The Strategic Default World – $100,000 negative equity the pushing point. 12 percent of all U.S. defaults in February were strategic. 30,000 people a month are able to pay their mortgage but are deciding not to.

I’ve been getting a few e-mails from people regarding a study on strategic defaults making the internet rounds. What is a strategic default? This occurs when the current homeowner is able to pay their mortgage but because they feel they are too underwater or simply are sick of the mortgage albatross, decide to stop paying. So much for that pride of ownership. In California with the massive number of Alt-A and toxic option ARMs this is very common. But how common? The article making the rounds actually refers to a study conducted by the Kellogg School of Management. The study is nearly a year old being published back in June of 2009. Since that time, I imagine many strategic defaults were temporarily stalled by programs like HAMP. When the study was released it was estimated that 26 percent of current defaults were strategic in nature.

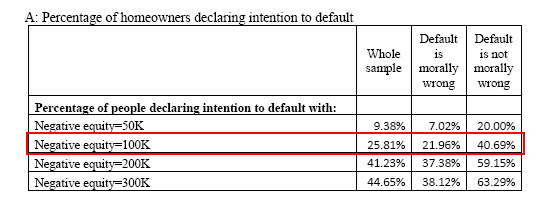

Since California housing is still massively underwater, we should look at break points that push people to strategically default:

When a home is underwater by $100,000 this seems to be the final nail in the coffin. Yet the current median price of a home nationwide is closer to $160,000. So clearly to get to this level you have to be part of the bubble happy states like California, Florida, Nevada, and Arizona.  Other states have these issues as well but clearly if your home went up to $130,000 as a total current value in a modest part of the country, it is unlikely you are even close to being under by $100,000. Compare that to California were the median price neared $600,000 but current prices are closer to $250,000.

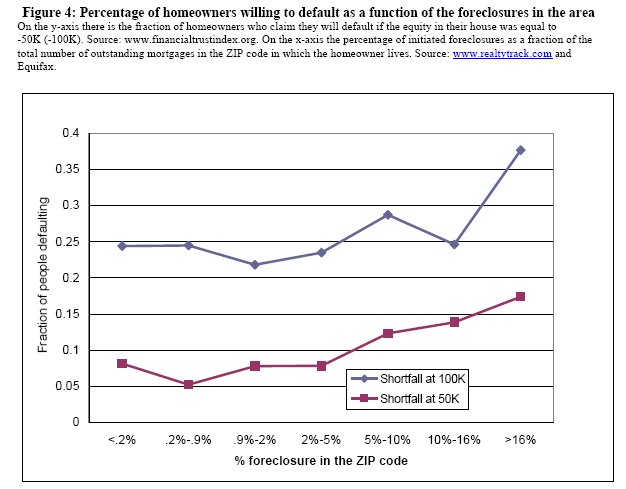

Of course, the more negative equity you have, the more likely it is that you will strategically walk away:

The above chart basically shows that if your neighbors do it, you’ll most likely do it too. All it takes is a few people to realize the toxicity of Alt-A and option ARM products to say goodbye to their mortgage once and for all. The study is a little older but I think many of the facts are still relevant. I wanted to find a more recent study and found one through Morgan Stanley:

“April 29 (Bloomberg) — Decisions by U.S. homeowners to walk away from mortgages they can afford account for an increasing share of defaults, according to Morgan Stanley.

About 12 percent of all mortgage defaults in February were “strategic,†up from 4 percent in mid-2007, New York-based Morgan Stanley analysts led by Vishwanath Tirupattur wrote in a report today. Borrowers are more likely to stop paying their mortgages the higher their credit scores and the larger their loans, the analysts said.

Defaults by borrowers who owe more than their homes’ values are among the biggest risks for the housing market, according to analysts including Zelman & Associates’ Ivy Zelman and Amherst Securities Group LP’s Laurie Goodman. Last month, the Obama administration said it would adjust its anti-foreclosure program to encourage reductions to borrowers’ principal amounts, instead of just the payments they make, to address the issue.â€

According to the study, 12 percent of defaults in February were strategic. Given that we are seeing roughly 300,000 foreclosure filings a month, it is safe to say that 30,000 people a month are simply deciding not to pay their mortgage even though they have the income to do so. We already know that 7 million mortgages are currently in foreclosure or 30+ days late. How many of those are strategic? Not the majority but certainly a large number.

