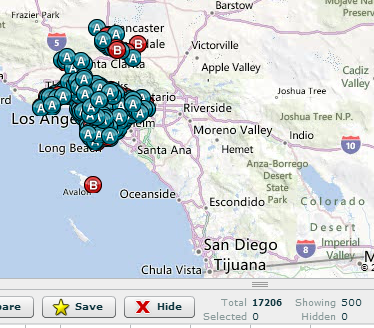

Does shadow inventory even matter in Los Angeles County? Non-distressed inventory at 17,000 and distressed inventory at 17,000.

The housing market continues to face a few trends in 2013. Low inventory, higher leverage because of low interest rates, and high demand from investors. Take for example the share of foreclosure re-sale properties that are being sold. In Southern California, the peak was reached in 2009 at 58.3 percent of all sales. Today foreclosure re-sales make up only 15 percent of all sales. This of course is one reason why the median home price has soared in the last year. With such high demand and low inventory, investors are able to poach high quality properties since coming in with an all cash position is much better than relying on a mortgage which most typical buyers will use. Also, the shadow inventory is being slowly leaked out since there is little reason to flood the market and depress prices. Banks have figured out that frenzied buying and record breaking low inventory is a good recipe for causing prices to jump up. Does distressed inventory even matter in Los Angeles anymore?

Los Angeles Distressed Inventory

One interesting point in all of this is that people now somehow think that there are no foreclosures or that somehow the housing market is back to the days of 2005 and 2006. Let us look at foreclosures in Los Angeles County:

Over 17,000 properties are in some stage of foreclosure in the county. Is this high? Well let us take a look at the non-distressed inventory that is listed in the MLS:

What is interesting is that for every one property on the MLS that is non-distressed, you have one that is in some stage of foreclosure. Obviously this does have an impact on market conditions and also price. Yet if banks are not releasing these properties, what difference does it make to your average Joe or Jane on the street? So now, the average buyer looking to buy now has to compete with the mania like conditions and lose out to all cash investors. Yet many of these investors are looking for cap rates and a potential sale down the road. They do not have a 30 year buy and hold strategy. Flippers are another group that have an even shorter timeframe.

The comments sections are filled with case after case of people going to open houses and finding out that already multiple offers have been made and many of them way above asking price. So this is the market you are left to contend with. Housing purchases are driven by emotions and right now, the air is filled with “I don’t want to miss out this time†and “the game is rigged so let me dive in.â€Â Given rental yields in many places, I don’t see investor demand at this level for much longer, certainly it will cool down in one or two years. In fact, many larger funds are looking at ways to securitize rent streams into tradable securities. Good luck with that in the unpredictable rental market. Many are beyond optimistic on vacancies and costs moving forward.

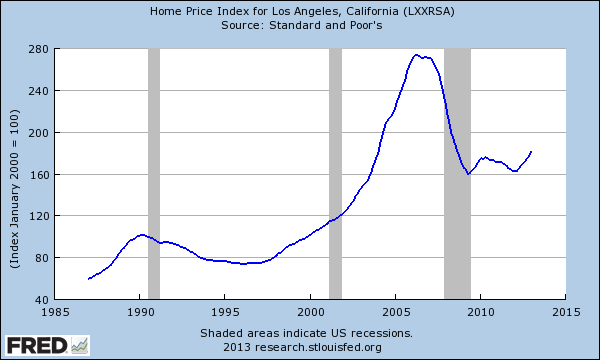

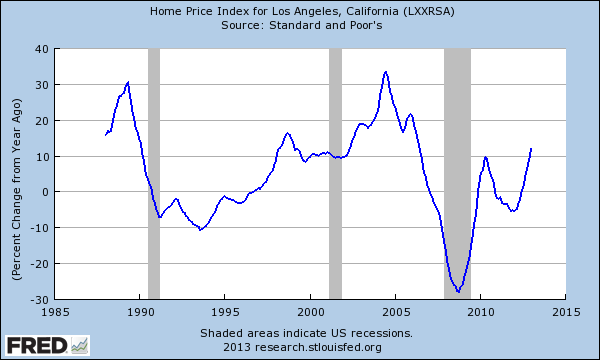

Without a doubt these conditions are boosting housing prices:

Ironically none of this is being driven by income growth or solid household income growth. It is interesting that some people say “income doesn’t matter†because of course it does. Essentially what we are developing is a perpetual system of boom and bust and the only way people can keep up is by guesstimating what is the next bubble. What do you think will happen when investors are exhausted of rental real estate? For years 30 percent of all purchases have come from this group. Then what when things return to their inevitable equilibrium?

You see from the chart above that home prices in Los Angeles are up. In fact, they are up by double-digits:

Income is stagnant. So you have to reconcile these facts but as we have discussed, investor money is coming from Wall Street and foreigners so it is not driven by local economics. Does shadow inventory matter? Probably not since regular buyers can only act on homes that are available on the MLS. You can have all the shadow inventory in the world but if banks refuse to list the property, you can only act with what is available. This is a part of freezing mark-to-market accounting regulations and in a game of attrition, many people are falling in line and now diving into the market (or trying at least since they are losing out to the all-cash crowd). What the distressed inventory tells us is that many regular buyers are still having a tough time paying their mortgage. No problem. Let an investor take it off your hands and then you can rent it back. That is the mantra. Yet many of these regular current buyers are with the mindset of being put many years (decades) while investors have a 1 to 5 year time horizon. We are definitely in the mania stage of the housing market and talking to average folks on the street, they are back to the good old days.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

78 Responses to “Does shadow inventory even matter in Los Angeles County? Non-distressed inventory at 17,000 and distressed inventory at 17,000.”

Seems the fed and the banks know exactly how to manipulate the common buyer. We are good sheep off to the slaughter.

