Rental Nation: US Home ownership rate continues to decline to multi-decade lows while rental vacancies continue to decline. Record prices in a few areas.

This week we had two interesting headlines converge. One had to do with home prices continuing to move up. In fact, four markets hit new record levels. These were mostly in Texas; Houston, Austin, Dallas, and Denver. Given the lower prices of Texas, this isn’t really a shock especially combining this with the record low mortgage rates courtesy of the Fed. At the same time, we find out that the home ownership rate continues to fall reaching a multi-decade low while rental vacancies slowly decline. All of this of course makes sense given a supply constrained market and a massive amount of investor buying over the last few years adding rental properties to the market (taking off market potential single-family homes for actual purchase). What is troubling about the data is the difficulty for first-time buyers to enter into this odd market. Having a larger share of our market as renters might make sense given economic constraints of household incomes yet it should be abundantly clear who the big winners were from all the Quantitative Easing that has occurred. Welcome to rental nation.

Home ownership rate and rental vacancies

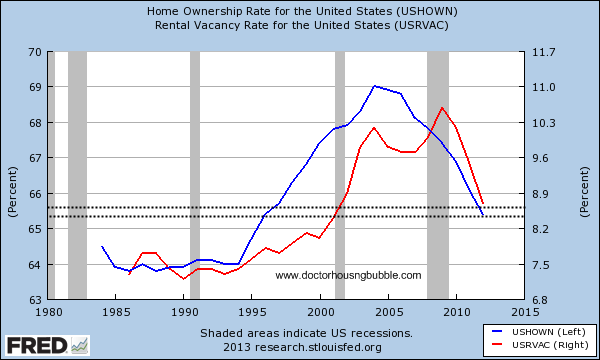

This chart should give you a good sense as to what is happening in this housing recovery:

The home ownership rate is now down to 65.1 percent taking us back into the past of two decades ago (prior to any of the toxic mortgage shenanigans). Los Angeles is virtually half renters and half home owners. At the same time, the rental vacancy rate is also falling dramatically as more households become renters. After all, when you foreclose on 5,000,000 households the needs of shelter still exist.

In housing unlike many other investment vehicles, the options are rather simple. You either rent or buy. Given the current market, many are renting either by choice or necessity. In a place like California, many are simply being priced out by investors, flippers, or foreign money. The all-cash crowd is hard to compete with and this year we have seen a record amount of cash buying in California.

For one, many people that “owned†a home during the last decade had no business buying just like banks have no business making the loans. Even today, the home ownership rate would be a few percentage points lower if we inputted all the negative equity households. If you are underwater you do not “own†your home. Try selling it right now and see how much money you will get for it.

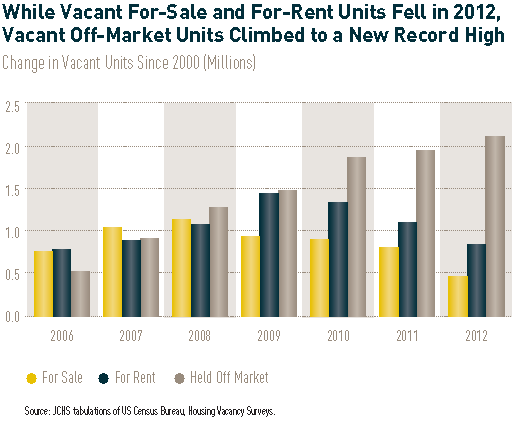

You would think that somehow with such a low amount of inventory that supply is nowhere to be found:

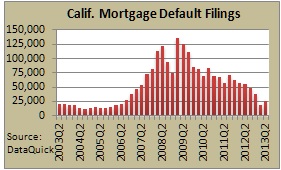

That is simply not the case as the chart above highlights. In 2012 a record number of properties, over 2,000,000 were held off market. In 2006 this was 500,000. This is inventory that is in banking purgatory where foreclosure timelines are drawn out to comically long standards. Why would banks operate differently when this climate is working fantastic for their bottom-line? Although given the massive price hikes in this controlled market, banks are licking their chops and moving on some properties:

This is why in California, foreclosure starts are up 38 percent over the last quarter in what is supposedly a blazing hot market. This inventory didn’t miraculously appear. It was being held off. And now that the market is frothy banks are choosing to unload but as the data has shown, banks in many cases are simply moving properties from one financial institution to another (say a hedge fund to turn a property into a rental).