I haven’t seen this data broken out into states but would imagine that California leads the charge. This is based on the fact that nearly 60 percent of all active option ARMs are here in the state. The option ARM is the king of toxic mortgages and is the ultimate financial time bomb. That is why default rates on option ARMs are now tracking subprime loans even though we have barely entered the first recast period:

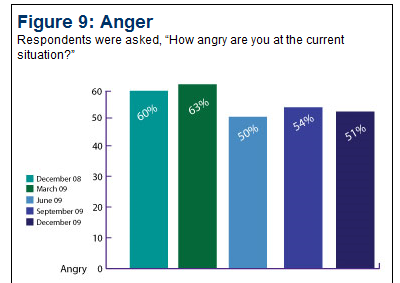

I know many would like to think that this issue has been swept under the rug but it hasn’t. A large number of these loans are still active and are very likely to enter default in the next few years. Banks are being a tiny bit more aggressive on foreclosing since the taxpayer is footing their too big to fail bill. And public anger is still elevated:

From the Kellogg surveys we find that half the country is still angry about the current economic situation and keep in mind we have just witnessed a 70 percent stock market rally. Apparently the bulk of the population wasn’t invited to the party. It is time we have our own Pecora Investigation.

Strategic defaults have also provided a short-term stimulus into the economy. After all, if you aren’t paying a $4,000 mortgage and now rent a $2,000 place you basically have increased your cash flow by $2,000 per month to buy more consumer goods. We’ve seen car sales jump up recently and we have seen spending tick up as well even though the unemployment situation is still near the trough and wages are stagnant. It would be one thing if people were spending more because they were earning more but this isn’t exactly what is happening.

Strategic defaults have a limited shelf life. After two more years, most of the crap mortgages will be wiped out of the system. Then what? I’m not sure we should be excited that a large number of people have stopped paying their mortgages and are now using freed up cash flow to buy more consumer goods. Is this the purpose of the bailout? What a farce.

The fact that we have tens of thousands of people able to pay their mortgage but not doing so tells us that many people are simply following the path Goldman Sachs has laid out. Game the system. Screw the majority. This is how the game is currently being played. Yet this isn’t sustainable. Just look at how the market is reacting with the Greece bailout (you do realize we are partially bailing them out as well?). The current system is rewarding the wrong people and the majority in the public gets this and that is why you see data like the above in surveys. Strategic defaults are merely an extension of this. What people are saying is screw this mortgage and walking away (not before they yank out as many months of free rent before the bank moves on the property). Banks have been doing this kind of crony robbery of the public for decades.

Do I blame people for walking away? Not at all. Without any actual changes to the current financial system why should banks take the corrupt route and expect people to honor their responsibilities? It is the height of hypocrisy but that is now synonymous with Wall Street.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

54 Responses to “The Strategic Default World – $100,000 negative equity the pushing point. 12 percent of all U.S. defaults in February were strategic. 30,000 people a month are able to pay their mortgage but are deciding not to.”

If interest rates stay low do Option Arms still recast at a higher rate?

Those home buyers aren’t blameless. Regardless of what the banks have done, how hard is it to recognize a massive bubble and wait for the inevitable market correction? Anyone who bought a house in California between 2003 and 2008 has to face the fact that they were overpaying and that had no guarantee of selling before the bottom dropped out.

We went through this in the early 90s in California. Numerous people of my acquaintance were stuck with real estate that had gone underwater for much of that decade. In many cases the owner had already moved into another, typically bigger and better, place and had been trying to sell when the market plotzed. So they found themselves with a rental property that in most cases didn;t make back its mortgage and other costs.

But strategic defaults were rare. They held out and eventually the market came back to where a sale could be made without taking it in the shorts. Back then, the credit industry hadn’t gone insane and the average home buyer was a more reliable sort. Because they had to be to get a loan.

What a difference a decade makes when standards are forgotten.

“The current system is rewarding the wrong people and the majority in the public gets this and that is why you see data like the above in surveys. Strategic defaults are merely an extension of this. What people are saying is screw this mortgage and walking away (not before they yank out as many months of free rent before the bank moves on the property).”

Not to mention yanking out the kitchen cabinets (sink/faucet and new granite countertops and all!), light and bath fixtures, bath vanities (and even marble/granite slabs in the new showers) before the sheriff comes a knocking. I’ve even seen flooring – hardwood floors, carpet and even tile torn up and out/destroyed in a nice little “screw you, bank!” scorched earth strategy. Hell I’ve even seen toilets torn out and cement poured down every single drain.

