Real Homes of Genius – The bubble city of Santa Monica. When shadow inventory dominates prime cities and foreclosures still sell for $739,000 and are listed with 935 square feet.

What is hard to believe is that many cities in the Westside of Los Angeles still remain in what one would designate as housing bubbles. A large part of California culture simply does not shy away from diving into massive mortgages even if incomes do not justify current purchases. Just drive on the freeway and you would think that everyone was making a high six-figure income by the cars they are driving. Of course when we pry into household income data this is far from the reality and we realize that many are simply living way beyond their means. All hat and no cattle. This week we found out that California revenues came in a stunning 10 percent below expected projections setting up more problems down the road. The stock market is back to casino like behavior and confidence is still brittle. Today we will examine a bubble city with Santa Monica. Santa Monica is an odd sort of area because you have extreme wealth mixed in with extreme posing. Yet the cracks are there if you only know where to look for them. Today we salute Santa Monica with our Real Homes of Genius Award.

Santa Monica foreclosure situation

1514 MAPLE STREET, Santa Monica, CA 90405

Listed   08/09/11

Beds     2

Full Baths            2

Partial Baths      0

Property Type  SFR

Sq. Ft.  935

Lot Size 6,299 Sq. Ft.

Year Built            1941

The above home is a 2 bedrooms and 2 baths home located in the 90405 zip code of Santa Monica. The place was originally built in 1941 and comes in at a whopping 935 square feet. Yes, this is a home and not a starter apartment. The advertisement on this place cuts to the point:

“Bank owned reo! 2 beds 2 full baths. Hardwood floors. Dining room. Garage is semi converted with french doors but there is a second one car garage. Extra addition at rear of garage.â€

French doors? Who can argue with that? The inside has all the nice details of HGTV inspired design:

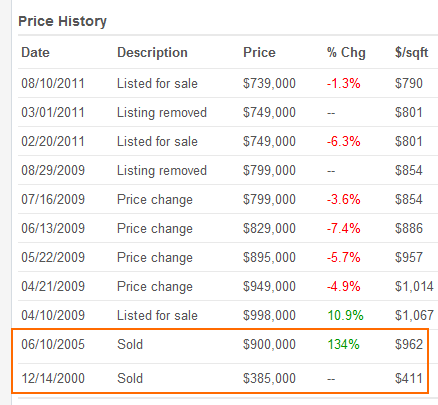

Now these cities in the Westside of Los Angeles are clearly in bubbles. I hear the argument that people are still buying so therefore there is no bubble. A bubble is not defined by how many suckers continue to perpetuate the game. A bubble is defined by unreasonable prices driven by mania and not underlying economic valuations and fundamentals. Bubbles by definition pop. The uncertainty comes on pegging a date. Let us look at the sales history here:

The home sold for $385,000 in 2000 and then sold for $900,000 in 2005. Someone tried selling this place for close to $1 million back in 2009! A 935 square foot home in the 90405 zip code for $1 million once the market had already imploded especially with the California economy was not going to happen. Of course this didn’t jive and then it became a game of chasing the market down.

The current list price is:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $739,000

This is a 17 percent drop from the 2005 price but what is more likely is that the ultimate final value is closer to what was seen in 2000. Again, these markets are fully engaged in bubbles.

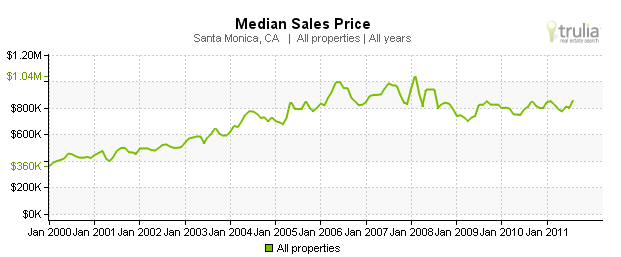

Santa Monica has held up rather well in spite of what is going on:

Back in 2000 the median sales price was closer to $360,000 and peaked at $1.04 million in 2008. Today it is slightly above $800,000. To make the point very clear, there are many locations in Southern California including Santa Monica that are still in housing bubbles.

