The Housing Stalemate and Why Prices Will Continue Going Down: A California Housing Story in 5 Charts.

The housing market is facing conflicting headwinds like a dog being asked to “come here” from both owners at opposite sides of the room and reading through the countless market indicators can drive you dizzy like 3am at an EDM concert. But the reality is, the market had grown accustomed to record low mortgages rates like a crackhead looking for their next hit and a flood of money during the pandemic and now, we are dealing with the usual reckoning. It is rather amazing how Taco Tuesday baby boomers fell deeply in love with the Fed in a codependent relationship, either with eyes wide open or naively, in terms of favorable policies that enriched their lifestyle of rent seeking behavior. Just browse social media and you’ll see all the 2nd home buyers and AirBnB “investors” that are suddenly starting to understand the true cost of capital. Who pays for renting an AirBnB or any rental for that matter? People that need to generate income in the real economy. And the real economy is flashing massive red signs of capitulation. The credit markets are stalling out, the student debt jubilee was stalled, and the easy money from the government from PPP to stimulus checks is now reversing. And because of all of this, people are going to learn a quick lesson of the perils of artificially low rates that went on too long. There are five indicators telling us something in terms of where things will be going. The punchbowl at the party has run dry my friends and the hangover is just beginning.

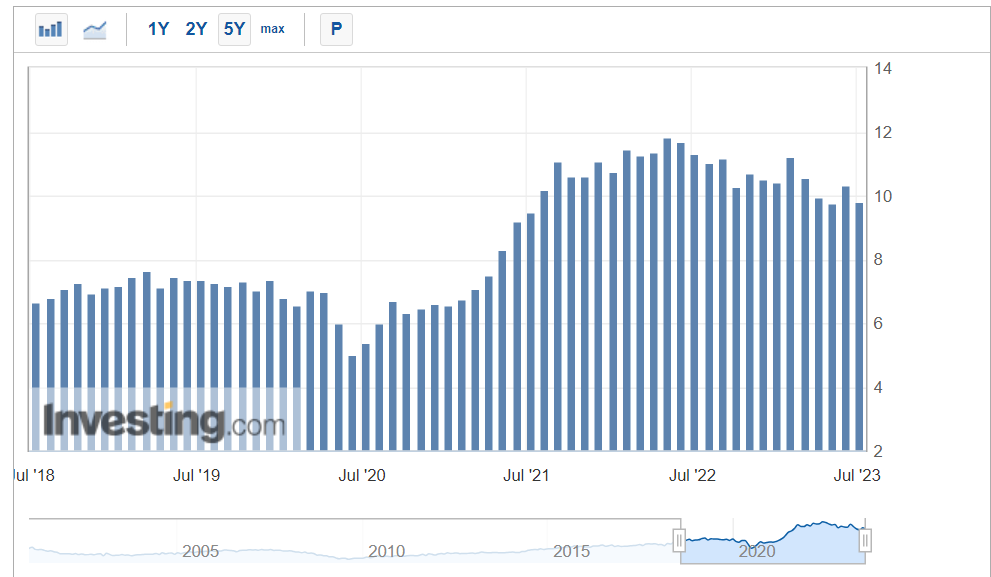

#1 – Job Openings via JOLTS

The first chart to look at is the JOLTs chart which looks at job openings:

We hit a peak of 11.85 million job openings back in March of 2022. The last reading came in at 9.82 million job openings which is down 17 percent in one-year. There was much being said about the red-hot ADP jobs report that came out. But if you look at the ADP report closely, half of the jobs added were in hospitality and tourism. In other words, people are taking jobs they “have” to take versus holding out. Stimulus funding is done, interest rates are up, and credit card debt and auto debt is at tipping points (and delinquencies are up). Like a WWE match, someone is tapping out. People had to move off the fence to make ends meet now. Which leads into the next chart.

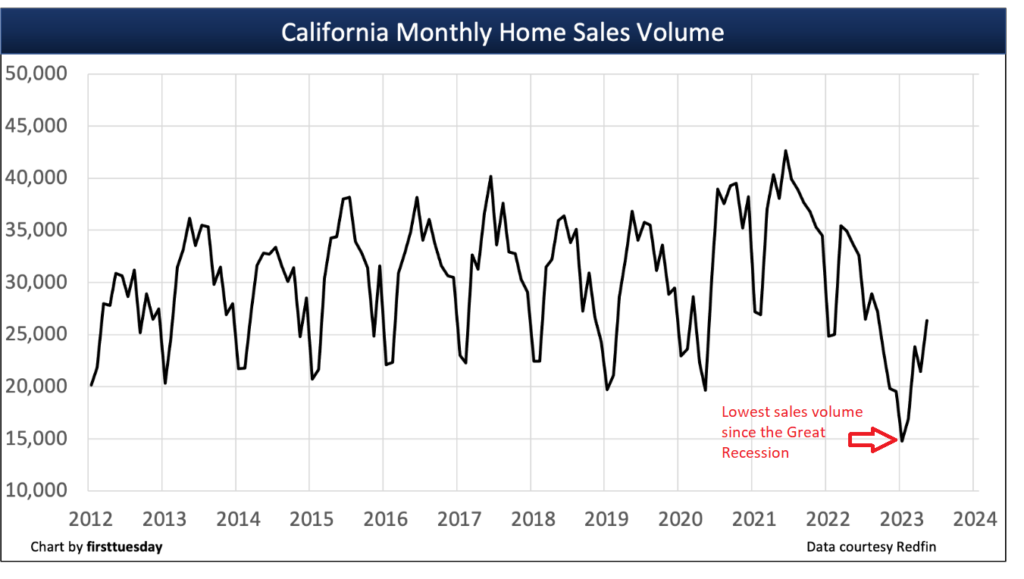

#2 – Home Sales are Weak Overall

We continue to hear how hot the market is for housing by looking at prices. But look at home sales volume:

For California, this is the weakest sales cycle since the Great Recession. But with 40+ million residents, should we not have more home sales simply based on population growth? We should but inventory is also at low levels because of horrible incentives. You have baby boomers sitting on homes with low rates and complaining “inflation” is horrible for their kids to buy a home. You now have younger home buyers that bought a crap shack condo for close to $1 million and wondering how they are going to move into their “forever” home when there simply is no movement and sheep like behavior is taking place and the fog may be leading you to a cliff. Make no mistake, all of this was generated by bad policy that made incentives for people to rent seek versus actually supporting real job growth.

Which leads us to the price trend chart.

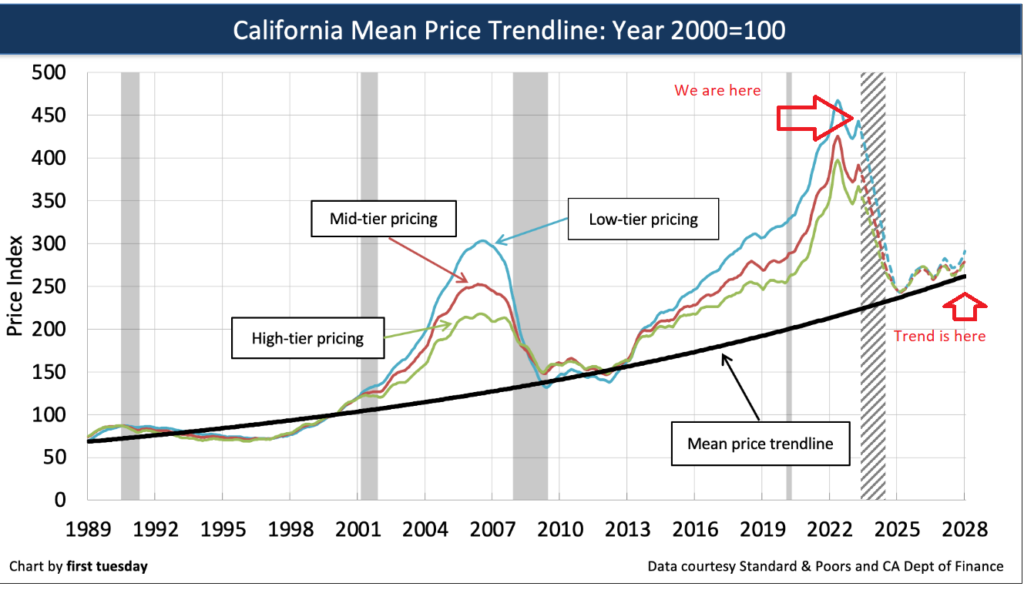

#3 – Are We Going Back to the Mean?

Home prices are more inflated than they were during the Great Recession:

The rhetoric you hear is that no one is going to sell if they have a mortgage of 2 to 3 percent. Some are simply renting out their properties, but many are realizing you need renters with money from the real economy (see JOLTs report and previous points made). This is one large game of musical chairs built on cheap interest rates. Those rates are done for now because as we saw with the inflation train, things almost went fully out of control. So the above chart simply highlights a massive distortion in prices. Since 1989 in California, we’ve always reverted back to the mean. Of course, “this time is different” and the new sauce here is: the Fed will never let that happen (to me that is), supply is so low (now why is that?), and there is no NINJA loans (although artificial low rates are a form of distortion if your income can’t keep up).

So with record low sales, we probably do not need more agents to sell right?

