The Psychology of a Crashing Housing Market: Sending in Your Home Keys Just Got Easier.

Well it shouldn’t come as a surprise to you that the market was expecting new home sales to come in at 645,000 but the actual number came in at 604,000. Being off by 41,000 isn’t a big deal given how horrible the establishment is at predicting the will of the people. Just a few short months ago, it was almost a given that the front runners in the 2008 presidential race were going to be Hillary and Rudy. It was hard to see anyone else in the race (that is if you only listened to the media). This past weekend we just saw how frustrated the public is with the status quo and following in the footsteps of the past. They gave a resounding vote to someone new and someone utterly different. Yes, we’ve heard a million times but people want change. Even Joe and Susie public realize that when they hear “tax cuts stimulate the economy” and watching corrupt corporation leaders get off with massive severance packages, they understand that somehow that does not translate to a healthier economy or better wages. In fact, many are starting to believe that the country is falling more and more into a plutocracy and looking at wealth correlations and distributions, this belief is well founded. Corporate welfare is alive and strong.The housing bubble just went mainstream with a cover report on 60 Minutes called “House of Cards.” You can click on the link and watch the clip if you did not watch it during the weekend. It is well worth your time and plays out like any bubble blogger post. Take a wild guess at what city was in main focus? Stockton California. In fact, they were showing folks going on repo bus tours to buy homes. Sort of like a Universal Studios tour except instead of Jaws coming out to eat you alive you have overpriced McMansions waiting to sink their teeth into your wallet. For any of you who have taken trips to the Inland Empire to what are now defunct new subdivisions, this will not come to you as a surprise. The piece didn’t really shed any new light of information in regards to numbers and economics that many housing blog readers wouldn’t know, but what it did is that it collectively cemented the fact that yes, housing is in a historical bubble for the entire nation. It is a good piece and is well worth your time.

The main thing that was telling is how willing people are to game the system. Learning from the best on Wall Street, many recent American homebuyers are giving the middle finger to lenders and are willingly going into foreclosure. They had two couples that bought homes with exotic mortgages. One couple talked about buying a home in a better area and not knowing the terms of the note and that was their justification for not fighting to keep the home. Yet another couple which gives us insight into the psychology of recent buyers, tells us they are allowing foreclosure to happen because “the home isn’t appreciating” and therefore isn’t worth it. If you think about the psychology behind this and dig deeper, we have a nationwide epidemic of free lunches. People from Wall Street to main street are expecting profits each and every time they take a huge risk yet when losses appear, they want society to bail them out. A reader sent in a piece about “Intentional Foreclosure” from CBS News in Sacramento:

“This is how it works. Bob paid $420,000 for his home. Then he notices the house across the street, with more upgrades, and is selling for $315,000.

So Bob, who has pretty good credit, decides to buy the cheaper house. He can’t afford both, so then he walks away from his original home, letting it fall into foreclosure. That will hurt his credit, but he’s willing to take the hit for a more affordable home.

“Is it wrong to steal when you’re hungry? That’s an issue that a lot of people are trying to figure out right now,” says Linda.”

I imagine that this strategy will become more and more pervasive as the market declines. A large number of people try to build up good credit to have the ability to purchase a home. For many this is the end-game of good credit. So if you can get out and buy another home while your credit is still good, lock in a good rate (thanks Boom Boom Bernanke) move into your new place and simply try to sell your previous home or let it foreclose then you succeeded. And you wonder why there is such an uproar about rate cuts. Suddenly that poor family being kicked out in the street is mixed in with a boatload of folks that speculated in real estate, got burned, and now want you to pick up the tab. No need to mince words, this is a bailout. You wouldn’t be receiving your $600 check in the mail and providing golden parachutes to these greedy companies and recent buyers. How do you feel about raising mortgage caps to $625,500 now?

