Renters Become Majority in More than 20 Major US cities – The Millennials are Not Coming to Save the Market.

The notion that somehow an affluent set of Millennials is going to shift the housing market is not happening. What is happening is rather clear; historically low housing inventory is causing prices to inflate in the face of what has been very low new home building. If you want to buy, your options are usually an outdated crap shack that is already at an inflated price or in some new areas, glorified condos where builders are trying to max out every square inch of development where you can smell what your neighbor is cooking. The fact remains the same, over the past decade there has been a dramatic shift of renter household formation (not homeownership). For Millennials, tastes are dramatically different. Sure, you have Taco Tuesday baby boomers glued to Fox, MSBC, or CNN (typical age of viewers is 60+) so many are simply out of touch with the wants of younger Americans. Builders however understand this dynamic and multi-family unit construction has been running briskly for the last few years. Many large cities have now converted into renting majority locations.

Majority Renter Cities Expand

More than 20 large cities are now renting majority cities. This is a big shift and of course goes against the trend that things are back to “normal†in the sense that if you want to own in certain locations you will need to overpay for a crap shack. Low inventory and house humping logic are powerful draws. Many over spend dramatically when they buy. You see this with DINKs – they buy with two incomes but then pop out a kid and suddenly realize that in many overpriced hoods that daycare is expensive if you want to maintain a dual income household. We’re talking $1,200 to $1,800 a month. Forget about feeding an extra mouth or two. Yet they assume today will be like tomorrow. Nothing in their formula accounts for unexpected costs.

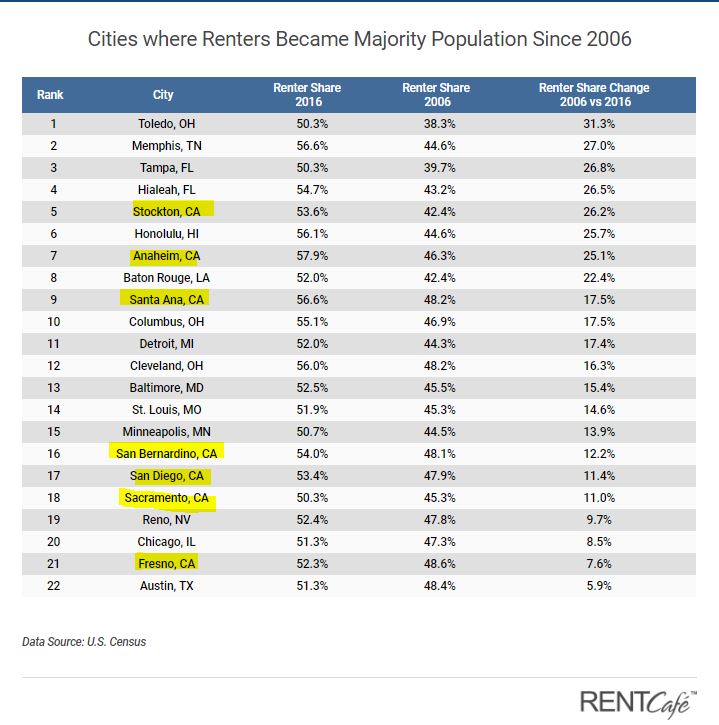

Take a look at this list that now shows 22 large cities that have shifted to renting majority areas:

Out of the 22 cities, 7 (33%) are in California. You have places like Stockton, Anaheim, Santa Ana, San Bernardino, San Diego, Sacramento, and Fresno. The cause of course is affordability. The vast majority of people are renting because of lifestyle choice and money.

Many baby boomers assume that their way of life is going to be the way of life for future younger Americans. It is not. Technological change, pensions, job security, and all of these changes of a slower paced life are not congruent with how things are today. The above numbers speak rather clearly. The vast majority of household formation in the last decade came from renter households.

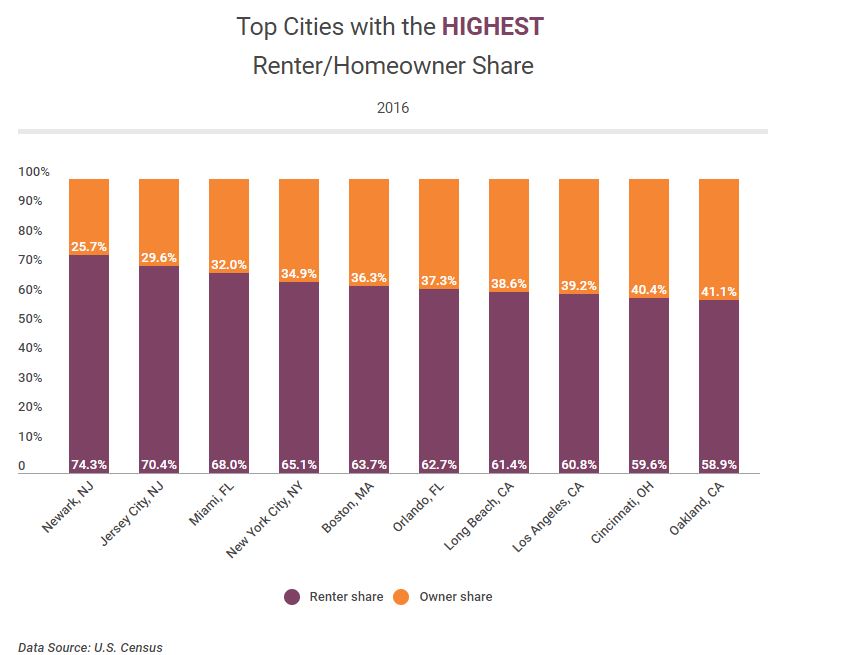

And some places have an incredibly high number of renters:

Of course, Los Angeles makes the list. This is the all hat and no cattle land. There was a report showing that credit card delinquencies are starting to shoot up because people are living on borrowed funds. Low down payment mortgages are back and I’ve had the chance to talk with multiple banks. The housing ATM is creeping back once again. And in some areas, homelessness is a big issue.

It’ll be interesting to see how this impacts future elections. You also are seeing kids growing up that witnessed their families struggle in the midst of the 7,000,000+ foreclosures that happened. Do you think they have a Leave it to Beaver vision of home? No, they witnessed struggles and stress all related to paying the mortgage and it is no surprise that their view on homeownership is more practical. It is telling that the housing cheerleaders like to look at the cold numbers when it is in their favor but then use emotive logic like “but you can paint your walls†or “your kids have a secure place†or “prices are going up for a reason†when justifying owning a home. They forget about opportunity cost, taxes, insurance, maintenance that never goes away, and yes that home prices can go down and dramatically so. In other words, there is a reason why renting household formation has dominated over the past decade.

If the decision was so simple there wouldn’t be an ongoing debate. This is the biggest purchase a family is going to make. And many cities are now renting majority cities so the idea of being an “owner†is lost on them and now that we are in a time of raging populism, it’ll be interesting to see how people feel when they wake up to realize that there is no free lunch when you go into deep debt to pay for life.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

518 Responses to “Renters Become Majority in More than 20 Major US cities – The Millennials are Not Coming to Save the Market.”

I wonder if all this desperation will cause a spike in suicides. With no hope for the future what’s the point of living?

It must be a very depressing existence to live a hopeless life. Even more depressing to put your hope in material possessions which you can have today and lose tomorrow. Or to put your hope in the red politician or the blue politician or the brown politician or the white politician. No wonder we witness an opioid epidemic!

Most people today lost all sense of what is important and valuable in life.

LOL you’re out of touch with reality if you think the issue at hand is just “oh people are placing too much importance on material things” issue.

People no longer have job security, can’t hardly afford to live outside their parents homes anymore, no pensions/benefits, no retirement, etc. etc. etc.

Those are all things that previous post WWII generations could expect to get, and they all have real impacts on the standard of living, yet today’s younger generations are told they’re being greedy or entitled for wanting/expecting the same things.

So yeah they’re going to be kinda angsty about life in general right now to say the least.

TTS, I NEVER knew what job security or pension plan is. I am a boomer who came to US decades ago. I even did not know the language and I did not have a penny. I was raised in poverty and NEVER inherited a dime. I am a self made millionaire. I jumped from one job to another and I never had a pension plan. I created my own cash flows from RE investments purchased as a result of financial discipline, hard work and delayed gratification. You think that was easy? I always had to pay rent since I was 18 and got my first real job.