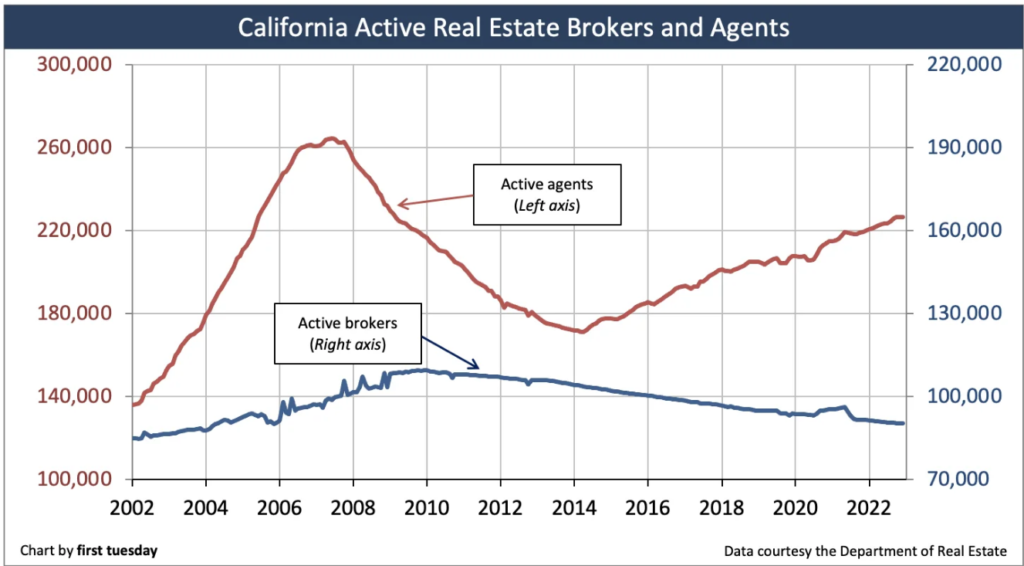

#4 – California Real Estate Agents Chasing the Train Late

Just like the last cycle, real estate agents unfortunately are last to the party:

In the last cycle, we reached a peak number of agents in 2009. What else happened around that time? Sales absolutely imploded. Keep in mind how agents make money. They make money on sales volume. Lots of it. Chart #2 shows you sales volume going back to Great Recession levels. So of course, once this hit a peak, many let their license expire and went back to other work. This indicator highlights that many are simply chasing the sizzle and once they get to the smell, there is no steak (and hence the JOLTs number going down but people going to work in sectors that were less attractive because of easy money flowing through the system). Lower incomes, higher rates, tighter credit, and delusion will once again come to a date with reality over a meal at Chipotle, but with no scoop of avocado.

Which leads us to the most significant shock here.

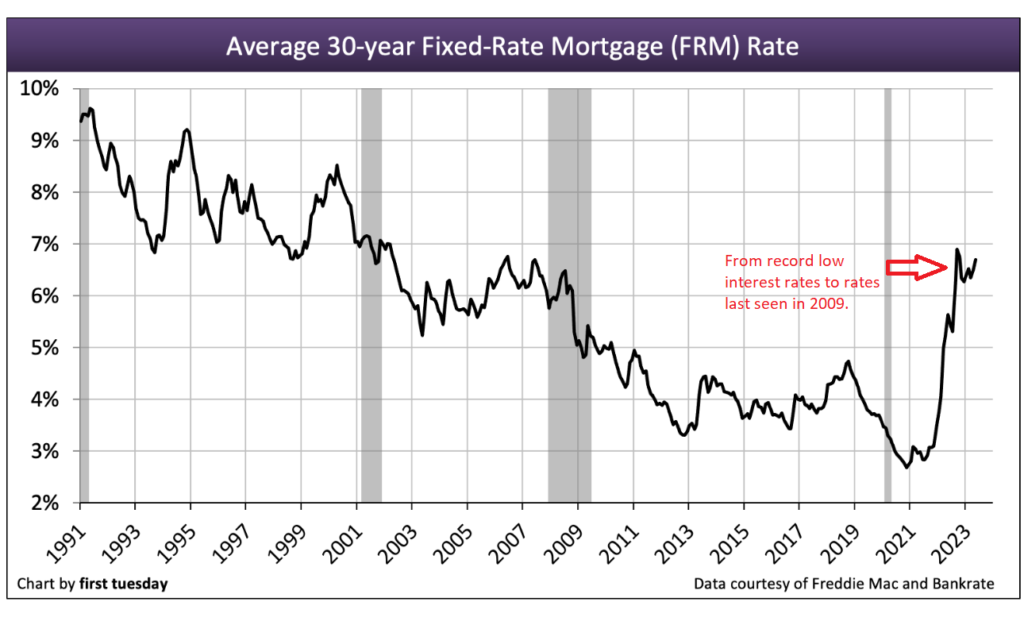

# 5 – Mortgage Rates Go Up

Here is the come to Jesus chart with the rapture starring you right in your Tesla smiling face:

Mortgage rates are back to where they were in 2009. What happened in 2009? Crap shack reality hit. Let us do the math here. Say you bought a $1 million crap shack at 2.875 percent with 20 percent down. What is your monthly nut?

Mortgage Rate: 2.875%

Price: $1,000,000

Down payment: $200,000

Mortgage: $800,000

PITI: $4,113

Let us run those number today with current rates:

Mortgage Rate: 7.1%

Price: $1,000,000

Down payment: $200,000

Mortgage: $800,000

PITI: $6,181

Keep in mind households were already stretching themselves thin for that $4,113 monthly payment on some dump of a condo that is built with cheap drywall and a roof that will cave in when the cat eats one extra Friskies cup. So the monthly nut went up by 50% all within a few months! So this is where you get the denial talk of “I’ll stay here for life with my low rate and my fat cat!” talk. People are ignorant of history. In the 1980s, there was a thing called assumable mortgages, largely with the FHA. What does this mean? You could sell a home and have someone “assume” your rate. I know this seems odd and people think it is out of the question. But at some point, if you need to sell because of a job loss or if you need money, then you will sell. This idea that you will die on your hill for a low rate is absurd. Even if you pay your home off, you still have to pay taxes, insurance, and maintenance. In Texas for example, you can have a $300,000 home paid off for example and still have $1,000 or $1,500 carrying costs. The same applies for California with a $1 million home, aka, a kids play structure converted to your “starter home” as if this is dogma etched into the DNA of 2 million years of humanity (the housing rules somehow started after World War II in 1945 apparently). You still will pay roughly $1,000 to $1,500 a month just to maintain your home. In other words, a form of “rent” to live somewhere.

The price chart is telling. Will we revert to the mean? California home prices are already down from their peak and this was already trending that way prior to the mortgage spike which takes time to filter through the system. The “this time is different” crowd is out in full force – usually the AirBnB investors, commercial real estate investors, and generally low rate credit addicted consumers. I’m looking forward to the Netflix special and the parade of experts that will be marched out like watching the Westminster Kennel Club Dog Show.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

118 Responses to “The Housing Stalemate and Why Prices Will Continue Going Down: A California Housing Story in 5 Charts.”

Illuminating post. After watching some insane bidding wars in the spring, things are starting to quiet down. More houses are sitting. There’ve been some significant price cuts.

How many extra homes will Boomers have to buy to keep this market afloat? From NBC:

“The National Association of Realtors said in March that baby boomers now make up 39% of home buyers — the most of any generation — and an increase from 29% last year.”

https://www.nbcnews.com/news/amp/rcna92905

Junior Mint,

That is an interesting article. Boomers are leading the way with home buying.

Note the article says they are buying with cash so either they are likely selling a house or are pulling money from other investments to get the cash. It doesn’t indicate they are buying second houses for an investment.

Being a late Boomer/Gen X, I have older Boomer friends. I see this trend in areas where housing prices have skyrocketed and the Boomer owns a house with huge equity.

Why would a Boomer buy another house?

1) A Boomer likely purchased a home 30 years ago in a high priced area to raise their family. They likely paid around 200K in an area like S.CA. Now that house is worth 1.2M and they are sitting on 1M in equity as they consider retirement. The house is likely paid for and in CA, their property taxes are low around 4K/year with Prop 13 but income and sales tax is likely high. They can become real millionaires if they sell and pay cash for a smaller 300K house in a lower tax state.

2) Some of my Boomer friends are cashing out and following their kids and grandkids who have moved out of higher cost areas to raise their families. They are selling and moving and buying in a lower cost area due to family.

3) Boomers could be selling and moving from higher tax colder climates and buying houses in NC, SC, TN, KY, and FL for both the weather and taxes for their retirement.

4) Some Boomers may have never owned a house in a high cost area and rented to be close to their high paid job. They have seen huge increases in rent during the last 3 years and may buy a house for stability during retirement.

Personally, we like where we are at now but my wife occasionally suggests that it might be nice to live closer to the grandkids. Family may win eventually.

it’s because of semi-recent prop13. boomers can sell their old place and go somewhere else and retain their property tax rate savings while doing it. more bang for your buck.

FooBarBear,

True, but only if they move to a lower cost part of CA. If they move out of state, their Prop 13 benefits disappear.

Where are the Boomer kids and grandkids going? Denver, Boise, Austin, Dallas?

