Real Homes of Genius: January Recap and Compton Prices Rising. At Least in Theory.

If January is any indicator for the rest of the year, we are in for a world of economic hurt. The housing market is quickly adjusting and the law of unintended consequences is unfolding at a rapid pace. Many of you have read or heard of the idea of “intentional foreclosure” where owners let their homes foreclose even should they have the funds to make the mortgage payment. This was highlighted in a 60 Minutes piece last weekend with an interesting couple who was more the willing to let their home foreclose even though they had the money to pay the bill. I have gotten numerous e-mails from both sides of the fence on this one. Some of you argue from a moral perspective stating that this couple has an obligation to uphold their commitment. Others argue that it is the smartest thing they can do since economically, it no longer makes sense to keep opening the blue mortgage book and sending off checks for an asset that is continually declining. I’m a bit torn between both sides. First, the gravy train of handouts is in full force. Not only are we talking about bailing out insurers for their incredible miscalculation of risk, we are now talking openly about creating a fund that will buy subprime loans:“Senator Chris Dodd, the committee chair, said he is working to create a Home Ownership Preservation Corporation, which would purchase mortgage securities that are backed by at-risk, subprime loans from lenders and investors.

This corporation would give these lenders and investors a better price for the securities than they would get if the properties backing them were put through foreclosure.

Additionally the loans on these properties would be restructured so that borrowers could afford the new payments and remain in their homes.”

This is without a doubt a bailout plan. There are still some permabulls arguing that bailing out insurers is the right thing to do but there is absolutely no way you can spin this one. You’d have to be one cynical person to say with a straight face, this isn’t a form of corporate welfare. In fact, the rhetoric of “give investors a better price” smacks of market manipulation by the government in favor of investors (aka Wall Street investment firms). We’ve gotten to the point where these politicians don’t even bother hiding their pandering to financial special interest. We can smell the ink getting ready to print our stimulating and exciting tax checks.

Could it be that there is no liquidity in the subprime mortgage backed securities market because some of these loans are crap? Absolutely. The government is setting up a crap buying fund (CBF). Like crap, this legislation needs to be flushed down the toilet since it doesn’t even help many borrowers since some are using the intentional foreclosure to remedy the situation. It does help the lenders and holders of these loans. Subprime borrowers figured out the solution before the government! That is, if it costs too much to service your mortgage simply stop paying it. I guess that is what Bush was talking about with his ownership society; some of these subprime lenders just got owned by their borrowers. Make no mistake about it, in some areas the premium on renting is growing.

Let us recap January in pictures:

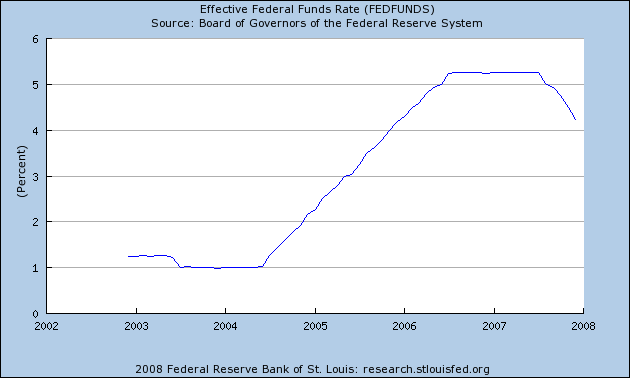

What we are seeing is even with the most valiant efforts by the Federal Reserve, the market is still correcting, as it should. It was an unprecedented action that the Fed dropped rates by 125 basis points in 8 days. It smacks of panic even though they smile and tell you everything is a-ok. We have over spent and have lived beyond our means for the entire decade. We are coming to terms with the idea that we live in a society that supports and advocates for personal responsibility but many in our society do not follow this with their actions. When things get tough they throw up their hands and beg for free money.

