Do you believe in housing market cycles? Some analysts do and many markets are hitting an exuberant apex.

The economy and stock market definitely go in cycles. Real estate was largely immune to this up until the late 1990s when creative financing was introduced into this largely boring sector. Aside from pocket bubbles and localized frenzies, real estate was a fairly drab and reliable asset class. That of course has dramatically changed. People forget about cycles and I am consistently reminded of Black Swan events. Over 7,000,000 people lost their homes to foreclosures over the past decade. 1,000,000 of these were in California yet somehow, the nonsensical drumbeat that buying a home is always a good deal is being echoed by house humpers. Back in the last cycle there were investors from Nevada and Arizona and they were simply adamant that no bubble was possible. “These places rent out and cover the loan!â€Â Until local economies got hit. Or they were able to flip in a short period and make a good amount of money. Until prices went down. Some seem to think banking is fantastic again and fail to look at what just happened with Wells Fargo. Yeah, everything is Kosher. That time was different. Yet this time, it is a stable market even when magnificent crap shacks in the Bay Area are going for way above one million dollars. Cycles in real estate are now a thing thanks to the massive debt fueling this machine.

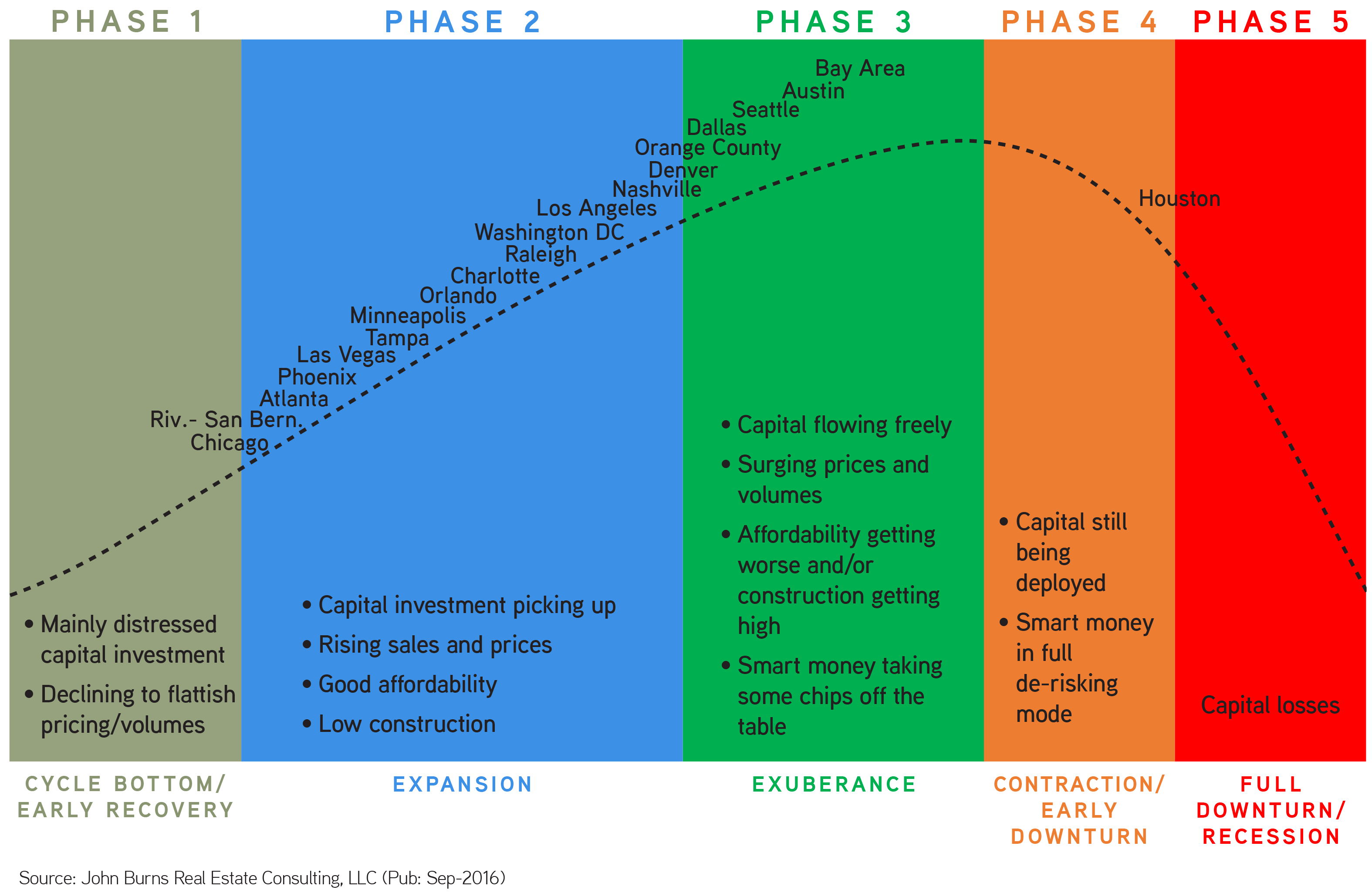

The housing cycle based on various markets

Someone sent over a really interesting chart in terms of housing markets and what stage they were in based on market cycles. I like to think of real estate as a massive cruise ship. To turn a ship from its current course takes a lot of time. And also, like a cruise ship, people get lazy and simply follow the herd and eat themselves into a coma of nonsensical information.

At this point, it is safe to say that the previous bubble is a long gone memory for most. All those “losers†that lost their homes simply did not have the winning formula. And here is the thing, say you bought a home for $600,000 and it is now worth $800,000. You only get that money when you close escrow and tap the money out.

The chart is interesting because it still shows room to go for some markets. So do you buy based on this? Jump on the cruise ship before heading back to port?

I don’t fully agree but I do like how it is laid out. You want to buy when many people are saying real estate is a bad investment. Right now, you have every Taco Tuesday baby boomer telling you real estate is a great deal! Rents are going up so you always win! You have to live somewhere so why not mortgage yourself into your next life and buy a crap shack? After all, every area is the next Newport Beach or Malibu.

What is interesting is that the chart above shows that the Inland Empire is still in expansion mode. For places like Los Angeles and Orange County things are frothy. Austin and the Bay Area are pretty much hitting a peak based on their listed criteria. Smart money has been pulling back in the last year for sure. Affordability is already pathetic in practically the entire state of California.

The only market that is in bad shape above is Houston and even then, home prices are still strong there. Pretty much every housing market is doing well at this point because access to debt is still cheap. Just look at interest rates. But if there is such a thing as market cycles, when does the turning point hit? L.A. and O.C. are deep in exuberance. In Orange County new construction and building is taking place everywhere. But things can and typically do change. The real estate market is now largely tracking the stock market since big money is looking for alternative investments.

