Shadow Inventory Case Study: Inventory in the Shadows Twice as Big as Normal Resale Inventory in Los Angeles and not on the MLS or for Public Viewing. Foreclosures and Distress Properties Clogging the System.

The pent up inventory is getting ready to unleash in 2010. The gigantic bet made by the bankers and Wall Street was that somehow by allowing banks to fudge numbers since the crisis started that housing would find its footing and the market would stabilize. Sweep the collapse under the bailout rug. This perceived grounding was then going to allow banks to unload these properties and avoid realizing institutional ending losses. Yet 21 months into this painful recession and trillions handed out to the banking sector, housing prices are not spiking. The tiny uptick in home prices is a mirage brought on by three major factors. First, the $8,000 tax credit lured additional home buyers into the market. Next banks have held back on the shadow inventory thus artificially lowering the supply of homes on the market. Finally, the U.S. Treasury and Federal Reserve have artificially kept mortgage rates low by buying up some $1.25 trillion in mortgage backed securities.  All this and housing prices have barely stabilized in some regions while foreclosures are at record breaking heights.

Yet the problem with operating in a crony banking system is that the tainted few are merely looking out for their own gain as they always do. They tried convincing the public that what they were doing was for the good of the average American yet behind the scenes, have shot down cram down legislation at every turn and have their hand out for every bailout. In reality, the current loan modifications are a joke and recent reports by the OCC and OTS show massive amounts of re-default rates.

NPR had a show last week discussing strategic defaults. A strategic default is when someone purposely stops paying even though they have the money to make the payment. This is in contrast to say a job loss default where the person has run out of cash. It was a fascinating show. Many people had little issue with defaulting on their home. Many argued that banks received their bailout so why shouldn’t they? We can thank the government for creating one enormous moral hazard. How can you argue with the borrower’s logic? However there is a problem. The taxpayer is now on the hook for nearly every major bank and let us be honest, the bulk of the mortgages are pumped out by the too big to fail. The government is the mortgage market now. So these strategic defaults are going to harm the average taxpayer even more.

To be honest, I have no problem with people walking away from their mortgage. In a sustainable environment, the punishment to this borrower will be a battered credit score and the inability to buy a home for many years. Yet the government in their infinite wisdom combined with Wall Street felt that by co-opting the banks with taxpayer money, somehow the prudent majority was going to be supportive of all these government handouts to the crony banking system. It is no surprise that people are downright dissatisfied with how things are being operated.

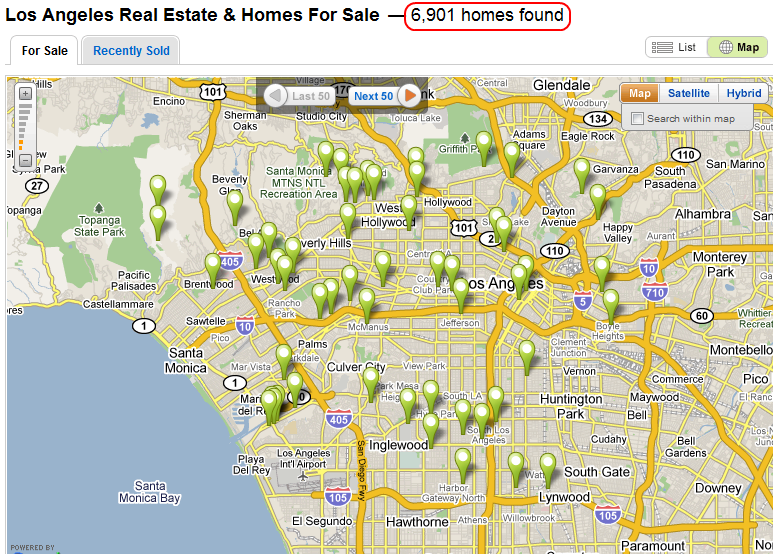

I love how some pundits argue that the shadow inventory will cause no problem on the markets or even, that it doesn’t exist. Keep in mind that we have never had a housing market like this. The Great Depression had a major housing downturn but mortgages were nothing like they are today. At least then, you knew who owned your mortgage. They didn’t have option ARM or toxic nuclear waste Alt-A loans. In fact, many of the prime loans are going bad because people also went HELOC crazy and yanked out equity actually believing their home was worth the inflated price. Let us look at a real case study of shadow inventory. I will use a bigger sample size here and look at Los Angeles:

A quick search of properties shows us some 6,901 homes up for sale. Seems like a small amount of inventory for a big area. But let us add the entire shadow inventory into the mix:

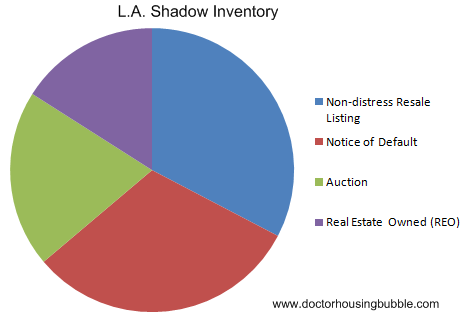

Well isn’t that something? We have 6,901 homes for sale yet we have:

Notice of Defaults:Â Â Â Â Â Â Â Â Â 6,583

Auction:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 4,264

Real Estate Owned:Â Â Â Â Â Â Â 3,376

The shadow market is twice as big as the regular market! This for the biggest area in Southern California! And don’t feed me any of this hogwash that most of these mortgages will be modified. Loans that are modified are re-defaulting by 50, 60, and 70 percent and that is nationwide. Here in California you can imagine what that number will be. Also, many of the option ARMs and Alt-A products don’t even qualify for HAMP or any other loan modification because they are deep underwater. Want to try this exercise on another area? Let us look at Costa Mesa in Orange County for another example:

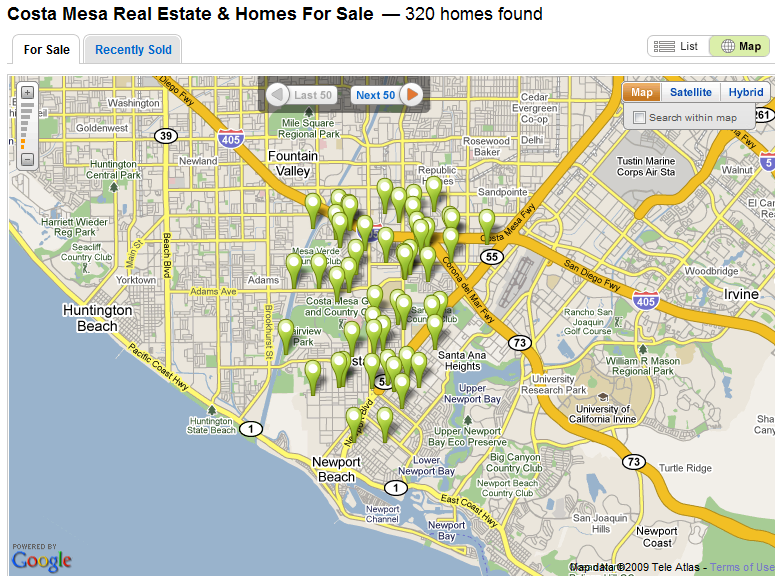

320 homes found. This is probably what your real estate agent is feeding you. But what is the shadow inventory figures?

Notice of Defaults:Â Â Â Â Â Â Â Â Â 227

Auction:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 160

Real Estate Owned:Â Â Â Â Â Â Â 86

The shadow inventory is larger than the actual re-sale number. The reality is that most of these loans won’t cure. Sure, a handful will be modified. But the REO number won’t be modified, the bank already owns these properties. Those scheduled for auction are pretty much a lost cause with the owner. The notice of default data is linked to an audience that is 3 to 6 months behind and given the large mortgage payments in California, if you are this behind chances are you are not catching up. Keep in mind that this data is only for homes that have action being taken on. There is probably a shadow to the shadow inventory! That is, we have heard and know that many banks are not even sending notice of defaults to some late paying borrowers. In other words, there is a boatload of toxic debt out there.

2010 will usher in the recast era of the Alt-A and option ARM tsunami. We’ve talked about this for well over a year. Like subprime, there isn’t much that can be done about this. There are only two scenarios out:

1 – Home prices skyrocket, the employment situation improves, and people can sell out of their problems. Given the 12.2 percent unemployment rate and 23 percent unemployment/underemployment rate in the state, this scenario is highly unlikely. People forget that now that we are back to more conventional lending standards, the easy leverage of the bubble days has caused home buyers to have less pull in buying homes (aka, can’t use other people’s money as easy).

2 – Home prices stagnant, drop in mid to upper tier, and employment remains in the doldrums. This is actually happening. This is our path. Why do you think Realtors are pushing hard for the tax credit to be extended? Why do you think the Fed is still buying up agency debt like an addict? The 30 year fixed mortgage is hovering around 5 percent. The 40 year historical rate for a 30 year fixed mortgage is more like 9 percent. Are they planning on buying agency debt forever? Only if they can convince the world and hold the charade up long enough.

If you haven’t noticed, we have chosen the Japanese option. For Ben Bernanke being an expert on the Great Depression, he is no expert on Japan or doesn’t care we are going to repeat their mistakes. Let us count the ways we are like Japan:

1 – Massive banking bailout and failure to recognize losses. Banks keep walking around like zombies continually eating up resources from the living sectors of the economy.

2 – Real Estate bubble bursting and slow recognition of real losses. Can you say shadow inventory?

