Real Homes of Genius: How to Make $1.18 Million in Housing Equity Disappear in Long Beach. 5 Homes that the Housing Bubble Burst.

88 cities are in the county of Los Angeles. The most populace of these cities is of course Los Angeles with approximately 3.8 million people. However, the second largest city is Long Beach with 466,718 people making it the 5th largest city in California. Keep in mind that the county of Los Angeles has close to 10,000,000 with the majority of people, 52.1 percent who rent.

The Port of Long Beach is one of the busiest and largest shipping ports in the world. Providing easy access to the large Southern California market has allowed it to grow over the years. I’ve gotten many e-mails from readers about Long Beach and even with all the housing market coverage recently in the mainstream media, little attention has been given to the second largest city in Los Angeles county. Most are obsessed with certain enclaves in the “Westside” sometimes neglecting the south part of the county. So to provide some balance to this coverage, we are going to examine 5 homes in Long Beach who have fallen on hard times with this housing market.

Long Beach like any large city has multiple niche markets within itself. Areas like Naples and Belmont Shores are pricier markets in the city. You also have areas in North Long Beach that are being hit very hard and have lower priced homes.

Long Beach itself was incorporated in 1888. The larger area which initially included Long Beach was called Rancho Los Cerritos and was bought in 1843 by John Temple who had come to California in 1827. His historic home known as Los Cerritos Ranch House still stands as a historic landmark. Temple at one point in his life was the wealthiest man in Los Angeles County partly based on his cattle ranch. Temple and his ranch house had important roles during the Mexican-American War so contrary to what many would think Southern California does have history.

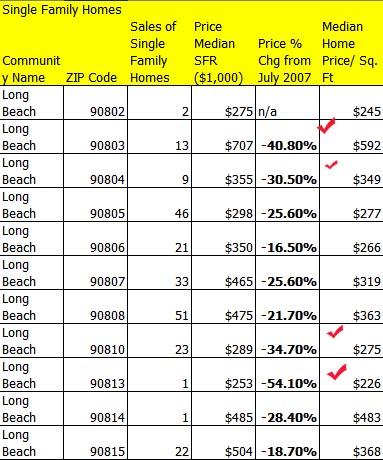

Long Beach is also home to the Queen Mary and once housed Howard Hughes Spruce Goose. You would think with so many things and being in Southern California that prices would hold up steady. That is not the case. As usual, the areas where the majority of people live are seeing the steepest price corrections but you’ll also notice that more prime areas are seeing declines as well. Here is the list of all zip codes for the city and their data:

Every zip code in Long Beach is showing a major year over year correction, you should also look at the anemic sales in the city. For the month of July, 222 homes sold for the entire city. How much inventory does Long Beach have? How about 2,395. Keep in mind July is a heavy selling month and even then, the market still has 10.7 months of inventory and we’ve already discussed in detail that much of the hidden inventory isn’t even being reported. I would safely assume that Long Beach has over 1 year of inventory currently.

So how does one make $1.18 million in equity disappear with 5 homes?  It actually isn’t too hard. Today we salute you Long Beach with our Real Homes of Genius Award.

Long Beach Home #1

Peak Sale Price:Â Â Â Â Â Â Â Â Â $375,000 (October 2005)

Current Sale Price:Â Â Â Â Â $114,900

Square Feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 986

Year Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1917

Days on Market:Â Â Â Â Â Â Â Â 8

Equity Evaporation Estimate:Â Â Â Â Â Â Â Â Â Â Â Â $260,100

Our first home takes us into our historical past. This home was built 12 years before the start of the Great Depression. This is a 2 bedroom and 1 bath home which the ad tells us is very cozy. This home sold for $320,000 in November of 2004 and then less than one year later, sold for $375,000. Apparently people thought this place was extremely cozy!

