The rent versus buying math in Culver City: People are betting heavily on continual real estate appreciation.

It is pretty safe to say that housing has become like a stock in many markets across the United States. People need to carefully evaluate many factors before buying and things are moving at a much faster pace in our globally connected economy. The market is complex and in some areas big investors and foreign money create even more complicated scenarios. The idea of simply buying a home and enjoying the spoils isn’t so clear cut anymore. If it were a simple decision we wouldn’t be debating the merits and you certainly wouldn’t have the Fed chasing interest rates lower trying to keep the debt game going. But in this current environment, we are betting. Some are betting that home prices will continue to rise despite stagnant income growth and the precarious leverage some households are taking just to own. For many in SoCal their retirement strategy suddenly becomes a “one asset†portfolio when they put their large down payment on their crap shack. Let us run some numbers on buying and renting in Culver City.

The rent versus buying math in Culver City

Culver City has felt another resurgence in prices and people are back at it with flips. This year the momentum has slowed down in line with the stock market. Prices are up along with many other California cities but the question now becomes, is this sustainable? If it is, then should you buy? If it isn’t, what is the next phase?

For many, prices are so out of control that the decision is already made – they are unable to buy simply because they don’t have the money. In L.A. County the last few years has shown most households are being pushed into renting situations. This trend doesn’t seem to be going away.

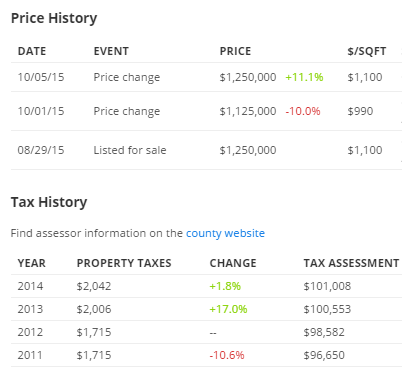

Let us look at a home for sale in Culver City:

4159 Jackson Ave,

Culver City, CA 90232

3 beds 2 baths 1,136 sqft

A nice starter home. 1,136 square feet isn’t too big of a place. From looking at this place, there isn’t anything to blow you away. Let us look at the list price:

The current asking price is $1,250,000. Let us now look at a rental nearby:

4210 Lincoln Ave,

Culver City, CA 90232

3 beds 2 baths 1,485 sqft

The rental will give you an additional 349 square feet. The current monthly lease amount is $4,000. Let us say you are determined to buy. You have 10 percent to put down (a common figure). Here is what you are looking at:

$125,000 down payment

Monthly PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $6,341

So you are out the $125,000 and are paying $2,341 more a month on your housing payment. Say you stick that down payment in a total market index fund (which historically has kicked back about 7 percent). You will have $951,531 in 30 years just by doing this with your down payment. If you invest the difference between your rent and housing payment the difference is even larger.

And did you catch how much they are paying on taxes for the house that is for sale? For 2014 they paid $2,042 (assessed at $101,008 thanks to good old Prop 13). You as the new buyer will have it assessed at the market rate of $1,250,000 (you are looking at roughly $15,000 in taxes annually). And taxes will never ever go away.

The home for sale was built in 1923 so there will be required work over the next 30 years. And people over estimate how long they will stay. Data shows most people move before that 30 year mark. According to the National Association of Home Builders the average length of stay is 13 years (certainly not 30). Why is that? Because life happens in between. At these price levels, you need to stay put for a good duration to make a profit (or even break even).

But you say you want to paint the walls. At $4,000 a month, I’m sure you can sign a multi-year lease with a landlord and ask if it is okay to paint the walls. Or you can put $125,000 (or $250,000) down and paint the walls blue, yellow, or green. I think a lot of people are misinterpreting the security of a “home†with wise financial planning. In California, many are approaching investing with the one asset approach and most of it is in housing – a proven boom and bust asset class. Even after 1,000,000+ recent completed foreclosures in the state, there is still this allure that housing is the perfect investment. Keep mind once the home is paid off, you still have taxes, insurance, and maintenance costs taking money out of your wallet. Even a million dollar home that you live in is not throwing any money your way like a dividend producing stock for example.

I rarely see any articles discussing the opportunity cost of your down payment being invested or a deeper examination of the true tax benefits of owning. Many with higher incomes are already using other tax strategies like diverting income into 401ks and IRAs so the net benefit of the mortgage deduction may not be as big as you think. You also have things like the AMT that kick-in.

In other words, the renting versus buying decision is not as simple as some would like you to believe. The decision becomes even cloudier in frothy markets like the one we are seeing today. The above real world example proves that.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

85 Responses to “The rent versus buying math in Culver City: People are betting heavily on continual real estate appreciation.”

In addition to “homes of genius,” I love realtors’ idiotic Listing descriptions. They seem to get ever more silly and hyperbolic. Here’s a description for a 1947 Sears & Roebuck “mail-order home,” located in Venice, priced at $969k:

Yodel-Ay-Ee-Oooh! … elaborate carved boards adding to the spirit of a Swiss chalet. … the “It” place to be

Yup, just looking at this million dollar crapshack makes me feel that I’m skiing on the Swiss alps: https://www.redfin.com/CA/Venice/1087-Marco-Pl-90291/home/6744021

Curiously, the realtor’s description says these “mail-order homes” were built between 1908 to 1940, yet the listing says that the house was built in 1947.

I hate it when Realtors describe a house that “boasts” something. Houses can’t talk.

My rentals aren’t high end, are in more “artsy” communities, but we have no problem when tenants paint interiors as long as it looks nice. In fact we have found that rent is paid on time, tenants are happier, stay longer and take better care of the property when they feel at home. Sometimes when a tenant moves one of their friends wants to rent the place, requests the paint stay as is. Once I had a tenant paint a mural of a dinosaur (was fine with us). When she moved, while showing the place to a prospective tenant, we stated we would paint over the dinosaur and he said no, please leave it, I love it. He rented the apartment, was a great tenant, stayed for a couple years. Go figure.

You sound like the kind of landlord I like!

First thing I do when I move into a place is replace those loose dodgy old electrical sockets. They only cost a couple of bucks each, so I don’t mind d the cost and a little effort. Flip the main breaker, pull the old ones, install the new ones. Hardly more difficult than legos.

I’ve painted, carpeted, done all kinds of repairs on places over the years. Yes, arguably the landlords responsibility, but not worth quibbling over.

Houses don’t only “boast.” Some houses “ooze.” As in, “oozes vintage charm and pride of ownership.”

Of course, “vintage” is just a nice word for “old.” As in “kitchen still retains its original, vintage charm.”

Then there are the houses that are “flooded with sunshine.”

And all those descriptions that end in WELCOME HOME!

“Vintage German restaurant decor” is more like it. The only person who will be yodeling is seller after this deal closes.

Makes me want to put on my skis. If you scroll down there are even more opportunities just like that one ! I’m in.

Makes me want to entertain myself drawing with my fingernail on the caked up grease on the table while I wait for my cheap wienerschnitzel, then go home and wake up in the middle of the night with food poisoning.

Those houses are very depressing. There’s no way that lawn isn’t photoshopped. That area has a sort of clayey soil that can’t grow a nice lawn even if you spare the water.

1920s construction means you’ll be lucky to not have bare wire on standoffs electrical.

I’ve been in houses in that general area and the interior will likely be decorated in a decades of cigarette smoke theme. Yum!

this is insanity, the taxes alone are more than my current rent. Income to qualify must be in the $250k range and if you’re pulling down that kind of coin AND that’s the house you can afford something is seriously out of wack!!

The ‘neighborhood quality’ versus ‘ station in life’ is a growing problem isn’t it. For a professional or executive the home you live in typically reflects your position in society but not in coastal California. Here it reflects ‘when you bought’ as much if not more than your income.