First, we have folks fixated on these quick fixes. Whatever happened to the slogan no pain no gain? If you aren’t happy with your marriage, divorce. Can’t sleep then take a pill. Kids too hyper? Give them some Ritalin. Overweight? Take a drug. Quick short cuts are a societal phenomenon now and are being reflected in the housing market. Want to get rich quick? Then jump into real estate. We’ve been living in some suspended state of reality these last few years. Instead of coming to terms with the overarching lesson, we are risking going into deeper problems because heaven forbid they take away the credit crack. And that’s what it is, an economic drug. What’s so wrong with saving up for a down payment and getting a 30 year fixed mortgage? It does take some time and effort but so does losing weight by working out and eating right.

People are amazed that now with tighter credit standards, many cannot get credit. I’ve had a couple of people come up to me and tell me how dare their credit card company drop their credit line. Historically you had to earn credit. And if you look at the market’s reaction in the last few days, it is the same Pavlovian response as giving Fido a biscuit. The bad news floweth with Countrywide showing a loss (what happened to Mozilo’s 4th quarter profit?), builders such as Lennar reporting losses, and insurers losing mad amounts of money and experiencing write-downs. You would think this would be bad for stock prices but to the contraire! We are in full blown bailout mode and bad news is good. Let us take a quick snap shot of the housing sector for the year:

Lennar:Â +14.81% YTD

D.R. Horton:Â +31% YTD

Beazer Homes:Â +17.23% YTD

Lowe’s:Â +19% YTD

Apparently, declining prices and record low new home sales mean nothing since we are in a new era of economics. Today’s rally was your typical Fed promising to make future rate cuts rally. There is no substantive data behind it except hope of lower rates. Didn’t we just announce a low GDP rate suggesting we are entering recession? People need more examples since they think we need a minor correction and will be back on the consumption hamster wheel by the time we have another American Idol.  Unless you’ve been in Southern California you have no idea how crazy things have gotten. But let us drive the point home again with another Real Home of Genius.

Compton California

This above palatial home is located in the prime location of Compton California. Many of you in the Midwest know exactly what $250,000 will buy you but here in Southern California, we dance to a different drummer. This 1,015 square foot home has 3 bedrooms and 1 bath. I love how the ad tells us that this is one of the best deals in Compton. Here we have what I call the raising the price when no one is looking to buy strategy. Let us look at the pricing action:

Price Increased: 12/14/07 — $315,000 to $330,000

Price Increased: 01/23/08 — $330,000 to $340,000

I’m as perplexed as you are in regards to boosting the price up given the current market conditions. But let us take a trip down absurd housing price lane:

Sale History

07/20/2006: $435,000

12/30/2002: $180,000

07/01/2002: $125,800

The home is already selling for nearly a $100,000 discount in a little over a year. That is money that is now destroyed. The idea that this $435,000 existed is a myth since it was never ever going to be paid fully. In fact, a 20 percent drop may not be the ultimate bottom. A similar home like this would rent for $1,700 per month. Now here is another thing that the market in California is contesting with, a bad economy.

Being on a winning team makes even mediocre players look good. The once infallible Governator is now showing chinks in his armor. His massive healthcare overhaul package was shot down this week since we are in a budget worse than when he came into office during the recall of Mr. Davis. Ironically, he came just as the fuel was exploding on the California housing dream bonfire. Everything was rosy since homes like this Real Home of Genius where creating commission check for realtors, brokers, money for banks, cash for remodeling, and equity lines of spending for new owners. It was a fantastic world since the state was also gaining more tax revenues from property taxes and the wealth effect of everyone spending like crack heads boosted sales taxes. Now that this paper tiger has collapsed, we realize that we were really on a house of cards and now the Governator doesn’t have the benefit of jumping into a state with the momentum of a big bubble to help him out. Now he is talking about letting inmates out to balance the budget. What a difference a bubble makes.