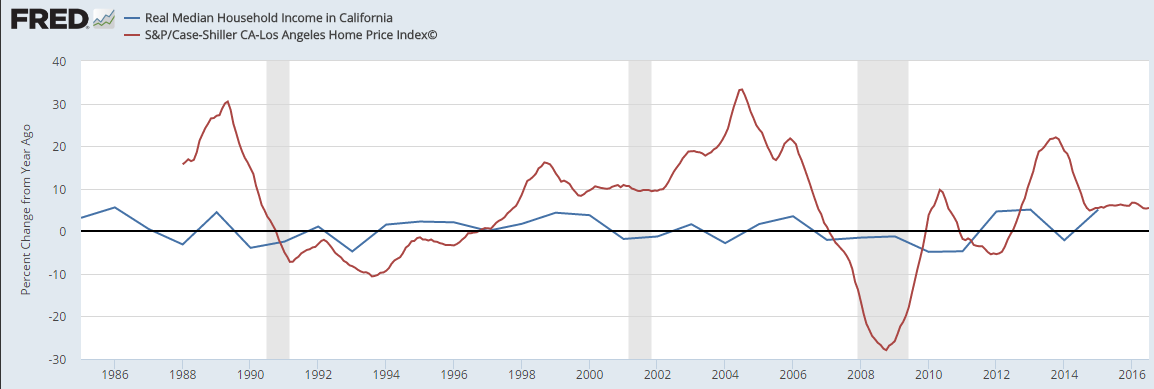

Here is an example:

This is year-over-year changes in California income and home prices for the LA/OC metro area. In 2014, real California household income went down by 2 percent yet housing prices in the LA/OC area went up by 20 percent. You can see the late 1980s bubbles, followed by the largely stable 1990s, and the wild ride we have been on since.

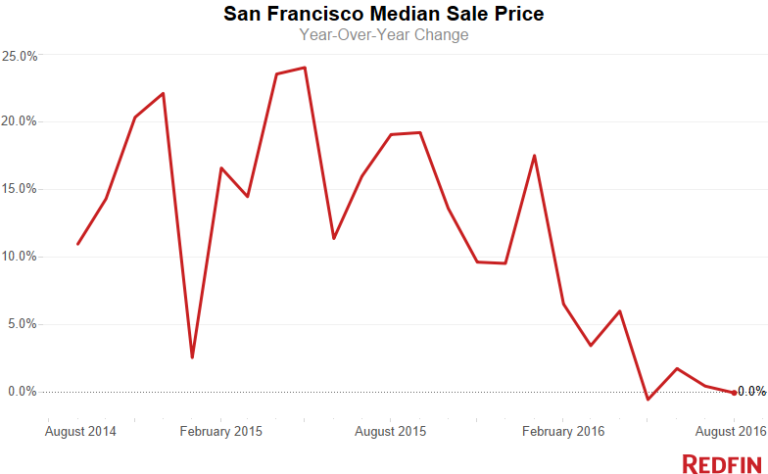

The market cycle chart does seem to be calling it on some markets. Look at San Francisco:

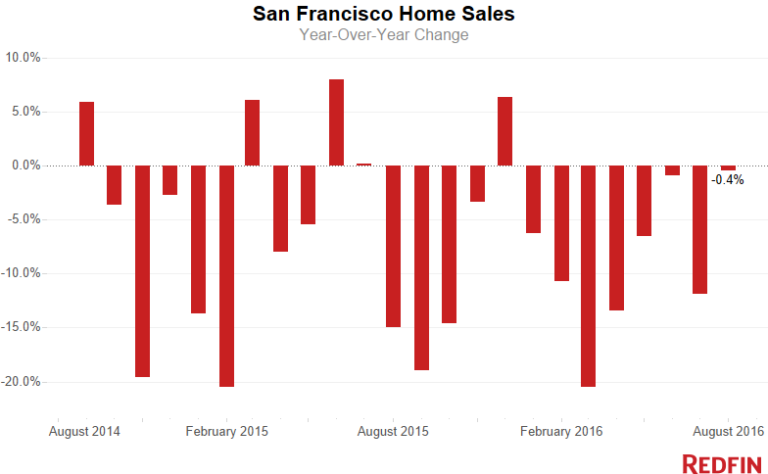

It definitely looks like prices are hitting a peak. What about home sales?

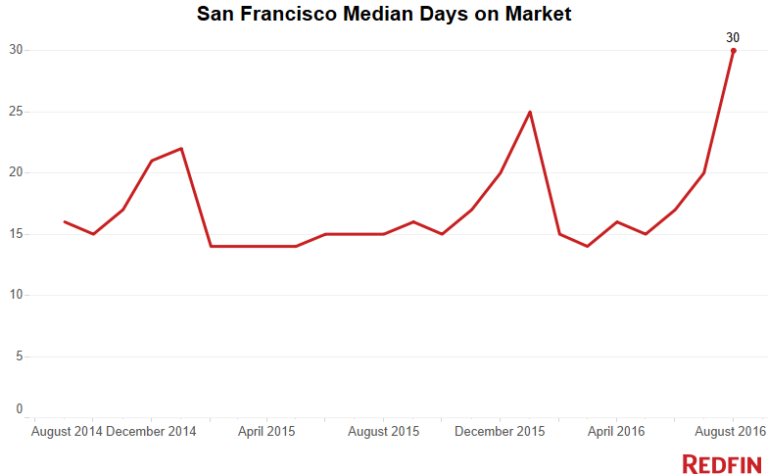

Looks like a slowdown for sure. What about time on market?

All of these are pointing to a slowdown in California’s hottest market. But of course SoCal is different. Seattle is different. Boulder is different. Portland is different. China is different. Everyone is immune to market cycles until they are not. Things just slowly start changing and when you exit a mania like this, there is always a hangover.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

107 Responses to “Do you believe in housing market cycles? Some analysts do and many markets are hitting an exuberant apex.”

Housing market cycles?

The housing market is both a leading and lagging indicator of other cycles.

Peaks and nadirs are only seen in the rear view mirror.

If there is a housing market cycle, it is passive in nature.

I find a book by Phillip J. Anderson, “The Secret Life of Real Estate and Banking”, convincing in its thesis. The severity of economic downturns is predicted by the extent to which urban land values have inflated (and hence the amount of deflation likely). Dr Housing Bubble said in the original article here, “Real estate was largely immune” to the cyclical effect until the 1990’s. Historically, this is not strictly correct: there was a hiatus for several decades. However, Anderson’s thesis has major explanatory power for the 1920’s / 30’s cycle and preceding ones. The focus of historians on stock markets is seriously misleading.

Very clear, volatile, cyclical fluctuations in urban land values are apparent in the works of authorities from the first half of the 20th century, such as Homer Hoyt and Louis Winnick.

Furthermore, both Hoyt and Winnick pointed out, in their time, a momentous paradigm shift that was underway, and eventually stabilized urban land values at a level an order of magnitude lower, swamping the historical trend of volatility. This was the massive increase in the elasticity of supply of land for the urban economy due to automobiles. This is what led to decades of lower volatility in the entire economic cycle. The return of the volatility in urban land values and hence in the economic cycle itself, is due to the destruction of the beneficial effect of automobility, in increasing numbers of cities, by restrictions on the rate of conversion of land to urban use. These restrictions can be geographic, in rare cases, but explicit planned growth boundaries are an obvious issue; so is very low-density zoning in municipalities surrounding a city (which acts as a de facto growth boundary). Some cities that claim to have no planned growth boundary, have binding “infrastructure plans” that render land non-developable just as effectively as a growth boundary.

Phoenix and Las Vegas are widely misunderstood, as the constraints in their case are not “regulatory” so much as “government monopoly ownership” of material quantities of the land supply. There are National Parks, there is Defence Department land, there are flood plains, and other geographic obstacles; which make the urban land market behave like those with explicit boundaries.

I can submit a long essay with references and excerpts from the literature, if you are interested, Doctor.

Housing To Tank Hard in 2016!

You said that at the start of September.

It’s now the start of October.

2016 is 75% over.

Just like a broken clock, Jim will be right one of these days. Just no time soon…there is no tanking in sight. And even if we have a tank, the market will take years to unwind just like previous times.

