Sins of Years Ago Come to Haunt the Housing Market: Foreclosure is a Slow Process in California.

Even though things appear to be deteriorating rapidly and are shocking the public and officials, this castle made of mortgage sand was built over a decade of frankly irresponsible greed and corruption. There really is no way of sugar coating it. In the middle of it all, there was ethical behavior and those who acted as agents of financial responsibility but an incredibly large number of folks inflated the market. The power bestowed on this large number of people simply created a market that has no way of being supported try as the government may. The philosophy is inherently wrong. There are a small handful of politicians that have the backbone to flat out say that this was a decade long spending spree built on debt and now the edifice is crumbling like the walls of Jericho. If you really cut to the core of all bail outs and crutches being placed on the market, you will find that many still somehow believe that peak prices were warranted and the only reason prices are going down is because of lack of credit.

In fact, I would argue that even if we were to bring back all the no income, no documentation, and no pulse products the market would still be collapsing because the wizard has been exposed. This is like revealing to the public a convincing argument that the world is round. People did not accept this truth for sometime but eventually they did. This psychological stage in any mania has been seen time and time again. Think about the technology bust and how we had a few precursors before the actual market tanking yet people preferred to ignore these cues. Think of the case of a person making $14,000 being able to get a loan for $720,000 and which was publicly announced in May of 2007, way before the credit crunch.

Or what about the man that was given a few more decades on his mortgage and he was 100 years old? Apparently, this housing golden era was also going to be the fountain of youth. These upcoming weeks will , in my opinion via earnings, show the sins of housing past. This week we have 65 S&P 500 companies reporting mostly financials and big hitters such as JP Morgan, Merrill Lynch, and Washington Mutual. General Electric, the third largest company in the world just showed us how deep and pervasive this housing bust is going to be. What was disturbing about the earnings miss is that General Electric is an extremely diversified company and is a microcosm of the entire economy. This wasn’t your typical investment bank coming out and telling us that as it turns out, their triple-AAA rated bonds are as valuable as Monopoly money.

A suggestion for fixing these ills has been to create a market where these lenders and note holders can bring their paper and trade in a transparent market such as the New York Stock Exchange except for asset backed paper. Of course, the institutions and Wall Street balk at this idea because they fully understand the extent of junk they have on their books and would be forced to mark these things down or at least take whatever the open market would offer. You have a better option by going over to the Federal Reserve and exchanging absolute garbage for U.S. Treasury securities nearly on par. Frankly, this is insanity and as such, I’ll be leaving up the button to contact your local representative up on this site permanently on the right sidebar because I’m sure that I am not the only one that feels they are taking crazy pills.

