Scorecard on housing for the last decade: Renter households up 10 million, homeowner households down 1 million.

The current homeownership rate has fallen to where it was two decades ago. The demand for home buying from traditional buyers is simply not there. Recent surveys find that the majority of Millennials would rather rent than buy. This is the group that will need to pick up the slack moving forward should the housing market return to any normal environment. But what is truly normal at this point? Over the last decade we have added 10 million renter households while actually losing 1 million owner occupied properties. The recent buying spree of 2013 and 2014 came in the form of investor demand. Real estate has become simply another speculative silo for Wall Street to speculate on. And many buy it up. Across the nation, home prices with current interest rates seem reasonable with the median priced home running close to $200,000. So why is the trend still pushing towards more people renting? Is this simply a nationwide trend or is this also impacting high cost states?

The growth of rental nation

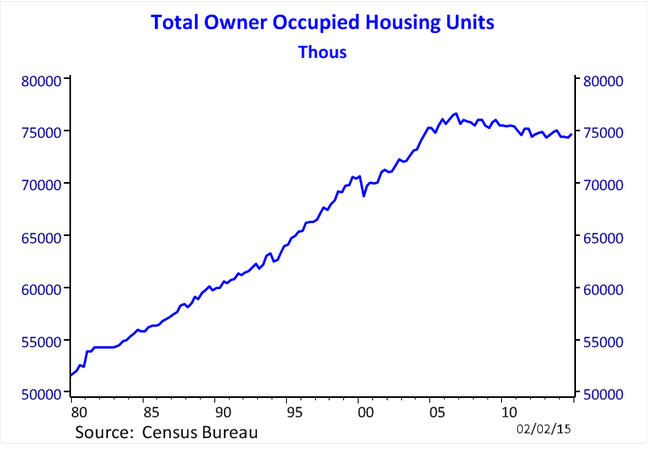

People are hardwired to look forward. History is for nostalgia and past financial events are for economics classes. It doesn’t surprise me when you look at credit repair forums and people that lost their home to foreclosure during housing bubble 1.0 are eager to jump on the bandwagon once again. Yet the habits that caused the problems back then still exist. One dirty secret that is rarely discussed is the bulk of the 7,000,000+ foreclosures came in the form of vanilla flavored 30-year fixed rate mortgages. People just leveraged too much for the income coming in. A recession was enough to tip the scales. And that is why we now have 1 million fewer homeowners than we did a decade ago:

Of course the population continues to grow but this is hardly an argument for pent up demand. You have millions of young adults living at home with parents because financially, they are unable to form new households. Many are unable to pay rent let alone take on a mortgage. Some seem angry that they missed out on buying a crap shack for $500,000 instead of $700,000. But if you are planning on staying put for 30 years you are merely trying to time the market then. You might as well time the S&P 500 which is up close to 200 percent since 2009. A much better return. Also, you will only unlock that equity when you actually sell and close on escrow which people seem to forget.

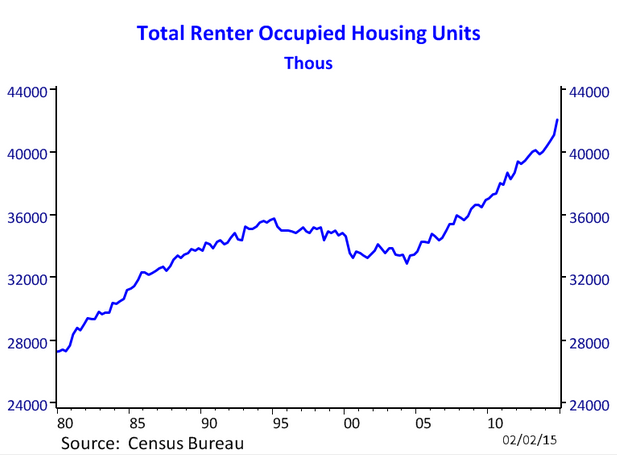

Large macro data speaks better and the trend is unmistakable. The nation has been on a massive trend to renting:

We’ve added over 10 million renter households over the last decade. Wall Street and big investors were busy buying up properties starting in 2008 up until last year turning many single family homes into rentals. This has contributed to the big drop in supply especially in areas where new building is hard to come by.

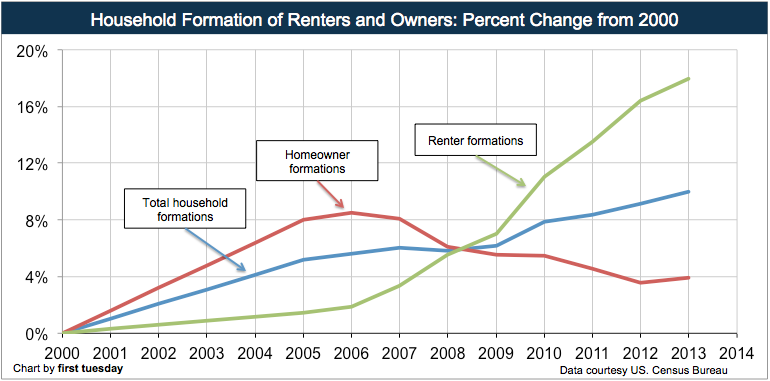

California has seen a big jump in rental households as well:

Most of the household formation since 2000 in California has come in the form of renters. 18% more households rent in California in 2015 versus 2000. Compare this to a 4% growth rate in homeowner households. And where is the big rise coming from? Single family homes being turned into rentals (this accounts for two-thirds of the growth looking at a report from Zillow).

I can see how we may see some growth nationwide but in high priced states like California it is hard to see the homeownership rate trending higher anytime soon. Net score over the last 10 years: 10 million plus renter households versus -1 million owner occupied households.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

103 Responses to “Scorecard on housing for the last decade: Renter households up 10 million, homeowner households down 1 million.”