No place for the young

Unfortunately the recent bust and boom has been unkind to young Americans. Household formation is still very weak:

“(WSJ) Americans will likely remain renters for longer than previous generations who viewed homeownership as the ultimate symbol of success. But many people remain scarred from living through or seeing someone else deal with a foreclosure or short sale. Despite home values rising in some markets, plenty of Americans owe more on their homes than they’re worth. Meanwhile, consumers continue to face “tight credit conditions, shaky personal finances and competition from investment buyers able to offer cash,†Mr. Diggle points out.

This has forced many into mom and dad’s basement, slowing household formation. The 477,000 households formed this year is well below the norm of 1.2 million. That’s a lot of money not being spent on everything from the hottest paint colors to dining room tables.â€

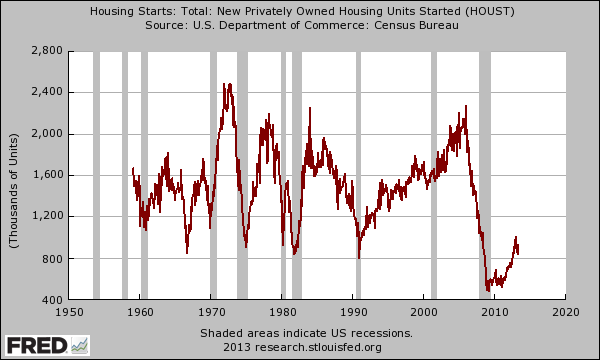

Given the record speed in which home prices are rising, constrained supply, and the supposed new demand you would expect that housing starts would be soaring:

Housing starts had a big jump from the bottom but let us put this into context. At the peak we were knocking out over 2,000,000 housing starts a year while today, it is at 836,000 (off the low of 478,000). You’ll also notice that we are recently trending lower (a few months ago we hit a rate of 1,000,000+ starts but have dropped nearly 200,000 in the recent point of data).

In essence, household formation is not justifying new housing starts since new homes typically cost more money. A younger less affluent generation is challenging half-a-century of robust housing starts (we never dipped below 800,000 going back to 1950 and only until 2008 did this happen).

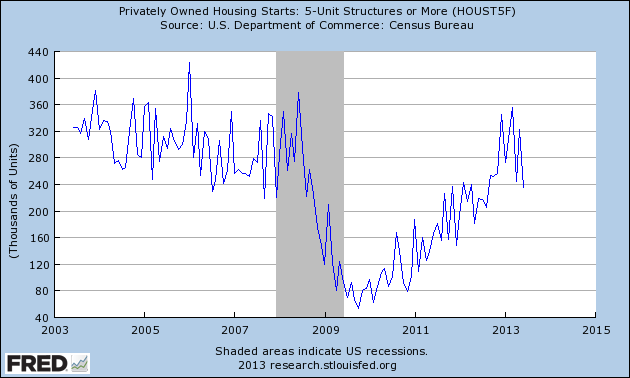

What is interesting is that housing starts for multi-family units are back to where we were in 2007 (pre-housing bust) although this has slowed down recently as well:

In other words, builders are betting on a rental nation for years to come since these projects will take time to fully go online. With incomes lower for younger Americans, it will be difficult to justify building in any large number massive McMansions. As we have noted however inventory seemed to have bottom earlier in the year and some areas are starting to see a softening of the mania. And with the Fed telegraphing a slowdown in QE in September, it’ll be interesting to see when the market-maker of the Fed eases back on the current housing system.

Is this renting increase simply a temporary outcome of the current real estate market or a longer-term trend?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

56 Responses to “Rental Nation: US Home ownership rate continues to decline to multi-decade lows while rental vacancies continue to decline. Record prices in a few areas.”

Doctor, I was gonna tell you this but forgot. You said:

“In fact, four markets hit new record levels. These were mostly in Texas; Houston, Austin, Dallas, and Denver. ” (I’d add Atlanta there, Doc).

Those are in fact, this time around, where a bubble will form – and burst without affecting the rest of the country. A good testbed for the new Fed policy, and confirmation that those guys know what they are doing there at the Fed, despite public opinions to the contrary.

Think this way, prices in those places are not supposed to be a function of demands, or at least not much of demands alone. Prices won’t go up even if demand goes up, just because the locals will continue to sprawl out, build out more and keep prices below new construction.

How does higher interest rate come in the picture? To the extent that rates drive demands, then you could have exacerbating impact of higher rates in Atlanta and Houston, more so than in Cali or NYC. (remember you yourself wrote a lot of the people trade up their existing equity, cash buyers, institutional, in Cali and NY, Doc?)

This is no 2006, much in the same way that high school kids create various versions of Les Miserables for their school performances (for example Black Collette + civil rights issues of blacks as opposed that of the whites in the original script).

