The twin lost decades in housing and stocks – baby boomers selling homes to a less affluent young American population. The impact of baby boomers on the housing market.

10,000 baby boomers are retiring per day. This two decade trend has only started but will certainly have an impact on the housing situation moving forward. In most economic reports the boom and bust of the housing market was not factored into the equation. Many boomers will downsize or sell as they age. This is just a matter of demographics. While trends are harder to predict, we know that 10,000 baby boomers will be retiring on a daily basis for well over a decade. What does this do to housing? The challenge we will face is that the younger home buying generation is less affluent and more in debt prior to purchasing a home. Instead of growing households, we saw over 2 million young adults move back home to live with their parents. So much for household formation taking up all that excess demand. The recipe for the moment has been to constrain inventory and artificially push rates lower but this has done very little to increase actual financial security. What happens when millions of baby boomers retire?

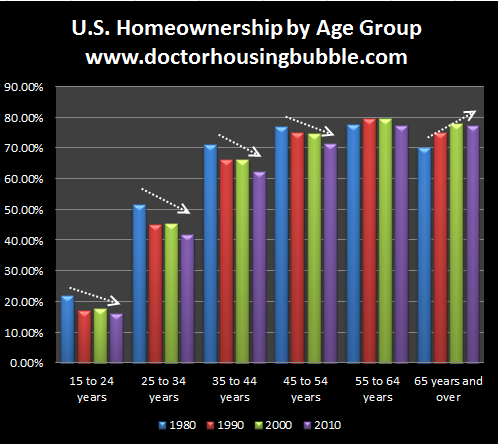

Home ownership rate by cohort

The recent major Census report shows one clear thing. Home ownership is dominated by older Americans:

The big changes can be seen when looking at the trend from a much higher perspective:

1980 home ownership rate

15 to 24:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 22.1%

25 to 34:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 51.6%

65 years and older:Â Â Â Â Â Â Â Â Â 70.1%

2010 home ownership rate

15 to 24:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 16.1%

25 to 34:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 42%

65 years and older:Â Â Â Â Â Â Â Â Â 77.5%

The home ownership rate from those 15 to 24 and 25 to 34 has declined substantially over this time while the 65 year and older group has seen their home ownership rate increase. The good news is that nationwide home values have fallen dramatically yet in many large metro areas home prices are still inflated. Bubbles do not deflate uniformly.

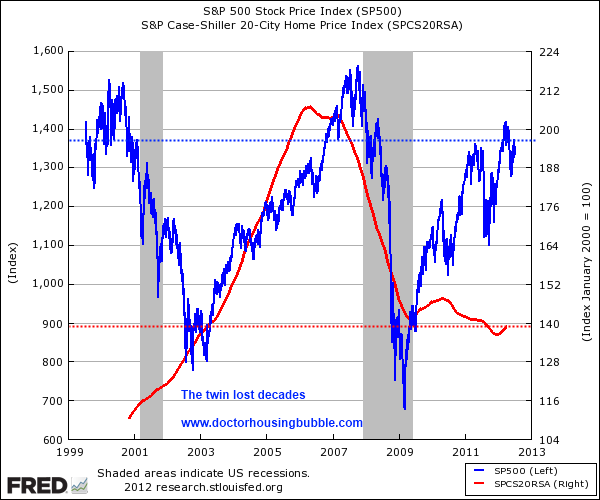

The twin lost decades

People have a hard time imaging a lost decade for the US but we have just experienced that with housing and the stock market:

Both home values and stock values are back to levels last seen over a decade ago. Economists and financial analysts have built models with stock markets returning 7 percent almost on a continual basis. Yet for housing, Professor Shiller went back to the 1800s and found that housing prices essentially only kept track with inflation. Stocks? Do we have a long-term model where many multi-national corporations make money from their businesses abroad? Why can someone assume the stock market will return 7 percent after adjusting for inflation in a dynamically different world?

As baby boomers retire, their stock portfolios look very much like they did a decade ago (assuming they even saved and data suggests very few even did). Most Americans have their wealth stored up in housing. And housing is still near a trough. Part of the low inventory also comes from many Americans unable to sell their homes because they are flat out underwater.

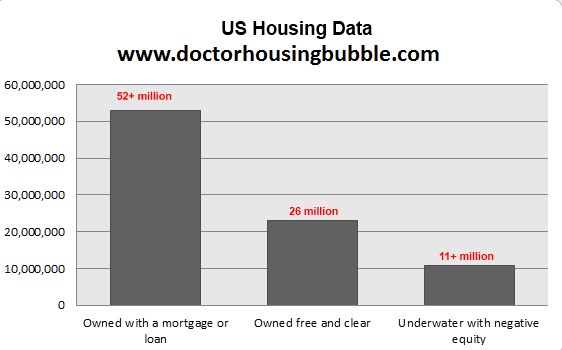

Underwater home owners

It should be clear that the bulk of home owners come from the older cohorts. Many of these are actually in negative equity positions:

11.4 million (23.7 percent) of homeowners are in a negative equity position. That is, you have a large segment of our home owning population that simply cannot sell without losing money, and this does not factor in the standard 5 to 6 percent selling costs.  Many need that money since they do not have enough cash until payday.  So many baby boomers are simply staying put if they can. It was interesting but not surprising to read the following:

“(Bloomberg) When Bank of America Corp. sent letters to 60,000 struggling homeowners offering to slice an average $150,000 off their loans, the lender got an unusual response from most of them: silence.â€

So why would someone not respond to a $150,000 reduction on their mortgage? Well if you are in Nevada and bought a $500,000 home that will now carry a $350,000 mortgage but is worth $150,000 is this even worth your time? Can you even afford the lowered price? Many obviously cannot as indicated by the foreclosure rate. So the foreclosure pipeline is still healthy and full yet leaked out inventory looks better because:

-1. Banks are selectively leaking out properties

-2. The 11.4 homeowners in negative equity keep supply low as well (many may like to sell but cannot)

-3. Household formation has slowed so less demand on more expensive homes (competition from echo boomers and boomers can be strong because of low inventory in some locations)

Yet the low inventory is more of a symptom of dysfunctional housing market. The baby boomer home selling trend is going to have a big impact. Much of the analysis we see assumes that the new home buying generation is basically going to replicate the trend that the boomers did. Why should we assume that? There are a few things that have changed after WWII:

-1. The massive stock bull market. After WWII with many industrial countries in ruin, the US had a major competitive advantage in nearly all economic sectors ushering in multi-decades of prosperity. Look at the stock market chart above. The world has become more competitive and wages for Americans have been stagnant for well over a decade. This is support for lower home prices not expensive home values.

