The End of the Tribe of Housing: Breaking Down the National Housing Neurosis.

This method of keeping everyone in perpetual fear failed because what the hell were you suppose to do if the rating went from green to orange? Or red? What the does general risk of terrorist attacks mean? How do we distinguish between high and severe? It was there to keep everyone in this constant state of fear. In this same fashion the rating agencies were there giving out AAA ratings on practically every company keeping investors in this perpetual delusion that all was well in credit bubble land. As investors realized that ratings meant very little and the downgrades started coming, a domino effect ensued.

It is easy to get overwhelmed by all this data. In fact, it is so confusing you may even mistake the Fed Chairmen for someone else. Bwahaha! Someone thought Ben Bernanke was Hank Paulson. They get that all the time in her defense. When you are tagging up on the dollar and pounding it into submission does it really matter if it is the Fed Chairman or the Secretary of the Treasury who is throwing the punches? It was a moment showing how disconnected politicians on the Hill are with the true economic issues of middle class Americans. Then on Friday we have President Bush rolling out his $140 billion proposed stimulus package that of course, includes tax cuts. You get $500 bucks to blow on boos and pay per view while financial institutions get to write off billions of dollars in bad loans and jump out of

The End of the Tribe of Housing

With this as our weekly back drop, we can now safely say that this mass hysteria is now fragmenting into warring factions. The national neurosis and infatuation with housing is now going away. Whether people admit it or not we still have many tribal instincts. Just because we walk around in tailored suits and drive nice cars doesn’t mean we don’t have primordial instincts that still emerge once in awhile. Need we remember the diaper astronaut? Think of a baseball game. If anyone has ever been to a Dodgers versus Giants game here in

Now that the tribe realizes that this cannot go on forever, we have to find our scapegoat. Mortgage brokers are now blaming Wall Street for creating the game in the first place with mortgage backed securities. Wall Street is blaming the ratings agencies for not doing their due diligence. Recent buyers are blaming the lenders for not telling them a Pay Option ARM doesn’t really give you any options and makes you pay with your physical arms. The government is blaming regulators for not doing their job even though these fall under the government jurisdiction. Agents are blaming buyers for pressuring them to find bigger and more expensive homes. Appraisers are blaming banks for turning up the heat on meeting higher prices. Blame, blame, and blame. What happened to all the love amongst these folks? Only a few years ago it was a total love fest in the tribe. Who cares if we mortgage our future away and put the next generation at a disadvantage as long as we get a McMansion with a helipad. We have dug such a disastrous hole that we may in fact look at this decade as a lost one. With a tsunami of mortgages resetting in the next four years, the reality of what no politician is capable of saying is going to happen. We are going to have a reduced standard of living.

Four Reasons Why Housing Will Not Recover in 2008

The tribe needs answers and many in the tribe believe that the media is talking down prices and this is the main culprit of the correction. “Stop talking bad about housing!†as if housing was some living being with feelings. Plus, can you really talk down $13 trillion in mortgage debt? If you had that strong of a voice you should audition for the new season of American Idol. Yet there is dissention in the tribe. Some are digging up facts not provided by the mainstream media and many are realizing that this entire game is a sham. Word is spreading like wild fire and no longer is there a honeymoon for housing. Yet some in the tribe require concrete facts and some still believe that the tribal fire dances around housing wealth are only a matter of a few months away. Let us now outline the fall of the tribe of housing:

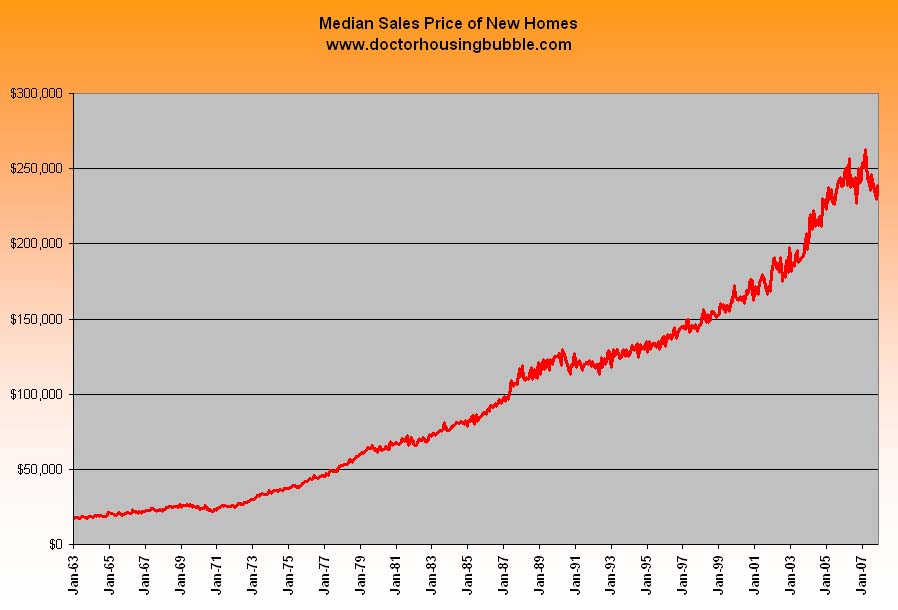

#1 – New Home Median Prices Falling

Last year we witnessed our first national year over year decline in median home prices since the Great Depression. We are now back down to the median prices of December of 2005 and this is for new home sales. Why does this matter? Since construction and new home spending fueled a lot of this economy, having new homes drop in price is a big deal. Also, winter is a seasonally weak time of the year seeing prices drop this early only signifies more pain ahead. Yet some in the tribe call this a seasonal adjustment and we’ll see prices jump again this summer. Why is this time different?

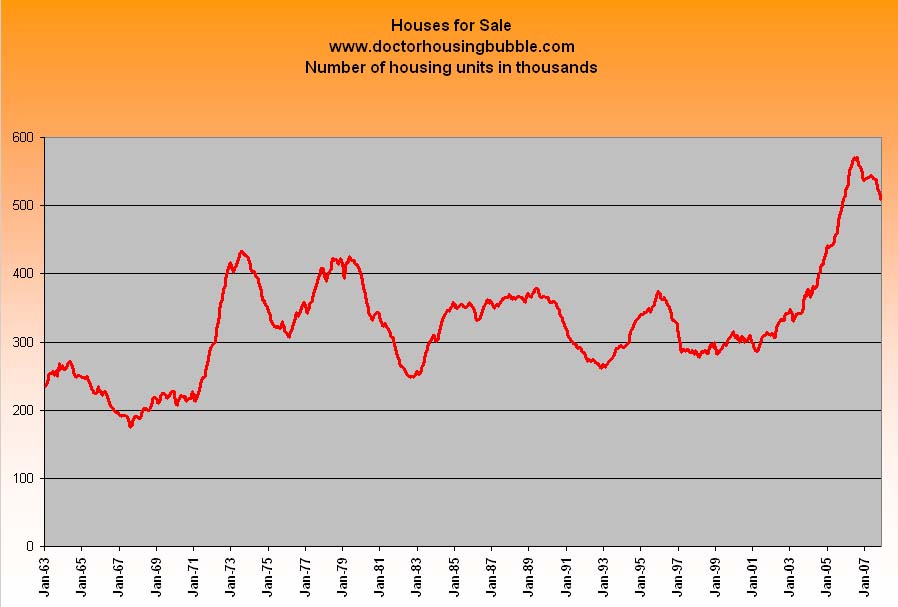

#2 – Record Amounts of New Homes for

We have never had this much inventory on the market. Never. We are swimming in uncharted territory. As you can see from this chart we hit our monthly peak in June of 2006 and have slowly started depleting the inventory since then. Unfortunately, the only thing that will deplete inventory is sales and this is not happening. We still have a record amount of housing inventory on the market and as you are all aware, housing sales have come to a near screeching halt. Yet this is good for housing since it shows pent up demand cries the shaman of the housing tribe. Let us look at this pent up demand shall we?

