The Greatest Heist of the Century: Stealing and Mortgaging the United States’ Future.

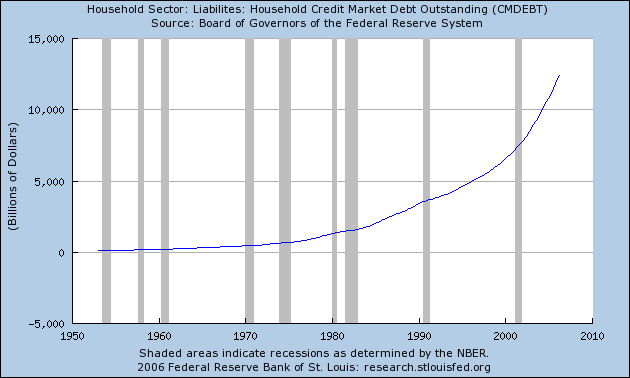

The Growth of Mortgage Debt

As it stands, the current mortgage debt outstanding is $13.3 trillion. In 2000, mortgage debt was at $6.5 trillion. That means in 7 years we have doubled the national mortgage debt outstanding which is simply amazing. You can see from the above chart, grey areas showing recessions, that each slowdown in the economy had a net effect of flattening the curve down for a few years. Not this time. You’ll notice that during the previous recession, mortgage debt suddenly sky rocketed into an exponential dimension. The amount of mortgage debt outstanding is incredible. Let us take a look at another chart:

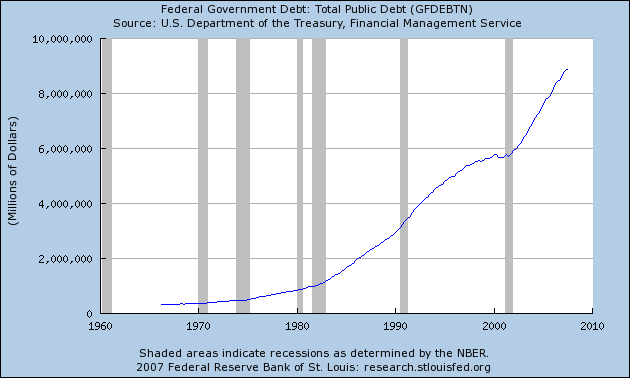

For comparison sake, this chart shows the total public debt outstanding. In 2000, total public debt outstanding stood at approximately $6 trillion, almost on par with the total mortgage debt of $6.5 trillion. Fast forward to 2007 and total public debt is at $9.1 trillion and mortgage debt is at $13.3 trillion. A difference of $4.2 trillion. You may get a better understanding of what I was talking about in July of this year about a severe housing crash slashing $5 trillion in wealth. Dean Baker, co-director of the Center for Economic and Policy Research estimates that a housing slump may lead to $8 trillion in wealth lost because of the impact of a negative wealth effect and our reliance on debt as money. What seemed far fetched during a feverish housing market is starting to seem more realistic. If we were to divide the total public debt to each woman, man, and child in

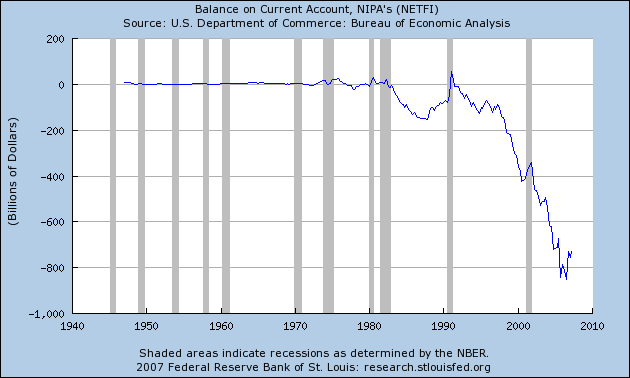

Importing Goods and Exporting Debt

Don’t be shocked by the chart above. Both Republicans and Democrats are guilty of running massive trade deficits. As you can see, during the Reagan 80s we started dabbling in the art of running serious trade deficits.

