The housing market is turning, and Millennials are unhappy about their home purchases – California has highest months of supply for homes going back to 2012.

I was reading an article where it discussed how a small number of Millennials are now inching back into the housing market. But what was telling was that many of them were unhappy with their purchases. Why? As you might expect, buying a home always isn’t the right choice and there are expenses. You have taxes, insurance, maintenance, a 30-year mortgage, and other things that many people just don’t factor in. I’ve made this point before where many people buy a home and then start popping out kids. Usually the rush to buy is the external considerations of life versus the actual economics. So you get hit with big expenses all at once. For many professionals, childcare equates to what you would pay for college tuition per year! And of course, many Millennials are buying houses at near peak levels using mega mortgages just to squeeze in. In places like California we are already seeing inventory rising. Of course inventory is rising as fewer and fewer people can afford homes at current prices.

The turning market

The real estate market turns at the speed of a massive cruise ship. Little by little things start to turn:

-Inventory rises

-Sales drop

-Fewer people can afford homes

-Sellers slowly come to terms (more price cuts)

Eventually equilibrium is found. The fortunate thing right now is the economy is still robust but people are massively in debt. The Fed doesn’t have much more ammunition should we have a recession, let alone a severe recession.

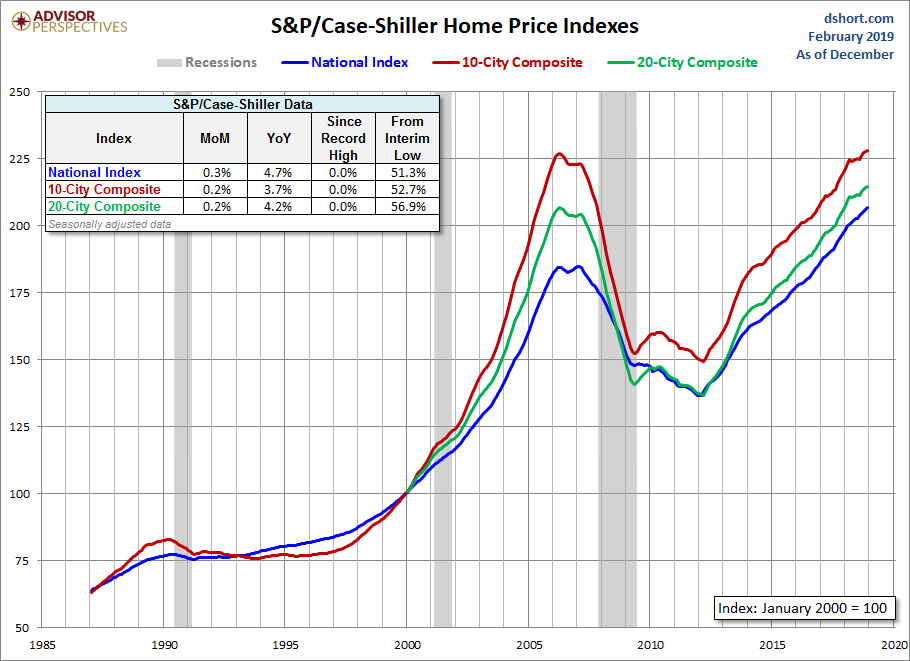

Home prices are now back to peak levels:

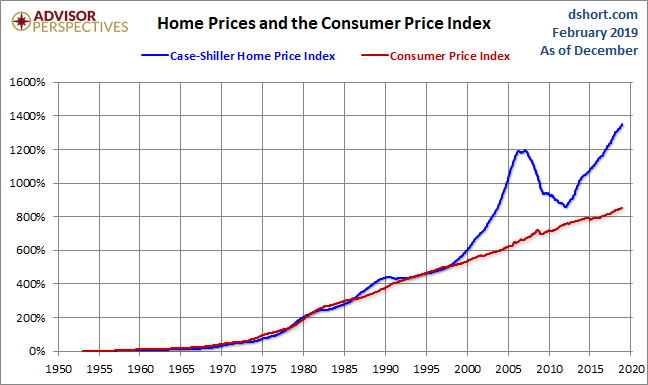

These are new peaks being achieved. And home prices are once again disconnecting from the overall inflation rate:

What you can see from the last chart is that after the housing bubble burst, at the trough, home prices actually aligned with the overall rate of inflation historical trend. But the market is now clearly turning.

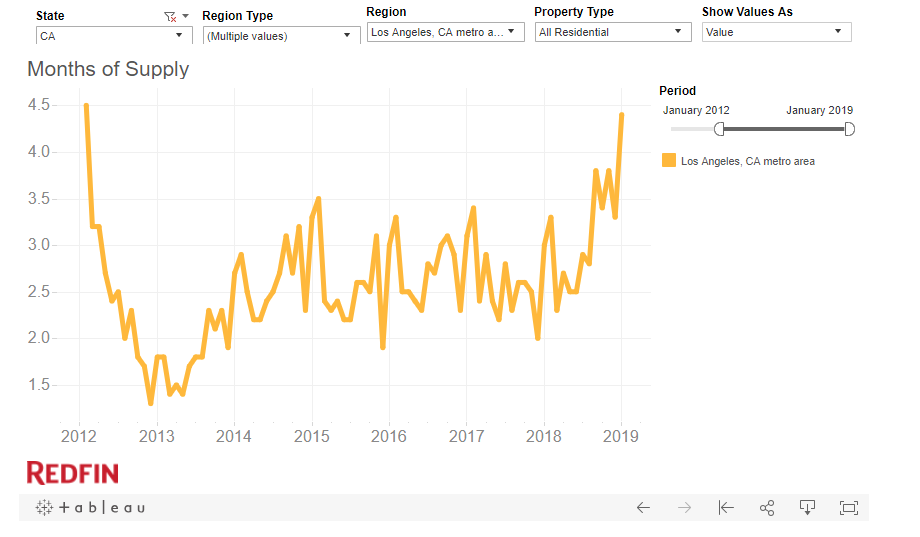

Take California for example. The amount of inventory floating in the market is slightly growing but more important the number of people that can afford homes is astronomically low. Take a look at Los Angeles:

This is the highest months of supply of homes in Los Angeles going dating back to 2012 during the trough. At some point something has to give and it looks like people are simply buying at a much slower pace. There have been many more price reductions as well in the last couple of years to entice buyers and Millennials to purchase homes.

As we all know, there is no free lunch and eventually things do find a balance, just like they do in nature. Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

331 Responses to “The housing market is turning, and Millennials are unhappy about their home purchases – California has highest months of supply for homes going back to 2012.”

What were prices back in 2012? LOL

This article indicates that California real estate (at least in prime locations) will NOT tank anytime soon: https://www.latimes.com/politics/la-pol-sac-skelton-income-tax-california-wealthy-20190311-story.html

High taxes be damned, the rich keep moving to California

Are rich people fleeing California to escape astronomical state income taxes? That’s the word. But it’s fake news.

In fact, more wealthy people are moving to California than leaving, research indicates. It’s the poor and middle class who are departing.

It makes sense. If you’re getting rich in California and can afford to live comfortably here in this balmy climate, there’s little incentive to leave — except to stick it to the tax collector in Sacramento.

“If you’ve got your business here and you’re making money, it’s hard to leave,†says Allan Zaremberg, president of the California Chamber of Commerce. …

“California has a net out-migration of low-income folks who can’t afford to live in their state and are being pushed out by high-income homeowners. And there’s a whole other story of middle-class people struggling to pay their bills and the housing shortage hitting them hard.â€

The Stanford report concludes that California has “consistently become a more attractive place for millionaires,†adding that perhaps this is because California has become “a winner-take-all economy.â€

That would be Fake News….

Exactly! But here’s the irony: liberals in “planning” deplore “exclusionary suburbs” and yet the “liberal economic success stories” they boast about, are merely entire cities and entire States that are exclusionary. How plausible would an argument be, that said that exclusionary suburbs with their large lots, all had “above average income earners” and therefore exclusionary suburbs should be the urban planning model for the entire nation?

That is how logical it is to say that SF and California are the urban planning model the entire nation should adopt “because of economic benefits”. The whole system of belief in economic benefits from forcing cities to be “compact” is based on false assumptions. It is a form of cargo-cultism; it does not see where wealth itself comes from and how it is created. The “wealthy, compact” parts of cities are havens of “economic rent” such as finance and bureaucracy and media. Economic rent is not “created wealth” at all, it is a transfer of wealth that was created elsewhere, in the dirty, heavy-lifting rural and resource-extraction and manufacturing-suburban parts of the economy.