3 – Central bank zero bound problems. We didn’t invent quantitative easing!

4 – Massive government spending. Trillions in government injections in Japan and all they got was a 20 year sideways moving market. Stock markets still massively down after two long decades.

You might want to read about the Heisei Bubble for more details. Clearly we are different than Japan in many ways but the above repetition is unmistakable. After 21 months there should be little doubt why our economy is still in a mess. We’ve put the economy on financial Valium and we are trying to pretend that our deep seated problems will go away. We either confront the issues face on or gear up for at least a lost decade for our country. The shadow inventory will depress real estate values for years to come. There are still a few that want the government to buy up all the option ARM and Alt-A junk. You know why that hasn’t happened? Because even the crony Wall Street bankers can’t convince the bailout happy government that these loans are any good. But let us assume we do buy all those toxic loans. Then what? The government will need to sell and face the losses at some point. In the end, price discovery needs to occur. You can’t maintain these bubble prices. Yes, prices in many areas of California are still in a bubble. The dam is going to break one way or another. You can listen to the same dubious folks that missed the biggest collapse since the Great Depression or spend a few minutes looking at the data above and putting two and two together. The path ahead is not good for housing values.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

51 Responses to “Shadow Inventory Case Study: Inventory in the Shadows Twice as Big as Normal Resale Inventory in Los Angeles and not on the MLS or for Public Viewing. Foreclosures and Distress Properties Clogging the System.”

How long can they keep this game going? If they can keep holding back these homes and slowly letting them out on to the market, then prices will not tank… I fear that this will go on for many many months.

Thanks dr,

Regarding M. Bernankee:

http://www.dailymotion.com/user/marcel5555555/video/xalq1l_bernankewhyarewestilllisteningtothi_news

Currently, interest rates are lower than they have been in some time. If you are thinking of buying a home, now is certainly the time to do so. A recent market report reflects that U.S. property has become an increasingly more attractive opportunity for home buyers and investors. U.S. property values in many areas are at an all time low thus causing much upside potential. Knowing where not to buy a home is as important as are the dos and don’ts of buying a home. There is a tool which can erase all the confusion related to home buying. It’s a tool which Identifies properties with the most value, establishes the right price range to pay, projects long-term cash flow and appreciation & assesses how to maximize after-tax returns. For more information look into http://www.smartzip.com/info/score

There will be more government bailouts in 2010. According to the Tax Policy Center, 47% of families pay NO federal income tax.

If you do not pay for it, why not more bailouts? Why not buy up toxic mortgages? Why not more cash for clunkers, or home buying credits?

You know it won’t come out of your pocket!

Also, 2010 is an election year.

Everyone in D.C. will try to keep the plates spinning up in the air until Nov.elections.

They can deal with the aftermath, after being re-elected.

I like that new term, “the shadow Shadow Inventory”. I personally know of two people who after not paying any mortgage payment since last October still are not showing a NOD or anything.

Ken Louis is leaving Bank of America, however not in handcuffs.

I think Ben actually recommended QE to Japan in early 2000’s…

http://www.pimco.com/LeftNav/Featured+Market+Commentary/FF/2009/July+2009+Global+Central+Bank+Focus+McCulley.htm

From the California Housing Forecast site, (which until recently was about as doomish as Dr. Housing bubble) on the shadow inventory:

“It is highly unlikely that we are going to get a deluge of REO inventory for sale. More likely, banks will keep delaying foreclosures at all stages, and rent out homes they have already foreclosed. I’ve read claims that banks must quickly dispose of REOs, but I doubt it. They can dispose of REOs into their holding companies. Or, they can get FASB rules changed or get more money from the Fed to get around this limitation.

I think putting REOs into a holding company is the most likely option. Billie deSpain, my friend and veteran realtor, managed 500 properties for a bank holding company in the 1980’s. Glenborough Holdings was spun off from American Savings & Loan. She hired a handyman and housekeepers, and oversaw each house from eviction to rental to final sale. The homes were in the most prime southern CA real estate markets, in Laguna Niguel and surrounding coastal areas. After the market turned around five years later, Glenborough put the properties on the market, twelve at a time. It is likely banks are going to do this again. It is financial suicide to dump REOs on the market, so why would any corporation do so?

In short, banks are managing their REO inventory, with the goal of selling it off gradually over a period of years. They won’t worry about lack of cash flow. They have access to cheap Fed money and besides, the MBSs are not held exclusively by banks – the pain is shared by investors all over the world.

Banks want to let homeowners become renters in their own homes, so they don’t have to foreclose. Dean Baker’s Right to Rent Plan is supported by Congress, including Senator Charles Schumer, and is currently considered by the White House, according to the California Association of Realtors.”

