The four corners of the non-California economic recovery – Underemployment at 23 percent, affordability signifies bubble in prices, $25 billion budget deficit, no market is healthy when active foreclosures out number MLS non-distress inventory.

We have two economic worlds developing in the US. In one, you have a stock market that is bouncing back with many companies, especially large banks reporting extraordinary profits thanks to cheap loans from the Fed. In the other world, you have millions of Americans who have exhausted unemployment benefits and 1 out of 7 Americans on food stamps. Here in California it is expected that 454,000 will lose their benefits by year end if nothing is acted upon. Congress is a mess and we have people wanting to dole out money while at the same time, saying they want to reduce the deficit. Mathematically something has to give but the crony protection is coming at the expense of the many. Here in California we are not part of the recovery (at least at the moment we are not). Even though things seem to be on a short mend nationwide, anything in the state is temporary. Let us examine a few reasons why California will have a tougher time recovering than the nation in the upcoming year.

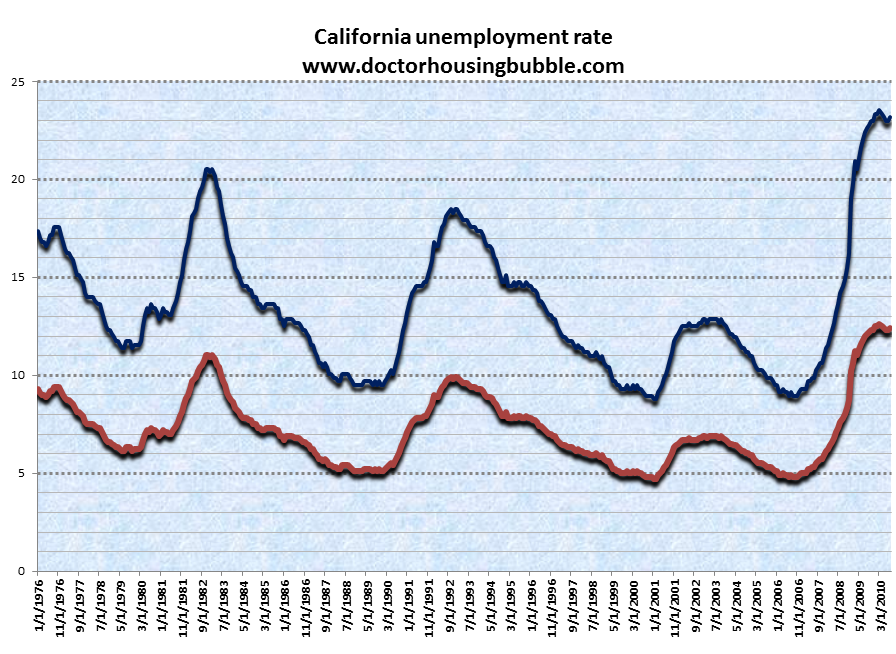

Reason #1 – Employment

The California unemployment rate still remains at 12.4 percent with recent October data released. This means the underemployment rate is up to 23 percent. No one is going to be buying houses when the economy is this bad. Jobs were added nationwide but California is still in a deep rut. Just look at the above chart and you can see how premature it is to call for a victory in the economy right now. On the contrary, it seems that the consumer shopping opiate has gotten people numb to the real numbers that are hitting in the market.

And remember how the Fed and all the political hacks were claiming that TARP was not going to cost us a cent? Well as it turns out, during the crisis the Fed lent out $9 trillion:

“(New York Times) At home, from March 2008 to May 2009, the Fed extended a cumulative total of nearly $9 trillion in short-term loans to 18 financial institutions under a credit program.

Previously, the Fed had only revealed that four financial firms had tapped the special lending program, and did not reveal their identities or the loan amounts.â€

Good timing on the Fed’s behalf to release this report while people are bamboozled by the holiday shopping season. $9-freaking-trillion-dollars of cheap loans. How much of this cheap loan money did you get to see? The economy must be doing fantastic if the Fed had to lend this amount of money plus QE1, QE2, etc. As they say, don’t believe the hype.

Reason #2 – The Budget

The California budget is one giant festering mess. But let us enjoy the holidays before diving into this pile of crap. As it turns out, we are starring at a $25 billion hole:

“(SacBee) The overall $25.4 billion deficit consists of two parts. It includes a $6.1 billion deficit through June 30 that exists because state leaders relied on rosy assumptions in their record-late October budget package, according to the nonpartisan Legislative Analyst’s Office. It also includes a $19.3 billion deficit in the next 2011-12 fiscal year.â€

Only two ways can solve this; cuts in programs (higher layoffs) or higher taxes. Either way, these are drags on the economy. The only “good†way to increase revenues is if people are earning money and filling up coffers. Do we see that happening? The unemployment rate would have to dip into the single digits rather quickly to get any noticeable changes for the state. I’m not sure how someone can look at a $25 billion gap and think things are healthy. California is still largely structured and reliant on a booming housing market.