The market won’t tank. But just in case it does, [fill in the blank].

Denial and bargaining all in one phase.

In my opinion, with all these acquired Apartment complexes by these large property groups the SP 500 has just included REIT’s . So that means in order to keep the rentals full or nearly full the economy has to keep people employed to pay those rents so the REIT’s can show a return. This means likely no crash but maybe moderate correction. Otherwise the REIT would probably collapse from all the lost jobs and lost rental payments. maybe it was planned to short the REIT after making in to the SP500?

At least JT does says with a sense of humor. LB takes himself way to seriously.

Actually, there is convincing literature to the effect that “cycle length” is set in concrete at a length of around 16 – 18 years, and the fundamentals affect the volatility of the ups and downs, not the length. I found this hard to accept for years, but it is a good explanation for a crash that just does not come, and does not come, and does not come – even when prices and debt seem insane enough already.

There is no fixed cycle length of the housing bubbles. Bubbles occurred in 2006, 1991, 1982, 1972, 1967, and 1955. That’s about one every 11.5 years. Data from NY Times Case-Shiller housing price graph.

http://www.businessinsider.com/the-housing-chart-thats-worth-1000-words-2009-2

That graph identifies a few “boom/busts”, but there is a longer economic cycle within which each one is embedded. That is what I am talking about, not the duration of shorter periods where the prices seemed to be doing something abnormal. If you add back in the “missing years” (where the graph is not specifying any boom plus bust), the average is more like one every 18 years.

Actually I should have said that the theory also says the economic cycles can be shortened in their duration by black swan events like a world war, but they never seem to run longer than 18 years.

Well, if the 16 year “cycle” is so insignificant that it can’t be seen on the graph of the actual housing price data, then there is no cycle. A cycle would indicate a wave like increase and decrease in the amplitude of the housing price. Show me the data on the graph where that occurs.

There is no 16 year cycle – just random boom/busts as the data shows.

People in California are starting to use their homes as piggy banks

http://www.businessinsider.com/california-home-equity-2016-10

Do not believe anything that Business Insider prints! They have been predicting a recession since ’09! They preach doom and gloom in the bullest of times! They are lying fabricators

I thought I heard all markets are local? So I am guessing SF and LA LA Land are doomed and small towns are not? I guess I will leave to a different state as the new migrants from these towns start piling in.

Homerun….Not sure if you run the grass is greener somewhere else. Most of property in America is over valued, the core principals is this country have disappear long ago.

The Govt. is like the avg. citizen leverage to the hilt and hoping the World economy will shake out so they like JOE taxpayer keep borrowing at low rates hoping for the comeback.

Remember if the fed is scared to raise even a 1/4%, you can be assured we are on the brink, and 1929 will look mild compared to what western nations are facing.

First millions in debt was scary, than billions, now trillions? Nobody has any money to stay in the poker game, America may be the last to fold, but looks like we will fold no matter who gets elected, the pot is to large now and pulling out of the game and trying to get back your money on a slot machine (WALL STREET), you know where we are headed, a one way road, that dead ends?

What do we do? Buy gold and bullets? Im serious!

Go by the Demographia Annual Reports on housing affordability. Cities that have had median multiples moving around within the range of 3 to 4 for decades, and still remaining in that range, do not have the downside potential of cities that hit 9, 10 and even higher during the cycle. It is a mystery to me why this is taking so many people so long to work out, and so much commentary is about “the US property market” in the aggregate.

In the real life “Big Short”, the smartest traders focused on shorting mortgage backed securities from California. The very smartest ones of all, after the crash, bought up Texas ones that were undervalued because most people still had not worked out what was going on. Look at the recent postings on Issi Romem’s “Buildzoom” blog, for convincing analysis of the correlation between house price volatility and the allowed rate of expansion of urban areas. High demand either results in lots of houses in new greenfields subdivisions, or it results in a price bubble.

If we are to become a third world in the not far off future or Banana Republic I would likely be looking to hard assets other than paper.

Houston is in trouble due to the oil decline, similar to Calgary, Alberta. But the price of oil will correct. Austin is weird, same goes for San Fran freako.

You mean the price of oil will fall much further in its correction? Oil and commodities are a cautionary tale of Fed-induced mal-investment due to cheap and easy credit. Likewise, housing has been treated like a commodity.

Oil went down to oversupply, partly by the frackers and of course, the stupid banks loaned them money and now they will cry about not getting repaid.

Prince of Heck: It is a “given” that a city with a housing market where the median multiples remain within a range of 3 to 4, will have higher discretionary income and spending than cities where the median multiple goes to double that and higher. It is also a “given” that “equity loans” will not be a significant issue. In fact I have seen reports that these are a rarity in Texas, period.

You can’t serious be defending the alternative to having an elastic supply of housing? The inelastic-supply, price-volatile cities are where you should be targeting your concerns about constrained discretionary spending, saving, and equity loans. I fail to see the logic in focusing your argument on Houston.

An elastic supply of housing is absolutely not comparable to “the same mistake that the Fed is making”, and again I fail to see any logic at all. The increased supply of money is a cause of major problems, but properly elastic supply of anything is simply “how the world should work” – including in housing (and the land for it). You might as well be advocating quotas and rackets (and consequent price-gouging) in the supply of everything including basic foodstuffs and other necessities, with your weird attitude to “supply”.

Elasticity is often a question of the time lag between demand shifts and supply responses. Housing in Texas tracks around 3 months. Spain’s equivalent was 7 years. How’d that work out for them?

If you have a little too much supply at some stage, which is less likely when supply is so responsive (it reduces responsively as well), the slack is quickly taken up by household formation and in-migration in response to the temporarily even more affordable house prices. For example, the median multiple might fall to something like 2.8. (It takes real economic disaster to make it go below 2 – like Detroit did).

The stabilisation of prices below a median multiple of 4 actually guarantees discretionary spending for non-construction consumables. This “IS” sustainable; it is absurd house price inflation, unaffordability, and mortgage slavery that is unsustainable, as it sucks so much discretionary income out of the local economy, apart from everything else it does (especially in the inevitable periodic busts). The big-picture impact is overwhelmingly one where elastic housing supply and stable prices are the “sustainable” option. This is precisely the point I was making earlier about the decades of stability that came between the advent of the automobile and the advent of restrictions on urban expansion. The evidence makes this a slam-dunk.

@Phil Hayward

In the U.S., the correlation between a high discretionary income and high savings rate is very weak. In the industrialized world, the U.S. places high in the former but relatively low in the latter. Also, this article states that Texans have “some of the highest home equity rates in the country”: http://www.dallasnews.com/business/business/2016/09/16/soaring-home-values-fueling-rise-cash-loans-credit

I’m not saying that a large supply is bad. I’m saying that a large supply of housing that is increasingly unaffordable to the local population is bad. The latter is what the cheap and easy credit policies initiated by the Fed has encouraged. There is plenty of physical inventory — not just enough that is affordable.

High house prices encourages owners lots of equity to take out HELOC’s. High housing prices limits the discretionary spending power of owners with little equity

Prince of Heck:

That article about Dallas says that Texans have “some of the highest home equity rates in the countryâ€

That is home equity rates, not equity-withdrawal loans. This supports what I am saying: they have paid their mortgages off at a very successful rate. The actual house price appreciation is minimal compared to the volatile housing-supply-constrained cities. Median multiples don’t lie. Again, I always find it ironic, and somewhat heartening, that the commentariat in Texas are so “concerned” about house prices, that even when the M.M. has never gone over 4, they are calling for “something to be done”. In many cities and other nations, we have the experts assuring everyone that a median multiple of 9 and rising is “just a new norm”.