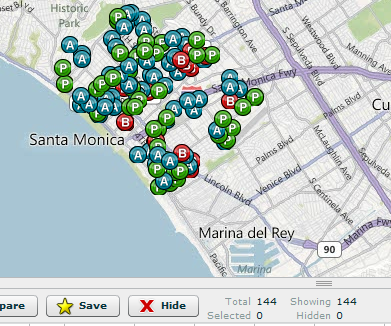

Santa Monica has 326 homes listed on the MLS. This is what the public can view:

Foreclosures listed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 14

Short sales:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 30

Non-distressed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 282

Yet the shadow inventory as you would expect is rather large:

144 properties are bank owned, have a notice of default filed, or are scheduled for auction in the city. This is half the size of the non-distressed pipeline. When you look at this data you can’t help but wonder how long it will take for this bubble to unwind? My guess is that it will take years but buying real estate in these locations is a long run losing proposition. The average adjusted gross household income for the 90405 zip code is $107,000. How in the world would someone with that income afford even a 935 square foot home?

In order to purchase this home in a less desirable Santa Monica zip code a family would need over $200,000 in income per year. Do you see a household with that income cramming into a 935 square foot home? Very close to this place you have a very nice apartment renting for $1,500:

There is no doubt that Santa Monica is in a housing bubble. Today we salute you Santa Monica with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

62 Responses to “Real Homes of Genius – The bubble city of Santa Monica. When shadow inventory dominates prime cities and foreclosures still sell for $739,000 and are listed with 935 square feet.”

I currently live in Orange County and am considering moving to L.A so I am very aware of L.A neighborhoods. You are right, Santa Monica is probably somewhat in a bubble and yes, there are lots of posers (leased Mercedes and BMW etc) but Santa Monica is truly one of the most desirable areas to live in Los Angeles; the Westside in general is the most desirable locations. Santa Monica is expensive because it’s close to the beach. To be honest, yes, I can sort of imagine someone making $200k a year living in a 900 square feet home; not a family but maybe a single or married couple. Some people really do prefer living in their own smaller home instead of a nice managed apartment; it just depends on what type of lifestyle you want. There is a lot of posing in the area but there is true wealth there too I think. Many people would pay that kind of money just to live closer to the beach plus the air is cleaner in Santa Monica than the central parts of L.A

That place is over a mile from the beach. At that distance, 5, 6 or 8 miles away is practically the same thing.

It’s a starter home that was overpriced when it sold for just south of 400K.

And I don’t make 200k but I couldn’t imagine making that much and chaining myself to this little home because it’s 1.2 miles from the ocean. My god.

Yeah, but, James. What you don’t understand about Very Special CA real estate is there are many other factors to consider. For instance, if you’re a mile from the beach, that gives you a 5,280-foot running start on any incoming tsunamis.

Hah? HAH?

In a related note, when we were shopping for our place, with a blank check from half a dozen lenders (two commas), the RealTorz kept trying to sell is Waterfront Estates. Not only did either of us not want the upkeep, nor the black mold issues, nor the mud/rock slides, etc. We also didn’t want to have a house closer to high tide than six or eight feet.

That’s how much higher our nearest city’s planners rebuilt the cross-bay bridge after the old one was demolished in an earthquake last decade. Factoring in, that is, climate change and greater average, median, and storm high tides.

Only in LA, however, would people pollute the air so badly that being able to breathe at home had a $3/4 million price tag on it.

Reminds me of simple silly fact: A toyota at lets say, $20K will idle on the 405, and eventually get me to wherever I’m going, same as a BMW/MBenz at 3-Times the price. No rational person would buy the german car….oh I forgot, humans aren’t always rational!!