Reason #3 – Housing

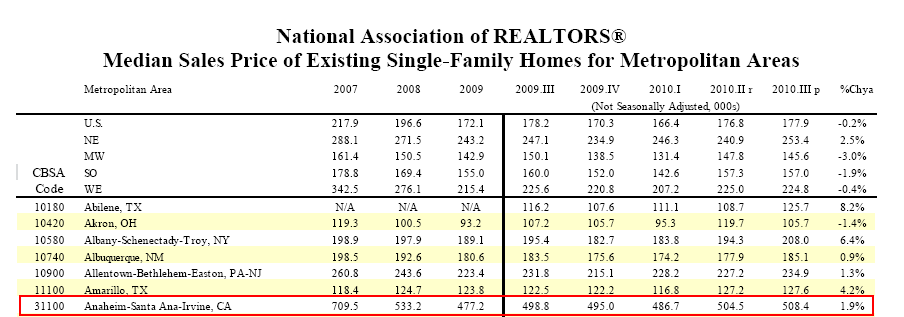

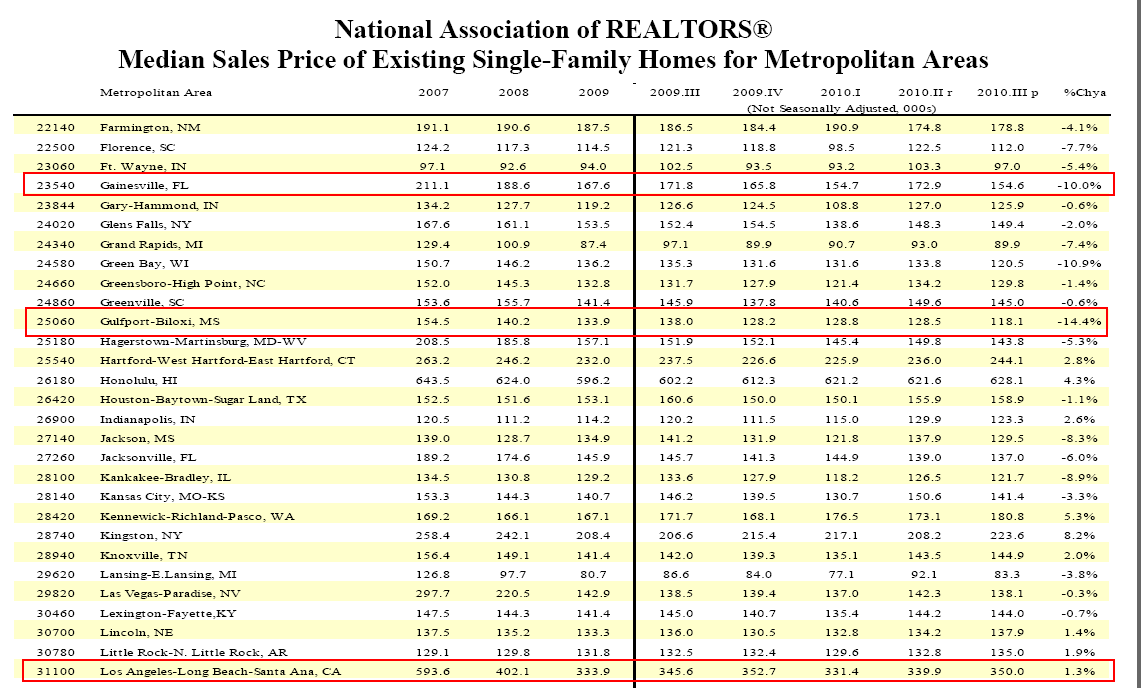

Many areas of California are still largely in massive housing bubbles. For example, Orange and Los Angeles Counties are home to most people in Southern California yet they are the most overpriced. Even after the severe correction, prices do not make sense. At one point in 2007 according to the NAR the median OC home price was $700,000! Insanity! So at $508,000 it must seem like a bargain but it isn’t. Los Angeles is also in a bubble:

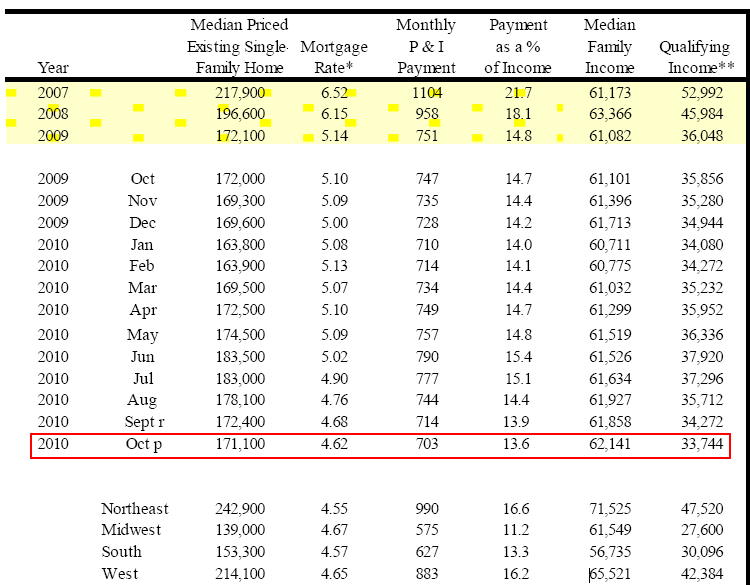

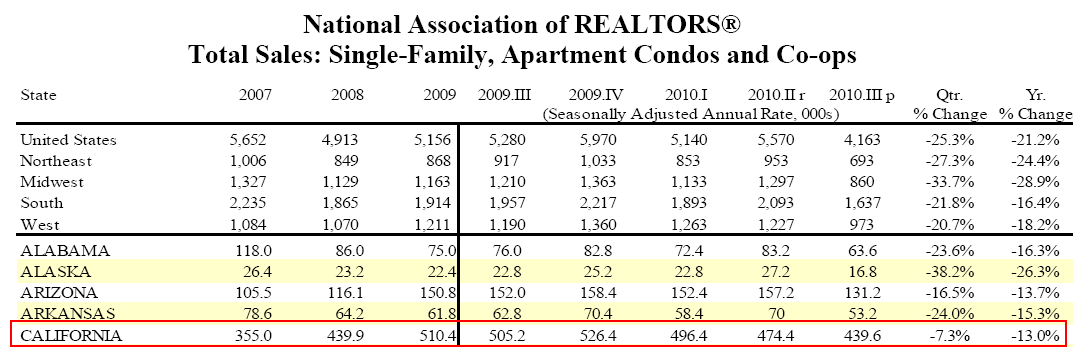

Los Angeles is down to $350,000 from the near $600,000 peak. Keep in mind the NAR factors out condos so prices look much more inflated versus other measures. Is this a good price? Yes if we had a large portion of the population making six-figures and had a healthy unemployment rate (i.e., 5 percent or lower). We are anything but that. Right now you have this cheerleading about pending home sales going up but this is largely driven by areas outside the state. Why? With absurdly low interest rates and weak markets, prices have gotten cheaper for many states:

Source:Â NAR

California isn’t one of those places. That is why we see home sales tanking in the state:

Things have sped up recently as well. In the last two months the sales rate for Southern California has imploded. What this means is lower prices for 2011. Two worlds and California is still largely in a recession by most sensible measures.

Reason #4 – Backlog of homes

And let us not forget the large shadow inventory in the state:

Non-distressed MLS homes for sale:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 166,000

Distressed active properties (non-MLS):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 291,000

You will always have a certain amount of distressed properties on the market. I was looking back at foreclosures and notice of defaults in healthier times and it was always the case that active MLS listings were 3 to 4 times the size of the distressed inventory. Having the distressed inventory larger than the active MLS is completely uncharacteristic. We can’t even talk about things being “healthy†until the active MLS data is higher than the non-MLS foreclosure pipeline.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

65 Responses to “The four corners of the non-California economic recovery – Underemployment at 23 percent, affordability signifies bubble in prices, $25 billion budget deficit, no market is healthy when active foreclosures out number MLS non-distress inventory.”