You say:

“I’m not saying that a large supply is bad. I’m saying that a large supply of housing that is increasingly unaffordable to the local population is bad.”

And I totally agree on that. I suggest you compare new house price advertisements on RE sites, for Texas Cities; LA and SF; Vancouver; Toronto; UK cities of any size – Manchester, Nottingham, Coventry, whatever; any Australian city, Sydney. Melbourne; and Auckland New Zealand. Then try and tell me with a straight face that Texas has a problem with new housing supply that is “unaffordable”.

The evidence everywhere you look, is entirely consistent with the median multiple evidence. I am baffled why people even try to claim that Texas is an exemplar of housing affordability PROBLEMS rather than a shining-light-on-a-hill exemplar of “what works”. Millions of young people locked out of housing markets in dozens of cities around the world, would look at Texas RE advertisements like a concentration camp inmate would look at lifestyle magazines.

Why would a city (like Houston) whose house price median multiple has never even hit 4, be “in trouble”, compared to the kind of trouble experienced by ones like SF that hit 12.5 in 2007, and looks like repeating that insanity this time around? Actually building lots of houses in response to demand, like Houston does, insulates the local economy from a LOT of grief later.

Why is this so hard to understand?

A stable RE market would make sense if Houston natives had a high savings rate to weather an economic slowdown. However, there’s a good chance that many have taken equity loans out or are stretching to meet additional expenses.

Do not make the same mistake that the Fed is making in applying a supply-side solution to a demand-based problem. You can build as much housing as you want. But without enough qualifiable demand from customers outside of construction-related industries, the trend can’t be sustained in the long run.

Builders around the last housing boom 03-07 supposedly were allowing bidding on lots before a house was built , which is silly and thought they could keep building second or more homes for people who were already stretched. Seems like a momentum play. More new buyers, more loan approvals, more realtors, more homes to build, on and on.

I am in my 40s and will retire at the end of the year. I will take a part time job. This was all made possible by investing in the so called crap shack houses in beach cities when I was in my 20s. I am teaching my kids about the importance of saving their money and investing in real estate as soon as you can get a good entry level property.

So many people my age wasted all their money in their 20s on travelling, partying, and sports cars. Now they are bitter renters. Don’t let that happen to you. Be smart.

I agree with jt, I own rentals and have done very well. I don’t think my primary residence needs to be a palace, live below your means, invest in rentals (fourplexes are best) and manage your own rentals. Don’t buy the hype!

jt

To paraphrase Proust, all we have to look forward to tomorrow are memories of yesterday.

Those traveling and partying memories of the twenties and early thirties can not truly be repeated, for one major reason. I am old and no longer pretty. My body hurts and I want to be in bed by 11. there is a reason most athletes retire when they are in there mid-30s, it is not because they don’t like making money, its because they their bodies don’t let them any more.

Nightclubs and dating are fantastic when your youthful. That can not be repeated. Raising children, saving money in a diverse portfolio, and renting my beautifully historic brownstone for $2300 and a 15 minute commute, which still allows me to travel with my family and enjoy life sounds better to me than having lived like a miser my whole life.

To each his own, buy sitting around counting my gold while sneering at the people enjoying life seems boring and dull. You may dies tomorrow, or live to be 100 years old. An appropriate balance is needed.

You are in your 40’s??? You sound like a 65 year old! If you feel that crappy now just wait until your 60’s if you even make it that long! Geez guy….40’s should be some of your best years physically and sexually! Im 37 and am approaching my 40’s as the best shape of my life! I’ll probably retire at 70 lmao but you sound like you’ll be dead by then. I’ll take my health and vitality and pounding 25-30 year olds over retiring in my 40’s!!! ðŸ‘ðŸ‘

Again with the beach cities.

Jim Tayor is always promising a Hard Tank, soon.

And jt is always going on about how he bought beach city properties in his 20s.

Neil Diamond sang in the early 1970’s, in a song called “I Am, I Said”:

LA’s fine, the sun shines most of the time…

And the feeling is laid back

Palm trees grow, and RENTS ARE LOW…

Of course young people once bought beach city property without a problem – because at one time, it was little different in affordability to “flyover country” cities. As long as rural land – very low cost – is being converted by developers in competitive markets, to housing use, the finished product will differ very little in price from one region to another. In fact because volumes of housing construction were so high in California’s big growth spurt in the 1950’s and 60’s, economies of scale may well have made new housing cheaper than slower-growing regions.

The difference since the 1990’s is that so much potential land supply is now protected from urban growth.

“Be smart.”

JT,

I am very smart. Instead of buying at the top as you encourage others, I’ll buy when “there is blood in the streets”.

Buy low and sell high – that is what a smart person does all the time. I did it for decades and served me very well. Today I am a multimillionaire and have all my real estate properties paid in full. I made all my money in real estate.

Two things:

– Investing in real estate 20 years ago isn’t necessarily analogous to investing in real estate today. There was a time when you could have been rich from investing in stagecoaches, too.

– Who’s to say it’s better to enjoy life after 40, rather than before it?

I’m not saying you’re right or wrong, but I tend to be weary of anyone who thinks they’re right. There are more unusable variables in this market than ever before.

In 1994, everyone told me how the 350K crap shacks in Manhattan Beach were overpriced and could not appreciate further since they were worth about 40K about 20 years earlier. Now the sand section crap shacks start in the high 2M to low 3M, based on the location.

Now, everyone says they can’t rise any more since they went up so much in the last 20 years. My guess … the Fed prints and prints and prints more. Twenty years, I will be in my 60s, and I bet the same crap shacks rise again.

@JT

If the Fed continues ZIRP indiscriminately, high real estate values will be the least of our concerns. Think about the costs of basic needs. Even the European Central Bank is realizing that NIRP is a threat to the stability of their financial institutions and are planning to reverse course.

JT

Poor reasoning!!!…If the mortgage interest in 40 years goes down, obviously you will have increase in price for 40 years. So, based on your reasoning do you expect the interest to go down to minus (-) 12 in the next 20 years? If not, what is going to raise the prices? Incomes? How do you raise incomes under faster and faster globalization????…. If you have the answer, please publish it because you might get the Nobel prize in economics.

Also, in 40 years the US turned from a creditor nation to a debtor nation. Can you continue to increase the debt in order to increase RE values???? To what point? 100Trillions???….All the money in the economy are created through debt. How can you finance increase in debt with less jobs and decreasing or stagnant wages????…Prince of Heck is right. On the current course RE prices will be the least of our worries when you’ll pay a million dollar for a piece of bread.

The current financial system is unsustainable (a slow motion train wreck) – mathematically it can not go on indefinitely. Past performance is no guaranty of future events. The law of economics still apply.

JT,

Are you saying you’re currently buying up all the $2M crap shacks in Manhattan Beach, since they’ll keep going up an up? Are you recommending we do the same??

Actually, I am on the hunt for 1M crap shacks in South Redondo Beach ( on the Avenues ) in a quiet location.

@jt:

People could have bought on the S. Redondo Avenue streets for around 700K only 5 short years ago. I also saw places WEST of PCH selling for ~850K. What a bargain, we won’t see these prices ever again…and that’s a fact!

JT, the big difference is that telling someone to buy an overpriced home in 1995, when the median multiple in LA was close to 4, is much different than telling someone to stretch and buy a home in LA now, when the median multiple is double that number.

