REO-to-rentals another Fed subsidy for big investors and select banks. Federal Reserve looking to engineer yet another bailout for key banking allies. Fed acknowledges 12,000,000 homes with negative equity.

The Federal Reserve recently came out with an unprecedented analysis directed to the Committee on Financial Services regarding various methods to improving the housing market. The paper is striking because it magnifies how little was learned from this banking and housing debacle. One of the big recommendations centers on creating a “REO to rental†program by facilitating bulk sales to large investors. Ironically the Federal Reserve by bailing out select banks has allowed home values to remain inflated thus causing this backup in inventory to emerge in the first place. Setting that obvious point aside, let us examine the merits of an REO to rental program.

REO bulk sales to select groups – Fed picking winners and losers again

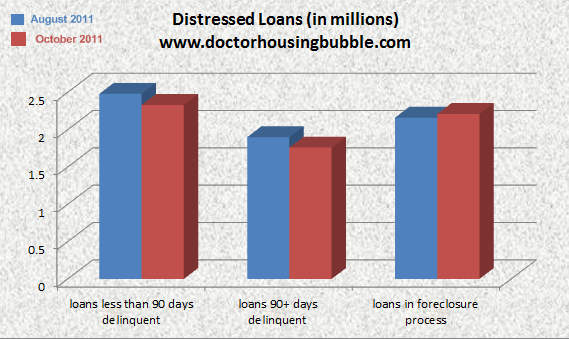

The paper at least acknowledges the reality that there is an enormous amount of REOs on the market. The Fed only discusses visible REO data but the shadow inventory is much larger:

The paper mentions the following:

“Although small investors are currently buying and converting foreclosed properties to rental units on a limited scale, large-scale conversions have not occurred for at least three interrelated reasons.â€

The three reasons specified are:

-1. Geographic grouping of properties

-2. Investors want much larger discounts

-3. GSE/banking policy encourages sale of home as soon as possible

Showing that the Fed is somewhat behind the curve, bulk buying is already happening:

“(SF Gate) Waypoint Real Estate Group – which buys, renovates and rents out distressed single-family homes, primarily in hard-hit Contra Costa and Solano counties – has just received a capital infusion worth $250 million from GI Partners, a private equity firm headquartered in Menlo Park.

The money will enable Waypoint, which owns about 1,000 homes in the East Bay and Southern California, to buy several thousand more as it expands both locally and nationally, said the company’s managing director, Gary Beasley. And there may be more money to come.â€

So apparently the market is working in some areas to clear out some excess inventory without the Fed meddling. Why is it working? Primarily because lower prices have pulled money off the sidelines. The article ends with:

“Referring to the white paper, Magnuson remarked, “the Fed apparently didn’t know that capital like ours is available.”

The Fed goes on to discuss Fannie Mae, Freddie Mac, and FHA and how roughly half of REO inventory comes from these entities. Keep in mind this is visible REO data which is only a sliver of the distressed inventory out there. What isn’t a surprise is that most of the inventory is in hard hit states like California, Florida, and Nevada to mention a few.

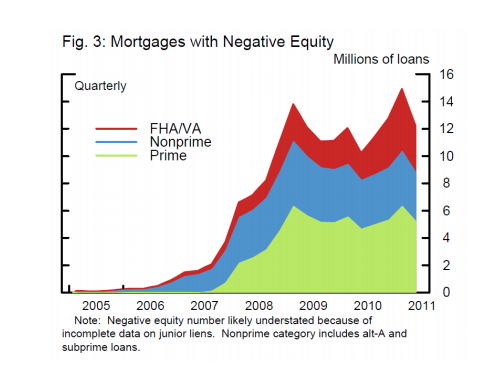

The Fed does at least recognize the 12,000,000 underwater mortgages in the country:

Yet the Fed is trying to pick winners here again under the guise of helping communities. Interestingly enough they don’t seem too concerned about helping some of the harder hit areas:

“Not all of these REO properties are good candidates for rental properties, even in large geographic markets with sufficient scale. As discussed in more detail later, some properties are badly damaged, in low-demand locations, or otherwise low value.â€

In other words, they want to sweeten the pot to their connected allies only when it brings in money for them even on the taxpayer dime. But in truly hard hit communities like Cleveland or Detroit, well who really cares right? Many of these homes are $20,000 or less so there is little potential financial profit here. So to structure the argument as aiding communities is not exactly true. As the earlier article mentioned, in hard hit markets with potential, private investors are starting to move in. Part of the desire to do this is the low yield overall which ironically yet again, is artificially put in place by the Fed.