These are measured as TEUs or 20-foot equivalent units. Think of your common 18 wheeler and you’ll get an idea of the magnitude of goods coming into one of the single busiest ports of our nation. You’ll notice that for the past month, we brought in 323,131 while sending out 144,839. Once you realize how tilted the scale is you start to understand the extent of our growing trade deficits. Some have argued that this is the reason that the Fed is actually happy to see a declining dollar. The short-term spike would suggest that a falling dollar is doing something to our trade deficit but at the same time it is hitting you straight in your pockets. We have been exporting our dollars to foreign nations and they have been allowing not only Americans, but also Europeans and Australians to live beyond their means. No country can run deficits indefinitely. All these things are tied in the now global marketplace. Why do you think OPEC was jawboning about the drop in the dollar? Not sure if they can do much since they get paid a large portion in dollars so it benefits them to have a strong dollar but you understand that one winner equals another loser in a different part of the world. This has become a zero sum game because debt has become money. When the numbers are broken down we see that consumers are merely reflecting the lead of their nation; that is spending more than they earn. This unsustainable policy cannot go on forever and we will have tough decisions to make.

The U.S. Dollar Faces Major Challenges

As previously mentioned the US Dollar is facing a steady decline. It is now facing steep competition for the title of world’s reserve currency. As you can see from the chart above, the Euro had a tough few years starting out. The Euro is the currency of the Eurozone which includes 13 states. These include

“Greenspan says it doesn’t matter what currency he is paid in. “Key question, basically, is, in what currency do you wish to hold your assets,” he explains.â€And what I’ve done is I diversify.â€

I wonder if consumers paid with Euros during the holiday rush? Do you think consumer spending was influenced by a psychological urge to unload dollars that are becoming worth less and less each day? Hard to believe the amount of money “aka debt†being spent out there. Now we realize why globally, other countries are starting to worry. Many are starting to realize that something has to give in this global Ponzi credit scheme.

Dow Jones, Meet Negative Returns

The week starts off on an interesting note. Not because we saw another triple digit loss but because we are now technically in a correction. If you look at the above chart, the DOW is up only 2.25 percent for the year. Given that the US Dollar index has fallen from 85 to the current 75, and inflation is running around 3 percent (so says the ministry of truth), you are actually in negative territory. I heard someone talking about it that it “isn’t so bad with a 2.25 percent increase considering all the problems going on.” Well, it is much worse than that if you are paid in dollars (which I’m guessing most of you are) and the under reported inflation numbers make it seem like nothing is really going on. It is a two hit combo; first you’re currency is debased to make up for the massive deficits while the government skimps on inflation numbers to hold back on fixed payments. Take a look at the below oil chart:

Do you notice something? Given that energy is a large part of our consumption, it is hard to believe the data that is being dished out. And what of housing? Incredibly the government uses owners equivalent of rent to factor in housing prices. Well we all should know by now with the often quoted 70 percent of Americans own their home figure that we should examine mortgage payments as a true indicator of true cost of housing since the majority own. But of course these two things would show inflation running at a much higher rate so we don’t want to do that. Inflation is a silent tax. For some reason politically people are happier being told that no taxes will be raised while the green dollars in their wallet (if they still carry any) are slowly shrinking in purchasing power. No wonder why monetary policy isn’t taught in high schools. The public would understand the slight of hand the government is dishing out and they would demand restraint on spending. Given the spending binge this past weekend it is becoming more apparent that many Americans are using shopping as a sedative to facing the brutal facts. Like Social Security, the time is running out to right this ship before it is too late. Either way we will have some tough decisions ahead of us.

Where we are Going

Knowing a little bit of history can give you an idea of where we are heading. Human behavior has common patterns. With common patterns we can predict to a certain extent what will happen in the future. The complexities of the global market are large and I’m reminded of the adages that if a butterfly flaps its wings in

A good starting point is to look at the

Where the consumer goes so goes the economy. Our trading partners are watching just as closely because a slow down here means a larger slow down in their respective regions (and less dollars). It’ll be important to keep an eye on incoming cargo from various ports to monitor the flow of goods since this typically will react very quickly. We are already seeing a minor slow down but it is hard to say with us being in full holiday swing. We will have better numbers to work with in January and February of 2008. The above chart shows consumer sentiment. As you can see we are now reaching lows only seen in the last recession earlier in the decade. What is fascinating here is that employment numbers are still healthy, GDP is still humming along, and people are still spending. So why is this trending downward? It should be rather obvious that most previous downturns were led by falling industries. That is, the technology boom and bust (look at the 90s) led to increase in sentiment followed by a decrease with loss of jobs and sentiment. This bust will be led by credit which I believe gives the title “credit crunch†a new meaning. Even with the booming housing market consumer sentiment never reached the high that was reached in 2000.