When I was a teenager in the early 90s, my family almost moved from Indiana to Orange County, and my dad decided he wasn’t going to be paid enough to make up the difference, so our life style would go down a bit. At that time, the median multiple between Indianapolis and LA was only something like 1.5. Now the difference is nearly 4x that much, and the idea of moving to California would have never even been on the table these days. That’s why I laugh when I hear people say California was “always expensive.” Sure, it’s always been a bit more, but now the difference is nonsensical.

@GH

Spot on. I can’t stand when people say “it always has been expensive in California”, as if it’s apples to apples when comparing today to 20 or 30 years ago. It’s not like the weather just got better in 2005.

Oh ya? In what beach city are we supposed to invest so we can retire in 20 years from now?

Galveston?

Actually the best tactic if you were in on some kind of conspiracy, is to buy up land just outside the current fringe in a currently cheap city, then use advocacy and politics to get a growth boundary enacted “to save the planet”. The boundary would ideally be just outside your own land holdings.

Your rentals in LA’s beach cities are built over active earthquake fault lines and you could lose them at any time. LA’s beach cities are dependent on having water and food shipped in from hundreds of miles away over the mountains to get into the LA basin. LA’s beach cities are also adjacent to some inland ghetto areas and the wealth concentrated in LA’s beach cities will be easy pickings if the SHTF.

But lots of wealthy people live in L.A.’s beach towns and hills. Billionaires, even. And big money buys political clout. Enough clout to guarantee lots of police protection, earthquake relief, financial bailouts, and yes, water,

You saw Chinatown, didn’t you?

That’s why you should always live in as rich an area as you can afford. Rich neighborhoods receive a lot of TLC. Cops are polite. Politicians return calls. Roads, sewers, and utilities are better maintained. The riff raff are kept at bay. Just look at San Paulo.

I’ve been watching the housing market cycle up and down for over 40 years, when I bought my first home. Each cycle is quite different in its length and height/depth, but the pattern of ups and downs is unmistakable.

Interest rates have a huge influence on these cycles. When rates are low, like they have been, both housing prices and sales tend to increase. But, even with low rates, once prices get too high, sales tend to drop as people leave the market. Once sales drop, prices do as well to entice people to buy again.

The herd mentality also has a huge influence on the cycle. There are times when everyone is in a frenzy to buy. And there are other times when the market is literally dead.

There can be good deals in any market, you just need to find them and not let your emotions take over.

Interest rates strongly affect the cycle timing, but the volatility up and down depends on the elasticity of housing supply – whether the demand merely resulted in lots of new houses being supplied at roughly static prices in competitive markets, or whether it goosed prices.

Low interest rates can actually be beneficial to construction, household formation, mortgage repayment etc – the toxicity with which they have come to be associated is due to housing supply being strangled by modern-day political-cultural factors.

The media-NAR-industrial complex will never accept a market decline until it is well in the rear view mirror. In their eyes, there need be no link between income and home prices, and RE can appreciate faster in perpetuity. Everytime is a good time to buy.

They use the “all markets are local” defense to explain both the upswing and deny the downswing. Well, if housing goes bonkers simultaneously everywhere from Nigeria to London to San Francisco to Beijing to Sydney to Toronto, you can pretty much bet they aren’t all experiencing the same simultaneous local factors. More likely it’s the global asset bubble inflated buy search for yield due to low rates around the world.

This isn’t going to end pretty, although as JP Morgan famously said, markets can stay irrational longer than you can stay solvent. Problem is, housing is fundamentally something financed via rent or mortgage or cash by regular people needing a home. Try as you might, Sacramento isn’t and never will be a destination for billionaires seeking to hide away $100m in a playboy mansion.

I call peak housing in California in Q2 2017 with a 20% market decline bottoming out in 2019.

“I call peak housing in California in Q2 2017 with a 20% market decline bottoming out in 2019.”

While I hope you’re at least partially correct, the 20% estimation basically means nothing to me. A 20% reduction is where we were at only 1.5-2 years ago in many West Coast cities, and things felt very overvalued to many of us then, too. If we’re all waiting on only 20%, it hardly seems worth it. 30%-40%+ would be more interesting, I think.

I’m predicting only 20%, and not a return to the long-term inflation adjusted Case Schiller average, because the government will, once again, step in and manipulate the market. Otherwise, it would be closer to 50%. The government, however, is always late and a dollar short, so you will see something modest, like 20%.

@Son of Jim

I don’t see the public tolerate another government bailout — especially of private investors who have dominated the current market cycle. The last round of bailouts were meant for the TBTF financial institutions. Hedge funds don’t qualify.

Besides, falling prices despite record-setting ongoing subsidies for the RE industry. What ammo does the government have left?

“as JP Morgan famously said, markets can stay irrational longer than you can stay solvent.”

This quote is usually attributed to Keynes. I found this investigation:

http://quoteinvestigator.com/2011/08/09/remain-solvent/

Quote Investigator traced it back to the ’90s in a Gary Shilling article. It may be apocryphal.

One thing about this cycle

1. Prime age labor force growth which peaked in 2007 ( population ages 25-54) is slowing growing again. Ages 21-26 are the biggest in America and this will give housing much cover in the years 2020-2024

2. Annual months of inventory actually have only been over 6 months years 2006-2011 ( 1996-2016) So, a massive housing bubble/burst and a recession allow inventory to blow over 6 months

2016

Existing home sales are the best of the cycle with the highest mortgage buyers and lowest cash buyers

( Existing Home Sales Trends In Line)

https://loganmohtashami.com/2016/09/22/existing-home-sales-trends-in-line/

Still you never had a print over 4.5 million once you exclude extra percentage cash buyers

New home sales are also at cycle highs with the best internal data in the cycle as well

(2016 New Home Sales: Best Of The Cycle)

https://loganmohtashami.com/2016/09/26/2016-new-home-sales-best-of-the-cycle/

Even with that you’re not that much higher that the recession lows back in the early 1980’s when rates where north of 14%

California sales haven’t gone anywhere for years

2014 lower than 2016 and 2015 growth was only based on the low bar set in 2014

No booming housing cycle as their is no over investment thesis unlike the last cycle

and you can clearly see that in the housing start data

(Housing Starts Roof Being Tested)

https://loganmohtashami.com/2016/09/20/housing-starts-roof-being-tested/

Each cycle has it’s own unique equilibrium factors to it .. San Francisco is tech boom but those people make money.. growth limited due to that but making housing much more expensive which is showing up on the sales numbers not just for this year but for entire cycle

Any one have any particular opinions on Sacramento? i want to move there?

I own two apartment complexes in Sacramento and live here part time. It is not a wonderful place to live for a myriad of reasons and if I could escape I would. However with my buildings here I cannot for now. Can I ask why you would want to move to Sacramento? I am very curious.

Don’t bother – its pretty much a run-down dump full of state workers and a large welfare population. The average job is yet again back on the band wagon in regards to owning property here in Sacramento. Every fool and their dog is buying anything that hits the market, with increasingly dodgy loans.

Cow Town

Cow town? That’s not an accurate description. Sacramento is a dumpy Democrat plantation full of welfare recipients and government workers. If you want to live in the Sacramento area, look at homes in Roseville, Auburn, Folsom, or El Dorado Hills.

Rocklin is better than the towns you mentioned.

Per the charts provided for SF the peak was mid 2015. Median sale prices and sales volume are declining.

Jim’s tanking will begin once the year over year median sales price turns negative. The market has entered the fall slowdown and it will not recover in the spring.