In most of America if you pay a million plus for a home it will look it. It will be a McMansion in places like Atlanta, Houston or Washington. In smaller cities or more depressed areas it will be a true mansion. A old, stately home that would be hard to reproduce today. Think Pacific Heights in San Francisco. Only in California will it be house that might have been The Beaver Cleaver’s family starter home.

most of the 40-somethings i know that have a home in socal have it because they inherited it not because they had the income to buy it. I have one friend who’s grandparents really took care of her, she has what would be a nice house if she maintained it in central Anaheim and her taxes are $800 a year and other than utilities that’s her only expense.

and yet she is still one of those woe is me types that’s “depressed” all the time, it kinda pisses me off

All my 40 something friends who have houses had help with the down payment from one or both sets of parents

I bought a one bedroom condo in downtown Long beach in November 96 for less than $39,000 and sold it last year for 170,000. Used the proceeds to buy a car and pay off my parents mortgage

Couldn’t agree with you more!!!

Keep dreaming that you can afford the CA DREAM on less than 5 million. The 2 examples above, from the Doc and SOL, tell you clearly the type of dream you can afford being a millionaire with 1.5 millions. You have to be asleep to dream that you are in a Swiss chalet.

For Lord Blenfein, when I said 5 million I did not mean to buy a house for 5 million. Buying a house is ONLY a part of the dream. You may read again my postings in detail to understand what I mean.

https://www.youtube.com/watch?v=-14SllPPLxY

the american dream – because you have to be asleep to believe it – george carlin

I think the point is, unless you have substantial financial resources, you will likely get hurt badly in the next downturn. A two-wage earner family can quickly become a one-wage earner family or worse … memories are short. I remember hiring IT professionals after the dot com bust for 1/2 of their former salaries! And if you had to put 20% down, now the bank is the winner … they can afford the 20% haircut, the homeowner can’t! Likely those foreigners who are helping keep this market high, are among those who can weather future downturns. But, the smug $250k working household with a mortgage on a $1 million house may not!

This. One person making minimum wage supporting three others was pretty much the norm a few years ago.

You aren’t factoring in the relentless California increases in rent and what inflation will do to both positions by the end of 30 years.

This will fix it all. Thankfully last time this happened things ended well?

http://www.zerohedge.com/news/2015-10-16/theyre-back-own-0-money-down

As for another parallel, I’m sure most of your recall circa 2007, there were a number of different real estate company signs on front lawns aside from that of the usual suspects (Century 21, Caldwell et al.). I’ve noticed recently in Glendora, Covina, La Verne etc. that the signs out front are from people and companies I’ve never heard of. I won’t even get started on the egregious building that is going on in these cities especially Glendora. Me thinks Jim is right this time.

It must be some sort of promo, that is not a typical financing situation. Have you actually tried getting a mortgage lately? My wife and I are dual income with no kids, we put a 30% down payment, our home ownership cost to net income percentage is over 35%. Getting a mortgage with those metrics was still a proctology exam, they wouldn’t make any exceptions for anything and it took over 45 days to finish (we closed 5 months ago). So I don’t know what you’re talking about, lending standards now are completely different than they were 10 years ago. Everyone I know who is buying a house right now put down 20-40%, some all cash, they are all dual income, high-earning families. Everyone else is renting, which is why vacancy rates in big cities are at record lows and rents continue to increase year after year. I’m not saying that home prices are not inflated, but this bizarre narrative that we are back to 2007 is simply not true. Something very different is happening. Are we in a bubble? Maybe we are, but loose lending standards are not what is driving up home prices today.

It is quite evident that you don’t know what I’m talking about. For starters, I did not take the picture nor post the article. I merely posted the link to it. Secondly, there are parallels to what happened in 2007 to what is happening now. You make the statement about lending standards being tougher than they were back then. I am not disagreeing (nor did I make any reference to that of lending standards) with this statement that lending practices since 2007 have had stricter standards. There are, however, also signs around the city of La Puente advertising to purchase a home with only $1,000 down. IF this picture is accurate, it is very likely that a big company like Lennar can work with any bank big or small that they choose to and can modify what is necessary to complete the transaction. If you read what I wrote again, the comparisons I was making were that of the amount of building going on, which, if completed, there will be at least 400 new homes in the city of Glendora on top of the standard 200 home inventor which has slowly increasing. In other words, builders are going crazy again which was reflected in today’s builder sentiment survey. The second, was that of the different realtor signs on the homes that are currently for sale are from small players that most people reading will never have heard of.

Is this another bubble? Yes. Are the parameters for this bubble the same as 2007? Of course not. Do some homework and you will find that no two consecutive bubbles have the same parameters to cause the bubble but there are, as I wrote, parallels. We all (well most of us) know who to thank for the current bubble.

And as far as the difficulty in finding a place to purchase, maybe you and your friends are looking in the wrong place(s). If you are looking out anywhere west of let’s say the 15 freeway, then of course the competition is going to be more fierce. A friend of mine that recently retired from being a custodian had no problem purchasing a home out in Banning. They did not have the 20% down and can barely make the payments but they had very little problem making the purchase. Did you try shopping Ontario? Beaumont? Moreno Valley? You’ll find that there is less competition there for purchasing than that of Pasadena for example.

Loose lending standards are indeed again at the heart of the rise in asset prices. The difference is that this “recovery” is based on trickle down economics. Cheap credit based on ZIRP is abundantly available to mostly the privileged few. REIT’s borrow to purchase large tracts of real estate and price out organic buyers. With rates so low, investment funds are forced to pour their money into risky assets and ventures. Corporations borrow cheaply to finance share buybacks and company acquisitions. Corporate debt is at record levels while overall economic growth is stagnant.

Bonzo – Moreno valley is noted for a high meth and suicide rate. Ontario can be nice, its green and farmy. Dunno about Beaumont but I think it’s closely akin to San berdoo.

Bonzo, no need to get defensive, I’m just pointing out that I actually don’t know anyone who isn’t VERY financially secure trying to buy a house right now. 10 years ago, it was just the opposite, most people I knew who were buying a home literally had no money in the bank, they had to borrow money from family even for closing costs. All those people are now renters. That’s just my anecdotal experience and from reading news articles and this blog, it seems consistent with the rest of the country. The fallout from the great recession was that it damaged the credit of millions of people on top of destroying them financially and psychologically. The friends that I have who walked away from their homes were traumatized by that experience. Some have been able to buy again, but they would never over-leveraged themselves like they did the last time, it literally broke up families. I agree that people have short memories, but they’re not stupid. As for where to buy homes, I would only buy near where I work, I don’t believe in doing the 1-2 hour long commutes that a lot of people put up with in order to buy more house. Life is short, you shouldn’t spend it on the freeways. So yeah, I live on the Westside, I don’t actually know anyone who lives east of the 15.

Dean – your posts are an asset here.

Indeed, the crash of 07-08 was a life changer. People who went through it are cautious as hell, scarred for life. I met tons of people who’d had good jobs and were afterward doing things like peddling soap.

I met them because I was out on the street pretending I was Studs Terkel inquiring the great American public as to the status of its spare change!

Dean: it depends almost entirely on the lender. Some are looser than others. Some will put you through the ringer – for example, requiring you to prove the down payment is “seasoned” by showing 6 months or more of bank statements. Others don’t care as long as you have the money. If you’re upgrading to a new home with a plan to rent out your old one, some lenders require a year of occupancy before they will count part of that rent as income (typically 75%). Others will cut you some slack and count “potential” rental income and maybe charge a slightly higher interest rate or require a little more down. It varies WILDLY. I’ve refied several times in the last couple years and the worst so far has been Schwab. New American Funding was cake.

There’s a big real estate crash coming, in my opinion.

Be grateful the banks are not dishing out easy mortgages to you.

Meanwhile the property Vested-Interests/Flippers/Landlords etc are all spaced-out high that Gov is going to protect values, pointing to one of the no-influence schemes to help buyers, whilst behind the scenes, things tighten up and political change is set to come in.

