Subprime by any other name: FHA insured loans are least appealing financing option for home sellers. The psychology of rising home prices.

FHA insured loans filled a giant void from the private mortgage market exiting the game by brute force as the housing bubble burst. One thing is certain when it comes to consumer psychology especially with such an emotional decision like buying a home. People have wine expectations but come with beer budgets and this is especially true in housing. Becoming accustomed to low down payment mortgages, the bust in housing was a hard retreat for many Americans. In the 1970s and 1980s nothing down or close to it was left to the late night infomercials for those too inebriated to sleep before midnight. Most people knew this was a tiny pipedream. It was only until the 2000s that this became a common pathway to owning a home. FHA insured loans with a 3.5 percent down payment are now viewed as the subprime of current loans. Even recent potential home seller surveys confirm this perception.

Seller’s perception on loans

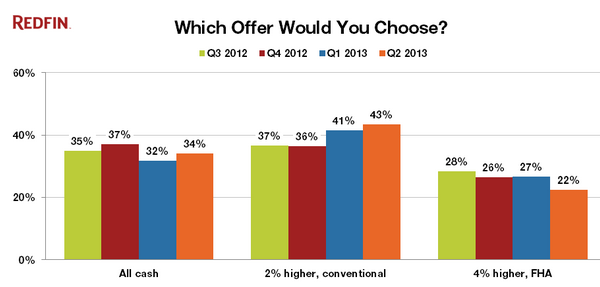

People are under the impression that sellers are somehow oblivious to the differing financing options out in the market. A recent Redfin survey asked potential home sellers what kind of financing option would they choose for their buyers?

Is it surprising that FHA is at the bottom of the list? And keep in mind this is for sellers in various regions. For prime locations, I assure you the figures are much more skewed. Why would anyone take an offer with such little skin in the game when you can simply go with an all-cash offer and know escrow will close without a problem? It really is a no brainer.

On the side of buyers, FHA insured loans have actually gotten much more expensive with mortgage insurance. It is crazy that FHA mortgage insurance premiums can add up to 1.55 percentage points to your overall effective FHA mortgage rate. That is very high in this rock bottom interest environment. Why is the rate so high? Because of legacy defaults but also the reality that you are giving people 30x leverage right off the bat.

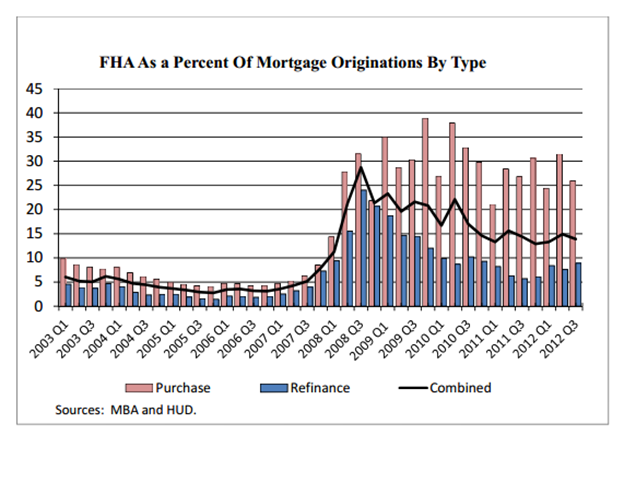

FHA loan volume picked up right in line with the burst of the housing bubble:

Over $1.1 trillion in FHA insured loans are now outstanding. Keep in mind FHA insured loans were never intended to be a big part of the market. For many years they have consumed a large part of all mortgage originations. Even in Southern California FHA insured loans make up 22.9 percent of all purchases (another 34 percent came from all cash buyers).

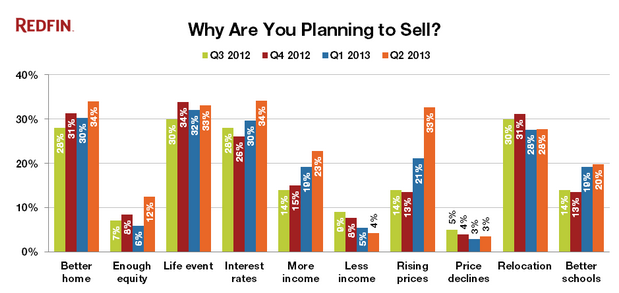

It is abundantly clear that the government and banks are all in on the housing market. We’ve recently talked about the reemergence of interest only mortgages. The market is now tilting to a full sense that home prices cannot and will not go down, regardless of underlying economic fundamentals. What is tenuous about this recovery is that it is being spurred on by massive monetary intervention that has never been witnessed in history. So those that claim they have a sense as to how this is all going to play out have a much better crystal ball. Yet one thing seems certain in the short-term and human nature and behavior is not going to evolve just because we had the worse financial crises since the Great Depression. Take a look at another piece of data from the Redfin survey:

Two big things jump out at me here. The first is that more people are planning to sell because home prices are going up. That makes sense. Yet adding more inventory is likely to help in keeping prices in place or lowering them depending on how much is put on the market. The next one is the “enough equity†section. Obviously perceptions are changing and many underwater homeowners are now reemerging from their negative equity positions.

In most of the country, owning a home makes a whole lot of sense today. Rock bottom interest rates and home prices that have adjusted from the peak make it a sensible move. In higher priced regions, the decision isn’t so clear cut. It is interesting that some think $200,000 is chump change when it comes to a down payment. Yet compounding $200,000 at 7 percent over 10 years will get you close to $400,000 during this time. Will a $600,000 home suddenly rise to $800,000 in this period if incomes are not going up? Right now homes are reaching max levels courtesy of all cash buying, hot foreign money flowing in, and people now leveraging up and entertaining interest only loans again. At least with the interest only loans of today, you need 20 percent down. FHA insured loans are not exactly the Ferrari option in the housing market.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

36 Responses to “Subprime by any other name: FHA insured loans are least appealing financing option for home sellers. The psychology of rising home prices.”

Interesting article, but where can anyone get 7% interest on an investment these days?

It’s there, you need to look beyond the bank.

OK, I’m listening …

DJIA up 12.27% since Jan 1st 2013

To your friends who are good risks you can offer payday loans. You can offer business loans. If your a good risk and have a good track record of performance I know where you can get all the money you want for construction finance at 10%, which isn’t bad comparing it to what we payed in years past , or todays getting nothing from a bank.

You can make money with your money. But you have to take an active role in the business. The days of handing your money over to Edward Jones and relaxing nets you next to nothing. You have to take an active posture. You have to stay on top of your game.

With adversity comes opportunity . The two walk hand in hand.

Anyone making 7% on their $200k… Is making risky investments. Odds are probably 50/50 they lose 7% or more some years… So over 10 years they might break even. Investing in stocks at all-time highs is risky… Any stock!

One phrase in your post jumped out at me:

“compounding $200,000 at 7 percent over 10 years will get you close to $400,000 during this time”

WHERE can anyone get anything like a 7 percent return on a reasonably safe investment? Bank CDs are paying 1.5% for a 5 year or longer CD. There are stocks that pay more, but with risk far beyond the tolerance of most savers and all seniors.

While a house or condo is certainly not guaranteed to keep its value or appreciate, you still have a place to live, which, if bought at rental parity or below, will reward you financially as a defense against rent increases, and give you housing security.

My thoughts exactly. Investing in any asset class today is risky. At least with a house, you have a place to live with a relative constant payment. You are no longer at the whims of greedy landlords. Also from the past five years, the Fed and government will do anything and everything to help the housing market and homeowners. Renters will always be second class citizens since they are not a priority for TPTB.

Good luck trying to convince your wife into renting for the next ten years while our down payment “hopefully” doubles (and don’t forget about capital gains taxes on profits). And what happens if those investments turn sour, have fun explaining that one. If you have a good downpayment today and can easily afford the monthly payments, buying seems like the right thing to do.

LB – You’re quite right that there are no safe asset classes anymore. This suggests that *some* fraction of one’s assets should be invested in real estate – even in such a questionable environment as this. The question is what fraction? At present I have about 15% of my net worth in my house and I’m wondering if that’s an appropriate level. (Yes, I’m probably fishing for another justification to either move up into a larger home or invest in a 2nd property – but the question is valid nonetheless).

* assuming rents go up

** if bought at rental parity

If you don’t know where to find a 7% yield today, then you’re not looking hard enough.

Does your definition of reasonably safe include today’s housing market?

Weren’t the Russian oligarchs getting something like 7% in the Cypress Banks??? Relative to risk, a 7% return in today’s environment is not for the feint of heart.

For some quick flipping action, some bread baking in the oven should command a $10,000 premium on the down, or bait a larger pool of all-cash investors.

A little shag carpeting in the second bath couldn’t hurt.