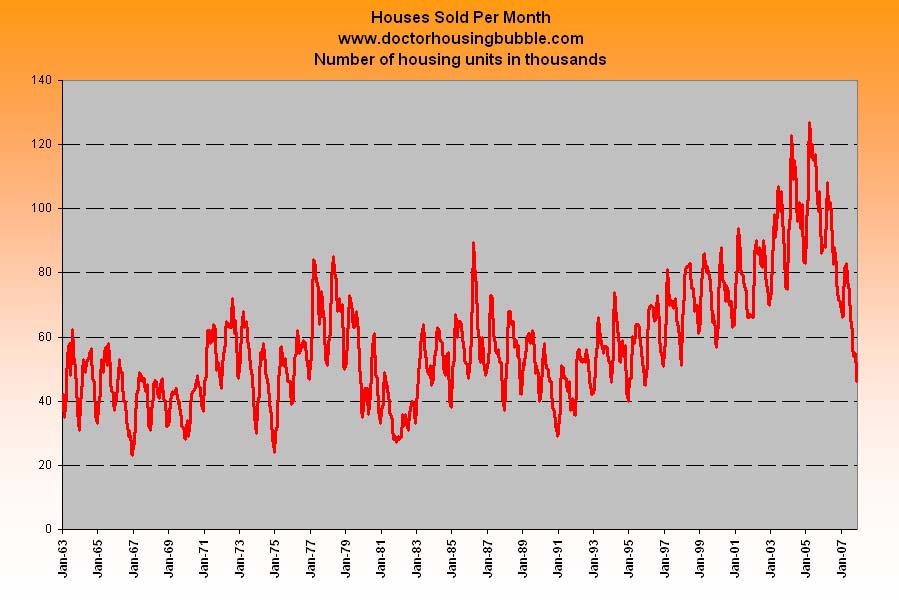

#3 – New Homes Sold Per Month Cliff Diving

This chart should be taken in reference with the previous chart. If we are at record inventories and sales are at record lows, what does this mean? It means that we have 11.1 months of supply at the current sales rate. When was the last time we had a monthly double-digit supply of new homes? How about January of 1991. New homes sales started trending downward significantly in March of 2006, plenty of time and heads up to the tribe to prepare themselves but now it is simply easier to pass the blame. The chart is still diving lower and there is yet to be a bottom. Given the winter season and the incredibly weak economy, we may see sales numbers fall even further. Yet more proof is needed you say. Maybe there is a minor funk but people are still building!

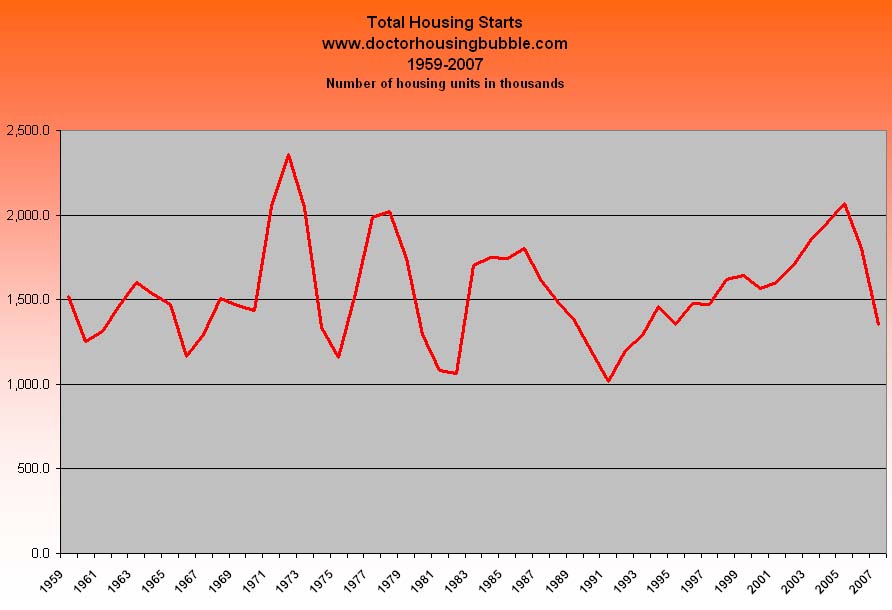

#4 – New Housing Starts

Housing starts are on an annual 12 year low but if we are to look at last month’s data, we are at a monthly 25 year low. What this means is we can expect further cuts in construction and all industries related to this field. Meaning your home accessory stores and those involved in selling and manufacturing these homes will see more contraction in their industry. As you can see from the chart, the trend is clearly toward the downside. What we are now left with is historically high inventory which will increase not from housing starts, but added foreclosure inventory created by the weak economy. Never in our history have we been so dependent as a nation on housing for our economic health. Now unless you are part of the now growing minority faction of the tribe that believes housing has bottomed, you will have to invest accordingly in the next few years and get out there and vote! The tribe will continue to fight throughout the year until some semblance of normalcy is arrived at. But given the current insanity expect the delusion to flow from the alters of financial irresponsibility. Enjoy the few hundred you get in the mail while those on Wall Street figure out ways to write off billions in losses and pass them on to the tribe without calling it the sacred bailout word; after all, much of the tribe is fixated on screaming mental patients on American Idol and they won’t even notice.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

13 Responses to “The End of the Tribe of Housing: Breaking Down the National Housing Neurosis.”

Was in Chicago and Seattle last week and noticed that there was a lot of condo construction still going on.