——————————————–

The property Vested Interest have fallen for it – took the bait, entered the run and followed it to be torn apart near the high stand.

Young Renter Savers – all positioned just where they should be, knives laid against and inside the body of an over-extended, worn-out enemy, just ready to cut…

@bonzo

I’m still trying to figure out who they bribed to get that huge building in Glendora approved.

@GalaxyBrain

All I can say is, you win the thread!

It’s difficult to see the Jackson Avenue house in that picture; a lot of brown. They’re asking $1100.00 a square foot. I hope the lot is large. It will be interesting to see what it sells for, IF it sells.

If you must treat at your house like a stock, then act accordingly: Buy low sell high. Hint: right now is high not low.

Welcome to the epicenter of Silicon Beach. This Playa Vista property sold for $1.4M in august and now asking for close to $2M. Seeking around $550k profit in TWO MONTHS, I’m in the wrong business!

https://www.redfin.com/CA/Playa-Vista/5742-Kiyot-Way-90094/unit-11/home/8123582

I’m seeing a LOT of recently-purchased attempted flips. Houses bought in 2013, 2014, or even 2015 — bought long after prices had risen out of the 2009/2010 bottom — and now listed for an exorbitant increase. Latecomer Flippers, seeking huge profits despite arriving late to the party.

They should have bought in 2012 at the latest. Instead, they paid high, and are now hoping someone else will pay even higher.

SonOfAL- this is how bubble psychology always works.

Here’s an attempted flip gone bad: https://www.redfin.com/CA/Los-Angeles/1544-N-Doheny-Dr-90069/home/7121823. Bought for $3.05M in January, listed for $3.5M in February, and now after about 15 price drops is listed at $2.9M.

AFinLA: that’s one of the “Million Dollar Listing” realtors from that Bravo TV show. The douchebag guy. [Hard to tell you know, douchiest, I should say].

AFinLA, that house reminds me of an elaborate masoleum in Mexico where a dead Drug Lord would be entombed. It also reminds me of something that would appeal to a fame wh*re rich kid moving to LA to try to make him/herself “happen”; I imagine Instragram posts of idiots posing while rolling joints with $100 bills, laughing drunk bimbos spilling booze on the white patio seat cushions #yob!tch #wecool #daddysmoney #yay

AFinLA, a good example of why asking price matters. It informs us that the property will currently not sell above previous purchase price. Some will try to spin this as a cherry picked edge case and instead point to stale trailing data although the falling ask trend continues consolidation.

Enjoyed this entry. Renting for the win.

_______________

Everybody was making money on land, prices were climbing to incredible heights, and those who came to scoff remained to speculate.

-Frederick Lewis Allen

on US Real Estate in the 1920s

Galaxy, you keep renting and I’ll keep being a landlord. Everyone stays happy 🙂

I couldn’t afford to be a landlord just about everywhere in CA, but the business is going well in MT.

Jeff – By which you mean, renting out a 5 bedroom place for $800 a month to 7 people, who have to do things like yard work, shoveling snow, and selling pine cones on eBay to survive?

Thanks Jeff.

The support for my happiness is that landlords are taking the risk in the market for me, and that a major event is set to occur.

In the UK Government has recently turn hard on landlords. The move against leveraged landlords in the UK is nothing short of ASTONISHING; a new tax regime begins in 2017 but many landlords who are realising the consequences are beginning to panic now. I suggest we will see a similar move in the US. In my view the banks want a big crash so they can lend in volume to owner occupiers. It is the owners who are currently carrying the main risk. Banks have offloaded so much of their risk back to the market in recent years.

I will allow a UK senior Chartered Accountant to explain from this post made recently elsewhere. (BTL = Buy To Let = landlords with mortgages.)

_____

What makes your landlord hand weak is that if buy-to-let mortgage rates move up sharply and a recession hits and you find that you can’t secure the rents that you’d anticipated, the net cash flows on your property can turn negative. Now your work as a contractor generates income, but sometimes bad things happen.

You might find your contracting services are no longer required. The recession makes it difficult for you to get work and your buy-to-let investments, as well as sundry expenses like tissues and hand lotion, are bleeding your savings. A point would come where you might want to sell the BTLs so you could get out ahead. However, you’d find that a house price crash meant that if you sold the BTL you’d make a capital loss, (that is of course what the deposit is really for, to ensure that you and not the bank absorb the capital loss).

Hence you’d be looking at a situation where you thought the market was irrational (your BTL, in your estimation, was worth 400k, although nobody would pay you 400k for it) but the rate at which the negative cash flows and your own living expenses were bleeding out your liquid assets meant that you couldn’t hold out forever because eventually you’d run out of savings to pay the mortgages on the BTLs; you would no longer be able to meet your obligations as they fell due, i.e. you would be insolvent, but sometimes the market can stay irrational longer than you can stay solvent. That is the heart of the aphorism; it’s about holding on to a leveraged investment position when the market turns against you.

Late entrants are piss weak because in reality the gross yields people are signing up for are too thin to absorb much movement on rents or BTL mortgage rates, much less disadvantageous movements of both at the same time.

You’ve got it all back to front. The bank demands the big deposit because they know that you are weak. Arguing that you are not weak because you’ve handed over a big deposit is an interesting way to look at things, but in my opinion, completely wrong headed.

_____

Re the UK landlords who have been writing to UK Gov en-masse in protest at the new rules (beginning 2017), claiming tenants will be made homeless (not true.. they may have to move rentals but will eventually get opportunity to buy at crashed prices and no homes will get destroyed.. simply tenants become owners at much lower prices) and landlords will be made bankrupt, campaigning to try and get Gov to stop going through with it (but Gov is not going to back down).

_____

You exaggerate the consequences for renters. It is a pain in the @rse having to move, but it is not, “losing the roof” over your head, it is changing the roof. I’ve been booted out by landlords who were selling up. On one occasion I moved somewhere much cheaper, and on another occasion I moved to somewhere larger and more expensive, (because local rents appeared to have softened between 2007 and 2012 and thus the larger stuff looked like better value 😉 ).

Likewise, I think that you exaggerate the pain for BTLers. They take a punt; maybe they win, maybe they lose. If they are taking that punt because they don’t see any other investment that will give them the capital gains and investment income that they need to make up for the fact that they don’t have a pension, then the heart of their problem is not BTL, it’s the fact that they haven’t made adequate provision for a retirement income. If they took the what savings they did have and put it all on a horse, we wouldn’t (well, I wouldn’t) be here posting “Oh, the poor devils, the terrible pain!”, I’d just think that it was unfortunate that a fool had made their poor position worse by being foolish. The fact that ‘retail investors’ believe that there is a difference between leveraging up what little you do have and taking a punt on UK property in 2014 and betting on horses is bizarre to me, especially as we must have a sizeable cohort of 2007/2008 BTLers who got into the wrong markets at the wrong time and had their financial faces ripped off.

Finally, look at the risk reward profile for renters. Let’s say rates rise enough to make prices fall. Maybe during that correction they have to move, maybe they get screwed for an extra tenner a week in order to avoid moving. It’s not the end of the world. But maybe they gain the opportunity to buy at prices discounted by somewhere between 25%-40%. It won’t make a poor man rich, but the truth for me is that I presently regard part of my rent expense as the price that I pay for having somebody else take the balance sheet risk with an illiquid frothy asset that I would rather pay them to take than take myself.

_____

Look at the reaction of one landlord (below) in the UK. This is what over 1 million landlords are going to wake up to, and worse for those who are carrying a lot more on mortgage debt. The mortgage debt gets taxed like income from 2017. What a turnaround!!!