You clearly haven’t driven a BMW! : )

Living near the beach and driving a beautiful, convertible, German car is a dream for most LA people. If that doesn’t suit everybody, that’s fine.

But a Honda is not a BMW and the midwest will never be Santa Monica.

Things cost more because people value them more.

I have been watching the market in Santa Monica closely for years and it’s ridiculous. We’ve consistently rented nice places (much larger than 930 sq ft) at half the cost of owning them. People give us trouble because we’re not “owners” but ha! Why pay twice as much for the same thing?

Ill take the apartment! 🙂

Dr HB, thanks very much for this post, as I am one of the people sitting on the sidelines for what will likely be another 3-5+ years, waiting for this bubble to unfold in these areas. It’s such a simple equation – house prices should not be up almost 3x, let alone 2x, since 2000 when you consider flat income growth during the decade. Until the price:income ratio gets back to historical averages, buying in SM or anywhere else with the same economics will absolutely be a loosing proposition. And that doesn’t even factor in the current deflationary period we’re undergoing in RE prices. All you need to do is look a chart from Japan 1989-2003 and you’ll see an 80% decline in RE prices from the peak. While I am not saying that’s necessarily going to happen to us here, would might get close to that on an inflation-adjusted basis (especially if you factor in the “true” inflation levels vs the government’s watered down CPI). Pretty scary what is still ahead!

As a full-time investor, ironically I can say that this is the best time to be a small investor in terms of true opportunity. Us small guys have literally become “the bank” for businesses and house flippers, as they can’t get funding from traditional sources. So, while everything continues to go to hell, it’s an excellent time to make money, as long as you’re staying away from the land mines, such as the home you mentioned above.

Thanks again for all of your hard work – we all appreciate it. I look forward to watching the slow motion meltdown continue in the coming years while I happily continue to rent!

Good luck to everyone,

Investor J

http://www.meetup.com/FIBICashFlowInvestors/

http://www.meetup.com/investing-363/

WTF? Who is in that market in August 2011. $3/4 Million for 900 square. Assinine.

Who was the primate that paid $900K? Must be the flouridated water. Unbelievable.

West L.A. Fade Away…No just go away.

Go knock on the door and meet them. They’re still there, trying to sell the crapper for over 2 years now.

One disagreement with Dr Bubble — $739k is just a list price. The fact that nobody bought means it’s not a marketable price. I would suggest anyone who wants to live there go make very, very low ball offers. It’s a short sale anyway, and the owners don’t care what they get. Heck, I’d offer $200k or $200 per square foot… but I don’t want to live within 100 miles of there.

Hello Doc. I’m a buyer on the Westside sitting it out. From the median sale price it is not yet easy to see that the proverbial bubble will pop but I think I will sit it out until Summer 2012 and see where prices are at. My main interest though is a 3Bd 2Ba in the 90064 or 90066. thanks

Plum houses will always fetch a high price no matter what the market is.

Unfortunately, even though the housing bubble collapse will have a supply glut, it won’t help those who have no houses.

Most of such houses are in unattractive area, and the builders and sellers would rather demolish it than let it be used by those who can’t afford it.

I rented near that area for about a year. It is pretty awesome being that close to the beach and Los Angeles. All that place needs is a little tlc and it should be good to go.

^ Is it any wonder why the bubble continues in Santa Monica?

What do you mean “TLC”? It’s already had the extreme TV makeover. Dwell for a second on the awesome payments you’d be making on that shack. Forking out five thousand dollars every thirty days. And that’s after funneling a quarter million dollars into the equity burp hole.

I’m not sure why so many people insist on trashing the best parts of LA. They aren’t going to be worthless tomorrow. Really. Look at NY real estate. How many people can afford to live in a small apartment there? But people make the sacrifices because NY is a great city and they want that to be their day to day reality.

If you want to live in a small suburb, go ahead. Those property values are pretty low now. And they will never be as high as as property values in a great city or beach community. People will pay a lot to live well.