Anecdotally, that’s where my kid’s friends are going. They aren’t moving to Baker or Bakersfield. My kid’s friends Boomer parents are cashing out and following them.

Uh Oh, somebody better sell quickly and get some magic beans, this didn’t workout so well :(((

“Among those worried about falling home equity is father-of-two James Mayfield, 42. Mayfield – who runs an engineering firm – bought a three-bedroom, two-bathroom home in Long Beach, California, for $450,000 in April 2021. It was an investment purchase which he planned to let out as an Airbnb. He fixed a 30-year mortgage with an interest rate of 3.2 percent. But little over two years later, his property has lost around $50,000 in equity. He told DailyMail.com: ‘I anticipated certain fluctuations in the market when I purchased the house but the downturn was more significant than expected. It’s a reminder of how quickly things can change.’”

Got popcorn :))

The boomers will find a way to ride this out until they die. Once there’s no Boomer’s around or in office and the millennial generation is running the country there will be change. Currently working 72 hours a week as a LVN in socal just to make rent and raise a family. Pshhh lazy millennial! Buy a house with your minimum wage Job at home Depot like I did!

Good Dr,

Thank you for another excellent article!

I think the Mean Price Trendline chart #3 is very informative!

Houses as a place to live (and not an investment) should track inflation. The latest bubble from this chart shows how far it has deviated. As you pointed out, it has always returned to the mean. I think that the high inflation during the last 3 years will cause the mean to also rise faster for the next few years until inflation is controlled. Eventually the 2 lines will intersect again and it will be an excellent time to buy a home. I predict they will intersect again in 2024-2025 at 2019 home price levels.

Do you have any charts showing the mean during the high inflation periods of the late 70’s and early 80’s? During that time there wasn’t a housing bubble so house prices rose with inflation.

It is a wrong assumption that housing should track inflation. Maybe you would like it to do so, but housing it is not just a consumable to live in. It has so many different aspects (inflation, monetary policy, leveraging/interest rates) that a simpleton assumption about tracking inflation is making me laugh.

Surge,

Before 2000, housing prices tracked inflation very well (except after WWII). Refer to this chart.

https://www.longtermtrends.net/home-price-vs-inflation/

The bottom for house prices during Housing Bubble 1 was in 2012 when housing prices intersected with the CPI inflation line.

https://www.bankingstrategist.com/housing-prices-hpi-vs-cpi

I believe 2000 was when speculation and Fed intervention became normal. Before that, people purchased homes mostly to live in.

If the lines intersect again, like they did in 2012, It means speculation has been mostly removed. This intersection can happen again if inflation increases and/or housing prices drop. I would buy then.

Should include CA residients who are rich enough to leave to California for good. Who will be left to pay the high taxes, cost of living? Broken Justice system, dirty cops, etc.

Plenty of money floating around. People spend like drunken sailors. Job market still going strong. The bears lost again but this defeat is a hurtful one: houses in 2023 are significantly more expensive compared to 2022. Rates increasing to 7+ % increased that monthly house payment quite a bit. The lesson here is: the best time to buy was yesterday. The second best time is today.

I’d love to see RFK kick Biden out and debate Trump. 2024 should be fun.

Uh, cool. Except prices on sold homes are down YoY. Look at CS index. You’re hype-y blather can’t keep the noise floor high forever.

M didn’t claims home prices were up YoY, he claimed that housing is significantly more expensive in 2023 than in 2022, which is true. A house that cost 700k w/ a 7% mortgage rate has a much higher payment and cost of the loan overtime than an 800k house at 3% interest. Median home price is only down 4% from peak last year, so interest rates doubling assuredly makes housing more expensive than last year.

I cringefully will have to agree with M on this one. @Peter_Heavy you missed M’s point about house prices going down 1% but yet you’ve gained 4% on interest.

High income individuals are taking their AGI to other states to escape CA taxes. 1% of CA residents pay 50% of the tax revenue and that 1% has the means to easily establish residency in a low income tax state while still living in CA. Expect CA cost of living to increase.

https://www.howmoneywalks.com/irs-tax-migration/

Just don’t move to a state with no income tax and keep your CA house as a rental property.

CA will tax any rental income from properties in CA even though the owner is a resident of a state without income tax. The tax rate will be based on the Federal income tax rate of the landlord. If you are a resident of another state and are in the 1%, you will pay the highest CA tax rate on any rent earned from CA properties.

Let’s analyze your five points:

1. “Job openings down 17% from their recent high”

Yes but up 25% from their previous peak in early 2019. By November of that year it was down from its peak. This is still pre-Covid, was the market in trouble then?

2. “Home sales are weak overall”

Okay so we’re going to ignore that spike right after the red arrow.

3. “Are we going back to mean?”

Why are people so obsessed with list price and completely ignore rates, dual income households becoming the norm and the price of consumer staples? Take those very real and very relevant factors and you’ll see we’re actually AT the median!

4. “California RE agents chasing the train late”

The price of Pokémon trading cards are more relevant than this point.

5. “Mortgage rates go up”

Mortgage rates more than doubled and no significant drop in sight. Remember the 10% rule? For every 1% increase in rates, price would have to come down by 10% to equalize monthly payments. Rates are up 4%, I don’t see a 40% drop anywhere (at least places worth living in like SoCal).

I DID see homes as low as 15% below their ATH but that’s long gone, they’re back up to their ATH (as I accurately predicted) back in November of 2022. Rates were sitting at 6% and homes that are now selling for $825K were selling for $675K. You coulda had a $3900 mortgage back in December but instead to patiently wait for a $5700 mortgage today. That’s the power of leveraging the ultimate home analytics metric: LOGIC

Thank you for coming to my TED talk.

Dear housing bubble doc, we have historic low inventory. No crash happening without inventory skyrocketing.

Great article Dr – however as a buyer currently looking in California, this unfortunately is not what I am seeing on the ground in my market. Despite over 7% 30 yr mortgage rates, the market remains “hot”! Yes, transactions and refis are way down…but so what? I am not a realtor or loan broker earning commissions so I don’t really care. I care about prices, and they have barely nudged lower after going up 35-50% in Just over 2 years! In my CA market: Teslas everywhere, restaurants and bars are packed, jobs a plenty, and there is little to no existing home inventory, homes sell very fast, and prices remain quite robust! This housing market sadly seems unbreakable.

It seemed unbreakable in 2006 too.

This period will be looked back years from now as a “What the hell was I thinking?” Just like the dot com stocks, beanie babies, tulips, etc

i did some quick Logic/Math

lets price houses at their utility Value

assume a hotel is $100/night

Thats $36,500 per year times 30 years = $1,095,000

Maybe that’s where they come up with this ridiculous values?? I MIGHT be dead-on…as the robot metrics on redfin assume every house is an Air B N B???

i think ive discovered something!!!

It used to be a $100 prior to Covid. Depends where of course but when i stay down in SD for the night after a padres game the night cost $200 plus valet parking plus hotel “whatever” fee. I mostly do this stuff on points. It seems like you can get $100 a night at some dump. Usually places where you find hockers or drugs (not that I would really know).

I like your logic and I think houses are cheap from a utility point of view. In 5 years from now a night at a nice hotel will be $250

Come on, something that is equivalent to a $100/night hotel (no kitchen, small) can be had for 300k or less even in prime coastal area.

As an active BOOMER I rather enjoy these ninny’s cry about the high prices and unavailable housing inventory. They had their rent delayed and their student loan’s frozen courtesy of the elected leaders who have promised the moon and the stars to only get re-elected. Unless your high valued degree can enable you to get an in-demand job that will support you and your family, you just wasted your time and money. Lawyers and Real-Estate agents, both depend on churning the market to make an income producing job and when there is no action, you better learn where the local food bank is located. Better ask your parents why they didn’t teach you about economics instead of encouraging you to go to Collage instead of a trade school. Rots of Ruck sucka , just keep paying the monthly rent and lease on your high dollar car. Happiness is a positive cash flow. And by the way, I need to raise your rent, because I got a boat payment to make.

As a millennial, who is also a millionaire on paper, I totally agree with picapoi.

Low inventory and high prices are not the worst thing when you own houses. Some of my millennial friends and relatives are jealous because they don’t own a house or condo. And some of my boomer relatives and friends are jealous because their houses are old dumps. (I bought new construction because I didn’t want to pay a boomer). The only boomers that are not jealous are the ones who are multi millionaires due to smart housing decisions. And what were their decision that was so smart? Buy when you can and let time and inflation do its thing. That’s why warren and I always say: the best time to buy was yesterday, the second best time is today at noon.

You crack me up. You brag as if you’re smart – but if not for your inheritance you’d still be living in a cheap apartment and sneaking into your neighbors apartment pool. You ain’t smart, you’re just lucky. So quit bragging.

Dude, Richard, thank you for bringing this up. Rich is right: I am suuuper lucky.

Get this: saving, living frugal in a shitty apartment. My buddy lived in a complex adjacent to us and provided me with his key code to get in to use their amenities. I called it house-hacking but today I would say it’s trespassing. I used their pool for years. Once in a while he needed to text me a new key code as they would change it (annoying).

I couldn’t get myself to pull the trigger to buy because I only consumed bearish content. Watching housing bubble / housing crash videos and read that BS online. I was convinced the market is going to crash.