That anger Dr. H B speaks of is there and it is palpable, no matter what the powers that be in their ivory towers in D.C. and on Wall Street pretend the situation is – “recovery well under way, stock market rebounded 70%, etc.”. Hopefully it’s only a matter of time before the shit really hits the fan and this farce comes undone.

You obviously are not one of the unlucky responsible people trapped in this situation.

My husband and I put down 20% on our first home in Arizona. We have put more than 170 thousand dollars of our hard earned money into the down payment, landscaping, painting, shutters, lighting fixtures, ceiling fans, etc all paid with our hard earned cash. Despite our hard work now our house is worth about 100K less than the mortgage because of all the irresponsible people (investors driving the prices falsely high, banks lending multiple mortgages to people who don’t even live in the state or have an income, people buying above their means etc).

We cannot even refi for a lower interest rate because the value of the home is not at least 60% of the mortgage amount, as they require.

The bank wont let anybody do a short refi, why would they when we have been paying (more) than our mortgage each month?

Everyone else screwed up and now we have to be the ones to pay? We have a growing family to think about and are literally prisoners in our own mortgaged home.

We are seriously considering cutting our losses and bailing.

I agree. I think both parties are responsible, but I think the calculations of the bankers were much more diabolical in nature. Sad that it has come to this, and scary that we still have a ton of adjustable rate mortgage resets still to come in the next two years.

One suspicion is that the Wall Street types showed how to play within the law but without commonly held morality, and the public got wise to this and said good enough for me! My suspicion is that in CA there will be a push to make mortgages recourse as in other states, recourse mortgages make strategic default much less attractive, as they require bankruptcy to clear up the deficiency. So in recourse states there are a lot fewer strategic defaults. I am surprised there has not been a push to go recourse nationwide. Of course the home as ATM crowd are in recourse mode at least for the money they took from the ATM.

They might Gael, because on a lot of those option arms people were paying the minimum payment and negative amoritazation is occuring. By the time it comes to reset their principal has increased. I can’t wait to see the carnage.

In general, I am a big fan of your well-researched and thoughtful articles, Doc. However, I think you are conflicted on one issue which surfaces frequently in your blogs.

In this blog, you say, “many people are simply following the path Goldman Sachs has laid out. Game the system. Screw the majority,” followed shortly by:

“Do I blame people for walking away? Not at all. Without any actual changes to the current financial system why should banks take the corrupt route and expect people to honor their responsibilities?”

Is this the “two wrongs do make a right” argument? Is it ok to screw the majority if you are a little guy and the big guys are already doing it? Really?

Anything that involves gaming systems and ripping off large numbers of people is, at best, unethical and, at worst, criminal in my mind. Regardless of whether you are a big guy or a little guy.

Are the “strategic defaulters” ripping off the big banks or all of us “little guys”? A scam artist is a scam artist, whether you be Goldman Sachs or a “strategic defaulter.”

In California, people have already paid extra to have the option of defaulting – it is a non-recourse state, reflected in higher closing costs and written into the contract. Also, the governor recently (a couple weeks ago if I remember correctly) approved a measure forgiving the potential state tax liability garnered from defaulting and eventual foreclosure. So, I wouldn’t call strategic defaulting in California ‘gaming’ the system – the option has been written in there for a very long time, though most mortgage holders were unaware until recently. It certainly wasn’t something the banks were going to mention. Interesting times, to be sure.

I don’t care who’s doing it. Banks, big name money-men or the couple who only owns their house. If they can pay and yet chose to walk away, that’s stealing. No one twisted their arms to sign contracts. They owe the money.

I’m seeing articles that FICO score of a walk-away will recover in three to five years. If this is true then it, in essence, makes the FICO scores worthless.

Weather it’s fiat currency, off shoring industry, banks selling their mortgage potfolios, commission sales driven investments , rating agencies paid by synthetic financial investment originators, flipping houses, obscene bonuses, they all have the same theme: Get mine now with zero accountability and to hell with the other guys future. The only way to discourage looting is to tax absurd personnel income at high rates like we used to. I’m sorry to say that human beings can not handle the temptation of getting rich quick but it appears to be true.

Here’s a nice one from this morning on Yahoo, great look at the complete and utter disconnect between Wall Street and Main Street:

http://news.yahoo.com/s/huffpost/20100504/cm_huffpost/562493#mwpphu-container

Rutgers survey shows 80% of unemployed from last summer were still unemployed in March! Of the 1 in 5 that did find jobs since last summer, over 60% of them just found “filler” jobs to get by. Be sure and read the comments from posters under the article…lots of anger and rage out there and JUSTIFIABLY SO!

