Real Homes of Genius: Manhattan Beach Short Sale. Another Prime Real Estate Area Impacted.

Investing psychology is fascinating. When I profiled a 676 square foot Real Homes of Genius in Santa Monica there were a few doubters. “Santa Monica is immune!” or “I don’t believe that home is in Santa Monica” were a couple of the responses. Yet people forget that Santa Monica has a few zip codes. That is beside the point. The point of the article is there are fewer and fewer places to hide in Southern California real estate.

Some people are still delusional. So far, we have featured 99 Real Homes of Genius since we started the series back in 2007. It is interesting that whenever I feature a home in a low to middle income neighborhood that is overpriced, normally most people are in agreement. Yet when we touch tiny over priced markets in Southern California people once again put on their bubble hats and preach the “real estate never goes down here” mentality. This flawed logic is being exposed as each day passes by.

When we talked about the Ed McMahon foreclosure in Beverly Hills, we actually noticed a major price decline at the time. This was occurring in a period when bidders were supposedly going to take over the home. That did not happen (at least not at the peak price). Here is the bottom line. Having a prime area isn’t enough anymore. Now people want a prime home in a prime area with the right zip code. Notice how the contingencies are getting more extensive? It used to be having a home in California was enough to ask for outrageous prices. This is no longer the case.

The reversal happened in typical fashion. Here are the stages of unraveling:

(a)Â Low priced sub-prime homes fall first

(b)Â Low to middle priced sub-prime, option ARM, and Alt-A homes then fall

(c)Â Middle to high income non-prime zip code areas fall

(d)Â Upper income prime zip codes start falling

We are in the initial stages of “d” right now. It is now widely accepted that lower income areas are going to implode. These areas are off 50 percent or more. Now, middle income areas are falling quickly with drops of over 40 percent. Finally, more prime areas will fall. At any given stage, there is resistance to believe that it can actually occur until it does. In fact, if you read some of the articles in 2007 some of the comment sections are comical. People denying the housing bubble and other such non-sense were prominent. Now it is self-evident.

Before we examine our Real Home of Genius today, let us first run a quick analysis of the Los Angeles market:

216 zip codes negative year over year median price

27 zip codes with positive year over year gains

27 zip codes with no sales last month or no data reporting

Interestingly enough, some zip codes in Santa Monica and Los Angeles had zero sales last month. We should also cut through the data with more precision

Sales in 216 negative year over year areas: Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3,468

Sales in 27 zip codes with positive year over year gains:Â Â Â Â Â Â Â Â Â Â Â Â Â 188

That should put things into a more clear perspective for those trying to hide out. Only 188 sold homes in L.A. County last month actually saw a year over year positive median price jump. Considering this county has 10,000,000 people, that is a dismal performance.

Today’s Real Homes of Genius Award takes us to Manhattan Beach, another supposedly untouchable Los Angeles stronghold.

Manhattan Beach – Prime Garbage Can Photography

Most people have visions of the beach when they think of prime Southern California real estate. Maybe scenes from Baywatch go running through your mind. That is what someone thought when they purchased this 1,102 square foot home in Manhattan Beach in 2004 for $820,000. Good deal for a prime location right? You get 3 bedrooms and 1 bath in a prime L.A. zip code. After all, the current median price for Manhattan Beach is $1.183 million (although that is down 35.6% from last year). Of course detractors will once again try to knit pick but the point is this…no longer will a prime zip code save you from price declines.

So what is the pricing action on this place?

Price Reduced: 11/18/08 — $799,000 to $749,000

Price Reduced: 01/02/09 — $749,000 to $699,000

And with this kind of pricing action how can we ever leave out our fascinating trend of garbage can photography 2.0:

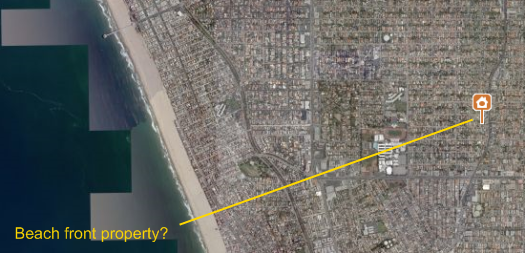

I love how the short sale ad tells us this is the perfect place for a first time buyer in Manhattan Beach. Too bad this place is not exactly what we would call beach front property:

You may think that a price reduction of $121,000 isn’t such a big deal but you need to know Los Angeles to realize how big these changes are especially in these zip codes. Why? Because few homes sell in these areas anyways and these will hurt comps. Drops in Santa Monica and Manhattan Beach are only the early signs that this is a once in a lifetime housing crash.