Hi Dr. – Enjoy your postings here and am generally in agreement about your major themes around westside real estate. That said, I am somewhat skeptical about using the adjusted gross household income as a metric for home affordability. Assuming homeownership in Santa Monica is roughly ~45% (similar to nationwide), aren’t you dragging many of the lowest earning households/least likely homeowners into your equation? secondarily, is the ratio really as relevant in the current interest rate environment? certainly, rates where they are today versus their historic average of ~7% improves affordability regardless of incomes.

And what do you do when rates eventually go up, and housing prices come down to maintain that “affordability” equilibrium? You are stuck with negative equity because you paid $800k for a house that is now worth $600k.

If one went door to door in that area they’d likely find:

5% who could buy at current prices and afford a nice well rounded lifestyle

20% who bought and are massively overleveraged with zero disposable income

25% who bought 10+ years ago at very high but not mind blowingly stupid prices (i.e. $300-350K for house in question)

50% who bought 20+ years ago or who’ve been trading equity gains from other homes and sit on low tax basis with no real mortgage problem unless they refi’d to finance their lifestyle too much.

Current actions are to protect massive equity on the 50% and some semblance of equity on the 25% neighborhood tranches as this is likely their biggest asset by far. This also protects bank balance sheets by keeping prices high and not realizing too many losses at once (carrying others at full value).

Totally aside – why does everyone assume leasing a vehicle makes one a poser? Do you really want to own a BMW and deal with maintenance and other issues past 3 years (hint – repairs are exorbitant and reliability not high but fun cars)? Cheap payments and turn them over every few years. Not a bad system especially with used car prices at a premium (helps lease depreciation calc) and dealers doing everything in the world to move/finance/lease new vehicles at big discounts. No better time to be on the new car side of the equation and lease where residual values are high (depreciation calc low). Now if you are stretching yourself to afford a flashy vehicle to impress others, that’s just dumb but leasing right now is a pretty damn good deal for certain vehicles (sport/lux). This comes from someone who bought his last vehicle 2 years old at auction (a few $K below dealer black book) and kept it for nearly 10 years saving a ton of cash – so I’m very familiar with the other side and can say this without bias speaking of financials only.

You just convinced me to go lease a porsche. Who should i ask for when I get there? I assume your fellow car-brokers dont call you slim.

A lot of people inherit the homes. Lucky bastards.

Interesting that the same house sold for 385k in 2000. The economy was booming, jobs were plentiful. Now they want 780k+ for the same house in this economy?

I am extremely familiar with this area, having lived nearby for years. Posters fail to recongize it was a very different neighborhood 11 years ago. That explains at least the majority of the difference in market price between then and now. That area has fallen now onto the “rich” side of the balkanization line between rich and poor. Used to be – that was in the south of Pico “hood” of Santa Monica, with lots of gang shootings, etc. It is still in the lower tier part of town. I figure if it were dressed up a bit, it rents for 2K per month. For some reaon, people around here are willing to pay 2X rents to be called “owners.” Based on that, it could actually sell for 675K, which is all that the sellers are actually looking for.

Why is it taking so long for housing prices in the Westside and South Bay to go down? My husband and I make over $100k a year combined and would love to buy a house, but it just seems silly to at this point since it’s obvious that prices are going down and will continue to do so. It’s difficult talking to friends and family in other areas of the country that can buy $200k houses and make significantly less money than we do. If there were good houses in that price range here, we would buy one tomorrow!

How long until prices are reasonable again? 2 years? 5 years? How long will first time home buyers have to wait until a house is a good investment in LA and South Bay?

