Two 400+ Point Days in Two-Weeks: Why this is Horrible News for Housing. Volcker and Protecting your Mac.

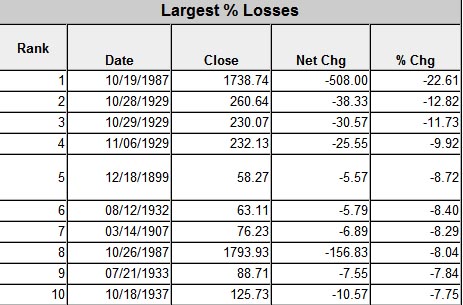

So much for the 420-point rally. The euphoria only lasted one day and volatility is going haywire in every market including a massive sell off in commodities. So much for juicing the credit markets with another rate cut. I’ve been seeing an argument being thrown around that having two 400+ point days in two consecutive weeks is good. Unfortunately, we are still hovering near yearly lows and we are nowhere close to the peak of 14,198. Volatility as we are seeing in the current market is significant in telling us that the market is not doing well. Aside from perma-bull thinking that we are hitting support levels, we need only look at yes, the Great Depression to show us that in the worst economic markets we see the fiercest single up and down days. Take a look at the most significant one day gains and losses as a percentage of the total market for the DOW:

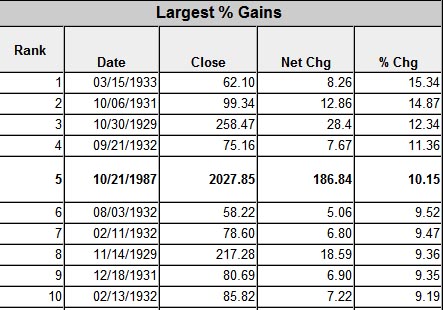

If we are simply to look at the data, we realize that six of the top ten single down days for the DOW occurred during the Great Depression. We also have the panic of 1907 and of course the largest one day drop in 1987. There is a reason that they say the bigger they are, the harder they fall. Let us now look at the largest single day gains:

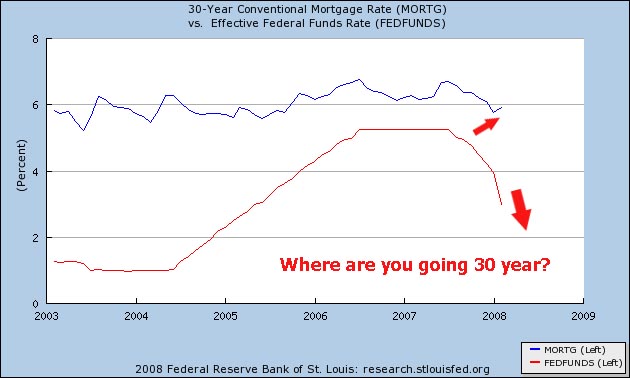

Amazingly, the most positive single day DOW gains occurred during the Great Depression. In fact, nine out of the top ten single day gains occurred during this era. Obviously having major up and down days is not exactly a sign of confidence or a rosy red economy. In fact, it only tells us that the market is still unsure of itself like a self-conscious teenager. You’ll also notice that the Great Depression didn’t happen overnight but slowly unfolded over four painful market years. Many are now whispering that we may have our own lost decade like Japan. After all, we are looking more and more like we are approaching a zero interest rate policy. The incredible irony of this is that as the Fed has chopped rates to the ground, mortgage rates are barely moving. Take a look at the following graph that has the 3o-year mortgage rate plotted in relation to the Federal Funds Rates:

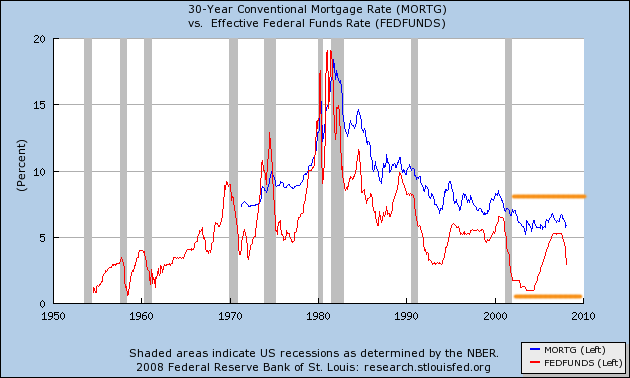

You’ll also notice on the converse that rates barely moved as the Fed raised rates. Why is this? Well for one, you need to remember that the massive excess that occurred in the market during this decade was not necessarily in conventional mortgages but sub-prime, jumbos, and adjustable rate mortgages that did not track or did not have any impact from the Fed funds rate. Now, there has never been a direct linkage between these two items but historically a correlation has existed between these two items, that is until this housing bubble:

You’ll notice this pattern rather clearly above except for the start of this decade. During this time, the 30-year rate has been stable while the Fed funds rate looks like a Magic Mountain rollercoaster. And in reality, this matters very little since many people were using unconventional financing to prime this housing market. There came a point in August of 2005 where 70+ percent of all homes in California were financed with adjustable rate mortgages. So why care about this rate now? It seems from multiple sources that the next push will be to look at Fannie Mae and Freddie Mac to pick up the slack in the housing market. Today, the capital reserve requirements were dropped on both of the GSEs and should allow them to pick up the slack on $200 billion worth of mortgages. Yet if you read between the lines, what they are also saying is that the Fed has proven completely impotent in helping this market. In fact, all they have done is put the seeds for future inflation into the ground and also, have kicked the dollar in the gonads and for what?

Paul Volcker and Charlie Rose Saving The Economy and his Mac

Things are getting downright dirty in the economy. On Monday, Charlie Rose interviewed former Fed Chairman Paul Volcker. The interview is online at the Wall Street Journal Economics Blog:

*Click to watch full interview

Here is an exchange from the interview:

“Volcker: We’ve seen the Federal Reserve take more extreme measures in some respects than any that have been taken in the past to deal with a financial crisis, which raises some real questions about not only for the Federal Reserve and its authorities, but for the structure of the financial system… The Federal Reserve is designed to lend to banks. And the banks were considered to be at the center of the financial system, and lend liquidity, provide cash in return for good assets, when a bank got in trouble. Now they found in this case, where some of the investment houses were in trouble, and prototypically Bear Stearns … it’s lightly regulated by the SEC or some other, but not for the same reasons. They haven’t got the concern over the stability of those things….We’re going to lend to them and protect them, shouldn’t they be regulated?

Rose: Is it a wise precedent?

Volcker: Whether it’s wise or not depended upon how severe this crisis was and their judgment about the threat of demise of Bear Stearns. That’s a judgment they had to make and an understandable judgment. There is no question about it.”

In the interview, Mr. Volcker goes on to say that Fannie Mae and Freddie Mac need to step up to the plate. Keep in mind that this is no bubble blowing Greenspan or Bernanke; Paul Volcker jacked up rates to the moon to fight inflation and has been generally credited for reigning in inflation that was in the double-digits. In fact, many when recalling Volcker also remember restaurant menus with white stickers that were placed over old prices on a nearly monthly basis to adjust for prices. The interview is well worth your time and generally speaking, Mr. Volcker is optimistic about our economy but does see a soft patch hitting us. I think we have much more than a soft patch but I guess one doesn’t talk ill of their previous post especially when so much criticism has been leveled against the Fed, both rightfully and sometimes unjustly. Bernanke is no Volcker.

But did you notice something more ominous in the image above? Take a look at this;

Did Mr. Rose throw down with Mr. Paul Volcker after discussing the need for more aggressive rate cuts? Nope. It turns out that in a time of protecting assets, Mr. Rose did what any person would do. He sacrificed a little pain to save his MacBook Air:

“The host, whom Arrington says is a gadget-hound, was carrying his new MacBook Air, and thus he had a big decision to make: Protect his face, or the beautiful machine? In the split-second before he kissed the pavement, Rose chose to save the computer.

“In doing so, he pretty much hit the pavement face first, unfortunately,” producers told Arrington.