One of the options presented includes “REO holders to rent†properties out directly. But as we have seen with the massive shadow inventory, banks don’t seem keen on doing this. In fact, it would appear banks would rather wait and see if a nice bailout is coming their way and simply ignore non-payment on homes or taking action on existing inventory. Banks are not in the property management business. Good property managers realize this is a long and time intensive business and profits are there but banks are more into the quick turnaround with larger profits. They have no intention of being property managers when they can’t even get the paperwork straight on many foreclosures.

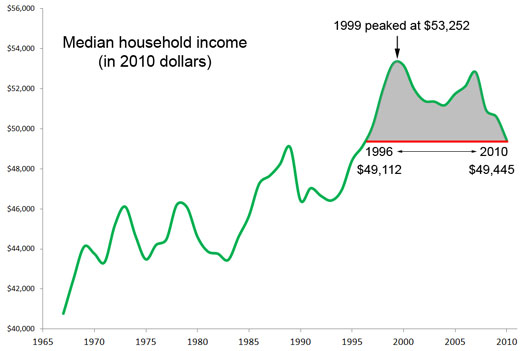

Another underwhelming option presented in the paper is subsidizing loans to bulk REO buyers. In subsidizing, they mean the taxpayer is going to help fund these deep pocket investors to do something the market will do anyways. The reasons prices are still too high in some markets is because first, the system allowed banks to suspend mark-to-market and allowed these banks to use accounting chicanery. As the paper notes, “small time†investors are already buying homes and fixing them up to rent out. This occurs when prices make sense. Yet banks are basically creating an artificial market where they collude with the Fed to create an artificial ceiling. The market is demanding lower priced homes because household incomes are much lower:

Source:Â Singularity Hub

You would think this is obvious but apparently it is not. The Fed in the paper fails to acknowledge the reality that there is no bulk financing for REOs because this is a losing proposition. If there were money to be made here banks would be all over it in two seconds. Almost a century of housing programs in the US and there is a reason that we do not have a REO bulk sale program. Yet here we go again with the Fed subsidizing big players to keep prices inflated. The Fed by pushing mortgage rates lower was a big reason for inflating prices in the first place. As the above chart highlights, the reason home prices remain low is because household incomes are also lower. The paper fails to acknowledge the glaring reality that all gains in the last decade were bubble induced with easy debt.

The Fed has broad enforcement powers yet states the following:

“An REO-to-rental program should also consider the effects that poorly managed or maintained properties have on communities and, in particular, ensure that communities are not damaged by rental practices.â€

Instead of using this as an argument to give big gifts to select bulk investors how about cracking down on slumlord banks? The Fed can easily come down on banks and penalize them for their glaring disregard of properties. This would be easier and can be implemented as soon as possible.

The Fed consistently mentions “tight lending standards†and yet fails to make the bigger connection that this is because households are actually on weaker economic terms. In other words, cheaper homes are what they can afford. The premise is wrong and subsidizing here makes winners only out of key investors and banks at the expense of the public. This story is sounding all too familiar. Demand for housing will be there if the economy were stronger. Demand for housing would be there if prices were more in line with household incomes. Instead of focusing on these key topics, the Fed once again looks at subsidizing banks instead of correcting the errors of what led us into this mess.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

41 Responses to “REO-to-rentals another Fed subsidy for big investors and select banks. Federal Reserve looking to engineer yet another bailout for key banking allies. Fed acknowledges 12,000,000 homes with negative equity.”

I suspect hedge funds will be the buyers, but I doubt they want to be landlords. They’ll get the best deal and then sell them to investors that will then be the landlords. All financial backing by the federal govt.