JJ, I hate to break it too you but although it’s great to have a job in this economy, 100,000 is chump change to buy a house in desirable neighborhoods in LA. This is the new reality that will not go away anytime soon. As soon as prices do go down a bit, there will be plenty of people who jump in, further perpetuating the long slide back to reality. If you want a decent house, you’re gonna have to drive right now. This is like gas prices. Everyone adjusted to the new norm. If we pay under 4 bucks a gallon we think it’s “reasonable”. I’m seeing houses listed, and then relisted higher. You need to make over 200 K to even think of the westside, Burbank, Pasadena, ect… And then you have to not care that the house will slowly loose value.

Sure…the old ‘pent-up demand’ argument. Demand does not equal qualified demand, so the idea that, if prices corrected tomorrow, all this pent-up demand would flood in from the sidelines is just nonsense fear mongering designed to keep people shoehorning themselves into a loan they can’t afford in order to beat the inevitable mad rush. Right.

BTW – A combined salary of 100K is a damn fine income — depending on your liabilities — and will be more than enough income if you’re patient and sock away your money for the next couple of years.

@bulfinch. Prices will not correct tomorrow, but…people that make well over that marvelous 100K that JJ makes will buy as prices slowly drop. This is the rigged game the banks are perpetuating. They will slowly trickle out inventory, dragging out short sales and foreclosures while those who make the bucks (over 200K) say what the hell, and buy. Yes there is pent up demand for decent priced homes in good neighborhoods, and it is a bank made problem. Just look at all the comments on this site, full of people eager to buy an affordable home. Some will give up the wait (JJ ??) and over leverage. Those who make the bucks won’t care. BTW 100K is not that much money after LA cost of living, CA tax… eats into it. Sure in some places you could live like a king, but in LA…chump change.

I’ll second that, combined 100K income is not that much if you truly want to own in a premium LA area. You will be competing with people or couples making 2, 3+ times that. I drive PCH every morning in the South Bay, I see huge amounts of young professinals with their Notre Dame, Michigan, Purdue, Cal, UCLA, MIT, Standord, etc alumni license plate frames. These are the people you are competing with and there seems to be an endless supply of them who live or want to own in the premium areas.

As much as I want prices to go down and eventually buy, there are many others in the same boat who won’t mind jumping in sooner. Prices are definitely coming down, but very slowly. The key is having the patience to wait and further position yourself when it finally becomes time to buy.

I currently rent in the South Bay and have a pretty good pulse on the market here. You have a combination of things working against people who want to buy. Let’s make a list: great weather, close to the beach, relatively safe, good schools for the most part, entrenched owners (people who have lived here for decades in the same house and literally won the CA state lottery), close to jobs centers and a large Asian population (I’ll let you fill in the blank there…look at Irvine and Cerritos for comparisons). Put all those things together and you have very sticky prices.

Prices are definitely coming down, but at a very slow rate. For people sitting on a large downpayment and stable jobs, it might make sense to pull the trigger soon with sub 4% interest rates. And as we’ve seen from the past few years, homeowners are held in higher regard than renters by the leaders of this country. Free money, squatting for years, loan mods, principal reductions, etc might make owning more attractive than renting. Just my 2 cents!

Try 10 years, 20 years.

I’d guess 12/21/2012…Homes should be within your price range then.

When the stock market goes up or down 500 points, either way, I now yawn….

Can someone explain the “garage is semi-converted with french doors” item in the listing? Do you, like, drive the car in at night to sleep in the Murphy bed in the living room, or what?

Is the photo the semi-converted garage, or the second garage? Different window arrangement than the house’s street view.

In SF during the peak of the housing mania, real living space SF was fudged for tax purposes–garages converted partly into apartments but without separate street entrances, for instance.

Sorry. The first SF = San Francisco. The second SF = square footage.

It’s waiting for the wrecking ball. Build a 3/3/2 on it and you have a gem. It’s the land stupid (me of course)! The 3 L’s my friend! All of these neighborhoods will be transformed this way. It’s happening all of the nation in prime locations so get use to the rent.

The three Ls…Lame, Lamer and Lamest.

Everybody who can register a blip on an EEG hates that cheap NAR speak.