Contemporary western urban planners differ only in stupidity, from their intellectual ancestors in the former USSR, in the precise form of the harm they are doing. Hayek was right about the kind of mind attracted to central planning. Everything they do once they achieve power, thinking it to represent the optimum, is wrong anyway.

Nice explanation and exposure of the liberal mindset!!!…+1000

We have seen this all before. In Russia, under Tsar Nicholas, In Cuba, under Batista. Marie Antoinette had a quote for the poor who could not afford rent or food. “Let them eat cake”. Maybe she didn’t say it, but in the end, they said she did and her head was cut off.

Of course the most revenue is coming from people who live in gated communities with armed guards. They are the top 5%. We’ve seen this before under the tsar, and Batista. Republicans ignore the pleas of the poor while rents keep increasing and they are forced into being homeless.

Flyover has every right to hate communism. It is a failure. However he needs to look at how the majority of people voted it in Russia and now will likely vote it in the US, unless the Republicans do something about the situation of the poor and middle class who to not live in gated communities. History shows what will happen. The Democrats will save us. As history has shown, the Republicans will doom our great country with their “Let Them Eat Cake” attitude because history does repeat itself.

Republicans ignore the pleas of the poor while rents keep increasing and they are forced into being homeless.

High rents have nothing to do with homelessness. The vast majority of homeless are either alcoholics, dope fiends, mentally ill, or some combination. Among the longterm homeless, nearly 100% fall into one or more of those categories.

Normal people who can’t afford the rent either get roommates, move in with family or friends, or move to a cheaper building or city.

Bob, you are wrong about that.

The Republicans know that they don’t have anything to offer the poor except “money” (currency). The government does not produce anything that the poor need to consume. The money they produce creates massive inflation and INFLATION is the most REGRESSIVE form of taxation on poor and middle class alike. Therefore, they want to increase the pie and employment – true, productive employment, not government jobs like AOC. Higher employment is good for everyone. Today, the unemployment among the minorities is lower than it has been in decades under democratic rule, and that is a fact regardless of the spin you want to give. This is a situation where everyone (liberal or conservative) participate in the economic growth in the measure of their abilities and training.

The Democrats had the war on poverty since forever and trillions spent on it and the poor under Obama were still a very thick percentage. Do you think that the poor like to be beggars to the government for all their needs? Maybe a very small percentage of addicts but most want to feel useful and worth something. The Democrats, like all politicians, are afraid to tax the very rich, because they are their contributors, too. Therefore, in order to give to the poor, they tax to death the middle class creating even a larger class off poor, till you have only billionaires and poor.

I lived for over 3 decades here, and I always did better under republican leadership regardless if I was poor, middle class or rich. The biggest problem for the poor and middle class is massive immigration. They are attacked on three fronts to become poor:

1. Cost of living getting higher because massive infusion of people in the same living space.

2. More competition on labor driving incomes lower.

3. The FED via QE and low interests enriching those already rich and making those middle class poor.

All three of them create a thicker and thicker class of poor. On this I blame ALL Democrats and a good percentage of GOP made up by RINOs.

In my opinion this is a major driver of poverty and desperation among large percentages of minorities who don’t have capital and they have only labor to sell. The reason the doctors make so much is a very high barrier to entry for other doctors from outside. That is not the case for the average guy in the street, regardless of his training or expertise. This is one of the few issues where Trump gets it right and Democrats don’t. That explains the election of Trump regardless of what the whole MSM said. He has higher popularity than the GOP in Congress. The Democrats can bash Trump forever, but on this issue they are wrong and they will lose again next time to Trump. This phenomena is not unique to US only; you can see it in EU, too.

I agree with you that Trump is not trying to address ALL the issues of the poor, but he does at least on some of them where it is possible politically – the low hanging fruit. For example, immigration and employment is easier to fix that eliminating the FED. You have to remember that he is not an emperor (glad he is not) and whatever he tries to do, he needs the support of Congress. He has many traitors in his own party (RINOs).

I am sure Marie Antoinette, Tsar Nicholas, and Batista were just like the Republicans today.

They shook their heads and said “Those lazy drug addicts poor people really need a job and let them eat cake.”

If the Republicans should get their heads out of you-know-what and see that the median rent in the US requires a $20/hour job. The majority of the lower income people do not make $20 per hour. It seems really obvious to me that Democratic Socialists have a solution to this problem with higher minimum wage, universal healthcare. The Republicans have no solution. That is why AOC has been elected. That is why the Republicans will be voted out of office in the next election. People don’t make enough in wages to afford rent. Republicans only have a chance on winning if wages go up, or rent goes down.

One solution would be to pack 3-4 families into small apartments to share the rent. How many landlords allow this in their leases?

“The vast majority of homeless are either alcoholics, dope fiends, mentally ill, or some combination.”

After reading about all of the homeless and people living in RV’s in Woodland Hills below, how can you say this?

Another example of Republican’s saying “Let Them Eat Cake”. Bernie is guaranteed to win in 2020 with that attitude.

History repeats itself. We are in the same situation with homeless as the Great Depression. That Democratic Socialist FDR was elected for 16 years after that.

In a city not that far away….

https://www.youtube.com/watch?v=bpAi70WWBlw

“The majority of the lower income people do not make $20 per hour. It seems really obvious to me that Democratic Socialists have a solution to this problem with higher minimum wage, universal healthcare. ”

Bob, sorry to burst your bubble. I said it before and I will say it again. I’ll just state the obvious for you because you REFUSE to understand it. Repeat after me – a minimum wage job will ALWAYS offer a minimum wage lifestyle. The government you liberals so much look up to can not decree wealth and increase in living standards. The government NEVER creates wealth.

Money=store of value and medium of exchange

Currency=medium of exchange (ONLY); crypto and all the “money” we use today are not money and they are not wealth. They are just a medium of exchange, NO store of value.

If the minimum wage is $15, $150 or $1,500 is totally irrelevant. The standard of living for the poor will not increase one bit because the inflation will take everything away from them. Actually it will harm them more because the inflation is the most REGRESSIVE form of taxation (if you understand basic economics). It affects the poor and the middle class the most. They will also lose most of the jobs the higher the minimum wage is. A real study on this was published by the Univ. of Washington (three years ago), which is a bastion of liberal democrats. They could not go around the obvious and common sense like you and AOC do.

Because of this inflation, medicare for all and increase in minimum wage is no solution. You are terrible mistaken to buy into the Socialist Democrat propaganda. It will ruin the standard of living for most of the americans who are not billionaires. Maybe some studies of economics will help you understand this; on the other hand, if you take economics from the same school AOC graduated, you will waste your time and money.

The real solutions are those offered by Trump – stop the legal and illegal immigration so the workers have a chance to really higher pay with more purchasing power (leverage for wage negotiation). Higher pay with no increase in purchasing power are what the socialist democrats and Zimbabwe proposes. Decrease regulation on businesses so real productive jobs can be created is what sound economics and Trump propose. More immigration (what AOC and your socialist democrats propose) just lead to a race to the bottom for US workers and a decimation of the middle class. More pay with more inflation does not help anyone.

Sorry to bust your bubble.

Flyover, you are not listening.

Ask the voters living in the lines of tents and RVs in most US cities because of Republican policies whether they would ever vote Republican or for Trump again.

I believe in results. I don’t see them and the voters will only believe false promises for so long.

I agree communism is a disaster. However countries like Norway and Denmark have implemented Bernie type Democratic Socialism and their voters are doing well.

You can point to Venezuela, but you need to look at how many billions their corrupt government embezzled in oil money. Sort of like Trump is doing now. Democratic Socialism is working today in much of Europe and they don’t have people living in tents because they can’t afford food or rent.

You can ask how tariffs did under Hoover during the Great Depression. Look up Smoot-Hawley.

Also ask any Senior Citizen whether Medicare or Social Security is a failure and should be taken away. Trump and the Republicans are trying to cut Medicare.

This is the end of the Republican Party. History will repeat itself as it did when FDR was elected for 16 years (and when Trump style policies were implemented under Tsar Nicholas and Batista.) If we are lucky, like in 1930, we will elect a Democratic Socialist. Otherwise, due to these failed Republican policies, communism may rise again.

Bob: countries like Norway and Denmark have implemented Bernie type Democratic Socialism and their voters are doing well.

Norway and Denmark had the advantage of being full of Norwegians and Danes. As they import Third Worlders, they will increasingly have Third World problems.

Bob, you’ve mentioned Tsar Nicolas and Batista in three different posts in this thread.

You also mentioned Tsar Nicolas and Batista in the previous thread.

You’ve a major obsession with the Tsar and Batista. And a smaller obsession with Marie Antoinette.