_____

For my rental properties the main problem for me is that the money I pay out each year to the mortgage companies, is magically re-defined by HMRC as ‘income!!’ How can money I pay out be called ‘income’? SO WHILE MY ACTUAL INCOME WILL BE £5,000, HMRC WILL TELL ME IT IS £95,000 AND PRESENT ME WITH A HUGE TAX BILL. And if interest rates rise further, as my income becomes a negative, they will tax me even more. You couldn’t make this thing up. It is an effective confiscation of assets, as I will have to sell everything (if my houses aren’t repossessed first) and make people homeless in the process, as there will be a glut in the market of all private landlords with mortgages (because this crazy policy makes Buy To Let unsustainable) and house prices could fall drastically with the over-supply. First time buyers won’t suddenly have the deposit and credit ratings to get mortgages and buy these houses. I think they will stay empty in poorer areas and get snapped up by corporations in more well-to-do areas. But it is uncharted waters, and anything could happen.

_____

Also see

http://www.housepricecrash.co.uk/forum/index.php?/topic/206811-osborne-shakes-buy-to-let-to-its-foundations/?p=1102812796

Some great replies by renters to a shocked landlord who, from 2017, is going to get hit hard by UK Government for taxes, as will so many others. There is £200Billion of Landlord mortgages in the UK, about the same as Greece’s debt. In effect, all the landlords mortgage debt will be treated as income, and they will be taxed on it, where previously they were allowed to set it aside as a cost (and pay no tax on it).

_____

It’s called POLITICAL RISK. Do not expect the future to always be the same as it is now. The rules can change. If you get caught out in it, as landlords, don’t look to blame anyone but yourselves.

I don’t know exactly what this guy does for a living (below), but I know, from reading thousands of his posts, that he is an elder poster, something big in finance, which is his speciality (numbers). He’s mostly UK housing market orientated, but keeps a close view on the US real estate market. Check out his recent views:- (Political Risk – there is a lot to be gained from a crash and fresh lending for so many market participants including banks, and of course, renter-savers.)

_____

FreeTrader: 01 August 2015 – 06:40 PM

For anyone who missed it, a US Census Bureau stats release a few days ago revealed that the US homeownership rate fell to a 48-year low in Q2 2015. This prompted a rush of articles and TV reports with the general theme that the American Dream is dying.

There’s been considerable debate over the causes – changing demographics, tighter mortgage lending, high student debt, declining real wages etc. – but real estate speculation by investors due to the Fed’s ‘wealth-effect’ low-interest rate policy is also seen as the culprit by some.

“We’ve noted that in places like California the big push in prices has come in the form of big investors, foreign money, and the ever present flipper brigade. Yet this trend is not only a coastal phenomenon. Contrary to stucco box sarcophagus loving boomers, the US does not revolve around Southern California. Big shock, I know. Large metro areas around the nation are following a similar path. The next generation of home buyers are priced out and many are viewing homeownership as a lofty if not impossible goal. Rents continue to rise and thanks to the big buy by large investors over the past few years, inventory has been siphoned off the market and regular families have been left in the lurch. We are quickly becoming a nation of renters.” [source]

“Since 2012, private equity firms bought several hundred thousand vacant single-family homes in key markets, drove up prices in the process, and started to rent them out. Thousands of smaller investors have jumped into the fray, buying homes, driving up prices, and trying to rent them out. This explains the record median home price across the country, and the totally crazy price increases in some key markets, even as regular Americans are trying to figure out how to pay for a basic roof over their heads.” [source]

As in the UK, this is a growing political issue , and despite already introducing owner-occupier subsidy measures similar to Help to Buy, I don’t think anyone will be surprised to see US policymakers taking further steps to reverse the trend and quell the disquiet.

Political risk should always be taken into account when making an investment. Politicians don’t give a fig about fairness, and they certainly don’t care who they ultimately have to throw under the bus in order to achieve their aims.

http://www.housepricecrash.co.uk/forum/index.php?/topic/205857-how-osborne-could-kill-btl/?p=1102765493

You can almost hear the sound of a barrel bottom being scraped in London, for buyers. Recent years buyers have stretched and stretched and stretched to buy at such very high prices, vs sloshy global money. The banks and the politicians have them in their targets. And the UK banks, like the US banks, can handle a proper prime real estate crash this time, unlike 2008, where there reflated and have sold off the risk to other market participants. Coming to US prime housing markets in the near future, imo.

————————

October 22, 2015

..Deutsche describes previous examples of house-price slumps, notably in Hong Kong and Japan, and writes:

There are multiple catalysts to suggest that 2015 is the turning point [for London]. The most significant are: impending higher interest rates, tighter macroprudential policies and a deepening politicisation of the housing issue. Again, all that needs to happen is for investors to think price outcomes are asymmetric, with low upside and large downside.

There is growing political risk embedded in prime London housing. It is not that prices cannot rise further. It is that the more they rise the greater the chance of a political backlash against further gains.

http://www.ft.com/fastft/412271/deutsche-bank-calls-time-on-london-property-party

Could you tell me why you are in the property business? I guess if you hold on long enough you use OPM to pay off an asset, but isn’t that true of any asset? The problem as I see is that with real estate you have property tax + income tax. Then when you sell you have cap gains or income tax again. Not to mention repairs or vacancies. Plus you have a lot of money tied up as a downpayment. Even at record high rents like we’re seeing, I feel that it’s hard to make any real money especially if you’re carrying a mortgage. Am I missing something?

Something else that’s is amazing from UK budget. Older landlords have been expanding last few years, in the belief that Government policy looked like it was always going to support house prices, and so they’ve added to their house portfolios. They’ve tried to capture “Generation Rent.” In so many instances they’ve borrowed against houses bought many years ago, to buy more properties.

The tax change (begins 2017) means they’re caught in a trap. They will have to pay big big tax (where previously they could offset their finance costs, they will now get taxed on it as income). They never anticipated having to sell the houses they bought many years ago; they expected to pass them down to be inherited by family. HOWEVER now this tax squeeze is going to mean more of them will be forced to sell property, and pay the CAPITAL GAINS TAX !!! Significant. Huge sums to find on selling property to pay the tax man. They are in a trap !! They’ve gone from smug, top cars, nice holidays, own homes worth $1m+ and lots of rentals, to taking about their own bankruptcy from 2017. If this can happen in the UK (and it’s a complete turnaround, and left overleveraged landlords in shock, and prices move at the margin) – then it can happen in the US. Wow. Political risk. Watch out for it. The banks are positioned. It’s no good to them to see houses worth $1m+ if they have no mortgage debt on it, and people paying them a monthly fee. Or in hands of other investors. Better for a crash and fresh lending.

————————

Other wisdoms from that UK Chartered Accountant (who is like the cleverest person I have ever read, and renting, awaiting a real estate price crash).

————————

RENTS CAN FALL

Also you’re totally missing the point. The anecdotal is consistent with falling rents, because the rental achieved recently is lower than the rental achieved earlier. However, we can add to the anecdotal because one way to square the circle is to propose that the BTLer/landlord took all that time because they couldn’t at first accept that they were going to have to accept a lower rent in order for the market to clear. Basically, the market stayed irrational* longer than they could stay solvent, so eventually they folded and let at a lower price. Now that suggests that some BTLers/landlords are simply unable to believe that rents fall, and you are giving the appearance of being additional anecdotal evidence to that end.

It also suggests two tricky questions for BTLers/landlords. How long do you keep a property void in order to wait for a pinch point in the mismatch between supply and demand to allow you to lock in the rent you want, and how many times does ‘bad luck’ on this score result in BTLers wiping out all their profits? On thin margins even a single month void is bad news. The take home message is that a wise BTLer/landlord with any sense wouldn’t hold the property void for too long. If that meant pulling the rent down sharply then plenty of BTLers/landlords will do just that, with the earlier entrants able to pull further down without turning cash flows negative. In the teeth of the next recession with all these piss weak late entrant BTLers desperate to avoid voids, rents could fall quite sharply. Sweet. Again, combine that with the end of FLS, BCBS RWA revisions and housing element of UC being trimmed and some late entrant BTLers/landlords are going to find that a 5% gross yield was just a ticket to an enormous capital loss on an investment with a negative carry. Double sweet.