Today we salute you Compton with our Real Home of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

14 Responses to “Real Homes of Genius: January Recap and Compton Prices Rising. At Least in Theory.”

Always enjoy your blog. Take a look at the amount of fiancial obligations piling up in derivates – something like 13 times the total US GDP. We are village next to the snow capped mountain, and an avalanch is coming (funny how close avalanche is to credit tranche)

The government thinks they are doing the morally right thing buy bailing out bad loans. They have no idea how much they are hurting financially responsible Californians who are waiting for the insanity to end. The prices here are STILL way out of reach for reasonable buyers. How long do we have to wait while the stupid government to STOP trying to fix this. Have they no compassion for future buyers who need California home prices to come down to realistic levels so they can buy. Why is it such a great thing to overpay by $200,000 for a house just because the jerkwads in Washington lowered the rates? I wanna buy a house and I’m sick of waiting for prices to come down! The government should butt out and let the prices drop once and for all! The whole mentality by both parties, is that debt is a wonderful thing. The bigger the debt the better. They actually like it. Sick bastards! –

I hope people who are upside down on their houses walk away, regardless of whether they can afford the payments. It’s the least they can do since they are the ones who drove the prices higher, by buying at a bad time. I believe it would actually be the morally “right thing” to do. Their actions could drive prices back down to reality, helping people who want to buy in the future.

Law & Econ doctrine of efficient breach suggests that we should get over our moral qualms about walking away from a mortgage: http://en.wikipedia.org/wiki/Efficient_breach

The reason Compton prices went up is because they are anticipating an increase in population soon, when all the inmates are freed. Great idea Arghhnold. Well that is what we get for voting for Commando. That is the worst decision he’s made since accepting the role for Kindergarten Cop.

Maybe the Governator thinks all those inmates will go house shopping and bid up the price of housing.

Actually the price of houses in Compton and surrounding skyrocketed at an even faster pace than the rest of the county, later than the rest of the county. In 2006 prices elevated some 35% (Doc- can you find the stats) even while the rest of the socal was slowing down from the double digit increases.

The advent of stated sub-prime 100% financing really took hold in late 2005, and combined that with the aggressive growth pattern of companies like Countrywide’s Full Spectrum Lending group (among others) that targeted minorities who previously had been left ‘out’ of the equity train gain with pitches that aimed at getting them to buy into the American Dream – well, the sales pitches were spectacularly successful.

One reason Compton remained lower priced was the high tax rate there, mandated by the need of the city to pay off lawsuits stemming from official corruption. In some zips the tax rate pushes 2%, making new purchasers pay some $3k or more in tax compared to surrounding municipalities at the more normal 1% rate.

Insofar as walking from commitments – LA Times trumpeted the HELOC backpedal by Countrywide and others in the 2/1/08 edition, front page. Verbiage in the HELOC contract states (has for years) that the lender reserves that right. Interesting that Chase will restrict lending to 70% LTV. What does that tell you the bankers think values are headed? The Fed can pump $60 Billion every two weeks in and it won’t matter – banks won’t lend, borrowers can’t qualify, and debt – and debtors – will be crushed. So what of the social contract that banks are supposed to lend to ready, willing, and able borrowers?

It’s the “able” part that troubles them.

It is the apex of immorality for Cramer and other pundits to advise underwater homeborrowers to “just walk away”, knowing full well that for every buried borrower who takes this advice, there will be many taxpayers who have to foot the bill.

All else I have to say is that if you are solvent and able to make your payments, you had damn well better do it. You agreed to pay XXX hundres of thousands (or millions) for your overpriced hovel, so if you have the dough, cough it up. It’s either you pay or the rest of us, who did not participate in this insanity, who pay. Defaulting borrowers who are proved solvent and able to pay should be confronting bank fraud charges should they “just walk away”. The only acceptable excuses are those that have always been forgiven- loss of income, catastrophic illness or accident.

That’s the real bite of proposed bailouts, that the few groups of defaulting owners who really and truly deserve help, such as the hapless denizens of Detroit and Cleveland whose jobs are being wiped out with no replacements appearing, are ineligible for assistance and won’t even get extended unemployment, while the careless, self-indulgent boobies who bit off more than can chew just might be assisted in holding on to houses they never could afford.

To commentor Dan Kearns- It’s not likely we actually know each other, but I have to ask- did you by any chance work at a brokerage in Chicago in the late 80s? Do we know each other?