Son of a landlord,

I believe History does repeat itself. We are repeating the times of Batista, Tsar Nicholas, Marie Antoinette, and Hoover.

We’ve seen it all before, yet we keep making the same mistakes.

“So the wealthy are not fleeing California in droves even though they’re being hammered by state income taxes. The top 5% of earners pays two-thirds of the tax. The bottom 80% pays less than 11%. That’s just bad tax policy because it leans too heavily on rich people’s capital gains that plummet during a recession.â€

Two mistakes here:

Yes, the wealthy are fleeing in droves. Why wouldn’t they?

Second, the rich (top 5%) should pay 80-85% of all taxes plus we need to repeal prop 13.

The discussion of the taxes from the very rich people always get blurred because the commentators don’t make a distinction between rich producers and rich cronies. There is a MAJOR difference in their behavior.

The rich producers (wealth creators), when they get taxed too heavily, they leave and nobody can stop them. They start producing wealth in a new red state.

The rich cronies (connected to the politicians) stay as long as what they steal is more than what they pay in taxes. The decision is made at the margin.

The problem is that when wealth creators flee, it doesn’t take too long till cronies flee, too (nothing else to steal). They move to low tax states and they bring their ideology of pillage with them changing the red state into a blue state. The previous blue city usually signs bankruptcy (nothing more to steal). The process is repeated the same way the locust move and stay till they eat everything in sight.

Flyover, in this mixed economy, I doubt there is a clear line between rich producers and rich cronies. These categories exist, but there’s a heavy overlap. Much of the rich are to some degree both producers and cronies.

Trump was a producer. But he also worked the system to his advantage.

Most productive businesses have lobbyists, and seek subsidies and tax advantages. If they don’t, they’ll be at the mercy of competitors who do.

SOL, I agree that there is some overlap. However, the principle still stands – if the taxes are greater than the benefits, they leave. The issue is that the government can never give anything unless they took first. When they take more than they give, businesses leave. One way or another, politicians have to be friendly to businesses if they don’t want to kill the goose who’s laying the golden egg.

Low-IQ post by ‘happy’ democrat

Clearly Ms. Happy is ignorant of how the elite in CA use ‘foundations’ to pay virtually zero taxes.

Welcome to the CON

#TheMoreYouKnow

#factsMatter

#SheepNoMore

Flyover – Wealth is created by the Fed. They create wealth out of thin air and then loan it to the Gov’t, which then gets deposited at a bank. The bank then creates 10 times as much wealth out of thin air and loans it to you, the “consumer”. You then turn around and spend it on houses and crap you don’t need.

That is our economy. It is completely fake. There are no wealth creators. Only bankers that create fake money out of thin air. Our economy produces nothing that improves anyone’s physical or emotional well being. The idea that there are “wealth creators” that flee when taxes get too high is ridiculous. The real economy died long ago and it has been replaced by the Gov’t and Fed creating wealth on a computer screen that then gets loaned out to companies that are very proficient at selling consumers crap at a high profit margin.

Real technological innovation is virtually non-existent because it impossible to create a product that adds value to anyones life that is actually profitable. The smartest people in the world “wealth creators” are creating technology that covertly tracks your location and preferences and makes it easier for companies to sell you crap. These “wealth creators” live exclusively in high tax states like California. Red states are innovation and cultural voids because nobody with a brain would ever want to live there.

@son of a landlord

That article is laughable BS.

The rich are a tiny minority of the population so they don’t buy that many homes and the homes they do buy aren’t the sort your average person would be able to buy ever and which compose the majority of the market of for sale property and homes.

IOW they can’t and won’t prop up the market by themselves.

Study is from 2007.

And yet, home prices and rental rates rose YoY in Los Angeles.

I dont think Trump will let the ekonomy tank, his pride will force him to do something to juice the ekonomy no matter what the consequences would be down the road. aka: kick the can on down the road.

According to Bruce Norris (RE professional in SoCal) the housing market wont tank until the affordability rate sinks to +/- 17%. It is still over 20%.

QE, I think you have a good point about housing affordability having to go below 20% before a crash can begin. In fact, I don’t even think home prices will top out this year. The spring of 2019 is the equivalent of the summer of 2006 so the final real estate top will likely not occur until about March of 2020.

We will know if I am correct if the stock market continues to make new all-time highs and the Fed starts to raise interest rates again in coming months. This is good news for President Trump since the next recession will likely not start until after the Nov. 2020 election.

House prices will only drop in LA if we hit a recession. The big question is how much will they drop when the recession arrives. They may drop a little, or they may drop a lot. But, a recession is required for prices to drop.

I’m a millenial and I’ve been reading this blog for quite some time. Jeez…bought a place back in 2009…so I’ve been on here since prior to 2009.

I’ve outgrown my starter home, and am currently renting it out…and renting a place myself. Essentially just waiting for prices to come back down to earth. If they don’t, then thats fine – I won’t overextend myself. My backup plan to living in CA is just moving to another state eventually. Either way…I will NOT overextend myself just to be an indentured servant.

Milenials aren’t happy about buying a house because they are clueless when it comes to doing anything. I’d bet 75% of Millies don’t know how to change an HVAC air filter. Alexa change the air filter!! Alexa? Hello?

That’s OK Millies, don’t buy and burden yourselves with all that silly maintenance. Keep renting from me. I’ll change the filter for you. And fix that leaky faucet too. It’s the least I can do for you as you’re buying me several houses which I will sell for millions of dollars in a decade or so.

Millennials know that they can learn and do anything by watching a YouTube video. You sound like the kind of guy that kicks someone out to upgrade one backsplash and double the rent because the market went up. You’ll be old soon and will need help wiping yourself. Who will be the ones helping you?…. I wonder if they would be as snotty to you and you seem to be to them.

You couldn’t be more wrong about me my renting friend. As I have said numerous times here, happy tenant = happy landlord. I have never raised anyone’s rent. Only time I do that is when one tenant moves out and I will raise rent for a new one. One of my rentals has had the same tenant in for almost 3 years, not a penny increase in the rent even though I could probably get 10-15% higher easily. So why don’t I? Well because I couldn’t ask for a better person in there. Rent is paid on time every month, and they take care of small maintenance issues, without bugging me.

@ Mr landlord

Nearly all Millenials are still making much less than their parents did when at the same age and are still saddled with far more school debt and a higher cost of living too.

The money just flat out isn’t there for them to be buying cheap homes much less homes that are near bubble peak.

https://www.businessinsider.com/millennials-kill-industries-because-poor-fed-report-2018-11

https://www.vice.com/en_us/article/8qq43g/millennials-are-way-poorer-than-boomers-ever-were

Bull, Generation M is in more professional jobs than baby boomers. Baby boomers were more in lower paying blue collar jobs while M are programmers. Baby boomers were layoff from the better paying factory jobs around 20 to 10 years ago and lost lots of pension money one reason why you see them working past 65 more.

“The money just flat out isn’t there for them to be buying cheap homes much less homes that are near bubble peak.”

Yet somehow the money is there for them to buy the latest tech gadgets and pack every Ethiopian Fusion bistro at night after sipping their $7 Starbucks Mocha in the morning.

Cynthia, Millennials are Gen Y, not Gen M.

@cynthia curran

“Bull, Generation M is in more professional jobs than baby boomers.”

That doesn’t matter. What matters is wages and cost of living.

Effectively wages are lower for millenials/genZ than for Baby Boomers while the cost of living is much higher AND mill/genZ are generally loaded with school debt that the Boomers never had to deal with.

Actually read the links that were given in the earlier post. It lays it all out for you and gives good sources. If you’re not gonna bother to read them then don’t post at all.

“Baby boomers were more in lower paying blue collar jobs while M are programmers.”

Those blue collar jobs had higher wages, more benefits, more job security, etc. Also most mills/genZ kids aren’t programmers and most programmers don’t make all that good money after you factor in the crunch time and lack of OT since many of those are contractors and not employees officially.

“Baby boomers were layoff from the better paying factory jobs around 20 to 10 years ago and lost lots of pension money one reason why you see them working past 65 more.”

LOL no. Boomers have had access to virtually all the of the last of the pension systems. For mills/genZ they don’t exist anymore. Even crappy 401k’s are going away for mills/genZ.

The reason why most Boomers are still working is because they were stupid and didn’t save a single thing despite living in what is looking more and more like the Best of Times for all of humanity. Virtually none of them saved anything, they were counting on SS and pensions to save them from themselves, and so the rising healthcare costs alone are leaving them screwed.

