The Correction is Here with Home Values Declining by $2.3 trillion in 2022: Personal Savings Plummets With Record Consumer Debt.

The housing market is entering a massive slowdown and only the naïve and delusional will ignore the red warning signs. First, there is this odd narrative that housing continues to excel and thrive in the current market. “Inventory is low therefore the market is hot” or “7% interest rates can’t stop the equity train baby!” This seems to be the mentality at this point. But the reality is, $2.3 trillion in housing wealth was wiped out in 2022, the most since the Great Recession in 2008. $2.3 trillion is a lot of equity that has gone up in smoke but somehow, the delusional housing brigade continues to beat on the “real estate never goes down” tagline. Keep in mind why real estate prices shot up. First, we had dangerously artificially low interest rates brought on by the Fed during the pandemic. Those rates were never “healthy” and with inflation raging out of control, the Fed has had to slam on the breaks. The idea of the free lunch is strong in a lot of people. Second, people were confined to their homes for two-years and many thought remote work was here to stay. That is absolutely not the case as companies bring people back either full-time, 4-days a week, or 3-days a week. In other words, being stuck at home is over and 2022 cleared out a ton of inflated equity.

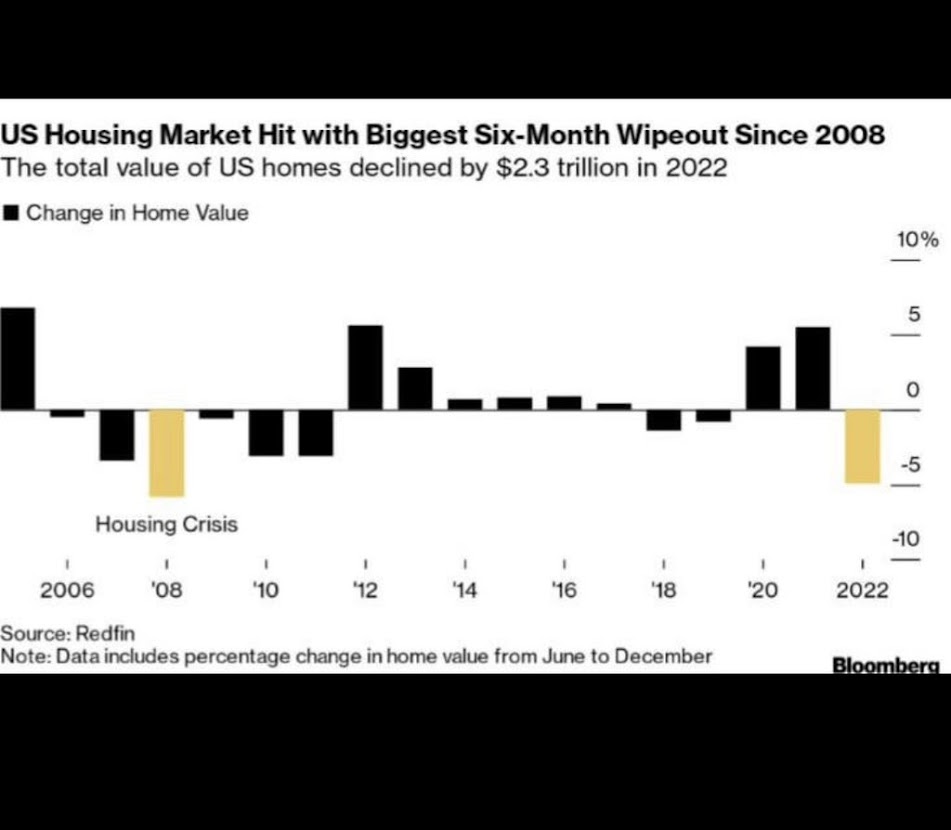

The 2022 Destruction of $2.3 trillion in Housing Equity

The last time we’ve seen this much destruction in real estate wealth was in 2008 at the core of the housing crash. So many people were saying that this was not possible because NINJA loans were not here or that lenders were the perfect example of financial prudence. Absolutely not! We had millions of people on pandemic forbearance, coupled with the Fed going Chernobyl on rates, and finally people thinking the home was the new office for life. All of that is reversing and reversing fast. 2022 wiped out that first layer of equity to the tune of $2.3 trillion. If you are selling today, your audience is looking at 7% mortgage rates and a tighter economy. You are now in a stucco sarcophagus like an Egyptian Pharaoh except instead of being buried with gold treasure, you will be buried with your Ikea ottoman and Double-Double from In-N-Out.

As we look forward, it should be obvious that we are in a cycle of a correction. Housing takes a long-time to go up and a long-time to go down. Unlike the stock market that can go mark-to-market in a day, housing takes a long time because you have delusional homeowners that can sit back until the good days come (or until they need to pay the bills and run out of cash).

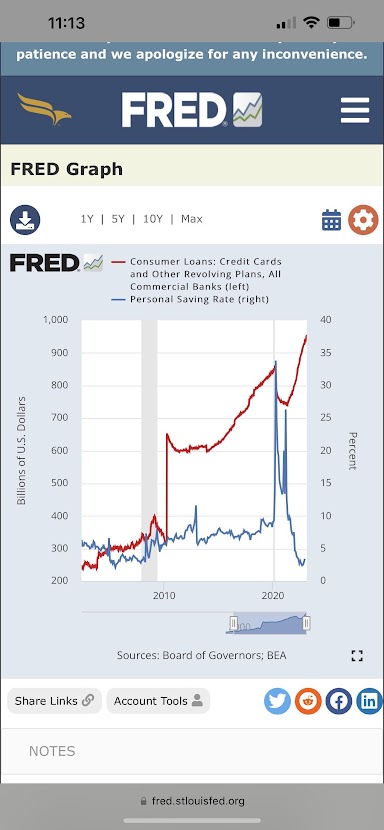

Next, you have troubling financial behavior by the public:

The spending rate has plummeted and consumer debt is at record levels. Keep in mind that consumer debt rates are off the charts. Cheap money is gone. Some places are offering 90-month car loans which should come with a therapist appointment. You can get 5% nearly risk free with US Treasuries. So why would a Wall Street investment firm buy tons of properties to gain a similar yield? We’ve seen places like Zillow and Opendoor take big hits because they overpaid with their algorithm that was built on higher and higher prices. These only work when buyers are willing to overpay.

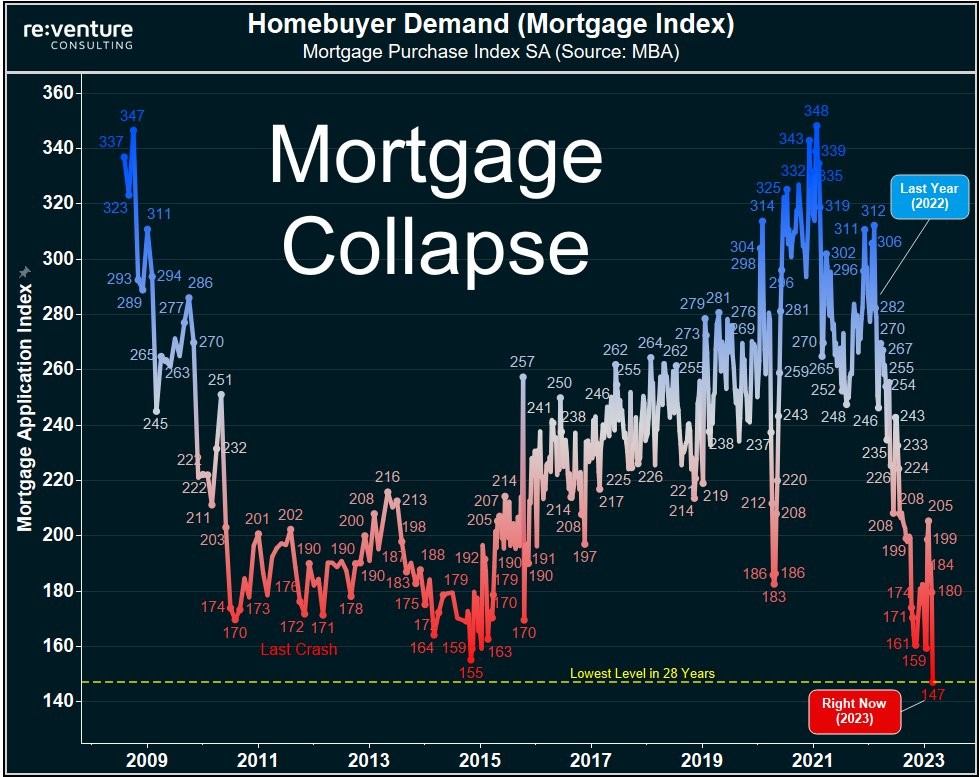

Mortgage demand is also now at a 28-year low:

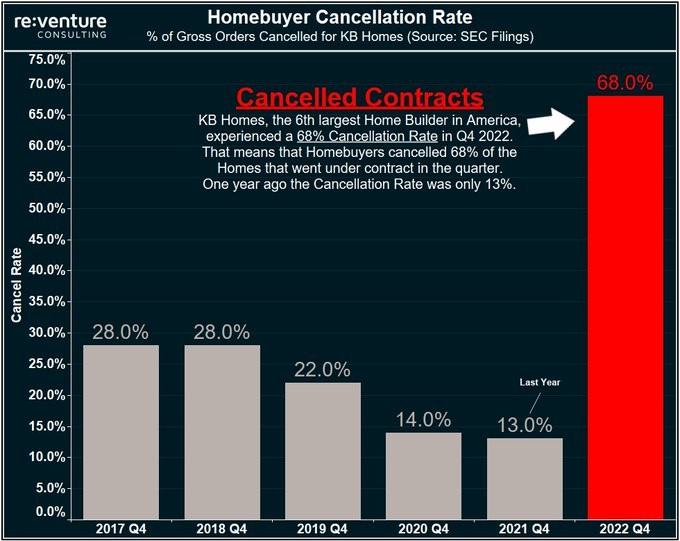

The vast majority of people beyond foreign buyers and Wall Street banks actually need a mortgage to purchase a crap shack. And like any market, you have leading indicators. New Homes are very telling since builders need to get rid of the inventory. And guess what? People are canceling contracts at very high levels:

Home builders have done everything to avoid lowering prices: incentives, upgrades, buy downs, and any other gimmick. But now, they are pulling the trigger on prices which will trickle down to your Taco Tuesday baby boomers that now think their crap shack is worth $1 million just because Zillow or Redfin says so.

The market is correcting with $2.3 trillion being incinerated. So are you buying, investing, or selling in 2023?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

240 Responses to “The Correction is Here with Home Values Declining by $2.3 trillion in 2022: Personal Savings Plummets With Record Consumer Debt.”

Median sales price in Q4 2019 was 327k for a house in the US. Compare that to the 467k in Q4 2022.

And we are honestly talking about a measly 2.3T that got shaved off the total value? What a nothin burger. The value of the US housing market is 45T. And it means very little. Who cares if my house is worth 1M or 1.3m or 1.5M. I don’t. It’s not like I am gonna do a cash out-refi. It’s nice to sit on a lot of equity but so what. Missing those days of 3% mortgages where you could do cash out refi and buy another house. Never did a cash out refi but I’d consider it if rates would be half of what they are right now. 7% mortgage rates sounds so dreadful.

It looks from the article that the 7% mortgage does have an impact on property values regardless of the inventory.

Real estate prices move super low, like an oil tanker, especially when they go down. From past history, they can go down like 3% the first year, 5% the second year, 33% the third year (capitulation stage), again 5 and 3% in the forth and fifth year – you get the picture. These numbers were pulled from a particular market I was following about 12 years ago. It is just an example of how slow a real estate market can drop.

Definitely, the real estate market does not correct at the speed of the stock market or crypto.

The thing about higher rates that people miss is that you can (finally!) make a decent return outside of RE and stocks. Getting 5%+ on money market and CDs is worth the marginal correction to my home equity, IMO. I don’t borrow from from my home, anyways. Savers haven’t had a break in 14 years. Now it’s our time.

“Missing those days of 3% mortgages where you could do cash out refi and buy another house.”

M, your irrational exuberance seems to be getting tamed. Hopefully it will also tame everyone else who have been using their house as a piggy bank to leverage into real estate (which always goes up or you can just become a slumlord millionaire landlord, right?). Prices will finally come down.

I adore high interest rates! At last, I can get reasonable interest on government bonds and even 5 year CDs- nice, defensive investments that are appropriate for someoone in my age bracket.

And you, M, should be grateful that the temptation to do a cash-out refi has been removed.

Why? My mortgage is so low. If we had below 3% rates now I would pull money out and put it to work.

Buy more real estate or Bitcoin. Worked out so far why wouldn’t it continue my dear?

Problem is we have 7%. It sounds so ugly. 7 is a no go. 3 or 2 is bueno when it comes to mortgage rates.

Laura,

What’s your real rate of return after factoring in inflation?

I’m not panicking, Yes housing prices are down, Yes the stock market is down, but I’m playing the long game and holding my assets. The economy is in a strange place, rising interest rates, but record low unemployment. My employer is so desperate for employees that they now have a bounty program, $300 if I recommend a new employee who stays 90 days. Unskilled labor, $16 per hour + benefits.

I have the same philosophy. I had the same philosophy of holding on during the 2008-2012 crash and did very well. I now live rent-free for the rest of my life.

There is some truth to this paraphrased saying for housing: “He who panics first does the best”. Look at the wealth you could have had by selling in early 2022 and 2005. He who doesn’t panic does even better. He who panics in the middle loses their shirt. I don’t think we are in the middle yet, but who knows?

Timing the top and bottom requires a good crystal ball. Mine broke in the 1994 Northridge Quake.

I’m riding this one out again.

“Douglas Adams’ use of “don’t panic” was perhaps the best advice that could be given to humanity.” – Arthur C Clarke

Not exactly rent free. You do pay property taxes, insurance, maintenance, lawn care, sewer, water, don’t you? Probably also a mortgage unless you bought for cash or paid it off. Some people pay HOA stuff. Nothing is rent free.

William,

Yes, it is not free to own anything; house, car, etc, even if it is paid off in full.

IMHO, in the long term, it is cheaper most of the time to own a house or car than to rent one. The person renting me a house or car is in business to make money. They are realizing a profit above the expenses like taxes, sewer, water, electric, insurance. These expenses are typically much lower than the cost of a mortgage/loan. (Though I have seen the TI part of PITI to be higher than the PI in some high property tax states prone to hurricanes.).

For example, when we were selling my mother’s vacant paid-for house in CA, we estimated the monthly costs were about $600/month for taxes, utilities, and insurance. The going rent in that area was $4K-$5K per month. My mother was grateful that she purchased the house 35 years prior and was able to live in comfort her entire retirement at an affordable cost while receiving SS. She couldn’t rent anything for $600/month in that area. She had the foresight to lock in her PI costs with a 30 year loan that would never go up and would go away in 30 years or less. Housing/rent prices went up and they also crashed during that time. She didn’t care.

That is my goal. It is rent-free but nothing owned is expense-free.

Still waiting for the prices to go down so I can afford my first home 🙁

How much do you need them to drop in order to pull the trigger? 10%, 20%, 30%?

Just speaking in general I think we can all agree the S&P 500, The DJIA, and housing prices in every US market are going to fall by 50% in the near future.

Me thinks housing will fall 50%.

I disagree. If housing prices cross the inflation curve which has been dramatically rising, it will be like 2012 again. Houses should track inflation as a place to live. If house prices are back to the inflation rate that means speculation is removed. According to the good Dr’s chart from his last post, this will be another 30% fall in prices (RE is local, so some areas will vary). I will buy a house at this point.

The speculator iBuyers are realizing this and their income and stocks are falling 90+%. They are starting to dump their houses on the market at whatever they can get to relieve their pain. This will cause housing prices to drop faster.

However, from January the January 1% rate drop caused a 30+% loan origination increase, This means buyer demand is very strong. Why not? Inflation is increasing wages and more income = more buying power. This should gobble up the iBuyer dumped homes causing a slower decline in prices. This will be a soft landing. Eventually house prices will settle to the inflation curve (~-30%). This will be about 2019 prices. 4-5 years of flat house asset gains will remove speculation.

If the economy crashes and unemployment increases beyond 7%, housing could crash more than 30%. This is when the Fed will step in to save us all 🙂 and start lowering rates again which will start Housing Bubble 3. I’ll buy then, if I can. At the recession level bottom. High unemployment could cause a 50% drop like last time in 2008-2012. Nobody sees high unemployment yet so that may be 2024 and beyond if it happens. It would be a hard landing.

Bob,

“If the economy crashes and unemployment increases beyond 7%, housing could crash more than 30%.”

The avg joe can’t afford to buy. Life long renter. When the economy crashes it really depends on which sectors are being hit the hardest. The homeowner in the US is doing fantastic financially. Future Mass unemployment-there are no signs for it. If economic data weakens the 10y yield will go lower. Bond market as always will be ahead of the fed. Lower bond yields translate into lower mortgages. Demand increases. People who sit on cash and keep their job will have great buying opportunities. Before you expect lower RE prices you need inventory to increase. We are below 1M active listings. In 2019 you had 1.5M.

“When the economy crashes it really depends on which sectors are being hit the hardest. The homeowner in the US is doing fantastic financially. Future Mass unemployment-there are no signs for it.”

I agree. There is no sign of mass unemployment today. Homeowners are paying their 3% mortgages and making more money with wage inflation due to low unemployment.

However, the Fed is trying to drive up unemployment to fight wage inflation.

They may be incompetent, but don’t fight the Fed.

Based on how they created this massive bubble in the first place, they are more likely to drive the economy into a recession and unemployment will reach 7%. Just like in 2008. We’ve seen it all before. Given their slow reaction time, I doubt they have supercomputers working on a solution. Decisions are being made the old-fashioned way over a 3 martini lunch.