> You agreed to pay XXX hundres of thousands (or millions) for your overpriced hovel, so if you have the dough, cough it up. It’s either you pay or the rest of us, who did not participate in this insanity, who pay.

The lender/investors would be the ones to eat the loss if a borrower walks. There is always the danger of a bail-out of investors by the taxpayer, but I would not blame the borrower for that. Dear borrower, please teach the lenders a lesson to insist on sizable downpayments (20%, 25%, 30%).

Hey Dr. HB

First of all I gotta say that I love your blog. I check it everyday. I do have to admit though that my husband and I just bought a house. Before the criticisms start flooding cyberspace let me add that I also think that I should be able to puchase a house for about the same price that my parents bought their last house (comparable house) for in ’97. So when the house that we wanted dropped into that range we took it, because we felt that it was actually a little undervalued. The sellers had moved to CA, (we are in OR) and I think they were hearing a lot of bad news about the housing market which worked out great for us. But I really think that’s what this blog is about. Not about not buying a house ever, but just waiting until it makes sense for you.

One of the things I would really be interested in is how some of the previous RHG are doing. Some of the postings are getting pretty old. Are the houses still on the market? Have any sold? for how much? Since during the bubble you could sell anything, I think that as the RHG’s go so eventually will go the nicer homes. What do you think?

I, also, saw the Dateline segment on Stockton housing and the couple who were walking away into foreclosure. The fact that the product they purchased is depreciating is hardly an excuse for default. A house is purchased for shelter not investment, if it was, for investment, then it must have a presumed risk as with a stock.

When a purchased vehicle declines in value, the owner does not consider default, were that the case the economy would long ago been in shambles.

from Businessweek via Yahoo

http://finance.yahoo.com/real-estate/article/104340/Housing-Meltdown

RHOG nationwide…

The rise of Compton is just the last straw of a bubble.

This is the same like any bubbles. First the quality ones rises beyond reasonable level, then the crappy ones and even substitutes rise to levels beyond belief. And like the stock market, the junk stocks usually have much better returns when reaching the peak of the bubble. Usually they rise at the last leg of the bubble like crazy and then tumble first.

Anybody remember the fish oil company that rises several hundred percent when it announces that it will be buying websites?

@Jenny,

First, congratulations on your sensible housing purchase. You are absolutely right in that the intention of this blog wasn’t to keep people from buying ever. It was to keep people from getting burned from buying overpriced homes with exotic mortgages. In fact, a national housing downturn will negatively impact my investment properties but unless I can justify the price via market rates, lease rates, and local area incomes I am simply speculating as well.

@Exit,

That is absolutely correct. Many of these lower to middle income areas exploded because this is where subprime loans thrived. They were the areas to get pumped up and the first to get taken down due to the market. The margin of error for many of these people is very slim. Incomes never ever justified prices even today’s current prices. Compton is down anywhere from 8 to 10 percent depending on which zipcode you look at. The median price is roughly $380,000 where last year it was $415,000.

Dr. Doom said “Some of you argue from a moral perspective stating that this couple has an obligation to uphold their commitment. Others argue that it is the smartest thing they can do since economically, it no longer makes sense to keep opening the blue mortgage book and sending off checks for an asset that is continually declining. I’m a bit torn between both sides.”

I’m not torn at all, they absolutely be sending off their checks to the mortgage company. The argument about sending money off to a depreciating is a red herring. Anyone who has ever purchased a car on credit goes through the same thing for between 2/3 and 3/4 of their loan term on the vehicle. People forget that the structure (ie the actual home) of a house actually wears out over time, just like your car. The only difference is how long can a structure continue to exist vs. the car without major repairs. If you look at your tax statement in most states/localities you’ll notice that your taxes actually show a different value for the home and the actual land. You’ll also notice that from year to year, it is the LAND value that is appreciating, not the structure value. I guess bottom line is, don’t buy what you can’t afford… and i don’t feel sorry for you one bit.

Leave a Reply