Carrington Mortage and Oaktree Capital have cemented phase one of their deal for Bulk REO’s For Rentals for $450M. Cents on the dollar, and planning to rent them out cheap. A few more of these partnerships are in the works.

As a cash & close homeowner (our final home – dealing w/ a Glaucoma issue) we are livid that us little peons can’t find a decent, yet let alone fairly priced home, and these backroom deals are going on. This country is a Banana Republic.

The Federal Reserve is the banker’s bank.

Although the Federal Reserve is chartered by Congress and the Chairman of the Fed is appointed by the President of the United States, the Fed is a privately held bank that is owned by other banks (i.e. Bank of America, Wells Fargo, Citigroup, JP Morgan/Chase, Goldman Sachs, etc).

All nationally chartered banks own non-transferrable stocks in one of the twelve regional Federal Reserve Banks.

The bottom line is that the Fed operates in the best interests of its member banks not what the market place dictates.

Exactly. It is a shame most Americans (even the educated) have no idea how the Federal Reserve Bank works.

Get real. The problem is very simple. Real estate was SOLD for a lot more than it was worth, bubble. That is the key, SOLD. Someone got the money. This was ill gotten “profit”. How do you remedy this injustist? Not by going after the buyer or the taxpayer but after the seller. That is where the fraud occurred. Why is this so difficult to understand. Just clawback all the rotten profit, and let the buyer walk. What is wrong with this? It is the most equitable solution. Forget buyer beware, it is seller beware.

There are two problems with this approach that I can see. First problem is that many of the sellers where buyers as well when they took the ill-gotten equity gains and purchased an even bigger starter castle (i.e. property ladder). The second problem is that we would have to change contract law to claw back gains on any transaction. I am not sure that is a great idea given that the purpose of a “free market†is to move assets to the one that “values†it the most. I think the real problem was the lending standards (i.e. banks) and the “.gov†lack of policing a system that has an implicit/explicit government backstop…

Who would accomplish the claw-back?…there are millions of properties. There would have to be restatements of income taxes, and what about statutes of limitations?

….or, even better (if only it worked like this): lender makes a bunch of bad loans; the loans default; lender goes up in flames; anyone left with a up to date mortgage from lender at that point owns their home free and clear (since lender no longer exists); owners now have an extra 1000, 2000, 3000 bucks per month to pump into economy or invest so they can retire.

DId sellers “force” buyers to buy? Your argument suggests that a high school degree is not worth what it used to be worth

opps I responded to the wrong one sorry

If this were a forum of less educated people, I would suggest you are trolling, because that idea is outrageous. Can we go back and give money to people who sold during low demand times, and thus got less than they should of? As someone else said, the buyers didn’t have to buy, and the banks didn’t have to provide these buyers with funds. The problem lied on the demand side, not the supply side.

You remind me of that poster I will never forget. At the entrance to the oil refinery the poster’s message “he who controls the supply controls the demand”.

Just another example of the class warefare being initiated by the 1%. They will not rest until they own every bit of wealth produced by this country. They will keep pretending they work harder than everyone else, but the truth is they are masters at manipulating the system in their favor. Hopefully at some point people will wake up and we go from non-violent protests to dragging these people into the streets and makign them scared to keep up what they are doing. As Warren Buffet said class warefare is already happening and his class is winning.

Being a landlord is a lot like being a welfare recipient. You do almost nothing and you collect a check each month. Please tell me how it is different?

Ding! We have a winner! This is why almost all major religions ban “usury”, including Judaism, Christianity, and Islam. However, this part of christianity is ignored and not applied as the Roman Catholic Church is knee deep in the financial systems of the world.

No worries DG, hold your morals and live right, in the end, ALL get what they have sown. On a side note, I’m starting the default on my home this month in order to take advantage of the Home Mortgage Debt Relief Forgiveness Act before it ends in 2012. A unit just went on sale in my complex for $255,000, pretty good seeing I paid $420,000 in 2004.

Having been a landlord for 1992 to 2007, I can tell you it is no picnic. In my state the market will only allow you to collect the equivalent of one month’s rent for a damage deposit and frequently tenants break their in the middle of winter when it is hard to replace them, or get pets that leave you with $2500 worth of urine-soaked carpeting, twice your average damage deposit. I didn’t get rich and I would never do it again.

