem to want an outcome that does the following:

a. Slowly devalues the dollar

b. Encourages home buying and selling putting a floor on prices

c. Reviving the financial and real estate industries

d. Back to happy days

I doubt that is going to happen. So much focus has been devoted for 21 months since the recession started on the banking industry bailouts that I think the Fed and U.S. government have forgotten that you need good paying jobs to make a sustainable economy. It is interesting to follow the rhetoric of Fed officials about pulling stimulus out of the market. They claim success but for who? Sure banks and their profits are back up but has the economy fundamentally corrected? It just shows you how out of touch they are with those on the ground.

With commercial real estate and Alt-A and option ARMs coming on stage in 2010 in a big way, I still think we haven’t seen the end of this recession. Technically we may be out of it already but that is because of the massive stimulus juice. We are assured a double-dip with the trillions in bad debt still on the books. If you travel the country you will find some strip malls that are simply empty. Some newly build CRE has never been occupied. Will it ever? Those loses are still coming forward.

One of the many unintended consequences of the U.S. Treasury and Federal Reserve is falling rents created by the $8,000 tax credit, rising unemployment, and problems with CRE. For example, many failed condo conversion projects are simply going back to being apartments thus adding inventory to the already saturated market. Also, many people are consolidating households to make ends meet. Given that owner’s equivalent of rent is the biggest component in the CPI, we may see additional pressure on the downside here. In other words, the needed inflation won’t show up in the data. Let us watch this closely because the reporting agencies might try to play fast and loose with the data here.

With lower rents there is less incentive to buy in today’s market. You need to remember that over 40 years of data shows us an average 30 year mortgage rate of 9 percent or nearly twice as high as the current rate. You might be able to buy that home at the low rate with massive tax credits but what happens when you sell in 3, 5, or 7 years? You think the Fed can keep rates this low with the coming baby boomers drawing like crazy on Social Security, Medicare, and other entitlements? Just saying, but zero percent seems awfully low for all that risk.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

15 Responses to “U.S. Dollar Index and Real Estate: Foreigners Buy Commercial Real Estate not run down Residential Properties. The March S&P 500 and USD Correlation. Phase Two of the Crisis.”

An excellent article! It’s very useful to see the fed funds rate on the same chart as the mortgage rates.

Dr. Bubble, taking into account that the US is headed to hell in a handbasket in terms of future economic growth (real growth), why would anyone want to buy up US real estate, commercial or not. Are you referring to city center commercial properties? Because that is the only segment of commercial real estate that would be worth buying as the suburbs were financed with debt and are now going broke one by one. It would be great to hear from you.

Thanks and keep up the good work!

Interest can stay low as long as the gov’t wants. They can and have been buying MBS and T-bills to keep rates low. If not for the gov’t buying debt, mortgage rates would probably start at 10% for prime borrowers putting 20% down. I wouldn’t make a real estate loan for under 10% to anyone for anything.

The gov’t wants the USD to plummet. At least the US gov’t does. No foreign gov’ts want this, but since the US is who creates USD, they have an advantage.

The actions of the government has created another bubble in Portland, Ore.

You virtually can not find any house under $300,000., even tiny homes,even in the worst areas (yes, Portland does have bad areas, despite it’s much hyped “liveability”.

First time buyers credit, low interest rates, and FHA low down payment programs have distorted this market all out of shape. If the buyers credit is extended, and increased,(a likely scenerio), this will just extend the bubble, with no real substance to it.

For young, recession offers deals of a lifetime

http://news.yahoo.com/s/ap/20091005/ap_on_bi_ge/us_meltdown_generation_gap

NEW YORK – The Great Recession has turned into the best of times for young investor Daniel Lee.

Early this year, the 30-year-old salesman in Scottsdale, Ariz., shelved expensive meals and vacation plans and threw “every spare dollar” into the stock market. The value of his portfolio has more than tripled as the market has rallied since March.

“This is like buying a swim suit in the fall or a winter jacket in the spring,” he says. “Get in while it’s a good deal.”