The Psychology of Housing Greed

From Calculated Risk we get a glaring statistics summing up the current market:

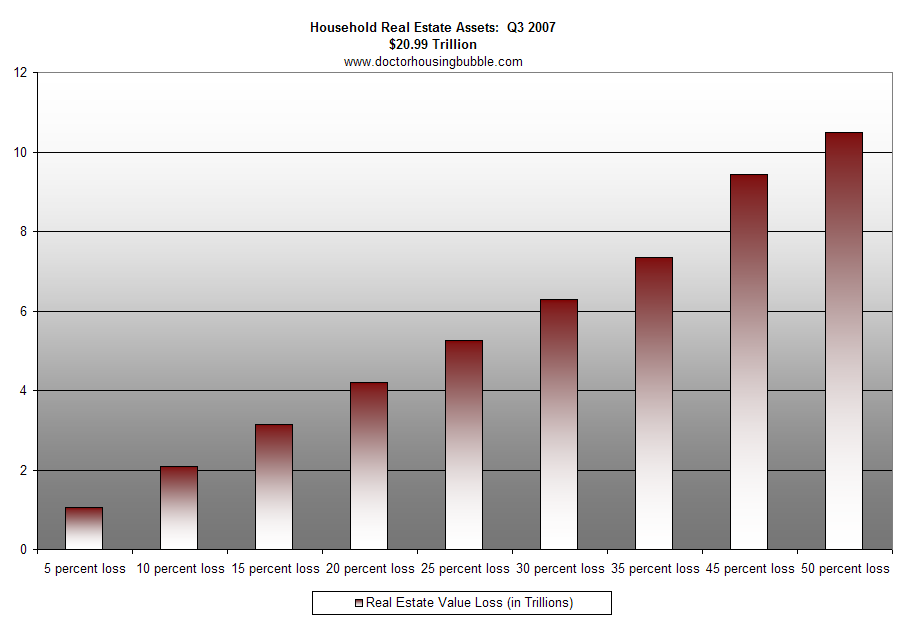

“From the Fed’s Flow of Funds report, household real estate assets totaled $20.99 trillion at the end of Q3 2007. So a 30% decline in prices would reduce “housing wealth” by about $6 trillion (Merrill’s number).”

Let us run a few scenarios to see how much damage potentially can occur:

Merrill Lynch has already come out stating that it is very possible that we will see a decline of household real estate wealth by 30 percent. In Southern California we have already seen 10 to 20 percent drops in all counties. I would imagine simply by the sheer size of homes and extent of bubble prices, California will be a large percentage of that $6 trillion loss. Again, let us go back to the presidential polls a few months ago. The media was utterly off and even this past weekend, they were predicting Hillary losing by a few percentage points (10 points at most) but that didn’t come out exactly how they planned. And this was only a few days before the vote!

Anyone using current housing prices is going to get burned because once you enter into a major bubble and you try to use peak prices to measure your decline, you are using once again artificial price measures to predict the future. Did anyone see California housing going up nearly 200 percent in some regions over this decade? Of course not. Yet that is the definition of a bubble. Prices disconnect from fundamentals and it becomes a question of psychology, consumer behavior, and the frontiers of what is legal or moral. Add to this a corrupt industry that went from greedy speculators, brokers, agents, Wall Street, builders, politicians, and foreign investors and you realize that everyone wanted a free lunch. As the 60 Minutes piece highlighted, at each step of the process someone was getting a cut.

Yet now we have this pervasive mentality where people are not only willing to let their homes foreclose and let their debt obligations fail, we have people that border the criminal. In the piece we also hear about people taking out “some equity” before knowingly letting their homes foreclose. Think about the mindset that occurs when this is happening. “Hey honey, we signed a contract but that doesn’t mean anything. How about we tap into our HELOC and take out $50,000 and let this home go into foreclosure. By the time we buy our new home and have some cash, who cares how our credit looks. After all, Wall Street is corrupt and the lenders were more the willing to give us the money. Take that Wall Street!” I assure you this conversation is happening at many households in the US as we speak. That is why fierce regulation and enforcement is utterly important. Trying to rush to raise caps is a knee-jerk reaction to the deeper and more profound problems with the economy. People are willing to go to any length so long as they can get away with it. All these get rich quick books cater to this free lunch mentality. Once at the fringe of late night infomercials, now a majority of Americans think nothing down is a birth right. Ben Bernanke was surprised that a trader in France was able to milk $7 billion from the markets. Why is that so shocking? If you allow people to take out $2 million loans in California I assure you people will. Yet when will the Fed and politicians stop and think, does this actually make any sense? I guess that is a lot to ask in an election year.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