Noticed one new tower in Seattle was completed but appeared to have only a few units with drapery in the windows. Maybe 80-90% of the others were bare. Across the street and even larger tower was in fhe final stages of construction and offered apartments from $1 million in 2008! Other condo construction was going on all over downtown including the remaking of a parking deck into condos.

Tower cranes were plentiful in downtown Chicago with several 50 story towers going up along Michigan Ave.

Thing is I passed by a real estate office and in the window was a condo being offered in a ‘renovated’ older highrise downtown for a mere $133,500 not the $500,000 and up the new towers were priced at.

Point is there is a lot of ‘momentum’ still underway as a result of a demand curve that no longer exists. A multimillion dollar highrise project takes time from concept to completion but once the building permits and construction loans are arranged the thing has to contnue on until completion. Its not like a suburban housing tract where a developer can stand down when his demand evaporates and leave half the lots vacant.

My guess is that a lot of these condo projects are going to fail… big time. The very market they were meant to be sold to is itself in deep trouble. It isn’t textile or auto workers losing their jobs these days it is MBAs in the financial services sector getting pink slips. The banks too are going to take another hit when these projects go belly up and its a lot harder to hide a $100 million dollar non performing construction loan than pretend a single family home mortage is still an ‘asset’.

This is groupthink on a wide scale. Amazing how people believe the hype (still) without doing their due diligence.

Actually, the graphs you have posted refute one of the points I think you were trying to make, that there has been an unprecedented bubble in US housing starts and inventory. None of the graphs are normalized for US population. The US population in 1973 was 212 million versus 301 million in 2007. That is a 42% population increase. If you normalize for population, you find that new housing starts per capita have been in a ragged secular decline since 1973. That is consistent with declining real worker wages since 1973 and declining new household formation as the demographic baby boom trailed off. You will also find that the inventory of houses for sale per capita in 1974 was slightly higher than 2006.

I remember 1971-1973 very well, in terms of house construction, the early 1970s building boom was even bigger than this decade and the 1974-1975 building bust was more severe. However that was a different flavor bubble as it was based on high incomes and on conventional finance with 20% down and fixed rate mortgages with maximum lending of 3x verified income. No 100% loans, no liar loans back then. So the banking system was not damaged by the 1974-1975 bust. The stock market did crash big time as that was before the PPT.

What is extraordinary about the current bubble is that it is a worldwide bubble of reckless lending. This has resulted in house valuations relative to income or rent not seen since Florida 1926 when my grandfather went bust trying to subdivide and flip undeveloped land in Melbourne, FL. As you have documented with the real homes of genius series, the current bubble is all about fraudulent appraisals, reckless lending and rampant speculation on crappy old existing homes even in urban war zones like Compton.

This is the opposite of the early 1970s building boom. In the early 1970s the middle class wanted to leave San Francisco for the new suburbs in Contra Costa. So you could buy a (fixer upper) large Victorian house in San Francisco for back taxes, or at most $10k. (Note, lenders effectively “red lined” some of these areas even though it was technically illegal). Honestly, hippies bought some of these houses for cash with money they made as street musicians and panhandlers. Later in the 1970s gays got into the SF gentrification. Of course all of these houses are supposedly worth millions today. Same situation with the famous old brownstones in NYC, even well built houses in “bad” neighborhoods were almost worthless during the early 1970s boom.

I would agree that the houses built in the US this decade were too big, badly constructed, built in the wrong places, and extremely overpriced. But that does not constitute a national building boom. I would argue that the still astronomical prices in places like the core SF Bay area are due to decades of a regional dearth of house construction relative to population growth. Unprecedented lending boom and overvaluation, yes! Unprecedented building boom, not really.

Funniest post in a while, Doc. Heard Sen. Clinton on NPR last evening backpedaling when the interviewer asked her if she was going to go the Sr. Bush route and promise “no new taxes”. She said, and I quote, “I’m not saying anything.” How’s that for a bit of political candor?

The $800 will go for a few venti latte’s, maybe a present for the significant other on Valentine’s day, maybe even a drop against the credit card bill. It certainly does nothing for a California mortgage payment. It maybe covers two months of taxes.