It has been my experience that appraisals are always tailored to who is asking for them. My House is “appraised” by Zillow and Trulia and Redfin at ~$870K, $750K by Realtor.com, and $890K at homes.com. Not exactly unanimity is it? I don’t see any major change in the house payment in constant dollars (adjusted for inflation) for middle income housing in the next couple of years. What I do see is seesawing interest rates making for a wild ride in prices and inflation affecting the value of a dollar.

As for “crapshacks”, you haven’t seen a real crapshack until you have driven out into isolated rural areas where poor people live in hovels constructed out of whatever they can salvage.

Here in Naples FL 2019 my neighbors from England took over a year to sell their home and for a price that was when they bought in 2013. That same house nearly doubled in value by 2022. And we all know that 2021 and 2022 there was a mania in housing. Now some people have put their houses on the market and they are not getting their price so they are taking them off the market. Having lived through the low point of real estate in 1982 to its high point in 1987 which took till 1991 to bottom, and having lived through the mania in housing starting in 2002 till 2008 where it took till 2011 to bottom, taking the punch bowl away of low interest rates should be history repeating itself.

I started buying short term t-bills in Jan and happy that I’m getting over 5% in tax equivalent yield (no state tax). It’s not making me rich, but it’s preserving cash. As mentioned in the article, how much longer is Wall Street going to continue buying properties when they can get the same return without the headache and risk?

I don’t even know why an individual investor would want to buy a property in the foreseeable future unless prices come way down. If you can afford to buy a primary residence then by all means buy one- who cares about the rate or price as long as you got the cash. You need a place to live. If you locked in a good rate then good for you. But don’t be surprised if you are underwater in a couple years.

The Fed is going to have to keep increasing rates. The inflation train is still chugging along. The dollar is starting to climb again (DXY) so I’ll go back to buying currency like I did last year.

Biden announced a fresh round of defense spending which is music to my ears as a DoD contractor. More sanctions against Russia means higher inflation here = higher rates = greater chance of a not-so-soft landing. And it’s not just Ukraine we are talking about here. The war is raging in Yemen. If you want to see a real crap shack, come with me to Djibouti.

What’s the best/easiest way to buy more than $10K in t-bills? Also, can they be easily liquidated?

Regarding your advice on primary residences, I don’t feel it’s that straight forward. Many people (including some I know) bought at the height of the market in circa-2006 and were soon underwater. Had they waited just a couple of years, they could have saved hundreds of thousands of dollars, particularly when considering interest. For most people, that amount of money is significant and translates into adding years of working prior to retirement. I’m a prospective buyer and hate renting, but I also don’t want to be kicking myself knowing I could have bought a nicer/bigger/better house for less money had I just waited a year or two.

That comment:

“ but I also don’t want to be kicking myself knowing I could have bought a nicer/bigger/better house for less money had I just waited a year or two.”

People talked like this during Q1 2020. Boy are they kicking themselves now. They wished they would have bought back then.

I use treasurydirect.gov which is free and easy to use. Personally, I’m buying 13 week treasuries in $10K denominations with automatic investment. If you wait until the maturity date then it’s very liquid- just don’t reinvest and transfer to your bank account.

If you want to sell a bill before maturity it takes a little more work as you have to transfer it to a broker (I use Vanguard that doesn’t charge a commission) to sell it on the market. It’s still relatively liquid but takes a little more work (not as easy as clicking transfer now from a money market).

You can buy I-bonds that are limited to $10K per SSN every year (and an additional $5K with your tax return) but those have to be held 12 months and currently paying 6.89%. And if you sell in less than 5 years you lose 3 months interest.

These are all state tax free so your actual yield is a little higher if you live here in CA.

No one has a crystal ball but, there are headwinds for home appreciation. Lets use your example of buying in the peak in 2006, if that person held their home this long they’d have paid off 17 years on their mortgage, have a house that is worth more today and hopefully locked in a real low rate.

Buy what you can afford and for most people that comes down to a payment. If you are relatively stable, have adequate cash/reserves and don’t plan to move for at least a decade, I think you’re safe in the long run. Your home is where you live. It’s not a stock or a crypto coin. You do as you please and make memories there which is worth a lot in my opinion.

You don’t need to go to Djibouti, try Red Mountain CA on hwy 395.

https://www.ghosttowns.com/states/ca/images/redmountain2.jpg

And yes, people still live there.

“ how much longer is Wall Street going to continue buying properties when they can get the same return without the headache and risk?”

Thing is, even if you explain that to people for the millionth time, they don’t get it.

investors low ball during this market and buy in all cash. Rents are high.

So now you are getting into a good property at a discount with the same high rental rates. Down the road you do a cash out refi.

Personally I can’t buy all cash and have to wait until prices come down to buy my next rental.

“Biden announced a fresh round of defense spending which is music to my ears as a DoD contractor. More sanctions against Russia means higher inflation here = higher rates = greater chance of a not-so-soft landing.”

You are lacking a moral compass

Key overpriced RE markets will see up to a 30% price decline as mortgage rates rachat up.

Yeah sure, just pull any number out of your hat. A number you can’t make up though is active listings. We are under 1M baby. Not even close to 2019 levels. Since a decade active inventory has been trending down.

Covid was supposed to be a skyrocketing inventory event. Then it was the forbearance tsunami that would skyrocket inventory. Now it’s the 7% mortgage rates. In two years it’s 6M of shadow inventory or some other BS. And so the bla bla bla goes on and on.

For context, In case anyone still reads facts. In 2007/2008 active listings were around 4M.

Record low inventory in SD but prices continue to decline. Wonder where prices will go once inventories increase during the spring peak.

https://timesofsandiego.com/business/2023/02/28/case-shiller-index-shows-home-prices-declined-in-san-diego-for-7th-straight-month/

Another 30% fall will be about 2019 levels.

The significance of a 30% fall is that house prices will again track inflation. No speculator/Ibuyer will hold an asset with a 4-5 year (2019-2024) 0% yield. Especially noting from SoCalGuy above that risk-free treasuries are paying 5%+. This is what happened in 2012 when house prices crossed the inflation curve before the Fed pumped up the housing market again by continuing to lower interest rates and buying MBS’s. 2012 was the start of Housing Bubble 2 where lower rates and increasing prices attracted speculators. The Fed could do this again if there is a recession causing lower rates and then we will enter Housing Bubble 3. I think the bottom will occur in 2024 when house prices fall to 2019 prices and intersect with the inflation curve just like 2012. It will be a good time to buy a primary home since no speculator will compete for 4-5 years of flat gains.

You are 100% correct Bob.

Joe Blow Homeowner isn’t selling any time soon. They’ve likely refinanced into a low rate with a mortgage payment below rent.

However, Wall St. doesn’t have an emotional attachment to real estate and only seeks yield. The cap rates locally and in metros like Phoenix are essentially on par with what you can get from the government. Moving forward, prices have no where to go but down albeit slowly until the capitulation stage as Flyover mentioned. As you said, no investor is going to hold onto a property with flat gains (at best) for the next few years.

Up until a week ago all you heard was the Fed is going to do a couple more .25 hikes and then take a pause. Wall Street liked that news and the markets settled. But now all bets are off due to inflation numbers, recent announcements of more defense spending (good for me) and more sanctions against Russia. Now they are debating writing off $400B in student loans.

Bottom line is investors will start selling but prices will have to come down. A new set of buyers will enter the market just as the recession starts to kick in forcing the fed to lower rates. Home values will rise, more people refinance and the cycle continues.

The only other variable I see is the AirBnB inventory. AirBnB didn’t really takeoff until 2015 although it started in 2007. Covid really fueled a lot of people to pull out equity and buy 2nd homes / AirBnB rentals. The pent-up demand also went thru the roof as we all know but that has cooled own dramatically. I personally know a few people in my circle and have overheard the grumbles that bookings are down along with the rates they are charging. I see cash flow becoming an issue.

“ Bottom line is investors will start selling but prices will have to come down”

Same guy predicted a RE crash in 2020 when Covid hit. Opposite happened.

He keeps saying investors will sell. But no reason why!

Investors who bought the last few years are way above water and have locked in low rates. Rents have skyrocketed over the past years. So why should investors sell Cashflow positive rentals? If anything they can buy more rentals at a discount right now. They often buy in all cash to get the best deal and then do a cash out refi down the road when rates improve.

Maybe people just interpret headlines incorrectly.

Investor activity plunging doesn’t mean they sell

Record low sales doesn’t mean prices are crashing.

People refuse to accept the fact that we have less than 1M active listings which ks historic low. But don’t worry, I will keep reminding you 🙂

“Same guy predicted a RE crash in 2020 when Covid hit. Opposite happened.”

Most of us saw a pandemic as a disaster. M is a genius and saw it as a great opportunity.

M saw:

1) The Fed lowing interest rates to historic lows blowing up the RE bubble. I still think M is related to Jerome Powell. Or he just got lucky.

2) The US Government sending out massive cash aid with PPP loans flooding the market with so much cash to purchase anything.

3) Work-from-home which forced workers to purchase a larger home somewhere so they could fit work, life, and kids. This is changing if companies are calling employees to the home office.