Just think, each time this place sold a lender, agent, escrow office, trust deed company, appraisal company, and owner got a nice chunk of change. That is no longer the case. This place is now priced to sell at $114,900 which seems like a more realistic price. Lenders are no longer messing around. This place has been on the market for only 8 days and the lender isn’t trying pie in the sky prices like we were seeing only a year ago. Right off the bat, this place is priced to move. But will it? That is yet to be seen.

This home has seen $260,100 in equity evaporate from the peak. With that amount, you can buy 2 of this same home and have enough to buy a hybrid. How quickly things change.

Long Beach Home #2

Peak Sale Price:Â Â Â Â Â Â Â Â Â $437,000Â (November 2006)

Current Sale Price:Â Â Â Â Â $174,900

Square Feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 792

Year Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1954

Days on Market:Â Â Â Â Â Â Â Â 3

Equity Evaporation Estimate:Â Â Â Â Â Â Â Â Â Â Â Â $262,100

This home once again features the amazing tried and perfected “garbage can” photography which is now very popular in Southern California:

This home is slightly smaller than the previous home coming in at 792 square feet but fear not! This place actually has 1 more room than the first place coming in with 3 bedrooms. Now that is what I call maximizing your space. Once again if we are to look at the sales history we see a same pattern here as our previous home:

Sale History

11/14/2006: $437,000

06/09/2006: $370,000

This home “appreciated” by $67,000 in 5 months back in 2006. Now at that rate, this home would cost $1 million by 2011. Think that is still going to happen? Not likely since this place is now selling for $174,900. Once again no frills by the lender here. It has been on the market for 3 days and they are simply not bothering with messing with the market. In fact, they are actually under pricing this place since this zip code has a price of $275 per square foot. Can you guess what this will do to future comps? Correct! We are assured lower prices for the next few months.

Long Beach Home #3

Peak Sale Price:Â Â Â Â Â Â Â Â Â $405,000 (July 2006)

Current Sale Price:Â Â Â Â Â $179,900

Square Feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1,178

Year Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1954

Days on Market:Â Â Â Â Â Â Â Â 134

Equity Evaporation Estimate:Â Â Â Â Â Â Â Â Â Â Â Â $225,100

This lender is quickly realizing what the other 2 homes know. That is, you cannot mess with the current market. Even though this place is larger coming in at 1,178 square feet it has been sitting on the market for 134 days. Initially, it was listed at $239,000 but the bank has had to drop the price down to $179,900 just to compete with the other homes.

This home shows us that yes, you can live through 2 bubbles and repeat the same mistake twice:

Sale History

07/14/2006: $405,000

11/15/1991: $115,000

We are now quickly approaching a price not seen for nearly 20 years! If you recall, Southern California had a real estate bubble back in the late 80s and early 90s. Fool me once, shame on you. Fool me twice, shame on California.

Long Beach Home #4

Peak Sale Price:Â Â Â Â Â Â Â Â Â $340,000 (April 2007)

Current Sale Price:Â Â Â Â Â $197,000

Square Feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 638

Year Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1923

Days on Market:Â Â Â Â Â Â Â Â 31

Equity Evaporation Estimate:Â Â Â Â Â Â Â Â Â Â Â Â $143,000

Everyone dreams of a picket white fence. Here, you can have half of your dream for half the price. You can add the fence later on. The ad tells us that this is “the perfect starter” home which coming in at 638 square feet makes you wonder if you even want to start. This home was also built prior to the Great Depression in 1923.

Let us look at the sales history:

Sale History

04/05/2007: $340,000

11/07/2001: $134,818

Given the pricing action on the other homes. It is very likely that this home is going to be flirting with its 2001 sales price. How in the world could someone pay $340,000 for this place? We’re talking about $532 per square foot! Either way, the market is quickly correcting the prices of these homes. When this home sells, you can rest assured comps are going to get hammered.