@MC… I remember hearing about someone trying to pass legislation that would either impose jail time, or at a minimum, a heavy fine, on anyone who can be proven to be able to pay the mortgage, but chooses to walk away. Not exactly the electric chair, but a step in the right direction.

Let’s face it — society has become all about “do it until it doesn’t work for you anymore”. I don’t want to go off-topic here, but things like marriage, housing commitments, employment, etc. (which I know are all different sorts of contracts) are now less of a commitment, and more of a “let’s try it & see if it works” type of arrangement. Layoffs, divorces and mortgage defaults are all rising, they’re all part of our “naaaahhhhh…. I can’t do this anymore, let’s change it up” mentality.

Employers risk lawsuits when they lay off an employee (yes, even with at-will employment). Spouses face tough life decisions if they go the divorce route when they have children.

But homeowners who just don’t want to pay anymore — they get a 3-year dip in their credit, and then it’s a reboot! What bullshit. Saddle these bastards with the albatross until they make good on their commitment.

Moral outrage aside, I know I would walk away from an upside-down mortgage that would ruin my finances. It’s tough, frustrating, and people shouldn’t have bought homes on interest-only loans – now we all have to pay for their mistakes.

Patrick: Doc. may have simply meant if they have to eat vs. pay the mortgage they’d probably best eat. The defaulters are ripping off the banks, now who ripped off who first?, then the banks are ripping off the little guys anyways. Some people have told me how much their home payments are, and I think, wow that would be easy to stop paying.

I would argue that not defaulting on a mortgage that is more than 100k upside down is financially irresponsible to your family. It would be like getting scammed by madeoff and not trying to get as much of your money back as possible. The mortgage industry was nothing but a big ponzi scam between 2004-2006… why should my kids not be able to go to college because of it? Sure I could pay the mortgage if I didn’t want to ever retire or pay for my kids to go to college, but wouldn’t I be doing my family a major disservice? I’m not saying I have no fault in this, but I owe it to my family to do what is best for them.

Sorry for the double post, but some of you want to put someone who has a job and is paying taxes(not to mention feeding and clothing their family) in jail for not paying the mortgage? That makes a whole lot of sense. Lets take someone who is following the current laws and being a productive member of society, but choosing to make a smart financial move in regards to their house in jail. That way his family will have to go on welfare and he will become a major burden on society. Its not like our jails are already so overcrowded that we are letting violent criminals out. We can’t even handle the real criminals we already have. Some of your are real geniuses.

What about the second mortgages and HELOCS so many of these people took out? If I understand correctly (and maybe I don’t), these strategic defaulters are still liable for those. If it’s anything like bankruptcy, the creditors will go after the ones able to pay. These people may think they’re smart, but their nightmares may be just beginning.

Dguy, you are right about the seconds and HELOCs but only if they were acquired after the purchase of the home. If a second was used to buy the home initially (ie and 80/20 loan for 100% financing) then the second is also a non-recourse loan (in CA). I walked away because my house was ~ $250k underwater. At auction it acutally sold for $212k two years after we bought it for $512k. The tax implications could have been devastating but due to the amount we were underwater when we walked away, we were considered insolvent so we avoided the tax payment on the “forgiven” principal.

DG, as always I completely agree with what you are saying. I seem to recall that you and I were in very similar situations, just on a different timeline. I have to say that buying the house initially was the worst mistake I have made but walking away was one of the best decisions. It is interesting to me to listen to our friends from our old neighborhood who were pissed about us walking now talking about doing it themselves. At least we are year or two ahead of them in the healing process when they finally come to the sensible conclusion that walking is the only way to get out of financial jail and save their family from a financial perspective.

Dguy,

I believe it depends on whether the second mort or HELOC was used to purchase the underlying property or whether it was taken out as a refi later on. Believe the purchase seconds are treated like the first in a foreclosure and are discharged. Not any later refis though. Again, depends on the state as well.

“Anyone who bought a house in California between 2003 and 2008 has to face the fact”

You make it sound like in 2009 housing price suddenly came back to normal.

California as it is today is still grossly overpriced.