“Clearly we are different than Japan in many ways”–this is true. We are prosecuting two wars of aggression with a third to come shortly. We are in much worse shape. At least Japan has a manufacturing base. We have been systematically dismembered(no accident). We were the last bastion of hope for the world. You can thank the moneychangers and their fellow travelers.

Thanks for another insightful article. I’d be interested in your long term view of the housing market. I see this as the major difference between our current situation and the Japan case. Japan has seen there population go from 120M people to 127M people in the past ten years,with negative growth in the past two, while the US has gone from 265M to 307M in the same period.

Even with the boom in building (1.283M in 2005) our single family housing supply has only gone from 68M in 1997 to 79M today. With the 75% decline in building from the peak (on pace for 367K in 2009) we will actually be under producing new units by 300-400K (compared to long term average). Total housing stock to population has remained flat at 1 per 3.9 people during the past decade. With steady birth rates,the US population is expected to expand to 450M in 2050. Population density will continue to increase but these 140M more people will need places to live…

Obviously none of the above is relevant to the short term and a wave of defaults, REO’s etc,should continue to put pressure on on prices, but dont be surprised if many banks do exactly as Sammie suggests and become landlords.

My personal belief is that the bailouts will continue until there is a revolution of some sorts.

I’m with Sammie – the government HAS to support the banking system but doesn’t have to do anything for Mr and Mrs. Unemployed Underwater Homeowner.

Yes, shadow and shadow of shadow inventory exists and it is huge. But…

The pain of holding distressed mortgages is real but managable while survival requires maintaining reserve requirements. So the shadow inventory will be released slowly and with caution. Prices will be modestly stable trending lower.

One structural shortcoming of the housing market is that there is no way to short houses. One can short the stock of a homebuilder but that is about it in so far as I know.

One big difference, Japan is and was a creditor nation while the US is guess what? It is a lot easier to ride out deflation if you have savings. As a wag once said, lowering your debt is not the same as saving. Regarding the housing inventory and demand; yes, there is demand to live beyond one’s means in this country but that is no longer possible as we hit the debt wall. It does not matter how small the inventory if you cannot pay for the product there is no demand…

We are Citibunk. We are too big to fail and the world knows it. They don’t know what to do with us. Everyone knows this is not perpetual motion, but they just stick their head in the lion’s mouth and hope he doesn’t bite. The whole system is on a highway to hell but you might as well get something from the beverage cart and watch the movie from the overhead LCD screen. I think Gone with the Wind-turbine is on tonight. Or maybe Goldmembersacks. Maybe even Ben Paulson in Honey I Shrunk the Economy. Or maybe just wait for the Thelma and Louise ending. If you can stay up late enough, they are showing the Abyss.

Comment by Lance Pitt

October 1st, 2009 at 2:14 am

Currently, interest rates are lower than they have been in some time. If you are thinking of buying a home, now is certainly the time to do so. A recent market report reflects that U.S. property has become an increasingly more attractive opportunity for home buyers and investors. U.S. property values in many areas are at an all time low thus causing much upside potential. Knowing where not to buy a home is as important as are the dos and don’ts of buying a home. There is a tool which can erase all the confusion related to home buying. It’s a tool which Identifies properties with the most value, establishes the right price range to pay, projects long-term cash flow and appreciation & assesses how to maximize after-tax returns. For more information look into http://www.smartzip.com/info/score

>>

___

>>

OH DO GO AWAY! Shill your snake oil somewhere else!

>>

Interest rates are artifically low having been forced down by the Fed. They will – and must – eventuallly rise. When the poor sucker who believed the garbage that ‘low interest rates are good’ and bought then goes to sell in 2, 4, or 6 years for now, they will be screwed.

>>

If the schmuck buys that house now for $200,000 with the 4.85% rate putting 20%, the principal and interest payment (not including taxes and insurance) will be $844.31. (Assume taxes are $166 a month and insurance is $134 for a total of $1144 a month which is ‘affordable’ at 28% of gross income for a household making $49,000 a year. )

>>

5 years from now the sucker goes to sell that house for which they paid $200,000. One problem. Interest rates are now back to the more normal 6.5%. With 20% down on $200,000, the next buyer will have a payment for principal and interest of $1011. Add the taxes ($166) and insurance ($134) and the next buyer has a monthly nut of $1311. To be able to make that at 28% of gross income that buyer has to have an income of $56,185 — 14.66% more than the sucker who bought because ‘interest rates are low.”

>>

Now the sucker really needs to unload the house 5 years from now. Since interest rates are up, there are fewer buyers who can pay the higher sticker price so more goes to interest. For the next buyer to have the same payment of $1144 a month with $844 going to interest and principal, the price of the house has to drop so that the buyer’s mortgage is not more than $125,000. With 20% down that means a total price of $156,300. And that is a price cut of 21.85% from what the sucker paid.