It was never easy for me even if I am a boomer. I was not raised with a silver spoon. Maybe for others it was easy, but for me it was not till later in life after I lived below my means for decades. Some millennials have what it takes (the grit), but most don’t.

I agree that at the present point in the cycle everything is a bubble, but always bubbles come and bubbles pop. What we have at the present time is a FED induced aberration. I always spoke against that on this blog and everyone reading my comments can confirm it. At the present time we have 2 powerful forces to create that type of high multiplier for house prices: actions of the FED and actions of the politicians. All the Democrats and RINOs (democrats with an R after their names) are responsible for this through unchecked immigration. I also spoke plenty against that.

“TTS, I NEVER knew what job security or pension plan is. I am a boomer who came to US decades ago.”

I don’t care. No one else does either.

Your personal life story about stuff that happened in a different economic environment decades ago isn’t relevant in any way shape or form to what is happening now today in this economic environment to people in general nationwide.

The harsh reality today that you have to address is that while the non-rich in general are getting poorer nationwide those that are young are getting even poorer faster than older generations. And these “young” people are now getting to be in their early or mid 30’s, when they should be seeing their income and wealth rise, and will all too soon be in their early or mid 40’s and what then?

Your ability to retrain and increase your income is dramatically reduced by that age. A few might make it OK but if everyone else is getting screwed it won’t matter.

“I agree that at the present point in the cycle everything is a bubble, but always bubbles come and bubbles pop.”

Bubbles similar in magnitude to what was seen during the GFC or GD aren’t at all common though and when they do pop they tend to cause prolonged and dramatic consequences for society.

“What we have at the present time is a FED induced aberration.”

Nope. The FED doesn’t dictate what the banks, builders, or local city planning commissions do. This whole problem is much more complex than you’re presenting.

“All the Democrats and RINOs (democrats with an R after their names) are responsible for this through unchecked immigration. I also spoke plenty against that.”

Immigration isn’t a issue. Illegals taking sub-minimum wage jobs aren’t a net negative on the economy either.

The problem is a lack of well paying blue collar jobs along with stagnating or declining wages, gig economy jobs as replacements, no benefits, no pensions, etc. etc. etc. Those are the problems. Anything else is BS.

TTS,

While you raise some valid points, you can not get what you want if you do not address the points I’m raising. Here they are:

“The FED doesn’t dictate what the banks, builders, or local city planning commissions do. This whole problem is much more complex than you’re presenting.” While I agree that the system is far more complex, I was addressing the main drivers. Many of the other ones, if you think hard enough, step by step, lead to the same root. I was trying to be brief. For a more detailed explanation, please read “The creature from Jeckill Island”. The effect of the FED decisions are very powerful, regardless of the city or who occupies the Commissioner seat.

“Immigration isn’t a issue. Illegals taking sub-minimum wage jobs aren’t a net negative on the economy either.” You are wrong on this one for more than one reason. By living many of them in crammed quarters, they can sustain high rents. High rents mean high RE prices because of higher ROI. That means higher property taxes. You can not have a social safety net with open borders. It is a mathematical impossibility. You have to chose one or the other. You can not have higher blue collar wages with open borders. You can not have high paying tech jobs with a constant influx of H1 Visas. You can deny what I am saying but you can not eliminate the effects on those people. In the end, it does not matter if you make $1000/mo or $10,000/mo. What matters is the purchasing power after all the taxes. High rents and RE prices because of congestion raises the cost of living for the blue collars workers till they descend into poverty in terms of purchasing power. In Zimbabwe, everyone is a billionaire with a very low standard of living because of low purchasing power (it is an extreme case offered to you so you can understand my point).

“The problem is a lack of well paying blue collar jobs along with stagnating or declining wages, gig economy jobs as replacements, no benefits, no pensions, etc. etc. etc. Those are the problems. Anything else is BS.” The wages are not declining nominally. The purchasing power declines because of open borders and low interest environment which pushes all prices to stratosphere. Please see my comments in the paragraph above. You can NOT have any of the benefits you mentioned while the interest is low and the borders are opened. These 2 factors enrich the richest of the richest and decrease the standard of living for everyone else. The inequality did not increase in the last decade in a vacuum. The 2 factors I mentioned are the MAIN drivers (not the only ones). Open borders are part of the globalization which decimates the middle class and enrich the biggest corporations. I am a beneficiary of this process because I understand what is at play; however, that does not change the objective truth of what I am saying.

You can not have good paying blue collar jobs and globalization at the same time. You can not have good pensions and globalization at the same time. You can not have unions and globalization at the same time (except government unions). I have an MBA and decades of experience in running a business. I am not talking only based on theory but experience, too. You can not have the blue collar workers compete for a house in an environment where trillions of dollars move at light speed across borders with no restriction – trillions created with a push of a button by central banks across the world and exchanged for hard assets and real labor by real people. You are on a treadmill for the FED. Repeat after me: dollars (or any fiat) are not wealth and they are not money – they are currencies (they don’t hold value, they are just a medium of exchange). They are just units of measurement for real wealth – PM or RE.

tts: Immigration isn’t a issue. Illegals taking sub-minimum wage jobs aren’t a net negative on the economy either. The problem is a lack of well paying blue collar jobs …

Illegal immigrants don’t only take sub-minimum wage jobs. Plenty of them work in construction, landscaping, and other (formerly high paying) skilled trades.

…along with stagnating or declining wages, gig economy jobs as replacements, no benefits, no pensions, etc. etc. etc.

Why do you think wages have been declining in construction, landscaping, and other skilled trades?

And while illegal Central American immigrants are pushing down wages in those above jobs, “legal” H1-B1 Indian immigrants are pushing down wages in high tech jobs. Not to mention job outsourcing to India, which furthers declining wages and a gig economy in the U.S.

Then there’s all the outsourcing of manufacturing to China and Mexico.

TTS,

I’m not a boomer. I have relatively good job security (not an at-will employee), I get a pension and my employer contributes enough money (with no money on my part) to more than max out my 401K (excess deposited on Jan 1), full medical coverage for the family, short/long term disability, life insurance, etc. And there are thousands of us.

“if you do not address the points I’m raising.”

You’re mostly just restating and rephrasing everything you said earlier so I’ve pretty much addressed your points.

If you want to rebut what I’m saying you have to come up with something better than “here is everything I said earlier but in a more wordy fashion” or even just a good ol’ “nuh uh”.

A few things you’re saying that are new stand out as particularly ridiculous though:

“please read “The creature from Jeckill Islandâ€.”

LOL that book was written by a far Right conspiracy monger who is also a Chemtrail believer and denies the existence of AIDS/HIV and somehow thinks its caused by various medicines. Actual economists, or even just historians, who know what they’re talking about regularly crap on that guy for a reason.

If you’re using guys like that as primary sources of information no wonder your thinking is so screwed up.

“By living many of them in crammed quarters, they can sustain high rents. High rents mean high RE prices because of higher ROI.”

HAHAHAHA you’re gonna blame higher rents on illegals?!?

You realize that rents went up along with the bubble prices because of the mortgage costs associated with the higher RE prices right? Or do you not think the mortgage on RE factors into the rent costs?? Especially in scummy ghetto hovels that most illegals would rent for $600-800 a pop. Those weren’t a major driver of rental price increases at all. Not when you had condo conversions of crappy 1br1ba apartments being put on the price for several hundred thousand dollars a pop.

“You can not have high paying tech jobs with a constant influx of H1 Visas.”

Yet we did exactly that for decades. If the economy grows at a reasonable rate and there isn’t insane levels of wealth inequality its totally doable to have a relatively high intake of immigrants and still have a high wages that go up with inflation.

“The wages are not declining nominally.”

LOL who the hell looks at nominal wages only?! That is deceptive if not outright dishonest to do!! In real terms wages are indeed declining. Once you factor in loss of benefits and pensions the situation is even worse.

“You can not have good paying blue collar jobs and globalization at the same time.”

Sure you can. Just fix the wealth inequality via redistributive taxation and do Medicare For All to get healthcare costs under control while also improving state college funding to get tuition costs under control.