Then I inherited money. A lot. Money was burning a hole in my pocket and we decided to buy. I’ll never forget the conversation with my wife: she’s like wait, what if the market is crashing, you have been telling me this for years. I am like yes. I know, market def is going to crash I just can’t justify not to buy anymore (sitting on all this cash). We can easily afford it. I just don’t want to wait any longer. So we bought.

we bought in Q1 2020, brand new f-ing awesome house. And people on this blog went nuts. “The peak is in. The last bear bought. Market is going to crash now” they even forecasted a depression. Lol

Rest is history: market took off and we are sitting on over 500k on equity on this first house alone and bought a second home (rental) in 2022.

Moral of the story: be smart like me. Buy when you can afford it. Cut out the noise. And do the opposite of what the majority of bearish people tell you.

Buying houses was the best investment besides crypto. And I was a mega bear. It took a lot of money to convince me to buy. But I accomplished to get over my bearish sentiment. I was A mega crash-bro. As soon as I bought it changed my opinion over night. I am like: no, I am no longer rooting for a crash. Now that I have my house I like the market to go up. Now that I have my house I no longer want property taxes to change. I love prop 13 now.

Be smart like M. The luck is something I couldn’t control. I had no idea the market would take off after 2020. Thank you FED and thank you Covid! And one thing I learned to is: “money alone doesn’t make you happy” is not really true. Having all this cash and a house that appreciated like crazy def makes me happy. I got hobbies, more friends and a big smile every day I wake up. Lucky and smart as Richard said!

M: I had no idea the market would take off after 2020. Thank you FED and thank you Covid!

Covid destroyed millions of small businesses. It empowered the oligarchs and their surveillance state. It fueled the BLM riots that caused billions in destruction and dozens killed. Not to mention the lives lost from either the virus or the “vaccine.”

But as long as M comes out ahead, I guess it was all worth it.

“Covid destroyed millions of small businesses.”

Such Bs. Leftist radicals destroyed small businesses. People like newscum who shut down restaurants and have them re-open for his privat parties.

People like Pelosi destroyed small businesses by forcing them to close but to re-open if she needed a haircut.

Covid was used for radical leftist BS.

I heard leftists say, “whatever it takes to get trump out”. They had no issue destroying the economy as long as it can be used for their political agenda.

Deluded, self centered boomer. I worked 10-12 hour days for 20 years as a top level motion graphics artist in Los Angeles and not one of my boomer employers paid me the kind of wages you earned in your day, so I’ve never been able to afford to buy anything. You don’t pay it forward. But I have a fantastic life and don’t care about money, and you’re near to the exit with nothing but money.

If you’ve never been in the market to buy, and don’t care about money, why are you here?

What does that kind of position pay? Seems like it would have a high income…

During the last crash, the first year after peak price was in only saw about a 4% drop from peak price per Case-Shiller, so pretty insignificant, just like this past year since peak Spring 2022. Expect further decline the second half of this year and then increasing % declines going forward. Reversion to the mean or somewhere close is not likely until 2026-27. People don’t trade houses including Air-B-N-B “investments” frequently like stocks. Much longer timeline for devaluation.

Falcon, today, I’d like to take you down history lane.

Inventory kept rising back in 2006-2008. Lending was loose.

People who couldn’t afford houses were buying them.

People who had good credit scores bought second houses to speculate.

The sentiment back then was: buy now or be priced out forever.

None of these things are a thing today. Everyone and their mom is saying houses are unaffordable and we will have a recession. And have you ever seen the same bubble occur in sequence? No…..Why? Because you rarely have a bubble in the same sector subsequently……And why is that? Because we fixed the root cause from the 2006-2008 bubble > loose lending standards.

In 08, active listings were at 4M. Today, it’s at 1M. You are telling me you think we will see an increase of 3M homes in active listings in the next couple of years? If I were into drugs I’d wanna have some of your stuff.

root cause from the 2006-2008 bubble > loose lending standards > buying frenzy

root cause current bubble > artificially low interest rates > buying frenzy

My prediction on mean reversion or thereabouts as I stated above is 2026-27 so we have quite some time to wait and see who is right, but I’ll be around don’t worry!

I started working in/for the homebuilding/real estate/finance industries in 1999 so we have had an inside seat to the whole sequence of events. The short-term consensus of my group in SoCal re values is another leg down the second half of 2023. 2024 should somewhat resemble 2023 aka a selling season bump or at worst flatline, then another leg down second half of 2024. Thin trading just like this year. No one is saying much about 2025 yet.

Also you have vastly oversimplified what happened during the last crash and the fixing of what you call the root cause. You will need to dig into the white papers and talk to some insiders before you see the whole picture. Facts differ from era to era but there is no escape from the fundamentals that effect price, up or down. We avoid recency bias in my group, and we see an overall downward trajectory looming.

Falcon,

I am actually all ears now. Reason being you are the only one who forecasts at least something (other than “it’s going to crash”).

Pls tell me how you model a leg down without inventory rising significantly? And if you forecast rising inventory, where is it coming from?

Thank you in advance!

Inventory is low…today.

If the economy takes a dive as most economists are predicting (aka hard landing by H1 2024) then we may see a cascade of foreclosures not because these are dead beats on liar loans but because this admin wrecked the economic engine of the nation and good people will suffer.

Stock correction -> Job loss -> Housing collapse.

The FED will not want a housing crash. They know housing is expensive but they do not want a foreclosure crash like in HB1. Maybe drift down or sideways and let wages catch up.

The GSE back 98% of all mortgages since 2010. They will put in place forbearance programs, loan modifications, etc…. if things get dicey.

Also, wall street can invest in SFH risk free as they are able to get their MBS guaranteed by the GSEs. They will scoop up the distressed properties that will be sold by the mom and pop landlords during the 1st phase of a housing downturn. Thus I am not counting on any decline in housing to be more than 10% to 20% at the most. If we go over 30%, then we start having HB1 foreclosure issues. The FED does not want that. The rescue programs will quickly be implemented. IMHO

They will let the mom and pop investors take a beating on their rentals but they will try to save the home owners.

Hi M,

We are not predicting a large spike in inventory this fall, but interest rates should remain elevated and the market thinly traded. We have had substantially less inventory YOY but prices have nevertheless declined, not spiked since ’22 peak, so it is not an inventory issue in a vacuum. Interest rates and continuing high inflation in goods and services are factors.

Notably, in a small volume market like we are seeing it is a result of removing not only a seller but also a buyer from the market, aka the seller would also be a buyer.

What we see is at least one more FFR increase, mortgage rates >7%, continuing high inflation, small market and buyer fatigue. That’s the rest of 2023. Again at the moment no real fireworks until 2025.

Wait, but you said another leg down in 2023.

“The short-term consensus of my group in SoCal re values is another leg down the second half of 2023. ”

So inventory remains low, interest rates elevated, transaction volume super low. We have seen price go up MoM but you are expecting another leg down in H2 of 2023?

Like a couple % points or a significant decline?

Btw., another rate hike doesn’t necessarily mean higher mortgage rates. The spreads are bad and the mortgage rate is closely tied to the ten year bond yield. If the labor market turns expect bond yields to go down which means lower rates. You might have the perfect mix for higher RE demand if the economy turns: lower rates and looser monetary policy by the FED.

Oh magic beans, don’t fail me know :0

The Orange County Register in California. “Homebuying in Los Angeles and Orange counties fell 24% in a year as pricey house payments scared away potential buyers. So just how slow is it? Second-slowest May for sales in records dating to 1988. 47th-smallest sales total for any month in over 35 years, and only 11% of all months have been slower. 39% below the average May sales pace since 1988. In the past 12 months, 112,483 sales were 34% below average. Lowest 12-month sales count since March 2009. Only 2.4% of all 12-month periods have been slower.”

“Next, consider how prices moved. In Los Angeles County, the $800,000 median was flat in a month and 6% lower in a year. It’s also 7% off the $860,000 record high set in April 2022. Orange County’s $1 million median was up 1.2% in a month but 4.8% off the $1.05 million peak of May 2022. L.A.’s $858,500 new-home median was down 13.3% in a month but 6% higher in a year. O.C.’s $1 million median was down 12% in a month and 24% lower in a year.”

Anyone who keeps spewing the virtues of buying at the hype of the bubble, will believe anything, Magic Beans :))))))))))

Got popcorn

Oh magic beans, don’t fail me now :0

The Orange County Register in California. “Homebuying in Los Angeles and Orange counties fell 24% in a year as pricey house payments scared away potential buyers. So just how slow is it? Second-slowest May for sales in records dating to 1988. 47th-smallest sales total for any month in over 35 years, and only 11% of all months have been slower. 39% below the average May sales pace since 1988. In the past 12 months, 112,483 sales were 34% below average. Lowest 12-month sales count since March 2009. Only 2.4% of all 12-month periods have been slower.”

“Next, consider how prices moved. In Los Angeles County, the $800,000 median was flat in a month and 6% lower in a year. It’s also 7% off the $860,000 record high set in April 2022. Orange County’s $1 million median was up 1.2% in a month but 4.8% off the $1.05 million peak of May 2022. L.A.’s $858,500 new-home median was down 13.3% in a month but 6% higher in a year. O.C.’s $1 million median was down 12% in a month and 24% lower in a year.”