<>

Realtors lie -they LIE through their teeth. 25+ years ago they were screaming ‘buy now buy now interest rates are all the way DOWN to 9.5%. We will NEVER see interest below 10% again in our lifetimes.” And this poster shows they are STILL peddling the same snake oil. They will say whatever it takes to sucker people into buying and handing them their 6% commission for doing squat. Never yet have seen a realtor who truly earned a commission much above an hourly rate of $20 for hours of work actually done. (Do the math – they rarely actually put more than 20-40 hours into selling a property. Highway robbery.)

>>

Low price for the house and high interest rates are far far far better than a high price and low interest rates. You can always refinance to a lower rate if rates drop. You can’t change what you paid for the blasted house if rates go up.

I wonder how long the lenders can operate with a constantly dwindling cash flow from non-paying loans? It’s one thing to ignore market value, but not getting any money from the borrow has to hurt their operation in a fundemental way.

HI, Sammie,

Your comments is what I worried. Everyone knows the shadow inventory problem, but the way it hit the market and the timing make difference. It can come out like fire hose, home water tap or dribble; banks can release it when market is going down, as I wish, or release when market go up (after 3-5 years).

The question is whether banks can afford doing so, since this time the amount of foreclosed house is huge. Maybe they can, taxpayer give them free money to play.

From the California Housing Forecast site, (which until recently was about as doomish as Dr. Housing bubble) on the shadow inventory:

“It is highly unlikely that we are going to get a deluge of REO inventory for sale. More likely, banks will keep delaying foreclosures at all stages, and rent out homes they have already foreclosed. I’ve read claims that banks must quickly dispose of REOs, but I doubt it. They can dispose of REOs into their holding companies. Or, they can get FASB rules changed or get more money from the Fed to get around this limitation.

I think putting REOs into a holding company is the most likely option. Billie deSpain, my friend and veteran realtor, managed 500 properties for a bank holding company in the 1980’s. Glenborough Holdings was spun off from American Savings & Loan. She hired a handyman and housekeepers, and oversaw each house from eviction to rental to final sale. The homes were in the most prime southern CA real estate markets, in Laguna Niguel and surrounding coastal areas. After the market turned around five years later, Glenborough put the properties on the market, twelve at a time. It is likely banks are going to do this again. It is financial suicide to dump REOs on the market, so why would any corporation do so?

In short, banks are managing their REO inventory, with the goal of selling it off gradually over a period of years. They won’t worry about lack of cash flow. They have access to cheap Fed money and besides, the MBSs are not held exclusively by banks – the pain is shared by investors all over the world.

Banks want to let homeowners become renters in their own homes, so they don’t have to foreclose. Dean Baker’s Right to Rent Plan is supported by Congress, including Senator Charles Schumer, and is currently considered by the White House, according to the California Association of Realtors.â€

@CAE

The 13 Trillion Dollar question. Since banks can quantify assets with mark to Mars or anything else they want to say, and fed backstops non-performing loans, the only banks that fail are the ones the FDIC says do. Yes, how long. Six Months? Six Years? There’s an asteroid coming and hemorrhoids working the problem…

I saw a Ben Stein ad that called him a ‘Financial Expert, economist’. Right, and I’m George Clooney. I want to choke that !@#$%^&* with Mozilla’s entrails.

NORMAN the only problem with your recovery horizon is that

it’s not going to be 5 years this time. It’s going to be 15 years

to a nominal match and a big NEVER to an inflation-adjusted one.

Banks can hold but they will never sell out their amassed inventory

at breakeven, much less a profit. That’s the big difference this time.

Today, there is no possible point of price stimulation. The last bubble

has burst. All forces from this point foward are deflationary.

Inflation, should we ever see it in housing prices, will always run less

than general economy inflationary gains. You see, it’s all coming out

of the butt of housing — today, tomorrow, and for the rest of your lifetime.

Amen.

Rents are going down, and some for rent signs are staying up for months. Renting out shadow inventory will become more and more expensive. How long can they hold out? I think that once prices start really falling in the middle and upper areas, they will fall fast. Just drive around L.A. and look at the for rent signs.

How long can the banks hold out? With the backing of the US govt, the answer is forever (or at least as long as the republic still stands). Its a smoke em out game. The banks and the govt have far far more resources than us patient renters ever will. At some point we will all get tired, capitulate and go on with our lives. Ive been waiting for 5 years, no way I am going to wait another 5 – a full 1/5th of my expected adult lifetime.

Everyone knows the saying “the market can stay irrational longer than you can stay solvent”? I have a new corrolary – the banks and the govt can kick the can down the road longer than you can stay alive…

Why would the government need to do anything for unemployed underwater homeowner? Unemployed should get unemployment under normal terms, that has nothing to do with helping keeping their home. The only people govt should be helping is NOBODY. Let the market dictate itself so that people who truly have been “homeless” fiscally responsible renters all this time can finally get what they deserve.