Regarding this line: “Only two ways can solve this; cuts in programs (higher layoffs) or higher taxes. Either way, these are drags on the economy.”

I’m not so sure I can agree with that sentiment. While i understand that the assertion is that the layoffs would lead to higher unemployment (which certainly is bad) it must be remembered that they would be government layoffs. The capital securing those jobs could be allocated to a more productive endeavors, likely with a higher multiplier for economic growth. Even if it’s only a few percent, I would gladly eliminate, oh say 95 government jobs if it meant opening up 100 private sector jobs.

And just to head off the inevitable “but those hundred jobs would have to make do with the pay of the 95 lost jobs”: Yes, and it would be good for everyone. Comparing public wages to private wages, you’ll find that government jobs usually make 10-25% more for similar job duties. Being that majority of workers are privately employed, this would help in the long term to bring the cost of living down to a more functional level.

Public workers paid more than private workers? Sorry, you have that one backwards:

http://economy.ocregister.com/2010/10/19/study-calif-s-public-workers-not-overpaid/42882/

There’s no way the private sector would be able to backfill public sector job losses on a 1-to-1 basis right now, simply because the public sector is funded by debt! That is, California is running deep in the red. It can really only afford a fraction of its employees to stay in the black. Small businesses, which do much of the hiring, can’t run millions or billions in the whole, so they would not be able to hire a similar number of employees.

Public job losses at this point would barely be recouped in the private sector, if at all.

Finally, the private sector being “more productive” than the public sector is a myth that has repeatedly been shown to be factually incorrect based on decades of economic data. Don’t believe it.

Permabear-you are full of misinformation. You remind me of this quote:

“The problem with liberals isn’t that they don’t know anything, it is just that they know so much that isn’t true.”

The govt is such a large portion of the ecomony that any pull back will be a huge hit to the economy. But, because it’s got a such a huge debt level, it must be reduced. Catch 22.

This will not end well. The govt is that last bubble and it’s getting ready to burst.

I’ve doubt very much that a private school teacher in the K-12 sector has a comp package even close to a public school teachers’. Most govt jobs would not even exists in the private sector. We’re in for a world of hurt on this one.

Put this in your pipe and smoke it. Add in benefits (especially ludicrous pensions) and it’s not even close.

http://www.usatoday.com/news/nation/2010-03-04-federal-pay_N.htm

Joe Average:

Permabear cited a source for his information on wages. you simply called him a liberal and wrong. Your argument is a non argument. You need to cite facts to get the attention of your audience. Until you provide factual information I and most sensible people will lean towards the scenario presented by permabear. Personally I would love for your to present something solid for me to believe what you say but if I do that on what you presented I am ripe for Barnum.

wydeeded- You are right. My post was a bit callous. In addition to the excellent link provided by wheresthebeef, here are a few more for you to peruse when you have the time:

http://www.cato.org/pubs/tbb/tbb-59.pdf

http://online.wsj.com/article/SB10001424052748704281204575003101210295246.html

http://www.forbes.com/forbes/2009/0216/078.html

http://reason.org/news/show/public-sector-private-sector-salary

http://mjperry.blogspot.com/2010/03/two-americas-public-vs-private-sector.html

http://www.usatoday.com/money/workplace/2009-04-09-compensation_N.htm

All the best on your journey, I went through it many years ago.

I can’t consider that study. First, it comes from Cal Berkeley. The source is dubious to begin with. But when they outright state that “The study, by Cal’s Institute for Research on Labor and Employment, did not compare specific jobs” on the justification is that there are no equivalent jobs between private and public entities, I hear bells, whistles, and alarms going off in the back of my head warning me that my BS detector is not just tripping but actually smoldering and nearly bursting into flames.

go here: http://contact.lacity.org/controller/lacityp_011220.pdf

Look up recognizable job titles. You’ll find things like Janitor, Clerk Typist, Engineers, Managers, and so on with reported salaries approximately 30-50% higher than equivalent positions reported as national medians in Census data. On top of this, they receive benefits packages well in excess of what is available in the private sector. For instance, they’re all eligible for state assisted pension programs. I, on my private salary, am forced to select two from the list of house, car, and retirement. I can’t afford to pay for all three at the same time. If you aren’t outraged at the fact that, oh say, a window washer at LAX pulls a $54,000 annual salary, then I don’t know what to tell you.

Regarding productivity, I am not talking about the industriousness of individual employees. That is more or less meaningless. I do believe that the difficulty of terminating government workers does lead to a lackadaisical attitude toward completing work but that is not what I mean when I say private jobs are more productive that public jobs. What I mean is that the funding for private jobs is basically investment capital. It is expected that private employees perform profitable tasks. Private jobs generally add create value. The easiest example of this would be simple manufacturing. Take raw materials and assemble them into a product that has an inherent value greater than the sum of its parts. That process does not exist with most public employees. While there are exceptions (private insurance workers don’t create much value and public construction workers probably do) the general trends are such that you are more likely to have economic growth when the efforts of labor are assigned through markets rather than by fiat. The inherent darwinistic nature of free markets encourages maximum efficiency.

What it comes down to is that every dollar spent by the government is a dollar taken out of the pockets of those who have somehow generated value. This value, then, is subtracted from the economy. Take for example, the high speed rail line that is being produced now. The market did not produce such a system. The government now is. The first 54 miles of track will cost approximately $4,300,000,000. that’s billion with a B. By the time this albatross is done, it will have cost taxpayer 40-50 BILLION dollars. That’s about $1300-1500 per California citizen. It comes out to about $4000-5000 per taxpayer. Without even considering the overwhelmingly probability that the line will never operate at a profit, what would have happened if that same 4000-5000 were to get applied to purchasing goods or invested in endeavors that might actually succeed in a free market? Economic growth. Growth that is now stunted by the value being subtracted from the economy by the inherently less product nature of public labor.

Yeah, sorry PermaBear but you got it wrong. In 2005 I was made privy to the inner workings of Cal Pers, the state pension fund. So much money is dragged into this program for employees who retire between the ages of 50 and 55 with 80% of their income and full benefits paid to them, that there is no way a regular employee making 10% less in pay and 60% less in benefits would not be more productive than the state employee, dollar per dollar.

Public sector employees not only enjoy a 15%+ salary premium over the private sector, they have a benefits and retirement package that is virtually non-existant in the private sector.