Producers say the MacBook Air was undamaged, save for the blood stains.”

Glad Charlie is all right since I really enjoy his show. For a moment there, I thought Paul and Charlie decided to take it to the street, the Wall Street.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

13 Responses to “Two 400+ Point Days in Two-Weeks: Why this is Horrible News for Housing. Volcker and Protecting your Mac.”

These “UP” days are suspicious. I am wondering how much of our tax dollars are being used to artificially prop up the stock market on certain days. Just as GMs stock has been propped up artificially. What happened to the free market?

http://www.lewrockwell.com/englund/englund40.html

erik markus – WHAT “free market”? There has not ever been a ‘free market’ economy in the recorded human history of any society over the tribal level. The Romans had tariffs and duties, and the government purchased, controlled and dispensed the grain supply. The Egyptians had tariffs, duties and what we would call ‘patents’ and monopolies authorized by the government, Medieval Europe had taxes and tariffs and guilds (authorized monopolies.) Ditto the Elizabethans. For example, if there really was a ‘free market’, there would be no such things as corporations which insulate the business owners from personal liability for bad decisions. The ‘free market’ concept has no more ever really existed than the same 18th century idea of the “Noble Savage” – and both originated around the same time.

See the doc’s Jiffy Popcorn Tin Hat post a few days back.

PPT = Plunge Protection Team. For some reason I get this image of Paulson and Bernanke holding a plunger standing over an overflowing toilet clogged with tangelo colored paper, water and filth up to their ankles already, desperately pumping but to no avail. Which one is Tom Hanks and which Shelley Long from “The Money Pit” I’m not sure.

Well AnnScott if you previous comments on GSE loan and MBS purchases are correct and there is not a third party involved I’d like to know how both FNM and the banks with the worst MBS portfolios can both be soaring on the stock market. FNM up another 12% today, Wamu up almost 20%, National City up over 16%, Countrywide 13%. Obviously investors in these banks believe that FNM will be taking the impaired loans off the banks balance sheets and that the Feds will not let FNM take a loss on them. If, 48 hours ago these loans, if rated triple A were fetching less than 60cents on the dollar, if it cost over 600 basis points to buy a CDS on Wamu debt what has happened since then to cause this euphoria if not a non market force. Did hundreds of thousands of delinquent mortgage recipients from CFC, Wamu, NCC etc march into those banks branch offices with checks and get current on their loans? Have property prices in Las Vegas, Riverside or , gawd sakes, Cleveland stopped sliding? Not that I or any buyer of these bank stocks can see. What has caused the sun to break through the gloomy skies over these stocks? Taxpayer dollars is my guess. I really don’t see how a subprime borrower can be repristinated into a prime borrower even if you cut the principal on his mortgage. He will still have a crummy house with no equity in it and his house will still be in a crummy neighborhood. The thing that induced most of these people to buy in the first place was not the need for a place to live. Everyone was living somewhere already. No, the lure was not owning a crummy house in a crummy neighborhood. The lure was the prospect of the house being worth 10 or 20% more next year. With that gone these folks are going to default on their loans no matter who owns it. Wamu,NCC, CFC or FNM. The difference is its off the banks books and on to ours.

I think that Mish (Michael Shedlock) has said that inflation is the expansion of money and.. credit.

* “Separately, the Fed said it will make $75 billion of Treasury securities available to big investment firms next week. Investment houses can bid on a slice of the securities at a Fed auction next Thursday; a second is set for April 3.

The Fed will allow investment firms to borrow up to $200 billion in safe Treasury securities by using some of their more risky investments as collateral. ” *

Well, that looks like an expansion of credit to me.

Things are going so well, that investment banks wasted no time in borrowing from the Fed:

Investment Firms Tap Fed for Billions

Now what’s to keep these firms from speculating in say, another bubble? Heck, don’t you wish you had access to funds at their rock bottom rates?