Unless banks decide they want to foreclose and sell, they will keep managing this inventory and delay foreclosures at all stages, delay listing REOs on the market. Don’t forget the Fed owns much of these mortgages!

I’m a realtor in the field seeing the impact of the shortage of cheap homes and REOs for sale. foreclosureradar.com data (subscription needed) shows the NOD, NTS is falling for SD County the last few months. MLS data shows REO inventory down.

I’m a housing bubble blogger who got a real estate license in 2007. I used to predict 50,000 REOs in San Diego County. Never did I imagine the government and banks would manage this inventory to this extent, that we have a shortage of cheap homes for sale! REO inventory is dwindling.

I now see the light.

The banks will do what they did in the 1980’s, when the S&Ls formed holding companies to manage their REOs for several years, rented them out until the market turned around. Another option is Dean Baker’s (CEPR) Right to Rent plan, which the Administration is eyeing.

This week, it all fell together, and I don’t know why I did not see this earlier: the REOs will trickle out slowly as they have done all year, and there will not be deluge of homes on the market.

So prices will fall above $1 mil, keep rising up to $700k due to inventory shortage.

I really wish the government interference would stop! If interest rates go up, prices will go down quickly.

Been reading “Gone with the Wind” about the Confederacy. The hero, Rhett Butler, is getting rich as the South is losing the Civil War.

He notes that one can make money when a nation is building or when a nation is collapsing. The former is slow while the latter can be much quicker.

I think we have a bunch of Rhett Butlers at the helm.

Hi Schahrzad,

So true about what you state. In areas with superior schools, there is a waiting list to rent or lease a house. These people are moving on and not waiting for some kind of deal that may or may not happen. I saw a house in Walnut sell for 590K in Dec. ’07. Today it is easily worth about the same. It seems that at the present time, the only homes for sell in nicer areas are in bad locations, such as flag lots, busy streets, or just plain beat. Sure, there are a few organic sells out there, but they get snapped up if they are priced right. Anybody out there that says it is easy to find a great deal in a desirable area is a dreamer. It’s all about AREA,AREA,AREA.

NPR today had an interview update with someone who recently had his 11% Martgage reduced to 3% fixed fully amortized for 30 years.

http://www.reuters.com/article/gc03/idUSTRE58S2LS20090929

“The government has been relying heavily on Fannie Mae and Freddie Mac in its efforts to stimulate the U.S. housing market by buying more mortgage loans, easing refinancing and helping homeowners avoid foreclosure.”

Can’t help but expect more $ printing in order to give huge principal reductions after they buy buy buy these toxic loans. Will they begin buying the jumbos also? Would like to have a 360 degree view of the ramifications, besides “sticking it†to the prudent. Why else would they allow shadow inventory to build? Will nature win?

Hlowe

Rents in San Diego are up.

The Shadow Inventory and Shadow Shadow Inventory is just one of several major factors that will plague, and depress, California home values far into the future. Some of the other factors are: 1) continuing high unemployment/underemployment 12%+ in California as noted in the Post; 2) California continuing to lose 200,000+ net high tech, high paying jobs to other states, a process now accelerating; 3) state tax rates ranging from income tax, use, sales, and gasoline having a negative impact on the state’s economy and employment; 4) prospective Pay Option ARM and Alt-A defaults doubling the numbers of REOs and foreclosures into 2012; 5) continuing failure of California government to control spending, budget crisis’, and the looming public employee pension plan shortfall time-bomb coupled with city and county insolvencies, and 6) the failure of California education which also drives both families and business out of the state.

Statistically it appears California is headed into a real estate depression, long term.

Robert Cramer is a liar and a fool.

In 2000 the Bureau of Labor Statistics forecast 22 million jobs would be created this decade. As we all know now, there was no net increase in private sector jobs this decade. Meanwhile, the population over 16 has increased by 22 million. Since the total population estimate that was behind the BLS projection was probably accurate, that indicates that there are 22 million more people unemployed than originally estimated. Ouch!!! That’s about one for every five households!! Given that fact plus the fact that 12 million housing units were added from 2000 to 2007, and the fact that house prices doubled in the first 6 years of this decade, no wonder the housing market collapsed, and is collapsing. I’ve been studying the Westchester, NY housing market lately, and there seems to be a huge oversupply of million dollar homes. In Armonk (home of IBM) where the median price is about $1 million, from May thru July seven $1 million+ homes were sold, and there are currently 107 $1 million+ homes on the market. That’s a 4 year supply, and a major adjustment waiting to happen!!!

Does the mortgage bankers association “foreclosures” count start at Notice of Default?” They report total mortgages in serious delinquencies over 90 days keep increasing at the same time they start foreclosure proceedings on 1.36 percent of mortgages in Q2 2009.