I’ve never understood the argument that the public sector isn’t paid as well as the private sector. There’s NO comparison. I know people with public sector jobs. They make more money to start, have more opportunities to move up in the organization and get raises simply by taking tests (not pleasing the boss), have more benefits than I’ve ever gotten in any job (even discounts to Disneyland!), get every holiday, vacation day, and sick day possible, do not have the pressure to meet deadlines and turn a profit, have a union to negotiate their pay and benefits, don’t get laid off or fired past a certain tenure, and somehow manage to do all this while being total slackers. It’s damn good work if you can get it!

Perma, First you say “Small businesses, which do much of the hiring, can’t run millions or billions in the whole, so they would not be able to hire a similar number of employees” from this I gather you are saying small business are more productive because they do not run their business on debt, I agree, you must be productive to run a business to make a profit.

Then you say this next “Finally, the private sector being “more productive†than the public sector is a myth that has repeatedly been shown to be factually incorrect based on decades of economic data. Don’t believe it”

If the government runs on debt and the private sector has to turn a profit, then it is more productive, you are really not making sense.

One small data point on public vs. private. I work in the private sector, my wife in the public. We have similar levels of education / advanced degrees. My salary is about 30% higher than hers, but her pension benefits substantially exceed mine (After 30 years I’d get about 20% of my annual salary at age 55; at the same time/age she’d get over 80%). Sadly, even given the disparity, my pension is probably generous compared to the average private sector benefit while hers is relatively weak compared to those of many other state employees.

I have many friends in various professional positions in both private and public sectors in California and my impression is that the wider world reflects the microcosm of my wife and me: The private sector does pay a bit more in straight salary, but pension benefits in the public sector more than make up the difference.

Permabear: Please read your own source, not the headline. In terms of population %, most employees private or public are not college educated! Therefore, by this author’s own statistics, most public employees earn more than their private counter part. Unless you believe everyone working for government has a college degree?

Much good info in this thread (outside of the stupid liberal jabs, nevermind the fact I’m not a liberal).

There are two things I want to point out, though. First, many of those comparisons are for FEDERAL (not State) jobs – and we were talking about the CA budget. They are different.

Second, “If you aren’t outraged at the fact that, oh say, a window washer at LAX pulls a $54,000 annual salary, then I don’t know what to tell you.” I absolutely AM outraged – but not at the government. $54,000 is a living wage. What I’m outraged at is that the CEO’s of major corporations have managed to break labor so oppressively, that they now make hundreds of times what rank-and-file workers make. This now FORCES most families to have two wage earners just to make ends meet.

The public-vs-private debate is great. But “the government” is only part of the problem. The bigger problem is that private corporations are exploiting workers – providing increasingly poor wages, benefits, and retirement packages. Real wages flat for decades while CEO pay skyrockets? THAT is the problem.

You are a liberal; you just don’t like the label. How many CEO’s are there? Not enough to be concerned about. I’m more concerned about overpaid workers such as the window washers, because there are far more of them out there.

Definitely an interesting thread, and I want to thank you for maintaining a civil discussion. I believe we can agree that the underlying problem is the fact that the current cost of living is out of line with wages. There is a subtle but very interesting difference in how we have proposed dealing with it. It would seem that you have suggested that wages need to rise to meet present costs while I’m suggesting taking steps to cool prices such that they might come into line with wages.

My name is _______ and I am responsible. That is the position of a CEO. Try be one and you will stop whining.

Sorry. Should read. Be one and you will stop whining.

It is an assumption to believe reallocating capital from cutting government jobs results in creating private sector jobs. However, let’s look at the risk involved in your assumption. You begin with 95 people with jobs and 100 people without jobs. If the assumption is correct, you wind up with 100 people with jobs and 95 people without jobs. If the assumption is incorrect, you wind up with 195 people without jobs. If you were gambling $95 to get $100 while you were $100 in the hole, I’d call you a fool unless you could all but guarantee the outcome. I did notice you used a condtional sentence when stating you’d cut the 95 government jobs IF 100 private sector jobs were created so we can assume you are not a fool. So let me say this, I’d cut 95 jobs from the government if I could get a guarantee of 100 jobs from the private sector. I’d also cut 95 jobs from the private sector to get a guarantee of 100 jobs from the government sector. So what? Unless your an idealistic teenager with no sense of real life experience, you know there is no such guarantee.

One side note on government vs. private wages for the same job. You are wrong. In CA, all state government-union contracts and wage information is a matter of public record. A simple web search for those contracts will show you the wages for a state employee and looking on monster.com (or any other job hiring website) will give you the current offering wage for the same or similar job in the private sector. I’ll help you with an example. With the State, an associate information analyst starts out at roughly $60,000 a year. (Note: usually you start out as an assistant information analyst making even less, but let’s keep apples to apples.) Private sector classifieds advertise similar positions with a salary range of $80,000 to $90,000 a year with a competative package.

Now, what you may be wanting to say is that the “cost” of an employee is higher with the State than the “cost” of the same type of employee with the private sector. That’s a little different than “wages.” While there is some poorly done research as to the cost of a state employee. I have not found even poor research on the “cost” of a private sector employee to even attempt a comparison. For example, the associate information analyst. You would have to compare: medical plans, retirement plans, bonuses (generally speaking public sector employees do not get bonuses), workers compensation insurance requirements (public sectors are often self insured), etc. Needless to say, if you truely meant wage comparison, you are verifiably incorrect.

I appreciate he irony in the homonymnal error in the (quite wrong) presumption about my age and life experiences. In point of fact, I am 30, college educated, and climbed to management level employment in under three years after finishing my degree, and have played a pretty key role in making sure that my particular sector of our business has continued to grow while the the economy (and our customer base) has been in recession. Attack the argument, not the man making it.

We can talk hypotheticals all day long and it’ll never get us anywhere. I only used the numbers an illustration of the concept. I have absolute faith that free markets will more efficiently allocate resources than a government ever can. I am willing to stake the entirety of my prosperity on that principle. I provided a link to the compendium of the city of LA’s public wage records. Look through it. It shows a clerk typist staring at about $20/hour. That’s rarely worth more than $12-15/hour in the private sector. Look for any kind of janitorial or custodial position. In the real world, you won’t find people making much more than minimum wage unless they own their own business and offer it as a service for multiple clients. But according Los Angeles, it’s worth $40,000-$60,000 per year. Structural and civil engineers are listed generally at the $100,000 level. In the private sector, you’ll be hard pressed to find anything over $80,000 unless you want to get an MBA and/or climb the ladder for a few decades.

