Real Homes of Genius: Today we Salute you Inglewood with our Real Home of Genius Award. Incorporating Technology into our Economic and Financial Crisis. Shopping Cart Technology.

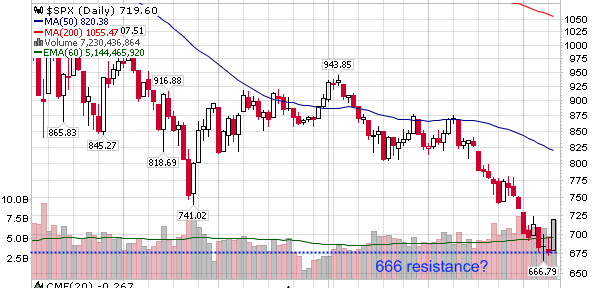

We are now in a “bull” market everyone! A “leaked” Citigroup memo discusses a word that has been foreign in the banking sector for much of 2008. Profit. The market enjoyed that even though it is based on the same fantasy of those that believe in elves and other mythical creatures. At least we enjoyed the Lord of the Financial Rings on Tuesday and the market shot up like it was flying on the next NASA rocket. Next, we have Boom Boom Helicopter Bernanke talking tough about how to solve the market and how we can prevent this mess from ever happening again (as if we are in the clear now). So today’s rally was based more on technical resistance and mere exhaustion of the market being so incredibly down for 2009:

So it looks like we have support at 666 which of course is interesting to say the least. The market shot up bouncing off resistance like a basketball. The Dow was up 5.8%, the S&P 500 up 6.37%, and the Nasdaq shot up 7.07%. It would be one thing if this bounce was precipitated by good news but it wasn’t. It was purely a technical bear market rally. Plus, throwing the book at Bernard Madoff probably helped a bit as a catharsis but there are higher criminals out in the markets operating. I know the pundits are salivating and we may in fact have a run up for some time but it will not occur because the fundamentals of the economy are sound. In fact, even after this historic rally the markets are down for 2009 by:

Dow:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 21%

S&P 500:Â Â Â Â Â Â Â Â Â Â Â Â 20%

Nasdaq:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 13%

Today’s home is another piece of evidence why the California housing market will not be bottoming out until 2011. This home is located in Inglewood California [hat tip HG] and includes a new variation of marketing. The new technique is called shopping cart technology version 2.0. Why would someone use such a technique? Think about the psychological implication of this for buyers; there is a deep connection of a shopping cart and buying stuff! Today we salute you Inglewood with our Real Homes of Genius Award.

Inglewood – Real Estate and Google Come Together

I’m always curious as to why people take pictures like this when they are selling something “worth” hundreds of thousands of dollars. In other Real Homes of Genius we have seen people leaving trash cans on their lawn as if this was a symbolic gesture or garden gnome. Yet I had not seen a home with a shopping cart in the real estate ads I have looked through. There is always a first for everything.

This home is 832 square feet with 2 bedrooms and 1 bath. The ad tells us that this is a “tear down” and that it is being sold “as-is.” You would think that if you were trying to sell a home like this you would at least remove the shopping cart from the picture but hey, this is California and anything can sell including homes with shopping carts parked on the front lawn. Or was that the mantra for 2005?

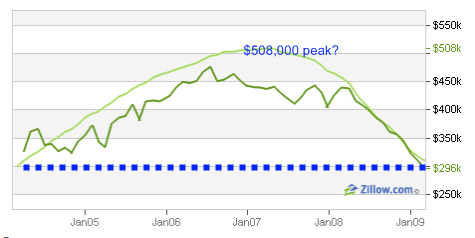

Nothing highlights the decline in prices in Inglewood like this chart:

According to the above chart, the peak reached in Inglewood was $508,000 which is downright nutty. I went ahead and pulled up the zip code data and the median price for last month was $365,000 which tells us nothing since the sample size is one home being sold. There is no sales history on the place so the angle here is that this place is being sold for the land. So what is the asking price?

$250,000

That is right. $250,000 for an 832 square foot home in Inglewood. And people think the bottom is here. We have yet to factor in the ominous wave of Option ARMs and Alt-A loans that’ll be hitting the market in 2009 through 2012. And thanks to Google Street View technology, we can get an idea of what we are buying here for $250,000:

Now this gives you a much better perspective right? You can see that this home is situated right next to an alley. You can also see all the additional amenities that you will get when you buy this place. Let us get another perspective of the neighborhood:

As you can tell, one side of the street is full of apartments. So to buy this place to live in would seem extremely expensive. But let us put on our investor hats and see what we can come up with. We are told in the ad you can possible build “10 units” but are then told to check with the city so who really knows. Let us just assume that we will be building four units on the lot.