Anyone who keeps spewing the virtues of buying at the hype of the bubble, will believe anything, Magic Beans :))))))))))

Got popcorn

Oh magic bean Oh magic beans Oh magic beans, don’t fail me now :0

The Orange County Register in California. “Homebuying in Los Angeles and Orange counties fell 24% in a year as pricey house payments scared away potential buyers. So just how slow is it? Second-slowest May for sales in records dating to 1988. 47th-smallest sales total for any month in over 35 years, and only 11% of all months have been slower. 39% below the average May sales pace since 1988. In the past 12 months, 112,483 sales were 34% below average. Lowest 12-month sales count since March 2009. Only 2.4% of all 12-month periods have been slower.”

“Next, consider how prices moved. In Los Angeles County, the $800,000 median was flat in a month and 6% lower in a year. It’s also 7% off the $860,000 record high set in April 2022. Orange County’s $1 million median was up 1.2% in a month but 4.8% off the $1.05 million peak of May 2022. L.A.’s $858,500 new-home median was down 13.3% in a month but 6% higher in a year. O.C.’s $1 million median was down 12% in a month and 24% lower in a year.”

Anyone who keeps spewing the virtues of buying at the height of the bubble, will believe anything, Magic Beans :))))))))))

Got popcorn

Honestly, things have been looking pretty decent. I don’t know what will happen but I am starting to be amused at hysterics year after year after year after year.

From financial writer Chris Igou:

The U.S. Existing Home Sales Months’ Supply shows it. This index measures how many months it would take to sell the existing supply of houses on the market.

The average of the past 20 years is more than five months. Today, the supply sits at just three months. That’s well below the long-term average…

https://assets.stansberryresearch.com/uploads/sites/2/2023/07/0712Graphic.png

[NB source of the chart is Bloomberg]

This is one reason why home prices in the U.S. are climbing. There aren’t many houses to choose from.

Take a closer look at that chart. Supply is below pre-pandemic levels… If anything, we may be setting up for a mini-boom in residential real estate even after home prices, on average nationally, are up 40% from before the pandemic.

That’s when, of course, the Fed cut bank lending rates to zero and held them there for way too long, which is what got us into the current inflation situation in the first place. (Well, it was that and the decades of fiat-currency manipulation that came before.)

Housing to tank hard!

Another Jim Taylor! Welcome back!

After posting only “Housing will tank hard soon” for at least 5 years (2009-2014), Jim said he eventually gave up and bought a house and is likely a millionaire now (on paper).

He must have purchased a better crystal ball.

People have been saying that for a decade now. Prices have gone way up since then. Even if the market tanks 50%, those people aren’t going to save a dime. But they have wasted years and years of rent. I tell people to jump state and buy if living in a HCOL area is the problem.

I went back to the westegg inflation calculator and put in $500000 in 2009. A big fancy house that dropped that far in 2009 would be $708664 as of 2022 in inflation adjusted dollars, maybe $723000 this far into 2023? (His calculator goes to the end of last year.) So there will be no fancy houses for $500K folks because the dollar isn’t holding up its end.

The OC Register has several articles dealing with the low inventory of houses for sale, including data that shows housing starts slipping.

Lawrence Yun, National Association of Realtors chief economist, has a proposal to free up housing inventory. He would like a temporary capital gains tax moratorium for investors who sell residential property to first time home buyers. He says there are 20 million single-family rentals owned by Mom and Pop investors. He thinks that a tax incentive might induce some to sell. It might indeed induce this rental owner to sell if it covered the state capital gains in the state I live in and the state I own in. Both are high income tax states. I doubt very much whether that would ever be the case.

The way you the market is right now, and the advice from many on this forum is

The Best time to buy was yesterday, the 2nd best time is today

That sounds a lot like buy now or be priced out forever doesn’t it?

Haven’t we heard that before?

Thanks for the question Willy.

The Best time to buy was yesterday, the 2nd best time is today.

That’s what warren and I and pretty much everyone else say. It’s true.

Buy now or be priced out forever is stupid because:

Let’s say you are black. What if California comes out with a law that funds a 40% downpayment to people of color? The tax payer would just have to pay a little more. I could see that happening in places like CA.

Or, what if you inherit a lot of money and/or a house from dying boomers?

Even if you are priced out for the next 3 decades you still got a chance to own a house in your last few years before you die.

So then what is the solution? How do you buy now when you’re out priced. You cannot. The only option is rent until you can buy. Can only buy if/when prices drop. Which sounds like it’s going to be a long waiting game.

“So then what is the solution? How do you buy now when you’re out priced. You cannot.”

You can though. If you have a downpayment and a decent dual income you can buy a condo. A lot of people want what I did: buy a dream house right after renting a shitty apartment. But life doesn’t work that way for most. Most have to start with a small old starter home or condo and buy their dream house when they are old. Still better than renting forever!

Even buying a smaller starter house or condo lets You build equity and are protected from ever increasing rents.

I have been following this blog for a while. I did buy my first house in 2014 and then moved up to my current house in 2018. I currently live in the Glendale area and I just don’t understand the math anymore. Why would anyone buy a 2M (20 percent down payments looking at 15k) house in my current area when they can rent probably a better house for 10k a month. I myself am probably going to list current house and try to maximize the current buying frenzy.

Current house worth 1.8-2.1M

Loan:800k

Equity minimum:1.0M

Monthly all in 5.6k(including property tax and maintenance)

So my thought process is: I can take my 1.0M get 5.5% T-Bills for the next year which comes out to 4k after tax per month. I can leverage that 4k and subsidize my current rental of 8k and come out ahead and save $1.6K and wait and see what housing does. Not sure why more people are not doing this? Is my math off? What am i missing here? The rental is better location, newer, and better quality of life for my family as well. I just don’t get it maybe i am wrong. I would love some insight.

I will attempt to answer at least partially your question. Others may add their opinions.

Not all the buyers have the same reasons or have the same motivation. Some have too much liquidity or too many stocks. Some want to diversify their wealth portfolio. In a highly inflationary environment, some want to own real wealth (i.e. real estate) instead of cash (just a medium of exchange). Also, many central banks and large corporations divest their dollar reserves and dollars come to US to chase the same amount of goods and services. Wages go up, not only RE. A pilot union this week rejected a 30% increase in wages over few years. These re-negotiated wages are highly inflationary if you extend them to the whole economy even if they are not the same across the board. Minimum wages went up in most of the US; that reprice all the wages by about the same percentage to keep a balance between entry level employees and highly skilled employees.

With the exception of energy prices which were forced down by the largest draw of oil reserves in US history, the inflation (even calculated with the bogus formula) went up not down. These days it cost about double to built houses than 5 years ago. For that reason, the supply will be constrained for many years. That is the elephant in the room that media doesn’t admit is a bigger reason than the low interest many sellers have.

Wars are highly inflationary. We already have a proxy war with Russia in Ukraine (US is the primary source of money) and soon a new one may develop in China Sea. The over 2 Trillion dollars deficit is mainly financed by printing money which is highly inflationary.

There are many other reasons, but what I stated above are strong enough reasons.

Thomas, I too have wondered why more men don’t die rich. After all they’ve had their whole life to work on it.

Your PITI is 5.6K per month. What’s your interest rate? 3%?

Renting a slightly better home costs you 8k in rent?

Why take the risk of getting stuck as a renter since you don’t know what’s going to happen with the market?

If interest rates go lower, why wouldn’t housing prices go up?

You are betting on lower prices: people on this blog have made that bet since 2014!

I’d never sell my primary house with a 2.75%. I’d never go back to renting. Instead I would rent out my primary and buy another house.

You are speculating we reached the top? People told me in Q1 2020 I bought the top. Housing nearly doubled since then.

You have a great deal. You live in a 2M dollar home and only pay 5.6k per month. You should jump up and down in joy daily. So many people wish they would be in your shoes.

I know two people who sold their house to rent because they were convinced the market will go down. That was many moons ago. They don’t show their face anymore.

Sometimes playing this safe and simple is better. A 1.6k net gain per month can easily get wiped out if housing appreciates a few % points.

Thomas, keep in mind that the 5.6k for your mortgage includes principal. you can’t see the entire amount as an expense. I’d deduct that principal amt which makes the difference in your example smaller.

I agree. People think too hard and risk too much. A person with $1M equity or that can afford to rent for $10K month (just don’t do it) has already won the game. Enjoy life under your own roof. There are better ways to increase wealth than by living under someone else roof (which as you say us a huge gamble).

Here is what’s going to happen (most likely).

1) You sell your home for 2mil, incur 120k selling costs (jot it down).

2) You incur a tax bill for gain on the house sold (500k+ profit). Probably 100-200k (that’s already 220k+ you spent)

3) You will invest your cash into T-Bill and incur taxable income (while losing your tax-deductible mortgage write off).

4) You wait, rent, get rent increases. You stress. You spend 5k on moving expenses (2x)

5) Time goes by. Maybe pricing drops by 20% (Maybe!). You buy your house back at 1.6mln. You spend 50k buying/renovating.

So, you sell your home for 2mil. You buy it back 400k cheaper. Meantime, you spend/waste close to 300k not including the tax on T-bills income and lost tax write off on mortgage. You will be stuck with higher interest loan and higher tax base (if in in California). THe 100k you gained you will eat up of the period of 5-6 years.

