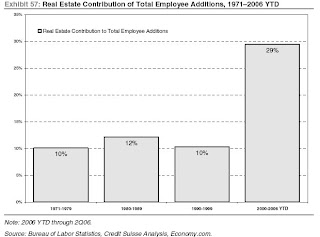

America’s Codependence on Housing: 30% of Job Growth Contributed by Real Estate. 5 Point Plan on how the Bubble Will Burst.

America has gone housing crazy. In the last six years, housing has contributed to 29% of total employee additions. How does this equate to past decades? Let us take a look:

1971-1979: 10%

1980-1989: 12%

1990-1999: 10%

2000-2006: 29%

Keep in mind that this is factoring the previous real estate run-up of the late 80s and early 90s. What we are witnessing is an unbelievable credit extravaganza anchored to one asset class, that of housing. As we all know diversification is the key to a healthy economy and each day that passes we are realizing how influenced we are by real estate. When any economy is rooted in one industry and that industry goes sour, what do you think happens? You can look at

February 2007: 526,308

February 2006: 486,395

February 2005: 427,389

February 2004: 374,546

February 2003: 340,548

February 2002: 316,898

February 2001: 310,109

February 2000: 304,477*

*California Department of Real Estate Statistics

As you can see from the growth numbers above, real estate attracted thousands of new recruits into an industry that is extremely cyclical. At this point, the Vilfredo 80/20 rule comes to mind. In many industries including real estate the market is dominated by 20 percent of the employees while the other 80 percent scrimp to get by. If you look at the national median salary of real estate agents you will see that it is not a lucrative career option. But like the California Gold Rush, money is made selling the sizzle not the steak.

1 – The Dwindling Down Payment

The down payment used to be a barometer of a buyer’s credit worthiness. It demonstrated your ability to baton down the hatches and save for a few years. Since American’s have a negative savings rate there had to be an alternative to this. As those in the mortgage industry sat up at night eating Ben and Jerry’s ice cream pondering their future, they witnessed a sign. Carleton Sheets with his no money down solution and Hawaiian Technicolor dream shirt gave the mortgage industry the solution to their stagnation, the no money down mainstream mortgage. No money down, once a thing left to experienced real estate investors became a standard practice throughout the industry. Now having a down payment is so passé.

2 – No Savings

As previously mentioned American’s are horrible savers. As witnessed by the above the beast needed to be fed and what better way than to collateralize your home as a massive stucco American Express card. Instead of signing on the dotted black line for a new line of credit, why not withdraw money from your most revered asset, your home. It became almost too easy and played into the cultural pathology of consumption perfectly. Spend today what you’ll earn tomorrow. If your car shows your place in the

4 – Risky Loan Business

While someone has opened up a can on the subprime industry we are still assessing the impacts this will have on the overall economy. 20% of all mortgage loan originations in the past three years have fallen in the subprime category. Resets of $1 trillion dollars are scheduled for 2007 and 2008 each consecutive year. As these loans default via the domino effect, slowly we are realizing the ramifications this debt service is having on the overall economy. As the housing syndicate tries to call the bottom, we realize that the game has just begun. Each month seems to usher a record breaking performance on the downside and demonstrates how wrong the housing syndicate is. Record 18 year drop in sales. Foreclosures up 800% in

5 – Stagnant Wages

Now that housing is trending down what impact will this have on the overall economy? We’ve heard countless times from housing pundits that a diverse economy like ours can withstand a real estate down turn. I point to the first graph above showing 29% of added jobs directly related to real estate. So let us do some math:

Housing down = loss of jobs in real estate (big portion of current economy) = BIG impact on economy

And besides this, 70% of Americans own their home. The wealth effect will be multiplied because losing a large portion of your equity does not bode well for spending. This may have gone on longer but the credit spigot is being turned off and we are witnessing early withdrawal symptoms in the public.

6 – Housing Led Recession

In the past job losses have led to recessions in real estate. This made sense because if you lost your job you weren’t mister sunshine ready to commit to a 30 year mortgage. However this time we are swimming in a different sewer system because jobs connected to real estate dominate a large portion of society; these jobs depended highly on real estate continuing to go up into perpetuity. As witnessed by the major decline in remittances to

Subscribe to feed

Subscribe to feed

18 Responses to “America’s Codependence on Housing: 30% of Job Growth Contributed by Real Estate. 5 Point Plan on how the Bubble Will Burst.”