With 5.44 percent of prime loans over 90 days and climbing, the notice of defaults is not keeping up, and you get the people with no NOD after 12 months of no payments.

Some of the loan servers and FDIC paper buyers have no interest in sending a NOD, they get 100 percent of the late fees and extra service charges during this period. Other servers are quick to send a NOD because that maximizes their short term profit, getting all the service fees and foreclosure costs into their short term revenue stream.

I wonder what the pie charts would look like if delinquent and serious delinquent were added. Is that the shadow shadow shadow inventory?

http://www.mortgagebankers.org/NewsandMedia/PressCenter/70050.htm

Not to forget the baby boomer’s retiring now and accelerating. The McMansions that suddenly sober people are not wanting with the same immature recklessness. The peak of the BB’s I believe is 1956, so the very nature of our social norms will be trending down after the lost decade that is coming. Where is the bottom? The Shadow knows…

A Map Of American Unemployment

Don’t worry, the Fed has everything under control.

Some may enjoy reading this 2006 research report from the Chicago Fed…although long, there are many hidden gems in this release.

http://www.chicagofed.org/publications/economicperspectives/ep_3qtr2006_part3_fisher_quayyum.pdf

A couple of passages…”While we have so far mostly avoided discussing housing prices, our findings do suggest that to the extent that house prices have grown considerably in recent years, this is not due to unusually excessive speculation in the housing market, such as would occur in a bubble.”

“First, it appears that the housing boom has not been driven by

unusually loose monetary policy. Instead, our findings point toward the high

prices being driven by fundamentals.”

Feel better?

Maybe the foreclosure wave is waiting on the ARM meltdown?

So guys, help me out here ok…so you think that the housing will go lower in 2011, 2012 and so on? Or will stay the same?

Gripe, complain whine. Not exactly a formula for success. It just so happens that I have an actual free market idea that might actually work to resolve the housing problem. No government intervention required. This idea may also subvert the fed.

for those who are interested, go here:

http://www.dnusbaum.com/fix.html

For California and specifically LA/OC/IE……….

The unemployment rate HAS to have an impact at some point. I can’t believe no one talks about the now 18 month delay the UE rate has.

You see, if someone makes I think its around $35K($18 an hour, not sure of the exact amount needed to qualify for a full payment), they qualify for full unemployment…around $430 a week.

Thats $1720 a month CASH. While they do owe taxes on that money, I doubt many set money aside.

For those of you unfamiliar with that amount of money, thats a biweekly paycheck of $860. Or better stated, its the take home pay of someone who makes around $34K a year.

Thats a LOT of money. A lot. Enough to pay the rent, pay some bills, and have entertainment money left over.

If its two people, thats $68K a year cash equivalent.

The gravy train ends at some point.

How many jobs do you know of that are available at $18 an hour?

So the Target/Home Depot/Lowes/retail reality eventually comes into play.

And that doesn’t pay for a 3 bedroom house in Encino.

And the hit is already arriving. I can get a 3 bedroom house in Tarzan for $1700 if I want ghetto, $2000 if I want remodled. Those prices are down from $2500 a month two years ago. Housing prices in the area mean a $3000 a month mortgage. Something will give. Once the rents hit $1500 a month, section 8 moves in. Then all hell breaks loose. Those houses will plunge and so will the schools. Welcome a wave of section 8ers tired of living in Lancracker and Palmtucky.

In West LA I can rent a 2 bedroom house for $2200 a month. Housing prices for the same place equal a mortgage in excess of $4K, often more. Again something has to give.

Those counting on being landlords really have a big surprise heading their way. Rents in many parts of LA are down as much as 15-20% from a few years ago. Overall I’d guess rents are down 5-10% in LA county from 2 years ago. Jobs of course will remedy this situation, but without the jobs, rents will decline.

Banks might very well be willing to play the waiting game on releasing the shadow inventory but here’s something to consider: if they do rent out the homes, they will be competing with the marketplace thus creating a rental housing bubble. If there is a flood of cheap rentals, this will depress for-sale prices. Either way, inventory is inventory to the market and when there is too much, prices must fall. This is the paradox that the banks musts consider.

Regarding the comments on prime area prices hanging tough (SD, Silicon Valley), we have just passed through the prime selling season and are now heading into the worst 6 months of the year. If you will be patient, you might find better deals coming, especially in areas driven by good schools. Let us know what you find.

L,

Thanks for digging up these old statements. And these economists are supposed to be the smart ones?

Good point Sammie but also consider that what is important is the total composition of the inventory and that appears to be mostly a mix of distressed property. While REO’s may not flood the market what is clear that organic sales priced at fundamental affordable levels say 3 or 4 times income will be a small percentage of the inventory. So what we have going forward will be a new mix for the U.S. housing industry that is an inventory that will be biased towards distressed sales causing a grinding down of prices over time. This new mix will also be a poor indicator for future sales price points since the mix will be very different then the past. Those that look at inventory lower levels and think it will be a good indicator for price points may be disappointed.