For those wishing and hoping that the proverbial $700,000 crap shack we often refer to here comes down 20% or so to about $550,000, remember what many, including me, learned the hard way in 2012/2013: the measly 20 to 30% saved for a down payment will not be able to compete with the investors/speculators who will return in force with their ALL CASH offers once prices drop. They will be there first..the system is rigged…and, as the Doctor shows, we indeed are fast becoming a nation of renters.

Yes, that is true. If they start selling homes for bargain prices again, A Cashier’s Check will put you in the front of the line. But be prepared for commenters on this blog to accuse you of trying to catch a falling knife.

RE investors didn’t pour into the market until the Fed and government went full out to bail out the industry. If RE were to fall 20-30% despite the continuance of those extraordinary measures, what additional programs would be enacted to restore investor confidence and reflate the bubble? Wouldn’t the situation be considered too dire despite trillions worth of subsidies?

Maybe. But higher interest rates may keep them in more traditional investments.

Can you tell us what you know about future events which portends that the next dip will turn out exactly like the last? I hear what you’re saying but where you lose me is on the fact that each bottom pull-up has inputs which don’t become obvious until after the event occurs. Investor/speculator all cash buying isn’t what pulled things up in other cycles and the theory is that lack of better investment options was the cause last time around, how does anyone know there won’t be other better options by the time the next RE bottom rolls around? That’s the thing, nobody does know because the future has not yet happened. It would be one thing if you put it in terms of a theory but it’s stated as if it’s factual.

“…how does anyone know there won’t be other better options by the time the next RE bottom rolls around?”

How could there not be? This Bubble 2.0 was more fantastical than the last in that instead of relying on greater fools, which are always in indeterminable supply, the specuvestors actually sold rental backed security’s based on 10% a year rent increases! I have no doubt we’ll se another CA RE mania in my lifetime, but it’ll be a ways off from this pop we’re experiencing now. The FED’s actions of the last 7 years have done nothing but exacerbate the demographic and income shock occurring. They gave a cancer patient a shot of meth. It got him up an animated in what looked like healthy energy, but the comedown isn’t going to be pretty…

I wonder how many of the bulls bother to look at the real world of uncertainty and economic instability we are living in right now. The FEDs confidence game can no long er hold this thing together. At this point I am certain Housing is the first sacrifice on the pyre because what the Wall street crowd really can’t afford is for the S&P to have a 2007 style correction. The stock buybacks of the last several years should help company’s positions, but they DESPERATELY need elevated levels of consumer spending to keep there PE ratios from going full retard. You can’t get that without lowering Joe6P fixed RE costs which are at ridiculous ratios in pretty much every metro and at total psychosis mode in SoCal.

Nhilst,

They can keep this thing going for decades though. They already have.

NZ, I consider your point of view as optimistic. Optimistic in the sense that some degree of reason ultimately prevails. The doomsayers are assuming that nothing changes for the better.

@Realist, you make my point for me. We’ve been in this cycle since Greenspan took over the FED and to a lesser (or greater depending on your POV) extent since Nixon ending gold money. And the fundamental truth of this grand farce is… EVERY BOOM IS FOLLOWED BY A BUST.

@Siggy it has nothing to do with reason as much as self interest. if the FED keeps the monetary meth binge going much longer, the damage is irreversible. The FED’s system of control as we’ve known it would come to an end in an economic meltdown that destroys the dollar. Why would they do this? It would invalidate the Iraq War, the bailouts, everything they’ve done to preserve the dollar as reserve currency. Yet some bulls think that there more worried about the asset prices they happen to own. the FED gives fuck all about housing values. They care how those values effect the velocity of money and other factors that benefit the banks. That is the extent of their concern.

The only question anyone need ask is: Do the Fed’s member banks benefit more from a frozen RE market with high prices that is choking the consumer economy or from a reasonable correction back to 2011 values? You all know the answer…

We have lost a lot of good paying jobs that fueled bubble 1.0. Fear brought on by employment jitters and losing or watching friends lose their house the last time around. The massive high density rental projects are going to become sketchy places to live if the sfh market ever makes a comeback. An earthquake oughta do it.

My question is, if the lies have gotten us to this point, and are continuing, and have no choice but to continue, then why would they stop anytime soon? Shorting the markets for a “great wealth transfer” to the rich would be penny wise and pound foolish. I can see some greedy bastards wanting to do that, sure, but the end result would not be desirable. The newly created vagrants running rampant in the streets would ruin the beautiful cities created by these oligarchs.

Boiling frog syndrome.

The beat will continue until is breaks. There is no other choice. And as much as people supposedly complain, as supposedly low a standard of living there is in L.A. from “renting”, it too is going on. People want to be in a city with nice weather and a ton to do. I’ll give it to some of the anti-Cali’s here, ok sure there may be other cities similar. But not the whole enchilada like SoCal, and that’s why so many people rent and so many rich people buy.

Or its all just prop 13.

It is not Prop. 13. I moved from a lifetime in California to Florida and found that they have similar–if not better–protections here. My property tax bill went up $8 between 2013 and 2014.

A lot of it is an attitudinal difference. In California, you walk into the market expecting to pay 10x your median income for a home or receive a 3% cap ex. rate of return. Here, in a very popular destination, people would think that’s a very unwise purchase/investment and would pass. Are the single family homes on the water comparable in price to Malibu? Of course, but the Torrance-like properties that are a mile inland cost 1/3 as much. Gotta re-train all of So. Cal. on living within your means.

No way man, I’ve got to keep telling everyone that Cali is the best place on earth because my highly leveraged mortgage in the wasteland empire depends on it! Florida and everywhere else are the worst places and Cali will always bring you massive riches because this craptastic commute I deal with every week has to be worth it! I have to prove how much I’ve made it to the fam and friends back in Saint Louie!