Today we salute you Manhattan Beach with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

16 Responses to “Real Homes of Genius: Manhattan Beach Short Sale. Another Prime Real Estate Area Impacted.”

I’ve never understood the appeal of Manhattan Beach. It is crowded and felt like the ghetto to me as a kid. MB proponets will still deny and claim immunity, pointing out that your example is east of P.C.H> so it doesn’t count. Bring on the pro-MB crowd, I am sitting in MB as I type this, and cant be convinced otherwise.

I am in Manhattan Beach as I type this as well. I can hardly equate MB to a ghetto, but I will agree that housing is just about to crash here. Plenty of denial here, still. For a good laugh, go to http://www.mbconfidential.com. The host does a fine job, but it’s the comments section where I have seen the least civil discourse that I have seen on any blog. The well heeled aren’t behaving so well. It won’t take you long to figure out the main antagonist.

Zero sales west of Sepulveda in 2009 so far. Mr. Blutarsky – 0.0, Fat. drunk and stupid is no way to go through life.

Prices are dropping in MB, but not as much as you state. I cannot find anyone quoting your down 35.6% number– what is your source? This is obviously a lot sale, and it is still a cheap one for this city.

I live in a non-wealthy area of Nor-Cal, yet when I go out to wealthier areas of town to shop at a specific store or meet friends, everyone around us ( the locals ) are still spending like it’s 2004. The expensive shops and restaurants are still packed. When will this downturn (read collapse) start to affect them? They seem oblivious to it…or maybe they are just delusional, with bigger credit lines.

J

“When will this downturn (read collapse) start to affect them? They seem oblivious to it…or maybe they are just delusional, with bigger credit lines.”

I feel the same way when I look around the homes and shops in the West Valley, but it occurs to me that many have owned their homes, or mostly owned them for years and years, and many are still employed at high wages, and will continue so, and if they don’t have much stock, they haven’t lost, except the escalated value of their homes, which was incidental to their lives anyway.

On the other hand, today’s trends are tomorrow’s reality, and since Wall St. crashed in 08′ we see see the results on the streets in 2009. It is predicted that the bigger crises will begin in earnest when home-owners refuse to pay outrageous, escalating property taxes on homes that have depreciated. And look for this to start happening after February, when the high from the inauguration has settled down.

The pain is just starting. I like MB, but it won’t be immune. The perfect storm of the credit crunch, housing crash, rising unemployment, etc., is bound to get much worse. I have a feeling that the DR. is right and housing won’t bottom until 2011, and then it will just sit at the bottom for years.

Also, people are LEAVING SOCA…so why would anybody with half a brain think that prices will not continue to dive?

I have seen a drop in the bars and restaurants in MB. It started a couple of months ago. I was in Vegas over New Years (yes, I know, still blowing money) and the cabbies, hotel staff and strippers all said it was the worst New Year’s by far. This was volunteered, I wasn’t bringing up the economy during a lap dance – except as a negotiating ploy. Was in the Playboy Club (nice view, but over rated – can’t sit w/o bottle service – I stood), it was a ghost town at midnight on a Friday on a big weekend. The jig is up. The spenders are spent.

Very well stated Dr. HB. Manhattan Beach, like other high-end areas of Santa Monica, Brentwood, Palisades, Malibu etc.. are due for some stunning declines this year. As you have mentioned, the declines have moved their way up the Real Estate Food Chain, into this market now. The tipping point has passed and “Wannabe Sellers” probably end up chasing the market down, possibly towards foreclosure. “Real Sellers” need to price their properties at least 10% below the latest comparable sale, in order to see some offers.

Buyers are holding the cards now, and ought to be patient, as denial begins to run short on homeowners in these neighborhoods. Just too many negative headwinds blowing now, for buyers to step up to the plate, unless it’s absolutely necessary.