4) Massive tech stock and bitcoin increases. You received all of this government aid, your tech company stock went through the roof, and can refi your house at record lows pulling out cash, where do you put the cash? A Work-from-home PC (Tech), a nice chair (Wayfair)? Real Estate looked like a good option with anything left. Maybe an investment apartment or AirBnB?

All of that is gone now. People still have cash and are spending it until they run out.

When they run out of cash, they will start looking for more. That 3% CAP rate AirBnB or rental may not look as attractive to hold when safer Treasuries are paying more.

I really don’t know what will happen. It is up to the Fed and US Government. They could lower rates again next week and we are off to the races with Housing Bubble 3 and massive inflation. We could have a foreclosure crisis and the US government will hand out 500K to new home buyers and forgive all home loans.

Or we could have a soft landing and home prices return to the inflation curve just like they did in 2012. I am betting on this. It is the least painful even though it will mean a 30% drop in housing prices back to 2019 values.

My reference is a chart from Wolf Street Reports. Both Wolf and our good Dr are geniuses at predicting the future without a crystal ball.

The chart link shows CPI housing inflation vs House prices.

2012 was when they intersected. I predict this will happen again in 2024.

https://wolfstreet.com/wp-content/uploads/2023/02/US-CPI-2023-02-26-Case-Shiller-Housing-CPI.png

In 2012, speculation fled the housing market. It was the best time to buy.

I predict that in 2024, the curves will intersect again. House prices will drop 30% to 2019 levels and inflation will rise another 10%. Real Estate is local. Phoenix and Las Vegas will plummet 50% again just like we saw in 2008. Please refer to Wolf’s excellent charts in this article:

https://wolfstreet.com/2023/02/28/the-most-splendid-housing-bubbles-in-america-february-update-biggest-price-drops-now-in-phoenix-portland-las-vegas-san-francisco-seattle-denver-san-diego/

Of course, capitalism is no longer in control. The Fed is in control and can change this at any time.

“ Most of us saw a pandemic as a disaster. M is a genius and saw it as a great opportunity.”

I think Bob got a point here. Can’t disagree with that.

M, please let us all know what your Uncle Jerome will do this year.

Your insider information was extremely accurate in 2020 when you flipped from a bear to a bull.

You have said some bearish statements lately. Should we all be worried?

Will do!

Got popcorn, this show is just starting 🙂

It never rains in southern california

https://www.youtube.com/watch?v=Gmq4WIjQxp0

LA, Orange County home sales crash 43% to record low

The sales pace was 48% below the average January dating back to 1988.

https://www.ocregister.com/2023/02/28/la-orange-county-home-sales-crash-43-to-record-low/

No worries, my magic beans will save me 🙁

munch munch munch ……. 😉

Home ‘sales’ down, not home ‘prices’ down. Big difference there buddy.

Got popcorn, lmao can’t make this up- How Bad

It was the worst January for sales in records dating to 1988.

It was the smallest sales total for any month in CoreLogic’s database.

The percentage sales drop ranked No. 2 largest over 35 years.

Sales were 48% below the average January pace since 1988.

Across the six-county Southern California region, sales also fell to an all-time low.

Los Angeles County had 3,097 closings, down 22% in a month and 44% lower in a year. Orange County had 1,291 sales – down 28% in a month and 41% lower in a year.

In Los Angeles County, the $763,000 median was down 1.5% in a month and 3% lower in a year. It’s also 12% off the $865,000 record high set in April 2022.

Orange County’s $950,000 median was up 1.7% in a month and flat in a year. It’s also 10% off the $1,054,000 peak of May 2022.

Nope, nothing to see here, back to my magic beans munch munch munch…

Of course sales are low.

I mean, who in their right mind wants to sell their house right now?

I get letters and requests all the time if I am interested in listing my house. I always say sure, if you pay me 1.5M ABOVE market value I sell.

But I would never ever sell at market value. I have a 30y locked in rate at below 3% and celebrate every day. Got Avocado!

We might not see 2-3% rates for a loooooong time. I will hold on to that loan and keep this avocado party going.

If people think like me and like they’re low locked in rate and their avocados, then why would you expect anything different than this current market: historic low inventory. We are below 1M active listings!!!! If nobody wants to sell why would sales be anything but low?!

Got avocado toast this morning.

M: I get letters and requests all the time if I am interested in listing my house.

Junk mail from realtors. I’ve been getting those letters for decades. Sometimes they even claim to have a “specific buyer” who’s interested in my condo.

M even brags about his junk mail.

M: I always say sure, if you pay me …

Not only brags about it. M actually replies to junk mailings.

Another one of SOL’s lies. Junk mail goes straight into the trash.

Maybe he lies so much because he’s jealous. I remember when he posted day and night that a bought the top and will lose my equity in Q1 2020. Maybe reality has sunk in and he realizes I made out like bandits and his calls were so wrong.

M: I remember when he posted day and night that a bought the top and will lose my equity in Q1 2020.

M lies.

I often posted that I doubted his claims of buying a house, as everyone remembers. So how could I post that he “bought at the top”? He certainly can’t provide a single link.

I’ve been getting “personalized” junk mail from realtors for decades asking if I want to sell. They send those letters to thousands of people at at time, hoping for a listing.

M even brags about his junk mail.

Can you actually give us an example of me bragging? I don’t think I brag at all.

I give free advice. If you would have listened and bought in Q1 2020 you would be sitting pretty. Instead you said the market will crash.

But honestly, if you would listen to me you would:

Not wrap yourself in a faraday bag

You would have a smart phone by now

You would have a nice sfh and bitcoin

You would def NOT pay over 1k in HOA fees AND

I am forgetting something.

Aaaah And you would def not have a landline anymore! Lol

:0 lmao Got Popcorn :))))))))

Inland Empire home sales crash 45%, 3rd-biggest drop on record

California home-price drops bigger than U.S. declines

Southern California home sales fall to all-time low

Home prices dropped in 90% of U.S. markets in 2nd half

Orange County loses 12 million-dollar ZIP codes since May but adds 9 ‘affordable’ communities

man I hope those magic beans work out 😉

Sorry but anyone counting on interest rates coming back down anytime soon do not understand currencies.. The dollar has lost its ability to offshore itself and hide the inflationary result. All the excess borrowing from Congress is immediately inflationary now. Omni”con” absolutely. There are explicit reasons for that but I’ll save that for another time.

Housing did not go up in value because of productivity it did so because more dollars were created via borrowing costs. That excess is going to be wiped out as it never should have existed in the first place. “All” corporate debt will be rolled over and crush earnings. Read Berkshire Hathaways last quarters discussion in regards to that.

You cannot create wealth through offshoring jobs, and pulling demand $$$ forward via cheap money. At some point that chicken is going to come home to roost and as we have kicked the can a couple more years the Federal Reserve got caught with their pants down. You want to crush to a government let rapid inflation takeover.

A service sector society is not a good recipe for long-term, healthy gdp. Mining, manufacturing, and agriculture are. Oh that’s right we off-shored all that in favor of corporatism, and then we papered over it through financial trickery.

I love our country but I’m so disappointed in what’s become of it. Housing is coming down, and it’s the least of our worries.

Actually Biden’s infrastructure bill is great for manufacturing. Foreign car companies are falling over themselves to build manufacturing plants, chip plants, battery plants in the US. They all need their car to qualify for that $7500 tax break or they won’t sell their EVs.

Manufacturing is coming back to the US shores. Apple is building a chip manufacturing plant. VR and AI are the future of tech and building the tech in the US will be the new gold rush.

At this point, I don’t think any economic data makes any sense, so I assume all stats are lies. Since I don’t trust the data, it’s hard to know what to do.

Finally an honest person here

I agree with about the data. Most of it is trash, especially the spin given by the media. Let’s see few examples:

1. Biden dumped on the market 240 million of tones of oil from the emergency strategic reserves to lower the CPI. Energy was the ONLY component from the index which dropped pulling the CPI down. Can he continue to do that indefinitely?!!…That gave the excuse for media to talk about pivot because the inflation is going down – good luck with that! The interest will continue to go up because the inflation is out of control.

2. In January 2023 they dropped again some components of the CPI to make it look better after they already changed the calculation from the Carter years. Calculated like before, without massaging the data, the real inflation for everything that matter is over 20%. Based on that REAL inflation, the nominal GDP translates into a massive negative REAL GDP – DEPRESSION. Sales increased ONLY because of the inflation. Adjusted for REAL numbers, sales decreased. It is a very FAKE picture of the REAL economy.

We have a CENTRAL Planned Economy by the FED and all central planned economies end up like the former Soviet Union – no exception. Most people already feel their standard of living dropping. When mortgages will go to 9% or higher, they will feel it even more. Mortgages are established by the bond market and bond holders already feel the pain.

The FED can do whatever they want, but all choices will be very bad. They are cornered. Doom on us if they raise the rates and worse if they don’t. Meanwhile the bond market will assert itself and the FED will stay put because the alternative is worse. The bond market wants positive rates of return (above inflation rate). At those rates, the economy will crash.

