Real Homes of Genius: Today we Salute you Cypress. Wait 5 Months, Then Drop Price by $130,000.

Today California once again got its Hollywood ego back on the main stage with Wachovia announcing a major cut in their dividend and more problems with guess what, pay Option ARM mortgages. It turns out Wachovia acquired Golden West which apparently was operating with a one-track mind. It was as if they went to a buffet with every available cuisine in the world and all they wanted to eat was Mac & Cheese. Well now they are facing major indigestion and again it seems that every time we hear a chorus of bottom talk appearing, those pesky toxic mortgages keep rearing their ugly heads:

“CNN – Golden West was a leading issuer of so-called option adjusted rate mortgages (ARMs) – loans that give borrowers the right to pay less than the full bill – with a portfolio now valued at roughly $120 billion. Wachovia’s holdings of those loans are getting painful: Wachovia said its reserve for possible loan losses on Golden West’s portfolio of Pick-a-Pay variable rate mortgages surged in the latest quarter to $1.1 billion, while late payments nearly doubled to 3.1% of the portfolio.

While a possible $1.1 billion loss hardly seems newsworthy in this era of multibillion writedowns, the fact that 58% of Wachovia’s option ARM portfolio is based in California is problematic. Independent research boutique CreditSights argues that a new computer model put into use for Wachovia’s risk management is implying losses of between 7% and 8% for the Pick-a-Pay portfolio. That could mean another $2 billion of potential losses. The bank estimated that 14% of the loans appeared to have negative equity, or loan-to-value percentages of greater than 100.”

This is actually very telling. If the portfolio is valued at $120 billion and they’ve only face $1.1 billion of losses so far, they are being extremely optimistic that they will only have a little bit more. Not only that, we are then told that 58% of the option ARM portfolio is based here in California! You know, the state that now has seen over $100,000 shaved off the entire state median price in one year. People are finding innovative ways in dealing with this housing market including moonwalking away from their mortgage obligations simply because it makes no sense to continue paying on an asset that has lost tens of thousands of dollars. Given that foreclosure takes time and the foreclosure process is long, the concept of walking away is more of a financial and mental capitulation of paying the lender. Plus, in 2006 20+ percent of California borrowers went zero down. No skin in the game except a bad credit score. Many will stay in their place for much longer simply because the process can draw out so when we say walk away, we mean from the mortgage.

Don’t you love how they named a part of the portfolio the “Pick-a-Pay” as if you were playing a otto Scratcher? Pick-a-pay is such an absurd concept to begin with. The vast majority of people from recent data elected to pick the lowest option which created a negative amortization scenario.

Now we are seeing that this housing market is hitting the economy with two massive waves:

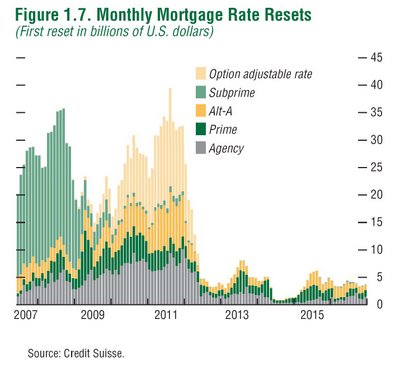

Clearly most of the pay Option ARMs aren’t scheduled to recast until 2010 and 2011 but it really doesn’t matter since the problems are now occurring simply because the economy is contracting. Now remember how they said 14 percent of the portfolio is now in negative equity? Those will not qualify for prime government financing. The option is pay and hope prices recover, short sell the home, or allow for a foreclosure to take place. Now the capitulation is hitting on all fronts with a recent survey showing that 60 percent of would be buyers are simply waiting it out:

“This is a great time to buy, but not necessarily to sell,” said Robert Jackson, who lives in a two-bedroom house in Ferguson, Mo., with his wife and four young children. He said he would love to purchase a larger home, but can’t because even if he found a buyer, he would probably lose thousands on his house, which he bought less than two years ago.

“We’re just going to have to slap a Band-Aid on it and stay here until the market gets a little bit better,” Jackson, 30, said in a follow-up interview.

Jackson is not alone. Sixty percent said they definitely won’t buy a home in the next two years, up from 53% who said so in an AP-AOL poll in September 2006. At the same time, just 11% are certain or very likely to buy soon, down from 15% two years ago.”

There still seems to be a cognitive dissonance going on in the minds of buyers and sellers. Those that are selling want to get top dollar and at the same time, be able to buy their dream home for the cheapest price. Clearly you can’t have it all and like the above person they would really want a bigger home but would have to sell their current home for a loss. Here is a sign of things to come. I made a quick observation that I thought Americans would be changing their habits based on the state of the economy but the above survey puts that observation to rest quickly. It appears that our nation is the Michael Jordan of debt spending. No matter what the circumstance, they would be willing to spend if someone would simply lend them the money. The only way the majority will stop spending when they literally pry the plastic out of their wallets. In the above survey, we also get this seemingly contradictory data:

“–The biggest worriers are those expecting to buy soon. Of that group 43% frets that their home’s value will drop in the next two years, compared with 25% of those not expecting to buy shortly.