Manhattan Beach? Are we talking about the neighborhood sandwiched between the poo plant and some other industrial ugliness? I’ve never understood the attraction. Some friends of mine are trying to sell their home now in Hermosa beach. They estimate it will take a couple months and fully expect to get more than they paid in 2004. What do you guys think?

@ J & polo

Neiman Marcus and Saks 5th Ave would most certainly disagree. The statistical reference is year-to-year same store sales. Their sales for the Xmas shopping season were betwen 30-35% DOWN from the 2007 season based upon gross revenues. And their porfit margin will suck big time – doesn’t work out to well when they kill their margin by selling $1295 Loro Piana sportscoats for $298 as they started doing right after Thanksgiving. They were discounting their entire stock like mad and STILL were down year-to-year. Those are some pretty ugly numbers from a retailers point of view. The biggest Y-T-Y drops where in the veddy veddy up-market stores, then the mid-range retailers took hits of 10-18% DOWN Y-T-Y and about the only one that had any kind of increase Y-T-Y was Walmart (and excluding gas sales, it was pretty bad – under 3% as I recall.)

They may be packing into the malls and restaurants but are (1) are they buying and (2) how much are they spending when they buy? Those 2 rmake a huge difference. If they are not paying the full retail or ordinary after Xmas sale prices (and prices were way below that coming into the holidays) and they are getting a $15 entree instead of a $40 entree…..well, then, it is just a throng of actors moving around on the stage who are trying to decide if the curtain is coming down.

@ Gael – that’s a joke right? Rhetorical sarcasm?

“When will this downturn (read collapse) start to affect them? They seem oblivious to it…or maybe they are just delusional, with bigger credit lines.â€

FWIW, same situation near the Grove, WEHO etc. Ask anyone… it’s different here! :-p Oh, while a few properties are priced lower than they would have been a year ago, many people are still listing houses at 2007 prices. Occasionally someone buys one too, so all the owners of unsold houses feel justified in their insane pricing. Maddening

I think housing in Manhappening Beach will drop, but only maybe 25%. Its sooo nice & White, only the elite will live there.

I was out looking at properties this past weekend and stopped by this MB house. My wife and I were looking at SFR’s in N. Redondo (just East of MB) and I was pretty amazed at the amount of people looking at the the same properties we were – around 500K. Over the past couple months, a lot of the SFR properties listed in the high 400K ~ mid 500K have been selling. It seems like that is a number that is pulling in a lot of interested buyers for starter SFR’s. Properties in this area with a 600K+ price are a turn off to the buyers.

The MB house is still too high at 699K – if it were listed at 599K, it would get a lot of action from the same crowd I saw looking at SFR’s in N Redondo.

Great article. Everything comes down to the moral aspects.

By the end of 19th century – many ideas about responsibility

of the economy were transformed into reality. They were

supported by many representants of the economy, politics and science.

Many CEO’s today are living in a completely remote world which

has in reality nothing to do with business.

It is a soviet-like nomenclatura of decadent parasites

where everyone in the company (except from the nomenclatura)

is a replaceable commodity and that the company they

alledgedly “manage” belongs to them. They can do with it

what they want – without any regret or fear.

So there is implicitely no place for any responsibility.

This was exactly the hallmark of soviet companies.

We saw that US/UK companies which existed over a century were

distroyed within a few years by tie wearing, greedy and slimy liars.

The decent work of millions of responsible people was washed away, like litter.

The people sitting at the top had to just to be cronies.

One year they sat at the top of company X of industry I, next

year in company B of industry J. They had no idea about

I and J … this was just a bunch of “Führer’s”.

Before the truth came out, they fired people to increase the

share price.Then they get the golden parachute, and

they successors which come from the same sort of “culture” whine

today for baylouts, and fire even more people.

If this system won’t change – then all the baylouts are lost

money – and people will be punished for generations, IF

the damage can be repaired at all.

@ AnnS: I wish that was a joke. They are serious. They want to sell and move to San Clemente. They think it will take a couple of months and they will move out and up. Think I’m too negative….:o(

This house has gone “Contingent” at $650,000 asking, not sure what the close will be, but asking was $170K off 2004 price or 21% below 2004 pricing….

Leave a Reply