Housing has many Skeletons Looming in the Closet

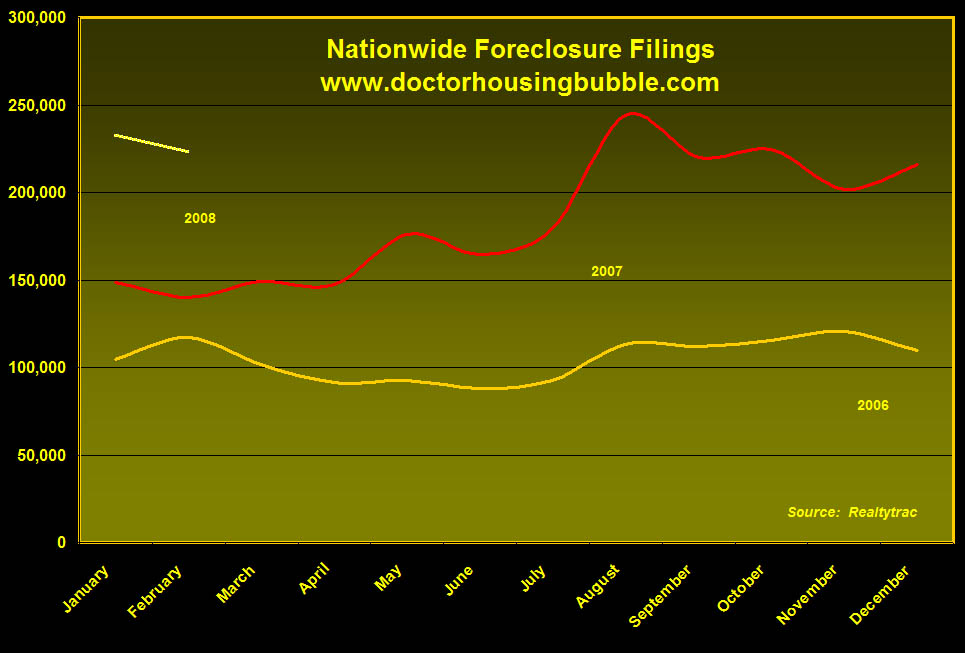

As we keep hearing about the growing amount of foreclosures, we need to pause and realize that foreclosure is a long and lengthy process. Tanta over at Calculated Risk has an excellent post that talks about changes to Maryland’s foreclosure law and the length of time it takes for a home to go from one missed payment to REO. However you want to slice it, foreclosure can take anywhere from 250 days to nearly a year. The homes that are hitting the market were already having problems many months ago. First, many homeowners that actually want to stay in their home (I would venture the majority) fought to stay current by drawing down emergency funds, credit lines, and retirement accounts to stay current on their home. The first missed payment was possibly a capitulation that they were simply having a quixotic fight. The onslaught of foreclosures hitting the market is simply a realization of what has occurred over the past decade especially during the peak years of 2005 through 2007. Take a look at nationwide filings of foreclosures I have put together:

The numbers have been steadily increasing for the past few years. Instead of putting restraint and applying a little pressure to the brakes, the industry decided to step on the gas and run this market into the wall we are currently hitting. Now they want a miraculous cure to fix the wreck but this car is unsalvageable. We are going to need new policy, new enforcement of regulations, and a government that is willing to stop this eternal boom and bust cycle. The current leadership has proven utterly incapable of doing this. We need leaders that are willing to look us squarely in the eyes and be honest about the magnitude of this mess we now have infecting our nation. I’ve noticed that a few people in the discussion forum were talking about buying in the current market. I’ll go ahead and show you a highlight of current market preforeclosures and show you how the creepy past is now being exposed and maybe, this will make you look deeper before you buy:

*Source: Foreclosureradar.com

Here is a brief look at some homes that are in some form of distress in Lakewood California, a middle class area of Southern California. I’ll use this city for the moment because one of the readers in the discussion board was looking to buy here. As you can see from the above chart, the loan amounts on many of these homes are through the roof. In a market that is deflating, debt is public enemy number one. The reason for this is that as the price of the underlying asset goes down, your debt stays the same thus forcing you to pay more for a depreciating asset. Basically you are stuck paying for something that has lost value. Now take a look at some of these estimates above. These are insanely optimistic because looking at sales data and price, from DataQuick we get the following:

| City | Sales | Median Price |

| Lakewood – 90712 | 23 | $430,000 (down 19.9% YoY) |

| Lakewood – 90713 | 11 | $450,000 (down 15.9% YoY) |

| Lakewood – 90715 | 5 | $394,000 (-22.1%) |

The data above is accurate up until February of 2008. Now how many homes are available for sale in Lakewood? How about 348. At the current sales rate from the latest month of data we have 11.2 months of inventory. 38 of these homes are distressed sales. So you can do the math and figure out that prices still have a way to go on the downside but what happens when you are already locked in to a high price mortgage? Welcome to the endgame. This is happening in the majority of the 88 cities in Los Angeles County. The only option for those that are facing trouble is to either do a short-sale or let the long drawn out process of foreclosure take place. Many lenders for whatever reason are holding out thinking this spring and summer will once again bring back the seasonal bounce. The mess is so deep that any seasonal benefit will be negated by the onslaught of foreclosures and REOs.

The sins of the past are coming up and showing up on a daily basis. Everyone knows that the nature of a bubble is to burst, this one included.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

12 Responses to “Sins of Years Ago Come to Haunt the Housing Market: Foreclosure is a Slow Process in California.”

There is an interesting article on SFGATE today. Fannie and Freddie must be getting frightened for they released this story warning folks not to walk away from their loans. It had the usual dire warning about the consequences to your credit rating but more ominously they said they would pursue walkaways for deficiency payments in those states that allow it AND possibly have the IRS go after people by declaring the defaulted loan INCOME! Being told you made a few hundred thousand dollars extra and haven’t paid your taxes on it might make a person think twice about walking away from a GSE insured mortgage! Then I read an article from the Houston Chronicle on how their real estate market is doing. Not bad. More jobs in Houston than anywhere else in the nation thanks to oil and gas. What caught my eye was how they expressed their real estate prices in terms of price per square foot. The median Houston area home costs just under $75 per square foot. I immediately thought of DHB’s RHG with their per square foot prices close to $1000 per square foot! A lawyer was trying to sell his all brick home in an upscale neighborhood for $770,000 or $220/sqft. and had no takers. That’d be a 3500 sq. ft McMansion and all brick homes, for those in California, are what ‘real’ homes are made of if you don’t live in earthquake zones.