Gael, a recast and reset are two different things. A reset means the interest rate changes – up or down. In the case of someone paying a lower intro rate for a set time the rate will reset to the full rate (just like with a credit card) when the intro period is over. A recast means that the principal and any interest you didn’t pay for the first five years is now due, so your loan is recalculated to include that amount in your new payment. Even if rates are lower when the intro period is up than when the loan closed the payment will jump when the loan recasts.

Should we really tar the productive rich with the same brush as the malefactors on Wall Street? Some billionaires actually did earn their lucre honestly- by building productive businesses that rendered our whole economy more productive and that enriched everyone from stockholders to common low-rank employees.

The “burn the rich” sentiment is unproductive and punishes some of best producers as well the bonus boyz on Wall St.

The rich vs poor divide is sad. The real divide in this country is the productive and honest vs the parasitical and theiving. This country has been rewarding parasites and thieves at all socio economic levels at the expense of the honest and productive for too long.

@partyboy

I reiterate a mortgage is not between you and God, but a financial agreement. When the underlying circumstances cause the deal to go bad, it is a legal, financial, contractural agreement–not a moral one. God is not a party in the agreement, although he probably tried to get you to make a better choice at the time and you wouldn’t listen. I’m OK with you. Life’s too short. If you’ve made a mistake, the faster you fix it the better. If you’re friends are pissed they’re not your friends. Your obligation is to your family. God’s more concerned about you taking care of your wife and children than helping Mozilla make his hell-icopter payments and your freinds getting a heloc to go to the Greek Isles (probably a good deal these days, btw).

@C

The Doc was not talking about any old default – like foreclosure to avoid going hungry- this article was specifically about people who can afford to pay their obligations but simply choose not to. Those brilliant strategists.

As for those of you who claim there is nothing unethical about not paying debts that you are capable of paying because it is not illegal…can’t the same argument be used for Goldman Sachs for their many shenanigans? If they were acting legally does it follow that they were ethical?

To me, not honoring your obligations (when you are capable of doing so) and expecting others to cover for you may be the best decision for your finances but I don’t buy that it is ethical.

And let’s be real, “strategic defaulters” may rationalize that they are only screwing the banks who fooled them, but with all of us backing and financing the banks, we (taxpayers and future taxpayers) are all footing the bill. Your neighbors and friends get to help pay your unpaid debt, not just some anonymous rich guy “getting a heloc to go to the Greek Isles.”

Last month while at B of A, a loan officer was calling Home Debtors and offering to refinance loans presently at 7% with a 5% fixed no fee loan. Loan officer told me they were offering this product to people who were current on their Fanny Mae owned loans. It’s very difficult to know how many are getting or will get loan mods and or principal reductions. Combined with so many getting away with not paying on their mortgages, perhaps…….???

What percentage of the risky loans has been purchased by Fannie and Freddie?

@Patrick – re: “do two wrongs make a right?” – I’d probably always argue that they do not, but in this case, they do. When the gov’t bailed out the banks, they essentially sent the message “don’t worry about your mistake,” while they left everyone else out in the cold. It’s not like the people defaulting aren’t losing any money on these deals (down payments, closing costs, and whatever payments made). They are still getting screwed. To me, defaulting just distributes the repercussions a little more equally.

Also – I also doubt that 100% of “strategic defaulters” had the money and just choose not too. There are many people that see what’s coming 6-12 months down the road and are just getting a jump start. People also act like these banks laid out all the cash for these purchases. They are just numbers on their balance sheet right now. The problem is they spent…err…gambled future money depending on those payments, while also paying out massive commissions at the time of sale. If I loan my dirtbag friend $100 bucks, I know the odds of me seeing that full amount are slim. I certainly would not be putting $100 on my receivables balance.

If everyone is that concerned, why dont we have a mortgage default affect a credit score by more than a meager 130 points? Oh right, because then there would be NOBODY to buy homes.

@Pat’s 2nd comment – true, but the problem is, this stuff already happened and there is no avoiding the pain now. Now matter how you slice it, we are paying for it. If the number of foreclosures reduce, then prices won’t fall, and thus someone like me will have to overpay for his first home.

All these “strategic defaulters” want to take the rest of us down with them.

Short-term thinkers that they are, they do not want to grasp that a college education for their kids won’t matter when there are no jobs – such as in Argentina that has gone through a currency collapse. Architects driving taxis – that’s what we’ll have here.