Let us take a look at an ominous sign for predicting the future of housing. Housing starts are a very crucial leading indicator of the health of the future housing market. Home prices are lagging indicators, telling you how good it was; housing starts tell you how good or bad it is going to get:

Housing starts are now reaching lows not seen since the early 90s. A fascinating thing to note is that for each previous recession, housing starts trended downward and then increased as the economy improved. You’ll notice that housing never skipped a beat in the previous recession. We went from a technology bubble to a credit bubble driven in large part by the housing industry. The stops in the chart make sense because who is thinking of buying a house in a downward economy? But the rather unusual thing of our current economy is a large part of our decade long prosperity was based on trading, financing, decorating, and flipping homes. Take a look at the construction numbers and again pay careful attention to the gray areas:

Never in the history of this country has so much relied on housing and credit. Just to demonstrate this even further consumers to compensate for stagnant wages are using a larger portion of their income to pay for the servicing of debt:

You notice that over 30 years the chart hovered around 11 to 12 percent. We are now solidly over 14 percent. This may not be a big difference but considering that the consumer powers 70 percent of the economy, this small increase can mean the difference between a growing economy and one on the brink of a recession.

I hope that we can now realize that this housing fiasco is more than a “subprime†issue. If we define subprime as giving loans to borrowers that are high risk and have a high likelihood of defaulting, we need to look in the mirror and ask some hard questions to our leaders. Amazingly none of the leading candidates are talking about this. Some see nothing wrong with this. Most seem to stick to multiple issues on a superficial level while never addressing a comprehensive solution. As I think about it, maybe it isn’t politically wise to tell your prospective voters that they should reign in their spending and be more prudent with their finances. Clearly the majority of the public doesn’t want to concern themselves with all this financial mumbo jumbo. The only time they will open their eyes is when calamity is too close to change course. I am hopeful that as a society we will come out better because of this challenge. It may encourage people to take a more active role in managing their own finances and questioning authority. It will also show how globally we can rise and fall because of the common ties of economics. There isn’t anything wrong with being prudent and financially responsible. We are in an unsustainable course and our goal should be to find a sustainable long-term solution to the problem. If nothing is learned from this debt bubble, the greatest heist in American history will go unpunished.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

24 Responses to “The Greatest Heist of the Century: Stealing and Mortgaging the United States’ Future.”

Thnks nice article. Only said thing is that the great idea behind this is to control the people. To make them debt slaves. Look to what they do now, lower interest rates again. Slashing people again out of their savings into the slot machines called Dow Jones, NASDAQ, SP 500, Hang Seng etc etc. The final aim of the socialist who are running the show on earth presently is take all wealth away from the people who have money. This will be a game which is going to take another 30 to 50 years but finally they will reach their goal we will be born and we will have to take credit to start in live. Your parents will have to go to the bank after your birth and to take out a loan to grow you up, to pay your school to fund your university etc etc. Than when you go into the labor process you will have a big debt to serve and that will become bigger if you decided instead of renting a house to buy a house. In between there will be constant fiscal policy changes and central bank rate changes that will force you to put you’re saving into high risk investments in the stock markets. So when the stock market goes down profit goes to the banks. Off course you can buy shares from banks and benefit in the short term but in the long term you loose. Building capital will not be forbidden but it will be made impossible. The above counts especially for the USA, EU, UK, CAN, AUS, JAPAN, NEW ZEALAND but finally for the whole world. The Socialist took over and I warn everybody who think he can beat this, that you will not succeed, a few like for example a Mr. bill gates kind of guy will be able to succeed till he dies but in the long run his family money will in the same process be destroyed. My advices for a lot of people give up your job and put your hand up at the government to take some money from them and life easy and have less stress and plenty of time with your friends to play poker or look to beautiful woman or better make love with them and built your own loyal army, who can support you when your old. Other option become politician run for 4 years and get nicely paid till you retire. Even don’t have to idea to work at a bank, in the future the bank will be a complete computer program with digital employees.

PS re the loyal army it might also be helpful incase the socialistic ideas run aground and total angry takes over control.

