Thanks to the Housing Bubble, I Made $500,000 with a High School Diploma: The Stockholm Syndrome and Defending the Perpetrators.

Today the market tumbled again reflecting the underlying reality that earnings are much weaker than expected and this will have a long and deep impact on our economy. This isn’t going to be a minor downturn but potentially a severe one. The market wasn’t dragged down heavily even after all the craptastic data we got this week, that is until General Electric came out and blamed their earnings miss on Bear Stearns. This tiny little caveat was enough to wipe out $47 billion in market cap for the big GE. Of course, General Electric has a huge financial arm and we all realize that this is not the place to have your money in the current environment. Here is a fast and hard rule; anytime you hear someone saying “slam dunk” or “in the bag” run the opposite way:

“GE declined 13 percent in New York trading, wiping out about $47 billion in market value and sending U.S. and European stock markets lower. Immelt slashed the company’s 2008 forecast of $2.42 a share, a goal he said in December was “in the bag” and repeated on March 13.

Bear Impact

Fairfield, Connecticut-based GE’s stock dropped $4.70 to $32.05 at 4:15 p.m. in New York Stock Exchange composite trading, the biggest percentage decline since October 1987. The shares had fallen less than 1 percent this year compared with a 7.3 percent decline in the Standard & Poor’s 500 index.

Immelt blamed the earnings decline on a seize-up in capital markets that forced GE to write down the value of loans and Chinese securities it held and thwarted some asset sales in the quarter’s final two weeks. The situation worsened after the Federal Reserve announced a rescue of Bear Stearns Cos. on March 14, the day after he had confirmed his annual earnings forecast on a Webcast with investors.”

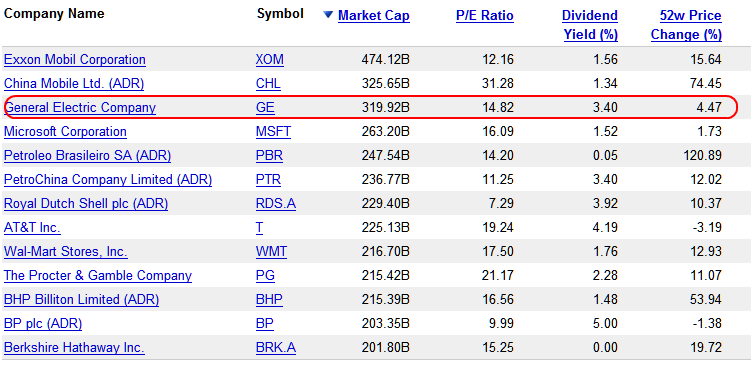

If this is what happens when people say they have it in the bag I think most want the out of bag option. Clearly nothing was in the bag and blaming Bear Stearns for GE’s problems is like blaming the ocean for being wet. Of course this didn’t come out of left field but this once again shows how delusional the entire market is about the current state of the economy. The general sentiment is that we have reached some sort of bottom but we are miles away from any bottom talking. We are still having a hard time getting our government officials to agree we are in a recession! If you are wondering why this earnings miss brought down the market significantly just look at how few companies have this large of a market cap:

*Click to enlarge

And for all of you that think that high oil costs aren’t such a big deal, I ask you to take a nice hard look at the list and see who is there. In fact, if we are to only look at these top market cap companies it would appear that all we do is shop at Wal-Mart, talk all day on phones, drive around like maniacs, load up our Windows operating system, and brush our teeth with Crest. Where in the world are the manufacturing companies? We have come a long way from U.S. Steel.

College is for the Middle-Class

There is an incredible movement in the current market of giving the perpetrators of this housing bubble, you know the financial institutions and builders, the blessing and anointment of market repairmen. The idea stems from the philosophy of, “hey, who would know better what went wrong in this market than me since I was selling and pushing these loan products or overbuilding homes.” It is simply amazing. Here is a list of a few examples of what I am talking about:

The Fed: Giving them the ability to bail out select institutions and picking up rancid mortgage products for exchange with Treasurys.

Mister Housing Bubble says I Pity the Fool Who Supports this Because: Alan Greenspan dropping rates to 1 percent helped fuel this speculative boom. And it didn’t help that he was cheerleading for ARM products and now he is on a legacy revisionist tour trying to atone for past sins.

The Builders: Allowing them to get a $15 billion tax break for past profits because they are hurting in the current market for get this, over building. Of course they blame the credit crunch and tighter lending standards (look at Fed above) for the current mess and not over building the country as if they were a kid playing with LEGO building blocks.