Regarding the analyst position, glassdoor.com tells me a junior level position should pay around $48-54K and that a senior level position pays on average $110-125K. Los Angeles shows various types of analysts a the I and II level between 60 and 100K and senior level analysts between 80 and 150K. Unforunately, I don’t have the tools available a the moment that I would need to dissect that data further. It would be very interesting to break down their reported wages into mean, median, and mode. The impression I’m getting scrolling through he list (and I’m usually pretty accurate in these things) is that the medians would be around 80 for jr’s and 120 for sr’s. That’s definitely higher than wha I see through my available resources for private wage data.

On a personal front, back in 2006, I applied for a position with the LA DWP. It was an entry level chemist position. My title was Associate Chemist at my then-employer. I didn’t get the DWP position. I am now two levels higher than my title then, and I’m making about 25% more than I was then. The DWP position back then would have given me 40% more than I was making then. The same no-experience required DWP position now, taking into account 5 years worth of 6% raises, would be worth 50% more than I am making *now* with my present management title. It just doesn’t make sense.

All that aside, even if the wages were equal between public and private, there is one little seven letter word that would push the overall compensation package of public employees well in excess of private: pension. My retirement fund contains approximately $90 I was required to submit when I worked for the university I attended. Any further retirement funds come directly out of my paycheck. If I were to save enough to have $1,000,000 available to me in another 40 years, I will have to put aside approximately 4 times as much money as the contributions necessary from, for instance, a teacher paying into calsters for the same level of benefits.

It just doesn’t add up. The more I look at the real numbers, the less it makes sense.

“I’m not so sure I can agree with that sentiment. While i understand that the assertion is that the layoffs would lead to higher unemployment (which certainly is bad) it must be remembered that they would be government layoffs. The capital securing those jobs could be allocated to a more productive endeavors, likely with a higher multiplier for economic growth. Even if it’s only a few percent, I would gladly eliminate, oh say 95 government jobs if it meant opening up 100 private sector jobs.”

You might have an argument if what you say was what is happening but what is happening is quite different.

The government is laying off because the money is not there, plain and simple.

What you imply is it would be better for the government to cut taxes and fire the public employees that revenue paid for and the private sector would spend it more efficiently.

I certainly won’t argue against that point but I will argue that the government is cutting public employees not due to tax cuts but due to loss of revenue. In other words the up coming public employee cuts will not leave one dime for the private sector to spend more efficiently.

Your premise may be sound but your logic is in question.

Doctor – I have been saying this for a long time. Real estate, espeicallly in places like California, is a ticking time bomb. A DISASTER WAITING TO HAPPEN.

You recently showed a house in Southern California for $2.7 million, and in another article (your last one) two shacks which are an insult to anyone with a brain. Those two shacks are pieces of crap! The sad fact is that California’s housing market is EXTREMELY OVERPRICED. The government and the banks caused this disaster, and the government and the banks are working to prevent housing from returning to its fair market value.

In my opinion, investing in the California real estate market at the current time is PLAYING WITH FIRE.

DangerMike

You make the assumption that capital has secured those government jobs. You don’t touch capital until all of the borrowed money is no longer borrowed. You would have to close the Dept. of Defense and 100% of the other federal employees and we still are borrowing “Treasuries” to fund the gap between what we take in taxes and spend.

” I was looking back at foreclosures and notice of defaults in healthier times and it was always the case that active MLS listings were 3 to 4 times the size of the distressed inventory. Having the distressed inventory larger than the active MLS is completely uncharacteristic ” That’s what I said to my husband, it’s wierd. If you look at where we want to buy a house, Goleta, CA. There are way more foreclosures then normal MLS lisitings, that means it’s not a good time to buy, because most of the foreclosures in that small area are the ones you want to buy, those are the good ones. The ones that are on the MLS are pieces of crap and are way overpriced. Same thing is occuring in Thousand Oaks. Thanks for agreeing with me. 🙂

A couple years ago I was looking to buy a small farm/ranch in the SB area , we looked at an avocado farm in Goleta , right up the hill , when we went round to view the property it was actually on fire ! The whole thing was going up in smoke actually there and then while we viewed the property !!! needless to say we passed that one up, sounds a bit like your current experience !

The reason that the foreclosures on the MLS are the shitty ones is because the banks have to dump those first. Plenty of knifecatchers are buying them too. That is a good thing.

If they put the good homes on the market, they would be in direct competition with the shitty homes and therefore the shitty homes would NEVER sell.

I’ve noticed that in Hancock Park (south of Hollywood) that 80% of the shortsales and foreclosures have been on Highland Ave. (a major arterial).

I have a tough time believing that all the HELOCers and OptionARMers were only on the busy streets.

I must confess that every morning when I wake up I turn on CNBC to see what the stock market is doing. And I find myself feeling slightly down when they’re having a good day, and feeling good when they’re having a bad day. For some reason I want to see the market go down, because I stubbornly think that if it goes down enough, maybe someone will do something to fix the economy, But Wall Street has managed to successfully decouple themselves from the rest of us, and so it pisses me off that insiders are making big money AND THEY AREN’T EVEN WORKING FOR IT! I just don’t call what they’re doing, work. I call it gambling. And to be perfectly honest, I guess I’m jealous that I’m not one of them.

Finally a valid use for the word ‘Decoupling’: Wall Street has completely decoupled form Mainstreet.

Reading Jared Diamond’s ‘Collapse’ it is obvious that the powerful always enslave and exploit the weak. It has been this way all throughout history. Why expect something different today? Has human nature changed?

Strangely, there are 1000 bubbles collapsing at once, but the Dow goes up 100, so everything must be OK. Housing ticks up by some distorted measure. Gold 1400/oz. Petro pushing 90/bbl. Even with all the shenanigans UE ticked up to 9.8 US. B of L shows employment as well as UE. There were more people working after the 2000 crash and 9/11 than now.

And somehow the major banks correctly predict the mark every single day. That’s comforting.

There’s not really a private sector anymore, so that major thread was moot. All business tinkles down from government contracts, workers and pensions anymore. Close down a military base and see how much private sector money an area generates, not counting residual government contacts-cleanup and so forth.

Who’s buying houses right now? If you wish in one hand…

That incredible first graph says it all. IT’S THE JOBS/ECONOMY, STUPID!

I read your blog and I feel hopeful that my husband and I will be able to buy a house in LA one day. It is a sad state of affairs when a school teacher (me) and a dentist (the hubby) can’t afford a three bedroom house in a decent neighborhood. I mean a small (1,400 sqft house).