Sorry Chuck, I was in no way referring to the “little” guy who rents a few apartments, or 1-2 homes working his rear off keeping things fixed and everything running. You sir, have my respect, and as you had learned, it is quite different then when you own an apartment community, where the staff is paid, and you “oversee” the bank deposits.

MARXist much? Perhaps if you emerged from Mom’s basement, you’d realize the GLARING difference between a welfare recipient, and someone who has a LARGE PILE OF *THEIR OWN MONEY* tied up in an asset which is (for the term of the lease) someone else’s “castle”, a castle which they can severely damage, out of plain sight. I won’t bother mentioning taxes, insurance, maintenance, interest… and declining equity… as these grown-up concepts would sail right over your monitor.

Yes, I’m a small-scale landlord, but the “big guys” w/ big complexes have the same issues, but with a better economy of scale to cushion most blows… still, they have to keep an eye on what they could sell the whole complex for, or (if legally allowed), how much $$ they’d have to risk in a conversion to condos.

Landlording is no picnic, and plenty do it wrong and LOSE MONEY. But don’t worry, FOR YOU, it would be a goldmine… don’t delay… 🙄

I discerned what this program was and who it was for the minute I first read about it. The “REO to rental†program is just another Crony program create to protect the banks and make the Bankster buddy’s more money. This is getting very scary! People need to wake up to what our government is doing.

“I discerned what this program was and who it was for the minute I first read about it. ”

That was my reaction also. Another FED funded backdoor bailout for the banks and their hedge fund buddies. They’ll cherry pick the best properties and leave the dross for everyone else.

I’ve read a few posts asking why the best bank-owned houses in the decent areas don’t seem to come onto the market, and why the banks seem reluctant to foreclose on to the most expensive properties. Well here’s the answer- they guessed a programme like this was coming down the track, and were keeping their powder dry.

I know therell be a fair few London hedge funds leaping at the chance to buy prime Cali real estate at subsidized prices. Easy money.

Yep, the next chapter in Duh Crony Banking Crimes Against Humanity. 😡

No worries, it will sail right over the sheeples’ heads.

The good news is that it won’t work for the bubble communities for obvious reasons (cost to own versus cost to rent). The bad news is that the “.gov†is signaling that it will pull no stops in preventing the required market correction. We will be in limbo (see Japan) until the market corrects…

What?

You’re right. This extend and pretend has Japan written all over it. What just pisses me off, is those of us who deserve homeownership (good FICO’s 820+), responsible, and actually, we’re a cash & close for a primary final home, are going to pay way too much. The homes we’re targeting in So Ca (one-story average size working class homes) should be $275K-$350K tops. (2002 prices) We’re looking at paying close to $400K. It just floors me how successful this controlled collapse has been.

We sold and held on to our housing dough, but for all the people who need financing, prices are absurd, too. Realturds preach the interest rates to 1st timers. BFD, I tell them. Housing does have a relationship to incomes. This fiasco gets my BP up.

BTW, Oaktree Capital and Carrington Mortgage (former Realty Trac, Rick Sharga VP now with them) cut a $450M bulk deal on the first phase of an REO Bulk Rental program. Must me nice when crony capitalism gives you an edge.

We’re working stiffs (wage slaves). We’ll never know.

I’m in a similar boat as you but honestly, you are giving them far too much credit. They have gone ‘ALL IN’ in beyond any conventional sense – granted they can still throw out some real humdingers like multi-year foreclosure moratorium etc…

However, you have to realize:

1) we suspended mark to market to allow the banks to hold properties and non-performing loans to control supply/demand balance in the market

2) the government has taken over the mortgage system and is funding it themselves

3) we are at Eisenhower interest rates on 30 year loans (not just 20 year as in that era)

4) we have thrown just about every bond we rationally could to try to get mortgage workouts without totally decimating the system, principal writedowns are real but not at the bank levels, they sell to another party and then it happens there but sale is at a discount so same net effect. The only issue is the very limited volume of those loans over 5 years as they haven’t needed to be marked so the banks just hold them and stall.