This is assuming housing drops 20% which it won’t.

Good points. I used to visit Dr. housing Bubble every day for years when we were priced out and convinced the bubble would pop. It finally did (sort of) and we bought at the end of 2011 for $480k when housing was plummeting. Believed we were going to eat it as it looked like prices were still heading down. Our sons were (7) and (4) so establishing a family home was worth the risk…flash forward to 2023 and I feel bad for those in the position we used to be in. Affordability is the worse it’s ever been with interest rates where they are combined with surprisingly still elevated prices. I always believed they had to go down as rates increased.

Though we have a decent amount of equity, I told my wife it only makes sense to sell if moving out of state, but we don’t want to leave the comforts and diversity of SoCal and family and friends.

Selling to buy another house in SoCal is a no go also. Doesn’t make sense to swap a property tax bill that’s adjusted to $560k for $2M+ (Equivalent value of our home today and what we’d be looking at….to effectively quadruple our tax payment for the rest of our lives.

1st House:

What’s your current interest rate ?

If you sell as a joint tenant don’t you only get a $500k tax exemption on your

overall appreciation and the rest is taxed at around a 20% cap gains rate ?

Then add in the Cali 13% or so tax and maybe that 4% Obomacare transfer

Tax. If that’s still around. Oh, and don’t forget a possible 5% RE selling commission of around $100k + escrow costs and add it up – what do you really have left to drive your T-bill income ? Then, what if in a year or two the T-bill goes to 3.5%. What’s your interest income then ? Could rents increase in the interim ? Probably. Do the math again, then see where you stand.

Thomas, your math is right. My spouse and I have the same conversation – sell our big, expensive home with lots of equity, put the money in 5% government bonds, rent for “free” as the interest would cover the monthly payments. So it does work on paper.

In our case we just have a hard time converting from owners to renters. If I decide I want to change something in my house, I take a hammer, smash it down and make a trip to Home Depot. Also, in my mind, renting promotes a temporary mindset (I moved every 6-12 months in my 20s), and I am just too old to put my mind back there. So I will end up just sitting where I am.

Pretending to have the capability of timing the market to sell and rent and buy back later has a slim chance of working out financially. So much could go wrong. People expect that rates will go back down to where they were. What if we don’t see 2.75% for 30 years fixed without points ever again in our lifetime?

And what if supply remains low for the next decade and prices remain elevated?

Trying to time the market by selling and renting is a fool’s game. As M pointed out, there is way too much that can go wrong. The cost of selling a home, walking away from an ultra low rate and your Prop 13 tax basis, moving, getting a decent rental and HOPING to buy at a lower price down the road would be a horrible gamble. This worked for a short window back in 2007-2010, but things were much different then. I remember one of the big wigs at Pimco did this (Mark Keisel)…but he ended up buying a home shortly thereafter. And if you did math, there is little reward for lots of risk. And if you have a family and kids, nobody in their right mind would consider doing this. More reason why there is no inventory and prices are so sticky.

Two articles in the OCRegister on the subject of California rent increases. From Mr Lansner:

The average annual increase for CA 2011-2020 was 4.2%. The range for major CA metro areas for the year ending in May 2023was 0.7% SF to 3.2% in SD Co. This is a general moderating trend.

Ben Christopher:

Central Valley towns are showing major increases in rents since 2020. Bakersfield rents are up 39% since March 2020. Other towns showing increased demand for rentals are Fresno, Visalia and Santa Maria. Rent control efforts in Fresno and Delano fizzled out.

Columnist Lazerson has an article on mortgages and financing in the current environment. Lazerson says he’s seen this before: “High mortgage rates and declining cash reserves have homebuyers, equity borrowers and industry brokers struggling to land a deal.”

Self-employed borrowers are being turned down for home equity lines of credit, which he blames on declining incomes. He sees the following rates for the well-qualified borrowers on loans with one point: 30 yr FHA @ 6%, 15 yr conventional @6%, 30 yr conventional # 6.5%, 15 yr conventional high balance @ 6.625% [$726K to $1089K], 30yr high-balance conventional @7% and a Jumbo 30-yr fixed @6.75%.

Hey young homebuyers… sounds like a bargain compared to my 14% rate in the early ’80s! [10% down and a 10% of home value second @12% carried by the seller’s seller].

Headline: Statewide expansion of rent control qualifies for 2024 ballot

https://smdp.com/2023/07/31/statewide-expansion-of-rent-control-qualifies-for-2024-ballot/

California voters will soon get a third chance to expand rent control rules statewide after the Secretary of State announced that supporters of a measure that would let cities put new restrictions on how much landlords can hike the rent have gathered enough signatures to put it on the November 2024 ballot.

A state law known as the Costa-Hawkins Rental Housing Act of 1995 currently puts limitations on local rent control regulations. The current rules prevent cities from limiting rents between tenants (allowing the units to hit market rate when a new tenant moves in), from establishing rent control on any unit first occupied after Feb. 1 1995, in single family homes or condominiums.

The newly qualified measure, known as the Justice for Renters Act, would repeal Costa-Hawkins …

A more recent state law put a California-wide cap on rent hikes of no more than 5% plus inflation with an absolute maximum of 10% (in Santa Monica, rent control increases are capped at 3% after voters reduced it from 6% in the last election)…

California voters are some of the dumbest people on the planet. Rent control always causes rents to increase in the long run.

More dumb people = more renters = more wealth for asset owners.

Rent control benefits some tenants at the expense of others.

In NYC, some tenants have kept their units in the family for generations. NYC allows tenants to leave their leases to their heirs, like any other property.

NYC also allows the original tenants to sublet at market rates. The tenant can’t permanently vacate the unit, and must show that they still live there sometimes. But there’s much fraud, and a lot of illegal sublets.

You occasionally read horror stories of tenants paying hundreds of dollars a month for prime Manhattan areas, and subletting for thousands of dollars. And that doesn’t include illegal Airbnb rentals.

Essentially, NYC rent control has transferred the units from the landlord to the original tenants.

New tenants must pay inflated market rates, either to landlords of newer buildings, or when subletting from the original tenants.

The reason for rent control is simple. The entrenched longtime tenants outnumber and outvote both landlords and prospective new tenants.

Pure democracy: two foxes and a chicken voting for what to have for dinner.

If rent/price control works, why not to have food price control?!!!….After all, food is even more important to human life than shelter.

The reason no politician brings that up is because price control on food will bring empty shelves super fast and they will lose power (they would deal with the consequences of their actions super fast). With shelter, you have the same effect but it takes years to see the effects; by then they hope they stole enough and someone else will deal with the consequences. That proves, that politicians, at least in CA and NY where they propose rent control, are not stupid but plain evil – they care less about the consequences of their actions on the useful idiots who put them in power.

From the OC Register:

https://www.ocregister.com/2023/08/02/southern-california-home-prices-still-rising-despite-high-mortgage-rates/

and yes, vote against the Justice for Renters Act next year. There’s no justice for

renters or owners in that act. Defeat Michael Weinstein for a 3rd time on this issue

and for misusing AIDS Healthcare Foundation funds to promote rent control.

Housing to Tank Hard!

Amid articles about predictions of where the value of houses will go in the next year and about of the manipulation of how houses are listed by RE agents (sweetheart deals?), there is an article today in the OC Register of the one predictable thing that happens in California: more expensive housing bond propositions for the coming year. $10B (B=billion) for “affordable housing”, $5B for homeless housing and treatment facilities for addicts and a potential $20 B Bay Area Housing Authority bond issue. Some housing lobbyists are worried about bond fatigue.

There are of course potential non-housing bonds… school, flood control, climate change, opioid crisis etc. The article says that since 1980, 75% of state bonds have passed at a cost of $182B. Bond measures are put on the ballot by the legislature, not by petitions.

Hasn’t Cali already spent $90B on homelessness in bond measures, etc. and the problem just keeps getting worse ? For me, enough of throwing $ away in

compassionate ignorance. No more of those bonds until the pols can come up with

real solutions. Also, didn’t Cali go from $100B surplus to $30B deficit in just

the last year or so ? Need to put our $ where it’ll make a difference.

It looks like most people in CA like all those measures. Otherwise, why would they vote the same politicians expecting different results????!!!!….

Those who don’t like them, vote with their feet. What else can they do when those people have a supermajority!?….

Homelessness in CA is a profitable industry that will never go away.

Headline: Buyer (agents) beware: Las Vegas Valley realtors react to looming lawsuit

https://www.fox5vegas.com/2023/08/17/buyer-agents-beware-local-realtors-react-looming-lawsuit/

A class-action lawsuit filed by home sellers that would fundamentally change the way houses are bought and sold, and in particular, the way real estate agents are compensated, is catching the attention of local agents.

Currently, no matter how much experience a buyer’s agent has in the real estate industry, they get the same commission from the seller that a seasoned veteran does. A case in Illinois known as Moehrl v. National Association of Realtors would change that if the plaintiffs win.

The plaintiffs filed suit against NAR and several major real estate brokerage companies, claiming the system that splits commissions paid by the seller between buyer and seller agents is anticompetitive. Instead, the plaintiffs argue, homebuyers should pay for their own agents.

One local agent who has more than two decades of experience in Southern Nevada says this will cause buyers to become much pickier and could drive many new agents out of the industry.