None of this is impossible to do and all of it makes sense in terms of numbers. The problem with implementing it is the political will isn’t there to make it happen. Yet.

SoCalGuy:

“I’m not a boomer. I have relatively good job security…………. And there are thousands of us.”

HAHAHAHA omg you don’t even vaguely understand the scale of the problem!! You’re effectively a outlier and don’t even know it!!

That there are thousands of people like you is EXACTLY the problem. There should be 10’s of millions more, not thousands of people, just like back in your parents and grandparents day with the same benefits.

That is how you get a strong healthy middle class. And no, in a nation of 100’s of millions, a few thousand, or few 10’s of thousands or even 100’s of thousands with good job security, income, benefits, etc. isn’t an example of a strong middle class.

It could definitely be considered an example of a drastically shrunken one from where it was 3-4 decades ago though.

SoCalGuy,

May I ask what your job title is? Are you working for the government? Getting a pension seems extremely rare in the private sector. Or am I misinformed? Thanks in advance!

Life is so much better than before. Yes, more expensive, but so much more good food, entertainment options, etc…

Yeah, real estate is more expensive, but it’s not all about owning real estate. in fact, I think, RE as a financial asset is on of the biggest mind-blockers out there

All kind of wonderful options….If you have any money!!! Must be nice to have disposable income to flaunt. Most of us in the real world are just getting by and life ain’t all that wonderful.

More things available for sale means nothing if you don’t have the money to buy those things and can’t even afford to move out of your parents home or get a steady job due to the gig economy while being loaded with debt from school.

There is more quantity of food available but the quality is lower than in the past. Crappy factory farmed meat, flavorless veggies flown in from far away, tons of chemicals and preservatives in food…..

For entertainment yes for the most part. Exception is theme parks which are way more expensive relative to income than in the past.

Tts,

Sounds to me that maybe you would really benefit from moving out of Cali. Some place like Huntsville, AL…lots of good-paying (almost as much as here LA) and houses are around $150k for a very nice neighborhood house that is normal size and has a real back yard (Madison, AL). Maybe it would be great for you.

@Glaba

I already moved out of CA several years ago at the bottom of the bust. And I went to a state that had much cheaper housing at the time and bought.

But guess what?

The same house I bought years ago for good price has now gotten so expensive that if I was to try and buy in the same are now I couldn’t afford it. The paper home value has more than doubled and is well on its way to tripling!!

And I don’t live anywhere near one of the “high end” areas either. Nor do I live in a ideal location. Nor are the schools all that great (schools here are in fact some of the worst in the nation) and the house builder is one who is known for cutting corners too!

Meanwhile wages have hardly budged in the area over this whole time and most of the locals can’t buy anything, its all out of staters from CA who are buying and driving up the prices, and they’re pissed about it. Most of them have been forced to rent at near CA rental prices and with their wages it means they’re broker than they’ve ever been in recent living memory. For most it feels like a recession here.

Only people moving in from out of state are doing well and only because they sold in CA or some other expensive area first for heaps of cash and are essentially retiring when they move here.

The whole situation is quite grim and its the new “normal” for all the surrounding states too. If you’re young and you’re trying to play the “grass is greener” game right now you’d be playing a loser’s game.

There is very simple explanation for the rise of % of renters.

Population grows, in dense cities (or cities with limited geography) the way to add more housing is higher density condos. Actual number of owners does not change, but as demand grows it is filled by high-density rentals.

So, in general:

# of houses stays flat and prices increase

# of high density housing (condos) increase to accommodate housing demand -> but this is mostly rental market.

No there isn’t enough condo growth either. Building in general for any type of structure hasn’t been all the high since the pop in late 2006.

The “growth” you’re seeing is in people living with 2-3 room mates to afford to rent and still have a car or pay down school debt. Or they still live with their parents and pay a rent to help mom n’ pop with the bills.

Los Angeles has been 60% renters for decades now.

The trend is not changing, in fact there will only be more landlords in the future.

“I wonder if all this desperation will cause a spike in suicides. With no hope for the future what’s the point of living?”

Your average Joe can still live a pretty good life in 90% of this country. Nobody is forcing anybody to live in uber expensive areas where the majority are renters. Certain areas (like desirable coastal CA) are forever changed. The middle class will not be making a resurgence here. I don’t like it, but those are the cold, hard facts.

As someone who lives in one of the lower cost areas the economy is pretty crap here too and there is no sign of a resurgence of a middle class here or any other lower cost (aka low income) area in the US either.

Pretty much everyone nationwide is getting poorer. Well, except for the rich. But then the rich are getting pretty much all the GDP growth funneled towards them for nearly a decade now so what else can you expect?

Just because a bunch of people want to live on top of one another getting high off of sniffing each others’ farts doesn’t make the area objectively desirable. A lot of people also find cocaine and hookers highly desirable.

Why would somebody kill themselves because they must rent instead of owning? They must have barren, materialistic lives. Maybe the world is better off without people like them. It would improve the gene pool if they don’t replicate before snuffing themselves.

I agree. Materialism is actually pretty boring. The best things in life are the people we love and the experiences we have.

Uhh that’s a bit extreme… all you need to do is move out of CA to somewhere with affordable housing. Life in other states is not bad.

I agree. Rockford, IL is particularly affordable – and a quick 75 miles away from O’Hare!

https://www.zillow.com/homes/rockford-il-61104_rb/

How are millennials supposed to “save the market” when the boomers have already milked the market through hyper-industrializing housing and making it an international market, allowing them to fatten their greedy pockets?

Remember folks, baby boomers:

* Had it better than any generation in history

* Were raised on home-cooked meals

* Mom stayed home and gave them attention

* College was cheap. A fraction of what we pay

* A degree (in anything) would land you a good job

* Corporations kept you for decades

* Stock portfolios and homes increased 4x in value

* Retirement was a human right

And they..

* presided over the outsourcing of jobs…

* …leading to the underclass’s opiate-drenched collapse

* paid illegal immigrants to tend to their homes, left immigration entirely unchecked

* fed us frozen pizza and fruit juice, no cooking

* hyper-industrialized prison, healthcare, education, housing, etc

* bought plastic junk and used toxic cleaning supplies

* prescribed antibiotics liberally, nuking our gut flora

* gave children Ritalin, Prozac, Wellbutrin, Klonopin…

* …pink slime, lead fillings, accutane, Snapple, Percocet

* got divorces and bought sports cars

Now we’re supposed to just take the scraps they left over as they strawman us as “lazy and self entitled youngsters who just want avocado toast”?

No. Boomers will forever be remembered as the selfish generation.

The boomers were just opportunity seekers like all people in all generations. All people are equal selfish. No generation has a monopoly on it.

The politics were driven by the banks and the politicians catering to them. I am talking about the largest banks who own the FED not the small regional banks – those just struggle to survive in an environment created by the big banks and for the big banks which hate competition.

“Paid illegal immigrants to tend to their homes, left immigration entirely unchecked” When Trump tried to enforce the EXISTING laws all the left media and politicians screamed bloody murder. All the liberal judges made it a point to frustrate Trump immigration policy at every turn. He was portrayed by liberal media as the second Hitler for trying to enforced the laws passed by democrats and republicans alike for decades. Really, why do we have laws if we are not supposed to implement them???!!!!….A country which does not enforce the laws is a banana republic.

Now a liberal on this site is trying to accuse the boomers for voting in a president who “tries” to enforce the immigration laws. Most millennials voted for Bernie Sanders, another globalist/collectivist who wants to continue the same immigration policy like Obama and Clinton who decimated the middle class. The globalization and unrestricted immigration are the main drivers of inequality by benefitting the richest and decimating the wages and employment of the middle class. During Obama, the inequality increased the most and that is a FACT (as to why, that is another subject). All the liberal politicians who do virtue signaling are as big offenders as the republicans when it comes for paying out of their own pocket for nannies and gardeners. They care less if they are illegals.

So, back to school Panders! You have to learn some real history, economics and human behavior.

Lol typical boomer-post right there.

1. I’m not a liberal. Not even close.

2. I’m not poorly educated, although your post indicates you’re projecting there.

3. You only attacked one of my points, and even though you typed up a short essay you failed to refute even that single point.