” It is interesting that some think $200,000 is chump change when it comes to a down payment.”

Just read today that one in five Americans is now on food stamps.

These are some crazy times we’re living in.

I think SNAP is now going to almost 50M people. Not sure if it’s quite 20% of all Americans, but’s pretty darned high compared to 5 years ago.

The divide between the haves and have nots is growing every year in this country. There are plenty of places in Socal where you can buy 200 to 300K houses all day long, unfortunately most people don’t want to live in these areas. So they focus on the premium/near premium areas (just like this blog does). Needless to say, supply and demand will determine prices in these highly sought after areas. Sure, cost of living in flyover country is much cheaper…but that is just not a realistic option that many would even consider. After amassing that 200K downpayment, it’s all gravy from there…

I like the last part of the article. In CA a 20% down payment is just about what a similar home in the Midwest costs. Incomes on California are definitely not five times rest of the country. Which leads me to question why are people in the rest of the country unable to make these $200,000 loans work?

I don’t think most people know when they buy a $600,000 to $800,000 home in California how much to real payments going to be what adding taxes, insurance, and other local taxes and associate fees.

The last $600k home I looked at required $30,000 year!!! The was before payment and interest.

In 1986 I bought my present house for $215000 in So Cal. It is now worth $800k+. I had a salary of $66k back then and put down 20% and financed the rest at 12% for 30 years. My houses appriciated primarily because interest rates dropped during the last 27 years. Now interest rates are at 3% but somehow I cannot fathom financing $700k for ANY house in an environment where interest rates have nowhere to go but UP. Do you know that that will do to housing values. You would have to be NUTS to buy any house now in an environment where interest rates are bound to rise in the next 30 years. Housing prices have nowhere to go but DOWN.

How much have interest rates risen in Japan in the last 20 years? Interest rates may have nowhere to go but up, but that doesn’t mean they’re likely to actually rise anytime in the foreseeable future.

Unclevito, I like seeing the perspective of people who bought almost 30 years ago. As you say, people would be nuts buying today. What is the alternative? Pay nosebleed high rent for the next 10 years? When I tell long time owners what rent is going for today, their head spins. Renters are bent over a barrel today. Why pay sky high rent when you can likely buy a place for the same monthly payment. This is the new train of thought…and it won’t change anytime soon.

You can always refinance a high interest rate. You can never take away the fact that you over paid for your house when interest rates rise. It is better to have a lower purchase price and a higher interest rate. Interest rates will never be this low again. But if you over pay for your house, interest rates don’t really matter. Love the propaganda that rates are at historic lows. Yes, but in some regions of the country (California) prices now are hovering toward pre bubble levels. And no inventory means you will be paying more inflated prices for a house. Who cares about interest rates in this environment.

Great points Sean. Look around at prices in other cities given prevailing interest rates and their markets should be going nuts. But the missing part of the equation is JOBS. The middle class has been decimated due to “globalization” and that is the/was the bread and butter of the US Economy. It makes me realize how out of whack housing on The Westside of Los Angeles really is. Everyone buying the “rich foreign buyer” argument will be sorry, once again. Just pure speculation. Can you say “PONZI”

http://www.westsideremeltdown.blogspot.com

US and Japanese Quantitative Easing

apolitical scientist:

Your assertion made me curious if the Japanese have been all in the money printing business like Bernanke.

According to this 3 minute presentation, they’ve been doing it since the 90’s.

The question then is how and when does this come to an end, since logically both countries cannot continue to print Fiat Money forever.

It also addresses Bernanke’s rationalization on “why” HIS money-printing really isn’t, and how we are not doing the same thing as Japan.

Ipad speech to text fail above.

I don’t think most people realize when they buy a $600,000 home in California how much the actual payment is going to be. After adding taxes, insurance, local taxes mello-ripoff, and association fees it’s extremely high.

The 650k home I looked at would cost $2500 month in taxes and other items!!! Thus if I pay the 650k in cash, 100% down, I still owe $2500 each month forever!

$2,500 seems a bit extraordinary but none the less, this is why you never truly *own* it.

Best case scenario is that you rent the rights to land title from the Government.

Since I have a $600k house I thought I would chime in here Sean. I agree mello-ripoffs would add to the cost (or in some places leased land-ugh) but mine in CA breaks down to an additional $11,300 a yr. Taxes around $6,500, assoc fees $350/mo=$4,200/yr and an additional $500/yr for insurance. (HOA covers a lot). That’s no where near an additional $2,500 a month.