It’s a known fact that it’s tough to live here but you have to push yourself 110%, and make it all worthwhile. It’s not easy but it pays off in the end. Big fat retirement kitty and all.

Who could blame them since it’s a much better deal to rent for tons of people. No one wants to commute out to the wasteland impire so they find it’s cheaper to rent near the jobs.

The two endgames we hear monetary doomsdayers talk about are 1) a deflationary bust and 2) an inflationary crack-up boom. The third option is to pretend the debt does not exist, but creating perpetual bonds, a term that has recently made headlines thanks to Varoufakis. Instead of defaulting or paying something back with deflated currency, we simply pretend it’s not there. This is the path we’re on, and it may be sustainable for a ridiculously long period of time.

As the 1% accumulate massive wealth, those assets act a lot like perpetual assets that are never traded or exchanged with real goods. As long as the rich are buying Manhattan condos, abstract art, and S&P futures, it doesn’t compete with the goods and services of the economy for the 99%, so we can just pretend it’s not there.

It’s only natural that the rich will gradually buy up the assets of the poor. The surprising thing is actually how slowly this shift is taking place (although if you’re making payments on your house and car, you are really paying rent to the rich). The smart thing for the poor to do would not be to demand livable wages, but a 95% pay reduction for the upper management. It is so important, they should be saying, “You know what? we are willing to take a 5% pay cut ourselves in return for a 95% pay cut for the CEO.” Longer term, this will make the poor much richer because right now we are probably sowing the seeds for a massive asset grab in the future.

I still get letters in the mail from investors who want to buy one of my houses, all cash. For 2 weeks, it looked like (Las Vegas) active inventory was going up again. Now, with a massive jump in contingent listings, active listings with no offer are resuming their downtrend, which has been in place for a couple of months. Of course, permabear Mark Hanson, in his latest post from January 26th, is predicting that lower prices are just around the corner (http://mhanson.com/archives/1751). Las Vegas, according to him, is the leading indicator to watch. He is probably right with regard to speculator interest. We have meetup groups with close to 100 attendees, all eager to get rich with housing.

Compare historical real estate sales volumes with household incomes and you will find striking similarities, they both have fallen to levels last seen in the mid-1990’s. This probably accounts for decreases in total home ownership! It may also be more than coincidence that the nations GDP hasn’t been able to muster a robust 6% – 7% number since around 2002. This should all raise questions about the risks associated with paying $700k for a shack or the sustainability of sky high prices in certain locales!

My wife and I are millenials with BA and MA degrees both working in great careers. But our paycheck doesn’t seem to support the current average mortgage payment, at least not realistically. This is why we’ve been renting. Now with a new addition to the family we are entertaining the thought of moving back with the folks! And if prices in California continue on this trajectory, we may even relocate to another state where we can own a home and raise a family without renting or lodging with parents.

My gut is telling me wait it out for a couple years, then interest rates will go up and house prices go down.

@eman: You know what they say about trusting your gut. That’s exactly what will happen. It ALWAYS does over a long enough curve, it’s a giant pendulum of credit availability, interest rates, and prices

We are doing the same. I wish we bought in 2012, but we couldn’t compete with the all cash offers.

We are in the same boat, although we do not live in CA. My husband and I both have professional degrees and I guess we could stretch ourselves to the limit and buy now, but something in my *tiny brain* can’t make sense of how we’ll feed ourselves, our future child (on the way! 🙂 and still save for college, retirement, etc…We have relatively low student debt and no other debt, no car loans (both cars are at least 12 years old…) still, I just can’t make the math work!

So…we might live with my parents for 8 months and save, save save…until we can come up with the money we need to buy what we want. YES rates will rise; YES prices will come back to earth and I believe that delaying gratification in the meantime might be the answer.

Since I am priced out of the RE market, I am pitting my savings in the stock market. The banks Interest rate is just not enough to save for house

Boy, you come on over to the great state of Texas if you want to own a home and raise a traditional family like you dream of . We are down right friendly folk and will invite you over for a BBQ(providing you are not one of those New Age Vegan types). Texas is a beef state not a tofu state. I make a powerful chili. I raise free range, grass fed, organic cattle.

You crack me up Tex! You stay up on those crazy ways! Let me keep it 100 though…

California is far more desirable, better weather, better food (there are a lot of BBQ places around Crenshaw and in the South Bay), better entertainment and a laid back style that is copied (attempted) by the inland states. Why do you think all the movies and music come from here? Does anything come from Texas? I thought it was mostly Cali-expats that require a more meager cost of living structure?

Texas has been top of my “to move to” list. And I definitely enjoy me some good BBQ!

Thanks for the invite 🙂 I’m not a vegan, due to my undying love of BBQ and bacon and all things smothered in cheese. 😉 My entire family lives in Colorado and I desperately want to live close to them, especially now that we’ll have a little one. But it is becoming harder and harder to justify the cost of living relative to the quality of life here. I guess I should stop complaining, but I do go back and forth about moving to a more affordable state.

Hey Tex,

In case you forgot, this is a SoCal housing blog. If we wanted to date our sisters, eat beef at every meal and listen to a bunch of redneck nonsense 24/7 we’d already BE in Texas. Now why don’t you mosey along, and don’t hit your head on that gun rack.

@Big Tex, once you get outside of the bubble real estate areas of the Bay Area, Los Angeles, Orange County and San Diego, much of California real estate is priced in line with what you have in Texas or the rest of the United States.

I was looking at crap shacks in California’s San Joaquin Valley a few weeks ago and there were sh#tloads of them in the $75K to $125K range. For the price of a down payment on a 1 bedroom 600 square foot condo in LA metro, I can buy a SFR with a yard in the SJV paid in full, no mortgage.