Anecdotally, we are seeing the same market activity in the Pacific NW, but the investor crowd here is predominantly local developers and RITs doing the re-hab and flip on every distressed property and dilapidated bungalow. Many properties hitting the market 2-3 months after initial purchase at 2x or 3x the previous list, lots of “contractor pack” kitchens and bath remodels.

On the flip side, it’s damn near impossible to find an organic sale (in the city) of a well maintained, owner-improved property. The ones that do show up are almost always purchases made within the last 3-5 years, with a resale mark-up enough to cover closing costs and break even, and they are subject to multiple offers and above ask selling prices, or pie-in-the-sky pricing which don’t move.

Belshazzar, if you’re referring to the Seattle market, then that tracks with what I’ve observed regarding similar tales of what’s been going on there lately. I live in Portland, and so far that’s an accurate summation of the current state of the RE market.

The whole concept of “distressed inventory” – that homes in financial difficulty somehow produce some additional urgency on the part of the seller or lien holder – no longer applies. If anything banks now have even less pressure to sell assets than do “organic” homeowners. Thus nominally distressed sales no longer have any price pressure compared to organic sales.

I hear what you’re saying, but when did these forces ever really apply to the average 3.5% down or conventional loan buyer’s real ability to LAND one of these properties? Even when the market was flooded with REO’s there was frustration on this blog that you couldn’t get your hands on them (non-MLS deals, cash buyers, etc.). And short sales were in essence a game that banks and distressed owners were playing with each other, with very few real short sales ever seeming to materialize.

So, sure, now prices aren’t being affected by the distressed inventory, but in the past few years the true access to this distressed inventory was severely limited.

Seems like the “bottom” is an actual, historical fact, but the correlation between distressed inventory coming to market and real access to properties during the “bottom” was illusory.

A few points:

– All of distressed + current listings would only make it a normal 6 month supply, right? Nothing mind-blowing.

– Given the number of options for underwater homeowners to refinance, it’s not surprising that many homes in some stage of foreclosure don’t make it to market. In fact, there’s another program coming online in July for underwater Fannie/Freddie owners. That doesn’t even take into account the homes that get sold before/at the courthouse to investors and never make it to MLS.

– An investor looking at cap rates isn’t necessarily looking to sell faster than the average holding time of a owner-occupied home (7 yrs?). The securitization of leased rentals is an indication that big investors are planning for the long-haul.

– At the very least, the amount of cash-investors purchasing at this home price:rental income ratio should tell you that THIS RATIO is the point where cash investors will buy homes. I don’t know if they will continue to buy homes should prices rise or rents drop, but this equilibrium is where the cash comes in regardless of interest rates.

– Yes, income does matter, but it matters less than wealth. Wealth is purchasing many of the properties.

-Globally, look at the income:home price ratios. The US is cheap in comparison. Next, focus on countries where there is a big disparity between the wealthy and poor and look at that ratio. Now ask yourself: Is the disparity in wealth in the US getting larger or smaller?

“The securitization of leased rentals is an indication that big investors are planning for the long-haul.”

Is that what they said about sub-prime? Actually ,securitization is how big money dumps their position on the market. If history is any indication.

The big gap in this business model is that the rental market really functions in the reality of incomes and wages while the home purchasing functions in the world of the highly leveraged. Purchases can easily go higher than the cap rate will sustain and the rental prices can easily fall with too much inventory on the market. This is a tricky environment.

“…securitization is how big money dumps their position on the market.”

The “Big Money Investors” are already planning their exits. Blackstone will dump those properties and securities onto lesser specuvestors and then the house of cards will fall. Of course the banks will have cleared their books of much inventory so all will be hunky-dory 🙂

Securitizing the leases means those homes will stay leased. A titling trust will own the homes and down the line investors will purchase the security.

I get it, when someone says securitization on a RE blog many people probably think MBS and the sub-prime disaster, but many many assets have been securitized. While securitizing residential home leases are new, car leases have been securitized for over two decades and are doing well. Initially there were problems with rating agencies not rating the auto lease securities, and then not accurately rating them, but they’re relatively commonplace now.

I don’t know how the securitization of property leases is going to work out in the long-run, and I’m not sure what the demand will be for them. No doubt they will need to be credit-enhanced in the beginning and won’t be sold to most investors until the rating agencies feel comfortable rating them, but it’s way too early to say it’s not possible.

“Securitizing the leases means those homes will stay leased”

How is the security a real world guarantee of a continued lease??? And if the cap rate drops and the lease gives an effective 3-4% yield whose going to want to hold that security???? What will happen is when rents drop the securities will be next to worthless but the banks and the hedges will have already moved on. And comparing them to something that is relatively liquid and return predictable like a car lease, shows just how insane this idea is! It’s all part of a Pump and Dump to clear the banks of their toxic “assets”, nothing more, nothing less.

From what I can see , securitization is about passing on risk in a way that can handle large volume. Start out with a nice yield and sell it while it still looks good.

Once out in the market, the price will be “adjusted” to reflect reality of actually maintaining the yield. I guess REIT’s are essentially this kind of model as well. It comes down to how accurately valued is the underlying asset?

@NihilistZerO: I’m not saying the securitization of leases will keep the homes occupied with a renter but it clearly telegraphs their intent to hold the homes as a rental as opposed to flipping it.

There was a time where leasing cars seemed crazy. You’re letting someone drive off the lot with a immediately depreciating asset (that’s mobile) and have little idea what condition the asset will be in at the end of the term. Furthermore, you have to factor in if the previously calculated residual was accurate and if the estimated buy-back percentage held up. Then it gets securitized? Crazy, but now commonplace and rated (fairly accurately too)

One of the early issues with securitizing car loans was that investors could have been held liable for issues with the vehicle. The easy work around? Re-write the laws indemnifying them of that liability. Yes, it’s awesome to have a powerful lobby.