I’ve cogitated about this at the Mexican Cantina over dinner and even with a few margaritas to loosen up the old grey matter I am still having trouble getting my mind around some things. Now I don’t work in the banking, mortgage or real estate sales industry. Natural gas is what paid my mortgage. So can some of those with more expertise than I help me out. Fannie Mae and the banks are now loaded up with make believe money. I mean they didn’t have any last week but this week they do so they can lend me all I want to buy a new house or even let me take some equity out of the one I live in. But, and this is where I’m having trouble, don’t I have to some equity first. I mean if I owe $300,000 on my house and I want to refinance my house has to be worth at least $300,000 or more? So how does all this new liquidity help those in most distress, i.e., the people who got mortgages in the past 2 or 3 years who have no equity or even negative equity? I might be able to get the best refinancing terms in history but I have to be able to get out of my current loan don’t I? Now property prices in much of the country have been declining. Oh there are few places where that isn’t true. North

Dakota is doing well I understand owing to high wheat prices and some Golden Ghettos haven’t noticed a thing but most places have had a bit of decline and those areas in most distress significant falls in property prices. So how are the people in these areas who bought during the bubble expected to qualify for this new mortgage bonanza? Obviously the RHG folks are beyond upside down. They reside at the bottom of the Grand Canyon. Even the more sensible Centex

Home new suburb are sitting in a pretty deep arroyo. If you’ve bought a house in the last 2 or 3 years even in a sensible neighborhood with less than 10% down your chances of being able to refi without a major cash input seem pretty dim. So, what am I missing. How do we move those who need to refi to better terms into a position where they can take advantage of them and gin up real estate sales to help the banks that are holding on these loans?

@Scott

Well, for what it’s worth, my view on the alphabet soup and the flushing of money into the system serves 2 purposes. 1, it provides the banks and IB’s the opportunity to shore up their balance sheets. 2, more importantly, it gives the APPEARANCE that ‘something is being done’. Re-establishing confidence is the true aim of all these measures. Market psychology is crucial for any downturn – or uptick. And if the PPT can somehow manage to sway psychology that, as Punk Ziegel’s Bove proclaimed the other day, we’re at the bottom now…. then, they hope, people will start buying and the asset decline will have halted.

@bw – Mish is a deflashionista. The swap for toxic MBS for securities is NOT expansion – he posted something on this in the last week. If the Fed exceeds the $709B in treasuries – then you’ll see expansion. But I’m no expert – you may have to lob him an email.

I’m working on a story for the L.A. Times on the use of California Props. 60 and 90, which allow homeowners over age 55 a one-time opportunity to transfer their existing property tax base to a new property of the same or lesser value, and I’m looking for people to interview.

In the case of Prop. 60, the law covers property within the same county. In the case of Prop. 90, although the law in theory allows homeowners to transfer their existing tax base to another California county, since each county gets to choose if they want to participate, only a few actually do so (including several in Southern California).

But for those who want to use this law to move to the counties of Riverside (i.e., Palm Springs) or San Bernardino (i.e., the High Desert) or most of the Bay Area and Central California, they’re out of luck. Consequently, I’m looking for people who would consider moving to these areas but haven’t because they don’t want their property taxes to rise exponentially.

Finally, Prop. 110 is similar to Prop. 60 but allows severely disabled people of any age to use this one-time opportunity to transfer their existing tax base within the same county, and I’ll also be including that in the story.

If you’d like to get an idea of my writing style and how I cover subjects, click here for a story I wrote on reverse mortgages last month.

Please send any potential interview subjects to me directly at psduffy@sbcglobal.net.

Hi Scott –

Your wrote “GSE loan and MBS purchases are correct and there is not a third party involved I’d like to know how both FNM and the banks with the worst MBS portfolios can both be soaring on the stock market. FNM up another 12% today, Wamu up almost 20%, National City up over 16%, Countrywide 13%. Obviously investors in these banks believe that FNM will be taking the impaired loans off the banks balance sheets and that the Feds will not let FNM take a loss on them.”

(1) Because now that they have seen Bear Sterns rescued, they could be assuming that the Fed will not let those companies fail either. They now know that Bernake is frantic to keep large blocks of motgage securities from having to be sold off (thus establishing the real value) and will do what ever it takes to hold those mortgage securities out of a bankruptcy fire sale.