Californians do not need to look to Texas if they are house horny for a SFR with a yard.

Yes, there are a lot of crap shacks in the $75K to $125K range once you go further inland in California’s Central Valley and in the Inland Empire. It’s like living in Tijuana. The houses are in the barrios, the crime is bad, gangs are out of control, and you need to speak español bueno.

I dont think prices will go down, or at least nothing significant. You will find a good deal every now and then. ie distressed. Even if rates went to 6%, you’d have less buyers. But owners with skin in the game can be stubborn. Nobody wants to take a loss on their money if they can avoid it, so they wait. That’s why I would keep on eye out on distressed sales and hit up the listing agent directly, they would be more inclined to talk to you if they know they can double their commission.

Having to wait without being able to move sucks, hope that doesn’t happen to me when I’m ready to sell.

If you want to live inland (empire), you might get a price drop with a rise in interest rates, but it may not happen if you’re looking at houses on the coast. There’s nothing wrong with renting/saving while raising a family. My wife and I raised our two kids in a 730 sq. ft rental (2005-2014) and waited for the crash, but it never happened at the beach. My point is that if you have the stable jobs and the DP, you might want to buy now so that you can pay down a good chunk of the mortgage. When I bought last year, I was 43. The mortgage was for 30 years! We just refinanced to a 15 year note, so the payments are bigger. It makes me think that buying right when you start a family is a good idea because you can get 10 years of payments under your belt at a time in your life when you’re pretty tied down anyway. Once we started a family, all the international travel stopped. I’d guess that’s how it is for most folks.

“If you want to live inland (empire), you might get a price drop with a rise in interest rates, but it may not happen if you’re looking at houses on the coast”. “My wife and I raised our two kids in a 730 sq. ft rental (2005-2014) and waited for the crash, but it never happened at the beach”.

Housing values never crashed at the beach, Brazil66? You might want to check out this article from the Doc’s archives…

http://www.doctorhousingbubble.com/seal-beach-home-from-a-price-listing-of-2900000-to-selling-for-900000-chasing-the-housing-market-down/

Looking at the graph, the home ownership percentage went up in 2003 when lenders rolled out the Liar loans (Stated Income, No Income, etc). Once those loans went away in 2007-2008, the trend headed back to where it would be if people have to qualify, so big deal.

The fact of the matter is, with so many people living in (or wanting to) CA, there are plenty of people that could afford homes at 2011/12 price levels. Heck, even the Hedge Funds thought there were great values out there, so prices went right back up to where they are today.

Look at any developed country and RE prices are up there. From my travels, prices in the non coastal USA are still some of the worlds best deals. So ya, everybody can not afford Coastal CA, deal with it and move inland.

I keep trying to get my kids to move from coastal San Diego up to Temecula, but they just do not want to own a home that bad. So ok, rent until I kick the bucket.

I read plenty of articles that the economy is going to sh!t the bed anytime and prices will come back down. We will see, as last time the buyer were doing 100% financing that made it easy to walk away, which made the prices go down (duh).

The last 7 years I have mostly done loans with 20%+ down, so I don’t think those people will walk away.

It would take huge job losses to make RE tank in my opinion.

@ Jim I agree, a job-loss recession is perhaps the only thing that will causing housing to crash. I am not saying that wont happen, but only that all the other factors QE, boomers retiring, low wage growth will not be major causes.

You speak the truth. Historically real estate values dont move like that. Only well qualified buyers, most with skin in the game, own ever since the meltdown. Nothing besides massive job losses will the market down like that again in so. cal.

All of the jobs want to be in SoCal now so no need to worry about there ever being job losses again. It’s true because the Fed will manipulate things forever.

Calamity Jane and Zero Interest Rate Policy

Hi Doc – your numbers correlate with other figures posted today

https://confoundedinterest.wordpress.com/2015/02/05/has-the-feds-policies-helped-homeownership-in-the-usa-homeowner-occupancy-continues-to-fall/

“Janet Yellen and The Federal Reserve (sounds like Linda Ronstadt and the Stone Canyon Band) have been doing zero interest rate policies (ZIRP) since 2008. While their cheap money strategy has certainly helped the stock market, it has been less than successful in the housing market.

In fact, since Q2 2008, the number of owner-occupied housing units has DECLINED by -1,345,000 while the number of renter-occupied units has INCREASED by +6,391,000….”

12 central banks have cut rates this year:

http://money.cnn.com/2015/02/05/investing/rate-cuts-central-banks/index.html

As I’ve said before, much as I want them to, I don’t see how the Fed is going to raise rates. My guess is that they’ll raise them a token .25% every six months for a year or two. Then they’ll have to go back to ZIRP again. All else being equal of course…

Silicon Valley young adults are bunking with mom and dad:

http://www.marketwatch.com/story/silicon-valley-young-adults-are-bunking-with-mom-and-dad-2015-02-04

“In the 18- to 34 year-old segment, 32.4% lived with one or both parents from 2009 to 2013, according to a yearly report conducted by think tank Joint Venture Silicon Valley. A full 25% of the population in the area is under 18 years old, and 28% are aged 20 to 39.”

Zombie foreclosures are picking up:

http://money.cnn.com/2015/02/06/real_estate/zombie-foreclosure/index.html

A bit light on data, but CA is mentioned.

Hello I am a new member as of today. I’m in my 70s, separated, a renter, high income last year, and high credit score, with a couple hundred thousand dollars for down payment and I’m being forced out of my rental cause the owner of the house I rent rooms is selling the house. I love Chino Hills but prices in Chino Hills are high and trending higher. My question is should I buy a house at today’s prices in Chino Hills?

You want a mortgage at your age?