The 1965 Hart-Cellar act marks what many might consider the beginning of the purposeful replacement of actual Americans. Ever since then there’s been an endless attack on the family unit, a mass broadening of the the welfare state and social “safety nets”, along with astronomical rates of inwards immigration. Throughout all of it, the boomers have been sitting idly by, doing nothing to help anyone except themselves. As long as they could watch their Johnny Carson at night, enjoy their cheap housing and cheap Chinese goods, and their 401ks kept growing, they didn’t care.

They NEVER, EVER held politician’s feet to the fire when it came to immigration. Reagan’s amnesty turned California blue overnight, and still they did nothing. Colorado, Nevada, and New Mexico went blue. Still nothing.

When immigration turns Arizona, Georgia, Florida, and yes, TEXAS into blue states, all of which will absolutely happen in the next 8-15 years due to LEGAL immigration, people will REALLY start waking up to the betrayal of the selfish generation.

” All people are equal selfish. ”

Nope, I don’t buy that at all. The selfish stealing is unique feature (of those still living, of course) of post-WW2-generation, at least in US and Europe.

Very big, relatively poor families where you had to grab whatever you found first teached to these people that if you share, you won’t get anything. These people never learned to share unless forced. Or not take more than they need.

Ideology which is pure greed by modern standards and a in a family with 1 or two kids, totally absurd. Different times, different people.

We can blame their parents but that’s kind of moot point: People are a product of the society which raised them and parents don’t have much influence to that.

Applies to every generation, of course.

Young people cope with much less as they have to. But they’ll learn how to do that, a skill the older generation didn’t ever even try to learn. Not then, even less now.

I mean a McMansion for 2 people? Why the heck? Totally incomprehensible to me and I’m a middle-aged guy.

Barnie Panders: The 1965 Hart-Cellar act marks what many might consider the beginning of the purposeful replacement of actual Americans. Ever since then … yada yada … boomers have been sitting idly by, doing nothing … They NEVER, EVER held politician’s feet to the fire when it came to immigration. …

In 1965, Boomers ranged in age from 1 to 20. I was 4. What were we supposed to do?

Clinton was the first Boomer president. It takes a while to rise in political power. Boomers didn’t get to the top in large numbers until the 1990s. Even then, there were plenty of Greatest Generation still in power.

And it’s not like I see a groundswell of Xer or Millennial politicians calling for an end to immigration. Almost every public figure, of every generation, is afraid of being called a racist.

Panders, I did not want to go line by line through all the non-sense you put there because I have better uses of my time. The reason was not that you posted something so intelligent that I can not refute.

I mentioned the immigration because of all the commotion the liberal created when Trump was mentioning the obvious (he was not PC). Immigration is a very important driver of low wages, high rents and high RE prices. Nobody can deny that. Not the ONLY driver, but an important one.

I put the immigration blame on both, democrats and RINOs (democrats with R after their name.). While you “claim” you are not a liberal, you talk and attack like a liberal, using feelings and no logic. If you walk like a duck and quack like a duck, you are a duck. It is the same with the RINOs who “claim” they are republicans but they always vote like a democrat (i.e. McCain and his Flake fellow).

Barnie, looks like you need to take your meds, to settle you down, or for you, some Emerald Triangle stuff, best stuff, I hear. Everything will seem fine after this.

The goyim are waking up, (((Ira))); you can’t stop it now. I wish you luck in what’s to come. You and yours are gonna need it.

Barnie, thank you for your good wishes. I can use it. The future is uncertain. Every day is a new adventure.

You have summarized it well. I was born in 1946 and by the late 70’s was watching the naive realism of fellow boomers shift to materialistic values as distorted or worse than that of the generation that raised us. I did not, however, find it at all easy, highly competitive, favoring the already privileged, with lots of challenges (rapid CPI inflation in the 70’s, recessions, huge housing inflation over decades, etc.). The median boomer 65 and up has an annual income around $25k and a net worth, if they own a home, around $125k, not a screaming success. I had two prior prior professions, both requiring advanced degrees, worked constantly and very hard, and at 41 finally moved into something that took me into the top 1% by about age 60 almost 20 years later. It was not easy and I had to continually learn. The millennials face an even more challenging environment but it wasn’t at all easy for those of us who started from scratch as boomers and it can be done and some millennials will.

> The median boomer 65 and up has an annual income around $25k and a net worth, if they own a home, around $125k,

I’m a tail end boomer. My impression, boomers as a group are anti-social and have poor impulse control. If you want proof look at the rise and decline of murder and rape from 1950 to present. Rates of rape and murder have declined[1] for every age bracket since 1990. However the rates for over 60 is still going up.

Short explanation about the low incomes and savings of most boomers, what do you expect. They just didn’t sell out their kids economically and politically, they sold out themselves.

[1] The rate of rape per 100,000 is down 75% from 1970. It was highest when baby boomer men were in their late teens and twenties.

You described your little subjective fantasyland world view, try reality. Boomers worked hard and saved equally harder. No free rides were given. You sound like a snowflake that has a root of bitterness , lose it. Otherwise your cognitive bias will blind you from truth. Furthermore , don’t believe everything you read.

Klaus,

Utter BS. Back when boomers were our age the avg house did not cost 10 times the household income. Tuition was free in California. You could afford a house with one income. Boomers lived large and deferred the payments to their offspring.

There was gold lying everywhere when boomers were in peak job years. Tons of money, pensions, new verticals, technology, consumership, media etc.

There can be no comparison of today vs the 60’s-2004. Everything is different, housing is now gamed by PE, hedge and investment reit leveraging. In the 70’s, if you stashed some of your cash in 18% cd’s you would be loaded. Try that in negative yields for 10 years straight. I’m a late boomer and would never make that comparison.

Underwriting even in the 80-90’s when i was buying paper was built on a good yield vs risk plus volume and loan to value. aka down payment. The world is quite different. I think I’ll now go back and watch the cup on my mobile phone.

Baby boomers filled up most of the metro areas, where the jobs are, leaving little room for those coming later. Hart-Celler (1965) opened the gates to millions. Population, population, population – drives everything. And, in the last 40 years, immigration has driven population. What did you expect to happen?

As a boomer I have to agree we had it great. And along with advances in modern medicine we are still going to be around for a while.

BUT …

At some point we will stop breathing. The interesting number for our children is that cumulatively Millenials will stand to inherit an astonishing $1 TRILLION – or more – each year for the next 40 some years.

We’re leaving the scene and letting our kids clean up after us. Not surprising really. Our parents, the Greatest Generation, cleaned up our messes when we were kids.

— disclaimer: my wife and I are in our early 60’s and both retired.

We’re leaving the scene and letting our kids clean up after us. Not surprising really. Our parents, the Greatest Generation, cleaned up our messes when we were kids.

Ah, the so-called “Greatest Generation” was in power when much of this mess was created. Johnson’s Great Society and Vietnam War did much to lead us on the road to deficit spending and a big national debt.

Bush 1 (Greatest Generation) had a golden opportunity to shut down the expensive American Empire after the end of Communism. (Remember the promised Peace Dividend that never materialized?) Instead, Bush sparked a new crusade against Israel’s enemies by announcing a New World Order, begun with the Gulf War. (The U.S. lured Saddam into attacking Kuwait, or as everyone forgotten?)

Yes, Clinton, Bush 2, Obama, Trump (all Boomers) continued the profligate military and social spending of the Greatest/Silent generations. But “we didn’t start the fire,” as Springsteen put it.

“We didn’t start the fire.†Billy Joel

The boomers took what was offered to them. Would anyone here turn down a coastal home priced at two or three times their income? Would you turn down a pension? Or the ability to live comfortably with one blue collar income?

“But I would feel like I’m taking advantage of the people born two generations from now, who may or may not have it harder than me.”

Riiight. Just like modern metro firefighters are refusing to accept their outrageous retirement benefits.

And naturally the average boomer should have known what a disaster plastic would turn out to be, and fought to stop it. In the 1960’s.

Blaming an entire generation is really helpful.

Barnie,

100 % on point.. He summarized Boomer GEN perfectly.

It’s nice to see posters call out these selfish boomers. You can write all day about them (and still not be done) how they screwed everything up just to benefit themselves. Just take prop13. Boomers love it because it benefits them greatly. They pay next to nothing in property taxes and own million dollar homes. If a millennial buys an overpriced condo next door he has to pay ten times more in property taxes on top of the inflated condo price. Boomers will scream at you “poor grandma “ when you call out this scam. Prop13 is designed to benefit these old farts and screw younger generation by transferring the tax burden entirely to them.

