Redefining Success: One Year of Inventory and 27 Percent Annual Drop for Southern California. Is This the Elusive Bottom?

Once again, for the umpteenth month in a row bottom fishing housing pundits were blown right out of the water. You need to realize that this is the first summer in many years that we are dealing with a very limited plate of mortgage products. Even last year before the August credit market pyrotechnic parade, many lenders were trying to squeeze in a few toxic mortgage products before the door entirely closed. This spring and upcoming summer we can already see that it is going to be brutal not only because $500 billion in option arm mortgages are set to start recasting, but the consumer is ultimately tapped out.This tapping out is coming at the behest of the great debt chokehold of this decade. Borrowing has gotten more stringent and this has put the breaks to our economy. If anything, the credit crack has been taken away from the consumer and it is now going into a full fledged withdrawal. The housing numbers for Southern California were released today and the results were once again horrific. Let us take a look:

| SoCal |

Median Sales Price |

||

| All homes |

2007-May |

2008-May |

% Change |

| Los Angeles |

$550,000 |

$422,000 |

-23.30% |

| Orange |

$635,000 |

$485,000 |

-23.60% |

| Riverside |

$406,000 |

$290,000 |

-28.60% |

| San Bernardino |

$361,750 |

$250,250 |

-30.80% |

| San Diego |

$492,000 |

$380,000 |

-22.80% |

| Ventura |

$590,000 |

$435,000 |

-26.30% |

| SoCal |

$505,000 |

$370,000 |

-26.70% |

*Source: DataQuick

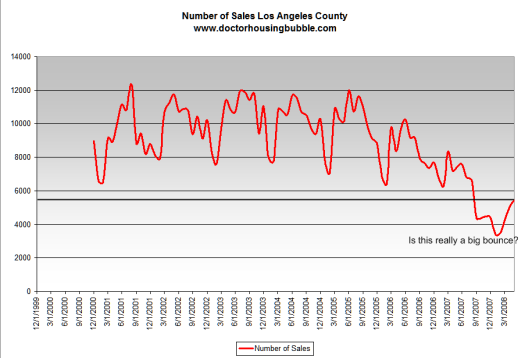

Does that look like a bottom to you? Southern California now has a median home price of $370,000 which makes all that preposterous push for $729,000+ mortgages rather pointless unless you are trying to bailout Ed McMahon. Even the elite Orange County is now at $485,000. Sure is a far cry from the $642,000 median price that was reached in August of 2007. Yet this decline is already set in stone. We already know the California housing market across the board is in the dumps. But how are sales looking for the most populated county of all, Los Angeles?

Keep in mind that bounce we are seeing is your typical spring and summer bounce. You can see that each previous year during this time, sales always jump up. Yet this summer we aren’t seeing the typical pizzazz accustomed to the Southern California market. If we have a few more months like this given the onslaught of option arms facing us, this will be a round two that will be absolutely worse than what we have seen with the current round of housing distress.

You also have to remember that many of the current sales are distressed properties being sold. We have a lot of bottom chasers hopping into the market thinking this is the absolute bottom. They will quickly realize that they over paid given that housing is still heading lower. How do we know this? Let us take a brief look at the current inventory for Southern California:

Total SoCal Inventory: 143,218

Total Sales for May 2008: 16,917

Total Months of Inventory: 11.8 months

Yet this number is flat out under representing the amount of inventory out there because many REOs are not placed in the MLS. Also, many notice of defaults are still technically owned by the current owner but they have no desire to keep the mortgage current. Take a look at the current data for California:

May 2008:

NODs: 41,965

NTS: 9,728

REOs: 20,237

Total for California: 71,930

Source: RealtyTrac

What is incredible about these numbers is that inventory from the MLS is steadily decreasing yet sales haven’t jumped up that drastically (see above chart). Yet we look at NODs and REOs and they are through the roof. So we can deduce the following:

-People that don’t need to sell right now are pulling their properties off the market hoping for a brighter day thus reducing elective inventory.

-Many REOs are not making it to the MLS thus making the numbers look artificially low.

-NODs are sky rocketing and many of these are simply zombie properties waiting to become REOs.

That is where we stand. The massive price declines in Southern California are simply reflecting the reality of the situation. My feeling is the option arm debacle will impact California beyond what anyone can currently imagine. Keep in mind that 60 percent of the $500 billion time bomb is here in the state. If numbers are this bad without hitting the option arm stride, can you only imagine once that happens?

A 50 percent decline which only a few years seemed out of a tin foil hat manual is seeming more and more possible. After all, the state is down 30 percent on a year over year basis and we have yet to face the biggest mortgage risk. Why in the world would prices stabilize given the above data? Does anyone really think this is the bottom?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

20 Responses to “Redefining Success: One Year of Inventory and 27 Percent Annual Drop for Southern California. Is This the Elusive Bottom?”