So even with a good economy the problem of qualifying for a loan is hitting everywhere. I’m not familiar with Lakewood but DHB’s data indicates homes there are valued at $400 or so per square foot. Even allowing for a possible higher construction cost in California, though I doubt that would be the case for a vinyl clad house versus a brick one, and higher property prices we have a serious disconnect here when you think of that Houston lawyer’s home in a toney

Houston neighborhood vs these Lakewood prices. Given that developers have been dumping building lots all over Socal for as little as 10 cents on the dollar and, even allowing for construction costs to be 100% higher there than Houston,

which I doubt, it would appear to me a developer, were there a market, could churn out new 1500 sq.ft home in SoCal for under $400,000 and make money.

Credit score…no big deal…..IRS BIG DEAL…..I would love to see an article where this actually happens…alas……i doubt it ever will……walkaway a winner

People are not panicky yet… but they will be. It will happen when we see Foreclosures in Laguna Niguel/Mission Viejo/Rancho Santa Margarita. These people haven’t hit the wall (yet) but I’m sure we’ll see the same set of statistics… these “average people” in South Orange County are leveraged to their eyeballs and believe that OC will somehow be spared in this collapse. When my co-workers tell me this, I say: HA! Let me know how that works out for ya, ok? HAPPY RENTER HERE!

http://www.irs.gov/publications/p544/ch01.html#d0e910 shows the specific rules that the IRS applies to defaulted mortgage debt.

The SFGate article is not ‘new’ news. See the NY Times article last Aug 20 2007 (note how close after the meltdown on Aug 16 this was): http://www.nytimes.com/2007/08/20/business/20taxes.html?_r=1&ei=5087&em=&en=f7a1269ba284eef5&ex=1187755200&pagewanted=all&oref=slogin

IMO, a conclusion we might draw from this post is that, since FC takes about 8 to 12 months to conclude, and jobs are down, anyone who expects a short-lived ‘dip’ to price declines is ignoring the elephant in the hallway. We can see his trunk – but the bulk of his body is still coming, and so is the stuff on the other end.

There are plenty of bulls s*itting over on OC Register blogs, who like to declare that ‘it’s different in OC’ – primarily because the weather is nice. And for once, I’ll disagree with you, DHB – if the toxic slime loans came back, I’d wager that much of OC would gladly drink the kool-aid again, so they could give the appearance of being ‘rich’, or at least, to stave off having to move from their nice neighborhoods. Then again, as even the bulls like to say, it’s different here. As in – delusion might be a form of fluoride – it’s as if it’s in the water.

“Many lenders for whatever reason are holding out thinking this spring and summer will once again bring back the seasonal bounce.”

My brother has finally given up. His home he bought for 300k is now worth 200k and he is going to ask the bank to accept a short sale. I don’t think they’ll do it til’ later this year though.

Hi Dr. HB,

It’s been awhile since I’ve written, but love your website. It gives me hope. Thank you.

Here is a funny story. My husband and I were planning on buying a house about five years ago in Glendale. It was at 560,000 for 1300sq ft. We had the contract, but I think the seller got a better offer and wanted to cancel ours, because they were asking for a deposit of $20,000 right after the inspection. The house was okay, but there were few things wrong with it. We got cold feet and backed out by not depositing the money. We didn’t want to tie us down so that we were slave to the bank. Now it’s back on the market and it’s owned by the bank. They want $539,900 for it.

Here is a question for you, if we have the money and the income to buy this, do you think we should buy or should we just wait? My husband think we should wait another year.

I have mix feelings, because we don’t want to leverage too much for a house.

If things are going to get worse, I’m willing to wait. We don’t want to over extend ourselves so that we’re forced to work for the bank.

Thanks again.

Crazed in Glendale

Via Mish, a link to the IRS site about how they may deal with the tax liability.

http://www.irs.gov/irs/article/0,,id=179073,00.html

@Crazed

All major expenditures – investments, if you will – depend on several factors, under these primary headings: risk tolerance and solvency.

What is your timeline for remaining in the property?

What is the likelihood of continued employment? And related, prospects for income increases? Then, what is the relative tax savings compared to the standard deduction?

What is the opportunity cost for the down payment? That is, what might you expect to earn on the funds if you did not use them as a down payment?