Long Beach Home #5

Peak Sale Price:Â Â Â Â Â Â Â Â Â $495,000 (January 2007)

Current Sale Price:Â Â Â Â Â $204,900

Square Feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1,270

Year Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1941

Days on Market:Â Â Â Â Â Â Â Â 90

Equity Evaporation Estimate:Â Â Â Â Â Â Â Â Â Â Â Â $290,100

Our final home should be used as an entry level community college real estate course exhibit. Rule number 1, make sure to move the garbage bin before taking a picture of a home. Rule number 2, pay someone $50 to cut the grass before snapping a picture! Show some effort here folks. What is becoming apparently clear is many agents and brokers were so used to selling homes even if they looked horrible simply because of the mass delusion during the bubble days.

This home is 1,270 square feet and has 2 bedrooms and 2 baths. Nearly twice as big as one of our other homes that had 3 bedrooms. These lame MLS tricks are not going to work anymore. “Oh yeah, this place is 792 square feet but is worth all of the $437,000 sales price.” No way no how. This home was initially listed at $249,900 but of course has been dropped to $204,900. Bwahaha! What is up with that $900 at the end? Is this like used car dealers selling cars for $9,999.99 thinking people won’t realize that it is really $10,000?

Sale History

01/18/2007: $495,000

10/04/2004: $325,000

This home has seen nearly $300,000 in equity disappear in less than 2 years. Who in the world made that $495,000 purchase early last year? As you can see, even though the delusion seems to have ended an eternity ago, these prices prove otherwise. On the MLS, this home had a price increase in early August which of course makes no sense only to be lowered again. 3 months on the market and still no action.

Summary

Let us do a quick recap of the 5 homes in Long Beach:

Total Peak Sale Price of all 5 Homes: $2,052,000

Total Current Sale Price of all 5 Homes:Â Â Â Â Â Â Â $871,600

Equity Evaporation Estimate Total:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,180,400

So with these 5 lower priced homes, we see that at the peak sales prices that the homes sold for over $2 million. If all 5 homes sold for the current listed prices they would bring in a whopping $871,600 for a loss of $1,180,400. Do you now see why 50 percent losses aren’t such a big shock? When you actually look at the prices and details of the homes that sold during the bubble heyday here in California you cannot be shocked at the current price. What you can be astounded by is the magnitude of the bubble. Lenders obviously did zero due diligence. Look at these places. Do these 5 properties combined look like a real estate portfolio of $2 million?

Let this serve as a lesson for anyone thinking we are completely out of the woods (or weeds). Today we salute you Long Beach with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

26 Responses to “Real Homes of Genius: How to Make $1.18 Million in Housing Equity Disappear in Long Beach. 5 Homes that the Housing Bubble Burst.”

Interestingly, all these homes must still be commanding 100%+ gain from 2000 price levels. At least 30% more equity needs to evaporate to have a stabilizing market.

It is hard to imagine that someone would pay more than $100,000 for any one of those homes, let alone closer to the $400,000 peak levels.

In 2005 I visited Los Angeles & did all the touresty stuff. While there I visited my girlfriends aunt. Bett lived in Long Beach for many years. Durring a conversation she told me that the houses in her neighborhood were going for as much as $600,000. As she put it “the land was worth more than the houses that were built on it.”

As we know now Bett was right on the money. Insedentilly the homes she refered to were all single story bungalos, many of wich were expanded outward but not upward keeping the original look while expanding living space.

The great thing about that area was the proximity of shopping for daly needs at Lakewood Center, such as Albertson’s. The bad thing was that it was the flight path for LGB.

Do we have any data on whether “real people” bought at these inflated prices or were these all scams to bilk the mortgage lenders and extract origination fees?

I think the proper exclamation here is…

ow ow ow ow ow

Yowza. And they’ve resurrected “90210”. Maybe prices will go back to 1994, too?

The sad truth is that all these home are still at least 40% overpriced. I just can’t wait for the shadow inventories to hit the market. Then we will truly see sellers get desperate.

Hey Doc,

Do you have any MLS links to these properties?

I enjoy reading your column every morning. As a Realtor it give me a real “lift” for the day.