“If this lawsuit goes through, it would probably cut the agent count from 1.6 million to about 200,000,” Las-Vegas based real estate agent Steve Hawks told FOX5 Wednesday. “It’s going to impact agents that aren’t experienced.”

Hawks says this lawsuit will take away a big advantage for inexperienced realtors if the plaintiffs win. …

Headline: Mortgage rates reach their highest rate in more than 20 YEARS – here’s what it means for new home buyers

https://www.dailymail.co.uk/yourmoney/property-and-mortgages/article-12418119/Mortgage-rates-reach-highest-rate-20-YEARS-heres-means-new-home-buyers.html

Home buyers are facing their highest mortgage rates since 2002, as experts warn higher loans could pour cold water on the property market.

Data from government-backed lender Freddie Mac shows that a 30-year fixed rate mortgage is now hovering at 7.09 percent.

It comes after economists predicted rates could shoot up past 8 percent if the Federal Reserve decides to hike interest rates again next month. …

Affordability for homes is the most out-of-whack in history.

Return to the mean will occur. Whether it is through higher incomes or lower house prices. Likely both.

This drama will continue.

I’m betting that higher primary incomes due to inflation and COLA will keep home prices flat for many years. Speculators will exit the market when home prices remain flat. Home prices will return to the inflation curve which will mean it is time to buy a primary home. Just like in 2012 or the 1990’s. Buy a house in 2024 and you will not be cheated. Just hold it for the historical 10-15 years and you will come out ahead.

This is all a good thing. Just like it was during most of history before the Fed artificially lowered rates causing a speculation bubble in 2019. Trumo(A*hole) started it to get re-elected. Biden(A*hole) was asleep at the wheel in 2021 after being elected. Now Biden is doing the right thing to recover. Trump (double A*hole is criticizing this).

In summary, I will vote for an A*hole than a double A*hole.

Remember, the historic average mortgage rate is 7.8%.

Just stop whining while mortgage rates are below the historic average. The Fed wrecked us all with 3% mortgages in 2019.

You can rejoice that wages have leaped so high(unless you work for a cheap-ass company that gave 2% raises last year.) . Time to leave.

If you have a 3% mortgage, can you afford it? As a WalMart Greeter? If so, thank goodness. If not, what in the heck were you thinking when you signed up for that 5K mortgage? Just hang on until you can’t. Foreclosures wrecked many of my friends and co-workers in 2009. You will be doing fine in 10-15 years if you can hang on.

If you die, divorce or become laid off, I wish you the best of luck in your future. Those are the killer 3.

Bob, historical avg of 7% doesn’t mean anything. Back in the day, a house cost 50k. Who cares if the interest rate is 15% if the price is 50k compared to 1M today. You can’t find a decent house in CA near good jobs or the coast for less than 1M.

SIABB,

There are three groups of people in the USA, with relatively similar population percentages:

1) People who hate Trump and won’t give him credit for anything good.

2) People who see Trump as the last hope for America.

3) People who judge Trump based on his performance as well as his personality, and give him credit where its due and criticism where it is deserved.

Here is a link to a chart of real inflation adjusted interest rates:

https://www.in2013dollars.com/us-economy/mortgage-rates-inflation-adjusted

The inflation adjusted mortgage rate was 5.63% the month Obama took over. His last month it was 1.46%. The month Trump took over it was 1.81%. The high was 3.20% and the low was 0.97% in January 2021 (Covid). Trump’s inflation-adjusted rate looks to be the flattest since the ’70s. Biden’s I-A rate started at 0.11%, dropped to a low of -4.99% and jumped to 3.61%as of last June 1st. Biden was printing money and handing it out with disastrous consequences for the economy and the inflation rate. The Republicans took over the House at the low point and the trajectory from then to last June was straight up. Coincidence? I don’t think so…!

Trump = steady hand although still subsidizing interest rates (three percent with zero inflation is the minimum that it should be for paying investors (including the Government) a fair return long term); Biden = yo-yo man.

You don’t have to pretend that you don’t suffer from TDS by calling Sleepy Joe Ahole. be proud that you don’t understand reality and prefer a corrupt useless President than the crazy one that had this country running well prior to 2020. It’s obvious you called out Sleepy Joe just to mask that fact that you would vote for him 99% even if he screwed you over. That is what Dems do. I won’t vote for either. I can be proud of my choices and not pretend. I did vote for Trump but would never again.

My parents bought their 1960’s S. CA tract home in 1974 for $65K. Of course, my dad was making 15K/year which was a good salary. 4.5X.

If they were laid off or divorced and lost that 15K income, they would have likely sold. Housing was not in a bubble at the time and there was not the potential for a mass sell-off.

That isn’t much different now when a 2 earner couple making 200K/year buys a 1M house. 5X.

Houses were cheaper back then but so were incomes and it was rarer to find a 2 income household.

If death, divorce, or layoffs occur, it is hard to stop the drop. So far, unemployment is low. Let’s hope we can continue this great economy don’t go back to 2008 when it was high.

What happened to the popcorn guy that said for 3 years straight we will have a crash and he “got popcorn, munch munch”.

I imagine that hasn’t been a healthy way of life. Would have been better to just buy real estate and eat veggies and plant based proteins. Nothing wrong with some good chicken and a steak once in a while but long term eat healthy and buy houses.

Why are you telling others to buy? Walk your talk and buy today in your state of California! Lead the way ol’ wise one LOL

Already did. I own.

If you can comfortably afford to buy and want to hold long term why wouldn’t you buy today? People told me in 2020 I shouldn’t buy because it’s the peak and I will lose my equity. A few years later i gained Half a million in equity. Nobody knows how expensive housing will get. Just imagine rates will come down…..the frenzy will be back on.

No you didn’t, I am saying buy another, at today’s prices. But you won’t because its expensive in California and you know it.

I also own, way before you did in fact, but I don’t go out of my way to “advise” others to buy at the current prices in the hope of retaining my home’s peak price ????

Actually, I bought two houses in the past few years. Everytime the expert Genius’ tell me I shouldn’t buy and it’s the peak, worst time, bla bla bla.

Humans sell / buy houses constantly. This year we will see close to 4M homes sales.

And you tell people not to buy just because you wouldn’t be able to afford it?

You don’t need to advise people of anything. If they can’t afford, there is no way they can buy since we don’t have liar loans and stated income anymore.

If they can afford it, who are you to give them advice???! Some people have money that burns a hole in their pocket. Some people sell one house and buy another one in cash.

If you can comfortably afford it and want to hold for the long run I see no issue with that. Doesn’t matter if the rate is 2, 7 or 15%.

I bet you a ton of people wished they would not have listen to the perma bear bull crap that’s all over the media. It used to be a crash is near. Since rates have gone up, the narrative shifted to now it’s unaffordable but before Covid it was very unaffordable. The goal post just gets moved.

I’m not waiting to time the market — I have plenty of savings and a great job — just can’t see buying something — putting 20% down ($200k) — and having a payment of $6k-8k per month when I can rent the same thing for $3k-4k and still have my 20% in T-bills making 5% interest — buying makes no sense to me at this time — it’s not about timing the market — it’s just not a market that I want to play in — so I won’t — and I’ll accept the fact that I may have lost my opportunity to buy — but I also know property values do not ALWAYS go up and the lack of affordability is not sustainable — time will tell — I’ve learned to be ZEN about it cause nothing makes sense to me right now — too much money given away by the government and tax breaks for the rich didn’t help either

If you follow John Hussman he articulates theY, in his current newsletter that the S&P is overvalued by more than 50%. With that said you can figure out how the housing scenario unfolds from there. We are living in an over-inflated monetary phenomena that is not going to end well regardless of what the cheerleaders here are so fond of spouting. Enjoy your wealth effect through pulling demand forward because it will all be coming out soon. Unfortunately it won’t be by choice. IOW our government borrows $1 for every 2 it takes in via taxes, Medicare is an ovebloaded pig that is filled with corporation monopolies.

What I think is really interesting is all you number dropping upper class people who think you’ll be shielded when all this comes down. You won’t.

The 50% overvaluation number for the S&P is nothing but a pie in the ski.

If you divide the S&P by the M2 money supply you see on a chart that it’s all driven by money printing. Stocks and bitcoin go up when we print more and contract with QT. We can never get out of borrowing money just like any other country.

It’s pretty simple: King dollar, king USA. There isnt a better country to become wealthy. Compared to other counties we are the top of the line with the best opportunities. Own our stocks and RE in the US in a decent location and you are set. Waiting for the pie in the ski and reading zerohedge will lead you down the losing street and frustration awaits on every corner.

Headline: If Supreme Court nixes NYC rent control, tenants AND landlords would be better off

https://nypost.com/2023/08/27/getting-rid-of-nyc-rent-control-would-benefit-tenants-and-landlords/

In a case that promises to utterly upend New York politics — and boost the city’s housing market — the Supreme Court may soon strike down the essence of the rent-control laws….

In May, New York landlord groups asked the court to hear their challenge to the state Rent Stabilization Law, which lets the city cap rent hikes and gives tenants a virtually ironclad right to renew their leases.

It’s led to some people renting the same unit for decades — and then passing it to a family member, caretaker or friend.

In many cases, building “owners” never regain control over those units, even if they want them for their own families or other purposes.