-2. Home buying on one income. It was feasible for many blue collar one income households to purchase into the American Dream. That is now tougher for many and virtually impossible in expensive metro areas. Blue collar work has been on a major off shoring trend. In expensive markets you need two professional incomes just to buy a decent home.

-3. Global debt bubble. Never in our history has there been so much debt both at the government and individual level. We are living through a major de-leveraging event.

-4. Multiple jobs with little security. While many boomers had guaranteed job security with one company and many times pensions, many younger Americans will have multiple jobs/careers over a life time. Many are looking for mobility and many do not have home buying as part of their future plans (certainly not at levels like that of the boomers).

You have a wealthier generation that has seen their wealth decline trying to sell to a less affluent and smaller generation. Instead of household formation or even renting, over 2 million young Americans moved back home. Is it any wonder why we have now faced a lost decade in housing?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

102 Responses to “The twin lost decades in housing and stocks – baby boomers selling homes to a less affluent young American population. The impact of baby boomers on the housing market.”

With re to ‘home buying on 1 income’ My grandparents and aunts and uncles all moved to LA from Montana in the 1950’s and were all able to purchase homes in decent areas of LA (Westchester, Playa Del Rey, Manhattan Beach, San Gabriel) on a single income and most had humble jobs (factory worker, carpenter, salesman, book keeper, architect). As I recall, it was up until the late 70’s, or early 80’s that a 1 income family was the norm for homeowners.

No offense, but in the 1950 s, those placese were like shit.

OMG laminate counter tops…ewwww! Can we like just torch the place? Is that like illegal?

Jim Gaffigan says it best: It’s all McDonalds — of the soul.

No they weren’t “shit”, they were sparsely populated areas. I know, I grew up in SoCal in the 1950s. Either you’re lying or you have no idea what “shit” looks like.

In the 50’s and early 60’s all those cities were nice. I grew up in Downey and had relatives in South Gate and Huntington Park. Watts and Pomona were the places you wanted to stay away from.

back then we had unions that give us good wages and benefits,something you don’t understand until your shit on by you boss to a point that you stand up and fight for what is right and just

and being planted in fruit crops….long time productions…

Dan,

When my wife and i married in 1972, my closest friend Kenny said this to me (he was 76) Timmy, during the depression times was tough but at least our wives didn’t have to work, but now to get ahead you both must work. And so it has been.

We had little and worked and saved, my wife working in a nursing home for minimum wage, me in construction being in and out of work for months at a time.

But through it all we have done well, some would say very well, in NW the top 1%.

The key to winning in this game, like the book the millionaire next door will tell you is not living even close to your means. When to kids with only one hi school education can do it, there is hope for all. Our work is our joy.

@ Tillamook Tim Well the problem with your analogy is the times. Yes back in 1972 2 income families, even blue collar could still buy a home. Now since wages have fallen or remained flat since your era of 1972, compared with today where 2 people have to work just to support living within their means, forget savings there has been no growth in savings in the last decade even investing the savings there is negative growth and that’s not even factoring inflation. a 2 income family just is not being paid the equivalent to what people 40 years ago were making. Whole different ball game now. This is due primarily to market rigging, fraud, fiat currency, debt. It’s comparing apples to oranges. People that saved, lived within their leans, bought homes with 20% down, but purchased their homes in the last decade have lost all of their equity (I should say it was stolen the day the closed escrow in the banks equity stripping ponzi scheme) either way it is GONE and it isn’t coming back. The jobs are paying less, the houses are worth less than zero, and so no matter how frugal one is you are barely surviving. Nice though to think you are well off because you did the right things but really it was just the luck of the timing in the economy of your era, because if you were starting over now, even living frugally and saving would not get you to where you are today. Different times. Inflation eats up any savings, no interest on any investments, just losing the value of anything saved….

That older guy was very smart and did it the righ way. He worked for it and earned it. That work ethic is gone today for the most part. I also got married in 1973. Adopted a child and had 2 of my own on 1 average blue collar salary. I just saved and lived below what we could buy. I saved $100 a week for 3 years WORKING overtime on the Trucking Docks until I had enough money ( 25% ) for a downpayment on my first house. I kept doing the same thing over and over until today when I own 35 properties and at least 10 of them frean clear. My wife never worked full time. She helps manage the properties but in the early and mif 70’s worked part time while raising kids delivering early morning newspapers for $6 per hour. 20 hours a week. It can still be done but I don’t think that many are willing to sacrifice and make the extra effort. It is a different mental state of a new generation. It is kind of sad to me bc that mentality is gone due to the feeling of entitlement. If every one knew they would not eat or have a place to sleep unless they would take any necessary job to feed thier family or self we would have no unemployment and attitudes would be real.

Moochie, chalk it up to being born at the right time. Nothing more, nothing less. Try saving up a 25% downpayment today in 3 years here in Socal on a blue collar wage. You’ll be lucky to have enought money every month to pay rent, put food on the table and gas in your car.

Things have changed quite a bit in 40 years!

Tim you say the key to winning is not living anywhere close to your means and you are exactly right. Problem is that is not what people want to hear. They want to live large and have all the material things that go blingy bling and they will borrow as much money as they can to buy as big a lifestyle as they can. Of course you need two incomes and can’t save a dime if you “need” the biggest house possible, granite counters, flatscreens in every room, every family member has their own i-phone, i-pad, and computer, cars for the kids, eating out, cable with 150,000 channels, etc etc. These people are freakish consumers and if they go down in flames because they could not live conservatively well below their means then it is their own fault, plain and simple. They will not acknowledge that, of course, because we live in a society with no personal responsibility where it’s always someone elses’ fault. I say let these people fail and fail hard and painfully.