“ Mortgages are established by the bond market”

Yep, and the 10y treasury has a hard time breaking 4.25%. Feds funds rate is at 4.5

When economic data weakens the 10y tends to come down……so mortgage rates will come down if/when that happens.

Stay off zerohedge! That is 100% garbage data 24/7.

Follow real, unbiased people like Logan Motashami, altos research, Steven Thomas or calculated risk. And by all means don’t get sucked into politics. It’s all garbage. You shouldn’t care what politicians say or promise. Don’t even listen to them and walk away.

Politicians are like that gold-scam ring that hangs out near the I5.

They are dressed well and make up stories. At the end they sell you their lie and hope you go for it. Then they drive away and you’ll never see them again.

I know an older man that told me about how he got scammed by them.

It reminds me of politicians and how people constantly fall for it. How many of you have believed them and given them your vote?

History does not repeat itself but it sure does rhyme. Regarding mortgage interest rates, the last time we saw this level of steep increases was in the late 70’s in response to the high inflation of the era. It took 4 years before mortgage interest rates topped out. It was about 13 years before rates dropped back down to their prior level. If this time is even marginally close as far as time frames, we are looking at a long road of much higher rates.

Regarding bidding wars for assets we have a long history of them be it RE or equities or commodities or something else. They almost all play out the same, with an ultimate major decrease in value of whatever the asset is. This time with RE it should be no different. We aren’t even a year from the peak. The decline will play out over years.

The importance of when you enter a market cannot be overstated. The simulations have long since been run and the data is available. Missing a major devaluation period at the outset of your investment will have a substantial positive impact over the long term. It’s not debatable, it’s just math. Buying into a market anywhere near the overbidding peak is not a good financial decision. People have other reasons for buying and do buy at such times, and that’s fine, but it doesn’t make it a good financial decision over the long term.

You are comparing the market today to the 70’s? So you must be a massive housing bull then?

Median home price in 1969 was 25k

Median home price in 1979 was 62k

Massive rent inflation too

Median rent in 1970 – 108 usd

Median rent in 1980 – 243 usd

I like the 70’s. My houses more than double in value while wages go up and my debt stays the same? Plus I can charge double the rent? Bring back the 70’s baby!

I agree with M to a certain extent.

There was no housing bubble in the 1970’s but the inflation rate was up to 15% for several years. House prices rose to track higher inflation. Currently, house prices are so mismatched with the inflation curve that they have to fall.

I remember getting COLA increases during that time. My wages were growing with inflation. This is true now with lower wage jobs but higher paid tech workers who buy more houses are not even getting raises to cover inflation. In fact with stocks plummeting for some tech, there is a 20-30% pay cut for many tech jobs.

I expect a pay decrease this year. Pay decrease, no more Covid handouts, no cash-out refi’s, no exploding bitcoin, no exploding stocks. How will M and I leverage into the next house??? 🙂

This is different than before in the 1970’s-1980’s.

1) Lower higher income wage increases. No more COLA. Unless you are making lower wages. The Upper Middle Class is getting squeezed.

2) No PPP loans or checks in the mail. Never happened in the 1970’s

3) No more house piggy bank refi’s. Never happened in the 1970’s

4) No more bitcoin/tech stock bubble. Never happened in the 1970’s

5) Inflation raising basic necessity costs . This was true in the 1970’s

6) Rampant speculation in the housing market driving house prices well above the inflation curve. This never happened in the 1970’s

House prices have to fall to compensate for these items. Housing prices will drop back to the inflation curve like it was in the 1970’s-1980’s. Down 30% to 2019 levels. Inflation will raise the house price floor just like it did in the 1970’s. There was no housing bubble in the 1970’s and housing rose with inflation just as M pointed out.

Econ is slowin’ down and it will take a 25% drop in Housing Prices to make that Market show any signs of Life. Until then, stay put and milk it while you can hold on to your job, hopefully. Next shoe to drop is Commercial Real Estate. Wait for it…..

Love this blog. Thank you.

“ Econ is slowin’ down and it will take a 25% drop in Housing”

Don’t be surprised to see the bond yield go down for the 10y treasuries if the economy weakens. Lower bond yield means lower mortgage rates. Lower mortgage rates translate into higher affordability.

Your 25% is just made up stuff. Why not say 40 or 30 or 50%?

M, you are correct if we assume we have a free market system; but do we??!!!…

There are many macro consideration the FED is looking at which are changing daily. They have the power to alter the market dramatically just by punching few numbers on a key board. Because of that, NOBODY knows the future, not even Powell. He might want to go one way and he can see that the market forces can throw at him a black swan event and he reverses course regardless of the consequences. We are also in a big and dangerous war and the FED works hand in hand with the Pentagon. Therefore the geopolitics also play a role; in that NOBODY knows anything unless they pretend they know, because they listen and believe the MSM propaganda.

It is naive to believe that Powell is concerned ONLY with asset prices. He might be till something else becomes a greater priority. If we would have a free market system, it would be easy to predict. The problem is we have a central planned economy with few individuals having all power to affect the market.

where my parents are east of Seattle, some neighbors sold a 4 bedroom house for $420,000 in 2016. In the past 5-6 years, Amazon and other tech companies moved a lot of jobs to Seattle, although I noticed a lot of similar houses being sold for $1 million in the last couple years are bought by investors and rented out. The absolute peak was March 2022 when a street with nice 3 bedroom ramblers, no sidewalk, houses were being sold for $1 million as teardowns, and several luxury houses retailing $2.5-3 million were built. The street has a lot of contrasts now but I don’t want to feel negative towards the people moving in. Zillow does show a 25-30% decline from March 2022 to present, but the newspaper reports more like a 5% decline over the year. I don’t know how they measure this.

For Posterity:

My New Year’s predictions for 2023.

1) If inflation is not tamed to below 4%, the Fed will stay the course and continue to raise rates another 1.5% in 2023. Mortgages will exceed 8% and finally be above the 30 year historic average mortgage rate (Then people have a right to cry, and they will). I cried in the 1980’s paying an 11% mortgage.

2) Due to higher mortgage rates, and less floating cash, house prices will decrease 20% in 2023. I expect the bottom will be in 2024 and house will fall another 10%. Speculation will be removed from the housing market and iBuyers will declare bankruptcy in droves. Housing will again track inflation. More supply will trickle into the market as the iBuyers, speculators, and flippers unload causing prices to slowly fall. My son (and most of the people waiting on this blog) will finally buy a primary home.

3) If the inept Fed causes more than 7% unemployment and crashes the economy into a recession just like they did in 2008, we will have deflation and the Fed will slowly lower rates based on decisions over their 3 martini lunches just like they did in 2008-2012.

4) The US Government is countering this early with the Inflation Act and Chips Act which will keep unemployment low and wages rising. This effect will happen in late 2023 and 2024. Their goal is to remove US dependency on foreign governments for defense. It does counter the Fed’s goal to lower inflation but may save us all if the Fed crashes the economy.

Those are my 2023 predictions. Please comment.

Again I find myself mostly agreeing with you in your prediction.

The only part I don’t agree on is the Inflation Acceleration Act. Those were money the US Government did not have, but they will be created and they will act as gasoline on the fire for the inflation. That will force the FED to increase the rates even more with a dramatic effect of lowering the standard of living for most people.

You can not get something for nothing. Inflation is taxation – government ends up with the newly printed money and most of the people can buy less than before – same effect as in the direct taxation, but in a round about way. This is the reason it is called “stealth taxation”. Under this taxation, the poor and middle class suffer the most – it is the most REGRESSIVE forms of taxation.

Housing cannot and will not drop 30% absent a severe job-loss recession. Anyone who bought between 2012 and 2022 is locked in under 4% interest and likely has at least some equity built up. Fire sales only happen when people have no options and let the bank take the house back. No options only happen when people are laid off and the govt doesn’t bail them out (as what happened in 2020, resulting in no foreclosure tsunami, as initially predicted). You’re correct about housing re-aligning with inflation moving forward, but thinking current pricing is going to correct more than single digits without additional economic stress is a fantasy.

Spot on Joe

Of course, with 8-10% annual inflation, prices standing still equals a price drop in constant dollars. In order to make waiting for price drops to get big enough to profit from them with saved cash, the drop has to be bigger than the loss of currency value from inflation. Informed people know that US Government inflation statistics understate inflation intentionally.

M is no longer championing crypto I notice. Look back to 2020 / 2021 for a real laugh. All he likes to brag about his home purchase in Q1. What happened to Bitcoin to 100K??

In regards to Bitcoin…..we have seen nothing yet (disbelief stage). This will be a massive, massive bull run in crypto. The likes we have never seen before and it will make 2017 look like a kids birthday party.

Buy and hold crypto. You will be easily able to come up with the DP when you cash out at the right time. Cardano #3 crypto currency by market cap is trading above a $1. That was it previous all time high 1.38. I am betting this will at least hit $3 during this bull run.

March 2021

2022 will be massive for the crypto market! I simply cannot wait

100k Bitcoin baby!

Dec 2021

So let’s see…. BTC plunged to $16k on Dec 22. Now it’s floating around $22 and when then fed hikes rates it will plunge even more, below 2022 lows.