25 Responses to “The Psychology of a Crashing Housing Market: Sending in Your Home Keys Just Got Easier.”

After seeing all of these foreclosure stories I turned to my husband and said, “I feel bad that people are losing their homes.” He said, “Why? Nobody feels bad that we don’t/can’t afford to buy a home at these prices.” Then I thought, he’s right.

I’m not sure why the media is calling people like me looking for a return to normalcy & affordability (relative) “bottom feeders” and “bargain hunters” as they did on 60 Minutes this weekend. I would hardly call a house in Stockton, CA for 300k+ a “bargain”. And about feeling bad for those foreclosures; I have friends that did 103% financing of the home they bought in 2005 on an interest only loan. They probably pay less per month for their mortgage than I do for my rent. I’m sure that some of these “foreclosures” are of the same situation where they have no “skin” in the game and are just walking away from a place they rented and/or used as an ATM. No one in this game deserves a bailout and “fair” will be when I use my hard earned down payment to buy my $450,000 3br house in south redondo beach at 6% interest!

Could not have said it better!! I moved to Ca in 2005, and did not buy, but rented and saved my money. I will continue to rent until the market falls. I am a physician and make over 300k a yr but the economics just did not make sense to buy. I felt it was better to rent than buy at the time. I feel sorry for those people who bought because many of them are uneducated people who did not understand how economics work

Gerardo

I’m wondering if there will be any criminal prosecution of those ‘stated income’ loans. As noted something like 90% of the people lied and half lied bigtime. I doubt the Feds will prosecute, though you never know what some US Attorney might do someplace, but it is quite possible some state AG or local prosecutor might on behalf of a state chartered institution.

Is there some reason I am not familiar with why a person lying on a loan application couldn’t be prosecuted? Seems a prima facie case to me and a way to circumvent anti-deficiency laws. A few prosecutions might make some of these deadbeats reconsider ‘walking away’ from their loan.

I think that taking out the HELOC and walking away is absolutely fair game. The stupid lenders allowed terms whereby that was possible, and so they should eat what’s coming to them. Lending terms will return to normal until the lessons of the coming collapse are again forgotten. 60 years or so.

Re: the French Flim Flam man. Besides the sheer mind boggling idea that some lone trader was sitting at his computer playing with $73 billion dollars secretly, the idea that he was attempting to cover his tracks by deliberately trying to ‘lose’

money to cover up his ‘winnings’ has to come a close second.

Yeah right, tell me if he had gone to management and confessed he had bought contracts surreptitiously and made $7 billion dollars SocGen would have called the police!

The Valdezs, who can afford their payments but are deciding to walk away, must be a riot in Vegas. Oh, Mr. Casino manager, we put money in your slot machines all day and only got 90% of back of what we put in. Our friends ended up with twice as much so now we want our money back. Geesh. It’s a gamble. Who told you an investment was always a guaranteed winner any more than rolling the dice at a casino?

Dude, I love your site and read it religiously, but suprisingly I disagree with you.

While the “Switch & Foreclose” maneuver is illegal AND immoral, there’s nothing immoral about walking away from an underwater loan—-it’s WRITTEN INTO THE CONTRACT. The house is the only equity and in CA, as you know, we’re a no-recourse state.

The stupid part is that anyone ever loaned 103% in a no-recourse state—this was guaranteed to happen and is totally legal AND moral–you are honoring the deal when you send them the keys.

Refi for cash or buy across the street & then foreclose the first one-illegal and immoral. Honor your contract by sending them the keys and ruining your credit? That’s just good business.

You’ll love this:

“The Paris trader accused of losing Societe Generale more than $7 billion reportedly admitted to concealing certain deals as his lawyers claimed he was being used as a smokescreen to deflect attention from the bank’s subprime-mortgage losses.”