One less-than trumpeted factor that was alluded to by the Governator – reduced government revenue. Tax bills will become increasingly delinquent not only because non-impounded borrowers don’t have the cash, but also because servicers going into default won’t pay the tax bill. That’ll be a nice how do you do to a borrower who IS impounded, but then gets a notice of tax sale anyways, because his servicer went under and didn’t pay the tax bill. Lower government revenue means fewer services, and those cops and firefighters and assorted government workers will also spend less into the real economy.

The permabulls don’t understand gravity. What goes up…. must come down.

Just to echo the above the Providence Journal last thursday reported a big downtown condo tower had sold, I believe, 18 of 178 units with 3 months to completion and was going to convert to rental. Obvious desperation which should put even more downward pressure on rentals. I’m very solidly in the its-only-just-begining camp, even in the yes-but-not-here areas. I think the bottom will be there in 2009. My rebate will pay for Cheezits while the Lear jets fly the bankers south with their bonus millions. Aint life grand when your a peasant in an aristocracy.

Ha, $800 for my wife and I means we can pay for 2 months of occupational therapy that our preschooler needs that’s not covered by insurance.

There are many factors on top of the housing bubble/crash that will make the next year or two much more painful than it, amongst them the slow motion collapse of the US health care system.

Economic dislocations are THE problem with an INCOME tax system that is highly manipulable – subject to influence by lobbyists and continual revision by politicians, taxes business resources and payroll whose costs can NOT be extracted from export prices and results in higher domestic “price tags” for consumers.

Clearly, the answer is in front of us – the FAIRTAX ( http://snipr.com/irsgone ); that’s right, the same plan ardently advocated by Gov. Huckabee ( http://snipr.com/fthuckabeeonirs ) and demagogued by people like Bruce Bartlett ( http://snipr.com/foulbb ).

The research makes a compelling case for EVERYONE to get involved in voicing their support for the FairTax Act of 2007 (HR 25 / S 1025) that’s been reintroduced into every session of Congress since 1999, and with growing numbers of co-sponsors:

The FairTax rate of 23 percent on a total taxable consumption base of $11.244 trillion will generate $2.586 trillion dollars – $358 billion more than the taxes it replaces ( http://snipurl.com/whatratewks ). [BHKPT]

The FairTax has the broadest base and the lowest rate of any single-rate tax reform plan ( http://snipurl.com/baserate ). [THBP]

Real wages are 10.3 percent, 9.5 percent, and 9.2 percent higher in years 1, 10, and 25, respectively than would otherwise be the case ( http://snipurl.com/realwages ). [THBNP]

The economy as measured by GDP is 2.4 percent higher in the first year and 11.3 percent higher by the 10th year than it would otherwise be ( http://snipurl.com/econbenes ). [ALM]

Consumption benefits ( http://snipurl.com/econbenes ) [ALM]:

• Disposable personal income is higher than if the current tax system remains in place: 1.7 percent in year 1, 8.7 percent in year 5, and 11.8 percent in year 10.

• Consumption increases by 2.4 percent more in the first year, which grows to 11.7 percent more by the tenth year than it would be if the current system were to remain in place.

• The increase in consumption is fueled by the 1.7 percent increase in disposable (after-tax) personal income that accompanies the rise in incomes from capital and labor once the FairTax is enacted.

• By the 10th year, consumption increases by 11.7 percent over what it would be if the current tax system remained in place, and disposable income is up by 11.8 percent.

Over time, the FairTax benefits all income groups. Of 42 household types (classified by income, marital status, age), all have lower average remaining lifetime tax rates under the FairTax than they would experience under the current tax system ( http://snipurl.com/kotcomparetaxrates ). [KR]

Implementing the FairTax at a 23 percent rate gives the poorest members of the generation born in 1990 a 13.5 percent improvement in economic well-being; their middle class and rich contemporaries experience a 5 percent and 2 percent improvement, respectively ( http://snipurl.com/kotftmacromicro ). [JK]

Based on standard measures of tax burden, the FairTax is more progressive than the individual income tax, payroll tax, and the corporate income tax ( http://snipurl.com/lessregress ). [THBPN]

Charitable giving increases by $2.1 billion (about 1 percent) in the first year over what it would be if the current system remained in place, by 2.4 percent in year 10, and by 5 percent in year 20 ( http://snipurl.com/moregiving ). [THPDB]

On average, states could cut their sales tax rates by more than half, or 3.2 percentage points from 5.4 to 2.2 percent, if they conformed their state sales tax bases to the FairTax base ( http://snipurl.com/staterates ). [TBJ]

The FairTax provides the equivalent of a supercharged mortgage interest deduction, reducing the true cost of buying a home by 19 percent ( http://snipurl.com/homebenes ). [WM]

ALERT: Kotlikoff refutes Bruce Bartlett’s shabby critiques of the FairTax ( http://snipr.com/bbrebuke ).