* Irrational according to the BTLer/landlord, natch.

————————

That’s not what I’m suggesting. My point of departure is the assumption that interest-only lending into the market for residential property is monumentally dumb. As soon as anyone looked at it in the owner-occupier sector, it was immediate ended, in the face of lobbying from banks and whining from hoi polloi.

Yet post 2012, interest-only lending into the buy-to-let sector continued. Why?

(Because there is no plan, just people making it up as they go along, accident to accident, f**k up to f**k up, the survival of interest-only mortgage financed buy-to-let investment is just a f**k up waiting for a fix, nothing more, nothing less. They are not special flowers. They are morons picking up nickels in front of a steam roller. Is that a starter motor I hear?)

————————

Re many of the landlords recently writing letter to the UK Tax Authority (HMRC) to protest the 2017 changes.

————————

The amazing thing is, having now thought my way through it and done the maths, I can now understand what this landlord/BTLer is saying. He just spells it out as bold as brass. Words to the effect of “You can’t change the rules so that I have to sell, because if I do sell, I won’t be able to pay the CGT I owe the HMRC because I’ve already spent it on more houses.”

[….]How many of these thick spivs have in fact known full well since 2008 of the existence of this interaction between the extent of their leverage and the CGT that would be payable on disposal, should disposal be required or desired.

[….]Anyone who was marooned by the April 2008 change and then has continued to leverage up since then, wilfully keeping themselves marooned with their so called “highly geared property investment strategy” (FFS!) deserves to have their face ripped off by the Revenue.

Why the f**k are you writing them letters? They are coming to get you, you stupid f**kers. You don’t write letters to a hungry bear as it lumbers towards you. You haven’t the means to fight or hide, so you get to die (financially) with a dignity you’ve conspicuously failed to demonstrate so far in life, or you can just keep mewling. Old habits die hard, I guess.

—————————

If this total turnaround can happen in the UK (beginning 2017), leaving landlords panicking and astonished (even if only a minority of landlords have realised so far, with the majority of landlords are still asleep to it, playing Golf and going on holidays, and basically living it up on the lifeblood of renters rent, having not read or understood the news) – then it can happen in the US. Political risk.

Another by that Chartered Accountant, renting, waiting for a crash in values in real estate – in response to a landlord who has been caught out by the recent tax changes in UK. (The landlords and property investors.. well those who release the implications, for so many are blissfully unaware at the moment, are in shock. They are blaming renter-savers for influencing Government for bringing in the tax changes against landlords!)

__________________

It’s quite interesting to me that these landlords keeps returning to the idea of the renter-savers now being manipulative. I think that what is going on here is that for a long time two very different groups (portfolio landlords and renter-savers) have looked at the same underlying market and constructed entirely different explanatory frameworks and reached entirely different conclusions. The highly geared property investors of have got a lot riding on their framework being right on a continuing basis.

The essential difference boils down to the stability of these prices. How confident can you be that you can get your money on the table and then get your money and your winnings off the table before the market turns against you. A lot of people would have said that by 2003 you were playing a very dangerous game by pulling up a chair at the gambling table and making a leveraged bet on property.

Of course, with the benefit of hindsight, many people entering after 2003 will have been able to get their money and their winnings off the table. I regret that they were allowed to gamble, but they were, and there is no denying that if you were lucky with your timing, you could make easy money.

I still hold the same opinion. I am not sufficiently convinced that prices are stable at this level to start handing over every last penny of savings to a bank in order to buy a shit house. I am happy to pay a landlord to take that balance sheet risk on my behalf.

I’d rather we’d had a massive correction in prices and the extermination of the landlording sector, but that hasn’t happened yet, so I take the world as I find it and make a call. I sleep well at night. I feel no rancour towards the landlord real-estate investor tw@ts. The whole business is not a big deal emotionally for me.

What I feel is, as I’ve said before, sadness and grief; I think that Byron cut to the chase when he mentioned his anger at the fact that these clowns meant that family formation is delayed and thus some people have gone to their grave having never met their grandchildren, just so that we could have a societally destructive housing bubble.

For me it’s all about how do you respond to idiocy and iniquity. If you see a chance to make an easy buck and pile in, I think you are scum. I don’t think that’s manipulative. It’s just my opinion.

The reason why I feel that it is fair game to mock these landlord property-investors after this tax change is that they are missing the point on something so fundamental. The fact that many renter-savers hold a different opinion to them and try to argue from the evidence to support that opinion does not make us manipulative.

I’m not saying, “Golly, if I can make everyone believe this rubbish, I’ll get a cheap house” …….. I’m actually saying, “This is societally destructive unsustainable idiocy and I refuse to be complicit by an act of commission”.

I can’t stop some herbert property-investors ganging up with a shit bank and using my earnings to pay a landlord-mortgage……… but I can chose not to hand over my savings and sign up for a whacking great repayment mortgage.

The fundamental error in the snared landlords reasoning about renter-savers is that they are true believer in themselves and house prices in this bubble. They are failing to understand that an alternative perspective on him is consistent with the facts.

Amoral chancers disrupting other people’s lives by making a daft and unsustainable pact with a bunch of banks that are so crap that not so long ago nearly put themselves out of business.

Galaxy, interesting anecdotes. It’s common sense that there’s no free lunch which comes with a property purchase so all that leaves left over is for some participants to claim x, y, and z about SoCal allows it to operate in a special vacuum.

It’s often conveniently overlooked that rents move in two directions (nominally and real) but when you purchase a property, the cost basis is permanent. I’m not sure if it’s more sad or sorry that a lot of people think the government won’t continue to change the rules mid-game.

One of the biggest misleading untruths that gets perpetuated on the public is that timing doesn’t matter.

Hotel California – thanks.

Exactly no free lunches. And again agree, re rents move in two directions, vs purchase where cost basis is permanent (and cost can rise even when values fall, in a squeeze).

I’m not sure if it’s more sad or sorry that a lot of people think the government won’t continue to change the rules mid-game.

That’s their own look-out. I expect it and I look out for myself and my family first… not to bailout others who only see paradise ahead. They’re not helping pay my rent, in celebrating their ownership of houses and how much they’re worth. Or the extent of their landlord property portfolio. Or how they bought decades again and brag how much it’s worth today. It works two ways. Ruthless market decisions from this point. It’s my view political risk is going to impact hard in time ahead.

One of the biggest misleading untruths that gets perpetuated on the public is that timing doesn’t matter.

That’s their own look out once again. Perpetuated on public.. ? If they lap it up, as they do, they are responsible for their own market decisions. Especially with prices in prime as bubbled out as they are. I’m waiting for a crash, not worrying for those dancing about how much their homes are worth, or bragging about buying at high prices.

It is for each of us to take ownership of our own market decisions. It’s not a socialist paradise, that much is for certain, but one of extremes.

I can’t do anything for those who lap up ‘timing doesn’t matter’ and who choose to pay extremely high prices, that other would-be buyers recoil from. I certainly WILL NOT be part of BAILOUT 2.0 for the latest round of bubble-price buyers. It’s house price crash for me, and value for my family. My perspective is, you make your profit when you buy, not when you sell. Meaning, you have a duty to wait to buy at a price which makes economic long-range sense. Not pay any higher price (outbidding others in process). For those who do, they stand alone by their own market decisions.

Banks: They will want to lend you money at an inappropriate time. If they think you are a good bet they will want to ‘sell’ you money. The clever bit about selling is that the seller decides when they intended victim will buy, and the subtle thing about buying is buying exactly when you want to. If you let them suck you in you could be making fatal mistakes.

Math is math – it’s not my job to spell out all the risks, nor bail out, my competition. Certainly not at the prices they are paying in prime areas, when the paradise money flows slow to a trickle in next recession. I want to buy at value, not continue renting and hand over another taxpayer bailout to keep them in over-valued property, while my family rents for rest of our lives. No way. It’s a market. And the banks and political risk is closing in. Can’t pay the mortgage…? Tough; next time around it will be quick repos in prime. Banks can handle a big house price crash in prime. Make way for the renter-savers at much lower prices.