I am hoping for Jim since we still have 3 months left for this to occur.

Michael, the thing you are forgetting is that the MSM won’t acknowledge any decline until we get past the summer selling season with reduced prices. They will explain away any statistics as a “seasonal slowdown”. So if things crap out on December 31st, it will be “the slow holiday season”. Reality won’t set it until Q2 2017.

If you were around in the last bubble, the lame stream media didnt acknowledge the downturn until it was well underway. This is by design, to lure more suckers in and give their owners the opportunity to make more profits. Same goes for the upturn, their always late in admitting the truth. Its similar to what the government does in regards to reporting recessions. Its all a scam, you have to do your own analysis. I believe the top in my area – and probably others – was late 2014/early 2015 on a price per square foot basis. Got confirmation fall 2015.

Son of Jim, I agree with 2Q of 2017. With most of the LA real estate that I am looking at, you can tell the homes are empty, (but staged for the photos). There is a huge inventory of properties that are losing money in the big landlord companies. Remember when DHB used to talk about the shadow inventory? It is still with us. Properties in the LA area are sitting longer and longer on the mls, stratospherically overpriced. From what I can see prices are over valued by at least 50% and sometimes more. There is no real economy of scale. Sellers are just throwing a big number out there to see if it sticks. But I do appreciate the 2 million dollar home with the blurry photos and the trash cans in front.

No first time home buyers. No move up buyers. No More money from China. Read today that Vancouver has finally cooled off, (they are proposing legislation that will cool it off further). We are at the apex. It will be held together by duct tape and bubble gum until after the election. The downturn around December will be noted as “seasonal”. But by March 2017, the truth will out. The Feds have no more cards to play. They are tapped out. I have a feeling that for a lot of people this is going to be very very bad. But the free money is going to end. Lather rinse repeat.

Before this is all over we are going to see zero down, zero interest for 60 months, cash back, 80 year mortgages.

Something is changing! I own a second home in an area that has a considerable number of vacation or second homes. Realtors tell me that the $1 million plus home market has essentially stalled, though there are quite a few on the market. Lower priced properties are still moving fairly well. Considering that expensive vacation homes in this area are usually owned by and sold to successful business owners, corporate exec’s, etc., the fact that this clientele are leaving their wallets closed … they may have insights that we don’t!

1) Houston is on the down because oil is down.

2)West Coat is filled with high tax no growth liberals. There are all sorts of building restrictions which drive up price PLUS KEY WEST COAST CITIES IN US, VANCOUVER IN CANADA, SYDNEY AND MELBOURNE IN AUSTRALIA EVEN NEW ZEALAND HAVE BEEN BIG UP WITH CHINESE MONEY FLEEING THE CHINESE BUBBLE.

2B) This also goes for major pieces of real estate in New York.

3) Rust Belt and inland cities were very slow to recover and didn’t inflate with overseas money so they aren’t in a bubble.

When it comes to Real Estate…its all about location. Remember when Miami had insane real estate because of the south American money fleeing a deflating commodity boom. There are stable cities that just plod along and there are boom bust cities. This article atleast took that into consideration…many don’t (or don’t mention what local they are talking about)

Yes, but there are cities that prove that if you simply build enough houses in response, with liberal enough regulatory regimes, you can still accommodate high numbers of new immigrants without prices inflating. All the major cities in Texas are like this. Nashville and Indianapolis and Kansas City are too.

Ironically the cities with prices bubbling tend to have not so much actual immigration, and instead have more absentee speculator owners of property. The immigrants who go to low-housing-cost, high-growth, “strong real economy” cities are probably the best immigrants to have, there is more integrity in their motivations.

I have a bunch of rentals. Great equity, easy to manage, and predictable. I like this mora than the stock market. It makes sleeping easier.

I fully agree with you and have followed the same investment strategy. I retired at 52 (I am now 65). Rental properties are the key to a long term, steady, conservative cash flow and wealth creating portfolio.

I posted only once before but was rebuked but son of a landlord when I boasted about my $2000000 net real estate portfolio (not including my residence). I was told I was not “rich” etc. I agree. All I can say is good luck to you all, and if you think it is easy go do it yourself. Cheers. Congrats to you Bob.

I believe real estate market in Orange County is 30% over priced now and we will soon see crisis in the market to adjust the price and drop it to where is suppose to be. Looking at rental cost compare to purchase is also showing 30% lower if one rents compare to if one purchases and pays mortgage, insurance, taxes and other repair costs. Definitely a big correction is coming up in 2017 as started in Bay area already. 2 bedroom single family price will drop to $450k in a good neighbourhod in Irvine

A 30% correction in OC would mean today’s 800K crap shack would sell for 560K. Highly doubtful you will see a correction like that without a MAJOR external trigger.

Are you assuming zero down payment for your buy vs. rent scenario? That’s the only way I see being the calculation being that far above rental parity.

I want to add a beach close rental, so a tank would work out great for me too. Tank this market hard!

DEAR LORD,

A 53% CORRECTION IS ON THE BOOKS. CARRY ON AND LET THE MJ MORTGAGE SMOKERS CONTINUE THEIR MYTHICAL BUBBLE DREAMS.

SEE YOU AT THE BOTTOM WHERE THE FISH CARRY WALLETS.

JPMR

HA! The Market Done 3Q/2016. It’s not for the public viewing until 4Q/16.

Only a fool waits to view the tsunami at sand level.

Prepare for losses 5x worse than 2005-2011.

Paupers will gain new bedfellows.

The good doctor, maybe 10 years ago, wrote a thoughtful blog on the pricing elasticity of real estate in California with a focus on the one factor that can be manipulated in any real estate development – the land. This is how the Irvine Company has famously manipulated the values. The are the master developer and your houses will be on postage stamp pieces of land. Don’t worry. You’ll also put in nice parks.

Phil Hayward’s missives this week emphasize this point.

Since California has constrained land use regulations and lengthy permit and approval processes our housing stock is under perpetual supply limits.

If you look at Robert Shiller’s chart with median housing prices we aren’t as bubbly now as it might seem. We’ve merely recovered to the median from the big rise of 2002 to 2007 and the subsequent crash of 2008 to 2011.

Of course prices reflect this ultra low interest environment too. People compute what they can afford and low interest mortgages help quite a bit.

The precipitating factors for a crash aren’t here yet and I saw nothing suggesting an agent will arrive in 2Q of 2017, only a prediction.

It is very difficult to afford real estate in coastal California, but all the major business centers of the world are unaffordable by most average income people these days. London, Paris, Singapore and Hong Kong also have stratospheric prices and constraints on growth due to governments and geography but I don’t see dissertations on their RE bubble and predictions on a crash.

Some things have changed geopolitically. The trade deals plus the Internet have made living opportunities more flexible. Articles about the internet based business moving to the isles of Greece to work also works in reverse. It gets a boost from people fleeing unstable markets – think Chinese, Latin American and Middle Eastern migrants.

There certainly will be a correction in the future but as much as I read the tea leaves I can’t see when or how much. Why would it happen? Because you can’t afford it?

Be careful of confirmation biases.

Very glad someone else is onto this point. There are a few global cities where the pressures are unique, from the global well-off owning homes that they don’t even live in a lot of the time. It is worth noting that for decades as New York rose to rival London, New York had relatively affordable housing. Even now, a multi-bedroom family house 30 minutes train ride from Manhattan is only a fraction of the price of an equivalent in London urban area. This is because New York “urban area” (not just the NYC municipal area) was sprawling freely at low density, while London was constrained within a planning system since 1947.

