Riding in the Short Bus of Housing: Southern California Short Sale Numbers. 1 in 10 Homes is a Distress Sale.

We are back in wonderland where losing jobs is apparently good news for the markets. These false rallies will once again lose steam once people realize that reality on Wall Street is very different from daily living on main street USA. In this short article, we are going to drill into the short sales data I have been accumulating since last summer. There are multiple indicators that can give us an idea of where the market will be heading but short sales are such an important factor in determining the depth of price changes and length of the downturn. Employment is another key factor since without a job you will find it difficult if not impossible to make your mortgage payment. Amazingly, the Fed fund rate hasn’t stopped the growth in short sales or foreclosures. In fact, it may be encouraging Ponzi behavior because as we are now vividly aware, folks are more and more willing to walk away from their mortgage obligations. The psychology is such that if a family purchased a home for $500,000 and now realizes they can purchase the same home for $350,000, why not hop into the other home with record low rates and let your $500,000 home foreclose? You can do this while your credit is still intact as I have been hearing from folks since many realize they are not going to get peak prices.

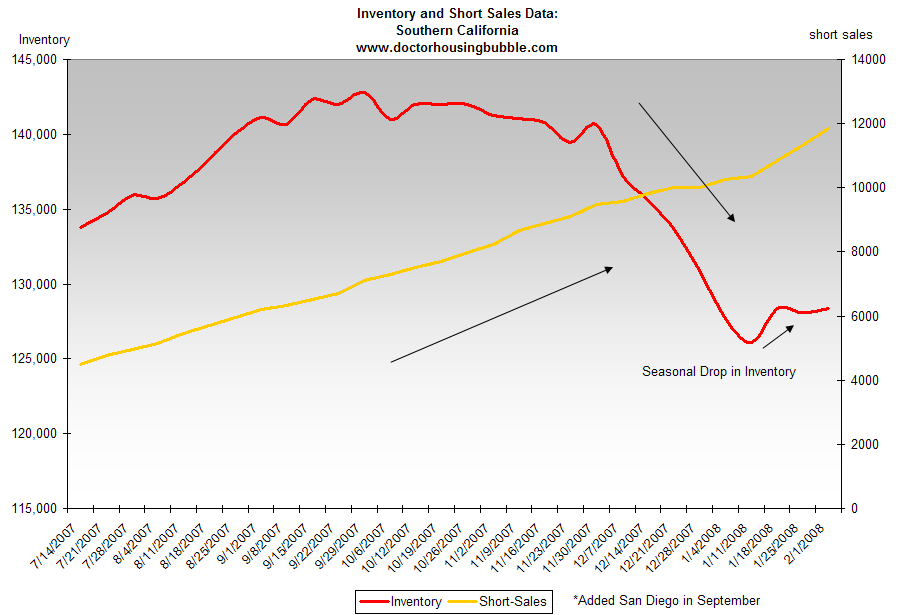

The good news is banks are raising their down payment requirements. At least this will force many buyers to have some skin in the game. Short sales are a significant indicator of market distress because these are homes that are being sold not because of voluntary action but because of circumstantial force. Unlike seasonal fluctuations that hit during the winter and summer months, short sales keep on increasing regardless of seasonal factors. These are based on reality factors and not the Surreal Life of Reality housing gauges. Southern California just crossed a monumental point today. Now, 1 out of every 10 homes for sale is in some form of distress. Since many of you love graphs, I think this graph sums up what we’ve been living through in Southern California:

*Click to enlarge like a subprime reset

Threshold Past

What you’ll notice is that inventory has been steadily declining since late September when it hit its peak. You’ll notice the seasonal decline which occurs every fall and winter. You’ll also notice from the graph the steady progression of short sales regardless of any movements in aggregate inventory. As a telling sign, short sales jumped from 3.3% of the market in July to the current 10.14%. We’ve nearly tripled the number of short sales in 7 months! If you are looking for signals of a market bottom, short sales are an important and crucial indicator. Until short sales slow down, any bottom calling is pointless. These are also important because they reflect the nature of local markets and are based on local inventory numbers. When you think of Real Homes of Genius, think short sales.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

7 Responses to “Riding in the Short Bus of Housing: Southern California Short Sale Numbers. 1 in 10 Homes is a Distress Sale.”

What would happen if you bought a house for $500K and two years later it is worth $275K, you let it slip into default and becomes an REO, then buy it back at the auction with another lender at a steep discount?

Do you have inventory levels covering the same period for the prior year. It would be interesting to see that and thus remove the impact of seasonality from the underlying trend.

Along with shortsales and foreclosures is there anyway to gather data on insurance claims on real estate. I’ve noticed there seems to be a rash of home fires in my neighborhood. Some of them are under construction, some brand new but with no occupants and others only a few years old. This in an area that didn’t use to have any fires that I can recall. I’m not talking about a kitchen fire doing minor damage but fires that cause a total loss of the property.

If you let your home go into default (which would trash your credit report), then tried to buy another, most lenders would not give you a mortgage (or the time of day) on the next house regardless of price without a very large down payment.

As the supply of homes for sale go down I would expect the percentage of homes on the market that are short sales to go up. Owners of homes that are not in financial trouble are not putting their home on the market either because they are waiting for the market to turn around or as you mentioned because of seasonal factors. The homeowner that is in trouble and must sell their home or lose it to foreclosure is going to list it for sale regardless of market conditions or seasonal factors. For this reason alone you would see the percentage of homes listed that are short sales go up. Lets see what the percentage of home that are short sales does when spring comes and the number of homes on the market typically go up.

John, if you read the Mr. Lansner’s column in the OC Register today you would know that the head of Redfin disclosed that over 40% of homes selling for $500,000 or less in Orange County are either short sales or foreclosures. This despite a 15 month inventory of housing already on the market.Given market conditions it is entirely reasonable to expect that only those who absolutely have to dispose of their property will be listing it this spring. I mean why try and sell into the teeth of a glutted market and collapsing home prices? For this reason Dr. H. Bubble is entirely correct. The situation will only get worse.

this was done in the early 90s, however you must time it correctly…you keep your credit good, then make the purchase on the lower reset priced house, then let your house go into foreclosure….this will be done in thousands of cases enroute to a market bottom….remember your new reduced purchase now becomes the comp, and your newly created reo will be based on that comp, thereby further reducing values and continuing on the downward spiral

Leave a Reply to Scott