There are lots of forces at play to bring about this outcome.

1. Interest rate kept low for the longest time in the history of US. It was determined by the FED, owned by private banks. Therefore, the cause were the bank policies. It helped the banks to increase their asset values – most RE titles are held by the banks and they are assets for the banks.

2. The cities policies for development and increasing the soft cost for developers were heavily influenced by banks to decrease supply and make their assets safer.

3. Those in charge of national and state building codes were strongly influenced by banking lobby groups in order to increase the cost of construction and implicitly decrease supply. That in turn increases the value of the bank assets.

The financial sector these days control almost half of the economy.

Above I stated generalities. Let me give you specific examples. The national electrical code and especially in WA state changed so much that almost doubled the cost of the same electric comparative to few years ago (assuming the labor and materials stay the same). Most of the change does not have anything to do with safety but it is politics driven. Add to that the higher cost for skilled labor and higher cost for materials and the cost of just electric work more than tripled. Try applying that to soft cost (permits and fees and cost of compliance), framing, HVAC and plumbing and you get the picture.

For more evidence, look at CA requiring builders to have sprinkler system in the ceiling, solar panels on the roofs, etc. All drive building costs higher and higher while globalization and immigration keep wages almost the same.

Yea, and when seatbelts became a legal requirement in all new cars, lots of people were whining how it will drive up the prices of the cars.

Surge, I’m not against safety. I’m against lack of common sense. Most of the building regulations passed before 2008, were common sense laws. What came after were pure BS driven by politics alone. I talked to those in the field and they told me the same thing. I talked to the fire marshal for the county (and chief inspector) and he agreed with that.

Just because some laws and regulations are good it does not mean more of them are better. Actually it becomes worse. For everything there is a sweet spot of balance. It is the same thing like with eating- not enough you die, too much you still die.

Flyover, what you are saying is sensible except the fact that in this forum i have not heard a praise for a SINGLE current new regulation. Is like we have reached optimal stage of regulations and no further evolution is possible.

NIMBY-ism in this forum is appalling.

Government always knows best. Repeat more inane libtard talking points.

No, actually people know the best. Of course.

My favorite quote is something like this “underemployed are best at micromanaging the congress”

When exposed for libtard statements, make different statements in order to confuse the issue.

In the Bay Area we keep the undesirables out with building codes, unlike the land of the Philistines, SoCal that turns into northern Mexico. The new federal income tax law encourages renting. A family can get close to a 24k standard deduction, so it does not make sense to buy. Also, the state income and property tax deduction is limited as well as the interest deduction. The Dems are stupid to complain. Within the next 12 months, people will wake up to this. Watch home prices go down. Raising interest rates also encourages renting. I am a landlord in The City, so I view all of this as good for me. It is good to be rich.

“It is good to be rich”

true dat…….BUT the very very best part of all that is when the shit hits the fan ya’ll get bailed out as well!!! Heads you win tails the rest of us lose. But I agree, it must be great to be in “the club”

Taxation and regulation will increase until it reaches levels now seen in Europe. That is how they intend to strangle us, just as they have Europe, with high income taxes, value added taxes, and regulation of everyone except insiders. Our industrial sector migrated to the second and third worlds, where taxes, regulation, and labor costs are low, to bring about the great socialist leveling. Just look at Europe; it is not capable of recovery. Their citizens are simply taxed to death. It’s all about control, and that is what government is all about. Taxation and regulation sap incentive, and that is how countries and economies fail. There will be no end to government regulations and interference. Even under Trump.

Millennials are also not forming families leading to a precipitous drop in demographics all while mass immigration brings in people to replace them.

As we can see in California the future of America is hispanic. It will resemble Mexico by the end of this century and the hispanics will not be clinging to the institutions, heritage and history of the gringo. The remaining whites will live as the white Mexicans live in gated communities in a corrupt and impoverished nation.

It’s already over for the USA because demographics is destiny. You just don’t know it yet.

Over the next several decades I think California will be like the Blade Runner world. I doubt it will be all hispanic. I think the Asian populations and other counties will likely start filling the gaps as well.

It’s already over for the USA because demographics is destiny.

Israel gets a pass when it shoots Palestinians trying to cross its border illegally. Then we hear “Israel is a sovereign state” and “Israel has a right to defend itself,” etc. The U.S. establishment gives Israel a routine slap on the wrist, then it’s back to celebrating the embassy opening in Jerusalem.

I wish the U.S. media, academia, and political establishment defended their own country (the U.S.) the way they defend Israel.

America has the best Congress and politicians that money can buy. Any group with enough money can buy their foreign or domestic policy, for that matter. As old Jesse Unruh(California politician) said, “money is the mother’s milk of politics.” It just so happens that old Sheldon Adelson has billions and with that comes influence(power). Everybody wants to be his bff. Some say that Israel has an Alt Right government like America.

We were living off stolen land anyway. We could always go back to Europe. If I see someone that doesn’t look like me, I run home as fast I can, get some vaseline, and watch Birth of Nation until I relax.

“Stolen land†what a load of horse shit. You’re saying the American indians owned the whole continent prior and before Europeans arrived they were all living in harmony like ebony and ivory?

It turns out Europeans were actually in North America before the asian ancestors of the American Indians:

https://www.independent.co.uk/news/world/americas/new-evidence-suggests-stone-age-hunters-from-europe-discovered-america-7447152.html

Regardless of who “owned†the continent of North America it was built by European settlers. If it had been left to American Indians it would still be savage brutality, teepees, peace pipes and tomahawks.

The land was really here before anyone. However, whoever has the horse, steal and disease wins the claim.

Guess the horseshit wins since horses evolved in North America 50 million years ago.

Jonny,

You did not seriously compare stone age hunters discovering new land to a civilized Europe conquering by killing, raping, and bringing disease? If you want to play the go back game, every human derived from Africa, so Africans own America then. The natives may have been living in teepees but they would have been happier, less fat, not addicted to objects and desire, take out their insecurities on others, and not brainwash others in a false sense of loyalty.

Dear Doctor,

I agree with you and the intelligence of the Millennials.

Why would they buy a house at the peak now when over 7M of their parents were wiped out financially at the last peak? That shows intelligence

Most Millennials are just starting their careers and would be financially stretched to buy a million dollar house now.

It is a cr*pshoot for a cr*pshack.

If they are lucky, have some savings, and keep their jobs during the next downturn, they will do very well.

If they are average and the economy tanks like 2008, they will be lucky to be living in a van.

I think it is a bad gamble to buy now unless you have a trust fund to back you up for the inevitable bad times.

Speaking of living in vans, have you seen these short pieces.

One is called Nomad Land, countless people living in their vans and RV’s

https://www.youtube.com/watch?v=DNdj6Rs3H5g

The other is Amazon’s ‘Camper Force’ of part time laborers who work for Amazon for $11 an hour, who live in their campers but clock in everyday for their Amazon warehouse job.

https://www.youtube.com/watch?v=kwaRoCCwzxk

That’s interesting. I haven’t heard of this. It’s like a new sort of migrant worker –elderly people living in RVs.

“Nomadland” was a good book.

Mortgage rates are now the highest since 2013 but I have yet to see a significant impact on prices. The increase has come at peak selling season so we’ll have fast market data. If values hold then Millenial has made quite a large mistake in putting off buying as now he has to contend with higher prices and higher rates, like what I said could happen to him.

I guess he can sit and pontificate in his rental on what the market COULD do while I enjoy my 3.25% mortgage and home I bought in 2014 with prop 13 taxes.

“Mortgage rates are now the highest since 2013 but I have yet to see a significant impact on prices. ”

The rates are not much higher at this point than they were at the bottom last year, and still affordable to many buyers. What’s happening now is that buyers are making a last-ditch frenzied effort to lock in before rates go any higher. This happened in Alameda, CA (where I lived at the time) right after the market there peaked in the spring of 2005. Before the end of that year, we had some record-shattering prices for a brief spurt of less than a month, and then the slide started down again and never stopped. The record-breaking sales in my neighborhood amounted to maybe 3 houses, not much, but the selling prices were quite a bit above the previous highs (+$50-100K) for the models in question.