This may be off topic, but is just about owning a house versus renting a house.

What’s different now from the past regarding owning a house versus renting?

I bought my first house in 1968 for $15,000 in Bell Gardens. Sold in 1973 for $22,000 and traded up with the $7000 gain into a great family house and area on the island in Downey California for $32,000. Sold Downey in 78′ for $62,000 into not so great area of La Habra for $73,000. Stayed there 12 years until sold in 1990 for $215,000 into a big view home in great neighborhood of Chino Hills for $330,000. X is still in that home. That home dropped in value in the 90’s to $230,000 went up to $800,000 then down to maybe $400’s in 2008 and now is back to $700,000.

ONE FACT ABOUT ME IS THAT I COULD NEVER SAVE MONEY FROM MY INCOME AND THE ONLY WAY I EVER MADE ANY MONEY WAS FROM OWNING A HOUSE. Yeah i know i never saw the money just went into another house.

Just seemed like owning a house was the right thing to do because it was great for the family and was the only way to get “ahead” and always seemed to make us a lot of money.

Bought a rental house 1978 in Whittier for $43,000. Still own it maybe worth $400,000. I had no savings so when i had a chance to buy a large investment property in 1991 was able to use $30,000 refinance money from Whittier rental to buy that property. Best thing I ever did as it allowed me to retire in 1997 from real work and has supported us right up to the present.

After reading a lot of comments here and other gurus it seems like now is not the time to buy a house for me. It appears the Chino Hills values may go up a little bit this year but the warning is that the bubble is going to pop and the drop in value will be even a bigger drop than in 2008. Do I do I care if there’s a big drop in value? Never bothered me before I just figured out I just keep living in the house and enjoy the house and then I would sell and move to another house but that’s different now. Im alone and the owner of the house i rent is selling. Because I rent I don’t have the choice to stay and it seems so traumatic to have to move. I guess as I get older it’s hard to make sudden moves.

So what do I do? haha I don’t know. The owner has not given me a 30 day notice to move so I’m just sitting here in limbo. I don’t want to get tied up into a lease with another owner but maybe that’s all I have. The owner did say in January I could stay at the house if it did not sell but now is telling me the realtors want me to move because I’m a distraction to the sale. But here i sit. Thanks for any comments or suggestions.

Mike, you need a woman to tell you what to do(they always seem to know). There is nothing like a strong Texas pistol packing mama. She will tell you what to do. Otherwise, it is the three friends, Johnnie Walker, Jim Beam, and Jack Daniels.

If I was you(which I am not), I would leave those Chino Hills, and move to the strand at Newport Beach or Venice Beach and party with the college kids(bring plenty of beer, they like beer).

@ Mike Barlow-

“after reading a lot of comments here and other gurus it seems like now is not the time to buy a house for me”

There are no “gurus” here Mike. Do your research. Trust your own numbers and make your own decision. You have more RE experience than most on this board.

The majority here will tell you not to buy just like they were saying in 2011-2012. Don’t catch a falling knife, they say. HA! People who took that advice are now kicking themselves in the ass. Yet the same people are holding off, waiting for that price drop. In the meantime they get older and keep paying that rent.

Chino Hills is a great area. The Asians are going to keep coming. Rates are not going up. 30 fixed conventional is 3.75 today. FHA is 3.25. YoY pricing is up over 6% in CHH/DB zip codes. Sales volume in the same markets is trending up so far this year as well.

Mike – couldn’t you move into your Whittier rental?

CAB,

The chinese are close to done with the hot money and ill gotten money moves to offshore real estate…Japan did this too and paid dearly…

Chino hills is not nice, where are you from, growing up in L.A. in the 70’s was nice, 80’s too and a bit of the 90’s, since then it’s a virtual merry go round of ups and downs. Anywhere on the other side of the 5 is onerous living in So Cal, without water everyone there is on borrowed time. Born and raised there, I can tell you owning now is just a big mirage of beggar thy neighbor’s wife, car and life…so boring, east texas might be just as fun and you can do it without the traffic.

Keep on spouting hopium, Chinese buyers sell homes too, Chino Hills is like living in Tijuana hills with better water, though Tijuana has much less smog and a nearby ocean..

Keep selling the dream, the dream will end like all others do….reality is a bee with an itch….the whole runup has been orchrestrated to slight perfection, the run down will not be as smooth

mike – if i were you and i really wanted to live in chino hills i would sell the whittier house and use the proceeds as a downpayment on my dream home …….. oh the problems of a millionaire

I wouldn’t buy. But they are your money and if do, you lose.

The FED can make money available to banks for lending but if people don’t borrow because they afraid, or can not borrow because of their credit, the FED is “pushing on a string”. Without borrowing you can not increase the credit money supply which is the main one. Even if the credit money supply does not decrease (by paying off debt or bankruptcy), it is still bad – how do you pay the interest on the existing debt???!!!! Maybe “Realist” can answer that question. I know that NetZero can not answer that question. “Realist” on the other hand can come up with explanations which “don’t hold water”.

Remember, the FED does not have an actual printing press like some people imagine. Every SINGLE dollar in the world is created through debt; part of it is actually printed in cash by Treasury with no real impact. Also, remember that the interest to be paid is never created – that is the tool to transfer wealth from sheeple to the 1% of the 1% (the money creators/money changers). With all so called “money printing” in the last 6 years, the credit money supply is still 20 TRILLIONS less than before 2008 (that is a fact easily to be checked). You don’t have to believe it – the main street feels it. If you ignore the bogus unemployment numbers and the part time minimum wage jobs, more than half of the workforce (people between 18 and 65 able to work) does not have work.