Most cities are not global cities, and it is worth comparing the “rest of the cities in the UK” with similar population cities in the USA. Cheshire et al at the London School of Economics say that land prices in the UK cities are more expensive than US benchmark cities by a factor of at least 100. One hundred. That shows what urban planners rationing land supply, can do for the racketeers under a rentier capitalism model. Even Liverpool, which is the UK’s Detroit, somehow manages to have land this much too expensive. This of course is an obstacle to economic recovery. London’s land is around 900 times too expensive at last count.

In the many median-multiple-3 cities in the USA, you can rent a modest house for the kind of money that in any UK city, will only get you a 1/4 share in two rooms, with kitchen and bathroom shared by even more roomers under the same roof. There are now plenty of horrific articles and essays on the UK’s situation, that use the term “generation rent”.

My point is that chronic, planned deprival of urban economies of land supply, will indeed prevent any “full and final” reversion to mean land values – the trend is inexorably upwards, with each “bust” ending higher and each “boom” peaking higher. Upzoning does NOT restore affordability – land values inflate faster than people are crammed in, leaving everyone paying MORE for LESS. The only winners are the land rentiers.

“Why would it happen? Because you can’t afford it?”

Fensterlips,

I can tell you how it can happen. Of course it is only one scenario out of many. The system is so unstable right now that anything can start a domino effect.

You admitted that we are in a very complex and interconnected system. The global bond market is in such a crisis that the FED was afraid in Sept to raise even 1/4 point. If it starts unraveling it takes down with it the stock market and the RE market. In these days of instant communication and Internet, things can move with light speed. All the derivative market is doing is to amplify the magnitude and speed of these moves – “weapons of mass destruction”.

The first Great Depression started with the collapse of Deutche Bank. That bank can collapse again any day due to their high level of speculation and derivatives (worse than Lehman). If that happens the whole EU and US system will unravel. The US banking system will be frozen and with it the RE market.

These are just 2 very probable scenarios. More black swans can happen. Just food for thought!

I agree completely. There will absolutely be a real estate downturn at some point, but it’s not clear when it will be. Could be 5, 10, 20 years. It’s difficult to time.

houston and other major cities in texas are in a housing affordability crisis to read the article google nancy sarnoff twitter and on there she has an other story how zoning is not stopping houston becoming more expensive.

It is good that Houston’s experts are concerned enough about affordability, that they start ringing alarm bells before the median multiple even reaches 4. It may never even reach that level. In contrast, we have experts in many other parts of the USA and the world, who are trying to tell us that median multiples of 8, 9, 10 are OK, just a new norm, get used to it, young people need to lower their expectations of house size, etc etc.

Most likely cheap and easy credit drove investors into RE speculating much like it encouraged over-investment in commodities. Yellen bucks searching for yield in the all the wrong places.

And yet: there are countries with very tight credit, but “supply of land for housing” is inelastic due to planning or corruption – and the median multiple can still be over 10. The chronic nature of the “illegal slum” problem in some countries is because of this phenomenon. The legal housing market, or rather the urban land market, is rigged to extract economic rent.

Instead of borrowing from institutions, most of the successful buyers of legal property do so from years of accumulated saving, and family assistance.

South Korea is the one example of a developed nation with extremely tough restrictions on mortgage credit – Loan to Value restrictions are typically around 50% – but the median multiple in Seoul goes as high as 14 and is volatile.

Ignoring land supply and the nature of land rent, leads to totally wrong proposed “solutions”. If you were to conceptualize urban property markets in a mathematical formula, you would have some large brackets with numerous demand-side factors on the inside, and “land supply” would be like a binary function outside the brackets that either changes prices exponentially, or not at all. What median multiples do not actually reveal, is that in many cities with a high median multiple, the urban land price is dozens of times higher than in median-multiple-3 cities. Density is what makes the difference. For example, Hong Kong has 66,000 people per square mile and a median multiple of 16. The land price is literally thousands of times higher than any median multiple 3 city. UK cities land prices are “hundreds” of times higher than median multiple 3 cities.

There are papers by Mills and Jansen, and by Heeboll and Anundsen, that successfully formularize house price volatility in US cities during the bubble, and the only way they can do it is by making “speculative demand” endogenous to housing supply inelasticity. There is no other way to explain such massive divergences between cities with median multiples that stay below 4 versus others that go over 12, in exactly the same national market with the same monetary and credit conditions. In fact the fastest population growth is in some of the median-multiple-3 cities, contrary to the assertion from some, that “population pressures drive prices up”. Yes, only if the supply of land for housing is rigged. Everything drives prices up if this is the case. Easy credit; subsidies; tax breaks; public investments in local amenity; etc

Realtors say that California home prices with RISE in 2017: http://www.latimes.com/business/la-fi-housing-market-forecast-20160928-snap-story.html

According to Realtors: No Tank in sight! Buy now or be priced out forever!

This is nonsense. Live in Silicon Valley and have been very observant of houses for sale around my block. Homes peaked at around 900K in Spring, last few houses have sold for 860K, 840K, and was shocked on last one just sold 799K. Its slowing but they are not telling you.

IMF slashes U.S. growth forecast for 2016:

http://money.cnn.com/2016/10/04/news/imf-u-s-economy-downgrade-forecast/index.html

Automakers 7-year winning streak is coming to an end:

http://money.cnn.com/2016/10/03/news/economy/car-sales-topping-out/index.html

Cisco’s Chambers says at IMF that 40% of businesses will disappear in a decade:

http://www.marketwatch.com/story/ciscos-chambers-says-at-imf-that-40-of-businesses-will-disappear-in-a-decade-2016-10-05

Some banks too-weak-to-survive:

http://www.marketwatch.com/story/imf-says-a-third-of-banks-in-top-countries-are-too-weak-to-survive-2016-10-05

It’s hard to believe people are in bidding wars over $500K+ stucco crapshacks in the crappy neighborhoods of LA. I left LA some years ago and recently had to return for business. There are some signs of progress like in Downtown and Hollywood, but generally LA has become a even deeper sh*thole. I was driving on Wilshire, West of Western Ave and I could swear I was in a 3rd world country. Actually I have been in 3rd world countries that were nicer then areas by LAX. Traffic is abysmal at best and it was hot as hell. It’s just amazing what people accept as quality of life today and what has become acceptable.

I grew up in LA; left there in 1990; I go back regularly because my daughter lives in the Santa Monica area. I couldn’t agree with Truthster more. I look at the horrible houses at $500k+ in the valley and I am slack-jawed. Good think the money is so cheap; put as little as you can down and you can walk away I suppose.

I don’t think anyone is getting priced out forever but you might be depressed when you see what your money buys you. We had friends in Manhattan selling their 2 bedroom 900 square foot co-op on the Upper East Side a block from the park in 1990 or so for $200,000. We thought that was insane. I’ll let you guess what the price is today.

I know we all think a correction would help sort things out but there aren’t the crazy option loans we saw in 2003 and there aren’t banks with wild and crazy MBS products. There always could be a black swan, and I also could benefit nicely from a correction. I could use some more property, but I just don’t see it.

Notice how Janice Yellen has been setting the stage for negative interest rates. That could give real estate an additional boost as people pull money from bonds and MM funds.