Even the land is overpriced. Face it: 2000 was a freakin’ BOOM year for America. I mean, easy money gravy trains for even the most untalented. This place is just an example of sticky prices, old habits dying hard, and innumerate buyers allowed to over leverage themselves with taxpayer guaranteed loans.

Speaking of the NAR, has anyone else seen the commercial blitz they’ve been engaging in lately? When they ask us to support their efforts for “reasonable mortgage reform” they mean a return to the good old days for them of loose lending, high prices & most importantly – FAT commission checks.

Don’t worry real estate investors will come in & save us! Says ABC News & the econemy will improve since gas prices will drop 50 cents pg. This will pump over $400,000,000 into the econemy & stop the forclosure crisis!

Wow, I’m so thrilled the bad days are behind us. LOL

The whole bubble can be summed up in one proverb:

“Pride goeth before destruction, and an haughty spirit before a fall.”

(Pride precedes a disaster, and an arrogant attitude precedes a fall.)

Our lust to be among the chosen ones causes us to make foolish choices, but living in this tool shed posing as a home will not get you into the club. The Manhattan Mob knows our weaknesses and simply entices us to willingly step into our own peril. But the advice of the wise will fall on deaf ears….

I like your quote and comments. Very apropos!

How about:

What goes up must come down.

(That’s not my department, said Werner von Braun III of the NAR.)

Oh the Humorati on the board…LOL

Yves has an interesting article today, on a new trend in RE:

http://www.nakedcapitalism.com/2011/08/another-real-estate-time-bomb-unsellable-vacant-homes.html

“My good friend is a real estate broker in Westchester/Dutchess County. He said he is seeing a real problem growing with title insurance. He said a large number of the REO properties banks try to get him to sell cannot close because of title problems. He’s worried about the growing number of vacant homes which may be impossible to sell.”

The Government wants to put their Freedie/Fannie REO’s out to rent. That’s going to screw a lot of rental investors. And lower rents, and prices. Ouch.

The only solution that I can see is for the local governments to take back these homes due to back taxes, and resell them. That solves a LOT of problems. Alas, it dings the Taxpayer funded bonuses for the bankers, which will result.

$350k in 2000 = $501,390 $900k in 2009 = $938,320

purchasing power in today’s value/money according to http://www.dollartimes/inflationcalculator

So, $739,000 asking price – $501,390 = $237,510 perceived value gain b/w 2000-2011.

And, $938,320 peak price – $739,000 ask’g price = $199,320 potential savings from peak

Maybe this is one reason why many sellers/agents still demand higher prices. When one plugs the numbers into today’s money values, asking prices magically appear less outrageous to eager buyers. Add record low 4% interest rates and there you have it. Some schmuck will buy this property for it’s overall value: very close beach location, low interest rate, and current discounted % / cost savings from peak sale’s price…..

Bottom line: income to debt ratios still apply. So, unless you throw down some serious cash with stellar credit, and have a very recession proof job (e.g. utilities), the banks won’t even lend you an ear.

Many still have this idea, that real estate in Santa Monica is a winniing proposition. Yes it is a great area to live, relative to other neighborhoods in LA. However, we have had a monumental shift in the buying of real estate. Financially, people are scared of making any large purchases, now that everything (especially real estate) is deflating. Much to the governments chigrin, anything they have tried fails to stop our deflation. Sure, someone will step up and buy this old, small house in a marginal srea of SM for $675,000. Only, because the government still makes it possible for those who can’t afford it , buy it. These prices are unsustainable even now, when interest rates are at record lows. That alone, should tell you something.

I have operated a couple of websites since 2007, that have chronicled home prices on the Westside of LA. They are Santa Monica RE Meltdown and Westside RE Meltdown. The pool of buyers has become miniscule, as renting for half the price of buying is now preferred by most. With the amount of financial headwinds facing us right now, it’s no-brainer to sit and watch the slow-motion train wreck. Prices in Santa Monica have corrected 25% off of their 2007 peak and still have another 25% to go. And, best of luck trying to get a loan now. If your lucky(or unlucky) enough to get one, then you will be able to watch your down payment vaporize over the next 2 years.

