Real Homes of Genius: Today we Salute you Beverly Hills 90210. Making $1 Million in Home Equity Disappear.

I’ve been getting numerous e-mails about doing another Real Home of Genius article and today I have found another excellent home in the 90210 area code that highlights the mortgage shenanigans of the last decade. As it turns out, Beverly Hills is having more and more foreclosures hitting the market. This has come to the forefront with the very public foreclosure of Ed McMahon and his $5 million home. Yet before you feel sorry for Ed, news broke this weekend after TMZ got their hands on a court filing from Citibank alleging that he owes approximately $180,000 as well:

“(TMZ) Ed McMahon: No Money, Mo’ Problems

Now Citibank has filed suit against the foreclosure-plagued star, alleging he owes them roughly $180,000. As we first reported, Ed’s wife Pamela’s out of control spending is gonna put him on the streets. Am Ex says he owes them nearly $750k. Time to cut the credit cards, Ed!

McMahon’s rep had no comment.”

You can go to the site to view the actual court filing but rumors of outrageous spending are looking more and more realistic. Ed and his wife Pamela appeared on CNN’s Larry King recently to plead their case but this looks more like a case of not being able to reign in your spouse and manage your own finances. If you have an out of control spending spouse you have two options; get them in line or get rid of them. Otherwise, get used to feeling broke even though you are a millionaire.

Is it any wonder that money is the number one reason for divorce?

“(Find Articles) Money enables people to buy many things; unfortunately, it can’t buy happiness, love or a lasting relationship. And surprisingly, money turns out to be the leading cause of today’s divorces.

Fifty-seven percent of divorced couples in the United States cited financial problems as the primary reason for the demise of their marriage according to a survey conducted by Citibank.

Financial incompatibility is one way of explaining the reason money is the primary cause of divorce, says Cheryl D. Broussard, a registered investment advisor and author of the book The Black Woman’s Guide To Financial Independence: Smart Ways To Take Charge Of Your Money, Build Wealth, and Achieve Financial Security.”

Now this should be rather obvious. If you are frugal and your spouse can’t drive anything less than a Mercedes, you may have issues down the line. In California, the home of Beverly Hills and Hollywood many marriages are based on power, fame, and money. In an almost ironic twist of fate, the divorce rate may actually fall given our economic conditions. During the Great Depression folks delayed marriage and the divorce rate dropped sharply:

“The Depression changed the family in dramatic ways. Many couples delayed marriage – the divorce rate dropped sharply (it was too expensive to pay the legal fees and support two households); and birth rates dropped below the replacement level for the first time in American history. Families suffered a dramatic loss of income during Herbert Hoover’s term in office, dropping 35% in those four years to $15M. This put a great deal of stress on families. Some reacted by pulling together, making due with what they had, and turning to family and friends for help. Only after exhausting all alternatives would they reluctantly look to the government for help. Other families did not fare as well, and ended up failing apart.”

So there might be a silver lining to some of the economic hardship we are experiencing. Yet many are still living their lives as if the easy money of this decade was still flowing from the credit fountain. Today we are going to look into a home in Beverly Hills that exemplified the mortgage mess. It has it all. Cash out refinances and a massive foreclosure that will burn a few lenders even though they are still hopeful that something will give this summer. Today we salute you Beverly Hills with our Real Home of Genius award.

Real Homes of Genius – It was fun While it Lasted

People not from the Los Angeles area sometimes do not realize that Beverly Hills also has modest homes. Normally the visions that enter the mind when one thinks of Beverly Hills is of palatial homes or Shannon Dougherty. Okay, maybe not the latter but the 90210 area code does bring lifestyles of the rich and famous. This 2 bedroom 2 bath home sits on 1,700 square feet. Not exactly the mansion you may envision but here in California you pay for the zip code, not the home. As you can see from the current $1.5 million sales tag, this home does carry a premium. Yet that number does not tell the entire story.

First, it would help to get a little sales history on this home:

Sale History

06/03/2004: $890,008

12/05/2001: $700,000

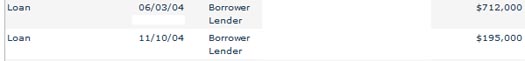

Nothing really out of the ordinary here. Again, we get to see the ridiculous bubble gains during this time. I caution to call this appreciation. This is like saying Yahoo! stock going to $100 was a gain. It is only a gain if you sold out and have the gains liquid. Yet you’ll be amazed how this home was financed in 2004:

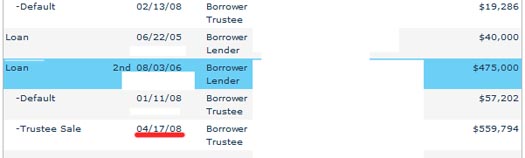

Someone purchases this home in June with a nice even 80 percent loan. But in the era of milk and honey, why let the equity sit? It is time to cash that baby out! So we see a few months later a loan taken out on the home to the tune of $195,000. So much for that cash cushion. Remember, this is California so people were using their homes like a piggybank and many must have felt that money grew on trees. The following year in 2005, it was time to refinance and get some more money:

Money is fantastic when it grows on trees. A year after the purchase and only a few months after the previous refinance, it was time to refinance the 2 bedroom home once again. This time, $1 million was the new loan and why not get another $40,000 just for the heck of it? If you aren’t from California, this is what you’ve been missing for the past decade. This is the type of mortgage fun that a taxpayer bailout is going to help. Don’t you feel bad for folks like this? I mean, $1 million doesn’t buy you what it once did so please ask your government to support people like this here in California.

You would think that the fun would end here but this bubble has still got legs! Talk about squeezing cash out of a 2 bedroom turnip. In 2006 as the nation was starting to have cracks in the housing market, California was only gearing up for more bubble mania. Let us look at what occurred in 2006:

Look at the above carefully. That is a 2nd mortgage! Bwahaha! Someone at the peak of the California bubble gave this 2 bedroom home a $475,000 2nd mortgage. So let us catch us up to the current loans on this place:

$1 million

$40,000

$475,000

Total of $1,515,000

Someone was trying to imitate Ed McMahon here who only lived a short distance away in the 90210 area code as well. Who said prime areas never go down in price? Well you can take a wild guess as to what happened after it all came crashing down:

Why go on a rollercoaster when you can take a ride on Southern California real estate? The home is now bank owned. The current sale price as you can see from the listing is slightly below $1.5 million which of course is a pipe dream for the current note holders. They are wishfully thinking they can get this to recoup their losses but the size of the 2nd is much too large and I’m sure the 2nd mortgage holder is hoping this place goes for the current list price. 126 days on the market and still no movement. Let us look at the Zestimate:

Bwahaha! Anyone want to offer $2 million for this place? This is exactly why California is in such bad shape and will only continue to go lower. On Friday, our unemployment numbers came out and the state now has a 6.8% unemployment rate. Just wait until July when they start digging into the $17 billion state budget short fall and the $500 billion in pay option ARMs start recasting. No type of reality show is going to make this 90210 mishap look glamorous.

Today we salute you Beverly Hills with our Real Home of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

7 Responses to “Real Homes of Genius: Today we Salute you Beverly Hills 90210. Making $1 Million in Home Equity Disappear.”

Will we ever see true capitulation on this one, where the trustee accepts a bid of under a million–pehaps the 560k listed on the last sale?

If we do, then I am back in the hunt for a house–but not this one, and not any zip code 90xxx. You can keep the roller coasters to yourselves, please.

The cool-aid in Beverly Hills must be green flavered.

After reading so many stories similar to this, I’m beginning to wonder if I missed the boat and never have an opportunity to get my hands on so much cash and never have to pay it back. Whats so bad about 300K plus cash in hand and a foreclosure on your credit report.

It’s true: Beverly Hills does make me think of Shannon Dougherty. And the absurd spread that Tori Spelling’s dad built. And Jethro Clampett.

The horrible reality of these homes is that people who had nothing to do with real estate are being fleeced because they owned bank stocks. Nice, safe, secure, dividend paying bank stocks. Real wealth is being destroyed at an astonishing rate. Tens of billions of dollars every week. Money that was in people’s IRA and 401K’s. Pension funds for policemen and schoolteachers. College tuition savings.

Gone. Money people assumed would be invested prudently by sophisticated loan officers at venerable banking institutions. Instead they find out their bankers were in cahoots with con artists posing as mortgage brokers, carnival barkers with real estate sales licenses and flim flam artists posing as buyers. Only a tiny handful of these criminals will ever be prosecuted and even less of the money

ever recovered. Our justice system cannot stay ahead of the scam artists. As soon as they shut down the World Coms, the Enrons and the Tycos the next con game is already underway. Sometimes I think we need an electric chair right inside the New York Stock Exchange with a CEO sitting in it every few months to act as a deterrent. Nothing else seems to work.

Just found this site for the first time. Really enjoyed the post. It’s interesting to see these examples and the five year history on how the home unraveled. It certainly makes you think twice about bailouts – it’s hard to root for anyone involved in deals like that to get let off the hook.

Before Ed McMahon: Pamela’s Federal Tax Lien, judgments and liens

http://www.webofdeception.com

Leave a Reply