Bottom in 2009 oldernotwiser? Don’t think so. Take a saunter through an OFHEO study that came out 1/11/08. Pay attention to Chart 1 and 2.

http://www.ofheo.gov/media/research/MMNOTE11108.pdf

Then read this study: http://www.ofheo.gov/media/WorkingPapers/workingpaper071.pdf

You want page Table 4 on page 12 (adobe page 16.)

In short (or not so short) this means really bad news for indebted homeowners for much longer.

The 2/28 and 3/27 ARMs were primarily subprime loans. The jumbo loans come in fixed and ARM varieties with the version of the TSFW (Too Scary For Words) loans being

(1) fixed rate with interest only – these will have a balloon or a reset into an amortized mortgage either fixed or ARM (means they have to start paying principal as well as interest)

(2) interest only ARM – these too will have a balloon or a reset into an amortized mortgage with usually an ARM (means they have to start paying principal as well as interest)

(3) option ARM – the ‘pick a payment loans’ that have a negative amortization rate until they reach a certain point when they convert to a loan requring repayment of principal as well as all the interest – probably have a reset on the interest rate

(4) hybrids – a combination of #2 and then it converts to a higher rate ARM with principal payments added on (counted as an interest-only ARM unless it has reset)

These typically came in versions with 3 or 5 years until reset and the most common length on these loans until they reset was 5 years. And therein is why San Fran, Seattle, LA $$ areas and other such places have not yet shown a price drop on the higher priced homes.

Here is the breakdown on the growth of the use of these loans showing the different loan types as a % of jumbo mortgages:

2002

Fixed with Amortization (FA) 59.1

Fixed Interest Only (FIO) .1

ARM with Amortization (AA) 31.1

ARM Interest Only (AIO) 9.2 (up from 1% ’00 and 2.7 in 02)

ARM Option (AO) .2

FIO – AIO – AO = 9.3% (probable resets ’05-’07)

2003

FA 49

FIO .6

AA 32.3

AIO 17.1

AO .5

FIO – AIO – AO = 18.2% (probable resets ’06-’08)

2004

FA 21.9

FIO 1.2

AA 28.4

AIO 38.3

AO 9.6

FIO – AIO – AO = 49.1% (probable resets ’07-’10)

2005

FA 19.1

FIO 4.8

AA 16.7

AIO 33.9

AO 22.1

FIO – AIO – AO = 60.8% (probable resets ’08-’011)

2006 – don’t have that data

2007 (1st qtr)

FA 26

FIO 18.9

AA 4.2

AIO 34.8

AO 12.3

FIO – AIO – AO = 66% (probable resets ’10-’12)

The FIO, AIO and AO loans increased rapidly from ’03 and thereafter. Given that the most selected length until reset was 5 years, the majority will not be resetting until 2008 and continuing through 2011.

Now there will be some AO loans that hit the point of negative amortization before the 3-5 years are up because the borrower paid less than the interest due, reached the neg am limits and now has to come up with principal and interest. Many of those will default. We are already hearing about some foreclousres where those were the type of loans taken out by borrowers. Remember that option ARMS are far far outnumbered by interest-only ARMs and fixed interest-only.

The AIO loans however outnumber the AO (neg am loans.) There the borrower has only managed to delay paying the full cost of the loan but at least is not adding to the principal.

It is when those loans AIO reset that the higher priced homes will start sliding into default.

(Keep in mind that many many many of these loans also have a 2nd as an 80/20 and a very large number were done as stated income loans aka liar’s loans – and the studies show 90% lied and close to 60% lied to the point of claiming more than 50% income than they had.)

It isn’t that LA (upper bracket areas) and San Fran and similar places are immue so far because they are ‘special’ but because the versions of the suicide loans for jumbo mortgages just haven’t exploded yet.