I’m surprised to see obvious NAR shills get their posts approved in these comments. (“Buy now! Trend is up!! Hurry, they’re going fast!!11!!1”) I have clients who are realtors and, while they claim things are “a little better these days,” the phones in their offices still rarely ring.

~

And to those who think a “dwindling supply” will “have to drive prices higher,” I have news for you: Even if there’s only ten houses for sale in all of LA county, they won’t sell unless there are qualified buyers. The days of liars loans are over, thankfully. The median household income of $50K/year simply won’t cut it anymore when it comes to buying that $750K McMansion.

I think that the good doctor allows the shills to post because they’re so godamned funny!

This is strictly my point of view. It seems as people opine about the future of house and try to guess about the future and when to plunk down their dough, they may be missing one crucial factor. That factor is deflation. Not price deflation but wage deflation. Unemployment in cal is terribly bad and will get worse. There are few industries adding jobs and we are facing some distressing choices as we wade through the economic morass.

We have few choices when it comes to boosting employment. We can create or fund new industries (highly unlikey or prohibivitably expensive), or export illegal imigrants (one I personally favor), or go to work for less money. The last is probably most likely and is indeed already happening in the form of wage cuts, reduced hours, slashed benefits furloughs etc.

People jumping into a house purchase lately at prices they can barely aford may find it even less or not affordable when their employer cuts their pay or lays them off. Employers will do this if for no other reason than because it is the current trend and you will swallow it or else. It’s sad but this is deflation at work.

Except for the most nimble or lucky, most speculators/flippers unable to immediately off these properties will take crushing losses. Rental property investors planning cash flow guestimates will bemoan the poor rental market as they lose month after month with no profit in sight as their properties coninually lose value.

Look around folks, all of these things are happening RIGHT NOW, but it happening in slow motion.

The only I can suggest is to reduce your debt (banks won’t like it but fuck em), try your best to stay employed and just wait until you see signs of a real bottom. In a bottom I would see it so dismal that droves of homeowners begin putting their homes on the market trying to get out while they still can (capitulation). Have your cash ready (if you still have any left).

See Macroshares UMM and DMM

Good Point Hunkerdown in San Jose.

I think at this point we have no other choice other than to “hunkerdown”.

In my area of LA county all the inventory has disapeared, and prices have definately been rising. Our horrible politicians are planning to expand the home buyer stimulus to $15k. I am convinced that prices will continue rising because of the stimulation.

I hope the job market dosn’t get worse, It is pretty bad right now. I don’t know if it was a mistake that I didn’t buy in’08, but like you the job situation and the rising prices just don’t make sense.

Good luck to all of us, It is rough in California.

AnnS wrote:

“OH DO GO AWAY! Shill your snake oil somewhere else!

>>

Interest rates are artifically low having been forced down by the Fed.”

1. The site isn’t selling anything- it’s a ratings engine

2. They are not agents, realtors, or mortgage brokers

3. The Fed has a lot less to do with Mortgage rates than you give them credit for

4. The site actually agrees with you on most of your math

5. You can argue about the accuracy of a certain engine, but not really about the legitimacy of a free service to help inform potential buyers.

Please research before spamming next time!

Jane Marks is a idiot, liar, fool, and retard.

Great article and I enjoyed the commits!

135,000 foreclosures and or bankruptices 40/60 every 30 days on avg.

Thats a small city or very large town going down every month worth.

However

LovE never fails it rises in life and death , feast and fast.

Enjoy LovE EternaL ( LE EL )

Here is a thought i do not here talked about.If you buy a house today at 30 yrs.old,for $185,000 at a fixed rate of lets say 5.5% for 30 yrs.you will pay out of pocket over the 30 yr.period of your loan about $480,000.Now you will be 60yrs. old and never be able to sell your home for any where near that amount,so basically buying now or any time in the foreseeable future would just be like renting,the only difference is when you are really renying the owner of the property pays for all the taxes .repairs ,and upgrades etc. in todays market being a new homeowner is like renting,but you pay for everything and get no equity what so ever.we are all screwed.

The result of the ‘delayed’ implementation of mark-to-market accounting allows banks to carry home mortgage in default at origination value rather than at a reasonable estimate of true market value. If the bank or investor completes a foreclosure then the property value must be reported at estimated market value or sales price, if sold. And, if the bank or investor completes the foreclosure that bank or invester becomes the leagl owner of the property and is liable for property taxes and other costs of ownership. Squatters in default protect the property from stripping and vandalism and are still liable for taxes and fees. [see: http://online.wsj.com/article/SB124396078596677535.html?KEYWORDS=Congress+helped+Banks+Defang

Leave a Reply to sigma