MY PARENTS BROUGHT ME UP IN 1950s India where poverty was the rule ( not the exception it is now). My father got a middle class job while my mother brought me up at home that she ran frugally. My parents spent ONLY 25% of their after tax income. They saved the rest in Bank CDs.

They refused help from their son me, who immigrated to USA and offered help. They took care of their expenses till they passed peacefully. Thinking back, I am ashamed to accept the inheritance they left me, though I encouraged them to live as well as they possibly could. The frugality was so ingrained in them that at 75, my father told me he is saving for a ‘rainy day’, Their main goal was NOT to depend on anyone ever. Not their son & not the government. Similar Frugality will solve half our problems in these United States!!

Then came the fabricated “womens lib” movement to make women feel inferior if God forbid they just stayed home and created a decent home for their families! It was a scam to get both men and women in the work force so they they could collect twice the amount of taxes! now you have to have 2 income family just to survive! It’s all done purposefully and intentionally by the real owners.

Yeah right dummy.

I have heard that old saw about “doubling the taxes collected” as the reason for the womens lib movement. How pray tell, did women going out to find jobs magically double the number of jobs to be had? It didn’t. It was done to emasculate the male and break up the family.

Those stats for the number of people underwater typically only take 1st mortgages into account. When you factor in 2nds and 3rds plus helocs the number underwater is closer to 50% in bubblicious areas. But I wouldnt expect boomers to sell in droves. In CA the prop 13 advantages can’t be ignored. In my hood it’s very common to see someone paying $12k/year in property taxes living right next door to someone paying $1k. No way boomers are going to sell and give that up. Many will transfer their homes to their kids. Many more will just live in their giant homes with rooms they never use until they move on due to old age. SoCal will be filled with aging seniors living in big under-used houses while young families cram into apts and condos. This will last for decades. If you want to own something decent your only option is to inherit a house or downpayment or go into massive debt. If you don’t like that choice then you’ll have to settle for renting, buying in a crappy hood or leaving SoCal.

With one exception, a good chunk of my friends with homes in SoCal have gone this route; generally you figure it out when they abruptly move across the city and into a place that nobody in their right mind would drop 350-400k on. Not going to lie, I’d do the same (from my POV, there’s simply no other way to make it happen).

Totally agree! The move to Palm Springs after the nest is empty crowd ain’t gonna happen. The elderly will die in their homes rather than try to downsize in this economy. Even if they can get good money for the larger home, what they can buy with the cash is also very limited. Most of these people have lots of kids that will be happy to live in the house after the folks are gone. This will not dramatically affect inventory.

That is such a keen and accurate observation. You got it right. Loving American History, one thing I read that really struck me, was in the declining days of the south before the civil war, many of the grand mansions, had broken windows that weren’t replaced and the house were falling into general disrepair.

We sure seem to be in a similar situation with a collapsed currency value. Ten years ago someone would have laughed at the comparison. Oh, that was the olden days and could never happen now.

There’s a flaw in your theory. Prop 13 allows seniors to transfer their Prop 13 protections to new properties.

Yes, that’s another not so well known fact about Prop 13. The 55 and over crowd can do a Prop 13 tax basis transfer to a different property (of equal or lesser value). I think you can do this within any county. However, certain counties will not allow transfers from other counties. And we thought this was to keep Granny in the same house indefinitely. Prop 13 is so wrong in so many ways…

Even more amusing you can inherit your parents Prop 13 tax exemption with the property.

could use a cheap room to rent and a private enterance , mini fridge, double burner and portable oven ..not exactly what they sell on saturday aFTERNOON TV BUT CLOSE….AND A TV THEN IF IM TERRIBLY MOBILE….

You also have to remember why we had so much home appreciation in CA in the 1970s – long before the bubble. First we had the bay boomers coming of age and increasing the demand for housing in the late 60s and 70s. You also had two income families entering the market. (Banks could no longer discriminate against women and were forced to now consider their incomes when underwriting loans.) Then you had Prop 13 decreasing taxes substantially and enabling people to pay more for home. (Prop 13 reduced my tax bill by about 80%.) There should have been an equilibrium point for the Prop 13 increases, but other factors (ultimately, the bubble, liar loans, teaser rate ARMs, 125% financing with HELOCs, etc) pushed prices even higher.

With baby boomers leaving the market (we’ll all die eventually), there will be less demand for housing because the new generation of home buyers is smaller. They are also less wealthy, as a whole, so their effective demand is even lower.

Add the factors listed above and the future looks particularly bad for the housing market.

the only reason real estate took off in the 70’s was because securitization took began then. “Depression era laws” were used to begin what is easily the greatest speculative enterprise in the history of human kind. these prices are not merely going to reset lower…they’re going to collapse. people will move/exist where they can get jobs, buy food, get those government checks and still have something left over…and that’s it. with prices falling there is no more “rolling over the debt.” i expect to see an outright spike in squatting.

We will see more instances of families living in RV’s and such as they travel seasonally to where the work for Mom and Dad is. Think the influx of workers in DeKalb, IL to work in the fields. They rent a room (for the entire family) or live in a small RV.

I just wanted to add that the baby boom generation’s impact on the economy and society is like a giant rat going through a snake’s body. Everything has to expand as we go through and then compress as we pass. Schools, then colleges, the housing market, financial products and now medical facilities and retirement homes.

I’m the third to last year of the baby boomers. I remember going past my junior high school not too many years attending there to see that is was closed and being used as a community center. A decade + later it became a school again but that was after the huge 80-90s housing boom in the center of Orange county CA

Gen-X and Gen-Y outnumber boomers. There isn’t going to be any shrinking after they pass.

I have a feeling that you didn’t read the entire post above – the main point is not so much the declining population coming up behind the boomers, it’s their rapidly diminishing economic prospects. Someone who doesn’t have the requisite funding will generally not be able to buy their first home, no matter what their desires. They’ll rent and keep on renting for the rest of their lives unless their financial situations improve markedly.

I think the main point was Gen X , Gen Y have little purchasing power as they are stuck in dead end jobs, saddled with student loan debt, & have zero incentive to take on a 30 year mortgage when they are working as temps on 6 month contracts for jobs paying $12 / hour.