BTW, 49.19% of jumbo loans are in CA. The next highest state is FL with 6.71% of them, then NY with 5.34% (say bye-bye NYC…..), then VA with 3.24% ( so sorry D.C.) and then WA with 3.21% (Seattle and Portland just got wet….) Those are the top 5 states in Jan. 2007.

Those with such interest-only that hit a reset before June or so of’ ’07 probably could refinance but it is doubtful that many could refinance into any amortizing loan they could afford – more likely just another interest-only with another reset in the future.

Here is the article mentioned by oldernotwiser on the condo problem I was discussing. It was but 14 of 193

units in this condo tower that have buyers.

http://www.projo.com/ri/providence/content/BZ_CONDOS_RENTALS_01-17-08_7P8KHS9_v60.1ac13cd.html

Thanks Annscott for the complete and factual response. I hate it when facts get in the way of my optimism and I keep hoping that we arent heading for a redo of 1929. For an outsider to this whole mess I must admit I find it incomprehensible that we got ourselves into this mess. If you wrote scifi with this combination of greed, avarice, dishonesty and stupidity it would be unbelievable. You just walk down to the bank and borrow any amount you want backed by nothing at all and Mr conservative banker says “sure, wouldnt you like interest only”. The intellectual effort seems to parallel “would you like fries with that” and “supersize my loan”. I have partial sympathy for the sheep who fell for the incessant TV adds for ARMs and worse, although its very partial. As for the Mozilos and bankers waterboarding is too good. I fear that the rippple effect will damage the sensible people with the wisdom to have been bystanders to all this.

Ian Repley, Ann Arbor GO PEDDLE YOUR SNAKE OIL TO PEOPLE WHO ARE STUPID enough to fall for this ‘FairTax” rate of 23 percent on sales and purchases. It is a load of bullhockey (as Colonel Potter from the 4055th MASH would have said.)

Example 1:

Household with $48200 income and 2 people and maried filing jointly. Not enough to itemized so standard deductions and exemptions of $17,500 leaves a taxable income of $30,700. Income tax is $4218 (8.75% pf gross) and Medicare/Social Security is another 7.65% or $3687. Total federal taxes = $7905 or 16.4% of gross.

Since this household has to spend at least 90% of what they make in order to live, they would be paying 23% tax on what they spend. Say they spend 90% or $43,380. They would have to pay $9977 in “Fair Tax” (a lieif I ever did hear one.) Given that $43,380 + 9977 = $53,357 and that is more than their income, they would have to cut their spending by $8,111 in order to still be able to save 10% of income and pay this incredibly stupid tax.

After federal tax income now = $40295 – 10% to savings $4820 = $35475

After the federal ‘stupid sales’ tax income would be $48200 -10% to savings $4820 = $43380 -23% tax of $9977 = $33403. This ‘help the rich’ tax would cost the median household 20.6% of their income.

Yep – real “Fair” when the median household is OUT $2072 with the ‘moron sales tax/’

Example 2:

Jacqueline Mars (heiress to Mars Candy fortune who has never worked a day in her life and has an income in the top .001% which is $6,000,000 and up.) Income at least $6,000,000 from ‘investments’.

Now she only pays 15% on capital gains or $900,000 or so.

With the ‘idiot fair tax’, lets say she spends $2,000,000 and leaves the other $4.000,000 in investment accounts. She pays $460,000 in the “insane Fair Sales Tax at 23%.. She pays NOTHING on the other $4,000,000.

Tax bill now = $900,000 (15% of income)

Tax bill with the idiot tax = $460,000 (if she can figure out how to spend at least $166,666 a month.) and only 7.6% of her income.

What deliberate pathological liar ever named this piece of garbage ‘Fair”????

Under it that household that has to spend its income to live would pay 20.6% of its incomein ffederal tax and have to cut its spending for necessities.

The uber rich get out of paying taxes on the vast majority of their income and can easily pay only 7.6% of income in Federal Taxes.

Another ‘stick it to the bottom 95% so the upper 5% don’t have to pay.’

Quit peddling these disgusting lies – only thing the peope pushing this bullhockey want to do is help the very very very rich pay less by making the rest pay a LOT more.

I betting that after the $800 tax gift from George W. is handed out, my shares of COACH will rise the next quarter.

Oh, BTW, the stock markets of the rest of the world reacted to the plans of the American government by plunging. This is one huge butterfly flapping….

God Bless America!