Excellent post Dr. Keep up the good work.

Yeah, good article, as always.

Not sure if you meant this:

Record 18 year drop in sales. Foreclosures up 800% in California. Yes, these are all signs that we are at the bottom.

Did you really intend to suggest we are AT the bottom, or that we are heading downhill? Somehow I don’t suspect you intended to be a bottom-caller, ALA Lereah!

Nice post, HB.

Wanted to point out that the CAR chart from the Sac Bee shows the % of 1st-time buyers who used a down-payment presents numbers that seem a bit low. I looked into it, and found this reference:

From mid-2005 to mid-2006, according to a statistical sampling of a representative group of 7,548 purchasers, nearly half of all first-time buyers financed the entire transaction, obtaining mortgages in the full amount of the home price. Also, 30% put down 10% or less.

The research was conducted by the National Assn. of Realtors, using information on home transactions supplied by Experian, a major credit and realty data firm. The median down payment of first-time purchasers, according to the study, was just 2%. In other words, the median-sized mortgage for first-timers represented 98% of the home purchase price.

That was from the L.A. Times, found here:

http://tinyurl.com/yojeku

So in reality, an overwhelming majority of 2006 1st-time buyers in California have very little “skin in the game” at this point, are already upside down, and thus are more likely to walk in the event the going gets rough (as it will).

The only question is when they will realize they’re in a precarious situation….

I am planning an upcoming post building on the problem created by the industries elimination of downpayments. Basically, it seems to me that once the lending industry started 100% financing, people stopped saving money for downpayments. Why would you? Now that downpayments are coming back, nobody has one. This is going to be a HUGE problem going forward.

IMO, it is the main reason the bottom of the market has had no sales over the last 30 days. No first-time buyers have any savings, so entry-level properties are essentially dead. This will serve as a dead weight on the market and will shortly lead to its demise. I think the collapse will begin this fall once the failure of the summer selling season cannot be denied.

If the housing bubble accounted for ~30% of job growth since 2000, then Bush’s War probably accounted for the other 70%… or more.

Way to keep the economy moving… growing debt and deficits buying stuff we don’t need and destroying people’s lives.

Great info Dr. HB! When I sold cars a few years ago, many purchases were made in cash. Where was this cash coming from? HELOC’s. Not savings, not trade in equity, not a duffle bag full of bills. We saw checks from HELOC’s to buy cars all the time. Even when the mfr. was offering 1.9%, people were still buying with HELOC’s. This was super dumb because the average interest rates on the home loans were surely more than the mfr. rate (even AFTER the tax writeoff). Why would you leverage your home to buy a seriously depreciating item like a car and at a higher rate to boot??

This why Americans are the dumbest financial people on earth. The ones who do get it will be laughing all the way to the bank. The people who refused to listen to the Cassandra’s are now feeling the pain.

I recently found this blog via iTulip, which I’ve been following since ’99. I’m a real estate broker with close to 30 years of experience. I’d like to clarify a couple of points. To blame mortgage brokers for this is unfair. Their job is to sell products. They don’t create these types of loans, they didn’t keep the prime down for a ridiculous amount of time, nor did they urge people to spend, since it was their “patriotic duty”. The blame should rest with the real power brokers, namely Alan Greenspan and George Bush & Co. (In the spirit of full disclosure, I voted for Reagan and Bush, Sr. and finally, Clinton. And I am not a lender.) The idea was to keep the ruling party in power, and that’s exactly what’s happened. The cost of this chicanery will be with us for a generation. Essentially, the message to the American public was buy, buy real estate because you can deduct the interest, don’t worry, since the market will go up infinitum. And we’ll back you with historically low interest rates. The problem with this, is that eventually, the creditors will come calling, as interest rates creep up, as they always do, and as the creditors come to their senses, as they always do. Who’s to blame? Certainly, there is plenty of blame to go around, but in the end, John Adams had it right when he said that “people get the government they deserve”. Does this apply to us? Does it apply to Iraq? You be the judge.

socalwatcher,

I’ve mentioned that before about people buying cars with HELOCS. You brought up a beautiful point about the financing charge. Some cars were being sold with ZERO percent financing!! That’s insane.

But what is even more insane is the fact that people would want to pay it off with their HELOC. Why you ask? PAYMENT PAYMENT PAYMENT. The HELOC payment is only interest only on 30 years which means your 50k BMW won’t cost 850 a month but only 312.50 a month AND it’s tax deductible.