Neither you or I know at what price point these whale investors were able to purchase their properties. Without that simple fact, how can anybody accurately judge whether or not they can be successful?

Take Blackstone for example. They’re concentrating in the SouthEast to consolidate properties. They’re partnering with Riverstone (a large and experienced property management firm that will get consolidate maintenance AND sign exclusive contracts with telecom/utility providers for further revenue) Furthermore they’re partnering with Experian to put together a national rental database. Get evicted in Tampa, FL? You’ve just narrowed the possible places for you to rent in that city. On top of all that, they have more money to throw at lobbyists to change laws if needed.

@CAE: Yes, the bottom line of why people buy and sell securities is to diversify portfolios and spread out the risk.

Is the IE the leader for SoCal as far as timing this bubble? I’ve seen properties closing at 15% over zillow on Redfin while also seeing rental asks coming down by 5% plus. This mania is likely to end faster than bubble 1.0 as these investors are probably already eying an exit strategy as rental yields are going steadily downward as more of these rentals come online. Not to mention the legion of part time workers that Obamacare is creating. They won’t be paying higher rents/mortgages anytime ever.

In the IE you’re not seeing the hot price appreciation like you are in the OC/SD/LA. It’s almost non existent. My cousin just bought a home out here it’s probably $30-40k more than it was at bottom big deal. No bidding wars nothing. His buying process was even more painless than mine was when I bought at the bottom 2009.

“bought at the bottom 2009”

“So this is the market you are left to contend with”…not me i simply can NOT afford a $500K starter home and i made what would be considered good money in every other state but this one.

Sure you can contend with it – by renting.

It’s looking to be the smarter play for the foreseeable term.

More news on bankrolling of ‘investor landlords’

(Reuters) – Private equity firm Cerberus Capital Management wants to provide financing to small investment firms that are buying foreclosed homes as part of a long-term bullish bet on the housing recovery, according to four sources familiar with the situation.

http://www.reuters.com/article/2013/03/28/us-cerberus-foreclosed-financing-idUSBRE92R0MK20130328

Everybody aboard, The Fail Train is about to leave the station!

I’ve tried to purchase twice in the last month, both times they received better offers even when I offered slightly more than asking price. Looks like a few more years of living in moms basement for me. I don’t know how people can afford houses, I make more than the median family income and I can only afford the lower 1/3 of listed properties. Maybe someday I’ll be able to afford a plywood roof to sleep under, it will just take 30 years of half my income.

The leveraged “buyers” can’t afford them. They are however, willing to purchase with some bank’s newly created checkbook money.

I Totally feel ya Buddy! I’m in the same predicament. I make pretty good money and it is darn near impossible for me to buy a house in Southern California. I’m living at home with my parents, and I guess I’m going to have to stay a little longer if I’m going to wait out this hellish housing frenzy part 2!

Well I’ll tell ya one thing. The longer things go bad in Europe, the better the Fed and Treasury look to the US and the world. Lamens terms that means the game goes on for a while this year. And just in time for spring and summer housing season.

P.S. I make my statement only at face value. Of course any number of things (good or bad) can happen longer term, that’s common sense. I’m only commenting on what’s happening as of late.

ZH has a couple of nice graphs on the housing recovery as it pertains to the whole country.

http://www.zerohedge.com/news/2013-03-28/spot-housing-recovery

So, prices nationally are back to 2004 levels, and the media is yacking up a storm about a housing recovery. No surprise, that’s what the media does….it loves a disaster and a recovery. A fall from grace and retribution. What the media doesn’t like is blah/bland/boring/prudence/stagnant/etc.

Since the primary residence real estate market is an emotional game as much as a financial one, the propaganda being filtered through the media about the recovery is most certainly working on the prospective home buying public.

The media meme of a “recovery” is like Home Depot dopamine to the brain of a home buyer; it instills confidence and a sense of urgency at the same time, which leads to a mini-mania we’re seeing now.

That being said, the biggest driver regarding regular prospective mortgage-holding people is that they’re sick and tired of waiting to “start their lives” and they feel a need to buy NOW.

What’s interesting about this bounce is that the transaction volume is quite low and many of the buyers are investors rather than owner-occupiers. So, essentially, we have a bounce in real estate market based heavily on speculation fueled by very easy money policies. Not by growth in employment or incomes. So this bounce is far from organic. It’s fundementally, very contrived and speculative. These kinds of things tend to end badly.

The housing bubble was inflated by the financial sector (as was the current student debt bubble).

The problem with both parties (BOTH!) is that their strategy to deal with this problem revolve around *smaller* government “debt” (i.e. fewer financial assets in the non-government economy), so they’ll be creating deflation as soon as the housing bubble they’re creating now bursts, pressuring debtors *even more*!!

Notice how little actual debtor relief has reached suffering homeowners, and how few prosecutions of illegitimate foreclosures have occurred. In fact the leaders of both parties are pointedly ignoring those things, Obama is prosecuting whistleblowers, and anyone who points out the charade is classified as “not serious.”

Awfully suspicious, BTW, that the bankruptcy law changed just before the creditors started driving the economy into the ditch.

To those who want smaller government “debt” — As a legacy of commodity-backed money, the Fed creates a dollar of “debt” for each dollar government net spends into the economy. This is where any new dollars come from.

So…without bigger government debt, or bigger net exports, the private sector’s financial assets will be diminishing just as their debt load has been fraudulently maximized.

The proposal to reduce government “debt” is is true of *all* proposed Federal budgets, left, right and center. Deflation, which is what we’ve had, and what transfers assets to creditors, will rule, at least until bigger government “debt” happens.

Why the quotes for “debt”? Because its an illusion. Treasury could legally, literally mint a few trillion-dollar coins tomorrow and extinguish the thing. Show me a household who can do that!