It is clear that the debt has increased. What about the value of assets? Have assets increased in a similar fashion?

I love to read your blog because I always learn so much. Your arguments are cogent and logical. I find the current state of affairs truly disturbing and the cause of major angst. Unfortunately, I agree with your assessment that the majority of people have their head in the sand, are uneducated, (or un-educatable, different story!), or just plain blissfully unaware. Therefore they will be unable to change direction in order to avoid the inevitable.

Your article begs the question, what is the right course of action to take at this point? Obvious are, reduce or eliminate all debt as quickly as possible but what to do with cash and investments?

I read the article in moneymorning.com regarding the GE money market fund this am. I found their point about the fund being worth .96 on the $1.00 to be of concern. I believe that most investors think that a money market cash fund remains at par and never loses principal while the interest rate fluctuates. This information negates that belief and raises a whole new potential consumer crisis. The housing and credit crisis may be just the tip of the iceberg, as you suggest, and that should have all of us more concerned than we seem to be.

Perhaps ignorance truly is blissful, for in this case, education is disturbingly stressful!

I work in the port of Long Beach, Most of what we export is wastepaper for recycling, historically that has been 30-50% of export volume. The other commodity is baled raw cotton, very little manufactured goods.

Seriously, what is made here that the Chinese would want to buy?

If you were to check the export mix on the containers, I would bet that a very large portion, 30-50% is wastepaper for recycling. Another large portion is baled raw cotton.

What do we make that the Chinese want to buy?

@Christiane – technically GE’s fund is not a money market fund of the kind you can find at your local bank, however the disturbance is legitimate.

@TT – we export waste. Great. We import stuff that we turn into waste, evidently. We export dollars to China, essentially.

@Doc – another good article. The chorus and tides are rising and our little rowboat has a big hole in the bottom.

@taba – I’m not ready to give up on this experiment we call democratic capitalism quite yet. “Socialism” is just another name for dependency; the same can be said of oligarchy, plutocracy, fascism, authoriarianism, communism – name your “ism” and essentially you unveil a steady concentration of wealth and power in the hands of a few. The big difference today is communication flow all over the world, via this ‘interweb’ thingy. It’s not guns that will bring down the system and create something better in its place – it’s knowledge which leads to action. Who was it that said, “Freedom isn’t free”?

taba,

Do you even know what “Socialism” means? All the U.S. problems are caused by unregulated Capitalism, and a society build on an everyone-for-themselves attitude. Your government is controlled by transnational corporations, not Socialists. Bill Gates isn’t a hero to be worshipped. The idea that anyone can become rich if you work hard enough is a lie to control you and distract you from the truth. You have to have credit for everything because you have no social programs. The idea of avoiding the doctor because you don’t have enough money is absolute lunacy.

Fred (in Canada)

Thanks for the in depth explanation of this complex problem. I’m just an average Jane trying to figure out the hows and whys of what has brought this country to its present state, and your concise, understandable analysis filled in the blnks and provided the answers I was looking for.

I agree that CPI understates true inflation, but disagree that mortgage should be used instead of owner’s equivalent rent. House prices, as we all, know, are susceptible to speculative bubbles, while rents are not. Therefore the CPI would be susceptible to bubbles if it were to use mortgages. Rents are a stable, slowly evolving picture of the true economy and drown out speculative noise.

In the early 18th century, European nations faced a similar problem. China (!) was selling W. Europe vast amounts of porcelain, tea, etc. The English, French, etc had very little the Chinese wanted in return, so specie flowed out in droves. National currencies were devalued, banks failed and so on.

The English in particular finally solved their addition to Chinese wares by exporting opium from India (and not coincidentally developing the tea trade). Today, we have an even simpler solution (if in some respects no more moral): we simply supply the Chinese and others with worthless paper. Granted, it must be worth something to begin with, but our financial minders are making sure that those promissory notes are, indeed, simply “scraps of paper”. Look forward to payday. I have heard that the street price of heroin is as yet unaffected.

Question: Are these real or nominal (inflated) dollars? Your main points will still hold, I suspect, but it makes a difference.

Rational expectations

@ David: Debt has increased, and assets, for the most part, did increase in a similar fashion. The problem now, is that these assets are likely to fall in value, near where they were before, while debts will remain at highly elevated levels, and then say hello to bankruptcy.