I’d say the post was dead on. Home owners in New Jersey can count on paying $20k per year for the crappiest 3 b/r ranch house. They are paying $12k now & the state if bankrupt. How high can they go? The sky is the limit. If you rent, at least you can move out. If you own, you are a slave to the needs of the public employee unions. Screw dat!

Ecuador or Panama, here we come! One of these years….

Take from someone who has lived in Ecuador recently as a Peace Corps Volunteer, you do not want to live there. I lived about 30 minutes outside of Vilcabamba and 3 hours south of Cuenca, which is where a lot of ex-pats go to retire. Sure the landscape is nice, but the prices are always inflated for foreigners. I can’t tell you how many times I heard the locals talk about how stupid the foreigners were for paying $300k for a home that locals would only pay $40k for. Not only did people pay more, they demanded services like we have in the states. Constant flow of water, sewage systems, and a stable electric grid are planned things that are expensive and are not the same in Ecuador. Not only that, the cops are corrupt and if you get sick, which older people tend to more often, there are no ambulance services and great hospitals in the countryside. I knew a local who died from a heart attack, not the actual attack, but the hospital stay. AARP doesn’t talk about how many robberies there are in their magazine when they publish things about Ecuador. If you want to retire some place cheap, buy a house in Las Vegas. I hear they’re going for pennies on the dollar. If I haven’t persuaded you away from Ecuador, at least learn Spanish. It’s freaking rude to go there and not learn the language!

I agree it is freaking rude to go th their country and not learn Spanish! Can you tell that to all the Latinos who come here also?Can you get free housing, free medical, free attorneys and legal service, free food stamps and social security in their country also?

Have you ever even visited these places? (don’t lie)…you’re in an inherited house with one of those wonderful legacy Prop 13 exemptions. Live it up.

Have I ever visited Panama, no. Unless you count the time I transited in the Airport on my way back to Ecuador. Have I ever visited Ecuador, no, I actually LIVED there. There is a big difference between the two. I saw what it was really like to live in a country and not surround myself with other ex-pats and/or tourist attractions. As for your prop 13 comment, like everyone else on the blog, I am mad that my wife and I cannot afford a house where we grew up without going into unsustainable debt.

No and no. Don’t even bother with Central America unless you can afford an estate with 20 foot walls and full-time security. In fact the only country in Latin America that might be worthwhile for American expats is Chile. The downside is it will have about the same cost of living as a medium-size city in the USA. Chile is a lot like CA in the 1950s, great opportunities everywhere. If you can learn to speak their odd version of Spanish, and have some energy (and cash) to burn, go for it.

“… and then compress as we pass.”

Good point, and gives a rough time frame of say 5 years as to when the compression you refer to should really kick in (last of the baby boomer’s children to graduate college).

Dr. HB leaves off one very important item: Long Memories

Here in Culver City, I have neighbors who fully remember that SFR’s peaked here at $925k in July 2007. They are all convinced that it is a question of when, not if, prices are going back up to the bubblicious levels of 2007. In the mean time, these people, ages in the mid-sixties to mid-seventies, refuse to list their homes for sale.

The ones who do list their homes, list them at the bubble prices of +$900K.

The problem with listing them so high is it gives the others hope…

DONT WANT THEM AT 140,000………

You call 2007 Long Memories? Really? How much have such “Long Memories” helped NASDAQ these days?

Long Memories should also tell buyers that the same places went for $200k in 1999, anyone feel like paying 5x of what people paid 10-15 years ago? Not me, thank you.

nasdaq IS STILL INFLATION ADJUSTED 65 PLUS PERCENT DOWN APX OF ITS 1999 PRICE….

and why not? if there is a sucker who will pay that price,god bless them.

The population issue is not as problematic as many posters are describing. Generation Y is actually more numerous than the Baby Boomers are. The biggest difference I see between the world Gen Yers are entering and the one described to me by Baby Boomers is the lack of opportunity for consistent employment. I hear older Americans say that “there’s always the military” for young people. It was true when they were graduating High School. It is not true now. In 1962, the armed forces employed nearly 10% of the workforce. National service was an open opportunity to nearly any physically healthy person who wanted it. Now it employs less than 2% and is turning away 75% of applicants. This is not to say there are no jobs. There are jobs. Few, if any, can be treated as long-term employment, or even skilled employment. In USA 2012, we have become a nation of boring temps.

If there are no solid, stable opportunities for unskilled and semi-skilled workers, what about the skilled ones? Yes, a person with a STEM degree, professional certificate, or graduate degree can expect to be able to find employment. Often not stable in one job, but can expect to be able to string opportunity together in the long term. The problem is that those skilled workers are loaded with education debt. The student debt problem has become so onerous that the Dept of Ed has gone from limiting repayment to a 10 year term to extending it out 20 years. I’ve heard talk of 25 and 30 year repayment terms coming on line within the next two years.

Yes, a young doctor or lawyer can nominally afford to buy a 1/2 million dollar home. Can he or she do it while carting around a $200K to $350K student loan debt? Would you recommend such a purchase, or would you say it’s wiser to rent until the education debt is paid down? It’s a no-brainer. The workers who ought to be buying those expensive McMansions from the Boomers are not in a financial position to do it.

There have been changes in the global economy, and they have been huge. But the reality is that many of the wealth problems being faced by the baby boomers where created by changes in public policy. We chose, beginning in the early seventies and through the eighties, to stop funding University education with taxes on high-earners and instead to finance it through student debt. We chose, as a country, to reduce direct government employment opportunities for high-school educated men and women in their twenties. The predictable result has been 40 years of higher unemployment and real income declines for that group. Now the people who want to sell their houses to individuals in those groups are dipping their buckets into a shallow well. Part of this is by circumstance, but much of it is by choice.

Another problem is the cost of fuel and water. In the 1950s and 1960s, there was little economic competition for these resource. The costs were so negligible that engineers and business planners didn’t even account for them when building capital projects.. Water tables were high. Oil reservoirs were 1000 ft deep. Now they’re 10,000 ft deep. Utility costs are as high if not higher than capital and interest.

In my view this all creates opportunities for investment, opportunities for success. The future is very bright.