In the slightly extreme example where the buyer commits more than half of their salary to mortgage payments to begin with, the initial interest payment on a £100,000 repayment loan at a 15 per cent interest rate is the same as that for a £300,000 loan at 2 per cent.

Galaxy, for what it’s worth, I have been a landlord for many years and thus have been through a few cycles as a renter, owner-occupant, and owner-investor.

It would be nice if individual failures were held to account but increasingly the free lunches meme out of hand results in unnecessary distortions that impact all of us, so here we are.

Glad you’re sharing the perspective from across the pond as our respective nations continue to share and learn much from each other. I like England!

Mail order houses were just that, you ordered it from the Sears catalog and the kit was delivered by railroad. Sears stuff tended to be pretty decent, so if you were handy, and most guys were expected to be, you got a decent house with some work. Not a spectacular house. Not a Swiss chalet. Just a house.

I miss Christmas shopping in the Sears Catalog. (And not just because the lingerie section was my first pr0n …)

LOL, i was just talking about that to somebody last night…..oh the memories of the sear Christmas catalog……

The Sears catalog was great! And I even remember using pages from an old one for TP in an actual outhouse!

Yes, we also had a party line phone about then, too.

Bus rides were a dime if you were a kid, and you got a punched paper transfer.

I remember kitchen trash went out once a week, if not longer. Food was precious, and there was hardly any waste.

I don’t understand why anyone would be nostalgic for the 1970s.

That Culver City crap shack has got nothing on this HOT blank canvas…

https://www.redfin.com/CA/Los-Angeles/1324-W-59th-St-90044/home/7271340

https://www.google.com/maps/@33.987509,-118.2989359,3a,37.5y,202.39h,78.07t/data=!3m6!1e1!3m4!1stE5j45jpY-cP2UN0fcpjTA!2e0!7i13312!8i6656!6m1!1e1

More favorite Realtor words. Blank canvas. Imagination.

Property needs a little TLC but with an imagination this can be a great opportunity for any homeowner looking to get creative on this blank canvas.

Code words for “a piece of crap.” It’s on you, the buyer, to clean up the crap and replace it with something night.

I saw a description for a house that said “backyard awaits your imagination for a creative landscape!”

When I read that, I knew the “backyard” was just gonna be an expanse of empty dirt. Which it was.

“She lives on Love Street… ” – Jim Morrison.

http://www.ssa.gov/cgi-bin/netcomp.cgi?year=2014

51% of working americans make less than $30,000 a year

I’m pretty sure 51% of people here in silicon valley make less than half that.

Why are they still in Silicon Valley? They are priced out…move on.

Tasty – in my own case I made a bit over ten grand last year. I might touch twelve this year, dunno.

I have a free place to live, albeit without running water. At least I have the electric, and 1995 level internet.

Now, I could leave for flyover country and be homeless, survive the winter by building a soddy and sewing my own clothes incorporating down I save from birds I catch…. Or I can stay here where I get so so called enjoy a 20th century life if not a 21st.

Tasty – that is just my case. Most people here live many to a house, and family is golden. They push ice cream carts, work day !labor, etc. They don’t have high speed internet, or any internet. They don’t care. This whole future, progress, gonna live like The Jetsons thing is a dead end and they know it.

Extend and pretend continues…?

here comes 3% down payment loans

http://www.zerohedge.com/news/2015-10-19/freddie-mac-hopes-lure-millennial-home-buyers-new-three-percent-down-mortgages

Freddie Mac and Quicken Loans Enter Partnership to Make Home Financing Accessible for New Buyers

New Effort Dedicated to Building a Better American Housing Finance System Through Innovative Lending Solutions and Ongoing Education for Homeowners

Freddie Mac (OTCQB: FMCC) and Quicken Loans, the nation’s second largest mortgage lender, today announced a partnership to pilot several new initiatives aimed at helping provide more Americans the opportunity to achieve homeownership, while also building a smarter American mortgage finance system.

The program will feature unique, co-developed products to meet the needs of emerging markets, including millennials, first-time homebuyers and middle-class borrowers. It will explore numerous modifications and expansions to Freddie Mac’s current Home Possible mortgage products, and will also include continued homebuyer education. Home Possible enables eligible borrowers to finance a house with a down payment of as little as three percent.

The new Freddie Mac/Quicken Loans partnership was announced at the Mortgage Bankers Association’s 102nd Annual Convention and Expo in San Diego, CA.

“New Effort Dedicated to Building a Better American Housing Finance System Through Innovative Lending Solutions and Ongoing Education for Homeowners”

the only response to that is: FACEPALM

Love the language of this, I picture the fascists behind this wearing leather gloves to administer the beatings (until morale improves) but they’re pink with unicorns to exude a friendly, warm vibe.

Lure millenials – yep, thats what you’re trying to do – but too bad they can’t get similar terms on their student loans, lol. Aint buying houses with that monkey on their backs.

And “Building a better American Housing Finance System” – wtf?! I just picture a smoking crater at the end of this story. All these morons and their grand schemes, it never ends.

Put 3% down on a $600K shack bordering the ghetto! Your mortgage payments will only be $3500/month!

Even if that was 50% of income, someone would have to make $7000/month take-home to comfortably afford that. How many young people can afford that? Shit, how many established folks can afford that?

“Million dollar shack documentary looks at Bay Area’s insane housing market” – THIS IS AN ARTICLE ABOUT THE DOCUMENTARY. Do note the wise words of the real estate agent (sarcasm)– to paraphrase — “housing process will double in the next 10 years and this will go on forever!!!”

http://www.sfgate.com/aboutsfgate/article/Million-Dollar-Shack-documentary-Bay-Area-housing-6582122.php

anyone want to rent an (illegal) RV in Echo Park for $850 per month? (1 bedroom apartments going for $1600 per month).

http://laist.com/2015/10/20/this_is_echo_park_at_2015.php

excerpt

…We know housing is expensive and it’s hard to afford up-and-coming, desirable neighborhoods like Echo Park, but we’re not sure about paying $850 a month to live in a Winnebago motorhome sitting in someone’s backyard.

A Craigslist ad posted over the weekend is offering a “unique rental”: a Winnebago motorhome that’s 215 square feet and advertised as a one bedroom, one bathroom. The $850 price tag seems a bit hefty to us, considering the home is on wheels, and it’s located near Belmont Avenue and Rockwood Street, which is not even in the fun, bustling part of Echo Park. According to the ad, you can get all this:….

“There is a sucker born every minute”

“A fool and his money are soon parted”

Just some of my favorite quotes. I think it applies to some of these houses and the listing prices.

QE & 0% Amounted To Going

To All Who Sold The 20008 Bubble

And Telling Them Here’s The Deal:

You’ll Get 0% On Your Proceeds,

We’ll Get Free Liquidity, And We Need

To Set Rates At 0% To Enable That

For All Intents And Purposes, Though

That Removes Much/Most Of The Natural

Business Cycle’s Reparative Dynamic

(Not Really Reparative–The Sellers Were

The Good Deciding Part Of The Normal

Business Cycle–Shafted. As In,

Get Lost.)

0% Also Necessary Cause Massively

Rewarding Massive Failure And Folly

​Killed The Cat.

http://www.zerohedge.com/news/2015-05-20/caterpillar-what-second-great-depression-looks

But It Benchmarks Savings And Investment

To A Big Fat 0%, That Policy Now

Entering Its 8th Year.

That reads like rap lyrics.

What do you all make of this?

http://www.trulia.com/blog/trends/millennials-rent-or-buy/

I love to be informed regarding economic turns including real estate which is why I come to this site but boy I have logged too many hours reading about the doom days ahead and I am not sure if I believe it anymore.