For those of you saying “Yeah, but debtors ought to pay what they owe…” I say “Even if lenders gave million-dollar loans for hot tips at the track?”

Lenders have an obligation to underwrite their loans (i.e. vet them to see the borrowers can pay them back). There’s even a colonial-days law that makes illegal lending to debtors unable to pay with the object of foreclosing and taking the property.

…and the banksters remain un-prosecuted, as do loan servicers, so they can do just about anything they want.

Anyway…forgiveness of fraudulent debts (or all debts) would certainly be possible, and shrink the unproductive, rent-seeking lenders. I’m not exactly holding my breath while waiting for it to happen, though.

Exactly:

The laws of nature and economics have changed since back in the days of the Weimar Republic.

No. There is no such thing as free money. America was allowed to run up this debt because we convinced the world we were good for it. The same principle applies on the mom and pop level of basic borrowing. If you are someone who is talented and unlikely to be unemployed for long, you will find it easier to borrow money from friends. If you look sharp and well-dressed and successful, you will convince more people you are talented, even if you’re not… It is about confidence.

America is the equivalent of a great confidence MAN, otherwise known as a con man. We made everyone believe we were good for the money; that we would be the great superpower forever, and the sun would never set on our majesty. That is why people bought our debt. They believed that in the long run, it WOULD be paid back, you see.

No one believes it anymore, not with the printing presses cranking like this, and the fundamentals of the economy in the toilet. It is only a matter of time before it becomes counterproductive for other nations to buy our debt, and then you will see why the fairy-tale that we can print money forever is just that — a fairy tale.

Sorry AdamEran, I skimmed your post and mistook what you were saying. I thought you were saying that debts could just be erased, that they didn’t have to be paid back, then the follow-up post fit that reading.

Anyway, my soapbox-y reply applies to many other recent posts on this board!

Here in the Monterey, California area, we have been shopping for a single family house for a couple years. In the last year, it has been a case of higher prices and bidding wars. Open houses have been having so many prospective buyers showing up one would think free food was being offered. We have offered on one or two houses but told the seller has gotten higher offers. On our bids, we have been pressured to make a $$$$ offer after just a walk through, without seeing any inspection or other evaluation reports.

Yesterday, we made a offer on a house and the seller was refusing to even let prospective buyers come inside to see the inside of the house unless she decided to accept our offer. In this case, we offered $325 (real estate agent’s estimate of value) on a 20 year 1,800 sf 3 bed 2.5 bath 2 story tract house with a postage stamp yard, but in a lower crime area. A house not even listed yet. Owner’s response? $399 she wanted. Real Estate lady’s comment re. $399 (“She is crazy….house selling range should be 325 to 350, no way house worth 399). And the real estate agent was one experienced with the current “flash mob” style open house scenes and cash bids well over asking.

First off, thanks for this website and thanks to all you commenters because your insights have been confirming my feelings, but its hard with all the noise/sales pitches coming from cnbc, bloomberg, etc.

I agree that the free money policy of the fed is distorting the stock and real estate markets, banks of messing with supply, cash bids are king and families like mine can’t get a house bc non-LA folks from NYC and overseas are controlling the market in so cal, etc

On the other side, as a NY-er who relocated here 3.5 years ago, I see east coasters getting sicker and sicker of the weather and trying to come out West to Cali, the world is scary and many people still trust the US the most so buying real estate in desirable spots may be a long term trend, rather than a short term investment (or maybe not), etc.

Knowing all that, I guess I just don’t know what to do with all this information in terms of buying now or waiting for some great crash that should happen in 1-2 years, but may not for a long time because the govt can manipulate things for quite some time and we’re in unprecedented territory now with all the fed easing.

Here’s my specifics. I saw a small house on a Tuesday back in december on spalding between beverly and melrose that was 2 bedroom and 1.5 baths on about 6000 sq ft. It was a cute small starter house, but when I went to bid, there were 8 bids above list with 2 cash. It went for about $850k.

Recently, I bid on a 1800 sq ft house in silver triangle in studio city. It’s on a cul de sac and has some recent clean up work, but nothing expensive. It’s move in but someone would want to do a little work eventually. its 3 bedroom/2 bathroom and was listed for around 930k. I came in strong at $975,000…but lost to an all cash bid of supposedly around the same amount or a little lower.

Now I don’t even know if I win a house bid, do I really ‘win?’ Am I overpaying? My buddy in FL tha flips houses says things are going apeshit in Miami, but he said be very careful bc this run feels like a 2 year not a 6 year run. He also said if you can’t rent the house for its mortgage/taxes costs in an emergency, I’m crazy to buy, is he right? Is that true in LA? I don’t think I an rent a 3 bedroom in studio city for $5000 to cover its costs if we had a horrible event or something happen to us.

I’m really confused first time home buyer that has saved enough to put down 20% and have some money leftover as protection, but i dnt want to piss way money either. just tired of living in 800-900 sq ft rentals forever. so any thoughts greatly appreciated. Thanks.

Don’t get caught up in the madness:

1. You are about to spend close to a million bucks on a house. Think about it.

2. You are in a competition with people to see who can out bid the other.

3. You’re in California and real estate bubbles and busts happen all the time.

Number one was epic, JQ. I’m exhausted with trying to process a lot of macro and micro information and that made me laugh. I’m the guy that pulled out if stocks right before the crash because I knew its was all bs….but I did not know of this wonderous thing called quantative easing, aka inflate assets for five years while my cash turns to crap in a bank account. So now I’m sitting on cash losing value every day. Even assuming your number 3 exists that LA is a bubbly land, what if that true bottom is another 5 years or more away instead of what a lot of us feel is 1-2 years away. I mean it feels like it should have ended already and it hasn’t yet so i mean its all USA, USA, USA…What if the bump in 2 years is 10% down (and then no one in prime spots sells) and then back up 2-3% average annually thereafter. Now remember the cash is nice and cozy in the bank account, but secretly uncle fed is sneaking some and giving it to by homies on Wall Street to gamble with (often against me for houses now) so I am technically losing money to inflation. Sorry if this is rambling. As a former corporate attorney, its hard not to play devils advocate because I’m hoping you say, yeah, but dummy, you’re forgetting…

First time buyer, the sad truth is that nobody here (or anywhere else) really knows what’s going to happen to home prices. On the one hand we all know that prices are being artificially manipulated and believe that they “should” come back down. That said, few can deny the effects of the massive injection of money into our financial system. If QE and its effects linger we may devalue the dollar enough so that nominal home prices may never fall. Personally, I’d hate for this to be true, but I recognize it’s very possible.