And that, the suit contends, amounts to an unconstitutional “taking” of property, in violation of the Fifth Amendment….

What do you expect from a democrat controlled city?!!!… It is the same wherever democrats/communists are in power – they nationalize private property, directly or indirectly.

“Home values in San Francisco had fallen by almost 8 percent year over year in June, a loss of nearly $60 billion in aggregate, according to Redfin data. Los Angeles saw the biggest decline in aggregate home value at nearly $153 billion, followed by Oakland at almost $86 billion.”

Just saw this on the internet. This might mean something.

Headline: Chicago’s mayor Brandon Johnson wants to push ‘mansion tax’ on homes that sell for more than $1 million – and members of his team want to tax households earning $100,000 or more in report named ‘First We Get the Money’

https://www.dailymail.co.uk/news/article-12508897/Chicago-mayor-brandon-johnson-mansion-tax.html

Chicago’s mayor Brandon Johnson is pushing a ‘mansion tax’ on sales of homes of more than $1 million, as his administration continues to push higher tax on households earning over $100,000.

The newly elected mayor, who took over from his disastrous predecessor Lori Lightfoot in May of this year, wants to push a hike in taxes in order to fight homelessness in the city.

Allies of Mayor Johnson, 47, have also announced plans to push a $12-billion plan for the city titled ‘First We Get the Money’.

The plan, seemingly named after a quote from the 1983 film Scarface, aims to build a ‘more just’ Chicago by slashing funding for the police and implementing new taxes in the city.

Johnson believes people that own properties worth $1 million in the third-largest city in the U.S. are ‘rich, and should pay if they sell those homes’.

In Los Angeles, a million dollar house is hardly a “mansion.” I assume the same is true in Chicago.

Plenty of condos in Santa Monica are well over a million.

Two OC Register columnists are dissecting the home sales statistics this week. Sales statistics show that they are off 32% in the last 12 months. The market is at its lowest place since the year 1990 (when the database started). It also noted that all major regions of the state are in a similar situation. The other one looked at cancellations for mortgage contracts and saw a significant rise in cancellations (mainly buyers). Reasons he has heard? Waiting for interest rate drop; can’t afford fix-up costs; cold feet; insurance problems because of wildfires; sellers won’t pay for home inspection. The writer says most will have to lower expectations the next time around.

The other subject is the California Environmental Quality Act. Democrats are floating a new law to exempt “affordable” apartment developments from CEQA (also their law).

Qualification for the exemption includes:

1) in a dense urban area

2) units set aside for earners making less than 80% of the area median

3) Stricter labor standards (looks like a pro-union rule)

The environmental lobby still is fighting this, but some of the Union opposition has been peeled off by promising unionized jobs. A lawyer who works for developers says that is swapping one cost (CEQA) for another (union wages). So the compromise is to have some subsidized units and some full price in the same complex. That could be a tricky balancing act… maybe one side for the poor with a green space (or a WALL ??? LOL) between those and the higher priced units?

Democrats continue to do amazing things for our state! NOT!

Formerly SIABB but changed since my posts aren’t being approved anymore.

If the good Dr would like to start posting “Real Homes of Genius” again, I found one.

Price drop from 500K to 350K

Requisite trash cans in front.

It has good bones since all that is left is a pile of bones.

https://www.zillow.com/homedetails/812-N-Record-Ave-Los-Angeles-CA-90063/20646595_zpid/?

I find it hard to believe that he’s cut you off. Besides, you outed yourself in this new post. Your posts are interesting and sometimes spot on. The idea of this blog is to have multiple opinions on the subject of housing, not a one note propaganda forum. I wonder if there was a glitch with your e-mail carrier?

Thank you for the kind words, Joe. And thank you for your excellent comments.

Wolf Street told me that SIABB was being put in the spam bucket and recommended that I change it since he had to manually move me out of spam. The same may be happening here. Whatever algorithm that makes these decisions doesn’t like SIABB.

I had been meaning to change it anyway. It was a bit arrogant. I don’t think anyone has ever seen the effects of the Fed lowering rates to near zero and than rapidly increasing them. I am as lost as everyone on what will happen.

Just came here to announce that I’m closing on a house in San Diego in a week and I just really need someone to break out their popcorn and tell me how much of a big stupid mistake I’m making ???? Please forgive me, my momma dropped me on my head when I was a wee lad and I haven’t gotten the hang of this “numbers thing” ever since. Admittedly, all of my spot on predictions dating back as far as 2016 have just been lucky guesses. Once I close, I will celebrate with a feast of 64 ct Crayola crayons (semi-gloss of course as a tribute to my half-sized glossy brain). Please direct your comments on popcorn below, I look forward to indulging on our respective feasts.

If you have money sitting in the bank, I believe it is a good time to buy. I am fully invested in RE in multiple states/markets and I feel good about it. I think that inflation will continue for many years for multiple reasons:

1. It is easier for government to manage debt in lower value units of currency. The whole debate between the 2 parties is in regard to the speed of spending increase (they call that “cuts”).

2. The fight against “fossil” fuels by some politicians in power is highly inflationary (the whole economy depends on price of fuel)

3. Wars are highly inflationary, and we are involved in many

4. The budget deficits are the highest ever and there are not as many foreign entities as in the past willing to finance them; the buyer of last resort is the FED by “printing” money, which is highly inflationary.

5. The increase in money supply in the last few years (over 40%) is highly inflationary

6. The Inflation Acceleration Act of one trillion is highly inflationary – they didn’t have the money and created them out of thin air.

7. Massive immigration (legal and illegal) is highly inflationary – the rent component of the inflation went up a lot.

There are many other reasons in regard to attack on the housing supply which are also highly inflationary.

I also bought a multimillion dollar property in May because I did not want to hold too much cash in account (I keep it just for emergency); I still feel good about it and regardless where the price goes, real estate is wealth and currency is just a medium of exchange.

Self-proclaimed real estate multi-millionaire puts last few million into yet another property-no big deal.

You are so tone-deaf it’s effing hilarious. GTFO

You are entitled to your own opinions and free to believe whatever you like.

I explained my opinion and why. If you believe it or agree with it or not, I care less.

Why so much hate for expressing a point of view???!!! What is your issue?

Congratulations!

It’s a great time to buy it you have the means/cash. Higher rates mean less competition and pressure on price. Once rates go down, prices will go up and we are a frenzy again. You on the other hand can refinance when rates go down.

Great move! Enjoy your house!! In which area of San Diego did you buy? A new build?

Congratulations! Break out the Champagne!

Buying a house to live in for the long term has historically never been a bad choice.

Even people who purchased at the peak of HB1 in 2006, are well above water now. And are able to retire with no house payments. They have something to leave for their heirs OR they have a backup insurance plan if they ever need to move into assisted living.

Depending on your personality, just stop reading gloomy Housing Bubble Blogs and enjoy your new home. Definitely never panic and sell or foreclose, Co-workers who foreclosed in 2009-2010, are definitely in far worse financial shape than those who hung on and rode it out to riches.

Enjoy your new home!

Realtors not doing a very good job convincing people “now is a good time to buy”. Or maybe the majority of realtors have transitioned into new careers already.

https://finance.yahoo.com/news/almost-everyone-thinks-its-a-bad-idea-to-buy-a-house-now-survey-shows-182243651.html

Why would it not be a good time to buy a home?

There are so many reasons depending on one’s personal situation but I think most are just waiting for an inheritance.

It has ALWAYS been a good time to buy a primary home as long as you hold it long enough. 15 years has historically been long enough.

Based on historical data, mostly before 2000, house prices have tracked inflation.

Even during the wild boom-busts since 2000, the CPI inflation rate has been the floor for house prices.

Houses are assets that most of the benefit is derived as a place to live without increasing rent forever.

Some scenarios if you live and enjoy your house for 15 years.

At the Fed target of 2% inflation.

1.02**15 =1.35

A house value would have to be 35% less in 15 years to not realize a benefit.

At a likely inflation rate of 4% for 15 years:

1.04**15 =1.80

The house value would have to be 80% less after 15 years. This has never happened.

My realtor would sneeze and it came out “BuyBuyBuy!!!!”

In my opinion a true deflationary depression like 1929 won’t ever happen again because the government will always inflate the currency; even in the 1930s the government resorted to inflation, the devaluation of the dollar from ~$20/Oz to $35/Oz. “Stagflationary” depressions will occur though. Real estate does well in the recovery phase but will drop big time in the crash, particularly when real estate speculation on credit is causing the crash. Right now, the situation is quite different from 2008 since there is much less credit for spectators to access. Easy credit is the mother’s milk of market crashes.

Inflation has permanently elevated the cost to build a new home. We’re going to see a phenomena in the housing market similar to vehicles. New car production is down, but people are so strapped for cash that their price hasn’t gone up much. Price competition is so competitive that it’s simultaneously caused used car prices to rise. On some makes and models, the spread between 2 years and 50k miles between used and new is only around $2K.

We’re going to see this in houses too. Monetary debasement has set the price floor–a likely intended consequence. Supply will continue to be restrained by limited new construction, high interest rates, and people clinging to their established low rate. The market will go up slowly, but it will continue to go up. This isn’t a banking credit cycle. It’s a currency crisis.

Leave a Reply