Jimmy Carter installed solar water heaters on the White House roof, turned down the thermostat, wore a cardigan sweater, asked the American people to sacrifice and acted as though he actually cared about human rights. His reward was to be despised the American people as weak President. The Reagan came along with his bird-chirping morning-in-America crap and the adoring public was entranced, notwithstanding that he started the American economy on its current debt-driven death spiral with his “starve the beast” tax cuts.

Russian emigre Dmitry Orlov has sagely observed that the Soviet Empire gave it citizens a choice of one bitter pill, while the American Empire gives its citizens a choice of two placebos. I don’t have a lot of hope for a political solution to our debt crisis. Any measures our finger-in-the-wind politicians are willing to take will be about as effective as the Argentinian finance ministry’s Corralito. Unfortunately, the only likely” solution” to our debt problem (mine included) is economic collapse.

The FBI is now going after mortgage fraud operations. I’m curious to get your thoughts:

http://www.doctorhousingbubble.com/forum/viewtopic.php?p=309#309

This pertains to an article regarding San Diego County. Incredibly a small office did everything imaginable to defraud lenders and buyers for $80 million. Straw buyers, fake documents, cash back, and other shady tactics. It seems like the entire operation was run by fraud. The next question is how pervasive and how many others like this are out there?

Hey!…Man i love reading your blog, interesting posts ! it was a great Tuesday . Sasha Cohen

Dr:

Best article you’ve written. The survey of macroeconomic impacts is precisely on point. Unfortunately, as you noted in a politically polite manner, the American public is blissfully ignorant of their impending doom, and indeed uninterested. Do not count on the “masses” suddenly informing themselves, they are comfortably ensconced in front of their 60″ HDTV’s watching “Dancing with the Stars”. The impending calamity will quite painful, and leave America in a greatly weakened position. You should also discuss the impending pension funding crisis, the health care precipice we face, and the impacts of boomer retirements on the entire financial picture. Only then will some people fully begin to grasp the magnitude of change that is before us.

Manny in Miami

One thing that annoys me watching the MSM is all the hopes that the consumer will spend the economy clear of a recession. The correlation between record levels of consumer spending and record levels of consumer debt should not be lost on anyone. Expecting more spending means expecting more debt which, eventually, means a bigger crash. Let’s take the hit and move on. I’ll take deep recession now over a deeper one later.

Al (also in Canada)

Excellent thesis, the recognition that subprime housing is but a symptom of a much larger, albeit yet unrecognized, malady affecting the entire world wide economy. Will it ever be recognized?

The exact same malady, a general debt bubble was the actual cause of the ’29-’33 collapse, yet has been sucessfully sold to the public as a mere stock market crash by revisionist economic historians. Ask just about anybody these days, since most of the participatants have passed on and they’ll say “stock market crash”. Even at the time that got most of the press as that was where much of the debt collapsed and stock crashes are fast therefore attention getting, though there was also a real estate and general debt bubble as well. My dad was a 21 year old man in ’29 and I can tell you it wasn’t the stock market he feared, he even made a bit of money in that through the ’50s and ’60s; he was absolutely phobic about debt. I never saw him borrow a nickel for anything, paying cash for our house and cars even. He had seen the devastation of friends and family, few if any of whom were in the stock market, by the debt bubble collapse.

It is amazing how the Fed and its protectors have sucessfully obscured (and are obscuring?) where the fault lies for these orgies of excess debt/money creation and their inevitable devastating aftermaths. If sucessful in avoiding the blame once again, our decendents will be dealing with an even larger, potentially more devastating debt bubble than the one we are about to live through the end of, as the only thing they seem to learn from history is how to increase the bubble size and duration.

On an optistimistic note, maybe there’s hope this time because there’s the internet, the peoples information exchange, and with the continuing publication of articles such as this one, maybe enough general understanding can be generated that the bums can be thrown out finally.

Doctor,

I agree with you. “CPI” and “Core Inflation” are thinly disguised lies. Why then do you trust the GDP and Unemployment numbers? The government is a well established liar. 99% of what they say is lies. From everything I’ve read, GDP and Unemployment numbers are just as heavily manipulated as inflation numbers. They are works of fiction.