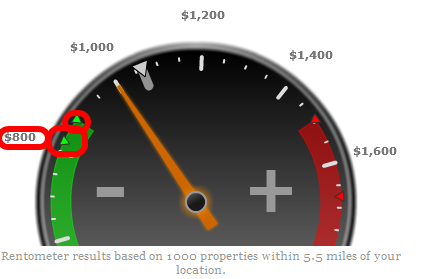

First, let us do some searching on local area rents:

Okay, we are simply doing a quick check here and it looks like we can build 1 bedroom places and rent them out at approximately $800 per month. So in total, we will be receiving $3,200 in cash flow simply from the rents assuming we manage the properties ourselves and have them occupied at all times.

But that is only one side of the equation. You need to remember that given how tight the credit markets are right now, you will need to go in with 30% down for investment properties:

$250,000 x 30% = $75,000 down payment

And this merely gets us the property. How much to tear down the home? Also, how much is it going to cost to build each unit? We are talking hundreds of thousands more. You think it is hard to get a loan for an investment property? Try getting a loan for demolishing and building more housing especially in California!

So even on the home alone, you will be carrying a mortgage of $175,000 probably at 7% or higher since it will be an investment property loan. Let us do the math on this note alone:

PITI:Â $1,424

And that is simply the cost to buy the home as is with doing nothing and going down with $75,000. Try factoring in the building cost and everything else and that $3,200 is gone. 10-units? If that is the case you are talking about years down the road before you turn a profit.

So instead of listening to those pundits telling you we are at a bottom, just do the math and you’ll realize we are still far away from any bottom at least here in California.

Today we salute you Inglewood with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

19 Responses to “Real Homes of Genius: Today we Salute you Inglewood with our Real Home of Genius Award. Incorporating Technology into our Economic and Financial Crisis. Shopping Cart Technology.”

A house with a shopping cart instead of a trash can…AND a disembodied floating head of Ben Bernanke WITH HAIR!?

~

Outta my way! There’s even a dumpster down the street for some bargain-hunting! I could use the SHOPPING CART to haul around that FREE STUFF! What an Opportunity! TEN units? Hell, let’s make it FIFTY!

~

Anyway, you are so right, DHB. Self delusion is still operating far and wide, and any “bottom” is yet to come, unless you count us all getting mooned by AIG and Citi.

~

I saw a property today in the South Puget Sound (on the Web, that is), listed for over $3/4 million. It last sold for $505,000 in 2006. Never mind the absolute disconnection from reality represented by the seller trying to tack on another quarter million at this point in the game (a sum that could go instead to snapping up that sweet Inglewood RHG!).

~

Even worse? The flatulent copy on the South Sound pile assures the reader that the house “is assessed at $1 million.”

~

Great, so I overpay for a house that I super-overpay for the taxes forever and in a compounding fashion (since subsequent assessments are based on previous ones)? And I do this as the house can command less and less and less in the market? That’s not property tax, that’s RENT. On your own damn place. Going to government. With no rent control. And if you say no, you lose your house.

~

So maybe this is the new spin. Values going down, inventories going up, assessments going through the roof anyway. But honey, we must be rich! We’re paying taxes on a million-dollar assessment!

~

rose

Last time we went to Disneyland, the night before we flew back, we stayed at the Motel 6 on Century next to the 405. We noticed that nobody was ever in the pool-it had a nice sheen of jet fuel on the top. At least you’re close to the airport.

So how does Citi get to claim they made a “profit” in the 2 months after a quarter in which they got a 45 billion bailout in cash from taxpayers and got to unload 300 billion in toxic assets, again funded by the taxpayers?

That shopping cart is a subliminal message to potential “investors” that you will be able cart out “shopping cart loads” of money from this property. Perhaps this real estate agent has a psychology degree they’re putting to good use here.

Mr. Housing Bubble. i enjoy getting these news updates but i want if possible to see more updates in places that are in Orange County close to the beach. how about Huntington Beach. it seems we still have a somewhat housing market that dropped at first but homes still seem too high. do you have any info on HB?

let me know

For those unfamiliar with LA: Besides being too lazy to move the cart, the RE agent that took the pic was afraid to get out of their BMW.

The shopping cart is there because the broker didn’t want to get out of the car and just drove by to snap the pic. Have you been to Inglewood?