@Mr Landlord

“Yet somehow the money is there for them to buy the latest tech gadgets and pack every Ethiopian Fusion bistro at night after sipping their $7 Starbucks Mocha in the morning.”

Millenials/genZ don’t really do much of either of those things. Note how phone sales have been trending flat or declining for years and more and more of them aren’t going to Starbucks anymore. They’re making their fancy coffee at home and putting in those vacuum sealed metal thermoses to take to work now.

https://www.forbes.com/sites/gregpetro/2018/08/19/more-debt-less-stuff-the-millennial-spending-dilemma/#257baf18314d

Millenials/genZ are so loaded down with debt, have a higher cost of living, and have such low income that virtually all their money goes for essentials and they spend hardly a thing on anything else.

Boomers and previous generations (post WWI) all spent more when they were the same age as current Millenials/genZ!! And currently Boomers are still spending more than Millenials/genZ as a whole on discretionary spending too. Its actually considered a huge problem in retail. Everyone is struggling to figure out a way to get Millenials/genZ to spend more money because if they don’t they’re screwed and they know it.

It won’t work though. The money is just flat out not there.

You and other “olds” are just getting played for a sucker by establishment media that is trying to sell you books about how the kids these days are the source of all the problems while ignoring the reality of who has been running the show in Congress for decades (hint: its not mills or genZ).

“It’s a great time to buy!!! Housing never goes down!! Or Stocks!! Spokane is the most desirable metro on earth. You think the economy is bad? LOL LOL LOL LOL OL OL OL LLO L OLL L O LO LLOL OL L OOL oLoL !!!!!” -Mr,,,Landlord

First! I’ve always wanted to do. Nothing else to contribute.

You were so close!!!!

You’ll always be first in my book. Come on back to the ranch.

Maybe somebody will Pay off their student debt & mortgage. Then they can live a care free life while somebody else pays for it.

Student loan defaults are doing nothing but going up over time and there is over $1 trillion worth of student loan debt at risk.

Since jobs just keep doing nothing but getting worse in general (ie. stagnating or cut pay, no pensions, no benefits, no job security, irregular hours, etc) its unlikely that this situation is going to improve. Its almost a given at this point that there will be a major default once enough of the loans become underperforming.

There is no default on student loans and if they ever allowed it much more absurd things would start to occur. Why bother ever paying your student loans back just take out as much money as possible. Take as many classes as possible and get as many degrees as possible. Then immediately declare bankruptcy discharging hundreds of thousands of dollars in debt. Wait 7 years for credit to recover and you are all set by 30 years old.

Woody,

Aside from the utter injustice of consigning gullible, desperate young student borrowers to a life of debt slavery while allowing borrowers to default on any other type of debt- home mortgages (even FHA, which are government insured) up to any amount of money, the guarantees given student lenders assure careless underwriting, with loans up to any amount of money given on signature for fields of study that everyone knows guarantee a lifetime of poverty.

Reversing the vicious Bankruptcy Reform Act of 2005, and allowing college borrowers who cannot pay, would accomplish many great things that badly need to happen. Besides freeing up youngsters whose degrees have proven worthless from a lifetime of poverty, it will accomplish even greater things:

It will shut down the student lending machine completely. Watch how fast lenders become EXTREMELY PRUDENT when their loans are no longer guaranteed by the federal government. No more borrowing $40,000, $80,000 or even $175,000 to major in fine art, or archeology, or some other elitist, impractical field where there are almost no opportunities for decent employment.

And when the lending ceases, and students are forced to rely on part time jobs, scholarships, and working their way through as part time students, the legitimate schools will start looking for ways to cut their costs so they can bring tuition back within the pale of affordability. Gone will be all the layers of administration that have been added in the past 30 years. And there will be no more 5-star-hotel-quality residence halls built.

Better yet, it will be sunset time for all the for-profit diploma-mills. There will be NO money available to attend these schools, and Phoenix, Kaplan, National-Louis (is that one even still extant?) et al, will go the way of Corinthian.

I’m not nuts about Trump, but I support his proposal to put a cap on borrowing for any one student. That is a necessary first step. Sadly, neither he nor his corrupt billionaire Secretary of Education will take the next necessary step, which is allowing students bankruptcy relief, and sunseting Sallie Mae. But things will come to this, and the sooner the better.

Reversing the vicious Bankruptcy Reform Act of 2005 … will shut down the student lending machine completely. Watch how fast lenders become EXTREMELY PRUDENT when their loans are no longer guaranteed by the federal government.

The University Lobby would never stand for it. It would end lucrative salaries for top professors and administrators. Consider the compen$ation for UC President Janet Napolitano: http://www.capoliticalreview.com/blog/uc-president-napolitano-to-receive-570k-base-salary/

In 2013, the UC regents approved a base salary of $570,000 per year for the incoming UC president. She also gets an auto allowance of $8,916, free housing and a one-time relocation fee of $142,500.

The “progressive press” and teachers would scream that limiting student loans would be an “attack on education” and only allow “the rich elite” to go to school.

Can’t wait to see how the cheerleaders wiggle their way out of this data.

What headline are you talking about? Highest inventory since 2012. Wasn’t 2012 one of the best times EVER to buy a home in socal. Even back in 2012, inventory was extremely low compared to historic norms. This is all you need to know.

No recession, no housing tank! Meanwhile, rents keep going up and up and up (that’s unless you are Millie).

Keep hearing rents are going up since 5 years now. Are any of these RE shills capable of doing simple math? If not, there are good templates out there….its called buy versus rent or rental parity. Renting does not even come close to what buying would do to your cash flow.

The housing market is so overpriced that you could rent two houses and would still save money compared to buying one.

“Wasn’t 2012 one of the best times EVER to buy a home in socal.”

Only because prices had crashed. Prices haven’t crashed yet. And prices crashing despite low inventory is pretty far from a good or normal market.

“No recession, no housing tank! Meanwhile, rents keep going up and up and up (that’s unless you are Millie).”

Just give it a bit more time. Even with the funny money loans they reintroduced housing is starting to level off and rents are driving more to live with their parents even later in life. There is no way any of this is normal or good or plays out without any tears at this point.

The prices are just too far out of line with what people make for a living.

The bottom was 2009/2010. By 2012 the recovery was well under way.

I am seeing 3% down offers again. Good Times.

Speaking of rental parity… let’s look west of the 405 and north of LAX below Santa Monica.

If you want a 1 bedroom with washer/dryer and a parking spot or two, you’re looking at $2,600 – $2,900 for nice places.

Look at this place:

https://www.lincolnplaceapthomes.com/en/apartments/floor-plans.html

Cheapest 1-bed is $2,873 plus $100 for each parking spot if you want it.

Then look at a place like this:

https://www.redfin.com/CA/Playa-Del-Rey/8505-Gulana-Ave-90293/unit-4302/home/6632110

10% Down

P&I: $2,234

Taxes: $909

MI: $217

Homeowners Ins: $46

HOA: $450

Total: $3,407

The first year an average of $585 or so goes to principal. So money down the drain is $2,822.

The condo has 2 parking spots. The apartment would charge an extra $200.

Maintenance on a condo is minimal as HOA covers the big stuff homeowners typically need to worry about. Essentially appliances. I’ve been to the first apartment complex, it has very thin walls/construction. It used to be the projects. It does have a very nice pool and gym though. The condo has an older but in decent shape kitchen.

Similar apartments: Marina 41 ($2,800); the other one owned by equity on sawtelle/national ($2,750). Keep in mind comparing apples to apples: in unit laundry and parking and location.

Is this close to rental parity? Or should one not count the principal pay down when comparing? To me it sounds like after 10 years one would be better off in the condo…even during the last crash, 10 years later everything here had recovered and then some.

There are TONS of singles or couples making $130k alone or combined in silicon beach with $50k saved that could do this. Trust me. I know many of them. Many of them are indeed trying to wait for a correction… but if all those people jump on at a slight correction I suspect they’ll end up just driving the price back up on each other.

Long term, west of 405, north of Torrance, below the valley, I don’t think it’s ever going to see another 25% crash. Sooooooo much demand here. I seriously wish it would happen, but property in sunny SoCal biking distance to the beach falls by less during a downturn and increases by more in the next upturn…and I think the general landscape of west side LA has changed permanently with how many businesses have set up shop.

Google is about to take over west side pavilion. How many high paid tech workers will that bring in to compete?

I hate it because I think things are overpriced as well. But when you live here it’s really hard to fathom a giant crash…

Buster, you used the example of a condo. Comparing condos to houses in the same area, you have to remember that condos fall in price first and by a larger percentage than SFH. When recovery happens, condos start increasing later than single family homes and by a smaller percentage.