The future might be bright, but it will not be a continuation or extension of the present standard of living as most middle class Americans have come to expect — even the crunchies with the chicken coops in their back yard. The law of diminishing returns is already a perceptible phenomenon. If you are ready to accept that, and you are not partial to the concomitant plushness of being the #1 super power/economy, (or are cool with medicating yourself so that you don’t think about how disappointed your are), then you, Sally Sunshine, will be vindicated. The future will be bright. Perhaps only in your mind, but that’s okay, too.

I have to disagrre with you on the job opportunities for Science, Technology, Engineering and Math trained individuals. The US allows millions of foreigners to flood the market each year using an arsenal of visas in order to flood the market with a cheap pool f labor. I have experienced a 2½ year stint of unemployment – without the benefit of unemployment – while cheap labor continued to take jobs I was qualified to perform. Besides H-1b visas there are diversity visas, student visas, O visas and many others. Also, once someon arrives here, there is no mechanism to send them back. I have known several people on H-1b visass who have continued to renew their visas over and over again. An H-b visa is supposed to only be open to renewal one time (for a total of 6 years). I have known more than one person who has renewed their visa more than one time. Politicians will tell you that it is only 65,000 per year but the rolling average is 390,000 per year (65,000 X 6) and that does not include those visas that are not counted. There are an additional 20,000 visas awarded through trade agreements and visas issued by government entities do not count toward the visa limit.

Cheap labor policies of the federal government are wrecking industries and careers. While these are present, do not expect the average American to be able to afford to purchase these homes at bloated prices. Expect these policies to contribute to more bankruptcies and foreclosures.

Those foreigners will pay tax the same way as US citizens after several years. They are effectively the same as US citizens except that they don’t vote. It’s just that there are more competitions in the labor market, and I don’t see this is a bad thing for the country. Outsourcing to foreign country is totally different though, and that scarifies the locals for the benefit of corporations.

I believe on financing education, the burden is on those who fell for the government shylocks encouraging debt to support the employment of College professors and Admin. To finance a bachelors degree is the biggest scam put forth. Younger people forgot to look back at what virtually everyone did in the past; work while you go to school, take longer, be lucky enough to have humble stable parents that would let you live at home while you attended school.

To watch decades of creepy young people partying while living a disneyland life on campus, on borrowed money, evokes no pity. The saddest thing is they whine about the debt, after the party is over. And condescend to the students who stayed local and debt free.

You have to look at yourself for rising prices of College. The government is out to rip people off not help you as “public education” brain washed you into thinking. Plus government educators only teach one industry, teaching. How useless is that.

The first half of your post identifying the problems is pretty much spot on. However, some of your conclusions don’t hold water.

Yes, there is a higher education bubble. But, just like the housing bubble, this has been fueled by government subsidizing the industry. When you give out loans at an artificially low interest rate and tell people that “those who attend college earn an avg. $1 million more than their counterparts in their lifetimes,” you’re going to have people attending college ignoring the costs of the endeavor or the value of skills acquired. That is, until they find themselves graduated with $100k in non-dischargeable debt and underemployed. You need to allow the market to impose cost controls on these schools by closing down Sallie Mae loan programs and allowing the schools and private banks to finance college. In one case, the schools would be on the hook for the loans, and would actually vet the recipients thoroughly (and lower their tuitions if they could not find enough applicants). In the other case, the banks would very seriously consider whether an 18-year-old with no collateral and no skills to speak of would be qualified to take out $100k in debt.

The answer is NOT more public-sector jobs. This has been refuted time and again, so I will only cover it briefly. In order to have public sector jobs, you necessarily have to siphon wealth from the private sector. Bastiat called this the “seen” and the “unseen”; in other words, you “see” the workers digging a ditch in the street, but you have to imagine the jobs or investments that would have otherwise been created with that capital in the private sector.

Some solutions I can think of:

– liberalize the economy, lower taxes and regulations (esp. in CA)

– open up federal/state lands for development (help bring supply of homes in line with demand)

– allow homes to be foreclosed upon, don’t bail out the banks

– allow college loans to be dischargeable in bankruptcy

I agree but would like to clarify “allow homes to be foreclosed upon, don’t bail out the banks”.

The FDIC should have taken control of the insolvent banks as the government did with AIG, Freddy Mac, Fanny May, etc. The Fed would print $ for net withdrawals to keep the FDIC fund solvent. Stock/bond holders lose everything. Management is gone. Regulations are put back in place and then privatize the new “healthy†banks. This punishes the correct people and causes less harm to the rest of the market.

There would be quite an impact to the bond market/pension funds but most of those are insured by, wait for it… AIG!!! You have two choices here. The government takes over the pensions or the government pays out through AIG printing yet more currency.

This is how the “system†is supposed to “workâ€. The “printing†of money to cover losses is no different than the Fed printing to purchase bad investments from the TBTF banks (i.e. QE). The current banking industry has proven that they are not manageable with the current regulations/management. None of these actions are all that great but we would be in a much better place today if we did a “reset†versus a continual kick the can…

“Some solutions I can think of:

– liberalize the economy, lower taxes and regulations (esp. in CA)

– open up federal/state lands for development (help bring supply of homes in line with demand)

– allow homes to be foreclosed upon, don’t bail out the banks

– allow college loans to be dischargeable in bankruptcy”

Are you kidding me:

Deregulation of the banks got us in this mess. No one was watching or caring what the banks were doing. Regulation of banking is the answer. And when in the history of any deregulation did it not end up in a mess.

“Open up development”, haven’t you been paying attention why build more there is no one to buy now.

Agree with foreclose and don’t bail out the banks.

“Allow bankruptcy for student loans” – Seriously? No one forced these students to get loans. I worked and paid my way through college. However, I realize that prices to income was different (1980’s). By allowing student loans to be discharged, only the rich will go to college. College costs will skyrocket with your suggestion. The writer was correct in stating those that stay home with their parents are better off then those that ‘go away’ to college. My son is going to community college and will transfer to the CSU less than 5 miles from my house. Community college was essentially free with the tax credits (American Opportunity) and the last two years at CSU will probably be around $12,000 unless he can qualify for something or tax credits. His friend on the other had go accepted to Columbia with a scholorship of $120,000. I am sure that is gone by now (starting her second year). She will end up $200,000 to $300,000 in debt just to graduate from a Ivy League School but that is what she chose. Why should the taxpayers be on the hook for her schooling? She knew the costs but she wanted the status, so she is going to pay for it. Too bad.