I am feeling really discouraged today because, yet again, a seller would not even consider the offer we made on his house. We offered $600,000 and it is listed for $800,000. This house really needs a lot of work. I actually think our offer is totally decent. Apparently some sucker even offered the seller $700,00 and he turned that offer down too. This house has been vacant for over 6 months. What is wrong with these sellers???? This has happened to us multiple times.

Move… you are living in a bubble when you are looking at paying $400/sq ft for a house that needs work. That’s crazy. No normal residence should cost much more than $100 sq ft + property value. Up here in the Sierras It’s a little less than $25000 for a 2400 sq ft on 1/5 acre, city gas/water, electric/sewer MUD. My equivalent 1200 sq/ft goes for about $180000.

They do not sell because their ally is the U.S. Government. And a powerful ally it is. Strong is their desire to prop up the housing market. Their drug is reelection, their enemy the free market. Bailouts? Hm? Size matters not.

Fear is the path to the dark side…

lolol! I have to say that the comments on here have gotten much funnier lately. I guess that’s all we can do at this point…laugh.

We are in the same situation, Wishful, but I will NOT have our family work only for a house that we need to fix up. I don’t know about your specific situation, but is $600,000 more than three times your combined annual salary? If it is, than you will be paying for a house and its repair, with little money left over for anything else.

We just sold our small condo and escrow is just about to close. When that money from the proceeds comes in, we will be placing it in a savings account, renting a larger place in a great neighborhood for less than our current total mortgage/taxes/hoa (we already found the house, yay). We will be waiting to buy, maybe years, because it makes no financial sense to spend all of your money on a mortgage payment. If one thing goes wrong and your pay decreases, you will lose your house.

Hi Wishful,

I feel your pain. Two school teachers in this household. Excellent credit. No debt aside from small college loans. Still, we can rent a beautiful house in a great neighborhood in Glendale for about 60% of what it would cost us on a monthly basis to buy. Until the prices come down substantially, we’ll be renters. Frankly, it was nice last month when the plumbing backed up that it wasn’t my problem. We’re waiting for a 3 bdrm/2 bath for around $500k in a good school district. We’ll keep waiting until it exists.

Join the club. Been waiting to buy in West LA for the past few years. I hate waiting. The bubble has basically robbed me 3-4 years of living a nice cozy HOME. Instead, i’m renting in an APT w/ community laundry that’s a mile away, cuz i’m not willing to fork out $2k/month rent to have laundry in my own unit. And no, i’m not willing to pay less and live in playa del rey w/ LAX in my backyard. I dont think that’s asking too much. Can’t buy when I see asking price of $699k in and near Santa Monica for a freakin teardown SFR. And the sellers have comparables because you have idiots willing to pay that price. It’s like you have a parking lot of 100 Hyundai’s, but only 5 are for sale for $40k ea. Under this environment, some buyers will get desperate, cave, buy, and screw it up for the rest of us, cuz they pull in over $300k/year or mommy/daddy helped out for down payment. They don’t care about volume of sales, only comparables.

Many of you fence sitters are probably masters of redfin already, but recently i found this website that i find very useful. Some properties on redfin do not show sale history, but you can look them up here: http://maps.assessor.lacounty.gov/mapping/viewer.asp. It’s shows value in public county records, but do your own research of what that means (e.g. public records may not include upgrades, etc.)

Good luck.

Oh, my goodness.

.

You read this blog, you offer to pay $600K for a shitbox, and you call someone else a sucker for paying $700k.

.

You have no idea what is coming to this state.

I just bought a house just south of Hancock Park, good area. I got it for 620K. 20K above asking once they had reduced it 60 below their original asking price. So I guess you could also say that I got it 40 below asking. Once they reduced the price, they were immediately received 3 bids in a day. This had been a flipped property. A construction company bought the property, came in and renovated it; once we moved in, we discovered they made it look nice, but there was very little oversight on the project; tiles were laid poorly, giant holes left in the cabinetry (where an inspector would never look), many things that were installed haphazardly. Ultimately, the construction company that did the work is going to redo everything– they are licensed and therefore liable– but had they not taken responsibility for all of their stuff, it would have cost us over 10K to fix what they did poorly. At the end of the day is illustrates a few points: 1) The construction company’s who have waited out the apparent and not quite true bubble burst are some of the few people who have the capital to invest in such projects, and secondly, the market is being propped up by people like us: people who desperately need more space, recognize that renting the equivalent home would be only a four hundred dollars less per month and welcome some tax write offs. My one justification is that even if the market goes down 10%, once the interest rate rises a 1% or more, we would still have a lower mortgage payment.

Lucerne south of Olympic isn’t a good neighborhood.

Hey Wishful – Count Your Blessings! $600,000 offer on a piece of crap that “needs a lot of work?” Foul! BS! No Way, Jose! Be thankful the loser (owner) turned you down! You are right – there is definetly something “wrong with these sellers.” THEY HAVE A HORRIBLE DISEASE CALLED GREED.

This nightmare will end soon enough. You will be happy you were turned down. Within a few years, the same house will be LUCKY to sell for $250,000. Mark my words!

A $278000 foreclosure across the street from me me went up for auction by williams auctions for $25000 minimum bid. The house is a good house. They yanked the offering after the auction date. I think the auction business is phoney too. The doctor needs to check out this kind of crap too.

Things are only worth what people are willing to pay for them. It’s called the market clearing price. This slow drip of leaking houses out on the market is delaying recovery. Dump everything out there…sell it for fifty bucks. Geta restart going sheesh.

The only real auction is at the courthouse, that is where the wholesale price for a house is set.

Possibly, but I recall reading about banks taking houses back when no bids are made on the court house steps and having to sell if for less months afterwords. Would that not mean in some cases the court house steps are above the wholesale price? Certainly with opening bids set by bubble price mortgages house do arrive on the steps above wholesale.

Resale homes are in a way akin to used cars in a down market. Cars of course are always depreciating assets (set aside classics like Shelby Cobras). Houses by comparison are depreciating in value as they attempt to correct to fundamentals. Buyer beware.

Fed ID’s companies that used crisis aid programs

New documents show that the most loan and other aid for U.S. institutions over time went to Citigroup ($2.2 trillion), followed by Merrill Lynch ($2.1 trillion), Morgan Stanley ($2 trillion), Bear Stearns ($960 billion), Bank of America ($887 billion), Goldman Sachs ($615 billion), JPMorgan Chase ($178 billion) and Wells Fargo ($154 billion).