The trillion dollar question for any politician (and I don’t claim to have an answer) is: how do you increase the number of full time middle wage jobs in a global economy when the US workers have to pay high rents and compete on wage with indian and chinese workers??!!!….and all the workers from low cost countries? Yes, some very high skilled workers can do that (in Sillicon Valley), but overall, what is happening for the average Joe middle class? It is also true that the very rich benefit from globalization and they get richer and we see that, but what about the middle class? Chino is middle class; it is not Beverly Hills or Bell Air or Santa Monica.

If you remember all this and want to buy, it is fine with me – they are your money.

“Even if the credit money supply does not decrease (by paying off debt or bankruptcy), it is still bad – how do you pay the interest on the existing debt???!!!!”

Well the answer is easy, you pay off the interest on existing debt by taking on more debt! It’s the American Way 🙂

Of course the velocity of money in our economy is asynchronous among its many participants. So as some party’s debts are paid down, others increase, This is how the FED has created a fake economy of rent seekers looking for the greater fools. Reversion to the mean is inevitable. Now that doesn’t mean RE everywhere drops 33%. I’m quite sure that Prime SoCal locations will adjust moderately for what will be higher mortgage rates and a decrease in International Oligarch Money Launderers. However the suburbs and inland areas that the specuvestors have bid up are due for a substantial haircut.

I’m no financial adviser, but it seems like tying up your savings as a down payment when you still would need a Mortgage in your 70’s is ill advised. You will lose access to that money at a time of life when liquidity is a godsend. Since you are a Senior, have you considered something like Laguna Woods (formerly Leisure World South) or Leisure World in Seal Beach? They are under-priced when compared to similar priced properties in SoCal and you might be able to buy something for cash (no mortgage) but you would still lose access to your savings!

If its trending, then its trending for a reason. But I’d advise to rent at 70 yo, unless you are nice and leaving it as an inheritance. But otherwise mathematically it would only make sense to buy if you plan on living to 100 or more.

Mike, you obviously have experienced the value of owning and renting real estate. It sounds like at this stage in your life you’re more interested in maintaining a quality of life jn Chino Hills. You’re right, chino is an awesome place to live. I would suggest buying only if you put enough money down to make the payment something you are comfortable with. You’re buying at the top of the market but i guess it doesnt matter if you dont plan to sell. Unless there are massive job losses, values will stay even if rates go up. Just less buyers to compete with the occasional distressed listings. Owners would rather stay in their home rather than take a loss of their 20%+ equity. Chino is one of the better areas too. Location, location, location.

Yo Donna it’s not really equity if there’s going to be a loss.

How many of the investors that turned single family homes into rentals hire all of their maintenance and repairs (If they do maintain their properties)? Single family rentals don’t provide a good return on investment in most of coastal California; @ least when I run the numbers. I’m thinking some of these investors will sell if appreciation turns into depreciation, which is probably happening in many areas.

When you run your numbers, plug in 0% as the interest rate on the loan. Those connected bastards on wall st get their money from the Fed for nothing…

Those investment businesses are repackaging their equity and reselling it on top of that. I’m not smart enough to figure out the math behind all of their machinations, but I’m pretty sure they’re making money for themselves.

Dennis, you make your money when you buy. At todays prices for investors with a lender req. of >20% down you’re right, the numbers dont cash flow. But if you put 40%+ down….then the argument comes, did you invest all your cash effectively. Invest in what you know.

Blowing my mind Donna! I keep telling them that you make money when you buy and sell for less later on. Gotta be 100.

“Some seem angry that they missed out on buying a crap shack for $500,000 instead of $700,000. But if you are planning on staying put for 30 years you are merely trying to time the market then.”

If you missed out on buying at $500,000 instead of $700,000 you aren’t just trying to time the market, you might not be able to afford the $700,000 mortgage.

I see no particular problem with renting. I am fine to rent for the rest of my life as long as rents remain reasonable. The problem is not renting vs owning, the problem is that housing in us is unaffordable.

Premium cities are high but most of the US is very affordable, and 1st class society. Out door plumbing is a fun we call camping I.e. roughing it!

Renting from landlords is for losers! You should become a Midwest transplanted wasteland empire commuter poser like me and rent from the bank. Then you get all of your friends and family to be jealous.

You sound like Midwest transplanted troll now…

Funny 😉 Complete with the shitty sales job (fingers crossed for your year end bonus) and your leased luxury car, and your interest only mortgage. You are a S. Cal winner!

I’m in my late 40’s and I truly feel sorry for the Millennials. Not only is the average student loan burden far higher in inflation-adjusted terms than for my generation, you also have much higher sales tax, Social Security and Medicare deductions, and here in California, the impact of Prop 13 means that the younger generations pay far more of their share than the older generations. Don’t forget the impact of a number of little fees/taxes that didn’t exist 30 years ago: $0.05 per beverage container, $0.10 for a grocery bag, and hazardous material fees for all sorts of stuff, such as tires, electronics, car batteries, etc. It’s all just a greedy money grab! Some may lampoon this detailed accounting, but the reality is that this is a death by a thousand cuts. It’s clear: the solution is to shrink the size of government.

But the problem is, we’re too addicted and dependent, now the only option is more Government.

It’s clear that shrinking the size of government is the answer? All these fees and little taxes are the result of profound cuts in taxes on the wealthy. Not only cuts but trade agreements which allow US corporations to park profits offshore. 15% on capital gains benefits the wealthy as well. The boomers benefitted from a world in which the tax base allowed the country to invest in continuous infrastructure projects, education & pensions. That created social stability and true opportunity (not just flipping houses or whatever other get rich scheme is currently on the market). Taxing the wealth created by extracting the resources of this country and utilizing it’s vast labor pool enabled a more fair distribution of that wealth. Federal, state & local authorities didn’t need to mickey mouse the working class to death with fees. In other words, it’s less government that has put the millenials in the predicament they find themselves in.