Read article here

Everyone is blaming everybody. If we were to look at personal responsibility in the world, it would look like Congressional approval charts. I am reminded of the Shaggy song, “it wasn’t me.”

The banks are screwed.. A real down payment is the only protection against jingle mail, but requiring a down payment is killing the market..

People are still jumping in on the market thinking it’s hit a bottom….. Next fall / winter will make 2007 look like a good housing market.

And why shouldn’t people walk away? We are all entitled to the good life aren’t we? Two new (Japanese) cars in the driveway, dinner out, and exotic vacations? The American way isn’t it? Only fools own houses without mortgages; just ask Alan. Now, the government is giving more money to spend because we lost all of ours! Why shoud we have to pay?

I think the famous quote by John Paul Getty is appropriate:

“If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem. “

I am amazed that in the bubble years, it was easier to get a home loan than to qualify for a cell phone plan. After watching the 60 Minutes report, I think most of you that have been responsible are thinking, “let the lenders, speculators, and sellers deal with their own greed.”

The good thing about the show was it took away the “poor” home owner myth. Yes, there is some unfortunate collateral because of the decline but in California there is a large portion of speculators who need to get burned and any bailout talk is simply absurd. There is always the option of renting! This isn’t Russia where you’ll be thrown out on the street; there are plenty of rentals around. In fact, that is why we are seeing a decline in the nationwide homeownership rate. If you want to buy a home, you’ll need to save up some change. If you don’t have change, then you simply aren’t ready to buy. This is such an important keystone in owning because it forces people to show some discipline before buying.

As we are seeing, many folks are not great forecasters in guesstimating their monthly payment. “Oh yeah, I’ll be able to flip the house in two years before the payment resets.” Well guess what, two years is here and no one has any moral obligation to pay. Bwahaha! Poetically, the bank gave loans to people it shouldn’t have and now everyone is asking for their money back. The genie is out of the housing bubble.

“Is it wrong to steal when you’re hungry?”

Gee whiz. This has nothing to do about someone starving.

It should read “Is it wrong to steal when you are status hungry?”

There is plenty to eat, it just seems like the eyes in California are way bigger than the stomach.

It’s amazing when people would most likely not take their car and leave it front of the dealer with the keys in the ignition, but will walk away from their house. I guess you could live in the car as a last resort. Bimmers are pretty roomy.

http://finance.yahoo.com/real-estate/article/104278/Best-and-Worst-Places-to-Buy-a-House

For some humor, read this article. I wasn’t aware that San Diego was considered a nearby city to Mission Viejo.

Yep. And a certain amount of poetic justice for Alan Greenspan and the other Ayn Rand-ites at the U of Chicago. I guess John Galt is a 20-something who makes $45k a year with a $500k mortgage on a $300k house.

Doctor,

I find the short sale stat an interesting one. Can you provide a breakout of what percentage of homes on the market are short sales? I’m guessing that since you added San Diego a while back, that this 14,000 plus number is for the 6 county region? So is it 5% of the market in LA, 6% of San Diego, etc..that sort of thing?

Mission Viejo is roughly 67 miles from San diego so it should only be an easy

2-3 hour, one-way commute to work and back! Heck, I’d love to spend 4-6 hours in the car commuting to work every day if I could buy a house in one of the TOP places in America! ;->)

“If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.“

Really when you think about it it truly is amazing how the banks and others could now see how this would all end badly. They paid out billions for millions of small assets that are immovable and for which there is no other use that for people to live in. The loans will eventually go away, but the condos and houses will remain. Someone will have to buy them but the consumer is totally tapped out. Anyone could have told them debtors walk away from the biggest debts first.

Short Sale Report is up:

http://www.doctorhousingbubble.com/forum/viewtopic.php?p=405#405

Big jump last week…

2.5 times income. That’s it. Forget about 2.8 for now with this recession and the massive solvency crisis. If median income is 50k then median house price will be 125k, etc.