Actually it is between you and God (please leave Him out of your delusional thinking):

“The wicked borroweth and payeth not again….” – Psalm 37:21

For “Kid Charlamagne”

Actually it is between you and God (please leave Him out of your delusional thinking):

“The wicked borroweth and payeth not again….†– Psalm 37:21

Were the heads of all the cigarette companies who after being sworn in and asked in a Congressional hearing to raise their hands if they personally believed that nicotine was not addictive breaking the law (they all, to a man, did raise their hands)? No. Were their families better off that their actions forestalled anti-smoking legislation longer so that they could continue to make huge salaries and bonuses while society in general suffered? Yes.

This is just one of innumerable examples of where one can act within the law while hurting the greater good and justify his/her actions because it benefits their families. Give me a break.

The Powerful banks met their match: Strategic Default.

It IS every man for himself out there. Always has been; always will be. Spare me this moral outrage at your fellow man.

Morally, I don’t agree with strategic defaults, and i don’t agree with government bailouts. But that doesn’t matter. What matters is this is the reality.

For anyone to expect anyone else to do something for the good of society at the expense of their own well-being…well…you’re naive. And a Communist.

That’s like saying it’s unpatriotic to short the Market because so many people’s 401K’s are tied to the Market. Um, NO. The fools that create the bubble are the one’s that are creating the imbalance. The people shorting are the one’s fixing the problem.

Looking out for yourself first and foremost is the definition of Capitalism. It has been proven as the best system for increasing the standard of living of a people.

So default away as far as i’m concerned. That’s not the problem. The problem is government rewarding that behavior and creating a worse bubble.

DG…people should be held accountable for their actions. No one forced you to buy that house. Buying a house is a gamble if you are in it for an investment. If you buy a house as a home to live in forever and not an investment then it should not matter if it goes down or up in value. No way is your situation even close to the Madeoff scam. Yes, the mortgage industry was a big ponzi scam BUT you jumped on the band wagon, you could have rented and waited it out. So is jail time right for people like you, no, but you should be held accountable more than you currently are.

Mortgage defaults, whether done strategically or not, has NOTHING to do with ethics. It is a contract between a borrower and the bank. The borrower agrees to pledge an asset (the house) to acquire X amount of money from the lender (bank). According to the contract, the lender will take the asset (the house) if the borrow defaults on the loan. Whether the borrower is truly able to make payments or not is simply irrelevant according to the contract. The borrower is simply choosing to exercise his right “put” the asset to the lender. And lastly, it certainly is not stealing by the borrower because the bank gets the asset (the house). The lending bank, by initially writing and accepting the contract, was WILLING TO ACCEPT THE RISK OF DEFAULT. Hence, they charge the upfront fees that are initially involved.

A mortgage is a 2-way agreement. Bank loans you the money, while holding title to said house as collateral. The understanding is that if payments are not made the bank has the option of taking the house back. I see nothing wrong with anyone choosing that as their exit strategy. In essence they *are* repaying the bank, by giving the house back! The bank, after all, did accept title to the house as collateral. The buyer always has 2 options, repay the loan in cash, or return the property. Again, the bank agreed, up front, to take the house back if the loan wasn’t paid. If they didn’t like the the odds, they shouldn’t have made the bet!

The reason people get ethically upset about defaults perhaps has nothing to with the concept that it is a contract between the borrower and the bank. I think people secretly suspect that THEY and not the banks are going to be the one to pay for these defaults though their taxes. And they are ethically outraged at the EXTERNALITY being passed on to the taxpayer. Now, I don’t know why they’d think this … oh yea it’s because we continually bail out banks whenever they get in any trouble. Duh. And if this is the end result their outraged is NOT misplaced. Why should some innocent permanent renter have to pay increased taxes to bail out someones irresponsible home bet and the irresponsible bankers who lent it?

Oh boy we sure shouldn’t have gone down this moral hazard road in the first place should we? Oh what we have sacrificed to allow not only less than 20% but less than 10% down mortgages! And why? Because it sounded so nice to get something for nothing and we didn’t want to regulate or dampen an economy fueled by low interest rates?

It is all coming back. Today I read in OC register the OC 90+ days delinquencies are at 8.33% exactly 3% up from last year. So is CA and USA all three of them up with around 3% up for year…

Today DJ was down at one point almost 1000 points (about 9%) just to recover and loose only 3.2% for the day, tree days in a row loses… Talk to me for recovery baby! Zombie economy is coming! It is back to haunt us and the gov have no ammunitions to pump positive expectations…

For those that think it is ok to choose an “exit strategy” and it has nothing to do with ethics, well it shows your INTEGRITY. The frenzy of buying over priced houses at the height was mostly fueled by greed. Now it is coming back to bite people in the butt, and they will try and justify what they did anyway possible.