— Sent from my Blackberry Z10, the best phone to watch Meatspin on —

Somehow donger your comments seem less coherent with each post. Do tell us all how those specific four markets will be the ones that burst the hardest while leaving the rest of the country A-OK? California is a boom or bust state, like Florida. See previous bubbles for proof or just read a little more on the internet. Also note that TX home prices barely went down while CA, FL, Phoenic, Vegas, etc crashed during bubble 1.0. We don’t get huge ups, but that means huge downs are less likely. Texas cities will likely burst as well to some degree, but unlike many areas of the country there are actually both an increase in jobs in TX (see every article that rates TX as the number one or two state for jobs in the US) as well as tons of CA residents moving here as they are priced out of CA. Unlike CA and NY where many new residents rent at first, many more buy when coming to TX as home prices seem great in comparison. CA folks seem to like to move to TX, CO and AZ so could these stats perhaps have something to do with CA getting too expensive for most folks? Decent Electricians, HVAC guys and other blue collar folks where i live in TX make the same rates they do in NY and CA, with a much lower standard of living. There are jobs everywhere, including ones for the state, like park ranger with no experience, with full benefits and pensions. Natural gas also needs engineers, attorneys, etc. My neighbor got a job in less than a week. My wife, without trying, got a job in 2 weeks and has since been offered more jobs. I’m not saying TX is perfect (the heat and insects aren’t for everyone and the water problem is legit) nor am I saying housing here wont go down (i assumed a downturn when i bought, but with a 10 year+ hold time), but your comments seem to be based on whatever enters your head and not supported by any facts.

Now we know of your texas pride. Any negative reference towards texas will not go unpunished, so says you. LOL. But what you are saying is not different at all than what I wrote (incoherently by your reckoning) in the first post.

Consider:

* coastal cities have limited supply and will go up and down significantly due to demand, but that demand lately is not a function of rate. Conversely, it’s not possible to call a bubble just because these places rise in home prices quickly. Many times (and you can see the data in the link below) they are false alarm. The typical # of years you are wrong if you follow a false alarm is about 5 years. Think about my name-sake: Karl Donglicker after you read that last statement, being short the stock market and wrong for 5 straight years.

* regional non-coastal places don’t go up and down significantly, like Texas as you said. But when they go up, watch out, the bottom is about to fall. Why? Because they aren’t supposed to go up in the first place, again, as you correctly noted in your observation. For these regional locations, the average # of years you could get a false alarm is 1.5 years. Much shorter than that of the coastal cities.

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1169182

—- SENT FROM BLACKBERRY Z10, THE BEST PHONE TO WATCH MEATSPIN ON —-

By the way, suppose someone buys that theory I just gave you, and succesfully ran a short and make the big bucks against the Texas and Atlanta of the world, would it not be the same as carting off your equity and take it to add to their home equity – and home prices – to the coastal cities where they live. 🙂 Parasitic, Vampiric yes, but legal and don’t say you didn’t hear someone think about this before it happens.

May the best (meat)spin wins!

— SENT FROM MY BLACKBERRY Z10, THE BEST PHONE TO WATCH MEATSPIN ON —

Quick question: why did my friend in prime LA see his house go down 30% from the peak and he’s still a little underwater then based on your theory that seems to really only focus on one factor-land/the ability to build new supply? Was LA not a coastal city at that time? Are you not even considering trends of people moving to new cities and jobs/wages? Or what about that in CA much of the demand is currently artificial in that its investors who may bounce for better returns? I agree the ability to build more houses caps growth for sure though. NYC is built on good paying jobs, not just limited supply. NJ and CT are the same as they are really just NYC suburbs for the first 45 miles out from NYC. Maryland and VA are suburbs of DC, which has good paying jobs. Its not just because land is more scarce.

FWIW, although clearly a TX ‘homer’ now, I lived in NYC for almost 30 years and LA for almost 4 years. My experience is real world, not just academic papers or the net. I had no ties to TX before moving here, but did so because in NYC you get a small box for a rat for a million plus maintenance charges for no reason and in studio city (not even super prime LA) you get a 2000 sq ft house from 1930 on a 6000 sq ft lot. I also think there is no better weather in the world than So Cal with warm days and cold nights and its cool to have beaches yearlong close by. I’m not a CA hater, but one can’t just ignore the economic realities and pay the ‘sun tax’, IMO, with no ties to CA like family or a good paying job. Like most folks, I found it a great place to visit, but not to live long term and I could actually afford to stay if I wanted to.

Something tells me you weren’t in Texas or maybe aren’t old enough to remember the Savings and Loan Disaster years back – Texas was slammed harder than any other state.