—

The documents help illustrate the global scope of the crisis. The Federal Reserve provided credit lines to some of the largest central banks overseas:

The European Central Bank took $8 trillion in temporary credit lines, while the Bank of England took $918 billion. That credit ensured that overseas markets wouldn’t freeze for a lack of U.S. dollars, the global reserve currency.

General Electric borrowed more than $16 billion, Harley-Davidson Inc. borrowed $2.3 billion and a group of independent Caterpillar Inc. dealers borrowed $733 million.

Two other recipients were the California State Teachers Retirement System and the City of Bristol (Conn.) General City Retirement Fund.

It looks like the best bet is you’re trying to buy a house in a specific area is to just go by and drop a postcard in the mailboxes asking if they’d like to sell. That’s what I plan to do when I go out to buy in 2012,

Permabear,

With all due respect, you claim to not be a liberal but your statements certainly make you sound like one. It’s not about breaking up labor or oppression. It’s about reality, i.e. survival. Yes, $54,000 may be a livable wage, but the value produced by the employee in exchange must be commensurate with that wage amount. And I’m sorry, but what is required to perform that function from a skill, education and talent standpoint is simply not worth $54,000 per year.

The corporate CEO that you villify, while indeed making much more than rank and file employees, is responsible for turning a profit, otherwise his company would be unable to compete in the marketplace. The private sector, unlike the government, must aggressively eliminate wasteful spending in order to succeed. They don’t have the luxury of paying economically unsound “livable” salaries or anything else, regardless of how noble the sentiment may be. If the government operated by the same principles i.e. if it had to compete to stay afloat instead of being free to succumb to pressure from the unions and to foster a culture of apathy and mediocrity from its employees, this country would be much more fiscally sound.

I know that some will reply by saying that big corporations are making billions, with CEOs making millions while rank and file employees can barely make ends meet, and therefore the survival argument is not valid yadda yadda yadda. Yes, executive compensation is a valid argument (especially as it relates to the financial sector), but don’t forget that a CEO’s job is to maximize profits for the shareholders. And speaking of employee value, obviously their talents, skills, education and mindset make them more valuable than the window washer, or the accountants and lawyers on staff.

Lastly, families are not “forced” to have two wage earners to make ends meet. We all make choices in life, and sometimes those choices put some people in a position where they are “forced” to do things they may not like – BUT no one has a gun to their heads. Not in America…not yet at least.

Warpspeed,

I hope you truly read and consider this post.

First off, your dismissal of me as “a liberal” is what undermines independent politics. Anytime I post siding with the middle class, I’m “a liberal”, and anytime I side with conservative ideals such as limitation of government I’m “a republithug”.

Sad.

You defend CEO’s, which means you aren’t one. Let me tell you about myself. I have built two businesses from the ground up. In both, I had the opportunity to pay people about 20% less and, in turn, become extraordinarily wealthy (at their expense). I declined. Still, currently I get paid about 50% more than my highest-paid employee, and that still seems a pretty fair premium to me. I’m still very well-off. As Jay Leno said, “How much cake can you eat?”

Today, there are numerous examples of CEO’s making 300, 500, 2000% more than their average employee. It’s absurd. Banker pay is egregiously abusive, and that’s a compliment. They have paid themselves bonuses directly from lifeline taxpayer funds, which should make everyone incredibly angry. It would in Europe.

Finally, you seem to assume that CEO’s have some amazing talent at making businesses succeed. That’s a myth that has been studied repeatedly by both economics and cognitive science. There are so many things involved that are out of your control, that the word “luck” doesn’t quite do it justice.

I wouldn’t be so quite to defend CEO’s. Because they, by and large, are not defending you.

I prefer libtard and rethuglikkkan.

Corporate kiss ass extraordinaire. Yeah laying off people and cooking the books for the short term is a skill. And getting an expensive degree to work as a lawyer for the state isn’t worth 54,000 a year. Your comments are so insane if I knew your real name I’d call the asylum to come take you away.

Yes, warp is so right!

The value produced by working people is nowhere near the value produced by speculators, managers, and profiteers!

How do we know this?

Because the latter make more money! Quod erat demonstrandum.

What do people with modest living wages do? Why they just work, save, live responsibly, volunteer, raise kids, shop, vote, and so on. That has no value. The only things that have value are the things turned into spreadsheets by accountants and puffed by PR departments!

Who needs window washers anyway? Hand out squeegees and Windex to ghetto kids, and let ’em scam LAX-goers for clean windows! Then we can save that $54K a year for the far more deserving. Like all those FIRE economy mavens who are down on their baller luck since the bust.

Really? It’s not about breaking up labor or oppression? Of course you are right it is about neither of those things – it is as you say about profits. And therein lies the rub. Take a look at the history of the last several decades, Nixon opening relations to China and ending the gold standard, Reagen championing business over workers leading to “fair trade”. The result has been oppressive conditions that include; strong unions comprising the back bone of American middle class being decimated in the private sector, the 80’s S&L scandal, Enron, jobs and manufacturing infrastructure moving offshore (SEO of Intel is on record lamenting this) and the current housing bubble cum economic crises. As caboy says in “days of yore private sector jobs” compensated more than civil service. Govt jobs are still strong because they haven’t been broken yet.

“….families are not “forced†to have two wage earners to make ends meet. We all make choices in life, and sometimes those choices put some people in a position where they are “forced†to do things they may not like – BUT no one has a gun to their heads. Not in America…not yet at least.” REALLY??

Do you read these posts? Are you aware of the earnings to cost ratio of buying a home in California? What kind of house can a $54,000.00 a year window washer buy in LA? (Incidentally you might want to check the wage scale of private sector high rise window washers). There are more forms of coercion than firearms. No one certainly goes into a home and points a gun at a sleeping person and orders them off to work. The coercion is a form of stacking the deck – cutting wages in the sacred name of profits – so that CEO’s make 300 so times the average employee and stocks always rise in the short term.

In the days of yore, private sector jobs payed way more than public sector. In today’s world, it has flipped and not only are public sector employees better paid, they get better benefits too.

But firing them is not going to create jobs and neither are those much hyped tax cuts. This year has been the biggest profit years in corporate history. So where are the jobs-in China and India. You don’t address the elephant in the room , we are only going to keep fighting amongst ourselves and these corporations are going to be laughing to the bank(or should I say from the bank?-they receive trillions at practically zero percent) no matter who wins .

Wow. You’ve obviously never worked in the public sector. We have a public sector employee in this household. In the past ten years he has taken on the jobs of three other people–who have retired. He is doing the work of four people, and his salary is about 20 percent higher than 10 years ago.