@Mistrial

True,

There is no simple way out of this; however, the point I was trying to make is that it is a financial contract. You did not put your hand on the Bible, like there’s one within a mile of any title company. Just because you don’t want to see your RHG head towards a rational level doesn’t mean your neighbor can’t declare: “I got screwed. I’ll be paying into negative equity for the rest of my life” and realizes it before you do. Too bad. Sue him. This is not your typical bubble. This one will destroy an entire generation. The DOW lost 1000 points in a couple of hours before the PPT stepped in and bailed out Wall Street yet again (thank God). (btw, anyone see Freddie needs another 11B? Doc call that one?)

I’m not the smartest guy on the blog by any means, but in almost 60 years I’ve seen a thing or two. This is true and you can take it to the bailed-out bank: You are on your own. Get used to it.

@Patrick

Good point, but one issue with GS is that they have their tentacles in all of government and helped get rules changed. But truly, they did break the law. You need to read a little more. It is hard to pin a suit on the largest army of lawyers in Manhattan and they will probably squirm out of this, if only by the Trump defense (I’m taking the economy down with me). Today may have been a shot across the bow. Who knows. If the strategy going in was to strategically suck cash out of the house and drop it, that’s unethical. To find out you bought a tulip in the mania and now they have them at walmart for 3.99 then the financial deal went bad and you choose to reneg on the deal as a financial decision. Think Wall Street consults with the Rabbi before they screw an entire country? I doubt it.

I’m not sure why everyone is so wound up about fort stinking desert anyway. It’s nice and green here…

@Mistrial

Can I get this straight: You are in a home that you paid way too much for so you want to see the bubble perpetuated so you don’t lose your phantom equity? If the market does not support your ‘value’ evenutally you will lose it. Just a matter of when. At least your property taxes will adjust to a more proper valuation, although the state in 30B debt will probably somehow filter down to your tax rate. I’m sorry. I really am. That’s why I’m here because we are all screwed and I couldn’t find anyone else to see that the emperor had no clothes. I just hope a few know-it-all 30-year olds can realize there’s a big problem and not wreck their financial lives. We’ve seen this movie already.

DG – a lesser evil is still an evil. i don’t believe that people who walk away deserve jail time. they should be tagged with a fine and be subject to stricter rules when they take on their next debt. [i.e. pay 35% down on their next home purchase]. like many other laws, one should be granted a greater freedom until there is reason to restrict it. think of it as a financial jail/rehab center.

sanderson – people make mistakes. sometimes you get caught into it and before you blink, you’ve already signed on the dotted line. not that walking away is the right thing to do, but if i were to have made this mistake, and i had a family, i’d walk away too 99 out of 100 times, and i’m leaving that 1 for a miracle case. i can certainly blame such people, but there’s always room for empathy.

Guys, for those of you waiting this out, let’s have fun till waiting … Check this out

http://www.redfin.com/CA/Torrance/22816-Anza-Ave-90505/home/7717752

1208 days for sale and still “activeâ€!? Wow, for sale starting from 14 january 2007! Dude, this is before the credit crunch! The world was flat back then! And still no significant price reduction like …you know to sell the damn thing!? I know, I know you have enough equity (because no resent sales show) to wait for the rebound, but I am patient too… Bwa-ha-ha! Wow, RHG Torrance style!? How long it takes to sell now!? What is the new normal, 5 years? Bwa-ha-ha! Yep, great investment! Bwa-ha-ha!

Kid Charlamagne:

First its “Misstrial” not Mistrial.

2nd, reread my post re God and repaying debt. I close the post that this scripture is for Christians.

Obviously you are not, so the scriptural command would not apply to you other than being counted among the wicked. *shrugs*

btw, in reply to your second post, I am a long-time renter and am debt-free with a $210k/yr income. I did not contribute in any way to the housing run-up or bust; as a matter of fact, I was victimized by it by way of ever-increasing rents.

I really don’t need any observations from a member of the generation who helped cause it all. Thanks!

@ed

Well put and I agree with what you say. Surely the leaders of banks and mortgage companies, followed by the fund managers on wall street who love them, are the ones most cynically responsible for the mess we are in. Regulations to stop the madness were either not enforced or non-existent, for which the blame lies with our government. Both parties. Finally, all eligible voters and citizens are ultimately responsible as it is up to us to keep an eye on what is going on upstairs, so to speak.