Well you can believe all that sillyness if you want but to say Prop 13 killed the educational system or our shrinking government is killing chances for Millenials but this totally belies the facts. Our government is larger than at any time since the middle of World War II. When you say the wealthy are paying less you forget that the actual marginal rate is lower but a lot of write-offs went away and the AMT showed up. What is a fair tax rate in your mind?

Remember when the Income Tax first showed up at the turn of the last century it was billed as something not to worry about because it only affects the wealthiest and only for a few percentage points. What has that led to?

You complain about money leaving the country but that’s simply people and businesses voting with their feet. Our tax rate on companies is the very highest in the world. So business leaves. What do you expect? Increasing taxes does not increase government revenue any more than Vizio doubling the price of TV sets is going to double their profits. People rationally decide to buy less of something when prices go up. Haven’t we all pretty much conceded that on house prices and values? The exact same laws apply to other business activities and taxes. Ask yourself why we are still in a low growth doldrum. It has become much more expensive to run a business. Just put an incredibly high tax rate on those starting, running and owning businesses and then watch in wonder as no one wants to do it anymore. It doesn’t pay and they get villified. Read the Doctor’s old posts on why California real estate is in the high priced ditch that it’s in. It’s land use policies and other government controls that make it near impossible to find and develop land and build houses.

Fensterlips, yeah the government is larger because we spend more on the military & homeland security than all of the other nations on the planet combined. It’s the military industrial complex (and now the prison industrial complex). I clearly stated that the 15% tax rate on capital gains need to be eliminated and that capital gains be taxed as ordinary income. I also stated that the US needs to tax WEALTH; not necessarily corporations or individuals starting businesses. Prop 13 has destroyed public education in the State of California. It’s also a vehicle to punish younger buyers who pay exorbitant sums in taxes while older folks get to sit on their properties further fueling price increases. As for offshoring profits; corporations may have the highest rates but the largest corporations offshore profits (where tax rates do not exist or are very low) while taking losses in the States. It’s another example of trade agreements that work against America and another example of Government & Wealth holding hands and writing the tax code to their enormous advantage. It’s all in line with the Corporate takeover of American Government. I really don’t see anything silly about it. Government has been co-opted by big business (i.e. wealth); the Judicial, Executive & Legislative lock stock & barrel.

BTW, I totally agree with you on proposition 13; I remember when it was being voted on that one of the predictions was that it would destroy public education in California. It did.

Premium education for a premium state. Don’t know why you won’t keep it 100.

Or move. There is life outside of So. Cal. where high taxes/big government isn’t tolerated, and it doesn’t mean that you’re living on a desolate plain watching the tornados rolling by. Move to a state with no income tax, for starters. Then find a fiscally conservative community from there. The problem is that Californians are brainwashed by other Californians into thinking that they have some exclusive slice of heaven, so they will never even consider moving out of state. From here, outside the bubble, the only ones who would ever think of moving to California are college-bound kids who have watched too many re-runs of CHiPs. Most parents here campaign to impart the foolishness of that choice.

There is no life outside of SoCal and all of my friends and family back in MO are totally jealous of my amazing life. I just don’t tell them that I visit the housing bubble blogs.

I’m sorry but everyone I talk too loves Cali, and will never leave. College students that don’t want to school elsewhere, people that transferred here from other states and say they will never go back, locals that love the fame of their city, you name it. There is life outside of Cali, but it frankly, sucks. The people here are beautiful, the state is beautiful, the weather is awesome, and there is always something to do or some good food to eat. Most people in other states dream of living here.

Good observation KR!…

WA state does not have income tax (zero). The east part of the state is as red as TX. The Olympia politicians are VERY afraid of extremes because they lose power really fast. WA is half red and half blue – no room for extremes…….and there are no tornados. It has wet climate and dry climate with very moderate temperatures. It has something for everyone.

All these “little fees/taxes” you call a greedy money grab are mostly to handle the strain on infrastructure caused by an ever-expanding population. Like the plastic bag tax; necessary to incentivize people to stop contributing to the enormous plastic trash problem. The problem may partly be “Big Gummint” but overwhelmingly it’s too many people, not enough resources.

Yeah, I completely agree on the student loan thing. It’s gotten out of hand, tenured professors making 150K at a non-ivy league university. Then the administrators telling h.s. students, if you dont go to my college you wont make any real money. It’s true though, statistics show the college grads on avg make a lot more than no degree. But you dont have to hold the degree hostage with a high tuition. C’mon now, $150K for a university professor! A brain surgeon or rocket scientist yeah, but to just teach a class.

Gotta pay to play and pay the premium prices for the premium education. We have the finest professors in the world and if it’s trending then you go with it. Community college is for the loser class.

Professors making $150k a year? What are you talking about? Maybe at UC Berkeley or Stanford and then only if you’ve been in the system for a bit or are a world renowned publisher or researcher. My wife is a full professor in the Cal State system; has been for 12 years and makes 85k. There have been no raises for 5 years (except for administrators). She worked her A$$ off to get her PhD and is utilizing her skills and aptitudes to try and help young people in their lives. Meanwhile corporate shrills are making millions creating shell companies so that billionaires can find safe cover for unethical, immoral dealings. It’s administrators that increasing in numbers and making money hand over fist. If your anger is directed at education, that’s where the significant problem is.

Markin, Cal State is an incredibly average school system. They are not talking about them making $150k.

Everybody just read this:

http://www.jamesaltucher.com/2011/03/why-i-am-never-going-to-own-a-home-again/

You have to own a home so you can tell everyone you made it. That especially goes for Cali because owning a home here is worth it at any price. The horrible air quality and commutes are worth it alone!