Cardano??? LOoooool. Down 88% from the peak. Currently at 0.34…. Oh and the crypto ETFs??? Down 65-70% since inception.

The housing bubble has popped along with crypto and everything else.

Cardano was one of my biggest money making machines.

I am waiting for my price target on Cardano to buy back in.

Same with ETH and some other s-coins.

I have already bought a good junk of a Bitcoin and are also waiting for another leg lower to buy more.

Yeah Bitcoin 100k did not happen. It got to 67k. Isn’t that funny? Remember when the bitcoin haters said it would never go to 20k. ROFL.

100k bitcoin maybe during the next bubble. 🙂

It will take a while though until uncle Powell turns on the money printer again.

At poster “Whatever”, there will be life changing opportunities AGAIN in crypto. Hold your powder dry and buy back in soon. I’ll provide you with the info once I go in heavy.

Right now, there isn’t too much to report on crypto, you just need some patience and wait for the buying opportunity.

Crypto is the best thing since sliced bread. Thank you

It’s interesting to read M the bot’s drivel. He post more than anyone. Where does he find all that time? Is he working at home or is some realtor who owns and writes for him doing the posting? Just curious.

Maybe M lives in his parents basement and has all the time in the world – since the delusion. Maybe he is telling his mom that he writes resumes.

Before 2020 he imagined working in tech with 6 figure income and now he imagines being a real estate agent.

Keep in mind posting here takes 30sec to 2min per post.

There are people here like Bob who also post on other sites like wolf street.

I only post here on dr housing bubble. Have been here since many years now.

It’s very entertaining.

And yes I work from home. Tech company.

I couldn’t do the work of a realtor. I’d hate to try to sell people something.

I like my friends who are realtor very much though. There are so many realtors out there!

M is correct.

I could spend far more time watching Netflix dramas. This excellent blog has much better drama than anything currently on Netflix. There are exploding bubbles, falling knives, zombie corporations, bears, and bulls daily.

This blog is so entertaining and educational that I’ve mostly given up on Netflix and spend all of my free time here.

Great questions LOL! If I cared enough I could probably find out for you because I know people that live in his neighborhood. But I just don’t care enough.

Hello! What basement is it that you keep talking about? Have you been to SoCal? Houses don’t have basements here. So who is the delusional one here 😉

Two different issues that I have commented on here came up again in today’s OC Register. Lansner’s series on the decline in the Case-Shiller 20 metro area index continues with a discussion of California’s 3 markets vs the other 17 markets. All 20 metro areas showed monthly declines for December 2022 (the latest data). San Francisco was the big CA loser while Portland and Phoenix were the big decliners outside CA (all at least 1.8%). The smallest drop in CA was LA/OC at 0.8%, and NYC was the smallest nationally at 0.2%. Demand may vary from area to area but interest rates aren’t as variable.

The other topic was the insurability of condos. I had posted about the impact of the Surfside condo collapse nationally. Specifically about problems with a Marina Del Rey complex. Today’s column by Lazerson isn’t about beach communities, but is about Laguna Hills in OC. Fannie Mae has pulled out of its condo warranty approve for over 6100 condos in Laguna Woods Village which is on the inland side of the Laguna Hills. They have a $1 billion insurance deficit The problem has been building worse and worse over the past few years. Buyers now need non-warrantable condo financing, which requires >20% down and higher interest rates. Since 2/3 of LWV condo buyers paid cash, there is still a pool of buyers who may want to go for it. One broker was very upfront with Lazerson about the situation (he didn’t have to ask!), but others didn’t volunteer the information or feigned ignorance. Buyer beware!!!

Got Popcorn, this collapse is just getting started, Timmmmmmmmbbbbrrrrrrr 😮

“Look at the 20 ZIPs with the largest declines since May’s peak, noting that pricing at the neighborhood level can be volatile. No. 1 Newport Beach 92663: Off 45% to $1.7 million between May 2022 and January. That’s a reversal from a 30% gain in the pandemic boom, February 2020 to the May 2022 peak. No. 2 Santa Ana 92701: Off 45% to $405,000 since May vs. gains of 102% in the boom. No. 3 La Habra 90631: Off 43% to $709,500 since May vs. gains of 101% in the boom. No. 4 Laguna Woods 92637: Off 37% to $284,000 since May vs. gains of 19% in the boom. No. 5 Corona del Mar 92625: Off 32% to $3.18 million since May vs. gains of 40% in the boom. No. 6 Anaheim 92808: Off 30% to $712,500 since May vs. gains of 52% in the boom. No. 7 Irvine 92614: Off 29% to $813,000 since May vs. gains of 44% in the boom. No. 8 Tustin 92780: Off 26% to $686,250 since May vs. gains of 39% in the boom.”

“No. 9 Fullerton 92832: Off 21% to $620,000 since May vs. gains of 31% in the boom. No. 10 Orange 92867: Off 21% to $890,000 since May vs. gains of 42% in the boom. No. 11 Huntington Beach 92648: Off 20% to $1.15 million since May vs. gains of 35% in the boom. No. 12 Los Alamitos 90720: Off 20% to $1.25 million since May vs. gains of 61% in the boom. No. 13 Yorba Linda 92887: Off 20% to $1.06 million since May vs. gains of 58% in the boom. No. 14 Cypress 90630: Off 19% to $783,000 since May vs. gains of 28% in the boom. No. 15 Santa Ana 92705: Off 18% to $1.24 million since May vs. gains of 68% in the boom. No. 16 Huntington Beach 92649: Off 18% to $885,000 since May vs. gains of 25% in the boom. No. 17 Orange 92865: Off 18% to $770,500 since May vs. gains of 45% in the boom. No. 18 Rancho Santa Margarita 92688: Off 18% to $730,000 since May vs. gains of 32% in the boom. No. 19 Santa Ana 92707: Off 17% to $485,000 since May vs. gains of 14% in the boom. No. 20 Irvine 92603: Off 17% to $1.87 million since May vs. gains of 87% in the boom.”

Magic beans oh magic beans, where have thou gone ? munch munch munch 🙂

Your OC zip list of % RE drop didn’t include my zip code. That fits in with what I’ve seen here. People are paying more than I think they should to move in. I’ll just sit tight with my Prop 13 and watch the fun.

Realist only a few more munches and you are ready to buy. The dream mansion with ocean view awaits you and will soon be in reach. Congratulations!

We should have all waited to buy and eat popcorn instead. Realist will buy the mansion of our dreams at a 90% discount very soon. Just open up a few more popcorn bags and you’ll enter the RE heaven! Well played realist! And please stay firm these next few years during this epic collapse. If you just believe and hold your powder dry you will most certainly buy that dream mansion. Almost there. Almost. Just endure this very last stretch. Congrats again!

Once again people are not getting wealthy over productivity gains. The wealth effect is nothing more than a slush fund from pulling demand forward via easy money. The old days of low interest rates made it easy to borrow 1% when inflation was running at 5%.

Credit cards, vehicles, crypto, housing, stock market, et al are addicted to credit creation. That’s fine as long as the productivity game outweighs the debt. How is our Congress borrowing money to finance our debt a productivity gain?

Powell just doubled down and the dovish theory is (not going to happen).

If you want to see civil unrest writ large let’s keep the inflation spigot going.

Powell knows that the runaway inflationary curve is a monetary phenomenon and the dollar can no longer hide it via swift.

As for M needs to learn how to relate to the middle and lower class folks that are going to pay a heavier price than could ever be imagined. Maybe could stand down off the 1% er pulpit (getting richer), and drink a cup of shut the f*** up.

Pulling demand forward via EZ corporate money or congress sponsored is actually stealing tax revenue that could be going towards a worthy cause. When the free handouts stop we’ll see how long that political capital lasts.

Coming g to America: About a third of China’s major cities are struggling to pay just the interest on debt they owe, according to a survey by Rhodium Group, a New York-based research firm. In one extreme case, in Lanzhou, the capital city of Gansu province, interest payments were the equivalent of 74% of fiscal revenue in 2021. This is rapidly approaching the infamous “Minsky Moment” now that debt has moved beyond “mere” Ponzi financing levels.

You are right that easy credit fuels non-productive investment booms (speculative financing). However, there has been smart money investing during this latest cycle, and our friend M was right in the thick of it. (Buying a new house when he did and all!) New housing is productive, unlike crypto which may some day be of use in a world gone nuts, but is currently in the tank thanks to Ruja Ignatova, Sam Bankman-Fried et al. There will be a crypto shakeout with the weak hands folding, and then we’ll see as WB says “who is swimming naked”!

Once again crypto is a Ponzi scheme. It does not collect interest or make money it just sits there waiting for somebody else to buy your share at a higher price so you can cash in. Crypto has to go to zero because of that very fact. It is a mathematical certainty I don’t care how you spin it, ftx notwithstanding.

Unfortunately the low interest rate environment helps serve corporate interest and not the little guy. The bank that just failed was levered at a ridiculous low (bond) interest rate and when interest rates ratcheted up they got caught, yes naked. Who will pay the price for that fallout? The CEO cashed in 3.5 million in shares the week before. Leverage is going to destroy the very fabric of our society. All those that know the why have seen this coming for 30 years and have been looked down upon as naysayers. It’s not that it’s me saying it’s how to protect our future in a sane and balanced way. Too late for that.

