Real Homes of Genius: Today we Salute you Riverside with our Real Home of Genius Award. Taking Porcelain to Another Level.

Sometimes you have to wonder if banks aren’t desperately waiting for the moment in which the government simply nationalizes the whole shebang. The mother of all bailouts. Call it the uber bailout in which we inject so much capital into the system that we actually become the system. After you see today’s Real Home of Genius, you will understand why I am arriving at this somewhat obvious conclusion.

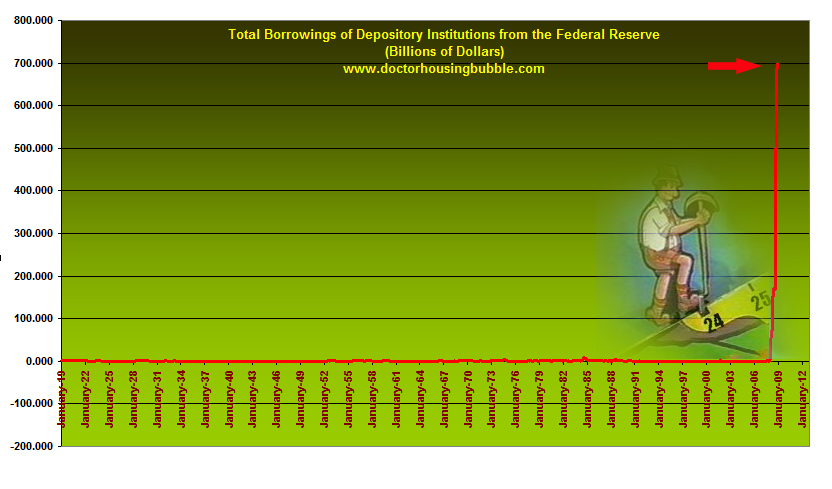

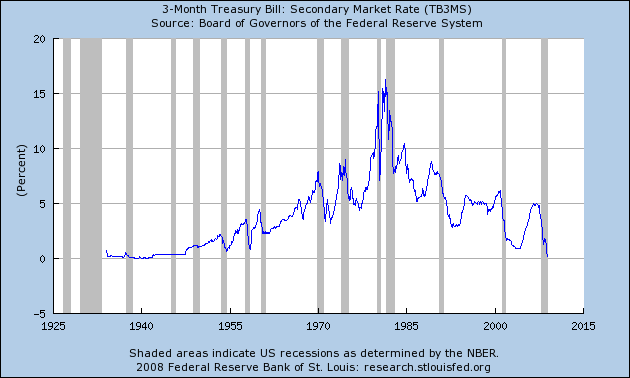

One of the main reasons central banks came about was the idea of the lender of last resort. That is, when banks stop lending who would be there to step in to fill the void? Ben Bernanke has pretty much put to rest any notion that the Fed is not only the lender of last resort but of first, second, and third resort. How much action is Bernanke taking with the markets? Let us take a look at a couple of charts:

*Click for a sharper image

These two charts do a good job summing up the current situation. The Federal Reserve is running out of arrows in its quiver. We have already reached 0 percent with the lowest term treasuries. In addition, banks are borrowing like mad already matching the $700 billion TARP amount through other mechanisms. The Federal Reserve has over $2 trillion on its balance sheets yet they continually deny the American public the ability to look inside its books. As the revered Madoff once said this is, “basically, a giant Ponzi scheme.”

I have to find some humor in that depository institutions are exchanging questionable assets for treasuries while at the same time we are injecting capital into them via the $700 billion TARP plan. Isn’t this like a double bailout? First, we already know that the assets they are exchanging are questionable. Why? If they weren’t questionable they would be trading them on the open market. The reason banks are still not lending to one another is because they know how corrupt their balance sheet is and what would make them suspect their neighboring bank would be any different? Early in the week, I heard Steve Forbes on the KNX Business Hour saying the government should suspend mark-to-market. I bet he would like that. How about we suspend any stock tickers from showing low bids?

Every once in awhile I see a home that shocks me in a certain way. Maybe the agent forgot to move the unsightly garbage can before taking the picture of the home. Or maybe the agent wanted to take a picture with two cars parked on the lawn. Sometimes it does make you wonder. But today we get a home where we say, “okay. Are you trying even just a tiny bit here?” Today we salute you Riverside with our Real Home of Genius Award.

Waiting for the 2009 Bailout

At first glance, we see that the home is boarded up and the grass has the foreclosure yellow we have grown accustomed to here in Southern California. Riverside is part of the Inland Empire which has been decimated by the housing bubble bursting. The median price for Riverside County is now $230,000 down a stunning 35% in one year.

The above home was brought to my attention by another shocked reader to the site. Given that we have covered nearly 100 Real Homes of Genius here in Southern California, it takes a lot to shock me with a home. Gutted homes. Steel pipes on the lawn. Big garbage can taking up half the picture of the home. Torn up lawns. You wonder if people are trying. Well in this case, it is taken to another level.

This home has 4 beds and 2 baths sitting on 1,954 square feet. A good sized home. Looking at the above picture, it appears to be in decent condition. The current zip code for the home above is down 42% in one year to a median price of $225,000. This home is lender owned but this picture will shock you so be forewarned:

Bwahahahaha! I went ahead and pixilated out the picture but I think you know what is behind the blur. I kid you not, this is from an actual listing. Now seriously, what in the world is the purpose of this? Going back to the beginning of the article, I hold firm that some lenders simply want the government to pop in and bail them out. Not help them overcome their economic problems but to take them over like some form of Soviet state planning. Why else would you post a picture like this? Maybe you think come 2009 we are going to get a blanket bailout.