If you bought more than this, you made a mistake. You screwed up. Your lender screwed up. We all know why this happened. Wall Street and real estate agents all had a record time of it, earning billions upon billions in commissions and bonuses. The US consumer spent his “equity” on lattes and plasma screens. The boom was spread around the globe and multiplied one thousand fold.

It’s a huge mess. Massive. These guys are all getting what they deserve. Walking on a house is not an easy thing and does cost the “owner” money. But it is legal and moral. I cannot imagine that there were people who entered into mortgages with the express intent of walking on the deal. The mortgage, a contract, provides for disposition the asset and debt upon rupture. The borrower is saddled with a bad rating, loss of earlier payments, and a tax liability for the write-off (I bet lots of folks are forgetting this). The lender pays for his greed and lack of due diligence.

The ones who are getting off scot-free for now are the real estate agents (oh, business is down, boo-hoo!), the mortgage brokers who did not hold loans on their books (again, business is down, boo-hoo again), the appraisers (how much for that damp cave? 4 million? thanks), and the Wall Street CDO traders who made billions in bonuses (ok, they are out of a job now but no trader on Wall Street who is fired for reasons other than cause has to give up or repay his bonus).

America basically got what it wanted, a free ride. Another bubble. Americans have totally and utterly abdicated responsability for anything, turning over their finances to Wall Street and their morals to K Street. Americans voted for Clinton, voted for the Republican right-wing congress, voted for Bush, and “voted” for Greenspan. You got your bubbles, your torture, and the highest personal and national debt ever.

In Asia and the Sub-continent, people joke about how in fifty years, they will be shouting at their Saudi maid to work harder. Well, America will now work for the Asians and the Arabs. Indentured servitude. They will own us. At least until we can pay off our debts. and judging by the way things are going on mortgages, that won’t be any time soon.

You obviously don’t know much about the Russian real estate market. It is notoriously difficult to “throw someone out on the street” for non-payment of a mortgage in Russia – one of the key reasons that the mortgage market has been slow to develop there.

> In the piece we also hear about people taking out “some equity†before knowingly letting their homes foreclose.

HELOC money is a recourse loan, and the lender should go after the borrower’s income. Tax has to be paid on forgiven HELOC money, and the IRS should go after the borrower’s income. People who “take out” equity before a planned foreclosure should get surprised by the bill.

People on the 60 minute video.

“I doesn’tz makes any sense. My house paymentz is goingz ups and my house values is goingz downs. I’z could stills makes da payments but what fors.”

This is going to be statement that will be repeated many o time in the next 3 years.

The real root of the issue is the corruption in all areas of our financial markets, Subprime is just a side effect of the real condition. As we can expect, we’ll see the bankers scramble to cover the losses up which is a good thing as it will help speed up the process of destroying our economy. I can’t see another way this level of corruption will end but the only path to salvation is destruction.

I guess I’m one of the “responsible” ones. In twenty years we’ve bought two homes and had three mortgages – 30 yr fixed, 30 yr fixed, and 15 yr fixed which will be paid off (early) in three years. But I have siblings in Orange and Kern counties and if I learned that they were suckered into one of these “exotic” loans I would advise them to walk in a heartbeat.

The whole financing community came up with a concerted program to vastly enrich themselves by transferring (stealing) wealth directly from the lower and middle classes. See how the owner of Ameriquest, one of the most egregious predatory lenders around, became a multi-billionaire and bought himself a comfortable ambassadorship: http://www.forbes.com/lists/2005/54/02WT.html All that wealth was amassed from the sweat of how many millions of families hit with excessive fees, higher rates than they could qualify for, no docs, no down, teaser rates, and the list is legion. Under mortgage terms of the last 5 years, people didn’t own their homes – they rented them. Would you think it was immoral for a tenant to find another place to live if their landlord doubled the rent?

Somehow the lenders either failed to notice that they were designing financial products that made walking away the only rational economic choice in a down market or they counted on shame and social stigmatization to keep victims as housing slaves for years to come.

Personally, I think it’s high time that the sheep refuse to be shorn.

Leave a Reply