In short buying a home now has significant risks, and so does holding onto cash and waiting for a better buying opportunity. Happier now? Me neither.

A…..men….I guess I feel better that someone else sees the same things I do and just doesn’t know how to react.

If the house you’re interested in will cost more monthly to own/finance than rent, then you should rent it. It’s really that simple. The risk is all to the downside right now. If you buy one of these small million dollar homes, how happy will you be paying hundreds more, maybe thousands more, monthly than you could be paying to rent it? How happy will you be when rates eventually begin to rise from sub-4% to 6-ish, and the value of your home drops $250k? If those likely scenarios make your stomach sick, then the last thing you should be doing is trying to buy one of these homes.

All good points and all makes me sick, but lets do the math:

House at million purchase price at let’s say 3.825% mortgage and 1.25% property tax is about $4780 per month. This would be even less if we weren’t being conservative and used 3.5-3.75%.

Lets say sht goes down 25% in your scenario and the house is now listed in a few years at $750,000k with 6% interest and still 1.25% property tax. It’s about $4,380 per month. So now I’m saving only $400 a month and then praying rates go down to 4% again I guess so I can refinance? I mean that’s a definite possibility, but lots of what ifs too with an uncertain political landscape next time sht hits the fan….if it does hit the fan of 25% and not just a little down/not much growth and then don’t forget the benefit of owning (now at least as things may change) is the mortgage and property tax deduction, the fact that I can feel vested in doing something to the property/home I live in, rather than not caring too much because its a rental, etc.

You wanna know something that really scares me, and this is probably why bubbles happen, and that maybe scares me more (undecided still as you can tell I waffle back n forth), is that what if home prices only go down 15% (say to 850k) and interest rates go up to 6%, then its $4960 per month. Remember things may go up more before they go down so even if they go down 25% or even 30%, that could be after going up 15% or more. If its a 10% down spread and 6% rates, then its $5255.

….and the who says its 6%….Now you see why I’m confused on what to do? 😉

First, your scenario of 25% down market and 6% interest rate is not realistic. We just had 40% market crash in housing, and the chart is crawling at the bottom. We have governments around the globe printing money to support the housing market. Another 25% crash from this level is just hard to imagine. 6% mortgage rate might happen, but not because it will crash the market, but everything is getting better, and capital demands return. I do not understand why people keep insisting on the rate will go up. Bernanke said this openly and repeatedly he will not raise rate till everything is going up. Bernanke controls the rate. Historically interest rate is the last to move in comparison to other economic indicators. Martin Armstrong did a lot work on this. It’s funny that many people don’t believe Bernanke, as he is the man who controls money and everything.

If this is purely a financial decision, do a rent/buy analysis with a comparable rental. If you’re bullish on the economy assume rents increase. If you’re bearish, assume rents stagnate or decrease. If the numbers tell you to buy, do so. If you want the flexiblity to move around every couple years if needed, assign a rental bonus per month. If you want the stability of a fixed-long term payment, assign a bonus to the home-purchase. Easy enough right?

Yeah, except it’s not. If you’re looking in an area that’s affluent, the rental of a SFH won’t be in-line with PITI. Because at that price point there’s the luxury aspect that people have assigned to owning a home in that area as opposed to renting. People who live there probably drive cars that are financially impractical and are willing to pay that difference. In the same vein, they’ll pay a premium to own there too.

Nobody can tell you what the housing market is going to do. Not even Ben Bernanke. And certainly nobody is going to know how you value stability, flexibility.

Good luck!

Thanks, MB. I guess you are confirming my thoughts that in prime spots here, its very hard to rent out a single residence for its monthly costs.

It’s not purely a financial decision as I feel like I need some space finally and a yard. Living in tiny 1 bedroom boxes with no yard my wife and dog in NYC FOREVER and it gets very, very old after a while. I just don’t want to be the sucker who overpays by 20% ya

I was reading a blog somewhere where a savvy investor just paid 375k for a place in Lake Forest and said he was going to rent it out for 2600 a month. That sure doesn’t pencil out for me.

First time buyer, I read several of your posts and you seem very uneasy about buying right now. I think one of the big reasons is you are literally shooting for the stars by trying to buy a million dollar house with 20% down. You did the math, you’ll have a pretty big monthly nut with that 800K mortgage and other costs. There is no way you can rent out that property to cover your monthly costs if something happens. Why not look for a slightly cheaper house or cheaper area? That way you can pay a higher percent down, have lower monthly costs and likely be close to rental parity.

As far as the big crash coming sometime in the near future, who knows. At this point, I wouldn’t count on it due to all the intervention we have seen in the past five years. If you can get yourself into a good area at rental parity I think you’ll be fine no matter what. Renting an 800 sq ft apartment is only tolerable for so long, many of the benefits of owning your own home are not found in the rent vs. buy equation. As I’ve said before, the desirable areas will become even more sought after as time goes on. Good luck with whatever you decide.