5) Foreclosure pipeline is what >5+ million homes just in process and 90 days (traditionally a near zero cure rate)

A full blown artificial market and the reality is that volumes are anemic and pricing is still far too high for the buyers outside the very lowest rung. Upper/middle homes are effectively stranded. Look at Case Shiller, it is at the lows and moving down month after month outside of some oddball blips (none in the recent months). Look at new home sales, they bound around on a % basis but we are bouncing on historic low 1960s data series bottoms – these aren’t adjusted for population. We have what 5+ million homes in foreclosure or 90+ days and another few million on the way, and even more with major negative equity so stranded and at risk of default.

Point here is that you are being to generous – they are ALL IN and there is NOT ONE SIGN that they are winning or even holding their own other than asking prices that remain too high on hope.

I realize years of your life are passing you by but would you really trade places with these folk? You want to be one of them or absorb a 6 digit equity loss? Rent a place to live and enjoy your life with a portion of the savings. Housing is like a supertanker, it takes forever to turn and there’s simply not enough money to create a real bottom at this level. We all know it, if you are reasonably smart and not totally risk intolerant you’ll be able to see when the odds get closer in your favor or become rational. Even then it won’t move for a long time. Too many headwinds with no move-up buyers (requires appreciation – which is dead and the interest rate game of the last 30 years is over), baby boomer demographics, young generation without jobs and saddled with debt.

You have one a huge battle by avoiding taking outsized leveraged losses in the greatest financial catastrophe to hit most people in this nation in 80 years. Irreparable harm has been done with shock waves around the world. Take some solace in that whether it be luck, skill, or some combination. Enjoy your time in the world, there are some real advantages to renting as well as disadvantages. Living well does not require title to property and structure especially at unaffordable levels.

Best of luck.

Apologies for not proof reading, I was in a hurry and apparently am far far worse at using incorrect words than I thought.

bond = bone

bound = bounce

one = won

Numerous others I’m sure. Simply atrocious, but content is valid.

Slim

Loved your post, and assumed it was directed at me. With a medical condition and one income, we need a paid off home. $350/mo for property tax liability sounds great to us. We’re paying 5 rents right. But I concur on all your points.

As for being a landlord. Ours is a slumlord. I usually do Asset Mgmt, but for mixed-use owners. I’ve always worked for honorable landlords. The lesson I got from our slumlord is always work for the good guys. The bad ones hire their own kind, and it will never be me. OMFG, when we give notice, after we buy our final home, they wanted to charge us for the cleaning of dust that settles between tenants. 1960’s windows mind you. I told them small claims, baby. What f@#king nerve.

Excellent post Slim…

your words ring true..you really never own your home to begin with, miss a tax payment or 2 and find out..I see federal taxes being changed in the future to the detriment of homeowners and landlords. They will pay more…Someone has to pay for all these bloated pensions and housing is easiest target..

Am I reading the chart wrong? 27 million homes underwater not 12 million. 12 million FHA + 9 million non-prime + 5 million prime.

i fell u body the gov is making the same mistake they apply 5 years ago,

allowing pizza delivery guy become mortgage orginator.

Yes, you are reading the chart wrong. This type of “stacked” bar graph shows the cumulative total of all 3 elements with the top line. For example, FHA/VA is not 12 Million, but the difference between the 12 million top line and the 8 million lower line, for 3 million FHA/VA negative equity loans. Only the section/area that is actually red is FHA/VA. It’s not that the graphs are overlayed one in front of the other.

so all is forgiven,welcome back,everybody line up and lets do this bubble again.

That median household income chart really gives me the creeps. And the 12,000,000 mortgages underwater is creepier still. Just goes to show that, contrary to the crap the NAR spews, no one is really a true homeowner as long as they have a mortgage. When/if the mortgage gets paid off, you may continue to lease your owned home from the State for as long as you are prepared to pay your property taxes, be they totally outrageous or merely oppressive.

The whole system screams for a flushing.