(more at link)

——————————————————————————————————————

Maybe I’m too cynical, but reading DoctorHousingBubble for the past few years makes me think these kids may just be tomorrows big losers. I can’t see how being saddled with student loan payments new mortgages and new car payments are something to be envied in this economic climate. I hope that kid knows when to get out of the market, too….

gael: Wow, since when has 30 yrs old been considered a ‘kid’? That’s pretty telling of your age and bitterness because your quote didn’t mention anything about having student loans or a new mortgage. It does seem he has done the wise thing by putting it in the stock market short term.

“Just saying, but zero percent seems awfully low for all that risk.” What risk? We’ll just print some money. It will not cause inflation. as a matter of fact, it will prevent deflation. And destroying the American dollar will just make our exports cheaper, so more Americans will be able to get jobs. I am now ready to be a banker.

@ Sigma:

I’m only a few years older, but it might illustrate my bitterness. The guy in the market is a disaster waiting to happen. And yes, if you read the whole article it does mention student loans.

“The unemployment rate for workers ages 20 to 24 jumped to 14.9 percent in September, up from 10.8 percent in the same month a year ago. Unemployment for those 25 to 34 is 10.6 percent, almost a point above the rate of 9.8 percent for people of all ages.

And the skyrocketing cost of undergraduate education means graduating seniors who borrowed money for tuition enter the work force with an average of $23,118 in student-loan debt, according to the Department of Education. About 65 percent of students take out a loan to finance their education. ”

But of course you need to know how to read the entire article. 😉

I think before any meaningful recovery in real estate prices can take root, we need to overcome three major obstacles…

“Rebound Obstacle #1: Inventory Glut. Nearly 10% of all homes built this decade are sitting vacant, compared to a historical average of 2.2%. In total, we’re sitting on almost 10 months worth of inventory versus a historical average of four months.

Rebound Obstacle #2: Loan Resets. Forget subprime. We’ve already worked through 80% of those resets and written down $1.47 trillion in the process. Now we’re facing a $2.5 trillion mountain of Alt-A loan resets. The first big wave hits mid-2011, with the peak expected to come in early 2013.

Rebound Obstacle #3: Foreclosures. One in four homeowners are now underwater. If we break it out by loan type the picture gets worse – 25% of prime loans, 45% of Alt-A loans, 50% of subprime loans are severely underwater. Add in the 6.5 million Americans out of work since the recession began and it doesn’t take an Einstein to predict where foreclosures are heading.â€

http://www.housingnewslive.com/articles/reasons-housing-market-going-down.php

Foreclosures mark pace of enduring U.S. housing crisis U.S. Reuters

MIAMI (Reuters) – Every 13 seconds in America, there is another foreclosure filing.

That’s the rhythm of a crisis that threatens to choke off hopes for a recovery in the U.S. housing market as it destroys hundreds of billions of dollars in property values a year.

There are more than 6,600 home foreclosure filings per day, according to the Center for Responsible Lending, a nonpartisan watchdog group based in Durham, North Carolina. With nearly two million already this year, the flood of foreclosures shows no sign of abating any time soon.

—

…mortgage delinquencies continue to rise. And that adds risk to any relatively upbeat assessment, since foreclosures depress the value of nearby properties while eroding the net worth of homeowners and the tax base for communities nationwide.

The Center for Responsible Lending says foreclosures are on track to wipe out $502 billion in property values this year.

That spillover effect from foreclosures is one reason why Celia Chen of Moody’s Economy.com says nationwide home prices won’t regain the peak levels they reached in 2006 until 2020.

In states hardest-hit by the housing bust, like Florida and California, the rebound will take until 2030, Chen predicted.

The big picture is that our system does not work long-term. It is an anti-algorithm: In the short-term we appear to have prosperity. In the long-term we have un-serviceable debt. Like any Ponzi scheme, it works well for a season. The summer of love is over, the leaves are falling, and the Kontradieff winter is closing in. Even a student of the Depression can’t stop it. Most of us will survive though, just maybe with less bling and designer everything. If we can just avoid WW-III, it’ll be OK.

Got rum?