I think people that are concerned about bank failures could pull more funds and place them in hard assets. RE might perform better than precious metals. Again, I know we’re all guessing from our education and experience but I can recount again my real estate experiences on prices from the 80’s that could make you sick. As an additional perspective, my family was sick and tired of the real estate “boat anchor” of an acre on Crenshaw Blvd at the top of the hill in Palos Verdes so they dumped it for something around $20,000. Next was the 1/2 acre in Sycamore Canyon near Malibu for the same reason and similar prices. It was considered a score at the time. Yeah, go figure, but 30 years can give amazing wisdom. I don’t want to once more explain in 30 years hence, if I’m still here, that I gave away a house for less than a million because I was tired of the hassles. It might not happen but history doesn’t look like that. Put it a different way, if you had a chance to buy more property at the end of the 90’s after a long slump or even in 1989 at the beginning, what would you do? Would you complain about the slump? the high prices? hope it happens again? We bought and sold a couple houses during that time. One for $285,000 and the other for $290,000.

Nearly 67% of American Young Adults Living With Parents…

Today, about 67 percent of 15- to 29 year-olds in the U.S. live with their parents as opposed to on their own or with a roommate…

(But I thought things were getting better.)

http://www.usnews.com/news/best-countries/articles/2016-10-05/countries-where-the-most-young-adults-live-with-their-parents

Really?!?!? I mean are so desperate to paint things in a worse climate than they already are?

What else is a 15 year old to do? It’s not uncommon at all for 15 to early 20 year olds to live with parents. I call BS on this whole article and post.

Houston won’t avoid the 5th phase of the cycle as our local pundits pretend it will, but ironically the oil bust could prove to be Houston’s saving grace. We’ve already had a portion of our wake-up call. The next test comes with the inevitable correction of a massively inflated stock and bond bubble. When that correction arrives, you’ll see other housing markets across the country roll over.

This latest housing cycle is different in many respects because the Fed (and global central banks in general) has distorted asset prices across the chain. Central banks have gone bonkers trying to delay the cycle or prevent the process of natural selection (aka capitalism and asset price discovery) from happening, and to that I would add for what purpose? Anyone with a brain can see that QE was an abysmal failure for the general population, but it has made a few people fabulously rich. Wealth and income inequality are off the charts…and getting worse!

The Fed’s latest investigation into the affordable housing problem in Texas reads like another comedy of errors…

http://aaronlayman.com/2016/10/fed-looks-at-texas-affordable-housing-problem-fails-to-look-in-the-mirror/

The dip in rental rates in Los Angeles from July and August was short lived….

http://la.curbed.com/2016/10/3/13153924/rental-prices-los-angeles-where-to-rent-rising

“…Those who got excited about a report last month showing that Los Angeles rents actually dropped off between July and August are in for a letdown this month. An analysis of pricing data from Apartment List shows that rents in Los Angeles rose just under a half-percent in September.

That’s only a slight increase, but it’s part of why prices have risen 3.1 percent since last year. That rate significantly outpaces the national average of 2.1 percent over the same time period.

In other parts of the metropolitan area, prices since last year have risen even more dramatically—particularly in Orange County. Rents in Fullerton, Anaheim, and Costa Mesa shot up more than six percent, with a median one-bedroom in the latter city fetching $1,680 per month.

Rents also soared last month in Pasadena, increasing by 5.9 percent. One-bedrooms in the City of Roses are now going for more than $2,000, with two-bedrooms asking $2,620. The one-bedroom price is actually higher than in Los Angeles itself, where the median falls at a significantly lower $1,910. Two-bedrooms in LA are priced at $2,630….”

Keep trying to justify real estate prices and why you would buy now, but prices in a number of cities simply are out of sync with reality. According to a number of sources/studies, the majority of America are non-savers, have extremely under-funded or no retirement accounts, still have too much debt, and are living month to month, including many who can be classified as high-earners! And, there are no real prospects for significantly improving our economy! Why do you think there are so many short-term rentals on those popular web sites, so many Uber drivers, etc. … everyone is scrounging for a buck to pay the bills! No one seems to want to talk about this reality and it’s long term impacts on real estate! There are only so many rich foreigners who can boost real estate prices, and only so many opportunities to artificially stimulate the market via loose lending standards, or low interest rates. Eventually, the tide will turn and there will be more wanting or needing to sell to get their hands on that equity, but few buyers due to economic and financial realities!

I was not trying to justify home prices – I posted an article that rental rates in LA are rising again.

There may be only so many rich foreigners but there are enough to cloud this for many decades to come.

Their will always be a bubble, and subsequent correction of all asset classes periodically. It’s always pretty much the same extended pump n’ dump-

1) Inflate an asset class (gold, real estate, etc…) with pundits/ tax policies / low rates

2) Wait for ensuing bubble

3) ……

4) Profit !

5) Wait for / expedite crash

6) Get the masses to think securities, commodities, real estate, etc.. are stagnant at best

7) Buy asset for depressed price

Rinse/Repeat

Canada makes major housing move, no more Foreign buyers unless they want to live in Canada. Good news for the Canadian citizens to stat getting housing affordable bad news for investors and mortgage companies.

Notice how many apt. and condos are going up? Yes folks this is EUROPE coming to you, houses will be now for the well healed and large inheritance and for the rest like most places in the world you will live with no backyard or privacy.

Why you ask, the gov’t can keep closer tabs on you when most Americans live in large complexes or like I say compounds, dangerous times for your freedom and vanished hope that you can have a home with a picket fence and single mail box in front?

Well said Robert.

As the middle class disappears we are destined to become just like European countries where property ownership is only for the wealthy elite and everyone else rents and eats sh#t.

I am seeking more information on Houston… I have moved to the area from Ca where I lost my house in the central valley. I have people all over telling me the same things when I wasn’t ready to by then… You have to buy the markets only going to go up. Your making good money stop wasting it on Rent… This town feels just like Fresno did in 2005. However I don’t want to be on that ride again. Im looking to find out how many ARM there are still in this area? I believe that QE is going to give us big pop in 2017 just looking for direction. Send me you thoughts.

Ryan, that’s a good question and I’d be curious about the answer as well. You can be fairly certain that there are almost no ARMs being created right now as the spread is only 1/8% between 30 yr fixed and a 5/1 ARM. What the spread was over the past 5 years, I don’t know.

It’s best to buy a house now,i read an article that people from overseas bought $10 billion dollars on texas real estate,in 2020 a million more people will move to houston so that’s gonna drive up the price to buy a house especially in the popular hoods in houston and you have to have a high paying or an inheritance to live in the popular hoods here.not only there’s the mortgage payment,the taxes are high.when oil companies start to re hire people that’s gonna drive up the price to buy a house.my mortgage is only $76,889 my house is 1,845 sqft lot size 4,000 and i live in the heights,im sitting on a boatload of equity and since houston is growing in population it doesn’t make sense for me to sell.im lucky i bought early in the area and have my homestead , because i have seen news stories about many homeowners in texas saying they are being priced out of their homes.

Are you ready for the double-flip?

Bought in Oct. 2013 for $235K

Sold in Feb. 2014 for $355K

Listed in Oct. 2016 for $530K

That’s some nice markup for the current owner in less then 2 years and doing little to no improvements.

https://www.redfin.com/CA/Los-Angeles/2308-S-Harcourt-Ave-90016/home/6899510

I’ve seen some astonishing flips close in Santa Monica. Several hundred thousand dollars in markups on condos and townhouses that were bought as recently as 2013.

I don’t think it’s as easy to get such high markups in non-prime areas. That house you posted is in a pretty shitty area, despite its “convenient freeway access.”

Leave a Reply