Now let’s get this multi trillion dollar government funding bill passed so we can move on to bigger and better inflammatory needless crap.

Hi bud,

“ As for M needs to learn how to relate to the middle and lower class folks that are going to pay a heavier price than could ever be imagined. ”

How do you measure this “pay a heavier price than could ever be imagined”.

Is consumer spending down significantly?

Do you see empty restaurants?

Do you see empty stores?

All I see is people pay for services and goods left and right. Often with their credit cards.

If you spend money for overpriced stuff and you don’t learn how to be frugal, then don’t blame others for it?

Nobody forced people to go out and eat. You know how much padres tickets are in demand? People who don’t have money (supposedly) could just use someone else’s password and watch it at home for free!

Instead, there is traffic and long lines at the stadium! And you tell me people are hurting? Give me a break.

Got Popcorn, Oh No, Please No No No, not my Magic Beans :(…….

The La Jolla Light in California. “La Jolla-based Silvergate Bank, which grew fast by catering to cryptocurrency traders, said March 8 that it is winding down operations and will liquidate amid mounting losses, customer defections and regulatory pressure. The bank’s parent company, Silvergate Capital, announced after markets closed that it had voluntarily decided to cease operations as the ‘best path forward’ given its deteriorating situation. Bloomberg News reported late the day before that officials of the Federal Deposit Insurance Corp. were at the bank’s headquarters in an effort to salvage the institution, but that apparently was not a viable option.”

Well, good thing I bought a home at the peak 🙂 oh wait, that’s crashing just as fast 🙁

The Lookout in California. “Santa Cruz County’s housing market is slowing as properties stay on the market for longer and fewer homes are being sold countywide. The Santa Cruz County Association of Realtors shows the median price of a single-family home fell an annualized 4.7% in Santa Cruz, from $1.6 million in February 2022 to $1.525 million in February 2023. Median prices fell 7.4% in Watsonville, from $810,000 to $750,000. Jennifer Watson, president-elect of the Santa Cruz County Association of Realtors added that she doesn’t expect those types of low interest rates to return anytime soon: ‘If we do have rates that low, then something bad happened.’”

“Some current sellers aren’t willing to reduce their asking prices enough to compensate for the changing market conditions. Some of our inventory is stuck with the peak pricing. Owners are asking the price that it may have sold before, but the market isn’t what it was last year,’ said Marvin Christie, president of Anderson Christie Real Estate. ‘I hate to say it, but it’s unrealistic sellers.’”

AND THIS IS JUST GETTING STARTED, the downfall of my empire 🙁 munch munch munch ….

Realist is starting to post facts and data with his posts after his 2 years of hysteria.

Maybe we should stop ignoring him. I am starting to read his posts.

Silvergate is the latest Bitcoin disaster. Maybe worse than FTX.

The FDIC has arrived to insure all of the moms and pops who deposited US Dollars there get their money back. The FDIC doesn’t insure the massive Bitcoin losses that customers will see. Bank customers should have stuck with US Dollars earning 0.1% instead of Bitcoin promising much more but delivering -100%.

I have a CD with Silvergate through Vanguard. I actually had no idea they were involved with crypto because they were vetted by Vanguard which is anti-crypto. I just thought they were an online business bank with a sweet rate. It matures next week. No more more Texas money to California.

Note: layoffs planned because of rate increases. Rolling debt will crush the

bottom line.

As an aside anyone who buys crypto is knowingly endorsing a pyramid

scheme and needs to check their values. Oh I’m sorry one really wouldn’t

have any values, and it shows the rampant greed and naivety of so-called

Investing. The same game is being played in the stock market.

Ark fund anyone? What percentage of the stock market are a result of companies being able to roll over debt?

Housing will be a slow burn.

From Challenger:

“Worst since Lehman” is never a good thing.”

“Certainly, employers are paying attention to rate increase plans from the Fed. Many have been planning for a downturn for months, cutting costs elsewhere. If things continue to cool, layoffs are typically the last piece in company cost-cutting strategies,” said Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc.

“Right now, the overwhelming bulk of cuts are occurring in Technology. Retail and Financial are also cutting right now, as consumer spending matches economic conditions. In February, job cuts occurred in all 30 industries Challenger tracks,” he added.

In fact, Challenger has not recorded announcements in every industry the firm tracks since January 2013, when cuts occurred in all 29 industries.

Tech Layoffs continue to dominate…

In retrospect, Tech layoffs were in the cards for a long time. Tech companies way over hired, and automation including AI was bound to catch up and eliminate jobs. Feed a censorship AI Bot with a limited amount of information (e.g.Orange Man bad) and it will do just as good a job as the overpriced censors Musk laid off. The AI mind cannot discriminate on its own. It is stuck in an air conditioned room with only the information feeds its master gives it.

I know someone with a Comp Sci degree who is old enough to get Social Security but is able to get work because they know machine language and real time programming. (The way big mechanical devices like harvesters, assembly lines and sawmills are controlled by computers in real time.)

@Emancel: “it shows the rampant greed and naivety of so-called

Investing.”

I like how you put it. Gambling to get rich quick on a failed currency. Everything about that is wrong but the early-ins made it seem so proper. So many people got burned when this “investing” went mainstream (crypto machines in Walmart, oh my). HELOC and retirement money going to crypto. Talk about FOMO. *slaps forehead*

@Joe R: “In retrospect, Tech layoffs were in the cards for a long time. Tech companies way over hired. Tech companies way over hired, and automation including AI was bound to catch up and eliminate jobs.”

Over-hired, yes. AI eliminating jobs? A few, the more – and eventually new jobs will be created to the point of having more or less a zero net loss. Dramatic technological tends to work that way. If only we could look just 10 years into the future and take a peak at the new industries and professions. That would be interesting.

I’ve been an AI skeptic but things are getting real. I’ve seen results from my use of AI that has translated into real money entering my bank account. AI going exponential is not just hype like Bitcoin was. AI is finally able to create real value and it’s only getting better. Exponential. Exciting and a bit scary at the same time.

A WHOPPING $2.3T of unrealized equity loss??? What is that like an 8% decline? Homeowners aren’t even selling so what did they lose? And if rates jumped 4% from their lows pushing mortgage payments 50% higher why isn’t that number a 33% decline? I love how Doc casually dismisses persistently low inventory rates as nothing to consider but keeps citing 2008 as if the market we are currently in is experiencing the same symptoms from the same factors. Notice how important points are completely ignored and how the narrative always resorts to drawing weak comparisons to 2008. That’s sounds a bit naive and delusional don’t you think?

1. Markets don’t decline drastically unless the supply exceeds demand. This is the big diffference between the current market and 2008.

2. Supply will not exceed demand unless homeowners default en masse.

3. Homeowners will not default en masse unless their payments are no long serviceable.

4. Payments are considered “unserviceable” unless the current market offers cheaper living options.

5. The market does not and will not offer cheaper living options than what current homeowners already have.

Using pure logic, it should be pretty clear to see that the market will not crash. If you disagree, you’re naive and delusional and we can reopen the conversation again in one year and see where the market stands. By then it would be 24 months since rate hikes so no reason to use the ol’ “the RE market moves slowly” argument.

“2008” ruined a lot of people. YouTuber, zerohedge, crumpy Wolf Richter and other perma bear sites capitalize on the “boom and bust” narrative. Sooo Many fall for it and actually believe there will be a similar downturn in RE. It might take another decade for people to realize this 2008 was a once in a lifetime event. In the meantime I am getting ready to buy my second rental. I am looking in Phoenix again.

One of the radical left relatives of mine…….. he’s the definition of woke. He sold his house and thinks he’s gonna win big by waiting for the epic crash. Of course he’s going to time it perfectly to buy a bigger, better house for much less. These clowns really exist. It’s gonna be fun to watch this show for the next few years. until he pulls the trigger to buy again he’s paying sky high rents and lives on half of the square footage compared to the house he sold. Dumbest decision ever. But keep watching perma bear YouTube videos and dream of that 50% crash. Any day now buddy. Needless to say he’s a big fan of “get-trump”.

Is the SVB the new Lehman? This is mainstream news not Zerohedge; it is a fact that a relatively big bank collapsed.

I predicted for months (since interest started to increase fast) that a black swan event will happen soon due to collapse of the bond market. I was wrong on location but not the imminent event. I thought it was going to be Credit Swiss not a US bank (the 16th largest in US).

What will the ramification be from this even? More regional overleveraged banks go bust? Any of the big banks? Personally I doubt this event will be contained – there are trillions and trillions of dollars owed which try to refinance at higher rate. I think only a major financial catastrophe will decrease the real inflation; changing the way you calculate it and using the oil reserves is not a long term solution.