I’m a data freak as you can tell. Even looking at the port cargo information fascinates me. I appreciate the comments about what is shipped in the containers. Nothing clearer than shipping out raw materials and bringing mounds of manufactured goods to highlight the trade deficit. Even today, existing home sales came under projections and the market is rallying because of a hint of a rate cut and oil trenching back a bit. The Fed is the consumer’s pusher and any hint of a new more pure form of credit heroine makes the market salivate like a junkie. There isn’t any good news out there. In fact, this shows again how dependent we are on easy credit. If the Fed cuts, expect gold to rally further and the dollar to decline even more.

This game can’t go on much longer. As predicted, 2008 will break the market. Not sure if it will be at the end of Q1 or Q2, but it will correct heavily. The reason I have doubt is because of the massive corporate welfare that the government is capable of. Who knows what the Fed will do. Clearly they don’t care about the dollar. Even now, we get reports how tax payer money is aiding big mortgage giants like Countrywide to brave the current storm. That is our money going to one of the most mismanaged companies in the country. The debt will crush many of these lenders. Even the fact that Citi is all giddy about getting a $7.5 billion life line from oil rich investors is ridiculous. It is such a circular feeding frenzy. The money is like extending a line of credit to a gambler that is in the hole for millions and he is promising you that soon he will go hot and win it all back. At what point to you realize that this person needs rehab more than money?

Excellent article confirmed by charts. Re: exports, I read we export our old appliances to China and residences of small villages dismantel them for recycling and resale of useable material. I understand this effort is contributing to the pollution in the country. I guess this is the “PRODUCT CYCLE” economists discuss (made there and returned there)

My dad was a kid in the depression and he did fear stocks. He had kids quite late in life so I’m a generation Xer. I doubt my dad ever put a penny in stocks! Stocks were “gambling”, stocks were to be avoided etc. Afterall stocks had crashed to nearly nothing in 29 …..

In my view stocks were just the particular locus of bubbleconomics back in the 20’s. Nowdays stocks may be overvalued, but the ultimate locus of the bubble was housing, of course. People bought stocks on ridiculous margins in the 20’s. People bought houses with interest only and negative amortization loans a few years ago. Same old, same old.

My dad’s retired now, and him and my mom who is somewhat younger have most of their money in cash. OMG, they will never realize what they are doing to cash!! The Fed is turning dollar based safe havens into fricken tiolet paper and fast!!!

It doesn’t help to live too long as a member of the “greatest generation”. The leasons you learn in the first part of your life as a kid (stocks are gambling, cash and government bonds are safe) may well mean you eat cat food at the end of your life (when Ben dumps cash out of helicopters).

The thing that really scares me is that we are quickly reaching the point of no return. In that I mean that we are so quickly consuming our resources that soon we will reach a point that if we do not find alternate energy sources like nuclear fusion before the civilization collapses we may never get the chance again.

Here is my thinking

1) It takes a certain amount of hydrocarbons to allow civilization to develop from pre-industrialized to industrialized. Without oil our standard of living would be much worse.

2) Oil and coal are finite resources and we are quickly using them.

3) Populations tends to grow exponentially if not kept in check by some outside source (predation, disease, etc) until it collapses.

So if we use all the hydrocarbons up on this cycle by our massive overconsumption the next cycle will be hydrocarbon poor and not allow us to develop any further then we are now, and maybe not even get this far.

I know this is pretty doom and gloom, but no civilization in history has persisted forever. And almost all collapses of civilizations in the past can be tied to resource depletion in some fashion. I think we are living on borrowed time on the memory of past greatness. Much like Rome when the Barbarians came, our greatness is already gone, but we don’t want to admit it.

keep in mind, housing is the basis for the money supply

for China to grow at a 10% clip, the global money supply also had to, meaning, housing globally had to explode. since half the world doesn’t count, the only way this could be achieved is 1) ponzi debt schemes, ie, derivatives, basically extending the value of the underlying capital; 2) over value existing housing & 3) building like mad until there’s a Walmart on every corner and the typical American now inhabits twice the floor space of their parents.

the problem – 1) and 2) are going backward, meaning 3) won’t grow, meaning, no more 10% growth in China, meaning a hell of a lot more trouble than just subprime.

Whats the ratio of debt to asset like? That would be very interesting to know in light of this.

Leave a Reply to taba