I was way too young (maybe 5?) during the savings and loan crises and not in TX. I was also too young or maybe just daddys sperm when NYC almost went bankrupt in the mid 70s. However, I am old enough to recall the recent CA bankruptcies of Stockton and San Bernandino. I also know that CA currently issues the most muni bonds of all states (20% of all muni bonds nationwide) and is way to fiscally liberal with horrible demographics. Here’s a recent article from May 2013 showing 10 more CA cities on the brink of bankruptcy in USA today:

http://www.usatoday.com/story/news/nation/2013/05/15/ten-california-cities-in-distress/2076217/

FTB

You give me hope for the future, but I would hope others in you generation had more of a grasp of resent history to understand the current economy. I am afraid i am wrong.

This is no different than a stock that is herded by a lot of traders trying to convince the public.. “this is different this time!”. If the housing market continues to act more like a stock trade we are really never going to have stability in the housing market. More people will eventually be desensitized to the value of home ownership but when they can flip their next deed. There will be no concern for providing for stability for families that need something to keep them from sane from these gyrations.

One simple observation,

Texas is pro business and attracting producers . Cal is anti business and attracting dependents. = Texas is safe for producers Cal is not. Detroit is a great example of blue state destiny.

There’s a reason why Texas and California are so often compared…they are roughly the same size, have have similar GDP’s, population and demographics, and long borders with Mexico, etc. However, one is solidly blue and one red. Subjective pro-business/anti-business arguments aside, that’s where the heated ideological rants come from.

My simple observation is this: one state’s economy is based on finite natural resources while the other’s is based on innovation. Where would you place your long-term bet?

Dfresh

I know “the big one” is a played out statement but it is possible. Water shortages are also a possible reality, the CO river and Lake Mead are shrinking.

I put my money on the elites continuing to habitat the very most desirable areas of SoCal, but the continuing disintegration of middle class. This gap and these areas will widen. Well, maybe shrink, in terms of land area inhabitated by the most elite.

TX will win the middle class battle hands down. Although they will have their share of money too.

Dougie Fresh-please read this (written by a long time CA man) as it talks about young innovative folks you speak of…

http://calwatchdog.com/2013/02/27/everyone-is-moving-out-of-california/

CA has Stanford which feeds Silicon Valley for sure and will continue to do so, but to think CA is going to be the only place for innovation offing forward seems far fetched, IMO as other states will continue to lure businesses away (like they are already doing). Besides Facebook (aka a big piece of crap advertising network), I haven’t heard that much in terms of innovaton as of late coming from CA, besides snapchat (a network for kids to send nude or stupid exploding pics or Wall Street traders to send illegal tips through or nights out of debautchery). Will CA still be the leader in innovation (if that’s how we are defing social networks)-probably yes. Can anyone with a brain and a computer come up with the next greatest thing from Anytown USA-yes as well.

Btw, besides oil and natural gas, Texas also is seeing more manufacturing coming its way as well as other companies that realize low taxes is the key to survival in a global marketplace bc not sun and the beach and expensive housing where their workers can’t afford to live:

Here’s one on Google, Paypal and Borland Software expanding in Austin and hiring engineers, etc:

http://crosslandteam.com/blog/2008/01/24/google-coming-to-downtown-austin/

Here’s State Farm relocating to TX:

http://www.westernjournalism.com/state-farm-to-leave-illinois-move-to-texas/

Here’s Apple expanding in TX:

http://mashable.com/2013/05/22/apple-macs-texas-factory/

Here’s Raytheon moving to TX:

http://www.dailybreeze.com/news/ci_23166366/raytheon-moving-its-el-segundo-headquarters-staff-texas

Also, since we believe in our constitutional rights, Colt is relocating to Texas and Berreta, Sturm Ruger and Magpil Industries are likely coming to TX as well.

The list goes on and on, but I think you get the point….we’re not just oil and natural gas…we’re pro business…and CA is not.

We all know that Texas is the promised land. People are leaving California for Texas. If you like meat so much, come on over to the ranch where we raise organic beef with none of those antibiotics or hormones, just the way God intended. Texas is getting so many people from California, that some of the native Texans are beginning to resent them. But I tell them that to have mercy on these refugees from the high tax, low opportunity state of Taxofornia.

So Fed policy has led to one bubble that ended up forcing people out of homes. Then you might think that if prices were low people could finally get affordable housing. But instead the Fed ratches up the QE and lowers rates to zero so that prices rise so new homebuyers can’t get into the housing market if they wanted to!

Why is it a policy to push housing prices up while not characterizing it as inflation.