What’s happening in Sonoma County, my current residential area, is that prices in my range of $700-$800K are down approximately $50K in the last 3 months, for similar properties. I agree with Ira, above, that house prices are now headed downward due to the new tax laws. Add to that, of course, interest rates going up. I figure that prices will continue to go down for 3-4 years. Unfortunately, my sweetie is pushing me to buy a house with him ASAP, threatening to buy one by himself if I don’t go along. I may just let him. Buying right now is stupid, in my opinion. He’s starting to see prices go down as well, so he’s not pushing quite as hard. He was one of the ‘gotta buy now before it’s too late’ ones, but the price reductions happening now are more than making up for the rise in rates. We’ll see.

Karin, I totally agree. Price will lag a good 6month to 1year for the tax change and mortgage rates to be fully baked in. I live in a NYC suburb and wife has been pushing me to buy for the last 3 years. Very low inventory in the exburbs last 2 years and all of a sudden, in the last 3 months, there’s almost an 100% increase in listings. People are slowly waking up, but mostly are still way over priced at $1M++. Not a lot of demand in that price range. its just a matter of time before price meets reality. Most are already dropping $50-100k on the price. We should see some nice price drops next spring. It takes a lot of patience.

You are incorrect in your statement about rates. Last week we touched on 8 yr highs. I know first hand; in some scenarios I was quoting 5% and sometimes higher (for the lower credit score profile).

Correction will happen of course, but with higher interest rates you might be roughly in the same spot as with higher prices/lower rate. Quite a moot point if buying mortgage and for a long term.

Also, I do not see correction being more than 10%-20% (and who knows when it starts). Homeowners have little incentive to sell (losing lower rate, transaction cost, etc…) for a dubious upgrade. Investors might pull a trigger, but rents are quite high and there are few alternatives to invest now…remember, the moment you sell you lose 5% in transnational cost AND opportunity cost of cash sitting in the bank. Stocks are very risky now.

What I do not know is how leveraged up people are…from my mortgage process, there is a LOT of scrutiny even on very good financial situation and I assume this is the same for cash-out refis..but this could be a trigger point for “forced” selling if they cannot meet obligation

Reality is housing costs (cost or rent) is unlikely to decrease for SFR and high quality areas. Even if prices drift down, higher rates will drive monthly cost up. Housing “shortage” can be addressed by higher density constructions, but SFRs inventory will not grow much.

So, 2 bigs questions:

1) Behavior of investors

2) How leveraged people are in general.

@Surge regarding the leverage and cash out refi comment.

Cash out refi’s are very restrictive these days for all borrowers (except for veterans).

Maximum loan to value (LTV); loan amount divided by value of property for the following programs for cash out:

Conventional 80% max LTV

FHA 85% max LTV

Jumbo 80-85% LTV (occasionally 90% is possible with excellent credit and very low debt to income ratio)

HELOC’s typically cut off around 80-85% LTV

VA up to 100% LTV

In summary, pulling cash out or leveraging your existing property is not like it used to be as most of the mortgage programs require 10-20% equity remaining AFTER all the cash out, fees, etc……..

VA is the only exception which allows up to 100% of the value of the property. For whatever reason, VA loans have a relatively low default rate (baked in discipline?) and therefore VA hasn’t changed or cut back this guideline.

This is not the old wild west days circa 2006 where one could pull up to 125% of the value of their property without proving income. Rates are also higher on these cash out refi’s (in the 5’s); so with more restrictions and higher rates the money is not cheap or easy.

In any case, just thought I would shed some light on the cash out issue.

“Mortgage rates are now the highest since 2013 but I have yet to see a significant impact on prices”

Amount of sales first, prices later. We already do see the amount of sales and granted mortgages dropping to smallest in a decade . Eventually it drops so low that only those who must sell, will sell. If there are enough of them, prices will start to drop.

Are there? That’s a question I can’t answer, at least now.

But one thing is sure: It will set a trend downwards. Possibly burst the bubble too and then investors are starting to sell.

“>Paid illegal immigrants to tend to their homes, left immigration entirely unchecked

When Trump tried to enforce the EXISTING laws all the left media and politicians screamed bloody murder.”

So? Hasn’t stopped Congress or Trump in any other case either, basically irrelevant point.

It’s obvious that it was internal opposition withing party which stopped that, not “left media”. Cheap maids and gardeners would be gone, that costs money.

And Republicans are all about money. Every time.

It’s obvious that it was internal opposition withing party which stopped that, not “left mediaâ€. Cheap maids and gardeners would be gone, that costs money.

And Republicans are all about money. Every time.

Wrong. Republican politicians do not support more immigration just because a few of them might save a few bucks on immigrant labor. They do it because they dread being called a racist.

Hell, it’s worse than that. You won’t just be called a racist. You risk violent Antifa demonstrators showing up outside your office and home.

NY lawyer Aaron Schlossberg was hounded for days by the press, just because he complained about women speaking Spanish in a restaurant, and the video went viral on social media. Now the building where he rented office space has evicted him. There’s a petition to disbar him. And leftist demonstrators are harassing him outside his condo: http://gothamist.com/2018/05/21/schlossberg_mariachi_protest.php#photo-1

And don’t forget the Republican Congressman was shot by an anti-Trump leftist.

The left is intolerant and violent toward “thought criminals.” Doxing. Harassing victims at work and at home. Pressuring landlords to evict them. Pressuring employers to fire them.

No, it’s not “about money. Every time.” It’s about personal safety. It’s becoming risky to be a Republican. Risky to oppose open immigration.

The left doesn’t want to just disagree with you they want to destroy you and every aspect of your life if you don’t want to be part of their “group think” I’ve never seen anything like this……….pure hate and pure evil…….think like us or else.

The only silver lining is it’s now so over the top that they are starting to turn on each other……it’s a game of who can be the most virtuous. And the hypocrisy is in over drive. Trump called MS13 killers animals and the left fell all over themselves to label Trump an evil racist….they were comparing him to Hitler…again………but never mind that one of the biggest mouths in that fiasco was Ana Navarro who had this to say about Trump.

Ana Navarro

✔

@ananavarro

Should Donald Trump drop out of the race? Yes. He should drop out of the human race.

He is an animal. Apologies to animals.

5:20 PM – Oct 9, 2016

read that again and again….that is the “moral” left in all it’s glory.

Ana Navarro is a Republican Strategist. Nice try fake news.

The left lies. About. Everything.

Jimmy Dean Sausages,

You lefties think Republicans can’t be globalist swine. You are wrong.

Jim Dean,

that’s right from her twitter feed dumb dumb…..and I saw her on TV saying the thing about the animals comment comparing Trump to Hitler yet again……and you call ME fake news…facepalm

Thomas, the republicans are not a homogeneous group. You have globalists RINOs (they act and vote like the Democrats but they have an “R” after their names) and constitutional conservatives (for limited government). The difference between them is like night and day. Both, Ron Paul and McCain, have “R” after their name but you can not find 2 politicians more different in their world view. One acts like a democrat and the other like a constitutional conservative.

The Democrats are all communists/globalists/collectivists. No hope there.

Given this dynamic, with all the Democrats and RINOs against him, Trump is very limited in what he can do regardless of his views. The Congress is packed with hypocrites and traitors.

So you are partially correct in your assessment.

Sorry. Trump is different. He is actually doing something for the white lower middle class and white lower class worker whose jobs are being shipped out of the country and whose neighborhoods are being decimated by illegals. Those white lower middle class and white lower class people have no one else to speak up for them. The Democrats want nothing to do with them because they are white. And, the Republicans want nothing to do with them because their interests conflict with corporate interests. But, there are a lot of them and Trump is pounding the pavement for them. Trump is even trying to expand his supporters into the black community who have been given lip service by the Democrats for years. Many in the Democratic and Republican party are really scared. Things are changing. FYI .. my support for Trump varies by the day. But, I can see reality.

Trump hasn’t done anything but hurt the RE market with this awful tax cut for corporations and the wealthy. Why anyone on RE investment discussion board would still support this whore of a administration bought and paid for by Russia and Saudis.

LG, what REAL proof do you have that Trump was paid by the Russians and Saudis? I know that Hillary was paid by the Russians and the uranium deal.