–59% think now is a good time to buy.”

Given that 67 percent of the nation is a homeowner, many would need to sell their current home (see above how prices are lower) and want to buy a house at a better price (59 percent think it’s a good time to buy). You cannot have it both ways. That is why you either have a seller’s or a buyer’s market. By definition the bubble was a seller’s market and now, the massive drop in prices is a buyer’s market – yet just like peak prices were reached in 2005 and 2006, the trough is still a few years away. No longer do people need to beg for a ticket to wait for pre-construction condos. The tables have now turned but the psychology is still too optimistic regarding housing.

Real Homes of Genius – Wait, Wait, Drop!

Capitulation happens quick. Amazingly, the above chart that has been out for a very long time gave us a maximum inflection point of when the market would turn. It appeared that the first quarter of 2008 would bring on the worst in the sub-prime arena and clearly the market is now in a different point of the cycle. The above home has been on the market for 6 months, 5 of those with very little pricing action. That is until last month:

Price Reduced: 03/01/08 — $565,000 to $435,000

Price Reduced: 03/04/08 — $435,000 to $417,000

Price Increased: 04/09/08 — $417,000 to $430,000

This kind of pricing action shows two things. First, this is a distressed property so yes they are going to move quickly. Second, it shows that many models pricing homes in the current market were simply shooting in the dark. They were making it up as they went along. Why drop $130,000 in one week? Then why drop it another $18,000 in the next three days? Then a month later you pump it up $13,000. This is as random as pricing during the housing bubble. This home in Cypress is a 3 bedroom 1 bath home. But what is the sales history on this place?

10/27/2006: $535,000

10/18/1996: $155,000

If the home were to sell for the current price, the bank would be eating a $100,000+ loss. Now take a look again at the above data from the Pick-a-Pay portfolio that hurt Wachovia today. I’m not sure what is the exact loan on this place but we know that with $120 billion in loans in California and the fact that our state is in a massive $14 billion deficit, there is no doubt going to be more losses for the foreseeable future. This home appreciated $38,000 per year for an entire decade, nearly the median pay for an American worker. How in the world is that supportable?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

17 Responses to “Real Homes of Genius: Today we Salute you Cypress. Wait 5 Months, Then Drop Price by $130,000.”

If you use Schiller’s idea that homes should follow inflation.

1996- $155,000.

12 years at 3% inflation =39%

2008- 39% x 155,000 = $215,000.

Its still $200,000 over valued.

I guess we will have to wait until 2011 or 2012 to see that price.

Doc, once again, a home run.

Hey, ran across a site that may be of interest. http://www.angryrenter.com

They are pulling together an online petition against any housing bailout. And, since I didn’t get a chance to practice my mendacity via a liars loan, I have signed 6 times so far. 🙂 Worth a look IMHO.

Kudos again Doc. Your homes of genius always

proves that the income levels in CA and probably the nation

do not support current prices. It makes me wonder who in the HELL

is buying these homes, and if these folks are suffering from delusions of grandjuer? I do hope in the future this kind of bamboozling problem can be avoided. Thanks for the heads up Matt. I do not agree with any bailouts due

to the facts that these folks took a risk and lost. Just like if you invest in the Dow Jones and lose, that’s the way it goes.

Are these the poor souls that the government is trying to use tax payer money to keep them in their 535,000$ house on a 50,000$ salary. Aaaahhhh the poor souls, I don’t mind the government taxing me if they are using the money to help out all these would be flippers in California. Yeah right! It takes a year for all the foreclosures to really start affecting the price of homes. One year from today the median price in SoCal will be 300,000$. 2009 buyers beware because not much will be happening as far as resetting loans so the NAR will be speaking of a bottom all year until the resets in 2010 begin. Then it will be Housing Armageddon Part II.

This month’s Harpers magazine (not Harpers Bazaar) says that 55% of Americans believe their homes are increasing in value. Not sure how anyone can believe such a thing with ‘bank owned’ signs on every other street, but it does indicate that deluded sellers are more the norm than the exception.

As today’s wholesale inflation report shows trying to help the housing market is causing pain elsewhere. Rising food and gasoline prices combined with reduced interest income are probably hurting far MORE people than it is helping over extended homeowners to stay in their over priced homes. If you have an ARM and didn’t over-extend yourself to buy your house Bernanke’s interest cuts are like manna from heaven. You can afford the gas price hikes and have enough left over to buy some $9/lbs steak for dinner. However, if you are overextended on your house payment shaving $1 or 2 hundred dollars per month from your payment may only delay the inevitable and leave you pinching pennies to pay for your gasoline and the closest you’re going to come to a steak bbq this summer is the smoke from your neighbor’s grill. Since nothing Bernanke or the Feds can do is going to restore housing prices and without that carrot to keep people on their mortgage treadmill the best that can be hoped for is to slow the foreclosure

tsunami so it doesn’t collapse the financial system. How that can be done IF it can be done is what ought to concern the FED, the Congress and the American people not worrying about keeping upside/down overextended borrowers in their homes. The only solution I see is to stimulate demand for housing especially for first time buyers. Any ideas?