So let us now look at some data:

Current Price:Â Â Â Â Â Â Â Â Â Â Â Â Â $170,900

Previous sales history

02/14/2006:Â Â Â Â $435,000

04/05/2005:Â Â Â Â $332,000

Okay, so the current price tells me they want this place to sell but that picture tells me they don’t. This isn’t like selling a $50 item on eBay and maybe someone just got lazy and took a really bad picture with an old cell phone presenting the item in a bad light. We are talking about $170,900 here. Maybe this home is a statement piece. I think someone may have found the bottom of the housing market here.

Today we salute you Riverside with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

19 Responses to “Real Homes of Genius: Today we Salute you Riverside with our Real Home of Genius Award. Taking Porcelain to Another Level.”

As usual, great job! I’ve been reading this blog for sometime and I think it provides the most insightful and comprehensive information available on the status of the housing and financial crisis in the country. It never fails to amaze, shock, and most of all, educate me. Keep up the good work.

Is that Revenge of the Real Estate Photographer? Glad I ate breakfast before reading your post this morning.

That there picture right there kinda says it all.

Bubble exhaust don’t smell like gardenias…

DrHB, thats one of the funniest things I’ve ever seen. and its real!

http://www.redfin.com/CA/Riverside/10347-Pendleton-St-92505/home/4784836

HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA

Whoo Hoo… laughed so hard I almost hurt myself.

One question for the agent… Do the t*rds convey??? HA HA HA HA HA HA HA HA

Almost as funny (or heartbreaking) is what the price was a few years ago.

You’re kidding, $170K for that piece of s**t?

Another great post from the doctor. Rates at zero, feds out of arrows, time to start the gold rush. History is our guide. Buy physical gold for protection and gold stocks for profit. Every other asset class is toast and bonds can’t go much higher once they’ve hit zero yield (the last bubble to burst…)

See the link for more info:

http://goldversuspaper.blogspot.com/2008/12/paper-revulsion-means-gold-profits.html

The closest cross street is Hole. So can we just call this one the “$hit Hole” property?

Spot on, as usual Doctor. Rates at zero, fed out of arrows and the race to hard physical cash and gold is on, just as Exeter’s inverse pyramid predicts (see link: http://goldversuspaper.blogspot.com/2008/12/paper-revulsion-means-gold-profits.html). The deflationary housing bust will overwhelm bureaucrats reflation and price stabilization efforts until the companies and citizens of this country, the true drivers of economic activity, decide the bust is over.

No no, Dr. The Ãœber bailout is the same as the Ãœber tax: INFLATION. Wait for it..

The listing says the house has two “full” baths. The realtor is just proving it. Seems reasonable to me.

Well the housing market may be going down the toilet/drain/tubes and taking the economy with it. But look on the bright side, not everything is going down the drain. Oh wait, I’ve seen the pictures, and that’s not actually a bright side is it?

Will the last employed realtor left in the state, please flush before they leave.

I call Realtor caption contest!!!

*Flush with potential!!!*

I’m sorry to report that I see many houses and condos depicted just this badly, here in our local market. Why someone could close the lid before taking the photo, I can’t figure, but I’ve seen something like this in numerous photos. More often, I see places where sweeping the floor would have helped, or washing all the dishes in the sink. And many of these places are “upscale”- 12-room mansions listed at over $1MM. It is like showing up for a job interview in your house-cleaning slacks, with dirty hair and no makeup.

I think the realtor listing this property should be sued for malpractice or just bad manners. What an idiot! I guess the commission on 180k isnt the same as 500 so why bother flushing the toilet? Realtors in the boom times just expected to make 10-15K on a property for showing up and now they need to do some real work. Just wait till these properties clear. Its gonna be a nuclear winter for a while and only the hungriest and sharpest will survive.

Thats the good thing about recessions. The ” cream” rises to the top and sets the foundation for the next boom. In boom times someone who’s competent,innovative and cautious has to compete against someone who’s slipshod,un-immaginative and reckless on equal footing because boom times make EVERYONE look like a genius. No body pays attention to detail in boom times, its just “:turn and burn”. It’s a distinct disadvantage to be “good” at what you do in a mania, but come hard times your not going to starve and in fact if you survive your going to be rich.

In the Redfin listing it says “Large rear yard ready to be utilized to your liking.”

~

;D ;D ;D ;D

~

oh my

rose

Methinks the owner/occupant made a farewell gesture before “walking away”.

Details needed!

What is the history of the cost of maintenance, insur., taxes, utilities, on

this house/lot (Riverside Calif?)

I think this picture demonstrates why I believe that often the worst “agent” you’ll ever have is a real estate agent. I guess agents of this sort were so spoiled by their windfalls during the good times that they can’t be bothered to exercise any of the sort of fiduciary responsibility one might expect to expect from a professional agent. The public defenders of the economic world; except with public defenders one has professional standards and some form of recourse if they aren’t met.

Thank God for the realtors who aren’t like this and I believe that their professionalism will be rewarded soon when they’re the only ones left still around.

Leave a Reply to Mich