Here are some of the bad things about rising home prices http://smaulgld.com/the-dark-side-of-rising-home-prices/

Many of the impacts of Fed and govt policy-making homes affordable, increasing home ownership-are the reverse of what they say is intended.

The Fed works for the banks and financial sector, NOT for the average person, who may one day wish to own a house. It is all about saving the people who created the bubble and were left with no collateral for their loans. Now they have their assets back in bubble and made of ton of money refinancing and in the stock and commodity markets. Where does they leave most people in the “recovery” faze?

Fascism at it’s finest!

Jim Jubak over at MSN is talking about the potential for deflation before the massive money printing tsunami of inflation inevitably hits someday. I can see the case for this.

Demand is down, it drives prices down. If people have no money and credit supply is contained, competition will by default drive prices down.

The “sticks and bricks” price home builders talk about is drivel as far as I’m concerned. Commodities, (including people!) can and do fluctuate in value. If no one is buying wood, it will get cheaper. If everyone is looking for work, wages go down as desperation builds. The fact home builders charge upwards of $300k to $500k for homes in the L.A. area is hogwash. Go out to Banning and see the $200k home for build signs. Those framers and painters and contractors are making the same exact money building in Banning as they are building in Chino Hills.

The real idiots are the people who continue to overpay for homes out here and drive the market higher. I’m sure the home value increase stated in the article in TX and CO has to do with companies and people moving OUT of CA and into those areas. I myself am in the same boat. Lose my job in SoCal, I’ll try to find one here but I’m betting much more $ the next one will be found in Phoenix or back in the Midwest. Their U3 is 4.5%!

If not for QE we would have had massive deflation from 2008-2010/11 the economy would have restructured but it would have been a nasty deflationary depression.

As it is now we will get our recession when QE finally catches up with the Fed and the BOJA

We SHOULD have had a bone jarring deflationary depression from 08 to 2010, and the recovery would be in full massive swing as we speak. But instead, since most Americans have turned into lilly sniffing panty waist wussies, where ‘no one can hurt boo hoo’, this is what we get.

Geez. Man up.

Soaring markets and markets declines are joined at the hip. Can’t escape it no matter how much money you throw at it. Markets need cleansing on occasion.

Papa Now,

Your comments are right on the money. People forget what laid the groundwork for the Reagan recovery. That was Volker putting the brakes on the money supply which stopped inflation but created a couple of years of pain.

If our market was allowed to correct, as any free market does, we would have been on the road to recovery. The current market is a perpetuation of the bubble market. Which was created to save the butts of the banks that should have been allowed to fail

But…but…but…Suzanne the NAR realtor did the research, Dr. Housing Bubble, and told me this time it’s different! It’s a new paradigm, don’t you know?!? Real estate NEVER goes down (except when it does)! Buy now or be priced out forever!

Remember this blast from the past?!?

http://www.youtube.com/watch?v=hPIxrzmatq0

From the front lines of the supposedly “hot” neighborhoods and areas, the market is stalling, starting to head into a tailspin and the bottom is falling out! Despite the mainstream media putting on a full court press pump and dump, big institutional investors/hedge funds/banks etc. are starting to unload their inventory and lock in profits, inventory is absolutely growing to the point of surging, the summer selling season is winding down, and what few buyers remain are balking at the “market prices” let alone paying a premium. And the ones that are willing to jump right off the cliff but require a loan, are finding VERY tight lending standards and appraisals that are coming up short. QE 5 6 7 8…here we come!

So, rental vacancies are low, home prices are rising, due to low inventory, underwater owners still can’t sell keeping inventory low, banks will continue trickling out inventory at a snail pace.

In what world was Fall 2011 not a bottom for the Los Angeles housing market?

Fall 2011 was the bottom of the LAST cycle. The next bottom will be appearing very shortly and WILL be lower than the previous cyclical bottom. As we’ve all said since 2005 math is math and while established neighborhoods with high income earners can skew the curve somewhat, it still comes down to incomes. The current upward trend is no more sustainable than Bubble 1.0. Anyone who won’t acknowledge these facts is guilty of willful ignorance.

I agree the 20-30% gains are unsustainable. But why would home prices drop below 2011 lows? 2011-2012 buyers all bought in cash or have 3% 30 year fixed mortgages with monthly nut less than comparable rentals. They have zero incentive to move or sell for a very long time. This will keep transactions so low that prices wont be able to fall dramatically.

Low risk-maybe the folks that bought to raise a family in 2011 won’t likely sell, but as the doctor has shown time and time again, what about institutions and flippers that bought during that period? Wouldn’t theirincentives be different (depending on what happens to rental rates and other ways to make a return on investment (stocks, bonds, gold, etc))?