The problem with the debate over individual actions and reactions is that there is a different story out there for every different kind of defaulting homeowner. Some of them are heart-wrenching accounts of human tragedy, some are just tales of financial ignorance, and some are blood pressure spiking stories of calculated scams. All of the stories are true.

This article was focused on the “strategic defaulters” who are defined as those who are following the GS path of “Game the system. Screw the majority.” Whatever their numbers, there are individuals (& families) operating right now who are ripping us all off , walking away from bad debts that they signed up for and cashed in on. Like the banks, they took the rewards and are now passing along the bad bets to all of us. Again, non-existent regulation makes this legal perhaps, but not ethical.

How do we sort it all out? It is clearly impossible to sort the cases to make the outcome just. Our focus as a society now must be to stop the bleeding. We must get this mess regulated so that neither companies nor individuals are allowed to “Game the system. Screw the majority.” Not without serious consequences.

Ethical systems are needed for social stability and economic health. So, empathy – yes. But, a little anger is justified and needed too right now…

@Sorry Miss

no only have time to pop in here and didn’t read you thorouly. I’m scared as hell and just want the truth no matter how bad it is.

Speaking of education costs, I just listened to the podcast of PBS Frontline’s recent episode “College, Inc.” Very interesting for those interested in the housing bubble. Colleges like Phoenix University have been building up another debt bubble –recruiting students who were not college prepared and throwing Federal student loans at them. Some of them are loaded with debt, but their degree lacks accredidation to get a job. Meanwhile admistrators of these universities are making a fortune –basically making a fortune off federal student loans, while students take on the debt, and tax payers pay for it.

http://www.pbs.org/wgbh/pages/frontline/collegeinc/?utm_campaign=collegeinc&utm_medium=googleads&utm_source=news

Re: 5/4–I’ve had to think on this one awhile.

~

If money is debt, and debt is a promise to pay that allows the banking system to conjure currency out of thin air, and that promise to pay is the only real currency in our system…

~

…then foreclosure/defaulting (intentional or otherwise) is a destruction of money at a ratio of at least 9:1, isn’t it?

~

So if a single house-debtor defaults on $100K of mortgage debt, they not only take out of circulation that $100K, but the nine to 30 times’ worth of money created by that debt in the fractional reserve system. Ergo $900,000 to $30 million.

~

Doc, correct me if you see it differently. In my mind this puts a whole new spin on “strategic defaults.” It isn’t about morals. It’s about numbers in a system.

~

rose

“Speaking of education costs, I just listened to the podcast of PBS Frontline’s recent episode “College, Inc.†Very interesting for those interested in the housing bubble. Colleges like Phoenix University have been building up another debt bubble –recruiting students who were not college prepared and throwing Federal student loans at them”

Well a lot of students are not prepared but they learn at college. With the CA K-12 education system having been a disaster for decades this is inevitable.

“Some of them are loaded with debt, but their degree lacks accredidation to get a job.”

This I’ll believe, their degrees are considered inferior to even state colleges. HOWEVER if all of these students went to state colleges instead the market for college graduates would also be too flooded to employ them all (and really almost is already). Formal education has become a bubble.

Kid C –

No worries. As Americans we should be concerned about national debt and irresponsible and short-sighted federal and state policies.

Take care, and fear not. You are aware and informed. You’ll do OK.

~Misstrial

@Rose

Since the1M made 30M, than one default would still leave 29M so the destruction should be the reverse ratio. Robert Pretcher of EWI explains how there really are no viable reserves anyway, and it is all pure fiat now. They just say a bunch of CDO’s are worth 3B; thus, they have 60B of play money to make. Since they don’t hold the mortgages but sell them, the multiplier effect comes in and they can then create more money from the fake money that paid for the sold tranches. Of course, the real money is in the swaps bet on the CDO’s and…what in the world has Wall Street created?? This surely will not end elegantly.

well, we thought that we were doing the responsible thing by having a fixed 30 year mortgage on the house with money down and has been paying it down almost $100K. So with our home price $130K up side down from how much we currently owe on the mortgage, it still doesn’t make sense for us to strategically default since we’ve already got a lot of money into the home. So I guess we are really the “dumb heads” nows. The whole thing is just so messed up!

Leave a Reply to Misstrial