As for the inventory, the MLS is a complete joke. A large majority of properties listed are zombies as the sellers are hopelessly upside down. Throw in the additional shadow inventory and prices will continue their march downward. Real estate agents will continue to boast about the home that had “multiple offers”, but what about the other 300+ homes driving down the neighborhood.

http://www.santamonicameltdownthe90402.blogspot.com

http://www.westsideremeltdown.blogspot.com

I have been a continuous reader of this blog and really appreciate point of view of dr and fellow members. This is the only source for me to get actual information on the current RE market.

I have just one question. Me and my wife are young and in early 30s and looking to buy a house. But for now we have put that idea on hold and waiting on sidelines to get all this settle down. My question is, looking at present scenario it will take years for settling this down. When will it be a good time to start looking for the house in the market? I mean how to check if market is about to hit bottom? It will be our first house so we don’t know much about RE market as such…any help in this will be greatly appreciated.

querious – Keys (1) Just look at price/rent ratios on a square foot basis in any area to see if price is reasonable compared. Do research on some of the blogs such as patrick.net to see where the ratio should be. (2) Evaluate local rent based on overall economic factors – unemployment levels, industrial capacity – to see if rents (and house prices) will fall. Hint – the current economic situation is bad and rents should fall. (3) Don’t mentally commit to the idea that you must own. Renting is ok and makes it easier to move when/if you lose your job. It’s ok to rent forever.

If you can’t draw the correct conclusion from the above then you are not qualified emotionally/intellectually to make rational business decisions.

SantaMonica:

Your last sentence assumes the emotional/intellectual capacity to recognize not making the correct conclusion in business decisions meaning that the prospective buyer is doomed to fail in a purchase. I think perhaps you have hit the nail on the head as to why people fell for the banking scam of the housing bubble. That goes double for realtards.

Here you go:

http://en.wikipedia.org/wiki/File:Stages_of_a_bubble.png

We’re currently starting the “fear” stage, IMO. The “return to normal” stage was the fed tax induced rebates. Those people who used that to buy in the Fall of 2009/Spring 2010 are likely underwater now.

But I wouldn’t try to time the bottom. That’s a fools game, and you hit it only if you are lucky. The main theme of the current crisis is excessive debt; and you want to remain out of debt right now, even for so-called “good deals”. The reason for this is because, in a deflationary environment, cash is scarce and is king.

Keep your powder dry in this Depression, for that’s what we’re in.

Once prices come down another 60%!

What’s the condo market situation? The way I see it, one of the advantages of a condo is higher turnover, lower cost, less maintenance. It’s not as nice as a living situation, but with this crap economy I need to maximize my ability to work… and maintaining a lawn cuts into the limited free time with family.

I moved to Santa Monica in 1986, before the Promenade, before Hollywood and new money moved there. Yes, it is quite a mix of rent control victims and extreme wealth, however, the crappy old apartment buildings, no parking and homeless make this city not as nice as it used to be. In the 1970’s, Santa Monica was a blue collar town and place to retire, hence the crappy apartments. Now it is so over valued and so crowded, I am just happy to have lived there when it was “real” and could not wait to leave in 2000. Blows me away what people pay for real estate there, especially since it has a major earthquake fault which runs north of Wilshire, the most desirable part.

I think the way to evaluate a property is to first evaluate the COMMUNITY. I happen to have lived in Santa Monica my entire life, raised my family in Santa Monica…I would never consider selling and leaving for any reason at any price. The community has changed, it has evolved over time, but I happen to LOVE the vibrancy, the youthfulness…..The prominade, the Pier area, parks and the beach. It’s nice to KNOW your city council members, they’re neighbors, the school board…neighbors…..it’s expensive but for anyone looking for a HOME TOWN, Santa Monica is still exactly that. When I bought my first home, 900 square feet was considered a LARGE home, certainly a perfect size for a family of 4. I have no idea why people seem to think they need more interior space. I guess Im old fashioned.