On another note, did GM actually say the housing market hurt car sales or that the market affected GMAC’s profit, which in turn would hurt GM’s total profit??

I am planning an upcoming post building on the problem created by the industries elimination of downpayments.

Basically, it seems to me that once the lending industry started 100% financing, people stopped saving money for downpayments. Why would you? Now that downpayments are coming back, nobody has one. This is going to be a HUGE problem going forward.

Especially when combined with a slowing economy, it won’t be any EASIER to cough up a down-payment nowadays: in our “I want it, and I want it NOW!” society, we know how Americans feel about delayed gratification!

But elimination of down-payments are only ONE element of lax credit standards that got us into this mess, fueling the real estate bubble to unexplored heights of mass idiocy.

The REIC’s game was a page straight out of Enron’s old play book, when Enron tried to manipulate the California electricity utility market, artifically reducing supplies to squeeze $$$ out of consumers. And it actually WORKED, since prices soared while Enron pumped millions into corporate coffers (and we all know how THAT one ended).

But as far as zero-down, we can thank Late-Night T.V. Informerical real estate guru Carlton Sheets for popularizing the concept; amazingly, the greater fools in the lending industry picked up on the concept, and actually legitimized the practice!

Old-school lenders (i.e. those who’ve been thru a market cycle) know zero-down is problematic when the market starts to turn, since recent borrowers “don’t having any skin in the game” as they say. The borrower has nothing to lose, and will walk out the door if there’s ANY choppy water; it’s no surprise we’re seeing it happen now. The over-leveraged borrower mails the keys back to the lender, and aside from ruining their FICO score, is done with it (oh, and there’s the matter of getting a pesky 1099 from the lender, but that stuff usually ends up in trash anyway! Your average borrowe never OPENS the mail (ALA Casey Serin), and has never SEEN a 1099 before, right, since they don’t save money? Besides, IRS implications are not to be worried about NOW, but when completing next year’s tax return, that is if they DO file at all!).

So they ruin their credit: so what? For the past few years, they’ve been innundated with ads saying, “no or poor credit? NO PROBLEM! A bankruptcy or foreclosure on your record? NO PROBLEM!” Advocating fiscal irresponsiblity has been the widespread message for years, and people have bought into that notion, too!

So they’ll simply play the game, mailing the keys back to the bank, while assuming the 2000-2007 rules of money apply.

So realize down-payment is only one factor here: let’s not forget the housing boom was driven at it’s core by a massive CREDIT bubble: vastly inflated prices are/were completely unattainable and incomprehensibile for the vast majority of the population, IF NOT for the artificial situation of buyers being armed with borrowed “funny money” they couldn’t afford in the first place. It’s like giving a kid a credit card and saying, “go nuts!”

Now that the credit pump has been unplugged from the housing market (after sub-prime/Alt-A lending melted), lenders are supposedly returning to prudent standards (such as actually checking a borrower’s ability to repay the loan: what a NOVEL concept), so there’s absolutely NO WAY to support those easy-credit bubble-era prices. As the old saying goes, you cannot squeeze water out of a turnip; consumers are tapped out, already having spent money they never had in the first place!

Using the turnip analogy, the lending industry attached a hypodermic syringe to a high-pressure pump to inject water into turnips, JUST so they could sqeeze water back out again! Now that the needle and pump has been confiscated, all we have left is a schriveled turnip. While you could FORCE a turnip to retain water, it never really did so of it’s own accord; underneath it all, it’s STILL a turnip.

So now we’re facing the cold reality that people really COULDN’T afford those loans in a sustainable manner, and the truth is the real estate market CANNOT float 70% of the population (!) to perpetual passive wealth through real estate riches (that is, unless they played the flipper game successfully)!

How silly, thinking we could ALL make money in a sustainable fashion by selling something that everyone else owns! We all can’t be ‘above average’.

For one, markets needs a constant infusion of qualified new buyers, and/or needs to be built on a commodity that is consumable (e.g. gas, food): real estate fits neither criteria right now. Anyone who’s been remotely thinking of buying an “investment property” has had PLENTY of opportunity during the past 6 years to do so, and now that we’re returning to more traditional lending standards means we’ve closed the door to unqualified buyers, which is a good thing. We’ve shut the entrance for the “greater fools” if you will..