Yes, I still believe there is a bubble waiting to pop but it will last a short time and the government and private entities will find a way to capitalize and turn things around. I am still not going to buy right away because I don’t want to blow our down payment on an asset that will fall but if wife gets pregnant and prices drop a bit I will jump ship. We make enough thank God to be comfortable if we buy way under our pre approval ranges.

Maybe I am a fool for not thinking everything will blow up hard but it is just getting to a point that the can keeps getting kicked and eventually we just keep paying and paying rent with no end in sight to this madness.

I dare not buy at these prices but an 8% drop is enough for me to feel like I am not getting completely ripped off, more is always better though.

I hear ya. At this point I believe that I’m a doom-and-gloomer by some quirk of my nature, and I just have to get on with life because, … I dont know… apparently whats wrong with the economic system isn’t that important to most folks? Or those who it is important to, have no power to do anything?

I’ve kind of given up hope on a crash as well. Guess we just have to make peace with how things are… boy, sure feels like serfdom to me. But other people seem to be getting by, I mean the sun still rises in the morning..

Doom and gloom is to not expect a reset. Optimism is placed not in the means of a “crash” but the outcome.

Some other good posts from elsewhere I’ve read recently, re the Housing Bubble and the explosion in landlording/renting, with market participants (landlords) seeking to capture younger ‘Generation Rent’ forever, in the prime bubble-market where ‘house prices can never fall’.

_________________

Banks to blame? Yawn. A lot of bankers did benefit, it’s just that plenty of other people also benefited and benefited much more in many cases. There are plenty of people who have made more through the housing bubble than they have ever earned in their lives. For landlords and prime homeowners or anyone with an inheritance the amounts are similar to lottery wins – hundreds of thousands or millions –

largely untaxed.

Those people wanted the banks to inflate the bubble, and they wanted the bailout. They may even be the reason there was a bailout, but none ever holds them responsible.

People love to blame banks for what happened, but millions of people were complicit. Most obviously the banks didn’t get any criticism when the damage was actually happening. They only get blamed for stopping it. Even now the middle aged middle classes are clamouring to go back to the days when the crisis was still looming, so they can play at being property developers and landlords.

_________________

The housing bubble. A big-boy done it and ran away. You have to be a pretty senior banker to have benefited as much from the Potempkin economy as a middle-class prime home owner, but no-one wants to talk about that.

_________________

Rentierism/landlording (multiple properties)

A strategy based on nothing other than a reverence of money, and a complete disregard for the havoc wreaked on the lives of others, both by running a very precarious business based on a never-ending supply of cheap money to corner a precious resource, and also by completely discounting the potential for upheaval in tenants’ lives if(when?) the money runs out.

They ought to be utterly ashamed of their overt avarice and the sooner insolvent chancers like these are systematically bankrupted, the better we will be as a nation.

_________________

Rentierism / Landlordism

You’ve just touched on something that I think is a fundamental failing in our culture. The inability to distinguish between productive and parasitic activity within a market economy. We’ve been brainwashed by neoliberalism to think that any distinction between activities within a market economy is marxism.

If I create a new product that improves people’s lives and enriches me in the process,then I have achieved the pinnacle of capitalism’s promise. I have – by helping myself – helped others.

If I buy finite resource with 100% borrowed money and then rent it back to someone who’s only disadvantage is that they not have access to as much debt as me, then I am engaging in completely parasitic and monopolistic behaviour. The idea that it is difficult/ unwise to distinguish between these two activities is a blindspot in our culture that never ceases to shock and depress me.

_________________

Response to a smug older homeowner with a house worth mega fortunes + landlord, telling renters to calm down; house prices have rocketed up, but that ‘nobody died’.

Indeed, but is this a question of death? Or about ensuring market participants bear consequences of their decisions without any artificial fiddling that makes the final reckoning much harder and destroying the standards of living of large swathes of the populace along the whole process. No, you said nothing about your beliefs explicitly indeed, but I can read between the lines.

That “nobody died” argument is another one from that league where bureaucrats can make arbitrary decisions of whom needs bailing out at the expense of whom and for what underlying purpose…

_________________

Re older homeowners, sitting on houses worth mega-fortunes, often with empty bedrooms, and not coming to market to cash them in (in my view because they have the belief they will appreciate to even higher values, and because they don’t fear a crash, because they don’t believe it possible, or much of a risk… their belief that values are locked in permanently).

______________________

The idea that older people don’t see their homes as investments is a ridiculous self-serving platitude.

If that were true, the age demographics of landlords wouldn’t be what they are, the newspapers wouldn’t print the house price of every serial killer and murder victim, and house prices probably wouldn’t be an issue.

Very few people can afford to ignore the value of their home, whatever their age, it’s a key factor in everyone’s decisions about housing.

I’ll repeat my earlier point, in the hope that reading comprehension wasn’t just a passing fad from my youth. We live in a market economy, of sorts. The selling point of a market economy is that selfish decisions should lead to an optimal allocation of resources.

The distribution of housing is not optimal. Why?

The elderly ought to downsize. Not that they should be forced to, like in a command economy, but that it ought to be the outcome of their selfish decisions, and it isn’t. That is a fact that needs explaining.

I claim that this can be explained by looking at the lack of incentives to move. Retired people don’t downsize because:

1. They don’t pay the costs of their decision, other people do.

2. Homes are investments, and the financial incentives beat the real economic incentives.

In other words, we don’t have a free market for housing. An alternative position is that we do have a free market, but free markets don’t work for some reason.

‘Some older people are poor’ isn’t an alternative argument. Nor is individual psychology, the relative mentality of demographic groups (as if such a thing even exists) or how anyone feels about anything.

wow, GalaxyBrain, those are powerful quotes and a perspective I had never considered before, but is now strikingly obvious. Thank you very much for assembling those.

Landlords

See image:

https://pbs.twimg.com/media/CR_T1s3WUAAMXzO.png

Yet your own view of yourselves as landlords needs to be broken by the wider markets.

You have the fragrant nice air on other peoples money/rentierism. It’s a long fall down, and you need to fall the entire distance, in a real estate crash. It’s the only way.

You ought to be ‘utterly ashamed of your overt avarice and the sooner such insolvent chancers like these are systematically bankrupted, the better we will be as a nation.’

A spectacular failure in landlordism is required to allow younger generations to enter market and prosper for next couple of hundred years.

Also all this property-investor junk has led to malinvestment. Too many buildings created that are simply for sloshy money profit chasing bubble world investors, rather than needs of families. In the crash, you can lose your own homes into a crash (with renter-savers buying cheap) and become renters yourselves, in your slaveboxes.

_____________

Renter-saver: When I was last viewing apartments, thinking I might stretch to buy, I almost always up against property-investor landlords as competition, rather than any first time buyers or other potential owner occupiers.

Other first time buyers didn’t always want a small apartment, they wanted a house or a larger apartment with a balcony or a little bit of garden.

The blocks of apartments were being sold to property-investor landlords because the first time buyer was not willing to pay the price asked or was not interested in buying a flat as a family home. That left a smaller group interested and competing against the property investor landlords.

In time, as prices escalated and fewer homes were built, in the areas I was looking at, there were only apartments being built. The occasional house being marketed was far far outside the price range for a first time buyer or even upsizer.

___________________

When I was viewing newbuild apartments they were blatantly being marketed to the property investor landlords. One company was guaranteeing their income for the first year. The marketing was not targeted at the first time buyers or owner occupiers.

So, it is possible that the market has an unwanted surplus of apartments, masked by the fact that,

1 Property-investor landlord demand caused apartments rather than houses to be built in the first place.

2 Although not really suitable, priced out tenants rent them because suitable houses, are firstly over priced, but also, not built in the first place because of property-investor landlord demand?

Landlords – The idea that you are somehow helping people is a complete fallacy, it would be like me cornering the market in dialysis machines, renting them to hospitals at inflated prices and then claiming I was “saving lives”.