Tricia – the problem with student loans is the same problem we had with mortgages. The government backstop allows banks to get a guaranteed return on the loans so they hunt day and night for prey/students to take out loans. I believe the reason that student loans are so prevalent is the same reason the cost of education is rising so fast. Artificially cheap financing with government backstop ensures rising cost. Sound familiar?

Read an article today that stated 1 out of 39 homes were in the foreclosure process from Jan-June of this year in San Bernardino/Riverside Counties. Where are they and why are they not for sale?

San Bernardino/Riverside Counties homes foreclosed and not for sale:

They were sold off to deep pocket investors for pennies on the dollar in buckets of $450M-$500M, and will eventually become cheap rentals. If that is not an asinine solution to the mess TPTB created, I don’t what is.(Yeah, we’re looking ourselves, so I do have a bias for main st not wall st.)Can’t wait to see what happens when the PBGC has to be bailed out. All these housing pension investments haven’t even hit hard yet. Fractional Reserve Investing! LOL

Please share the names of the investor groups that have been buying $500 million dollar blocks of IE real estate for pennies on the dollar. I think everyone in the public should know who these people are. You have some kind of list or copies of purchase contracts or can point to the sites where investors are bragging about the deals they got and the fat profits they will make, right?

Ant

One of the deep pocket investors is Carrington Mortgage /$450M REO deal. Rick Sharga, the former VP of RealtyTrac (the foreclosure data base firm) is now their VP. There are a bunch more. I get the Mortgage Association and REOMAC periodicals. I have a former career in Commercial.

Tyrone- This election is a two-headed snake. Both candidates are a puppet.

I’m reading this post totally differently.

The main points are:

*boomer parents owe/want more money for their houses than current market value

*the younger generations are moving back home/never left boomer parents home

*younger generation cannot afford and does not want to make the financial commitment to buy overpriced boomer parents homes

What may happen and would make a lot of sense, is that the parents who have adult children living in their homes anyway and who cannot sell for the price they want, will just sign the titles over to the kids someday and everybody just keeps living in the house. Problem solved for everyone.

Boomers stay in their homes, kids stay in the homes, these houses never go onto the market needing to be sold, and everybody just stays where they are. Houses get passed on through the generations without real estate market churn. It makes perfect sense for everyone involved.

Just because the American housing market has not operated this way in the last 60 years does not mean that that it can’t happen. Sometimes things that make sense do happen. And multiple generations living under one roof with the house being passed down among family members makes a lot of economic sense.

I predict we will be seeing a lot more of this. Perhaps it will change the American housing dynamic to something which very commonly occurs in other parts of the world. It will radically alter the US housing market into something more stable and less speculative, and drastically less financialiszed.

Boomers are stuck in the house until they die. Pretty bad. Now the kids are also stuck in the same house, on the same street, in the same town. No more mobility, no more vibrant career opportunity. That’s how most of the developing world work today. US is slowly sinking there. Sad. If no one sells, and no tax raise on prop 13, how will the realturds and local government deal with the new reality?

“I predict we will be seeing a lot more of this.”

With Prop 13’s inheritance transfer clause, it’s an absolute certainty.

Yeah, this scenario sounds quite logical, and may very well be in the process of happening. I see many homes in the surrounding neighborhoods that have five or six cars parked in the driveway, and they ain’t split into rentals. The big issue that may derail these plans is property taxes. The kids may not be able to afford 20-30,000 to support the local pensions.

I am not convinced this will work the way you believe. This will work only if we implement the one child rule. I know many children of California home owners and every one of them have siblings. Guess what they argue about? That’s right! Who is going to move in when dear old mom and dad leave this great earth? My friends with parents who passed had to sell the property. Most siblings go to war once the parents pass especially if there is money involved.

I dont see a lost decade in housing. The CS index is right about where it should be, if we hadnt had a bubble. It is up 15-20 points over the last 10 years. In 2002 it was in low to mid 120s.

And CS is up 40% since beginning of 2000. As long as you didnt BUY in the 2000s, it wasnt a lost decade at all. If you held across the whole time, your house is probably valued about where you expected it to be.

HAHAHAHA!!!

Wow, someone needs to lay off the crack pipe…

Paying for a house and owning it are two different things….how about a chart showing that by age grouping?

This is a good time for me to reference this article:

http://www.doctorhousingbubble.com/the-fallacy-of-cheap-home-prices-dual-income-trap-home-prices-over-valued-by-25-percent/

It shows a gorgeous graph there indicating that the movement from single to dual took place during the previous several decades and is probably topped out; we can’t squeeze more income from couples.

When I, a boomer, was graduating from college in 1975 there was a recession that rivaled this one, no jobs, people lined up at the gas stations (literally) for a ration of gas, big waves of layoffs in every industry. We were told that the lifetime employment our parents — I mean our fathers — had enjoyed, with its pensions (!) and benefits would not be there for us. And indeed, I don’t anyone my age who has a pension coming. Some people have 401’s, but we know what happened there. So please read some history and stop conflating the generation before us with our reality. Or how about this: stop dividing people into “generations”. That’s not how humanity actually exists. It’s much more subtle and complicated than that.

By the way, I have never owned a house. So I won’t be ripping off any sparkling generation coming up behind me.

So true Marachun! My sister and I used to line up and push our 71 impala tank( mom’s old car) and 64 comet (grandma’s old car), in gas lines in college in about ’79. we sound like “the grapes of wrath” compared to what is called depression conditions today!

Thank you and DITTO!!

The wall street elites, with their controlled media, have been deflecting the angers against them towards the immigrants legal or illegal, the boomers, … They are the true problem but you can’t do anything. Because the tumor has gotten so big that if it dies the host will die, too.

“10,000 baby boomers are retiring per day.”