The tax cuts for the small businesses was VERY good. They create more than 3/4 of the jobs in US and they used to pay the highest rate in the world – for real. The very large corporations ALWAYS had loopholes and an army of tax lawyers. I had years when I paid more in corporate taxes than GE and GM combined – that anomaly can not continue because that was the real cronyism everyone was talking about. Those high taxes paid by small businesses suffocated the Main Street economy for years. We experienced a decade of depression and all Obama and Hillary were talking about were more taxes. Not surprised given that it was coming from leeches who never produced anything of value in their lives. They were always leeches on government dole stealing from producers.

Now people like you clamor for another government leech – Bernie – who never produced anything of value in his life – never had a job in the real world.

Has Trump hurt the RE market? So far, the RE market is very strong, so I don’t think you can say that at all. In fact, I do not think you can say he has helped it or hurt it. It will be a while before the data is in.

Another thing. I am getting tired of leftist hate. Trump has done good and he has done bad. In fact, every president has done good and also done bad. That is reality. Trump has many years to go and after his time is done we can rank him. But, I refuse to be cowered by leftist hate and the demand I think the way they want me to.

Trump is doing a lot of good for certain people in this country that were left behind by Republicans and Democrats … like whites without much money. That group of people was neglected by both parties for many years. Trump changed that. Of course, Trump has not been so good for the affirmative action crowd and for wealthy people that do not own a business. Those are the facts.

Personally, my taxes are much higher after 8 years of Obama and several years of Trump. They were both bad for me. However, I am glad to see poor whites getting their representation by government.

LJ, lay off the MSNBC and the Pelosi talking points. The tax cut benefited your average Joe, these people really appreciated the extra crumbs in their paycheck.

Tax cuts for corporations? LOL. Dude stop watching Rachel Maddow it’s frying your brain. 90% of tax payers got a tax cut. And for the 100000000th time corps do NOT PAY ANY TAXES. They only pass the cost to consumers. So when corps get a tax cut, consumers get a tax cut. This has been explain to dullards like you for years and you still don’t get it. You also probably think rent control means lower rents, LOL.

If you replace “Republicans” with “politicians” then you are correct. I dont think it takes a D or an R next to your name to sell out the citizenry.

If a majority of the electorate are renters, rent control may be in the future.

Finally, a post that is on today’s topic from the good Dr. Rent control pops up in cities that wish to be frozen in time. Unless new buildings are exempt, you won’t get many of them. So today’s renters get a stranglehold over their rental unit and hang on for dear life. hey try to leave them to the kids when they die, too. Whether landlords do maintenance would depend on the value of the property and the zealousness of local code enforcers, I guess.

That’s called “Squat To Own”, Joe.

Boomers own 80% of everything globally!

MOSE ALLISON

“Young Man’s Blues”

(Mose Allison)

Oh well a young man ain’t got nothin’ in the world these days

I said a young man ain’t got nothin’ in the world these days

You know in the old days

When a young man was a strong man

All the people they’d step back

When a young man walked by

But you know nowadays

It’s the old man

He’s got all the money

And a young man ain’t got nothin’ in the world these days

I said nothing

Everybody knows that a young man ain’t got nothin’

Everybody!

Everybody knows that a young man ain’t got nothin’

He got nothin’

Nothin’

So what else is new?

https://www.youtube.com/watch?v=bpTSVy3yzts

And Boomers are getting older. Many are approaching 70.

Eventually, the Boomers will pass away into the beautiful CA sunset and then Milllennials will own 80% of everything. The cycle will repeat and under Trump, the Boomer dynasties will continue.

The Boomers are spending their home equity, they will leave their homes to the banks. No, the lazy children who live at home will receive nothing. On top of that, the adult children will inherit debt, such as the national debt. They are a lost generation.

That’s right! Why buy an overpriced crap shack if you inherit nice, big houses anyways? Until then, save money, invest wisely and stay flexible. Is there an easier formula for success than that? The last thing you want to do is buy an overpriced asset and lock up your hard earned money. House prices in California will go down 55-75 during the next crash….there is really only one way here to not screw up. Save and wait for a nice beautiful crash.

Eventually, the Boomers will pass away into the beautiful CA sunset and then Milllennials will own 80% of everything.

Well, 2% of Millennials will own 80% of everything. The other 98% of Millennials will be paying rent to that 2%.

Bob,

Actually the oldest boomers are 72. But even so, that’s still relatively young for today. Today’s oldsters aren’t the oldsters of yesteryear when they’d retire at 65 and croak at 73. People are already living well into their 80s and 90s on a regular basis. As medicine keeps advancing at the spectacular rate it has been for the past 20 years, people living past 100 won’t be a big deal anymore. Plus people generally lead an easier life than any other generation before them. Fewer smokers too. It’s going to take at least 15 years before the oldest boomers start dying off in significant numbers. And then there will be another 15 years after than before the youngest boomers (who are in their mid 50s today) start dying off. So 30 years before your dream comes true. That’s a long time to rent.

Who cares how old or young boomers are? Nobody. The only thing that matters is….have these boomers take care of the houses (upkeep, maintenance)

You don’t want to inherit a crap shack! That’s your retirement!

April 8 OC Register article quotes a Chapman U poll that says 59% of Orange Co residents support rent control. Only SJC currently has any laws ad those are only for mobile homes. 41% of those polled are renters. Santa Ana has petition drive for rent control on November’s ballot.

So few people here vote in municipal elections, that landlords have a lot more clout in most towns. I’ve met Hispanic families who live in nicer areas who own houses in Santa Ana that they rent out. They own there but can’t vote there.

As a landlord I welcome rent control with open arms. In the long run it raises rents across the board.

https://www.bloomberg.com/view/articles/2018-01-18/yup-rent-control-does-more-harm-than-good

I would not be sure of that, Mr Landlord.

I’m such a real estate junkie that, even though I’m happily settled into a place I love, I am forever cruising the real estate sites, in other cities as well as Chicago, to see what I’m missing. Was surfing the NYC listings when I came across this incredibly low-priced condo on the Upper West Side, which is now almost as expensive as the Upper East Side:

https://www.realtor.com/realestateandhomes-detail/243-W-98th-St-Apt-2C_New-York_NY_10025_M37357-32825

Read the listing- this large 3 bed 1 bath in a beautiful pre-war building sold in 2006 for $1.4, but it is now on offer for $364K, comparable to similar listings in my moderate priced Chicago nabe. What a bargain, huh? But there’s a big catch- the place is rent-controlled, and occupied by a tenant who cannot be evicted and is paying $620 a month rent. That’s less than my HOA & property taxes, and about $500 less than my 1 bed 4 room Chicago condo would rent for. The owner of this unit is effectively a slave, working for a steep and deepening loss. I can’t imagine anyone taking this place as a gift on these terms, but I guess someone or the other will think he knows a way around NYC’s notoriously draconian rent-control laws.

Rent control destroys every market it is applied to. It makes landlords poor, and makes rental housing scarce, and so expensive that only the affluent can afford it.

Fair enough Laura. But I think that story is an outlier and I’d rather slice of both my arms than ever become a landlord in a shithole like NYC.

I wouldn’t worry about rent control for my properties because I impose my own rent control. If I find a good tenant I don’t raise the rent. I have one tenant who is about to re-sign a lease for the 3rd time. Rent will stay what it was in 2016 when she first moved in. If I rented it out fresh, I could get an extra $100/mo easily. But to me that $1200 yearly income isn’t worth the hassle/risk of finding someone new. And by keeping the rent unchanged, I am making my tenant happy and happy tenants are tenants that treat properties well. It’s the Principle of Reciprocity….I do something nice for you, you feel the need to do something nice for me. I keep rent unchanged, you make sure you treat the place nicely and pay the rent on time.

While rent controlled NYC apartments with super low rents locked in, like this one, are rarer than they used to be, this unit is by no means an outlier. There are at this time, 27,000 rent-controlled housing units in NYC, and 1,030,000 rent-stabilized units there.