Thanks for the reply and advice Lord B. Agreed, I am nervous about buying right now in So Cal. If a buyer wasn’t somewhat nervous about purchasing in the current environment here, I would think something is wrong. Anyone who says they ‘know’ this market is a better man than I considering we’ve never experienced this set of circumstances as a nation before so there is no precedent.

Looking for a cheaper house in a cheaper area in LA is easier said then done, unfortunately. Once one area moves up in price, so do neighboring areas, so now you’re overpaying in that area even though it may be cheaper than the house in the better location. It’s all relative and finding a ‘deal’ here with all the investors, flippers, cash, etc-good luck. Also, picking non-prime areas out here can be great if there’s gentrification and not so great if the world slows down and those gentrification plans are delayed. Lastly, don’t forget with leverage at these rates, an extra 100k of purchase price on a mortgage is only like $400 a month. Keep in mind, I tried getting a 2 bedroom/1.5 bath and I lost to a cash bid of almost 850k!

I guess I’m confused mostly about if in LA, single residences in good spots are supposed to rent out for the costs of their mortgage and property taxes. From my online limited research on Redfin, it certainly doesn’t seem like it happens. There may be a premium here on ownership…or maybe things are just out of whack, not sure.

I’m sorry if flip flop back and forth….it’s because I do in my head every few hours. Curse of being a Gemini maybe. I also am backup on a $975k house that I’ll find out today if the cash buyer didnt perform, so I may need to make a decision very soon on purchasing. Doh!

Many of the benefits AND disincentives of owning/renting don’t show up in own vs rent comparisons.

Another factor – state of CA has major financial and demographic headwinds. There are already some creative tax schemes going on to increase property taxes. I bet good money there will be more of this moving forward. Property taxes and insurance guarantee there’s no such thing as a fixed payment when owning. Anyone who has been a home owner long enough knows this.

I’m not claiming that renting is the best answer in every scenario but when we’re honest about the financial comparisons, it’s rarely a clear cut choice, so things such as mobility and emotional desires come into play.

First time buyer, you said “I guess I’m confused mostly about if in LA, single residences in good spots are supposed to rent out for the costs of their mortgage and property taxes. From my online limited research on Redfin, it certainly doesn’t seem like it happens. There may be a premium here on ownership…or maybe things are just out of whack, not sure.”

That’s a tough question to answer, but I’ll take a stab. In the last 5 years in Socal, rents have definitely increased almost yearly. The monthly cost to own has definitely went down due to the super low rates and decrease in nominal prices. Back in 2007, the rent vs. buy equation wasn’t even close…but it definitely has tightened up quite substantially. Given today’s super cheap money, anything below 500K is probably at or below rental parity. When you start looking into the premium areas, rents will reflect that premium. With a 20% down payment, rental parity in premium areas is probably in the 700K to 800K range. The big drivers are today’s super low rates that allow a significant amount of principal to be paid down from the get go along with the numerous home owner tax breaks. Good luck with your home purchase.

Thanks Lord B. Your calculations seem right compared to what I’m seeing. At a million, I’m feeling like i could rent it for 4k furnished with costs of around 5k a month, so 1k loss per month (not inclusive of the mortgage interest/property tax deductions).

Also, like you said, my rent at a premium spot (but just a 1 bedroom) has gone up the past few years including the new record $250/month (over 12%) just this recent renewal.

First time buyer, I totally hear you regarding the rent increases. That was one of the key factors that got me off the fence last year. Every year I would have an envelope taped to my apartment front door saying something like this: “due to the improving the economy and much demand and no vacancies for these apartments, market rents have increased XX% from last year.” I’m sure we’re all in agreement that this is a complete BS economic recovery and the manipulated housing market has literally no inventory that essentially keeps renters renting. In a normal market, rents are generally capped at what the market can bear. However, we are far from a normal market and renters will likely keep getting squeezed for the next few years. The only options are to bite the bullet and stay in your rental, buy a home or move to another rental (moving every year or two is insane to say the least and that is not really an option for most).

These are all reasons why so many people are all of a sudden in the buying mentality. Having a fixed mortgage for the next 30 years and Prop 13 tax protection keeps monthly payments very constant. From what we have learned from the past 5 years is that renters are held in much lower regard than “owners.” And that isn’t going to change anytime soon. Good luck!

the regulators allow banks to rent out property while they wait for the prices to go up.Let’s face it, banks want the prices to go up now, so they can unload their inventory. For the next few years, prices will go up until the banks get rid of their inventory, then they will fall back again.

Hi Ben. I’m ‘first time buyer needs advice please’ above. It seems like many of us agree with the facts, but the conclusions on whether to buy in a better, not best, part of LA now makes sense. So if you overpay now and the market goes up a bunch in two or three years and then goes down, does that mean you’re better off buying now or waiting until the crash? It just seems so hard to tell now bc if it goes up another 15% in two years, then whatbf ony crashes 15% and now interst rates could be higher. I spend hours a day on this stuff and am well educated in business and corporate law and still just ant figure it out. Beyond frustrating. Old rich people can keep a part going on for a while and those of us who played by the rules are getting poorer each day with our money in bank accounts.

Buy what you can afford, when you can afford it.

Stressing out about a home purchase does not bring you happiness, which is what buying a home is supposed to bring in the first place.

The mindset of a house bringing happiness is part of the problem. A house can only compliment happiness.

When I hear and read that sort of sentiment, I’m reminded of people that have babies in an attempt to fix unhappy marriages.

Marc,

Do you need to live in LA for work? A million bucks goes a long way in other sunny, coastal CA locations.

Hey, brazil66. I’m open to other sunny spots in Cali besides LA, but most coastal spots I have looked at are just as pricey, if not pricier. Im scared shtless of IE and am a believer in location, location, location (and lack of free space to keep building more homes to control supply) in a scary uncertain world. Where ya thinking?