How much other inventory is on the market in the locale that you like?

What is your family situation – kids on the way, good school district, close to employment / family? These ‘intangibles’ become more tangible once you start driving further or shorter distances compared to similar properties.

You don’t say what the offer price was in 2003. If it’s close to that $539k, what does that tell you about the market? At 1300 s.f., the cost/sf is just a hair under $415. Is that common for the area?

It’s impossible to time the market, up or down, but the data suggest that the market still has room below. Waiting a year, then, appears to be prudent, but your personal circumstances may dictate buying sooner.

Exit, read the links you provided and I’m still a bit confused. For one thing whether your mortgage is non recourse or not maybe totally dependant on what

state you live in if the mortgage contract is not explicit on this. I suspect most are but I don’t know that. IANAL but it also seems possible to me to argue that a walkaway is doing something beyond not making required payments on a loan. They are unilaterally abrogating the contract IF they have the means to pay and causing injury to the other party by doing so. I’m sure contract law has to be full of precedent in this type of situation but I don’t think I could get away with deliberately refusing to honor a contract I am capable of fulfilling simply because I no longer find it advantageous. In any event, Congress, should it wish to could change the tax consequences of this as quickly as it changed the tax consequences of a short sale this year. If, as the rather ominous comments by Wachovia’s CEO today indicate, the mortgage models used by WB and others are no longer operative owing to a significant change in the behavior of debtors one might expect Congress to act to prevent financially capable homeowners from escaping unscathed by walking away.

Hi Dr. HD,

We’re a couple in So Cal who did everything the way we ‘should’, i.e., bought in the best part of the nicest centrally located neighborhood we could afford, when the prices were still low in 1999, got a 30year loan @ 5.5%, put 20% down, never used the house as an ATM, put in a ton of sweat equity…

Last year we found our dream property in Costa Rica and were ready to cash in on our investment here and semi-retire down there. However, as soon as we came home, we didn’t even have time to clean up for sale before the market took a nose-dive and we had to cancel our offer on the house down there…

Now we’re wondering how much longer we are going to have to stay here and work… When will the prices go up again to where they were last fall?

Anyone with a crystal ball willing to make some guesses? 5years? 10? 15? Never?

Some doom sayers think we’ll have the next big depression and think we ought to sell now anyway, and get whatever equity we still have, others are very optimistic saying it will be back up again in a few years… I’m confused!

Thanks, any comment much appreciated!

When will it be back up again,

I think your answer really depends on the health of the overall economy. If things improve, people start to make more money and business continue to stay in california conceivably it is possible that in 10 years it would be at bubble prices again. However, right now I wouldn’t put my hope in it.

Thanks Exit,

To tell you the truth, I like the apartment we live in. It’s in a better and convenient location, and I’m not sure if I’m ready to maintain a home yet. I actually wanted 3 to 4 bedrooms with 2 bathrooms. The house we are talking about only has 3 bedrooms and 1 bathroom. If it has an extra bathroom, then maybe I might consider buying. However, now I’ll just wait and see. I’m willing to take the risk. I’m in no hurry to buy yet. As long as the price stays the same, we’ll just have bigger down payment.

What is really cool is that because we didn’t buy the house in 2005( sorry it’s 4 years instead of 5 years ago), we ended up buying income properties with positive cash flow. : ) Maybe that is the way to go.

I’ll hold out for something better, 3 to 4 bedrooms with 2 bathrooms.

Thanks

Crazed in Glendale

@Scott – I guess the dreaded ‘consult your tax advisor’ – but not TODAY! – comes into play. Rules vary by state, and by the status of the loan. If it was owner occupied, or investor, if it was purchase money, or cash-out refi or 2nd/HELOC, was it residential, or commercial, was it “ruthless”, or unintended. How big the loss is, and whether the defaulting party has any other means to make good on the debt.

I concur, the whole ‘walk away’ issue is problematic (look at Calculated Risk for some good comments.) “Ruthless” foreclosures, when the borrower has the means to pay but chooses to default are supported by some (including Mish) because ‘the big corporations do it’. This line of reasoning goes something like, why should only individuals have to play by the rules, and corporations not?

Now we get into moral hazard….

Oh well, if Ug99 (http://www.farmandranchguide.com/articles/2008/03/13/ag_news/production_news/pro10.txt) comes to this country, we’ll have bigger problems to worry about than collapsing house prices. Collapsing food stocks – THAT’S the real worry.

Leave a Reply