I have no debt, money in the bank and my rental cost is less then half of what a mortgate would cost me. I may buy out of state for investment purposes and either sell or retire there. California is a fools game at these prices. The state is near bankruptcy, the local governments are laying off en mass, The federal government is a mess. No one is hiring except low paying service jobs. How long do you think those 200K plus earners are going to stay in this state? How long do you think they will earn that 200K salary. Then what will the prices of those now 700k + homes be. Being near the ocean is nice but you have to have a job to pay for that lifestyle.

Kman:

There are areas of California away from major urban (yes mainly coastal) areas that are the equivalent of “out of state”. You may want to look into those to find a place to live. Invest where it makes the most business sense.

Get real, all of Cali is overpriced and over rated. I spent the first 40 years of my life in the hell hole of SoCal and the last 15 years in CO. no comparison. What is going to kill Cali is that you can move to any other state, make the same money, buy a house for for half the cost, raise a family in a safe place, no illegals and no gang bangers. In one week and a U Haul you are set for life financially the day you leave with a superior quality of life. What a dump and I was born there.

It has to be a Blue state, though.

I have long been waiting for this region to fall to it’s knees. I make a healthy income and have almost 90k in liquid savings. I toyed with the idea of buying for the last six months. The problem I saw was that lenders were still offering me $1 million mortgages under the FHA loan. That is a major problem. I have saved for almost five years and even if I dump that money in now while everyone says that the rates are so low, the actual values don’t make sense. So in five years when the prices drop more and more I can wash away all of my hard work? Hell no to that! The crazier part is that you still have to pay the $300+ /month insurance for the FHA mortgage. So your house loses money and the more it loses the more you pay the government. So the banks take the down payment and the government takes the vig. This is all linked together between the banks and the government to syphon money from the stupid buyers out there. They will milk our country dry before they care about balancing the economy. I can’t believe we are protecting the prices because there are old people that bank on it for their retirements. Maybe these people should have been smarter and kept working hard rather than living off the false equity of their over valued asset. Meanwhile the rich keep getting richer while we pay high rents and eventually the middle class vanishes away. Anyone that buys on the westside is a fool. Just wait it out and see where the wheels fall off.

For those who think California real estate has a future, behold:

http://search.har.com/engine/2603-Avenue-O-Galveston-TX-77550_HAR29706120.htm

Look what $379,000 will buy you in Galveston, Texas, less than two minutes by bike from a great beach with amusement pier going in, one hour from the third/ fourth(?) largest city in the US, no state or city income tax, in a state that provided more than half of all US job growth last year. With 20% down, you’re talking about a monthly note of $1515 or so.

Gee, is Santa Monica that much better? Must be heaven…

Things are all relative – even though I agree that Santa Monica homes are overpriced you still have to take into consideration where market rents are. It’s very difficult to rent a single family home in Santa Monica, brentwood or pacific palisades for less than $4500/month – and if you ask anyone who has tried to rent a SFR recently the competition is fierce for these properties with lending standards tightening for home purchases. You can of course find apartments for less than this amount but it’s a different market. So as much as we think homes are overpriced – I do believe there is still a method to the madness; the reason home prices have not plummeted in Santa Monica is because rents are still very high. You cannot find a legitimate comparable property for this house for $1500.

@mercury rising, I would agree that real estate is insane in southern ca. But a great beach in Texas, a friend of mine who told me about surfing in Texas and coming out of the water smelling like oil. We can also talk about the hurricanes. there is a reason that house is 379k. And I think Santa Monica is not a bad city.

Didn’t Jack Tripper from “3s Company” live in Santa Monica? He didn’t seem that rich!

Leave a Reply to I1