He never worked this hard in the private sector, nor this efficiently. In fact his big salaries in the private sector reflected far more waste in a day than he sees in five years in his public job.

He has a few slacker colleagues–people working the system as in any institution or organization. But by and large most of them are doing more and more with less and less with higher and higher demands.

I had the exact same experience working in the public and private sectors (and owning a business).

But, I know I’m wrong. Let’s just fire EVERYONE who still has a decent paying job. Surely the priests of Ayn Rand could do something better with that money. Like puff their own superiority. (After all, the reason Greenspan failed was not because he was more disoriented than a compass in an iron box. He failed because he wasn’t Randian enough!)

I think it’s funnie that people. Always attack public employees. Sure there are jobs that could be eliminated but for the unions that refuse to allow lazy people to get fired. But that’s not the majority of the people. Most people are working at public agencies and if those people were not employed there at a substantially lesser pay than the private sector, those same agencies would have to hire professional experts from outside companies to do those jobs and it would cost almost double.

Also, I wonder why no one makes a stink about the fact that federal employees pay nothing towards their pension. Community college workers have a mandatory amount taken out of their pay every month toward their pension and it’s not a small amount. So we pay for our pension. I’m not sure if that same system applys to state workers because we are not considered state employees just funded by the state. My friend works for the feds and pays nothing towards pension. Anyhow, the bottom line is that its not improving and pitting this group against that group won’t help. I haven’t gotten a raise in over 3 years and at least 5 people in my office have retired and guess who is doing their work and my job for the same pay and is not complaining one bit. You know what I’m happy I have a job.

You have some very valid points, but unfortunately your lack of grammar and spelling comprehension basically validate the above anti-government-job posters. Too bad. 🙁

First. It’s spelled “funny” not funnie.

Second. People do complain about federal workers. Nice strawman.

Third. If you are now doing the work of 5 people, one can only assume that your job was pretty damn easy for the years prior to that.

Finally. I’d be willing to bet that there are plenty of people that would love to have your job and would do it for less than your current wage.

I prefer 2 funi.

The main problem with govt employment and spending is that it takes taxes and debt to pay for all of it. It does not create a profit and is therefore a very abstract value in a profit driven system. That’s why govt needs to be seriously reduced back to level where it provides the basics we need as a society. Trouble is that this reduction will create a contraction in the economy equal to the Great Depression. And this is the real dilemma we face.

Anyone whining about what CEOs make is nothing more than a class-envy promoting liberal. Simple as that.

Jack. Really?

What did they call them at the beginning of the last century? Robber Barons. That was of course before the progressive labor movement that created 40 hour work weeks and improved working conditions. yes dear lib denigrators it was workers putting themselves on the line (and sadly resorting to violence themselves) in the face of company goons that gave birth to our Fair labor standards today – and definitely not the free market – that gave us robber barons. Hmm what is it the doc and others are saying about banking ceos today?

Thanks for that brilliant insight Jack. You are obviously a well-read man. Knowing that America can count on people like you to right the ship, I can finally rest assured we will miss that iceberg and sail into New York in the morning. I too should listen to talk radio and have someone else do all my thinking for me…

The CEO:average worker compensation rate is a symptom of a greater ill in this country, which is the disparity between the ultra-rich (top 1%) in this country versus everyone else. The ultra-rich have never been wealthier and the middle class has been shrinking for 30 years. Is it whining for me to point this out? Can someone (ANYONE) provide a reason why this fact is a GOOD development for America? While we wait for that answer, let’s ask why the wealth disparity? No single reason, but here are a few suggestions: 1) America achieves very poor returns on our educational investment dollar, 2) America has over-invested in its military and in non-necessary wars; 3) America promotes free-trade and capitalism all over the world, which has resulted in a massive exportation of American jobs overseas by American corporations as well as a consumerism mind-set outside of America that is driving economic development at much higher rates than America’s; 4) Population growth outside of America; 5) Still glaring quality of life differences between America and emerging economies; 6) The emerging economnies (e.g., BRIC) are becomming self-sustaining, and not reliant on Western aid.

The world’s economy (yes, it’s rapidly becomming one, big, homogenous market), is changing rapidly, and America, the world’s largest economy, but home to only 5% of the world’s population, will find it very, very difficult to keep what we have while the rest of the 95% of the world’s population gets theirs.

Oh, I meant to say, 99% of Amercia will find it very, very difficult to keep its wealth. The other 1% is eating just fine, thank you very much.

RE: Private sector jobs that do pretty well, straight off the bat.

Unionized private sector jobs seem to do pretty well… at least in my brother-in-law’s case, they do.

My sister is a public school teacher and he works for the local electric company. Myself, I’m a midlevel cubicle jockey for one of the few companies around that still makes things, a you know, relatively traditional job that is capitalism in action (work, manufacture, sell). First, I do not, in any way whatsoever, mean to demean their efforts. I love them dearly and I’m know they both work their asses off, but damn, the differences between our families could not be more stark.

My sister is currently going back to get a master’s degree, all paid for by the school she works for, and tenure assures her a job when she comes back. I’m looking to go back and get an MBA, myself, but I wouldn’t have a job when I graduated, which is a terrifying prospect in this economy, especially with 50ish k worth of debt on top of it. How it looks right now, the only way I can escape a 15 year debt commitment is with an 8 year military commitment in the National Guard, something I’m seriously considering.

My brother-in-law gets a COL adjustment every year and this year his union was able to negotiate *only* 3%. This year I’ll probably get a 3% raise as our wages have finally been unfrozen, but my paycheck will still be smaller due to health care costs and my 401k contributions which must creep up every year if I ever hope to retire. But hey, at least our company match is back!

They had their second child this year, a beautiful baby boy they named after my father. Something arrived for me this year, too, a beautiful first ulcer which I named after one of my reps.

They bought a brand new luxury car this year, too, which has to cost a pretty penny. I keep the same old commuter I’ve had for 15 years to pinch pennies. They make the turkey, the stuffing, the cranberries, and the pie. I bring the crackers.

But probably the most interesting part is that my brother-in-law doesn’t have a degree at all, while I have a bachelors. Sometimes I wonder why I went.

I’m not speaking out of envy. I know my brother-in-law works his ass off, often has to work holidays and all that. My company’s policies are actually pretty decent as we have not had to lay anyone off, and comparatively, they are relatively generous.

This is just how it is right now. The market is telling us “Don’t go to school right now. Don’t go get a job in the middle of a supply chain. Don’t engage in capitalism, designing, manufacturing, and selling things. Instead, get a job as an electrician.”

Leave a Reply