I again chuckled to myself at your mention of the illustrious trash can photo as this is also one of my major pet peeves. The biggest pet peave is the photo of the toliet in the bathroom- WITH THE LID UP! The best one I saw the other day was two photos of the bathroom obviously taken within minutes of each other. One photo had the lid up, one photo had the lid down… which led me to think that the agent took a nature break between photos.

Keep it up the great columns!

I’m not sure I’d pay $20,000 for any of these places. Maybe the 1917 one.

The real question is the one Doc hints at toward the end–about lender due diligence. I’m thinking of those carnival-midway balloon-clowns. The ones into whose mouths you shoot a stream of water. And you keep going, as fast as you can, till the balloon pops.

Then you get your plastic thing.

Let me spare you my running on about regulating the financial industry, or anyway exposing it to some empirical standard that would rule out calling clown-popping “prosperity” and “wealth.” But that’s what I’m thinking.

Maybe the garbage cans are a subconscious cry for help from the RealTorz. Heh.

But all we need to sell a house is a bowl of oranges in the kitchen. Really! It’s the Pottery Barn Look!

http://www.contracostatimes.com/realestate/ci_10288952

rose

I recall you once posting that a person can look at the price increase or decrease two different ways. For example when the house price went from say $200K to $400K, the realtor would say 100% price appreciation. However, when the house price goes down from $400K to $200K, the statistics would say 50% decline.

Great post. How greedy and stupid were these lenders approving loans to finance these shanty houses. Now we taxpayers and our children/grandchildren will have to bail out the banks and homeowners for years to come…How sad..

Dr. How come my comments are not appearing on the previous post?

House number 5.

Didn’t I see a picture of that front yard at Home Depot. It was named “How to landscape your front yard with native plants'” and ” How to save water on your landscape.”

I have no problem admitting I get lost may of the numbers, graphs, etc. Good example is Mish’s blog yesterday about interest rates. I have absolutely no idea what he was talking about! Way too high for me.

>

This is a very good post Doctor. Nice and simple; pictures and numbers even I can understand and see clearly thru the spin.

First off, these houses are still priced to high.

None of them should go for more than $50 S.F. Max; which would put them around the $50K-60K range. this pricing takes into consideration the bad neighborhoods, schools, and the fact that all of the houses are in an area where hardly any of the people living there would have good credit with 10-20% to put down.

So, banks still need to reduce their reduced price by 50%.

Oh, but wait, I forgot, it’s California and their not making anymore land in California…..Baawwhaaaaaaaa.

Huh, my cubie lives in long beach and says his home hasn’t gone down in price.

When those 5 homes values total $375,000 – then it will be clear the housing market is back in order and representing sustainble valuations.

These homes are absolutley gorgeous…I can’t believe they depreciated so quickly.

It’s Flippers In Trouble: Long Beach!!!

When I hear stories/opinions about “lost equity,” the topic is generally “falling values.” That’s not lost equity. In other words, just because I could have sold my house for over half a million last summer, like the place across the street, and it would sit on the block now at its assessed value, because nothing’s moving, doesn’t mean I’ve lost $120K in equity. Opportunity costs and equity are not the same thing. We’re here for the long haul, and we’ll know whether we gain or lose when we sell, which is we-don’t-know-when. (Fortunately we’re set up not to have to move at present.) Probably when all those Boomers are looking for a smaller, energy efficient, single-storey, ADA compliant, passive solar place with tons of food gardens. 😀

Real lost equity is as documented in this piece: where someone actually paid for the house, and either has to resell it now for whatever reasons, or are way upside down on the mortgage. I wish the newsmedia, etc., would get this straight. I’m hearing it as well from people who are starting to fret about the possibility of shrinking municipal/county assessments for tax purposes.