Thanks to Dr. HBB I am still going to sit tight until 2011. I’m starting off, so I want to buy (can only afford to buy) in a rather ho- hum suburb of the LA airport called Hawthorne. Parts of Inglewood or Lawndale are also an option for me. Prices have almost Halved (500k to 250k) from the peak in some neighborhoods, and everybody I know has gotten the itch to just go out and buy. Several are going through with it. They think I’m crazy when I tell them houses may still get even “cheaper”. I find myself having to read this blog twice a day just to keep from getting the stupid itch myself. After we’ve all been conditioned for years to accept ridiculously high price tags for housing, it is hard to grasp that $250,000 can really still be an OUTRAGEOUS amount in some cases, considering what your getting…1000sf, maybe? So, my question is, if all these Alt-A foreclosures and similar waves all do really do come to fruition, does that mean fairly decent houses in Non-Compton Southern California will be sold in the mid 100,000’s? Or will demand simply create a floor at the 2’s, as I believe is happening today? Those prices would be incredible in So Cal, but my suspicion is still that the lousy Gov’t WILL somehow, someway stop the “RE carnage” at today’s levels, and force my Generation into debt servitude “whether we like it or not”.

Another Great article MD Bubble…

In fact it is so great at illustrating the situation, I don’t know how anyone can think inflation is not a major concern.

This nation imports nearly half of its oil. Imports just about everything we use in our daily lives and with a weak dollar, those things become more expensive.

I agree that the downside to the dollar is limited because the other world currencies aren’t exactly in great shape either, but it will fall, perhaps to 60 to 65 on the dollar index.

In conjunction with the u.s. government printing money to pay its bills and to pay the unemployed and to pay retirees and to pay for those “too big to fail” and to pay for the cost of being the worlds policeman and to pay for the cost of everyday government, deflation is a myth.

As the dollar continues to fall and interest remain near zero foreign holders will buy less new dollars (that’s all that needs to happen to create a dollar collapse) or God forbid, actually start selling their holdings, those dollars that use to be soaked up will add to inflationary pressures.

I have no doubt some prices are declining but the only prices that are declining were things involved in bubbles, specifically housing. And things made in Asia are declining due to massive excess capacities.

Those two categories are temporary in price declines.

Any good or service made here in the u.s. is still increasing, the easiest to illustrate is health care. How about insurance? Your food bill? Banking costs? Credit card fees? Barber/Hairdresser? Pet Sitter? Car repair?

The Fed is at war with savers and will bail out debtors (especially the Federal Government) at all costs.

If the Fed actually wanted inflation what would they tell the public and the financial markets? It would seem to me the best thing they could say is “We need to be concerned about deflation so we need to print. If we are lucky we will succeed in stopping deflation and create a steady inflation rate of 1 to 2%”.

I don’t think the Fed would every say, “Our Countrymen are in debt to Foreigners and our economy is suffocating from this debt. We will do our best to create an inflationary event that will inflate 65 to 75% of real debt away. The Central Bank will do this in an orderly fashion so that a moderate rate of inflation of 5 to 6% over 10 years will achieve this. Those Americans with savings or holding debt instruments will need to suffer for the good of our SpendThrift Countrymen”.

Even the FAKE CPI that always understates inflation will be able to hide the inflation that is coming. By the end of next year there will be no doubt in anyones minds that you can’t just print money endlessly.

By the time people realise inflation is here, places to park your wealth will have become exceedingly expensive.

A Guided Tour Of NYC Commercial Real Estate Wreckage

http://www.businessinsider.com/a-guided-tour-of-nyc-commercial-real-estate-wreckage-video-2009-10

Embedded five minute PBS NewsHour video clip is worth viewing. One featured office building sold for $1.7 billon in 2007, and again recently for around $600 million……..

The speculation in the market is that, situation has hit the bottom and the market will now begin to trend upwards again. The best Solution to gain from this crunch is, you should make an offer way below the current market value & you have to buy the property for much less than it is currently worth. Real estate investment should always be seen as a long term investment which will surely provide capital gains in terms of appreciation over a period of time. Here’s one such tool which will help you to determine if a property is a good investment. It’s a smart real estate rating engine that provides a lot of information & insight for making a safe real estate investment and can help produce positive cash flow for you. Look into http://www.smartzip.com/info/score

Here’s my 2 cents. Dropping dollar means your exports drop in price. This is an opportunity to rebuild manufacturing. Dropping dollar means interest rates go up, this means housing prices will go down again, or inflation everywhere else brings everything else up to match. Canadians have been living with a lousy dollar since the separatists got elected in Quebec almost 30 years ago, the new CSB rate is a towering 0.4%!

Leave a Reply to FYI