Whoever made the boneheaded comment about welfare recipients and landlords both doing nothing and getting a check every month obviously has never owned any rental property. Over the last 25 years I have owned over 40 rental properties. The amount of oversight, time and money needed to effectively manage properties is staggering. Add to the normal issues like standard deferred maintenance and paying the insurance, taxes and mortgage – it just takes one nightmare tenant to gut a home or live payment free for a year playing games with the courts to cause MASSIVE losses.

Pat, I agree with you 100%. I only have 1 property and already been to court, pet damage situation, complete remodeling and lengthy vacancies with no income. Not to mention the discipline it took to save enough money for the down payment and the time it took to search for the right property, show the property to potential tenants, stop by on weekends to handle little issues that need attention.

One question for you – I’m ready and willing to purchase another rental property but have been waiting for RE price to hit the bottom. Would you say the income from your properties was worth all your time and effort managing those properties? I’m wondering if it would be better to just keep the cash and not worry about the landlord headaches and potential $ lose from RE price depreciation. However, I like the idea of having secondary income in case I lose my job and for retirement in later years since I really don’t count on my social security income to be there by the time I retire. I thank you in advance for your advice.

I just want to be able to buy any house before I die and it doesn’t look like that will happen, if this kind of crap is going to continue.

Why Americans have abandoned free market principles is a mystery to me. Whenever the Federal Government gets involved politics become the overwhelming concern. This problem is especially severe in Western Europe where socialism is even stronger. Our country was built on free market principles and it has worked. It not always perfect, but sure beats the hell out of whats currently going on. We now have too many people believing that government is the answer and turning this around may be impossible. Simply, the Fed needs to let this market find its true bottom. The more this is artificially inflated the longer this problem will exist and the more severe it will become. Many people are so worried about the rich, they miss the basic issue. And so it goes…….

Our economy is not a free market and has never been. Free markets do not exist as they require every economic actor to be both fully informed (read: omnipotent) and to act in their own rational self-interest. Neither of those requirements is attainable by real living, breathing humans. Europe’s problems are certainly exacerbated by their politics, but don’t tout the “free market” like some sort of libertarian ideologue.

You are missing a piece or two in your free market definition and this confuses the issue.

Free markets do not REQUIRE that “every economic actor to be both fully informed (read: omnipotent) and to act in their own rational self-interest.” The theory underlying an understanding of a free market ASSUMES the players have the necessary information and ability to act in their self-interest.

As a free market (unfettered by regulations or monopoly) works, it works AS IF that were the case. This is the famous, an quite misunderstood Invisible Hand.

I suggest that we all re-read Adam Smith, Ludwig Von Mises and other thinkers to regain our grasp of this concept.

I have one question for you landlords: How come I have never heard of

a landlord who sold property because it was too much work and not worth it?

I am not talking of old ones who want to retire or use the cash to

spend on education, medical bills etc. I am talking of someone

just quitting because it is too much. Seems like owning rental property is a

good income source, though not without substantial personal labor.

Beats trying to please the boss at work every second.

Please respond, because I am considering buying my first cash positive

rental property in the mid-west area.

My Dad did. The house was bought for $27K in 1974, we lived there 13 yrs, made it rental in 1987, with (if the bastards paid rent on time) over $1000/month positive cashflow. Being a landlord sucked, we hated it. It was better to cash-out with the equity, and focus time and energy on stuff we wanted to do, like surfing and drag racing.

Happens ALL THE TIME, incl. 2 of my props bought pre-Bubble… but obviously the seller is not going to be upfront about shortcomings… either their own or the property’s, lol. After you’ve been ’round the block a few times though, it’s fairly easy to read the tea leaves, both in the words spoken and the types of deferred maintenance.

But you’re right about the labor, i.e. except for rare emergencies, most of the real work is done on YOUR schedule, no boss (but Duh Bank and Duh Taxman). You put in a big burst of work (reno, reroof, new tenants, etc.), then enjoy (hopefully) a long spell of checks rolling in… but it never feels like “coasting”, and you can never take your eye off the proverbial ball. Entropy/nature/weather are always attacking your assets, and tenants never inform you when they acquire a new wallet-draining drugs/sex/gambling addiction… 😉

Leave a Reply to Swiller