What is the take of fellow bloggers? Is RE going to be impacted a lot, or just a little?…

And yet again, the fed govt and Fed Reserve step in to backstop any depositors from taking losses. But somehow it’s not a bailout. Moral hazard is sooo last century…

It is my understanding that the asset SVB put money into was longer term US Treasury bills As rates rose, their portfolio dropped in current market value. In order to get money to cover debts, they had to sell at a loss. So much for “safe” treasuries! They are only safe if you are able to hold until maturity. In today’s market, there is a seriously inverted yield curve.Today the highest rates are for 3 & 4 month bills, the lowest for 10 year. (Range = 1 Mo to 30 yr.)

The failed banks should have had a better risk management plan. Don’t put most of their eggs in one safe padded basket and lock it away for 30 years.

The banks paid 0.1% to depositors and put all of that cash in 10/30 year guaranteed US treasuries paying as low as 0.65%. Sounds great right? Something grandma might do to guarantee a fixed income for the long term.

The problem is inflation and rate increases. Poor grandma is now seeing 10% inflation and 30% rent increases while making only 0.65% in the safest investment ever. That’s not very safe.

The poor banks are seeing everyone withdraw cash to put it in 6 month treasuries paying 5%. With all of that bank money tied up for 10/30 years at 0.65%, they need cash now to pay depositors. They are being forced to sell their treasuries before maturity at a huge loss to generate cash. If the Fed would lower rates to 0.65% again, every bank would be fine. However, grandma would be wiped out by inflation. The Fed has a problem.

It looks like I was off on Swiss Bank by few days. If that one goes down (high probability at this point), it will make a 1.5 trillion dollar hole. It will be a nuclear bomb on the financial system. Is the FED starting QE again? Inflation to infinity? What will it be the impact on the hundreds of trillion derivative market?

I think the FED has to drop interest to zero again, and fast, or the the whole financial system goes up in smoke. Everything is interconnected these days – think about the domino effect.

Depending on what the FED will do, we are talking more than 20% unemployment or inflation Venezuela style; …or a full blown WW3. There are no good option at the present time. The insanity started long time ago but went full blown with the Covid response…or was Covid just the cover for launching the present insanity???!!!!…Hard to tell if you don’t have your own intelligence agency funded in trillions of taxpayers money.

Headline: Crypto Scours the Globe for Banks to Replace Collapsed US Lenders

https://finance.yahoo.com/news/crypto-scours-globe-banks-replace-121524618.html

Crypto hedge fund executive Marco Lim spent Monday racing to open bank accounts in Hong Kong after the sudden collapse of three US lenders.

The hedge fund, MaiCapital, is based in the city and had cash at one of the fallen institutions, Signature Bank. MaiCapital needs alternatives and managing partner Lim was pressing lenders to speed up account opening.

“The two biggest crypto friendly banks are gone,” Lim said, referring to Signature and Silvergate Capital Corp., which also had many crypto clients and said Wednesday it would liquidate. “I’ve been through too many crises.” …

This article says everything you need to know about the banks and housing fragility that is so deeply corrupt in our system.

Nothing is ever free.

https://market-ticker.org/akcs-www?post=248301

Emanuel, I read most of the article. What I def agree with is: nobody with 3% mortgages is going to replace that mortgage voluntarily with a 6-7% mortgage unless they have to sell. And there is. Arely any forced selling out there. The waves of foreclosures apparently was a “ah nevermind, just kidding” thing.

The other stuff he says in the article: whenever people compare today to 2008 I kinda lose interest. And, he pretends like the SVB failure was soooo obvious. Well hindsight is 20/20. If it was soooo obvious why didn’t he short the SVB stock? He’d be swimming in money and wouldn’t need to sell books to make a living. Aaaaah, wait what? He is selling a book? There it is again, bad news sells. Now they all come out again and say, I told ya! I predicted it! Now buy my book and be prepared for the next one! That’s why they come out with a new version every year because they have to adjust the timeline. Kinda like the people who predict the end of earth. It is 1990 with 100% certainty. It is 1991 for sure this time. Now it’s 1992. The day is def in 1993……it will be with absolute certainty 2023.

FYI Deninger wrote the book in 2012 and did a presentation to the senate. He made his money from an MSC net and writes security software so pull your head out your ass and get your facts straight. He’s also one of the founding fathers of the Federalists movement. I’m not even going to waste my time posting to you anymore you keep the cheerleading up though. Next time do your homework.

So 2020 was the epic housing crash year, remember? You had a pandemic and people were losing their jobs! The perma bears had it but they were wrong (again).

2022, for sure will be the year of the crash though. This time for real. Interest rates are going up!!! Houses MUST come down. Except no crash (again).

2023 epic crash is happening. It just HAS to. Or does it?

Inventory……it’s even lower than at the beginning of the year. Wait what?!?! Spring season means inventory rises. Sellers are coming in droves.

And what about the glut of investors panicking and selling like their life depends on it? Or is this another marketing gimmick like the waves or foreclosures (forbearance crash bros)?!

In the meantime, it you still care for facts:

As said a million times before:

Without even going back to 2019 inventory levels you don’t even have a balanced market. Inventory is waaaay too low. AND

As soon as economic data weakens, the 10y yield goes lower. The banking crisis news hit and look at the 10y. Went from 4% yo 3.5% in a matter of days. Which translate directly into lower mortgage rates…..

But don’t take my word for it. Check yourself or keep hoping and praying for a RE crash.

Btw., ask yourself, do you know a person in this market who is excited to sell their home with a lock in 30y low rate, just to replace that low mortgage with a 6-7% rate????? I don’t, and I will HODL my low mortgages just like I HODL my precious bitcoins.

It won’t be a crash. Everyone will sit happily in their 3% mortgage home until they die or have to sell. Unemployment could be a reason to sell due to high payments or they have to move for a new job. There will be a low percentage of people dying and moving.

The question is: What can people afford at a much higher interest rate? Prices will slowly fall to match affordability. I predict a fall of 20% this year over the entire year if rates keep increasing. By 2024, house prices with another 10% decrease will intersect with the inflation curve and it will be a good time to buy again like in 2012. Inflation will increase and house prices will fall and eventually intersect.

Nobody must sell a house if they have a job and can afford it. The Fed is actively trying to kill jobs.

Just like in 2008-2012, there will be reverse FOMO. Absolutely nobody has to buy a house even if they can afford it. Fear of Jumping In will prevail. Who wants to catch a falling knife?

Today, it seems FOMO is still in control. Rates drop a little and people dive in. When the house drops another 5%, FOMO slowly fades and FOJI takes over.

The Fed is trying to kill jobs, raise unemployment, and wipe out FOMO to reduce inflation. Don’t fight the Fed.

There won’t be a crash. It will be a slow decline. A decreasing asset doesn’t attract speculators.

Good points Bob as always.

Don’t know if buying a house can be described with fomo. Pretty much all my cousins and millennial relatives don’t own homes. They pay high rent though. If they had invested in stocks and bitcoin and inherited money they would have a downpayment to buy a house.

You have to live somewhere. We all know that in places like California it’s financial suicide to rent longterm. Rents have completely exploded the last few years. My mortgage is lower than a 2b place to rent. And it’s worth over a Mio and has more bedrooms than we need. Insane.

Right now Sacramento is seeing bidding wars. Expected market time for homes below 800k is around 15-20 days. It’s crazy how low inventory is in some places. There is no price reductions in sight if you don’t have the inventory for it!!

Above 1M houses sit >100 days.

Everyone dreams of having a house. It’s the American dream. Nobody dreams of being a live long renter. I guess, you can actually describe it with fomo. I think of fomo when my bitcoins go up and people who criticized my precious coins suddenly want to buy bitcoins too because they have fomo. I guess live long renters fear that they will never be able to own a home. In that case, fomo is GOOD. Because you can’t go wrong buying a house that you plan on holding for the long run. Todays prices will appear dirt cheap in 10 years.

I can speak from experience that buying a house was the best thing for us in terms of happiness. So call a good realtor and enjoy the American dream. Be a happy homeowner and invest excess cash in crypto. Thank me later.

And to all those housing bulls in the metaverse (pun intended), we get another 10,000 layoffs. Bank failures a result of low interest rate Venture Capital that was going nowhere, never profitable. Yep housing will be the last of fall but it will fall. These jobs are not coming back they were all fueled by speculative money. That giveaway can no longer function without an immediate transition to an inflationary outcome. We know where that leads, at least anyone who understands the longer term repercussions of bad monetary policies for many years. By all means lets give the Pentagon 1 trillion dollars so we can police the problems we’ve created through international monetary intervention.

Emancel: Your comments are spot on! Most of the world is tired of American hegemony at every level. The weaponization of the ‘reserve’ dollar and American political duplicity are coming home to roost…..

As soon as rates dip slightly buyers come back to the market.

MarketWatch: “Mortgage demand jumps in past week amid bank closures, as rates took a dip”

It is ironic that the Credit Suisse Bank CEO’s last name is Lehmann, because we now have Lehmann Crisis 2.0

That is pretty funny!

But, credit Suisse will not fail. They will print enough money to keep the bank afloat. It’s similar to BOA, the US would never let that bank fail no matter how mismanaged it is.

Fighting inflation is one thing but when it comes to bank failures the FED and stakeholders will come out of bed on a Sunday to turn the money printer back on.