For some long-term homeowners, the thought of losing that “equity they’ve earned” will be a tough pill to swallow, EVEN THOUGH they haven’t actually lost a dime of THEIR money yet. It’s a blow to their ego, as that inflated equity was a part of THEIR retirement plans. Of course they’re not happy, since this is a set-back.

For other late-to-the-party buyers (2006-2007), or those who extracted equity from the home, any changes in life situations (job loss, etc) that force them to sell is going to be unpleasant for many. They might need to bring a checkbook to the closing table, which is not what they thought their “investment” would ever require!

They ALL forget that equity isn’t “real”, until it’s actually realized!

70& of people are ADDICTED to the IDEA of growing wealthy passively via their own perpetual-equity-producing machine, and the realization that they’re trying to defy economic principles will be as painful as getting a junkie to withdraw from heroin by going ‘cold turkey’.

Ladies and gents, this IS the ‘morning after’ a night of drinking and using illicit drugs, the morning when people are trying to remember exactly WHY they made the decisions that seemed like such a good idea at the time (insert your favorite ill-advised behavior, e.g. drunk driving, swinging at a Cop, wearing a lampshade on one’s head, etc).

I just talked to a 75 year old man in VA. HE is a RE agent with 7 properties, 4 of them are mortgaged. He has 7 credit cards totaling 67,000. He receives social security, his income from selling homes and only 1200 a month net rental income on the 6 rentals.

The guy then proceeds to tell me that he doesn’t invest in stocks because real estate is a much more sound and profitable investment.

I nearly rolled off my chair. I forwarded the call recording to my co-workers and they laughed their asses off!!

But here is the best part!!…The guy wanted, surprise surprise, a HELOC for his primary residence for 50K and he couldn’t qualify because he has less than 2 months PITI in his total life savings!!

He says…”but I own several properties free and clear!”

Reality Check

I don’t get the whole bmw scenario. So the buyer will pay like 300 a month for 30 yrs. Is that what you’re saying.

lendingmaestro,

The BMW example is spot on. Why on earth would you take a HELOC at higher interest for 20 years on an item that has a reasonable life of 5-10 years AND depreciates everytime you use it? The payment should never outlast the car. That is just obscenely foolish. No one, not even Warren Buffett, needs a 7 series Bimmer.

If you cannot afford to payoff a car in 48mos or less, then you can’t afford it. I heard of companies in CA lending 84mos on a new vehicle!! So, when you wonder how your neighbor can afford that new Escalade….just tap the house for some $$$$ and finance that bling!

I blame TV. The shows that flaunt wealth, the commercials promising high returns, and our nations immaturity towards gratification control is out of hand. A economic crash of biblical proportions may be the only way to learn.

Sure glad I have ZERO debt and cash in the bank and saving towards that down payment…

BTW: If you want a chuckle, check this site pathetic site out:

http://www.rentawheelofflorida.com/

anon-

Let’s assume you buy a 50,000 bimmer and get a 5% rate on a traditional 60 month car note. Your payment would be a cool 943 a month. Even if you did a 6 year loan the payment would stil be 805 a month.

OR

Buy the car in cash with a HELOC. Assume the HELOC is PRIME mius 3/4% or 7.5%. The monhtly interest only payment on the HELOC is only 312.50 a month.

This is a financially retarded thing to do. You will be taking equity out of an appreciating assets (at least it was) and paying off a depreciating asset. Not only ar you paying the car off over 30 years, but you’r paying interest only, and a higehr rate.

But that’s OK, cuz So Cal people just care about their PAYMENTS. ISn’t that why neg am loans exist in the first place?

On another note, did GM actually say the housing market hurt car sales or that the market affected GMAC’s profit, which in turn would hurt GM’s total profit??

Yes they did. They said the extra disposable income people were accustomed too has disappeared. They also saw impact from GMAC

California foreclosures up 68 percent

The baby bust from 1970 to the mid eighties isn’t helping. Thr baby boomers have nobody to sell to.

I’ve just come across your website–fine work! As a longtime LA-dwelling renter, I confess to wanting to buy once most of the air is out of the bubble. I’d be very appreciative of any articles that would guide buyers toward understanding the signs that we’re nearing a market bottom. I know how that tends to work in the stock market, but am not sure how much of that carries over into real estate. Even if it does (insder buying, for example), I wouldn’t know how to spot it. Your insigths would be much appreciated.

Leave a Reply