Got to agree that the 2011 buyers have absolutely zero reason to sell right now. Flippers have long since flipped, regular families will likely stay for the long haul. I think the big institution buying is also misleading. I see absolutely NO big institutions buying in desirable South Bay communities…this is just from my anecdotal evidence. When the for sale sign goes down, I see families moving into houses. I do not see for rent signs being immediately set up in the yard. Again, every neighborhood is different in this city. I highly doubt we will have the big collapse coming to the desirable areas.

@NihilistZerO, home selling prices are a function of interest rates. As interest rates go up, home selling prices will go down (the reverse is also true) but the monthly mortgage payment is not going to change.

The entire run up in selling prices in the last two years is due mostly to interest rates going from 5.5% down to 3.25%. Now that interest rates have stabilized at around 4.5% by September you should see selling prices plateauing.

The only way I see a bottom coming is if mortgage interest rates make a move to +6% and/or the Federal Reserve jacks up the overnight interest rate, currently near 0%. Jacking up the overnight interest rate would force banks to unload shadow inventory but since the Federal Reserve is owned by member banks of the Fed, this is highly unlikely.

You are right, low risk,

2011 was our bottom. I am a realtor and have been following Dr Housing Bubble for years. I met some investment clients in 2009 and told them to wait because the numbers did not work. In 2011, the numbers worked and they bought several rental properties that are bringing very good returns.

In 2012 and 2013, I told them to hold off because the numbers do not make any sense

Curiously, Bill, what do you mean by a 2011 bottom in CA? Is this the lowest CA real estate is going in our lifetimes in your opinion?

Hey Doc, I watch what is happening here in parts of Western LA.

Take a look at this. House listed at $495K then was repriced (due to multiple over asking offers) to $550K. House is now in escrow. Outdated with concrete front and backyards to boot !

http://www.trulia.com/property/3121407707-5727-Glenford-St-Los-Angeles-CA-90008

Here is another fine example of the pent up buyer demand: Sold for $307K in 10/2012 then sold for $400K May 2013, NOW listed again at $495K

http://www.trulia.com/property/3107001762-2419-S-Sycamore-Ave-Los-Angeles-CA-90016

Like so many others, asking myself will these prices flatten out OR crash….

Down here in Miami, the houses coming on market are flips or people getting out because they are no longer in negative equity (purchased on 2004/5) and they all seem a little over priced by 10-20k. Maybe they haven’t priced in the new interest rates.

And now I am seeing the investors who bought two years ago start coming online. There were a lot of deals down here in 2011 so selling now seems a good way to lock in profits and remove the risk of a hurricane making your life miserable. We shall see if the hedge funds do the same thing next year

Still hard to tell how it will go.

JVP, what’s your read of the Miami condo market? I live in Naples and like toying around with the idea of picking one up for a weekend getaway.

Select cities and states are experience mini bull markets while others sit stagnant. Doesn’t look like a recovery for everyone.

Big 180 for people in Detroit and a good example where LA could be if bad policies and jobs leave the state.

+1

Draw whatever conclusion you want, but that 10 percent lower sales compared to last year is an ominous sign, especially given that these data represent sales that were too early to be affected by the change in mortgage rates.

http://www.car.org/marketdata/data/countysalesactivity/

It will be interesting to see when the baby boomers will want to downsize….Who will be buying those homes? In the 1980s, you could buy a nice 3 bd, 2ba home for approx 230,000. Now those same properties are running in the high 800s to 900,000 dollars.

Referring to previous post. …This is in the area of Westlake Village….

We don’t need to have over 60% home ownership rate. A lot of that is very subsidized by the taxpayer-robbing Peter to pay Paul. Germany only has a 40% hom ownership rate and they are in better shape than us.

Most of the current building projects are now apartments. The American Dream of buying a home has evaporated. Now that banks are out of the home loan business and TBTF is expanding, it gives them a bigger license to take risk with taxpayer dollars. It is a sad state of affairs as the public becomes more enslaved to the 1%. Oh well as long as we have a big screen TV and a rented SUV life is grand!

http://Www.westsideremeltdown.blogspot.com

http://Www.santamonicameltdownthe90402.blogspot.com

Yep. Bread and circuses.

Everyone hoping for a big drop in home prices should ask what the upcoming crash they so desire would mean. If sales prices drop then all the owners will go back into hiding and all the decent homes for sale will disappear… again. We all watched this happen between 2008 and 2012. Prices were low, but inventory was crap.