As for the garbage cans, I think they represent a subconscious Cry For Help from the Realtorz. :]

rose

The equity of these homeowners may have vanished but tonight ( Friday) big things seem to be afoot. Following Bill Gross’s plea for a ‘new balance sheet’ ( at the Pimco website and it is a good read) meaning the US Treasury to stop ‘asset’ deflation, meaning the mortgage debt Pimco and others hold, Goldman er Treasury Secretary Paulson has gotten the message and a big bailout of the GSE’s is apparently going to take place this weekend. Gross was just on Bloomberg TV refusing to comment about much other than his desire to have his bonds rescued. Jim Cramer was on his show ranting that Wachovia! was now the stock to own. This seems to be entirely orchastrated as Cramer also is calling for more rate cuts from the FED to halt the ‘deflation’ that Gross spoke off. BTW Gross’s Pimco piece started off with a meandering praise of Jim Cramer before sequeing into a demand the Treasury bail Pimco out. So, it would seem we are about to get another ‘weekend bailout’ of bond traders at the expense taxpayers and those holding cash. With most Americans east of the Mississippi fixated on Atlantic hurricanes the Goldman fraternity ( at Citi, Wachovia and the US Treasury seems to have a free hand to save the bond traders.

I live in Long Beach. One of those houses looks familiar. I didn’t buy anything the last 10 years because of job security concerns (worked as a contract programmer, temporary contracts). Then when I actually got some kind of job security (permanent non-contractor job), the home prices just took off way out of my reach. Well, I still have my job security. When prices come back closer to 2000 or ’90s levels, I’ll be able to afford a home without being financially irresponsible. Keep droppin’, home prices..keep droppin’.. …come to daddy! I can’t wait to start making insulting offers.

Will Merced, Fresno and the Inland Empire meet New Orleans courtesy of Ike? Woke up to the sound of heavy rain pelting my windows so checked in with the National Hurricane Center to see what was up. Then I checked Hurricane Ike’s progress. Looks like the bullet named Gustav that New Orleans dodged last week won’t be enough to save that city. Ike is going to enter the Gulf of Mexico on a heading that could make it the storm that finishes that city off. With the GSEs ( and their tens of thousands of foreclosed homes) about to be taken over by the US Government it occurs to me that if Ike swamps the levees of Southern Louisiana a solution of sorts to the foreclosure mess could be at hand along with the political justification for it. Moving the population of Southern Louisiana out of their unviable homes and into the Feds newly acquired residential real estate portfolio. Gone will be much of the foreclosure sales undermining the real estate markets of California and Florida while at the same time giving the displaced populations of Plaquemines, Jefferson, St. Bernard and the low lying portions of New Orleans something better than a FEMA trailer or Sam’s Club warehouse to live in. We may have 500,000 people made permanently homeless by next weekend so I’m quite serious about this. Might even be cheaper than trying to restore lost wetlands and build levees sufficient to protect the parishes of Southern Louisiana.

Data Quick via OC register says median home price in OC this week is/was 445K. Last summer OC peak was 645K. A even 200K drop.

I have a friend who bought a 900 sq. ft. hut in the 90805 area in August of ’06 for 410K. Her payment reset and raised her monthly by $800 about 6 months ago to $3300, so she stopped paying. It’s a short sale house now and after 2 months, the best offer she has received is 220K with 40K down. (That’s cheaper than the above chart!) Now there’s your real price!…………..for now!

out here in Cali we ONLY fear EQs, but I understand your concerns, and can’t address them..valid points brother, stay safe.

These five homes are a perfect example why NO ONE should get bailed out of this mess. Let them all sink and die. In fact, most of the people involved should be surgically sterilized to prevent them from breeding. If they already have kids, then those kids should be sterilized.

Frankly, someone will point out to me that the Nazi overtones of my suggestion aside, we would have to sterilize about two-thirds of the population of the US. And? Don’t you think that is what I had in mind anyway. I think the rest of the world would breathe a collective sigh of relief.

Hey guys

I agree that housing mania was over done and a lot of pain is still on the way. What does surprise me is that every one here is unlikely to be a home owner because of the way they are describing the pain. It almost sounds that there is some pleasure they are deriving from other people’s misery.

Best

Leave a Reply to Scott