@Scott:

That is the thing that Florida is facing. Many of these large condo projects take years to finish and many are in the hole before they are even completed. The question now is do they complete the project or cut their losses? There are many of these that I have seen in Orange County and I imagine that they will be completed but they will take large losses. There is a rather prominent bankruptcy going on in the OC regarding this matter.

@New Zealand Renter,

The thing with housing starts is that once housing is built, it is added to the new pool of already existing homes. That is, starts are more dependent on the growth rate than the sheer population number. If you look at Los Angeles County you will find many homes built in 1940 or 1950. Some cities have seen a tiny amount of housing starts during this “boom†time but it doesn’t mean that they were short housing units. Once they are added they become part of the entire housing buffet. Also, many housing starts happen in blossoming states such as Arizona or Nevada reflecting a similar trend as the one you mentioned.

Either way, the dropping number in housing starts in relation to the current amount of monthly inventory points to a troubling picture. We are at a peak amount of housing in the current marketplace and there are certain areas where projects are still coming live. I know of a few in Los Angeles County that are in the early phases and won’t be completed for 6 to 9 months. These are large projects with a few hundred homes. Do they simply stop building?

We also have the downsizing of many baby boomers. This year the oldest baby boomers hit peak retirement age and we will now have an onslaught of people retiring and potentially selling their homes to downsize. No need for 5 bedrooms when there is only two people. This will add to inventory on the market. There seems to be a convergence of many factors at once going on.

@Exit,

Many tax bills have a deadline hitting at the end of this month, especially if you pay it in semi-annual payments. People in the early stages of foreclosure are worried more about staying afloat than paying their taxes. I think we’ll see the full ramifications once tax filing season is over.

@AnnScott,

That was a great report. Amazing the sheer amount of jumbo loans out of California. If we are to raise caps it will be to essentially bail out this state. It is interesting to note that caps are revisited annually and if the median price goes down, caps may in fact drop. We already saw that Southern California took major hits last year. Any reform or action will take months if not a year and by that time, the market may have already taken the cap issue out of the picture because of lower prices. And another point that the study highlights which is something we already anecdotally knew is that many jumbo mortgages are toxic products. These are not going to be bought by government sponsored entities. So what is then the point? Clearly the bubble was fueled by negative amortization loans, subprime products, and interest only loans which even if caps are raised, conventional mortgages make a small number of the jumbo market. If you are to take a conventional jumbo loan the market would still be in the current condition because people simply cannot afford a fully amortizing conventional mortgage.

@Ian and AnnScott,

Regarding the tax issue, on its face value the fair tax seems fair as Ian pointed out in his argument. It makes the issue extremely simple since it eliminates a lot of the overhead including the IRS but it isn’t 23 percent but 30 percent. It is a matter of wording. For example, say you buy a candy bar for $1 you will end up paying $1.30 for the markup price of the fair tax. It is a 30 percent pre-tax mark-up but 30 cents on $1.30 is 23 percent hence the 23 percent number.

And as Ann pointed out, those with higher incomes will be able to keep more of their money. Let us assume a, oh I don’t know, a hedge fund manager investing in subprime mortgages made $1 billion for the year. If he can get by on only spending $100 million, the other $900 million is essentially tax free. At this level his tax rate is about 2 percent. Proponents will argue that he will pay taxes once he spends but come on, is he really going to spend more than $100 million?

This tax issue is very important and deserves a deeper debate since this “tax rebate†we are currently hearing about impacts the discussion. Also, lower income families already pay a lower rate of taxes and spend nearly all their income on consumer goods so front loading a sales tax would unfairly burden them. There is a provision in the fair tax for this but I’m not sure how viable it would be. Better tax issues to discuss are one’s like the AMT hitting middle class families.

Also, I would say that the middle class squeeze is happening on the $50,000 to $150,000 households. The bulk of the population in the U.S., approximately 95 percent of all households makes less than $150,000 per year. The majority of the discussion should be here. Also, how fair is it to give tax breaks to companies that use offshore tax havens and corporations to shield income? Or look at the BofA Countrywide deal where BofA stands to benefit from writing off losses that Countrwide will surely face with the subprime implosion of its portfolio? Income that BofA earns can be offset by sucking up a company on the cheap and avoiding paying income taxes. How does this benefit the economy in the long run? The top 10 percent own 80 percent of all financial assets and the bottom 90 percent hold only 20 percent of all financial wealth. Clearly something wrong is going on here and people are finally starting to wake up and are saying, it’s the corporate welfare stupid.

Leave a Reply