Your simply a middle man in the chain between someone’s income and the mortgage payments to buy the house.

At the end of the day the world doesn’t owe you a pension, especially one funded by other peoples income while giving nothing of value back to the economy. If you want an income then make a real productive investment in something, start a business, get a better job and save more money i.e. do one of the things the people who incomes you arn’t able to farm anymore have to do.

Historical returns on S&P are actually higher at 10-11% per year. Granted inflation is low. Historical housing appreciation in USA is 3.1%, same as rate of inflation.

LA returns since 2000 have been 6-9% per year. USA median return has been 3.1% since 2000.

I have yet to figure out one credible reason backed with any data as to why this appreciation would so massively outpace inflation. Inflation does not account for that figure. Population growth does not account for the figure; population has been limited to 1% per year. Wage growth has not accounted for that figure.  Lower mortgage rates do not account for that figure. The rest of the country who enjoys the same lowered borrowing costs has not been anywhere near that rate of appreciation. Gentrification? While gentrification could explain certain targeted part of the city, it doesn’t explain >95% of the city vastly outpacing inflation. While rents have gone up considerably, the same rationale as above also applies to rents. Why would they be outpacing inflation and income? Current “market†rates represent a very small segment of the Los Angeles market as a huge amount of the population does not pay “market†rates for rents. Thus the actual “market†rate for Los Angeles is unknown (or at least can’t be looked up on Zillow).Â

I think I’m “quoting†Sherlock Holmes when I say, when you have eliminated every other explanation, the only explanation left, no matter how improbable is the answer.  Well the only answer is that the prices have been driven up not just by the mortgage junkies, but by people with money who can afford to pay too much for the houses based upon speculation. Rampant speculation throughout history has met the same end.Â

We’re not looking at a double bubble, but the slow end of one massive bubble that still has not met its death. Yes the bubble popped due to the financial crisis for speculative mortgages, but speculative pricing did not. The market has never found solid footing in Los Angeles.  Too much money from those who can afford it has propped up prices. It is no secret that current rental rates in Los Angeles are unstainable based upon incomes. It doesn’t even take much of a drive to get to areas that have undergone much more reasonable appreciation. When unsustainable prices are not sustained by wage growth, who is going to pay the ridiculous rents needed to justify the existence of the bubble?Â

Money can be lost by bad investments by institutional investors and rich speculators just as easy as greedy mortgage junkies. The only thing left to figure out is when and how will the market return to normal based upon fundamentals? The fact that Los Angeles is still in a bubble can be predicted by about the same certainty of that earthquake happening: 99.9%.

As a landlord, it would be helpful if there was a solid source of empirical rent data, but it doesn’t exist. Unlike property transactions, there is little to no public recording of contracted rent prices so we’re left with broadly vague ideas of going rents.

I don’t dispute that rents are increasing but I know I’m not the only landlord being conservative with rent increases for tenants worth keeping. I’ve been through this show more than once before – economy heats up and I can demand higher rents then it resets and rents come down to some extent.

Other wisdom:

____________

Action or inaction that is driven by sentiment is an expression of said sentiment. Sentiment which is not expressed through any means whatsoever cannot be discerned and therefore cannot be traded upon. Sentiment and the expression of sentiment are indistinguishable from an external standpoint.

Policy changes are as much an expression of sentiment as price movements. There is no rational reason why policy can’t front run price movements (there may be ideological arguments as to why it shouldn’t, but these are just that – ideological – and in practice sentiment is not so easily overridden) or vice versa.

On homeownerism working homeowners are not net subsidised. It’s specifically non-working homeowners and non-working landowners that are net subsidised. The net position is important because land rights require money to enforce, and surrounding value-adding infrastructure requires money to build, so where you have uncompensated for land rights you have to look at where the balance of taxation has been shifted instead because that compensation still needs to be paid and so somebody is paying it in lieu of the landowners.

Currently workers and businesses are picking up the tab via taxes on labour and productivity. This means that many working homeowners and working prospective homeowners (for home the situation is significantly worse if they are renting) are already effectively compensating for their own land use and then paying additional tax on top of that to compensate for the land use of unproductive others.

Homeownerism is the natural state, the thing which we evolved to do – shelter ourselves and our families. There is absolutely nothing wrong with that impulses. Landlordism, on the other hand, causes insecurity of shelter and all of the associated social ills that go with that and effectively imposes a greater burden of taxation on renters than on any other sector of society as their taxes effectively compensate for land rights and yet they have no free access to land and must pay for a second time in order to shelter themselves.

Everyone should have the opportunity to have security of shelter and the best way to achieve that would be through compensated property rights, a removal of all taxes on income and productivity, and widespread homeownership. Maybe those first two are pipe dreams but they are worth arguing for, and in the meantime we can at least practically shoot for the last one: house price crash!

____________

Also for my UK friends, I am so relaxed now that a proper house price correction is ahead. Gov is seriously taxing the landlords from 2017, and has them in a snare regarding Capital Gains Tax, from houses they bought many years ago, but levered up upon, to buy more houses!

_____________

Chartered Accountant (UK) – but also applies to US prime from my point of view

I’m going to hazard that in 2008 the banks went easy on the margin calls as they knew that the only thing that could save them was the government stepping in to fill the hole on the liability side of their balance sheet as the money markets closed to them. As Government did not want to see house prices collapse and that collapse to be interpreted as further evidence of his incompetency the lenders quickly came under pressure to put a halt to the fire sale (and were given assurances that they’d not be going to the wall).

Again, this time it is different. The liability side of the banks’ balance sheets are now to a much greater extent retail deposits which will not be flighty in a crash so the systemic threat to the solvency of the banking sector entire no longer exists. Further the systemic threat was so significant because there was no framework for handling the insolvency of a decent sized bank. Its books would essentially freeze – there is a reason that they bailed the banks, the alternative was worse. However, the Treasury immediately got the 2009 Banking Act on the statute books and there has been a practice run for the resolution regime with a minnow, which passed off without fuss.

Hence now the execs at the big lenders know two things. Firstly, they will be allowed to go bust. Secondly, they will know that if the bank they run goes bust, they will lose their nice little troughing job, and they won’t get another so good. They are going to throw the landlord property investors under the bus at the first sniff of trouble and each lender will know that they mustn’t dawdle with the mercy killings as their competitors would seize on the error by getting hold of and disposing the assets on which their loan books were secured before the opposition did.

The mechanics of all the leverage and the incentives for the lenders to murder their customers are extraordinary.

______________

Also points out that mortgage debt is a dog that won’t bark because there are $Trillions of dollars on the equity owner side now, and bank balance sheets might lighter, much better capitalized.

______________

Chartered Accountant (UK) – recently, after tax changes beginning in 2017, tapering in to 2020, but some landlords now panicking about early, foreseeing their own bankruptcy and a house price crash too. (Also Billions being cut from public spending too). They can rent whilst landlords panic these next few years. Watch out for Political Risk (and change) in US market too. If it can happen in the UK, it can happen in US prime too.

_____________

…you know that the most amazing crash is right around the corner (through the next few years) and after a decade and change of being wrong about the only game in town you can’t deal with the fact that you are about to be finally proved right, and that it was political risk what won it.

Cheer the f**k up. It’s on. House price crash.

_____________

And very fascinating to me, and where I think investors are completely wrong in a fallacy about supply and demand = values. The claim that there are too few properties, thus high prices, is not the entire picture at all, vs these prices. It can unwind.

______________

He seems to be accepting as an unquestioned premise the idea that prices are high because there is unmet demand for housing, however as we’ve argued a ton of times, rents are stable(ish) and whenever you want to rent you can rent.

If you want housing in the South East you can get it. It may not be quite as close to central as you’d like, but it’s there for the taking. Whilst house prices are out of whack with earnings that is not in and of itself evidence that there is unmet demand for housing.