On SFH there is a premium you pay for this safety. I am not saying to not invest in condos, but you have to keep this in mind. I bought a condo at the bottom of the market for a song and I made good money on it. However that was the first and the last time I put money into a condo. I prefer SFH, commercial or duplex-fourplex. No more than fourplex because for more units than that you are at the mercy of loan sharks who take all your profits in fees every 5 years. You can not get 30 yr loans on multi family complexes.

@Buster,

I would personally never buy a 1 bed/bath condo for 500K, but somebody bought that property last week. Rental parity with 10% down, do this example again with 20% down and it is definitely cheaper to buy relative to renting.

And you are correct that part of LA (west of the 405, north of LAX to Santa Monica) isn’t ever going to be cheap again EVER. We may get the Millie 50-70% crash in highly undesirable areas, not going to happen in that area!

Yeah of course SFH will always outpace condos in terms of appreciation and weathering downfalls. And a 1 bed condo is the worst of condos for sure.

If you’re single with a 140-150k income, work in silicon beach, like biking to the ocean, and you want a complex with pool, in unit laundry, and secure parking … the rents in the area will be 2,700-3,000. The real luxury units can be 3,500. For 1 bedrooms. At $500k a condo’s math seems to make sense at 20% – assuming you consider principal paydown as money you’re keeping.

I think price will only drop with huge job losses. But I think silicon beach means the “discovery†of LA as being better weather and nicer beaches than Silicon Valley. I don’t see why it will ever get cheaper than Silicon Valley as it’s much smaller in area. Frankly I’m surprised at how cheap it was until 2014 (during which time I was admittedly browsing this board agreeing that it wasn’t overpriced…ugh).

I looked again and it is at least hitting a limit. Playa vista has a 1 bed listed for $589k that’s been sitting. Though a similar one in same building is in escrow at $585k. Go figure.

I am pretty sure when home prices start correcting for millennials or any recent owners the county/state tax collectors or going to hate hearing reductions in tax valuations once again. Prices can’t keep going up forever based on their annual assessments.

Like some have said recently, well priced (not low price) are still selling fast.

This home in Westchester sold in first open house for $150K over asking.

https://www.redfin.com/CA/Los-Angeles/6441-W-83rd-St-90045/home/6610932

in looking at price history, you will see that YoY average increase since last sold in 2010 was 8.8% per year.

I live about 7 blocks north of there. That house is a little too close to the airport for me, but it might be ok.

In this area, houses sell quickly. The original one-story houses (like I live in) are almost invariably torn down and a two-story put up in place.

Been in this house over 38 years. Paid for, never refinanced, probably never move (unless I have to). Nice quiet neighborhood.

Could never afford it now.

Now Jim Now!

Best comment ever hahaha!

Lol

I’ve noticed several houses in my SF neighborhood sitting on the market for much longer than usual. They’re beautiful, renovated and in one of the best neighborhoods. They’re just massively overpriced. The tax law change is a massive hit to CA and can add $2,000 to the monthly cost of one of these homes. They’re not mansions, just nice family homes that could hold two kids comfortably.

But if you have student loan debt and childcare expenses I don’t know how you would manage. And of course you need a massive downpayment. If you can swing all that, then you can start thinking about upkeep, cars, eating out, summer camp, clothing, commuting expenses, utilities, insurance – the list is endless. Even if your company IPO gets you $1,000,000, after taxes you’ll barely get your foot in the door of the sort of house you would expect to be able to buy.

“The tax law change is a massive hit to CA and can add $2,000 to the monthly cost of one of these homes.”

LOL. Can you show the math on this extra $2K please? Nobody seem to understand the new tax law. It’s quite amusing. Let me guess, you also think a lower tax refund = you paid more taxes? Snort.

There is a federal deduction cap on the combined deduction of Mortgage interest and State income tax. It sucks. Its a huge hit, if you are a high income earner, and used to deduct your state income tax bill from your federal total, that is limited, and worse, it is combined with mort interest deduction and the total is limited.

When your IPO comes through and you get your million, after taxes it’s not even a downpayment on a decent house.

Buy and Hold , lather-rinse-repeat . Do the routine maintenance myself and keep the renters happy, and yes , the renter pays of the house for me. Happy-Happy-Happy.

I have been reading this blog for several years now. Never commented before. The reason I ended on this blog is I was frustrated with home prices not reflecting economic reality (not being in sync with incomes and with overall inflation rates) and started researching trying to understand what the hell is going on. So I googled a bunch of topics and ended up here, among other places.

I am at the time in my life where I really should be buying (married with kids in school age, great career in accounting with steady income, solid savings, etc.). But here in San Diego it just does not make sense to buy at current price levels. Example, I am renting a nice big property (5 bedroom, over 3,000 sq feet, in Ok conditon) in a very nice neighborhood for $3,500/month. The Zestimate for this house is over $1M and it is not for sale by the way. It is the more modest house in our neighborhood, so it would be a smart purchase. If it was for sale, I could really stretch out and buy it – we have household income and savings to put down 20% and pull off the monthly payments. But this would be a stupid financial decision – my monthly interest and property taxes (“money wasted”) would be more than my rent, my savings would not be making return, and I would be on the hook for maintenance (low estimate is 1% per year at least $1M purchase price). So to me this is another indication the market is artificially inflated with cheap money, speculation, and unreasonable expectations about the economic future. The graph is this article showing the disconnect between overall inflation and housing prices tells you what I am waiting for before I am comfortable to put my money in housing – I am waiting for the blue line to go back to red line. I am waiting for there to be parity between incomes and home prices – I don’t expect it to be like in Texas – coastal California will always be skewed by rich retirees and rich immigrants. But everything I read in books, everything I know about the way the economy works, all this tells me the market will crash horribly and the blue line will go back to the red line or below for some time. Thanks!

SD accountant

“…California will always be skewed by rich retirees and rich immigrants…”

Yes, but

Here are some interesting stats about San Diego

https://statisticalatlas.com/place/California/San-Diego/Household-Income

To me, a median *household* income of $~68K hardly qualifies as “rich”

Even households at the 80th percentile $~136K doesn’t exactly have excess cash to burn

IMO, the “rich retirees and rich immigrants” argument is largely a wet dream fantasy conceived and promoted by the REIC.

Kinda like those who promote UFO’s, the REIC agent will say “Prove to me that the ‘rich people’ *are not* buying houses.”

BTW

I happen to live [and own] in the OC (Irvine) but your own rent/buy situation here is pretty much the same.

I live in San Diego as well, and in the the same situation you’re in. Sit tight, my friend. Keep stacking chips and wait. Those $1 million homes will be $500k in no time, and then you’ll be able to buy one to live in and one to rent out. It’s happened several times here and will continue to, as long as the game is rigged to blow and pop bubbles.

Hi Josh.

I hope you are right! I would put my money in real estate, if I saw a correction of 25%+. My plan was to wait for a news-worthy crash and then hunt for new construction bargains, since developers are not guided by emotions and ideas of what their houses “should be” worth. So the developer inventory prices won’t be as sticky on way down as ones for existing homes.

My expectation (or wishful thinking?) for a while has been that sometime in 2019-2021 there would be a major slowdown in the economy (or depression), followed by stock market correction (or crash), followed by default wave, finally followed by housing correction (or crash).

1% was the case in the 60s and 70s when houses cost $50K, and then budgeting $500 for maintenance made sense. But today, with house prices where they are, 1% of house price for maintenance is not realistic On average I spent $500-1000 a year on maintenance and repairs for my homes. Granted I do a lot of the work myself, but even if i hired someone for every little thing it wouldn’t come close to 1% of the value of the home. And for a $1M suburban house in SD, there’s no way you’d spend $10K.

The 1% number is like changing the oil every 3K miles. No modern car needs it that frequently, yet all the “experts” still use that number.

Thanks for your response Mr Landlord. I do not dismiss what you say, but I disagree with it.

I think $10K per year is a realistic or even low estimate for 25+ year old building, which is the case for the one I rent (my example) and most real estate I see on the market. As I said in my post, my profession is accounting, and we use a 40-50 year useful life estimate for spreading depreciation expense for even concrete and steel buildings. There is a reason for that. Budgeting 1% for maintenance is a long-term estimate. Yes, most years you can get away with patching and painting here and there. But deferring big maintenance issues does not make them disappear. Sooner or later you need new roof, new gate, new windows, new floors, new plumbing, etc. These are all crazy-expensive things and I don’t the time or desire to do any of that crap myself, even if I could. My spare time is too valuable as I already spend most of my days at work and not enough time with my family and doing other things I enjoy – painting walls is not one of them.