Inglewood, like every community around it – is very overpriced. It happens to be in an ideal location amongst large business centers in LAX/Westchester, the Westside, Beaches and the South Bay. There are also many very lovely home and condo areas within the city as well as some very craptacular apartment ghettos – just like Culver City and Santa Monica closeby. This image is of this Inglewood property and neighborhood is the exception NOT the rule. I’m glad the Dr. highlighted the ridiculous pricing that still affects our smaller LA communities. As regular people lose their jobs in these business centers, and city funding collapses, everyone worries that these areas will quickly lose the working populations needed to sustain the neighborhoods.

Chuck, that’s how Citicorpse made a profit…by getting a gift of $45B while unloading $300B of toxic crap on the rest of us!

Could I maybe get about a $100K bailout while unloading my CC debt on the taxpayers?

Where’s MINE?

This place makes places in Compton look like Palos Verdes Estates. The good thing is the delusional trip the banks and sellers were on is beggining to wear off. It’s hard to believe that places like this one were selling for over 400K during the peak. I’m sorry to tell you DHB but your prediction of a housing bottom until 2011 is still to optimistic. With all the government intervention it will take until at least 2013. Anybody who buys before then will still be catching a falling knife unfortunately.

If you are looking for a HB blog check out the OC Register’s http://huntingtonhomes.freedomblogging.com/.

I’m sorry in advance if it is rude to list other websites on someone’s blog. I’m not sure of bloggin etiquette.

This may actually be near the bottom in dollar terms, since with the amount of dollars being created to fill the holes in bank balance sheets (about 10 trillion now), the value of the dollar will start to erode, as soon as this new money gets out into the economy. Within a couple years, I will not be surprised to see gas at $20/gal and a loaf of bread at $40.

You should provide home price data in ounces of gold; that will provide useful historical background.

@ Michael at 9:03am

That’s Dr. Housing Bubble to you, Michael. After all he didn’t put all those years in school to be called Mr. Housing Bubble. 🙂

The shopping cart is probably the only vehicle the idiot that last bought this place could afford after warding off tax lien, and it is probably also for sale on Crayg’s List.

Speaking of list, I think the Titanic is listing so far to port we will be bailing for a very long time. The good thing is that like this rally, when you get down far enough, it’s not too hard to get up (the legendary dead-cat bounce?). Since Citi is so far underwater, the corpse is just floating to the surface. All that flatulence should keep it afloat until the weekend when they shut it down.

Why buy that RHG and cart when you could instead get a quarter-million shares of Citi?

@ Michael

That’s Dr. Housing Bubble to you.

He earned his doctorate from real estate school!

Hee, hee!!

🙂

BTW, I love how Jon Stewart is stickin’ it to CNBC!!!

Planet of the Alt-Apes — The Optional Arm Returns:

By Les Christie, CNNMoney.com staff writer

March 12, 2009: 4:15 AM ET

NEW YORK (CNNMoney.com) — The foreclosure picture suddenly darkened again in February.

More than 74,000 homes were lost to bank repossessions during the month, up from 67,000 in January, according to a regular monthly report from RealtyTrac, the online marketer of foreclosed properties. Nearly 1.2 million have been lost since the foreclosure crisis hit in August 2007.

The number of foreclosure filings rose 6% during the month after falling 10% in January. Worse, filings leaped nearly 30% compared with February 2008. And the results confounded expectations: A downtrend had been expected due to the numerous foreclosure moratoriums in effect during the month.

in addition to bailout money, isn’t Citi also in the middle of a foreclosure moratorium? That would mean they’re not having to do many write-downs on loans this quarter.

While there are some areas of Inglewood that are nice, most of it is considered “the hood”. Translation, high proportion of blacks and a city that really is dangerous. People living in L.A. don’t consider Inglewood to be Compton or South Central, but to people in most other cities in America, Inglewood is a nightmare.

I would never drive to Inglewood on purpose.

I thought prices in California were coming down. I went on a real estate web site and looked at prices in Solana Beach near San Diego. You can buy a 848 square foot cottage with a galley kitchen for 1.9 million. Granted it is right on the ocean but for 1.9 million? If you put 20 percent down you can pay $8500 a month for PIT and then another 1500 a month for taxes and insurance. I dont take home $10000 a month, my stock account is down over a million dollars and I dont want to live in a two bedroom, one bath cottage for 9500 a month. Who cares where it is! Dr. Bubble you are wrong….there will never be a recovery! You see, the banks wont loan to anyone at those inflated bullshit prices. You need to be making over 250000 a year to qualify for that type of mortgage and for that you get a galley kitchen without a dishwasher. Insanity. The place is overpriced by 900000 dollars. Would you lend anyone 1.5 million dollars to buy this house if their name wasnt Buffet,Gates or Dell. I thought California got it. I guess not.

There will be a revolution or a depression…I am leaning toward a depression.

Leave a Reply