It’s not that people in the rest of the country outside of volatile costal markets are *unable* to leverage up to a $200K loan, it’s that they are *unwilling* to do it at the moment. They are typically more prudent and cautious than SoCal types.

Therefore, the government continues to pull out all of the stops. The problem is that the SoCal mentality is much more susceptible to these coercive tactics and we’re running the risk of burning the outside before the inside is fully cooked.

Everytime someone says interest rates have no where to go but up (which historically would be correct), I hear someone cite Japan as their one example of a country that held rates low forever (which also kept their home values low forever) as an example of the US to follow. I mean cnbc and the mainstream media posts it and all of a sudden its not just plausible, but odds-wise, its spoken as the almost likely outcome. We’re in unchartered territories. If someone has a crystal ball lemme know.

Also, would like joe’s (and sorry, but you too, doc) crystal ball on 7% returns if I just look hard enough. Child please. One of the most ridiculous statements ever unless its just toss a dart at a board and pray QE forever.

This is one of the reasons we’re seeing so much money running into real estate….you can’t get any kind of decent return in anything anymore, so why not get into a long term and tangible asset??

I think this market will have some legs for a while as the public is now interested and there’s a very good chance rates could go down again!

We’ll see – there are tons of ads all over the place here in Portland regarding the two hosts of “Flip My House,” who are doing a series of “talks” at the convention center about how to put no money down and make thousands literally overnight. First off, there’s no inventory to speak of here, and secondly none of the homes that are available are going to anyone but investors who put up money only. I don’t know about CA, but this smells a lot like funny money all over again.

The radio in this area (Cal. Central Coast) is running ads for these two on the radio all the time now.

And yes, it does sound like funny money now – all over again.

Good article. My son is considering buying now. He has saved a good chunk of cash for at least a 20% down payment where he lives. I put him in touch with my realtor for ‘honest advice’ (if that’s possible) since I have know this fellow for years. He gave my son solid advice…..don’t pay anything over $75 per sq foot. He said the market still has at least 20% correction in it and the cost the build right now has never been cheaper for builders since labor costs have plunged due to high unemployment. He said builders are able to build most houses now for less then $50 per sq foot….

These are things everyone should consider. Each local is a little different but keep it in mind…makes sense to me and jives with Shiller’s predictions. In my area builders are hiring immigrants for $6 an hour….pretty incredible….

That is in Texas or some other flyover region – on the east coast, DC area, construction costs are $150-200/sq ft. I have talked to many builders and contractors, this is the going rate in the area. Also, this does NOT include land costs – add in another $300k at least for a teardown. Don’t forget demolition and various other challenges to build. New SF home costs are ~$850k here for anything within 20 miles of Washington DC (excluding SE DC which is a war zone). It is super frustrating here, I lived in Texas and the cost of new build is $100/sq ft for something really nice in the suburbs. If you can get something for under $100/sq ft all in (structure and lot), it is a great opportunity. You pay down property, get a mortgage interest and property tax deduction, and have the luxury of not dealing with a deadbeat landlord (I have had one in the past). Just close your nose and buy, this bubble is NOT popping anytime soon despite my feelings and preference. Personally I rather have higher interest rates and lower property prices but thats just me 🙁

go into the city, make your money and get TFO

Ben or whomever follows him will continue to buy T’s until they have all the suckers on board, then the ship will pull out. (no safe place to put money) why not a house? Why not T-bills, etc) Better than renting (how many times have I heard that one……. I’ve seen four housing boom and busts.

They needed to get the home prices back up to substaniate for all the bad loans. They succeeded in raising prices, and to unload some of the toxic, when they are leveraged to their goal, that will be the end of QE’s. AND also the end of the sellers market, then rents will go down and well, THE WHEELS ON THE BUS GO ROUND AND ROUND ……. It’s not rocket science people. FYI Ben B will NOT be at the annual Jackson Hole Fed mtg this year. Why????? He’s planning HIS exit.

of course houses priced over $600,000 are going to go down if rates go up, but what about houses you buy for $75,000-$150,000 in the inland empire, those will still be worth about the same as what you paid, maybe more if you fix them up a little bit, also the rent from the rental will keep coming in whether the interest rate is 1% or 35%, put the rental houses you buy on a 15 year note or pay cash for them and you will have income for life and an appreciating asset. You cant really lose your a$$ in real estate if the loan payment is less than the market rent can you?

Leave a Reply to ronnie