Mister Housing Bubble says I Pity the Fool Who Supports this Because: Giving them tax breaks makes absolutely no sense since they are a primary reason we have record inventory on the market. Did these new homes magically appear out of the ground like a housing Chia Pet? Of course not. This happens in all housing run ups. Builders will build to the point of market saturation until the bubble bursts. And forget the affordable housing argument. Practically every new housing sub-division was a McMansion inspired dream. This was not about increasing housing affordability for the American people. It was greed plain and simple. Now they have to reap what they sow yet they are coming to the government hat in hand begging for help.

The Lenders: These were the cooks of the toxic mortgage stew. They could have easily pushed buyers into more conventional mortgage products but why? You don’t want to hurt your commission so stick them into whatever will get you the biggest kick backs. Fake documents, lack of due diligence, flat out corruption, are all reasons why these folks deserve very little in government aid.

Mister Housing Bubble says I Pity the Fool Who Supports this Because: It is astonishing that we are now seeing many ex sub-prime mortgage brokers working as loan counselors or “helping” those in foreclosure. This is absolute lunacy. We might as well ask Donald Trump what it means to live below your means or ask Bobby Brown what it means to be a sensitive husband. What in the world is going on here?

Stockholm Syndrome for Housing

There is a fascinating psychological response that happens when certain victims actually start having loyalty to those that are screwing them over. This has happened when hostages start associating protection and loyalty to those that have put them into harms way:

“Stockholm syndrome is a psychological response sometimes seen in an abducted hostage, in which the hostage shows signs of loyalty to the hostage-taker, regardless of the danger (or at least risk) in which the hostage has been placed. Stockholm syndrome is also sometimes discussed in reference to other situations with similar tensions, such as battered person syndrome, rape cases, child abuse cases and bride kidnapping. The syndrome is named after the Norrmalmstorg robbery of Kreditbanken at Norrmalmstorg, Stockholm, Sweden, in which the bank robbers held bank employees hostage from August 23 to August 28 in 1973. In this case, the victims became emotionally attached to their victimizers, and even defended their captors after they were freed from their six-day ordeal. The term Stockholm Syndrome was coined by the criminologist and psychiatrist Nils Bejerot, who assisted the police during the robbery, and referred to the syndrome in a news broadcast.”

This is the only logical reason I can arrive at for why the public isn’t marching on Wall Street and launching into mad protests over what is going on. The fact that some of these mortgage brokers are now trying to play both sides of the fence really shows how flexible their ethics have become. They said whatever they needed to say to get you to sign the loan documents now they’ll say anything to avert a public flogging. The fact that so many people were literally abused by these so-called financial professionals leads me to believe that folks still think these people actually knew a thing or two about economics. Let us look at the value of education here through a NPR piece on ex-subprime brokers:

“Amber Barbosa didn’t graduate college. But she did get an education – by working for the now infamous subprime lender New Century Mortgage Corp.

Barbosa was a quick study: A few years later, she struck out on her own as a mortgage broker.

“In 2006, I made close to $500,000,” she says. Not bad for a 28-year-old with no college degree.

By then Barbosa, who was living outside of San Francisco, had a nice boat, a 27-foot Bayliner. She had several houses, a Mercedes and a Cadillac.

“I was riding around in my ’07 Escalade,” she says. “God, I had three properties at the time – one right on the water with ocean access, another property worth $800,000.”

NPR checked the property records, and Barbosa really did own those houses. Since the crash of the housing market, though, she says she has pretty much lost everything.

But during the height of the housing bubble, brokers like Barbosa were working next to a river of money; all they had to do was reach in and grab some. Basically, the more costly and risky the loans they gave to their customers, the more money they made.”

There is nothing wrong with making a nice chunk of change without a college degree. But the fact of the matter here is that many of these brokers were making a mint selling financially and socially destructive products to their clients that is now leading to the current downturn. Sure, if we are going to blur the lines of ethics here we can make a lot of money by flying to Columbia and importing drugs to sell in our neighborhood. Yet this is illegal. That is what is so troubling here. Even the argument for the builder kickbacks is along this line. I’ve heard a few in the industry say, “how is this different from the bailing out of Bear Stearns?” They’re right. Both are huge mistakes yet hopefully on this one our leaders can show some restraint and vote it down.

But back to Amber, she was making $500,000 and now has lost it all? What about her safety cushion? Of course these folks in an ironic sort of way started to believe the crap they were peddling. Why not buy a home? It only goes up after all. They felt that the party would never end. What they did was flat out illegal and I encourage you to listen to the piece where you had an environment that was a wink-wink we’ll put down that you make $250,000 a year since everyone does and put you into this 2/28 option ARM mortgage. Falsifying documents, lying, and criminal activity are all part of the bubble world. Even if you didn’t commit something illegally, they knew deep down they were peddling a turd but turds don’t smell so bad when you get a $10,000 cut. And buyers aren’t getting off either. They have a financial Scarlett Letter and now that people are actually verifying credit and income, they’ll have to convince an institution to lend them money, sort of how things were done for decades before this decade long bubble. Many will lose their homes. They have the option to rent another home. You won’t be out on the street. It isn’t like we have debtors prison anymore. They’ll have to live with their financial mistake and with credit being tighter, institutions should own the paper they push out and have some skin in the game. Next time, they’ll think twice about giving loans to everyone. So what do we do now? Did we learn our lesson? Nope, we now promote them as prescription to the ills of our market!