I thought the forecast for home maintenance was about $1 per sq ft per year.

On that basis, my 1950 home which I have owned for 6 yrs has averaged about 50-75 cents per sq ft per year.

SD Accountant: Fair enough. I’m quite handy and I actually like painting (don’t laugh). Fixing things is in a way a hobby for me. I also cut my own lawn, which I know for a white person in SoCal is incomprehensible 🙂

But I get your point.

QE Abyss makes a point about sq ft. The value of the home is based on land cost. So you shouldn’t budget repairs based on the value of the home itself. That $1M is is $1M due to where it is. Same home in flyover would be 1/3 the cost. Both houses would cost abut the same to maintain. Maybe a little more in SD since labor price is higher, but not by that much.

https://www.forbes.com/sites/juliadellitt/2018/06/20/why-you-need-to-adjust-your-monthly-budget-for-home-maintenance/#55eb5ac534a0

San Diego Accountant: My spare time is too valuable as I already spend most of my days at work and not enough time with my family and doing other things I enjoy – painting walls is not one of them.

I remember — was it back in the 1990s? — when Paint Parties were a thing.

A young single, or couple, would move into a new apartment or house. They’d invite their friends over for a Paint Party. The whole day was spent painting every room, listening to music, talking, ordering take-out pizza.

In some romantic comedies, couples would have paint fights during a Paint Party, flinging paint at each other, then breaking into laughs and kisses. And some non-romantic comedies had Paint Parties end in messy disaster.

Mr Landlord try and talk to an honest contractor and you will find they charge you more to do the same job if your house is more expensive. They will argue it’s because they have to use higher end materials and “your” expectations will be higher.

Sound, well-thought out advice. You are (or should be) solidly Middle Class in the peak of your earning years, but wisely, you are holding out to see where things go. Housing Prices are at nosebleed levels and anyone with an ounce of common sense can see that they cannot go up at the same clip forever.

My wife and I are in the same boat as you: we have a fat stash of cash for a down payment and a baby on the way, but if we bought in now (at what I think is the peak of the market) our monthly costs of mortgage, taxes and insurance + childcare would leave us without a penny of our income to save for a rainy day. The math just does not add up.

And if you or your wife do buy that overpriced house, and then a downturn or an illness leaves one (or both) of you without work- then what? Life is unpredictable, and the Cali economy since 2000 has been nothing but a roller coaster of boom and bust cycles. You have nothing to lose by continuing to save and seeing where this market is headed. It could be a hard or a soft landing, but either way- you’ll be far more prepared than the bewildered herd.

Then why are Irvine new homes continuing to increase in prices?! Irvine seems to defy all data.

Sure it did LOL. Someone didn’t save their commission checks during the bubble years.

https://www.movoto.com/irvine-ca/market-trends/

https://finance.yahoo.com/news/toll-brothers-orders-plunge-california-144209405.html

It is the destination for wealthy asians. I don’t understand the fascination with the place except the stellar schools.

You gotta have a few silly buyers who overpay massively. Can’t have a bubble without losers participating. In other words, when the bubble pops only a few will win.

Because Irvine’s housing market doesn’t play by the same rules as most cities. I used to build homes in Irvine back in 2014 and we did a market study on who’s purchasing these inflated homes. Turns out 90% of buyers were not American but mainland Chinese citizens and 75% of those buyers were buying 2 or 3 at a time all cash. Irvine is a city where wealthy Chinese people can park their money. And since they invest so much money, they can easily apply for a Green Card and ultimately citizenship. So they’re essentially buying the ultra valuable American citizenship. You and I are already American citizens so we have no incentive to buy at these ridiculous prices.

This is why the United States should follow the lead of most countries and either ban non-citizens from buying real estate or implement a hefty tax on foreigners. If that happens, the market will correct down to where it should be.

“This is why the United States should follow the lead of most countries and either ban non-citizens from buying real estate or implement a hefty tax on foreigners. If that happens, the market will correct down to where it should be.”

In principle I don’t like the idea of doing this. But I’d support this for citizens of countries that have similar laws. If I as a non-Mexican citizen can’t buy a beachfront home in Mexico, then Mexican citizens shouldn’t be allowed to buy property in California either. I’d also support slapping some foreign buyer sales tax on real estate. Of course the second that law goes into effect, leftist groups would file suits against it and imbecile leftist judges would throw the law out cuz racist!!!

Landlord – I agree. Its only fair if I cant buy property in country X that citizens of country X cant buy property here.

Next up, universities with an endowment should not get a single dime of taxpayer money! They cant claim they need it when they sit on – in some cases – billions. Those giant slush funds need to be used to bring down the cost of tuition.

Irvine is a modern day Chinatown. One can go for weeks there and not see a young person of European ancestry. The few of us who not Asian are dying off so the future is clear: Only Asians need to apply for residency in Irvine.

The are a few key point to this discussion 1) Unlike 2007 there is no evidence of massive mortgage fraud 2) Oil is affordable 3) The banking and world economies are not tanking, and 4) This clip “… found that significantly more people earning above $125,000 were moving into California than were leaving. And more earning less than $75,000 were taking off.”

Many rich NY/NJ want to leave for Florida for weather and taxes, however if you live in California where are you going to go? AZ – Horrible Summers, Las Vegas – Same summers as Phx with worse winters, Oregon – rain and fires, Texas – hot humid bugs, Utah, Colorado beautiful but nasty winters come on!?

The only world class cities on the West Coast are San Fran and LA, maybe Vancouver. If you are in a competitive professional career your salary in CA should have doubled since 2007. Back in 2012 people were screaming because inventory was low, then it got worse, now back to 2012 levels? I hardly think this justifies gloom and doom. I am sorry for the people who are forced out but I am happy I purchased when I did. Sure I could save a couple grand a month in another state but you only live once and you’re not going to take your money with you when you die. If you can afford to live in California then I recommend you buy in California. PS we’ll enjoy our upcoming 80 degree weekend while others are in the latest Arctic blizzard.

Oregon – rain and fires,

Yeah, we never have fires in California. And no mudslides when it rains.

“Oregon – rain and fires,”

Good thing it never rains and there are never any fires in California. LOL

Salaries have doubled since 2007? Sure about that?

https://arstechnica.com/tech-policy/2018/11/study-over-20-years-silicon-valley-workers-median-wage-has-fallen-by-14/

“Over the last two decades, 90 percent of workers in San Mateo and Santa Clara counties— the heart of Silicon Valley — have seen their real wages go down, according to a new study by the University of California, Santa Cruz and the think tank Working Partnership USA. “The median wage for workers in the Silicon Valley region declined by 14 percent,” the research showed.In short, most workers—regardless of whether they work in the tech sector or not—are getting poorer due to venture capital-driven business models that prioritize outlandish returns fueled by low-wage work that captures a given market quickly.”

In other words, making $150K a year in Silicon Valley, doesn’t mean much when rent for a studio apartment is $3000 a month. And it’s not just rent. Everything is exorbitant in coastal CA cities; gas, utilities, groceries, health insurance, you name it. Add to it high income and sales tax and that $150K is the equivalent of $75K in Phoenix. But the same job in Phoenix pays $95K. Which means someone in Phoenix is relatively better off doing the same job that someone in San Mateo.

And have you ever been to Phoenix and experienced the weather? Sure, there are 3 months of brutal summer weather. But between Sept and May, there’s no better weather in the country. And yes that includes CA. Compare weather in Phoenix on a typical January day vs LA or SF. 70, dry and sunny vs 50s rain/cloudy/humid/foggy. I know which I would choose. And even in summer, once the sun goes down, nothing better than those hot dry desert nights, sitting by the pool. You really should give it a try sometime.

Phoenix is a great deal for those with high school diplomas. Very nice city. You might not make boatloads of money on your house, but life is very good in Phoenix. The women are awesome.

3 months? Lol.

You will be running air conditioning non-stop from May till October, day & night, at home, in your car and at work.