I wouldn’t say that it wasn’t known until after the events, I wrote about it myself back as early as 2009. I called it the great transfer of wealth. The whole housing bubble and burst was created so the banks could make money on the notes whether the loan was ever paid back or not or whether the homes that backed the underlying value of the note was in actuality worth far less, and then they came after the houses like vultures scavenging the bones.

For those readers who aren’t familiar with Bernanke’s famous statement that we have a technology called the printing press, you can find the original version here: http://www.federalreserve.gov/boarddocs/Speeches/2002/20021121/default.htm

Flyover claims that credit money supply is 20 trillion less than in 2008. He further claims that this fact is easily checked.

I tried finding any chart from any source to confirm that any measure of money supply is lower today than in 2008. The charts that show the lowest growth are at http://www.centerforfinancialstability.org/amfm_data.php?startc=1967&startt=2005

But even these charts show that Divisia M4, M4-, and M3 peaked in 2008 at 1295, 1195, and 1138, respectively. Today, they stand at 1353, 1288, and 1279, respectively.

I’d be very interested in seeing a data source that shows a decrease in money supply since 2008.

I dunno about all that bro, I simply follow anything from MiSH and go from there. No thinking required on my part. That way I get to spend all of my time enjoying the most amazing weather and city in the world all from the comfort of my computer. Fortunately we have good central a/c for the days when it gets hot like Vegas. You should come out and landlord in the IE, it’s way better than Vegas because then you’re in Cali with bad commutes and lame vanpools.

You Amuse me . You being a Midwest transplant explains your constant cheerleading to make yourself feel better about your life especially the commute

I’ve been thinking that the best advice for not knowing if it’s worth it to buy a house is if you’re drunk, keep drinking and it will pay off in the end. That’s trending and just being 100.

Loving the new What?

Vegas L,

Can Bernake provide a picture of his printing press? Did you ever see one? I am telling you the FED does not have any printing press – it is just a figure of speech. The FED does not “PRINT” money the way you understand it. It is true that the FED is the agent responsible for increasing or decreasing the money supply. The actual “PRINTING” is done by the Treasury.

In regard to the decrease in the credit money supply, I read an article. I’ll search when have time and post it for you. It did not take into account the mountain of derivatives.

I agree, nowadays 95% o cash in circulation is nothing more but the numbers on the computers. When someone say “prints” they mean issuing debt. I hope, I made it clear for you. If issuing debt is “cheap”, it is become readily available and the currency supply (aka debt) increases, which causes price inflation…

Bernanke’s printing press can be seen in action on the Wall Street Journal’s website in “The Federator”: http://projects.wsj.com/games/thefederator/

To everyone out there who is confused about money and whether or not we’re really printing it, make no mistake about it. The educational system intentionally deceives students to believe that when you borrow money from the bank, it’s the same as borrowing money from a friend. The key technique is to distract you with irrelevant information so you end up thinking that you are not smart enough to understand and you never think of asking the right questions. They’ll explain inflation through cost-push inflation and demand-pull inflation until you are too bored to question it any further. It is okay to trust your intuition. The only way that a house that sold for $30,000 in 1960 is now worth over a million is because of massive money printing, or as Bernanke himself put it in the speech I linked to earlier “its electronic equivalent”.

Interesting fact. My wife is a bookkeeper at an apartment management company. The company owns apartment complexes as well as some SFHs. They also mange “other pleoples” properties. So, the owner, who is not a poor guy, doesn’t own. I mean for a living, he rents an apartment with with wife and child. His company owns a bunch of rental properties, but he rents a luxury apartment in DT Bellevue (not one oh his own). So, obviously, some people know something that others don’t …

Yes, the guy is smart to have the “company” own everything to avoid personal liability but he still rakes in all the profits since he owns the company.

I make 80k a year in Ventura county and can not afford to buy even a old cap house in the ghetto where my kids would get shot. Something is wrong when the average household income in a city is 35k a year and the average home price is 380k. That’s a 2500 a month payment someone on 35k a year can not afford as well as me making 80k a year.

That the fed is printing hopium is what posters haven’t figured out here…

The fed, treasury and govt. maintain order by keeping consumer confidence in all markets via posturing, printing and moving pawns….

The problem is most people are easily led, sheeple whom follow flocks, their are few Muir’s, Burke’s and Monroe’s in the population non….as long as they get the govt. hand out and keep the oligarchists in power…they lose…

You should check out the wasteland empire and see how amazing the commuting lifestyle can be. Your 80 grand would go further.

I am a boomer (54) I am currently renting. Yes it is a decision. Perhaps I should have bought and squatted. Sorry that’s not in my DNA. I sold in 2008 and have rented since. I know folks that have been going on six years not paying their mortgage. There is going to be pain coming. I have taught me children to avoid debt. I don’t know the future but for us in the working class, it is not bright.

Home Prices could easily double from here along with the stock market. yup.

right now there is a global search for yield and accommodative central banks lowering interest rates.. QE is still going on in Japan, China and now the ECB. that money needs to go somewhere. it will go into real estate and stocks. with German 10 year bonds yielding less than .4% real estate even with a cap rate of 3% looks mighty attractive. SP500 yield is currently about 2%.

bottom line there is too much money chasing yield right now and governments continue the race to the bottom with their own versions of QE. Real Estate and Stocks will continue to go up.

You know, maybe there will be a lot of pain in the future, but here’s the thing. #1, the run ups will continue for years, maybe decades, because people will do ANYTHING not to feel pain. This generation is not conditioned to feel pain. #2, when it does happen, no one on this board will be able to escape it. So just go with it.

Just going with it means telling everyone to just go with it, because that’s trending and 100.

Read this article on curbed today:

http://la.curbed.com/archives/2015/02/los_angeles_rents_wages_lag.php

Leave a Reply to The Observer