“From New Century to Nonprofits

NPR spoke with Barbosa while she attended training at the Neighborhood Assistance Corporation of America, or NACA. Some out-of-work mortgage brokers have now found their way to nonprofits like this one. NACA is working with borrowers facing foreclosure all over the country, refinancing or restructuring their unaffordable subprime loans.

Bruce Marks heads up NACA and now helps retrain former subprime loan brokers. Who better to untangle these unaffordable loans than the brokers who helped set them up, he says. The former brokers understand the “exploding ARM loans” and the “pick-a-pay loans,” Marks says. “They are the experts, because they were a part of that industry, and they know that business inside and out.”

You mean the same subprime loan you put them into? I think comparing the Stockholm syndrome here is much more than a curious observation. How are these people going to counsel the same person they perpetrated the fraud upon? There is nothing complicated here. The vast majority of these loans were financial time bombs. Most of these folks that they want to counsel here in California are now underwater. Here is their three options; short-sale, negotiate better terms with your lender, or foreclose. Do you really need a training session for that? And what in the world are they calling them experts for? Drug dealers know the inside of selling on the street. Does that mean we are going to make all of them rehabilitation counselors? Bank robbers know how to use negotiating skills and brute force. Are we going to send them to Iraq?

From the e-mails I’ve been getting I know that I am not the only one that feels we are living in some bizarro universe. If you feel outraged and appalled by what is going on I encourage you to contact you Congress person and let them know how you feel about the current situation. Not many people take the time to get in touch with their local representatives. In fact, many are betting on your apathy and lack of interest in getting some of these horrific bills passed. With enough noise, you’ll light a fire underneath them and if they don’t respond, you know what to do this upcoming election season. Here is a site that makes it easy to find your representative. Don’t sit idly back while Nero fiddles away.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

10 Responses to “Thanks to the Housing Bubble, I Made $500,000 with a High School Diploma: The Stockholm Syndrome and Defending the Perpetrators.”

Who better to untangle these unaffordable loans than the brokers who helped set them up, he says.

Are you KIDDING me? Most agents I knew were complete idiots that knew how to schmooze and take instructions. The loan managers told them the terms, conditions, and how to sell it. They found the fish, baited the hook, and pulled them in. The ones I knew couldn’t spell secondary market, much less explain how the loan they just made sold for 104. Never mind the intricacies of default servicing (chapter 20 anyone?).

Don’t believe me? Give a loan officer a series of cash flows and ask them to calculate the NPV. For that matter, ask them any other Finance 101 question.

I started my career in the acquisitions group at Ocwen, back when all they did was buy portfolios of non-perf. In the mid-90s a colleague of mine was renting a house from a woman that defaulted on her mortgage. She told them they could live rent free until they were evicted. They worked the system so they lived rent free for close to 2 years. You want to jack the bank, find a loan resolution guy and pay him to teach you the ropes. You want to get screwed again, go back to your broker and ask him how to solve the mess he helped put you in.

Well, I used your link to find my representative’s website and I sent him an email urging him to vote against any form of bailout. It probably won’t change anything, because this is So Cal, and therefore he’s practically a Communist, but I feel a tiny bit better.

Love your blog, and I refer others to it when I can, because I have learned (and continue to learn!) so much!

HEAR, HEAR!

I know a girl in Canoga Park LA. Her mother bought her a house 2003 for ~250. Title in moms name.

Appraised at 600K 2 years ago and they took a HELOC out for 200K

She doesnt want the house anymore.

Mom is in the retirement home paid by are medicare taxes.

Daughter has not paid mortgage in 3 months and banks has yet to call.

She is going to let the bank take the house. Live there until they kick her out and take the 200K (ok after all the parties, cars etc its down to 30K) and buy a new house.

Its her moms credit that is effected not hers.

She also know a guy who stopped paying 8 months ago and the bank still hasnt done anything. He has the same plan.

Can someone please advise how I can get in on this racket?

I have zero debt. Enough to buy a house in cash. But am not a current home owner.

If its not illegal and they cant come after you….who cares????