Don’t be so sloppy with the facts. You should have said, “Since 01,01,11, the Boomers started turning 65 at the rate of ten thousand a day, and will continue until the last one turns 65 twenty years from now, all 70 plus million of them”. They are not retiring at anywhere near that rate. Any of them who have a job are keeping it for some time, and the unemployed are scrambling to survive somehow, because nobody will hire a 62 year old.

The Boomers have no money. Well, actually, hardly anybody has any tangible assets and savings in America, except for the famous one percent, and, a lot of them aren’t ready to stop working, either, because their expenses are so high. Everyone put their “forced savings” into their now overvalued home, and they forgot about the 401k and the IRA, after splurging on the BMWs and ski trips. Just ask yourself – if the Boomers were flush with money, why can’t they pay for their own kid’s college education? Those kids are forced into a lifetime of debt servitude with their student loans because Mom and Dad had to keep up with the neighbors. Retirement? I don’t think so. If they were retiring at such a rate, Florida and Phoenix and Vegas RE wouldn’t be languishing on the market for practically nothing. There would be bidding wars for junk, like in ’04. Not now. They can’t sell up north to even consider moving. Working until they drop, if they’re lucky.

Amen brother. So many boomers are in the process of realizing that they will have nothing to retire on except Social Security. Those who can will work well into their 70’s to maximize SS or simply to qualify. Highly likely that at some point SS will raise the retirement age. You should have said that nobody paying employee insurance premiums will hire a 62 year old. I am sure that contract positions with no benefits and careful monitoring of production will still hire a 62 year old who meets quota. But the same is true of young people deep in debt from non-recourse educational loans for ACME School of Fashion Design or some other useless major. Of course a couple of prodigies will undoubtedly graduate and make a fortune in Couture design with crotchless tennis shorts or some such momentary fad. Some one needs to point out the real needs in our country for math, hard science, medicine and the fields where we are losing global ground and start incenting students to go into those fields. I don’t imagine that there will be a huge wave of young people getting trained to the noses and butts of the baby boomers who can afford such services, but then most will either not wipe their orifices or try to parachute in on the kids they tossed out as soon as the kids turned 18 or 21 and for whom they did nothing relative to school costs for a real education. Should be interesting to see what happens in the tiny 1-2 bedroom apartments the Echo boomers have when mom and dad (in a wheel chair) pop in for a nice long stay. We are headed for a time when everyone will see clearly who has and who has not, a true two tiered real estate market where properties in IE and the other armpits of CA go down to meet stagnant to lower incomes as they must. The good areas will stay good. Maybe some professionals on the margins will have to give up a second or third home, but for people who have their money working for them, life won’t be too shabby. Makes me think of Al Pacino in Scarface when he brings out the machine gun and says something like “OK baby here comes the pain”.

Actually, it was, “Say hello to my little friend.” And it was an assault rifle/grenade launcher. So many great “lines” in that movie.

No, I remember it clearly as “Chay hallo to my leetle frend!”

I think it was Carlito’s Way you’re thinking of, when he’s outgunned in some dive bar, and trying to psych out his assailants:

“I’m reloaded! Okay? Come on in here, you motherLOVERS! Come on, I’m waitin’ for ya! What, you ain’t comin’ in? Okay, I’m comin’ out! Oh, you up against me now, motherLOVERS! I’m gonna blow your FLIPPIN’ brains out! You think you’re big time? You gonna FLIPPIN’ die big time! You ready? HERE COMES THE PAIN! “

I know two types of boomers near retirement age. Those with jobs and those who have been laid off. The ones who have been laid off can’t find a job and have to retire and collect social security at 62. Everyone else says they can’t retire because they can’t afford to and want to keep working, and will as long as they can keep their job. How does that figure into this? The idea that everyone retires at 65 is ridiculous.

Actually, a boomer that turns 65 and DOESN’T retire is actually causing more havoc than one who does. Think about it. Once a boomer retires from a $40,000/yr (or more) job, the same company can hire a gen-y kid for $30,000, and the health care costs for that position go through the floorboards, not to mention the employer’s half of social security and medicare are much lower as well. Perhaps the new worker would not even be eligible for a defined benefit type pension either.

Some companies are handing out early retirement packages, but most aren’t.

Low interest rates are definitely a mixed blessing. For someone that is borrowing money, they are welcome. But for savers, they suck. Also, consider a company with a large payroll. Economist Antal Fekete covers this frequently. Wages must be paid out of some sort of wage fund. If a company is getting a very low return on cash set aside for wages and similar expenses, it greatly limits their flexibility in hiring, putting downward pressure on total number of workers employed.

It also means downward pressure on wages. Of course the primary downward pressure on wages is globalization, but it never hurts to pile on more downward pressure, unless you are a worker, then it isn’t too rewarding.

I don’t think you need to worry about baby boomers not retiring. They’re being laid off now, in order to hire younger folks at low wages or temps. The big question the country faces isn’t “how are all these people going to retire?” it’s “how are all these people going to live?”

Maybe they’re not. Logan’s Run.

IM NEARLY BROKE AT 60 AND LOOKING FOR VERY SMALL GARDEN COTTAGE WITH FOOD STORAGE….VERY VERY CHEAP TO FOSTER CHEAP TAX…TRYING TO STRETCH A LITTLE SAVINGS THAT HAS HAD ITS EARNING ABILITYS RIPPED OFF FOR YEArs…..

I just wanted to comment on the Offer B of A sent out re: the up to 150K off the mortgage. There were so many strings attached to that BS offer including a 1099 you would owe the IRS for the forgiven debt (which can’t typically be discharged in BK so you would really be on the hook for it) plus they wanted a signing of a Promissory Note), they also dictate how long you have to keep the house before selling etc. etc. it was a BS deal like we have come to expect from the banksters that robbed the equioty to begin with!!

“it was a BS deal like we have come to expect from the banksters that robbed the equioty to begin with”!!