I think you’re onto what’s really happening. Just like QE is about saving the institutions that have all the crap loans. This cheap mortgage rates and all the banks that are allowed to hide the upside down loans is really about giving the banks and large institutions an exit strategy to rid themselves of all the crap on their imbalance sheets. Once this is relatively achieved, look for the whole thing to unwind once again.

The reason behind evaporation of foreclosure bank inventory for sale. The banks are now in the rental business. The banks now control the real estate market, that is why the FRB is financing all the purchases.

Board of Governors of the Federal Reserve System (Board) releases policy statement on rental of residential real estate.

On April 5, 2012, the Board released a policy statement reiterating that banking organizations may rent residential properties acquired in foreclosure as part of an orderly disposition strategy. The foreclosed properties (also known as other real estate owned, or OREO) may be rented within statutory and regulatory limits, such as within legal holding-period limits, without demonstrating continuous active marketing of the property for sale, provided that suitable policies and procedures are followed. The policy statement also clarifies to the extent that OREO rental properties meet the definition of community development under the Community Reinvestment Act (CRA) regulations, the banking organization would receive favorable CRA consideration. The policy statement applies to banking organizations for which the Federal Reserve is the primary federal supervisor, including state member banks, bank holding companies, nonbank subsidiaries of bank holding companies, savings and loan holding companies, nonthrift subsidiaries of savings and loan holding companies, and U.S. branches and agencies of foreign banking organizations.

“The banks now control the real estate market…”

The reality is though they control the inventory, they can’t control “the market”. By that I mean they can’t jump start income growth to support cap rates on rentals that will allow them to dump the inventory as quickly as they’d like. This Pump and Dump in collusion with the FED is as close as they can come. They can only fight gravity for so long, and much to Helicopter Ben’s chagrin, Bubble 2.0 will pop before his term is up.

The fed feeding Oreos to banks in poor neighborhoods and saying the CRA is satisfied if the banks hold the Oreos down. You couldn’t make this stuff up if you tried.

I work almost exclusively as a short sale listing agent, and it’s now taking anywhere from 3-12 months just to bring property to market after the borrower has received a notice of default. And this is normally after 2-3 years of not making a payment!

Due to the national mortgage settlement and the California Homeowners Bill of Rights, the banks are taking a very, very cautious approach to foreclosure. I’ve gotten borrowers into loan mod 1 day (!) before trustee sale just by calling the bank, something that was unthinkable a year ago.

I’ve got several loan mods in with Chase, Wells & BofA that have been stuck in review for 6 months waiting to go to underwriting. If they get denied, these may be my Fall sales. If approved, 50% of them are off the market for 18-24 months, based on the re-default statistics.

I’ve also got a couple with DOJ principle reduction loan mods (one for over $300K!) that may be removed from the market permanatly, or until a payment is missed and the offer rescinded. Seeing lots of seconds cancelled – up to $150K. This is supposed to make the payment more affordable, but is kind of a joke since no one was paying the second anyway.

I feel bad for these agents with their FHA clients. I turn down several of their offers every week because the additional financing conditions on top of a short sale are a lot of extra work to resolve. I’ve done it, but usually end up regretting it.

I’m actually pretty skeptical of the “all cash” buyer. Many of these guys are full of BS and use the all-cash, over asking price play to get their offer accepted. Just before closing, guess what – they want to switch to financing, or worse, start renegotiating the terms of the deal because they’re overextended and don’t have the cash.

Yes, the shadow inventory is out there. It just takes an extrondinary effort to pry it loose at the moment.

And you should see what they did in Nevada — The Nevada legislature, in its infinite wisdom, has made it a FELONY to fail to cross every ‘T’ and dot every ‘i’ in a foreclosure process. The bill is called AB284 and it creates onerous conditions for bank foreclosures, one of which I believe was overturned by a court already.

Immediately after the bill went into effect foreclosures fell from thousands per month to almost none — 80 percent drop in notices of default.

The squatters are happy, anyway, as are the home building companies.

Banks should be held responsible for improper foreclosure procedures – but in civil court. The effects this legislation has had on the housing market are very, very bad.

Remember all those people that were saying that the houses should be bull dozed in order to get rid of too much inventory? Well, essentially, they’re doing it.

By allowing banks to hold houses on their books at face value and to make the foreclosure process a scary endeavor, the system has basically sealed-off a bunch of existing homes from entering the market.

One other comment.

A fellow agent just went to work making offers for one of the large banks. He knocks on the door of people denied for loan mod and offers them the lease back program. Property is sold to an investor with a 3 year lease to the homeowner.

After 3 years, the homeowner gets the first right of refusal to buy it back. Price is adjusted up 5% per year. Agent just gave me one of the solicitation packages to review. Haven’t seen a final contract yet.

End result, more property held off market.

Annual Home Price Appreciation Rates in Los Angeles..went up by 58% in 3 years of late 80’s then fell down 20%…then went up by 132% between 98 and 2006 and only fell back down by about 30% (until 2009)… How can anyone say this is a recovery again? We have easily MINUS 60% in prices to go if the fed wasn’t giving away money to wall street

http://www.forecast-chart.com/prices-home-los-angeles.html

Ever think that your home appreciation analysis of LA is a pattern! Who says home prices have to drop 60% before they can go higher? I don’t think home prices have fallen 60% in history of the US.

Because they’re NOT a pattern. Housing never went up 150% to not drop again.

” I don’t think home prices have fallen 60% in history of the US.”

Did housing ever go up 150% up in a span of 5 years in US history? What is this “pattern” you speak of?

“Investor” cash is a pretty freaking magical ingredient. Here in central Mass., about 40 miles out from Boston the economy is better than the national average. It’s not good but it doesn’t seem to be as bad as most of the country. I work in civil engineering with a lot of connections to real estate and know a few veteran real estate guys. Things here are doing . . okay. But there’s no stampede to buy anything. It’s not 2009. We have clients just slowly, steadily selling homes in subdivisions that got their permits several years ago.