DHB_ I, too, sent my representative an e-mail, thanks for the link. I want to thank you for your witty wonderful blog, it has taught me more about economics and real estate than any Phd level course ever could.

Great blog. But what its teaching me is crime pays. Arent their any stories of people who actually don’t make out in this crisis?

This is what I have sent to Jane Harman. Will it work? I doubt and after all the problem is going to be mine since I have to cut the hand that is going to vote republican. Somebody 3 party system?

—————————————————————

Dear Jane Harman,

I want to inform you how disappointed I feel about the talk on the democtaratic side of the politics about “bailout” for “troubled homeowners” and lending institutions. All such effort will result only in longer support for inflated home prices and eroding the affordability of homeownership. I can assure you that there is significant crowd of your voters, responsible and thoughtful not to jump on the gipsy wagon of the real estate propaganda, which have been waiting patiently for this bubble to burst so they can fulfill their part of the American dream. Personally for me this by far is the issue of biggest concern. I don’t approve any support of my political representatives for “bailout” and I will not think long about switching party support if the disappointment on democrat’s side is going stronger.

Sincerely yours

Daniel Dimitrov

————————————————————

I’m agree with some of the above comments. It is hard to be very sympathetic or even consider people victims when they haven’t really lost much ( of their own) money and went to places for their loans that any normal person would run from. A few days ago I was driving to work down one of those declining commercial streets that feature mattress and rent to own furniture stores, used car dealerships, ethnic restaurants you wonder who would ever dare dine in and pay day loan shops. Fire engines were parked outside the smoldering remains of what had been a garishly painted building that housed a company that offered no questions asked small loans in exchange for the title on your automobile. News reports said the fire was suspicious in origin. I don’t doubt it. Someone who went in to get a $500 loan to pay their utility bill and found themselves owing $2000 6 months later and then, unable to pay, going out to see their car hooked to the back of a tow truck might just be angry enough to do something criminal. What has this to do with the housing crisis well if I need a loan I don’t go to some store front operation with a name like Quick Credit or EZ Mortgage or even a virtual loan company with amusing TV ads. I go to my bank or a car company’s

own lending operation. If they refuse to give me the loan I requested I might be disappointed and even embarrassed but that has never happened not because I am a rich man but because I know how much money I make and what I can afford. I may not be Milton Friedman or Henry Paulson but I know enough to use a loan calculator and plug in amount of loan, duration, normal interest rate to get monthly payment. Thus armed I can insist the lending officer explain why we are going beyond the parameters of normal finance to get my loan. I don’t need an Option Arm or teaser rate nor I am going to storm out and go visit EZ credit if I am turned down. If Wells Fargo or Toyota Motor Credit won’t lend me the money I’m going to figure they aren’t denying me the loan because they don’t like my skin color or my haircut but because they don’t think I’m good for it and the problem is my ability to pay or my history as a deadbeat. So the question I have in all this is the same I have when I see these pay day/car title loan shops I mentioned above. What are you doing in there? If you can’t work out a payment plan with Wells Fargo, PG&E or Ford Motor Company then you are essentially bankrupt. There is no point in trying to fix your problem with anyone else. If the primary lenders won’t touch you then give it up. You can’t afford to buy the house

the car or whatever else it is you need money for.

If you want to continue the party come to Kelowna Canada, its still going here. People are nuts, buying everything they can without money down. There is no one here that believes it can end, they think it was different in the USA. We do not have ARM mortgages but do have CMHC to 0% down and lots of mortgage brokers who will show you how to lie about your income and deposit if required. The real hit is going to come as our houses are right on the top. Inflation is going out of Control, Gas is $5.20/US gallon, Beer is $6.00/pint, Electricity is up 30% this year alone. The problem is we have no real jobs, all young people work in Real Estate, Construction or Resturants. This is a retirement community on a large lake with Vineyards all around. People with no debt like me live here and fly to work in Calgary Monday to Friday. Like California when the houses stop going up people will not be able to re-finance to keep there style of living and will start to sell property which will start the down turn. It has started in Calgary and will continue across Canada. The trend right now is oil boys like me in Calgary are selling our places in Kelowna or Vancouver Island and buying property in the US. I can sell my lake front home in Kelowna and buy a house on the ocean in California, a house in Palm Springs and one more in Arizone in Cash. I believe that the housing pain you are going through is almost over and then you can read about in going on in Canada in 2009.

another sweet ass post. i love your writing style and of course, the analytical thinking. you should get a book deal for real. anyway, i am looking to get into the investment prop game, 3-4 unit property, but i’ve been feeling the market for about a year now and i agree with most everything you say, especially agree with that chart you keep showing that is pretty much “slam dunk”!!! my greatest fear now is that rents will also decrease with job loss and etc. is that the trend?

Leave a Reply