BS deal? If you don’t live in a non-recourse state like CA, you would be on the hook for those taxes. And that offer from BofA was no more of a “BS deal†than the original loan the irresponsible borrower signed up for to begin with. Stop passing the buck and take responsibility for your gross error in judgment. Because you get your news from the National Association of Realtors isn’t mine or any other tax payers fault. The banksters didn’t rob the equity, the fools who purchased a home without the means to pay for it did – while pricing out the responsible savers. And now those very same people feeding from the tax payer trough have the nerve to complain. Shame on them!

ah..the on average 38 debt dollars printed up for every dollar borrowed that compete equally with a dollar of savings and bid and drive prices .at the fractional ereserve bank that collapsed and was bailed out in 2008,,,,,,,,,,,,,,,,,

Lynn,

Thanks for the information on the BofA deal. What’s your insider and gut feeling on the Ca HomeMoaners Bill Of Rights Bill Governator Brown just signed, effective Jan 01, 2013, which gives the bank the axe on double tracking modification and foreclosure?

Do you think the banks will say, the hell with playing (or pretending to play) ball, we’ll just fast forward to starting a foreclosure?

Also, do you think they’ll be even more BK activity in 2013?

We’re tracking auctions for our purchase, and BK is the way out for these “live frees”. I was told BK doesn’t always work if there is no equity, and the house isn’t protected, but it delays the home-moaner losing it and moving. Any feedback?

I believe it all depends on who OWNS these mortgages. B of A is a mortgage SERVICER not necessarily a mortgage HOLDER/OWNER. They get a service fee to MANAGE the mortgage for the mortgage HOLDER/OWNER (most likely Fanny Mae, Freddie Mac, MBS). The banks sold most of their MBS holdings to the Fed during QE1, QE2, Operation Twist 1 (aka QE3). So, I answer your question with a question, who OWNS these mortgages. If we pretend that these mortgages were OWNED directly or indirectly by the federal government, then this would be all part of the smoke and mirror game to artificially hold up the housing industry…

I live in the most oldest town in CA. Their are a lot of boomers retiring here, and others who made it and empty nesters living here- the most common wish in the now 4 years and still going 50 year planning document process is “aging in place”. You will see lots of old folks living off their reverse mortgages staying in these decaying stick built development homes, paying housekeepers and care-givers, with no one able to buy the houses, until they fall to 20 cents on the dollar.

insiders buying at a dime on the dollar over the last few years or driving auction prices as shill buyers or front runnewrs…market got bogus..bogus..bogus…….

Lets review the math. 52 mil with a mortgage, 26 mil no mortage for a total of 78mil. 11 mil are underwater. That is around 14% that are losers. Investors buy up the losers homes. Young people rent instead of buy. They rent from the investors. Young people rent for a number of reasons. The rents are higher than the comparable mortgage/taxes cost for a number of reasons.

The Obama administration has secret plans for the second term that will make everything all right. Don’t worry folks.

Please tell me you are joking! This is sarcasm, right??? We need some kind of notation when someone is sarcastic… Let’s all agree that we will use the “~” after a sarcastic remark going forward! Agreed???

ah….definitiveness…ha ha ha ha…….

Lots of very intelligent bloggers today!! Having seem Cali up close the Prop 13 comments are spot on. The only thing not spoken is what WILL happen eventually, and that is its repeal. Unless you don’t want a police force, fire dept. or school, parks, etc. Cali thought they could have their cake and eat it too. Sorry guy! You are broke and getting broker at the same time everything is rising. You have been warned.

Dr. Detroit, we’ll be hearing more and more about Prop 13 repeal in the near future. The loudest voices who support Prop 13 are those who greatly benefit from it. Prop 13 is a perfect example of “I want all these government provided services, but somebody else can pay for them.” 🙂

Maybe they need to come up with a Prop 13 means test. Prop 13 was sold as keeping Granny in her house. Maybe the Prop 13 lottery winners can pay for Granny because I sure as hell don’t want to!

I hear Stockton is doing very well with Prop 13. Bankruptcy takes care of those future public pensions and creates a death spiral of wealth distruction. You might just think about moving out of the Golden State.

wow you guys are over thinking this high price housing crap.if people are paying then the prices stay high.if no body pays prices come down but since goverment support banks with your tax dollars prices stay high, duh.

I agree with many that the less desirable areas of CA will remain generally stagnant to falling, as they should. Why should ghetto homes be $250k? It’s ludicrous. As for the IE, it’s up in the air. There are some very nice areas, and it’s the only place in SoCal left with any open land, but there are armpit areas there as well.

Some people say multi-generational living is the way to go. I can see the point and benefit, but I see major drawbacks as well. Many marriages suffer in this situation, and I’ve seen it first hand. Nothing hampers a good sex life like Ma and Pa in the next room, or grown kids.

PapaToBe

I miss a SFH for many reasons, but “yankee doodling” is on top of the list. Our neighbor’s set up the kid’s room behind our bedroom wall. Needless to say, we don’t

want to be the sex education instructors. They need their childhood left innocent.

Great new interview with Peter Schiff (mentions how housing will crash again). For those of you that don’t know Peter, he is one of only a handful of analysts that called the previous housing bust correctly. He was also pushing gold when it was $800 an oz. As long as I have been following him, he has always been correct. I have no reason to doubt him now.

America Heading Towards a Collapse Worse Than 2008 AND Europe! Says Peter Schiff

http://finance.yahoo.com/blogs/breakout/america-heading-towards-collapse-worse-2008-europe-says-155504860.html

Here’s another article talking about the next big crash:

How Bernanke will cause the next crash before 2014

http://www.marketwatch.com/story/how-bernanke-will-cause-the-next-crash-before-2014-2012-07-17?pagenumber=1

I heard on the way to work this morning that cities/counties are going after the “banks†to take care of the foreclosed properties that have gone into disrepair and become havens for prostitution, drug dealing, blah, blah, blah… The funny thing is that the cities/counties are going after the loan originating bank. The loan originating bank responds it is the responsibility of the servicer or holder and not the originator. They found that the holder has changed hands many times as well as the servicer. So, let me get this straight, there is the originator (this is the only constant in the equation), there is the servicer (this can change and is not necessarily the originator) and there is the holder (this can change by the hour). What a tangled web we weave…

that asset that should have been the cornerstione of food productions has wasted time……..life and survival…the controlers will be the cost of lives………….

This data does not surprise me one bit. Inflation is growing at an accelerated rate and debt seems to be at an all time high for college students. Hopefully, things will eventually start turning around!

Leave a Reply to Lynn Chase