I remember how ALL RE cheerleaders told us how there is no inventory!!! Fast forward a year and we see graphs showing inventory is as high as 2012. How quickly things have turned 🙂 the weekend is around the corner…..more open houses to visit. No crash>no purchase. Meanwhile I am watching my war chest get bigger while the cheerleaders keep telling me how high rents are. Pathetic, they have nothing left in their sales pitch portfolio! Almost boring. Almost 🙂

I am not seeing a bust yet, yes homes that are overpriced sit longer but that happens in any economy. On my south of Ventura Blvd. street a house across from me listed at 999,999 which seems like a fair price for 3000 square feet and just sold for $1.2 within 2 weeks. Over the summer a much smaller home listed at 799,000 and sold in a week for 950,000. I bought on this block for 725,000 a year ago improved the home and I am sure I could get 850,000 out the door. I would love to see a crash, I would buy a much nicer home and rent out my starter but I have a stable job and a niche skillset. Come on Trump, screw it up, I would benefit greatly…or do what you claimed you would do, and my home value keeps going up…

I really like Woodland Hills. I am surprised it is not more expensive … the location is great and west LA jobs are within a reasonable commute.

https://www.zerohedge.com/news/2019-03-15/housing-slump-foreclosure-activity-jumps-austin-miami-san-diego-and-seattle

Foreclosures are up. Big time. Crash is coming with big steps

One thing I am unclear on: Chairman Powell has made clear that he is a dove and will keep interest rates low, and throw in more QE if there is any sign of trouble. Warren Buffet says the stock market can go up forever if interest rates are kept near zero (because of fractional-reserve banking). If all that’s true, why would equities and real estate ever real tank hard? Just asking….

Nothing goes up forever. No manipulation of the market can drive prices up forever. Read about other fallen empires or japan for starters.

This is different. The banking elite are systematically devaluing the dollar, and the only way to protect yourself is hold something other than the dollar. So, these people sitting on the sidelines waiting for a crash are also watching their dollar evaporate. The fed is NEVER going to be willing to let the market decline meaningfully. With the world central banks buying stock and the fed still printing (nearly) free money, I don’t see any reason they can’t keep this run going for years (it’s already been 10). The social costs of this monetary policy(unaffordable housing, skyrocketing inequality) are obvious enough but, short of a political response, I don’t see any reason why the central banks can’t keep this dance going. I’m not saying it’s a good idea, I just don’t see what’s stopping them.

Keeping rates low forever will eventually trigger substantial inflation. And, substantial inflation will force rate increases to protect the US Dollar. There is no way around that.

I am usually bullish real estate, but it can not go up forever by keeping rates too low. Stupid.

I agree with you that this cannot go on forever, but it might go on for many more years. Again, most of the inflation in the system (housing, equities) is there by design, as part of general devaluing the dollar. This is killing savers and working people, but it’s paradise for people holding hard assets and stock. So, I don’t think there’s a big crash in real estate or stock until monetary policy changes. All of this cheap money has created a zombie economy and this zombie will be keep moving until the people feeding the zombie are forced to stop — i.e., political intervention.

Where’s Millennial commenting on this millennial article?

Did he finally throw in the towel?

If he did we may be at the top.

“Throw in the towel� Meaning what? Buying?

Why buy now if you can wait a few years and buy 50-70% off?

Btw, I have posted a year ago that the inventory-is-low lie is just marketing by RE cheerleaders. Inventory is increasing, sales decreasing. Need more signs?

I just went to an open house, for a new listing in Irvine, and witnessed a bidding war. In the one hour, I was there, 3 offers were presented to the listing agent–last being for more than the asking price. It ought to be interesting to see for how much the home eventually sells for above its asking price.

It went for 800K over asking!!! BUY NOW!!!! No time to waste. I SAID BUY NOW!!!! NOW IS THE BEST TIME TO BUY!!!! BIDDING WARS WITH CHINESE NOW

Our Millennial is still playing it smart and eating his 30 tubs of popcorn before the movie starts.

The FHA has tightened loan requirements that haven’t been this loose since 2000. 2000?? Wait, they are much looser than 2006/2007 during the NINJA heyday? See Dan’s comment below.

The good news is that we are no longer full-speed ahead and damn the icebergs.

Can the FHA turn the Titanic? Maybe they can and maybe they can’t. Stay tuned to this slow motion disaster movie. Meanwhile, don’t book a ticket to board just yet.

KA-CHING!

https://www.cnbc.com/2019/03/15/get-ready-to-pay-more-rent-even-as-home-prices-cool-off.html

“After taking a breather in 2018, due to new supply on the market, rents for both single-family homes and multifamily apartments are now rising at the fastest pace in nearly a year, according to Zillow. The median monthly rent in February came in at $1,472, an increase of 2.4 percent compared with February 2018. For the typical renter, this means about $400 more a year. This after rents actually fell last fall for the first time in more than six years.”

A 2.4% increase in rent means it just increased with inflation/wages. Nothing to see here as this is expected.

Isn’t Millennial going under the moniker “TheMillennial” ? Sounded a lot like him.

I’m sure he’s out there in the ether somewhere. Here, he mainly tried to convince shaky buyers to forego the pleasure or induce panic selling to speed up the RE cycle and get to some type of pullback. He loved claiming even seasonal pullbacks as a victory. Unfortunately for him, jobs are still being created at a fast clip, interest rates holding,etc., so he just couldn’t get any satisfaction, as the Stones would have put it.

But don’t lose hope, he’ll show up again and add to our entertainment. Meanwhile, the market keeps plugging away nicely, just at a slower rate.

HA HA HA HA HA HA

Poor milenials are so stressed out. Their top worries: not getting likes on social media, slow WiFi and their phone battery dying. Jezuz Fn Christ!

Every generation has its fair share of stupid. But come on Millies. You’re an embarrassment to all past generations. Grow up already. When you’re losing sleep 138 nights a year because WiFi is too slow, you need a serious lifestyle change.

https://www.studyfinds.org/survey-millennials-life-more-stressful-than-ever-before/

King county

February 2019: $655,000

February 2018: $649,950

0.08% increase YoY

Inventory very high, lower pending sales. Bubble popped. Going down from here on

https://seattlebubble.com/blog/

Two headlines in Sunday’s OC Register RE section:

1) Rents Still Rising in LA & OC

2) To Keep Prices Down, Homebuilders Thinking Small

Rents rose on an annualized basis 5.5% last month. Rents are the key reason local inflation topped the national rate. Other parts of the local CPI inflation rate are trending down.

We wonder if an uptick in legal/illegal foreign immigration to LA is a driving factor in rent increases?

Average home size for new construction peaked in 2015 at 2700 sq ft and has dropped below 2600 sq ft (national data). People looking to buy prefer suburbs and detached houses over urban areas and townhouses. And people surveyed only want “green” features if the savings are made clear up front. These are from a survey of builders and a survey of prospective buyers.

Sounds like buyers and sellers are approaching each other as non-performing construction trends are dropped in favor of realistic goals.

Long term renting strategies in places like socal are nothing short of financial suicide. Even that 3% yearly rent increase is murder after 10 or 15 years. We all know Millie never gets a rent increase, he is in the ultra minority. Most people who are on the fence to buy will throw in the towel after a few years of 5%+ rent increases. Unlike Millie, most people have finite time horizons…living in a cheap apartment in a shady part of town only will go on for so long.

Millie and his peeps spent too much time in school taking Trans Studies and not enough taking math and economics. They never learned about the magic of compound interest. A 4% yearly rent increase in 15 years is an 80% increase. After 30 years it’s 145% increase.

Meanwhile a fixed mortgage payment increases by 0%.

And at the end of the 15 or 30 year period, Millie is still paying rent and owns nothing, while the home owner is done paying and owns a home outright.

“We wonder if an uptick in legal/illegal foreign immigration to LA is a driving factor in rent increases?”

Joe, no need to wonder. It is ECON 101. More people means higher demand (no everyone wants to sleep in the streets) even if they stay more families in one dwelling. Higher demand for a relatively constant (very hard to build in SoCal and if they do, the cost is way higher than 10 years ago) supply mean higher rent prices. Higher rent prices mean higher ROI for RE investors who are bidding higher the RE prices.

Therefore, yes, the massive immigration does increase RE prices and rents even if the immigrants don’t buy RE (some do).

It is interesting that millennials and teachers, by and large (especially in SoCal) vote Democrat. But the Democrats push for more immigration, open borders and sanctuary cities. Then, the same millennials and teachers complain for not being able to rent (forget about buying) anything and being forced to live in mom’s basement. Still, being so illiterates in real economics, they can not connect the dots between cause and effect and the Democrats take advantage of them.

It is the same for the heavy traffic on the freeways – more people means more cars.

I know that my comment is not going to change anything – “you can not fix stupid”.

The ONLY beneficiaries of all of this are the largest banks who will continue to take advantage of people stupidity (touching all the right emotional buttons to have them where they want them).

You are 100% correct. I drive through formerly nice middle class neighborhoods in OC and the streets are filled on both sides with parked cars and many of the homes have multiple cars in the driveway and on the lawn. Without a doubt, there are multiple families – probably immigrants – living in those homes. That much demand is definitely going to put upward pressure on prices. The Democrats’ drive to import more voters by any means possible is increasing housing costs for everybody.