I live in the plains of Kansas and tried to get a friend who sold in 2005 a home he bought for 138,500 in 1993 for 383,000 to come out here and live like a king with incomes around $70,000 and housing around $150,000 for 4beds/3 baths on 5 acres… well he bought in Santa Maria for 565,000 no yard and thought he got a great deal since everyone wants to live in SoCal.. my comment at the time was great weather but horrible politics… now he wishes he was here as we still have housing for the same price and incomes around the same… even with our Tornadoes and hail we at least have a modicum of the American life left…

P.S. I have been to California many times and the one thing that bothers me everywhere I go is how much denial there is there about how the LA riots are just and isolated event…it is not.. people who are expecting a handout and live next to fabulous wealth are naturally jealous and will not put up with declining expectations much longer…

This is NOT the bottom – not in CA, not in DC not anywhere. It is that whole nasty little detail of incomes again.

***I am surprised that there is only an 11.8 month inventory on the MLS. In my county we are down 33-35% from 7/07. The median list price is $387,500 (and who knows what the median sales price is as nothing is selling) with over 2 dozen $1,000,000 – 8,000,000 properties. The inventory? Ah, there we have you way way beat. Our inventory supply at the current rate of sales of houses (houses, not land) is 35.7 months. Yep – a 3 year supply. The buyers of 2nd summer homes have vanished into thin air. And oh yes, the county median income has actually dropped over the past 8 years and is now $39,900 which down from the $42,000 in 2000. One can definitely say we have an income/price problem without the 2nd summer home buyers.

What I see is a housing correction that likely hasn’t even reached top speed yet, never mind scraping the bottom. At the current median prices you’re showing, houses are still way overpriced. Just because someone is willing to pay a certain amount for something, that doesn’t mean that that item is actually WORTH that amount. All it means is that someone is stupid enough to pay more than anyone else is for that particular item. When it comes to housing, American stupidity has never shone brighter or been more evident. Welcome to your new America, land of the fleeced and home of the naive, where cash is king and the king is circling the drain. Another great post, Doc, keep ’em coming!

Dr. HB. Hoope you take all your material and write a book. It will be fascinating.

I believe anybody who purchases during this time is still a fool. Prices still have a long way to go before they are in line with historic fundamentals. The only thing making these prices stay high are delusional realestate agents and sellers who have no clue why prices went up or why they are currently on a free fall. There is no way in hell a house should be worth more than 150$ a square foot unless you are living on the beach or it has baroque architecture with mosaic art on the ceiling. You are now starting to see the banks become desperate and lowering prices on some homes back to 1999 levels in cities like Downey, Compton, Paramount, Long Beach, and Lakewood. I am a proud renter sitting on the fence watching this catastrophe go down. I will gladly be willing to jump in once the smoke clears. Thanks for the insight and the numbers DHB.

Re: current inventory…Mr Mortgage did a great piece on ‘Shadow’ inventory. A quick estimate is 4+ years at the current sales pace. Lots and lots of REO stuff isn’t listed.

As for current buyers, all I can say is that the world needs knife catchers, too.

Thanks Dr.

Only the Faithful and Deluded sees current sales levels as a bottom. Dr HB, run a chart of sales “Ex Shorts + REO” (like inflation numbers, ex-food and energy) and then we’ll have something to compare year over year. I don’t think many people would like to see that kind of cliff diving in chart form, but the truth shall set you free.

We were at Disneyland this weekend and my husband overheard a couple talking about the new home they just purchased and how they were already looking for a better place to sell their current home and upgrade into. The man was saying that the new home should appreciated substantially over the next few months enabling them to buy the larger place. (They were speaking of million dollar homes, but in our neighborhood that could mean a 1800 sq foot spanish style 1930 home in need of repairs.) Clearly for some people the idea that the real estate market is suffering hasn’t hit home. A bit shocking actually in a time of easily accessible information.

son-of-curtis, the lustre has come off the Golden State for many. There has been a net out migration of middleclass whites for sometime now. Some are equity millionaires, doing what you suggested to your friend and others are just fed up with the congestion and high cost of living. In my opinion, you can’t really enjoy life in California without plenty of money. Being broke in California, and Dr. HB has gone to a great deal of trouble to point out, many if not most of its residents are, is worse than being broke elsewhere because what’s the point? $500,000 in most of America buys you a really nice home. Something it might be worth the effort and sacrifice to someday own. A $500,000 California Real Home of Genius

was an embarrasment to own and something one could only be proud to flip.

Couldn’t agree more Son of Curtis – the riots were not an isolated incident, and if the recession gets bad, you can expect dramatic increases in both property and violent crime, if not outright chaos (e.g., riots). You’d have to be a fool to live here without being heavily armed.