I’m not happy with the price increases I’ve been seeing over the last year, but at least some of the homes I’m seeing are places I’d actually like to live in. I was looking all through the last downturn and saw maybe 1-2 houses a year I would even consider. Going back to that mode may be morally satisfying, but won’t get us all into the homes we want any more than the current reflating bubble.

I dont know what area you’re looking in, but in south orange county I’ve seen exactly one property I’d consider moving into in my price range and even that property was insanely overpriced.

Meanwhile, I gather cash every month.

I know the conventional wisdom was that all those people who were forelcosed on the last 5 years need places to live, but were we dealing with people roaming the streets unable to find rentals the last few years?

All that has happened is the over-inventory moved from foreclosed, to REO and now for rent.

Yes the banks may be squeezing the forclosures to reduce whats for sale now, but all I see down here in Miami is a glut of rentals in the near future, if not already.

Which should make rents drop and continue to make renting equally attractive as buying. And the yo-yo will begin all over again until there is a true shortage all around in both rentals and sales.

I see more and more renovated units coming on the market for rent (a little paint, new laminate wood floors, a new fridge, etc).

I saw one duplex for sale that even the advertised rental income from the 2 units couldn’t cover the assumed mortgage.

Maybe the big boys think they can control the market or sell out visa IPO, but the small guy can’t wait 3 months to rent a place every year or two.

Time will tell but my feeling is that there won’t be a bubble popping but a lot of small investors just looking to get their capaital out.

So maybe there will be deals for those who are patient if you still want to own.

JVP

The basic fact home prices have nowhere to go but down. We are in a deflationary period that the fed is trying to money print away. The banks hate deflation that’s where they lose money. Deflation is actually a good thing for the people. The banks want to scare you with inflation talk into acting now…buy now! Things become more affordable when deflation is allowed to happen. The housing boom will be over soon and we will once again be fooled by these banks…it hurts to watch this again.

Meanwhile the banks are in a desperate bid to pump and dump this market. They love all the cash buyers and the government loans. They are getting their bad loans off their books onto yours. They are not making loans for the common man, they are using your bank deposits to gamble with your money.

They want you to come play at their field…the stock market and housing market. They want you to invest in their game…the only game in town so they can play you! You think you are playing with them but the game is rigged and they will let you know when they are done with you…when they have all your money. You think you are doing great in the market now wait till they pull the plug and you are back at 2008-2009 or worse levels. You gotta play with them but they know you never quit at the right time…they got us where they want us…we are pawns in their game.

Two other reasons why housing is over as a long term investment is the changing demographics. The baby boomers are aging out of high consumerism and will be down sizing, saving money and not spending as much money. This is a powerful force and it is very deflationary. The younger group is smaller coming up from behind to take their place and they are saddled with high consumer debt and student loans. This is a very negative factor since they are the consumers that are to step into boomers shoes.

When interest rates are on the downtrend housing is very profitable and is a very good investment. Interest rates have bottomed and have no where else to go but up and that makes housing a negative investment. Labor participation rate and stagnant wage growth will further depress this market.

It is hard to go against the crowd and not buy a home. The new economy has not proven itself to be here yet but it is coming. This is a given, the housing market will crash again and the stock market will crash again and because of demographics they will not come back for another 20 years until demographics change again for the positive. You will save yourself a lot of future heartache if you rent for the next 3-5 years and wait for housing to crash and take your money out of the stock market before it crashes also. Save your cash for the crash!

When you have a bubble prices reverse back to the mean and that is around the 2000 level for housing or more and the stock market too will reverse back to the mean also back to 5,000 and 6,000 level. It’s not magic, it well known patterns that they don’t want you to know about. If you take time to look at the big picture, look at motivations of banks ect. I know you want a home and buying a house is foremost on ones mind but bigger things are in the works with this economy and they are hoping that you play three card monty with them till the end.

Hope this helps in some small way 🙂

Brilliant.

Yeah that’s about what I’ve said in the past. 3-5 year time horizon for both markets to crash by then. I was going to wait 1-2 years or when I see markets falter and buy 2 year LEAP deep in the money (minimize time decay) put options on market indexes. Money moves from one bucket to another in cycling fashion. I can’t be precise on timing but I can say we are probably in the top 25% zone, to profit you need only be in the top 50% (above the mean) when you go short – you beat the average person. Where is the money going to go after this ? Probably back into bonds at soaring interest rates and other less-loved asset classes to the next hot market.