I have a question that maybe someone can help me with. My wife and I just about have enough to put 20% down on a property up to $350,000 in Los Angeles and surrounding areas. How can we best educate ourselves to tell when it’s time to jump in? I don’t want to jump in when prices are still too high, but I also understand that it’s impossible to jump in right at the bottom without some luck/planning involved. What indicators do I have to look for that prices are or about to bottom out? Thanks for any feedback. Great website! I can’t get enough. It has really opened my eyes.

long-time reader, first time post.

your blog is absolutely priceless and i just realized i’d never taken the time to tell you so.

i followed the link to the moonwalk (which i musta missed somehow) and laughed so hard the tears were rolling down my face.

You are TERRIFIC.

meli

man i love reading these blogs, its seems the only way to get any factual info any more is through sites like these, all the other forms of media are filled up with payed actors speaking in a sunshine diluted language of lies for N.A.R and C.A.R. with the total lack of transparency in the american financial sector fact of the matter is, no one knows where the next bearsterns is comming from and how hard its going to rock our banking system to the core. sooner or later the fed is going to run out of %.75 emergency cuts, and $30.000.000.000 power infusions of cash for bail outs and be faced with the fact you all point out, no one in america can afford this. its not just the housing market that bubbled, but all of american spending. this housing market seems to be a giant black hole pulling in any thing thats even close to it, and the more you throw at it the more it pulls into the giant void that is unpayable debt. its roots in american culture and spending go way back and there is no bail out in the world thats going to fix a problem thats this big. when you have floating currency, not paying your bills is a bad idea for the value of that currency. perhaps the fed should think of that at its next meeting.

Yeah, about that moonwalking stuff. What would you do if you were 68 semi retired supporting your youngest daughter and her three kids and upside down on your house? I’m worried about my parents….

gael’s post is quite sobering. Were it not for the ‘upside/down’ part and age 68 I’d say move to Houston. Location, location, location is what they say matters in real estate. Not anymore. What goes on in California, Las Vegas, Florida is now

pulling everyone else down. Including Houston. Imagine a city with abundant jobs, affordable housing and yet housing sales decline month after month even though the median price is under $160,000. It is happening. Still pain is relative. Houston sold 5100+ homes last month but now the big ticket ones aren’t moving.

Imagine that! I mean you are an oil company employee. Maybe one of those off shore types who work on drilling platforms and make $100,000+ per year. You want to move to a suburb with good schools and have a small swimming pool in your backyard so your kids can have fun. You find a 4 bedroom 3 bath house with a pool for $400,000 and you think you are ‘ in like Flynn’ but you are not! Now the banks are skeptical. They look at you like you are made of dirt. You might be one of those ‘moonwalkers’ Dr. Housing Bubble speaks of. Never mind the only time you were in California or Las Vegas was when you were on vacation or serving in the armed forces. You are suspect now because of the moonwalkers, the deadbeats and the speculators. Well, no one ever said life is fair and in Houston it sure isn’t.

Omar, your best indicator is to track the number of months of inventory on hand in the area you are looking to buy. Last I heard the LA area inventory number is up at between 11 & 12 months. While nobody can time the market, a good sign will be when that number comes way back down to between 4-6 months – which could possibly take anywhere from 18 months – 3 years from now. Don’t get sucked in too early!!! Good Luck!

“What indicators do I have to look for that prices are or about to bottom out?”

When we hit bottom prices will be stagnant for a few years.

Thanks for the comments. I guess I have a ways to go then. Better for us since we can continue saving. It’s incredible to actually see prices coming down. I am beginning to find $350,000 properties in real nice areas where you couldn’t find anything below $500,000 just one year ago. I wonder how much lower than will go.

Worm, I’d go with somewhat higher assumed inflation, maybe putting the house at 245-280 for 4-5% inflation (assuming we are going for the trend line and not an overcorrection), but still overpriced by AT LEAST 150k, assuming 5% annual price gains/inflation over the whole 12 year period. Give it another year or three and we’ll see that 150k slide and perhaps more.

When looking for a bottom in the bond business we have a little saying that goes along the lines of “It’s not quite shoot yourself time, but it’s definitely get the gun out and clean it time”.

Wait ’til you hear rounds going off, Omar, then you will know.

Reply to Omar’s question:

When should you buy? When the price for the home is

3 times your yearly income.

When your monthly mortgage payment on the house is

at least equal or less than going rental rate for this type of property.

Keep saving your money… the higher your downpayment the better.

In the mean time rent… but make sure that your landlord has a proven

track record and isn’t already in foreclosure or behind in his mortgage.

Leave a Reply