(2) The access to the discount window for investment banks is a huge support. Withing 48 hours Lehamn and Goldman had both been to the window (while all the while doing the innocent virgin act of ‘oh we just wanted to set an example’…uh huh.) Now they have been using it for a couple days and the sky hasn’t fallen on their stock because of the appearance that they are endangered and have no recourse BUT to use the Fed. (Sort of hard to give a bad appearance when everyone knows it is a fact, not an appearance.)

(3) Bill going to hearing April 9 in the House Finance Committee could help to deal with a number (not all and not even a majority) of the toxic loans. It is rather elaborate – the key is short refinances involving a special loan through FHA, defined losses to the lenders, soft seconds, and, still and always, DTI limits on eligibility for the program and for the final mortgage. Paulson and Bernake are throwing their weight behind it while my-cousin-George (yep, we are both Mayflower Winthrops) whines and complains about the idea. (And don’t panic over the bill propping up house prices.- it will force prices down hard and fast.) Biggest problem in the financial services indusrty is that no one KNOWS how much the mortgage securities are worth or who has how many of them in their desk draw. If the value of these mortgage securities can be stabilized, the financial markets will calm down. (Stabilizing the value of the securities is NOT the same thing as stabilizing house prices.) The only real way to value all those mortgage securities is to sit down and literally check the underwriting or do the underwriting – a massive job that is probably not feasible even with an army of auditors in less than a year or 2. The other alternative to establish a way to value them through a process that would act like a statistical sampling by setting a value on “a loan” by setting a value on the underlying asset – and that is what a short refi does.

(4) Like I said, all those endangered lenders and SIVs and investment banks, can now sell their good mortgages (the ones worth more on the market) and increase their capital reserves. Does this put them in a much better financial position? Yes. Would it get all those mass-psychology, more-nervous-than-a-cat-on-a-hot-tin-roof, taking-a-guess-and-going-on-a-hope investors to feel better about those companies? Yes. Are investors and stock market gamblers always logical, rational and only acting with full information? NO! One day a stock will be up, next day it will be down and nothing has changed at the company.

(Personally I think it would be a lot less stressful on everyone else if all Wall St sorts were placed on some nice psychtropic drugs to deal with their panic attacks.)

(5) Still do not see Freddie/Fannie buying up the NINJA 100LTV (and now the lost value makes it 120% LTV) loans with a 50,60 or more DTI. They are closely regulated. Barney Frank is threatening to slap the investment banks and shadow financial institutions under regulation. Congress will certainly not agree to turning Freddie/Fannie – which are quasi-private/public entities – into a dumping ground for toxic waste.

I heard some shill for the National Realtors Association on the radio today being interviewed. According to this twit, now is a GREAT time to buy! Why? Well, because “Freddie and Fannie are now providing mortgage money, and they’ve raised the jumbo limit!” So, I guess that takes care of everything, doesn’t it?

The interviewer tried to tease something out of him about housing prices, the need once again to prove ability to pay, etc. Of course he dodged this, but managed to say that “buyers are coming back.” “What about people who are upside down on their current mortgages?” “It’s easy to refinance now because jumbo limits are up and Freddie and Fannie are making loans.” I wish he were asked about that typical Alt-A borrower who makes $20,000 a year trying to refinance his $750,000 three bedroom house with a qualifying loan.

A disappointing interview, to say the least. But what would one expect from a Realtor trade association?

Still learning, but after a week long course heavy in technical analysis: The bounce right now is largely expected due to how fast and hard the market dropped earlier and I expect we can see a few more days of up before it drops again.

We’re still in a strong downtrend that looks like it will hit 10k before it’s over. 8k looks like a real possibility, and would wipe out all the market gains since 2003 if it happens. Looking at a quarterly chart, this downturn is harder and sharper than what the market saw when the dot.com bubble burst.

S&P would probably be a better index to look at than the Dow, but the big picture is similar.

Wow, who’da thunk March 08 emails would be so accurate 4 months later ??

Leave a Reply to Exit