My boss and his wife were looking to sell their house, a large, well kept, immaculate home in a nice neighborhood in a desirable town and they told me they got nothing but bottom feeders, people hoping to pick up a home way below real value.

I read Doc’s stories of this echo bubble and don’t know whether to laugh or to cry. Folks who are at all complacent about this insanity should remember that the american economy did pretty well in 1931 before utterly collapsing in 1932. Echo booms can happen early on in the transition to a terrible bust.

I work for a distressed debt investment company and I manage about 200 loans. The information you provided about the CA market is spot on. The mania is incredible, and you wouldn’t believe the amount of cash offers I get from investors. The few FHA offers we do accept, most of the time they don’t close, need an additional buyer, or fall out due to inspection or appraisal issues.

We have MANY properties that are still in some state of foreclosure from 2008-2011. New Jersey, Florida, and New York are completely backed up. It blows my mind how banks are able to hide this bad debt, unload it to investors, write it off, and keep making profits. The shadow inventory is huge, and will only get bigger.

I have also seen an increase in recently originated FHA loans going into default. I have a feeling FHA and FNMA will become a bigger part of my distressed loan portfolio.

I think that we can all agree that the banks make more money by not dumping property on the market all at once and driving down prices. People use to complain when forclosures and short sells were driving down their prices. Now people complain that the banks are not dumping property on the market because prices are going up and the inventory selection is poor. Give us a break folks. We just can’t make everybody happy all the times.

…..Or maybe there’s a happy medium between dumping them on the market and barely bleeding them out, usually to insiders in a secondary, opaque market.

You’re being quite disingenuous, to say the least – regardless of what current homeowners wish, in order for the housing market to operate in a transparent and free market, the bottom must be reached, as quickly as necessary. This was demonstrated repeatedly during the S & L crisis under the auspices of Paul Volcker, and should have been followed to the letter regarding this implosion. However it wasn’t, particularly because the banking industry has become inexorably intertwined with all of the levels of power in the government – spin it all you wish, that is the reality of the situation we find ourselves in today.

You could have ‘made everybody happy all the time’ by not giving out money to people who could not afford to pay it back in the first place. You created an artificial demand for real estate with zero regard for systemic risk. Recently, a series of bankers and financial types were sentenced to death for behaving with zero concern for systemic risk in Iran, and in the comments sections on the news websites reporting this, Western commenters cheered them (the state of Iran) on. I think Iceland et al. put their bankster-misbehavers behind bars.

I’m not blaming you for interest rate dynamics. I’m not blaming you for speculation mania, though you certainly were the catalyst there. But giving out 200k loans to illegal aliens, to folks whose annual salaries couldn’t justify the loan amount, etc. – that’s all you.

I took a loan out in 2005. I was moving an east coast town that had no bubble, to Los Angeles, and had no idea what was happening behind the scenes. It’s not that I’m not a smart guy – when I was 18, I could solve multi-variable calculus problems, and had aced all my statistics, calculus, econ, physics, etc. classes in college; it’s that I had no idea what I was doing (purchasing RE) was risky or something i, a financially responsible person, should be cautious about, having never seen it depreciate in my lifetime. It never occurred to me that I had to do lots of research into the market to truly understand the risk. I didn’t know what I didn’t know. I didn’t know that I had to know what I should have known: At the time I naively believed in the free market, and thus thought a bank wouldn’t put itself at risk by giving out loans to folks that couldn’t afford to pay them back (or had a low probability of doing so).

So here I am now, in 2013, who should have seen 2 or 3% annual appreciation on my place I purchased in 2005, which would have given me $145K to $170K in equity (including principle pay down, and pre-payments). In reality, I only have about 30K in equity, and that’s just because the market is so manipulated.

You probably understand the ideas of opportunity cost and appreciation. So you can fully understand that even if the bank erased my outstanding mortgage debt, allowing me to reallocate my mortgage payments into savings or investment, it would be damn near impossible to ‘catch-up’ to the amount of appreciation that should have been added to my RE purchase every year, had you not helped the bubble along so credibly. I know the macro-situation is more complex than this thought experiment, but what I’ve stated still holds true in the context viewing my situation versus that of the overall economy.

In an attempt to transfer my ‘wealth’ to you, you’ve let my ‘wealth’ spill out onto the bottom feeders, as I continue to subsidize idiots in Beverly Hills, living for free for years whilst not paying their mortgage, idiots that bought Mercedes with home equity lines of credit and then defaulted, idiots that got to live in nicer places than they should have been allowed to live in for years, etc.

I’m with Iran on this one.

Apologies – that wasn’t meant to sound like a personal attack. Just venting frustrations.

With renting becoming the only option for most ‘normal’ people in California, it seems like it is becoming a modern day feudal system.

The only way to beat this game is not to play it. The market is rigged for the bankers and has been since this all started. In a couple of years it will all come crumbling down again but the fed will have used up all its tricks. Then that will be the time to buy when interest rates are 8 or 12% and prices have dropped to 1980s prices. Rent now and save your money. Save all the money you can and let the suckers race into the fire.

Amen!

Just follow real incomes as that is what will pay for

the mortgages.

I’m also in the same boat as many of you. We’ve been looking for a house for 6 months now and continually get outbid by cash investors bidding 30-60k over the market value of the home. The OC is nuts. I’d like to go to Corona or Chino, but spending 2 hours on the freeway each day is no way to live. It’s really frustrating. My wife and I make double what the median income in LA/OC is and we still can’t find a home. I’d like to wait for a crash, but we have a family now and living with parents is getting old.

Move your family into a rental, problem solved.

Leave a Reply to Debt-Free