BTW, Dr. HB, when you try to reply to a specific comment by hitting the “Reply to this comment” link at the bottom of it, you get a scripting error – try it. Should be fixable.

scott the real issue is not the economic pain but the onset of reality that will cause social problems for SoCal especially… you cannot expect to defy the laws of economics of the mass majority providing for a small minority social equation and turn it into a small majority trying to provide for a mass minority…

The middle class provides the means for elderly and disabled to have a normal life… they cannot expect to provide the druggies, those disaffected socially, and any immigrant who wants to have a better life with that same type of life…

The social impact of those disaffected socially will be the issue… immigrants can and most likely will go home, druggies will find the law to be laid down more or less to them but the disaffected are the ones who will rebel at having to provide their own means… they think you owe them… this is not a race issue but a ethical and moral one…

I left Southern California in 1994 after spending the first 40 years of my life there. I never considered myself a California basher because I had a wonderfull time growing up and prospering there. I must admit however that I learned some very interesting lessons after I left. The media paints LA as such a glamorous place, as being the center of the univerise, and runs down anyone or any other place as being not as hip or desirable as LA. It’s just not true! The compromises that everyone make to deal with the congestion, the racial tension, and overall lack of moral structure in the populace are just NOT NECESSARY. Life can be very good when you are not forced to make these compromises. I feel sorry for the many good people who got stuck living ithe faded dream that LA has become.

As always, you are a great source of data and insight. the Greater Phoenix market is, like most places, in similar straights.

Our weekly foreclosure numbers have been holding in the 1400 range and are strongly effecting pricing in the resale market.

We are seeing significant rise in solds and pendings and a slight decrease in inventory.

The biggest saving grace to the Arizona market is our average residential home price is relatively low for a sunbelt state. We have a vital and diverse economic base. the downside is that our average income levels have not risen much and this makes housing affordability difficult for many… even with the lower prices.

Keep up the good work… it is much appreciated.

Jim

The dream is still alive. I just got outta the water, the waves were nice, nobody around, and the weather was perfect. I better get back to work to pay for the priviledge.

What do people think of the 12/31/08 deadline for the $729,000 FHA loan to revert back to the $500,000 range? If there are a lot of people with solid incomes but not much money saved for a downpayment, taking advantage of the $729,000 FHA limit in 2008 would seem to be a logical choice….once it reverts back to $500,000 or whatever it is come 1/1/09, you’re limited in what you can buy. Having said that, would we not see some bump in sales and a decrease in inventory as we approach the 12/31/08 FHA deadline, or will that be more than offset by foreclosures and typical fall/winter inventory bumps?

dbal you ask about the $729K FHA limit a d state that “If there are a lot of people with solid incomes but not much money saved for a downpayment, taking advantage of the $729,000 FHA limit in 2008 would seem to be a logical choice”

***** Slow down. An FHA mortgage of $729K will support a purchase price of $751K (97% LTV.) Under the FHA underwriting rules, the Principal, Interest, Taxes, Insurance and PMI (mortgage insurance) can not exceed 31% of gross income. (Front End Debt-to-Income ratio.) That means that the qualify for a $729 mortgage with 3% down, the borrower needs an income of around $18800 a month or $225,800 a year. That puts them pretty close to being in the top 2% of all households in the US (Top 2% start at $250,000, top 1% starts at $520,000.)

****Now HOW any households are in that income bracket?

*****A $500,000 FHA loan with 3% down and a purchase price of $516,000 means the borrower needs a monthly income of $12,900 or $154,800 a year. And that is in the top 5% of all households.

****Ergo changing the loan amount back to around $500K from $729K has an impact on less than 2-3% of all buyers. (And if at those income levels they do not have savings, they will probably end up in bankruptcy sooner or later from being profligates so it would probably, at most affect only 1/8 to 1/4 of those in that 2-3% which means it would only affect .025% – .075% of buyers.)

Ann is right, and what’s more, among those of us who are actually both in this income bracket and have the 25-50k+ downpayment lying around, how many of us are willing to buy into a very rapidly depreciating market? My cash downpayment would evaporate by the end of the year if I put it into a house, at least here in SoCal!

Hyperinflation is eating away at my savings very rapidly already, as by my measurements, my collective food and gas expenses have gone up by 2/3 or more since the beginning of 2007 (gas up 100%, food up 40% or more on many items I buy regularly), but not fast enough to dissolve $50k in a year! In contrast, if the projections by the banks, and the housing futures indexes are right, and housing values will drop another 30% or more over the next few years, a $700k home purchase would be $200k or more underwater by 2012! An FHA loan may get me a good rate, but not enough savings to make up for six figure depreciation – not by a long shot.

No, methinks that most people who can actually afford the mortgage on a $700k house will be sitting on the sidelines for a while.

Must be nice to be in that top 5% of earners. I have eliminated any extra driving, and have fed the family hot dogs for dinner 3 times in the last 10 days. I fall in the top 20% of earners. BTW the surf was again nice today, it’d be a waste to NOT get out there since it cost SO much to live here in SoCal vs (pick about 45 other states)

Response to surfaddict:

Good comeback on my comments about the faded dream. I do miss the surf and the beach. At my home overlooking the ocean in Washington State my stick sit forlornely in the back yard waiting for waves in the Puget Sound. I am glad you are enjoying your life.

Leave a Reply