People buy because the price is rising. It is psychological. It’s velocity is positive ergo is must go up more. Until it doesn’t. At this point the smart investors see the lack of velocity and try to get out, except the way housing is people can’t get out once they are underwater so easily – the inventory doesn’t flow like a normal supply and demand it gets crippled when price drops. When you see a ton of inventory growth that is the time to closely watch the price – it takes time for people to respond and lower their prices but it should happen. There is still a lot of $ out there to absorb globally too, and it tends to come into the coastal states. They are more exciting I guess.

I totally agree with your analysis. Additionally, if you are right people like you and me will win big, and if you are wrong then it not that big of a deal because we rented and saved a ton of money and can move to another market where prices are inline with reality.

“Deflation is actually a good thing for the people”

Care to cite some historical examples where deflation due to a shortage of money supply has benefited people? Deflation due to an increase in productivity is fine, but otherwise?

Deflation might lead to a few goods getting cheaper and savers gaining greater earning power, but will that really matter when unemployment skyrockets and business close their doors? Will anybody invest in anything in a deflationary cycle to create innovation and jobs?

“Meanwhile the banks are in a desperate bid to pump and dump this market”

Does that mean they’re flooding the market with ‘shadow inventory’ since they’re so desperate?

“Two other reasons why housing is over as a long term investment is the changing demographics.. The baby boomers are aging out of high consumerism”

Is the US population increasing or decreasing? There are more echo-boomers than baby boomers.

“Interest rates have bottomed and have no where else to go but up and that makes housing a negative investment”

Interest rates may or may not have bottomed. They’ve stayed lower than this in Japan for much longer. Has housing always been a negative investment in conjunction with rising rates?

Why is 2000 the mean for housing, and how do you calculate 5000/6000 for the DJIA?

In 2000, Real House Prices as calculated by the Case-Shiller National Index was at 100. In December 2011 that number went as low as 97. Yes, cheaper than 2000 when adjusted for inflation. It is at 110 now. Were you advocating people buy in 2011 or were you advising people rent for 3-5 years at that time as well?

http://money.cnn.com/2013/07/30/real_estate/richmond-underwater-homes/index.html

“The California city of Richmond said Tuesday that it’s ready to take an extraordinary step in its bid to stop foreclosures — threatening to wrest mortgages from the investors who now control them….”

Note the beneficiary in this: “The Richmond plan was proposed by a private backer, Mortgage Resolution Partners, which will find the money the city needs to buy the mortgages. It stands to profit by taking a cut when the loans are refinanced.”

Saw on the news yesterday that a Southern CA city was going to vote on this in the next day or two as well – sorry, I forgot the name of the city.

Oops, part of my post was cut off. The article also mentions eminent domain and an Aug 14 deadline.

Sales volume is very small, so it’s not a real market and can’t last too much longer. People are scared and not feeling any better about their economic situation here in CA. Some states are seeing a boom as they are part of the new economy of energy and resources.

This may last another year, but it will remain small volume and frustrated participants. The Fed is through buying the garbage paper from it’s important members. Deflationary pressure is starting pop up all over the place. Demographically as well as in employment.

Unless it is chaper to buy then rent, people will continue to rent.. The shift makes sense and is smart for people that don’t earn 200k+ a year to afford a ridiculously priced home in CA. What it sounds like to me is most people have learned the lesson that providing basic elements of living like food and clothing for their families trumps owning a home that will always appreciate then depreciate over the course of their loan term. So it may not be that they are being priced out with this bubble, but rather have decided that they don’t want to play the game anymore. They know eventually they will get burned. I for one are one of these people. I would rather contribute to my retirement, save and feel secure about my future. Been there done that. I will not be going down that road anytime soon. But it is comical to watch the lemmings fighting and overpaying for a crappy tract home 40 miles inland from San Feansusco.

And will definitely not be buying a house in the peninsula to work for Apple which has a crappy auto correct feature for the IPhone.

D, there is a premium associated with buying…especially if you have a family. People have been and will be paying this premium into the future. The idea of bouncing around from rental to rental while getting hit with yearly rent increases sucks! Having the kids go to different schools, making new friends and never having a place to call home is why people will always want to buy if the rent vs. buy equation is anywhere near close. Add in the financial benefits and myriad of other benefits of owning and it’s a no brainer. Homeowners will always be favored in socio economic hierarchy of this country.

Half of Californians headed for other states than Texas, its unemployment is around 6.5 which is nothing to bragged about. Minnesota has 5.2 percent but not growing as fast. Texas has demographics similar to California which means it will go from being Majority white to Majority Hispanic. Hispanics need to improve in income and education but the continue immigration of lower skilled Hispanics doesn’t help with this. The price increase is also the foreign market from Mexico, China and Canada and so forth in Texas.

Leave a Reply to KR