That “we” was an editorial “we”. Of course my family members all think that immigration is a big driver of rental demand here. It isn’t driving rentals in the area where I own a rental. Too far out in the sticks. But rents are also creeping up there.

Where’s the housing crash?

Consider this Santa Monica house: https://www.zillow.com/homedetails/2714-Washington-Ave-Santa-Monica-CA-90403/20469799_zpid/

* 2008 …. Sold for $2,550,000

* 2018 …. Listed for $3,700,000

* 2019 …. Sold for $3,249,000

Yes, it sat for five months before selling. The seller had an unrealistic price in mind. But when the price was lowering, it was sold at a nearly $700,000 markup since its last sale 11 years ago.

I don’t think Milli will get his beach house at a 70% discount.

Son of a Landlord,

“I don’t think”. That’s your first mistake….your thought process.

People who are familiar with the RE market know that you find a buyer once in awhile who overpays massively, especially during the peak of the market. Without having people who buy sky high you cant have a crash. Not everyone can win. Take 2008 for instance. We had 7 Mio foreclosures last time. They all had one thing in common…..they bought high. Most of them were on 30y conventional loans. They walked as they saw that their neighbor just bought for 50-70% off. Wouldn’t you walk as well? Btw, 50-70% discounts during a crash are a conservative estimate. Its out of the question that it will happen again. Just have some patience.

Say the owner put down 20% in 2008. There was 11 years of mortgage pay-down which at a 4% interest rate (which was the going rate in 2008) comes out to around $500K of principal pay-down.

So to recap. Owner invested $500K in 2008 and after selling, walked away with $1.1-$1.2M in 2019. And yes there were some costs along the way like closing costs, maintenance, repairs, taxes, etc. I will be generous and take off $200K for all that. We still have a profit in the $1M ballpark. And he/she did all this while living in a luxury home, 10 mins from the beach.

I keep saying over and over, it is virtually impossible to NOT make money in r/e in the long run.

Santa Monica is really volatile due to such low transaction volume but the median for SFR have fallen 20%. Median SFR price Feb 2018 $2,380,000 and Feb 2019 $1,913,000. Not a 70% crash but a 20% discount never the less.

27% Return in 10 years approx. ? Weak and actually terrible since the stock market tripled in price. Who would buy a house? Value destruction.

It’s not 27% my renting amigo. See my post above.

Remember, r/e is bought on margin, ie a mortgage. The ROI is on the down payment not the price paid. And the principal pauy-down is also considered since that’s money a buyer would have paid in rent otherwise. As a home owner you’re essentially paying yourself instead of paying a landlord. That is Inputed rent/income, look it up. And of course up to $500K of capital gains is tax free in real estate.

The fact you think it’s only 27% tells me so much about your financial abilities. And also why you think renting is a good idea. Each to their own.

Ok so in your example 500K became $1M i.e. doubled in Price TaxFree vs Stock Index Fund Triple? The Fund 500K investment tripled to $1.5M minus $150K in LTCG 15% = $1.35M minus Rent approx $3000/Month over 10 years $350K = $1M …..End Result seems about the same.

Class action lawsuit against the NAR on its way.

Pro tip to buyers and sellers: You don’t need to pay 6%. That fee is negotiable, for both the buyers and sellers.

Sounds good in theory. But, if you all think a massive class action settlement into the billions will make transaction costs cheaper for consumers, I have a nice bridge for sale in NY. Call me.

https://www.marketwatch.com/story/big-name-lawsuit-could-upend-realtors-and-their-6-fee-2019-03-19

I think the realtors are overpaid, esp 6% on a multimillion dollar home. The reason is that selling a multimillion dollar home is even easier than selling a crapshack. Why? people who buy multimillion dollar homes dont need all the hand-holding or explaining. Those buyers and sellers have prior experience in RE transactions and there are not nearly as many problems with loans, etc.

I think a 4% commission is plenty.

Real estate agents are operating like a cartel. It’s overdue that we get agents out of the real estate market. We need to let Software and technology solutions take over. An agent doesn’t deserve more then .5% IMO. Anything over 1% commission combined for both agents should be illegal.

Here some good news. Hopefully the NAR loses in court.

https://on.mktw.net/2FcM7cp

This is a frivolous law suit and they are going to lose. Yes, I agree that 6% is ridiculous and I never pay that. However, unlike social media, no RE firm has a monopoly. There is plenty of competition in the market. Every company is free to price themselves out of they so desire.

I always use owner/brokers who charge me 0.5% or flat fee (usually $500 to $1,000 depending on services provided) on the listing side and whatever % I decide to pay on the selling side. They are my money and my property and I am free to chose as long as I can live with the consequences of my decision. The employees of a RE firm do not have this freedom. They do what they are told by the brokers/owners and they should because they are employees. The problem is not with the brokers, but with people who don’t know and don’t want to shop around. As long as people are willing to pay 6%, the brokers will say “Thank You”. If the seller of shoes is asking $1,000 a pair who’s fault it is? The owner of the store decides the price not the desk person (the employee). The buyer decides if the pair of shoes is worth $1,000 by voting with his dollars. Who is at fault? The seller who is asking or the buyer who pays? It is the same in RE.

If they would have a monopoly, then I would agree with you. The fact is that they don’t.

Announcement today by HUD: FHA is tightening up it’s DTI (debt to income) ratios and credit score requirements.

There is no new established floor on credit scores; however, the automated underwriter will tighten up on the lower credit scores that have higher DTI’s. So, basically buyers that may have qualified or received pre-approvals in the past few months but are not in contract; may no longer qualify.

Here is the announcement: https://www.hud.gov/sites/dfiles/SFH/documents/SFH_FHA_INFO_19-07.pdf

This also applies to refinances; so, those looking to take cash out of their equity and have lower credit scores may no longer have that ablitity. BTW; max loan to value on a cash out refinance is 85% with FHA.

That is a smart move by the FHA. They see the potential hazard ahead.

Here is a concerning statement:

“FY 2018 were comprised of mortgages where the borrower had a DTI ratio above 50 percent, the highest percentage since the year 2000.”

Even above 2006/2007 when NINJA loans led to the Great Recession?

What does that mean?

This timing is also interesting. The FED announced today (and last year) they will be unloading the mortgage backed securities they are holding. What suckers will be buying these from the FED? The FED is bailing out of the housing market. That’s good so the taxpayers won’t be bailing them out also.

Impossible to measure DTI back then bc the income was “stated” and therefore fake

I’m confused.

The data was accurate under Clinton in 2000 and highly inaccurate under Bush in 2006?

However it is accurate now under Trump?

The warning sirens are going off in my mind. They are extremely loud.

Why should I

The Fed isn’t selling MBS, they are just not repurchasing MBS that undergo principle paydown, or that are fully paid off.

Sorry, I had a copy and paste problem above.

An increase in the concentration of mortgages with high debt-to-income (DTI) ratios, where almost 25 percent of all FHA-insured forward mortgage purchase transactions in FY 2018 were comprised of mortgages where the borrower had a DTI ratio above 50 percent, the highest percentage since the year 2000. The increase in higher DTI concentrations has continued in FY 2019, with more than 28 percent of January endorsements having a DTI ratio greater than 50 percent.

FHA is basically a housing welfare program like Section 8. Nobody every pays back FHA loans. Well, taxpayers pay it back, but I mean no borrower ever pays them back.

That OC Register writer I mentioned in a much earlier post was predicting this sort of thing for this year. So his info was good.

Excellent insight Dan.

Government dumping MBS and then in the 9th inning tightening lending standards on their way out the door is a pretty clear leading indicator.

Even Mr,,, Landlord’s beloved Spokompton will feel the pain. Even an impressive and substantial median HHI of $54k in Spokane won’t be enough to pack the wound. After hearing realtors in Spokane (I own 3 apartment buildings there, all north of 90 not fancy pants overpriced South Hill) for months brag about the expansion of Fairchild, it isn’t happening now. Did you see that? Thankfully I’m smart and I paid $20-30k a door for my units. Anything more in Spokane is idiotic.

Cryptocurrencies plummet 85% – https://www.wsj.com/articles/bitcoin-is-in-the-dumps-spreading-gloom-over-crypto-world-11552927208

Bitcoin is in the longest slump of its 10-year history. …

Signs of the crypto winter are everywhere, marking a sharp reversal since the manic highs of 2017. The price of bitcoin Tuesday was just below $4,000, down about 80% from a trading peak of about $19,800 in December 2017.