The two tiers of rental-rate regulation in NYC are Rent-Controlled, applying to units build before 1947, and Rent-Stabilized, applying to those built 1947-1974. Rent-stabilized units are allowed to raise rents in small increments in keeping with inflation, and are subject to income limits. Rent-controlled units, however, can almost never raise rents, and there is no limit on the tenant’s income. Worse, the unit is “grandfathered” for the tenant’s heirs, who can then squat for an ultra low rent until the owner finds a way to evict them, which is almost impossible. Tenants of rent-controlled units, which include many high-end units, tend to be affluent and well-connected- people it’s not safe to mess with. Most rent-controlled buildings were lost either to conversion to co-op, if the building was beautiful and in a good location, or was simply run down until it became uninhabitable and was abandoned. The Bronx neighborhood was by 1980 stuffed with formerly beautiful pre-war buildings in various stages of collapse, left to rot when it became less unprofitable to abandon the place than continue to operate it at a steep loss, and spend your life in housing court for all the code violations for repairs you couldn’t afford to make and the lack of heat, which you couldn’t afford to provide, on the rents collected.

This particular case I posted is interesting because it’s in a condo building. When the building converts to condo or co-op, the tenants usually have to leave, but (I’m only guessing) I suppose the owner wanted to rent it out, and, not knowing the rent control regs, bumbled into this unfortunate situation, and is held hostage by a tenant who is probably very savvy and knows every angle of the regulations & how to game them.

From my perspective, things don’t add up! This article is just more fodder! If the trend is renting, if home ownership is out of reach of 75% of L.A. residents for example, and observation says more and more people are doing mundane jobs for meager pay, exactly where are the future home buyers going to come from? The NAR and ‘house humpers’ need to stop spinning this as though 80% of the population have means, when in fact 80% of the population are barely hanging on paycheck to paycheck! There really is only a small percentage that can afford to buy. I wouldn’t bet the ‘farm’ on low inventory!

Houses don’t need to be bought by owner-occupiers to sell in any market if the profit from renting them is good enough. I hear about really high rents in some SoCal markets, and those markets are the ones with high prices. However, I think that the current prices are high enough to make purchase for rental purposes a rather risky proposition, except in the “Inland Empire”.

Ya; I dont think it makes sense to buy in CA as an investment property b/c the cap rates are soooo low. The only play is appreciation, which is risky.

Go to Flyover country and you’ll get wayyyyyyyyyyy more bang for your buck. Not to mention CA is not a landlord friendly state which means higher evictions costs and vacancy factors.

Exactly!!! Nice to see there are still people here that get it!

It actually adds up perfectly. It’s called limited supply. Those who are already in are holding on for dear life which leaves only a trickle of inventory for those with means who are not in your 80%. Doctor HB actually gets it and that’s why he hasn’t brought real homes of genius back. Instead he now pens articles about Millennials’ reduced purchasing power in the context of rental armageddon.

I saw a brief news clip of President Trump signing a new banking law that “removes regulation” on banks that was passes due to the 2008 crisis.

Only smaller banks and credit unions are covered under this legislation. The number of local banks fell during the Dodd-Frank era, and small state senators of both parties sponsored this bill. The big banks were mad as hell that they got none of the “action”.

The number of small banks that failed during the 2008 downturn was enormous. However, nobody went to jail. The FDIC just bailed out the account holders at our expense and the CEO’s of these banks had been making multi-millions for years with all of their bad management. Nobody went to jail. The CEO’s just walked away into the beautiful CA sunset while we all paid them.

Hey! What could go wrong again by loosening the laws? I’ve seen it all before.

It’s a semi-repeal of Dodd-Frank. And it’s about time. Next step needs to be full repeal of that monstrosity.

This really has very little to do with the rules and framework instituted by Doff-Frank. The D’s (and some R’s) will never let him repeal that legislation.

Huh? It is literally a repeal of D-F for smaller banks. Which is the right thing to do since a local bank with a couple of branches shouldn’t be subject to the same rules as Wells Fargo or Chase.

So we should predict that small banks will make irrational loans and keep these housing prices continuously going higher for at least 3 more years as was done before 2008. Property inflation is not over and will continue until a recession and that will not happen until these small banks stop making irrational loans.

This is terrific news!! Millennials will provide me with a never ending stream of rental income. Thanks y’all.

As long as the rent is so cheap compared to the cost of the underlying asset I will be happy to pay it.

Great. And in 15 years when the mortgage is paid off, I will own a home free and clear while you will own nothing and still be paying me rent. And we’re all happy!!

No I will own several million dollars in equities bought with the savings

Landlord, you will own a house in Spokane….I could buy two houses in Spokane in all cash (if they are 250k) I make over 100k, no debt, over 800 credit score and when the next crypto bull run starts I can call myself a millionaire. Buying a house in flyover country is nothing to brag about. We are talking about California where even a crap shack costs over 1mio. It’s much better to rent in California than to buy until the crash happens. Once the market in California drops by 55-75% buying makes sense again. It’s just a waiting game where buyers lose and renters win. It’s a different world here than in flyover country. You need to understand that you can’t compare Spokane to where we live. It’s like comparing TJ to San Diego or comparing a Mercedes E class to a Toyota Yaris.

Woodard, you will not

Amount if money you will save by renting vs. buying is miniscule.

Lets see:

Lets say you dont buy million dollar home.

You save 200k and maybe 1k a month in “rental parityâ€

1k advantage will dissapear in 5-7 years

Far cry from millions you are touting. 200k into several million in 15years?

Oh right. Because when housing crashes, equity markets soar, I forgot about that, LOL. Good luck with that strategy amigo.

200k plus 1k a month over 30 years at 7% (inflation adjusted equity market return) is 2.6 million. So yes it’s multiple millions.

Oh, 30years?

Lets see, your 1mil home today will be 2.6 in 30 years for sure.

Plus after 10 years or less your 1k disadvantage will dissapear.

So, you roughly in the same place (wealthwise)but with much lower living expenses

Surge,

“Lets see, your 1mil home today will be 2.6 in 30 years for sure.â€

That made me laugh out loud! Thanks surge!!

Reminds me of that condo complex not far from where I live. 2bd,2b 400k in 06, 240k in 2013 and now 350k in 2018. By 2020 we will see it at 175k (where it should be).

“Reminds me of that condo complex not far from where I live. 2bd,2b 400k in 06, 240k in 2013 and now 350k in 2018. By 2020 we will see it at 175k (where it should be).”

Holy crap, Millie is showing a glimmer of common sense. It’s not all correct, but hey, baby steps.

We finally we have a clue as to the type of area you live in. Slightly nasty yet still coastal city, so higher than inland values but not desirable either.

Your example doesn’t show the lowest point, which was more like 2008-2009. Based on the 40% drop in 2013, it would probably have been more like a 50% drop in 2009, and because of that, I’m guessing schools are terrible – coastal areas with good schools did not drop anywhere near 50%.

Given the fact that the current market is on more solid footing than the last peak, and that the long term trend is up (a low point in the cycle is almost never as low as previous lows), I can see 30% off if it dropped tomorrow or 40% off if it dropped in 2 years. Of course in 2 years it might be back to $400k or higher.

So I take it that when you looked at an actual property (gasp! A data point!) you realized that a 75% drop from $350k (to $87k) is ludicrous. Not because it’s too big of a drop, but because those condos would be snatched up long before they reached that point. That kind of drop would put inland condos at $50-75k, which a single fast food employee would qualify for, which is virtually everyone 18 or older. There simply aren’t enough properties for that to ever happen.

Anyway, so 40% off $400k is $240k. I can definitely see that happening in two years. It would be right in line with the long term trend – a $200k low followed by a $240k low.

John,

Nice! I knew you come around! Once values drop by 55-75% many will jump on the wagon saying, yeah “I expected that too†or “I agreed with Millie all alongâ€.

There are a few points I want to elaborate on.

In regards to the area, you are on track. I can’t disclosure the exact coordinates otherwise many will move here. 🙂 When I moved out from my in-laws house I wanted to have a much closer commute to the tech company I work for but most importantly I wanted it to be cheap. Otherwise moving out would not have been worth it. Looking at the people renting around me my income (I make six figures) is probably double of what some households bring in. Rents haven’t increased. My tip: rent a cheap apartment from a private landlord and be a good renter. Your landlord will be good to you, keeps your rent at the same price which lets you save a ton of money!

School district, it’s very spotty, depending on the zip code. I am not in school and have no kids so I am thinking/hoping it’s a bad school district. That keeps rents low as well.