Where did the option ARMs go? Cheaper to pay modified loan than paying market rents. Subsidizing the housing market through shadow finance. Interest only payment 10 percent cheaper than market rents.

To say that we are living in a financial moral hazard period is probably the biggest understatement of the century. The banking industry has ignored every sensible and prudent approach to lending and has turned finance into a giant vacuum that is draining every ounce of productivity from our system. Our economy is in a giant malaise because most of the money is going to the incredibly unproductive financial and real estate sector. In the last few months, word has gotten out that banks have been doing very little to help small businesses, the supposed life blood of our nation. Don’t you think this is something that the U.S. Treasury and Federal Reserve should have figured out first before shoveling out trillions of dollars to the toxic banking sector? Things are so bad in the system that I have now heard from many readers about people having loan modifications that effectively allow home borrowers to stay in their homes at below market rents. In other words, another subsidy to an already incredibly subsidized market.

Take for example this Chase modification that recently occurred here in Los Angeles County:

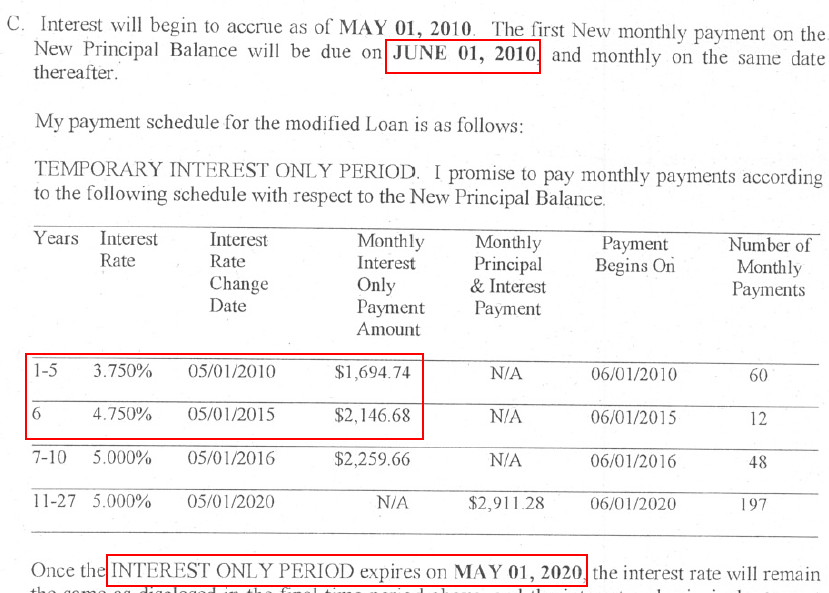

This loan modification occurred in the 91306 zip code of Los Angeles County. The current median price for this market is $355,000. Remember those horrific option ARMs? Well they are now morphing into other products. Here are the original terms on the note:

Option ARM payments

Negative Amortization:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,754

Interest Only:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2,265

P&I:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2,905

The “real†monthly cost on the mortgage is closer to $3,000. Yet with this new modification, the borrower can stay in the house paying $1,694 per month all the way until 2015 with a 3.75 percent interest rate. This is someone that took out an option ARM from one of the former option ARM kingpins. The borrower who speculated wins because they get to stay in the home and the bank has already won with all the taxpayer money they have stuffed into their pockets. Oh, and what is the new principal balance?

So the bank can assert that they have a $542,000 asset in a market where the median home price is closer to $355,000. What do they care? They already have taxpayer money to speculate on Wall Street and basically allow these mortgages to sit fertile for as long as the borrower can string by a few payments. Moral hazard? We are beyond that point. I’m surprised we don’t have tens of thousands of people marching down Wall Street but as long as those iPhones have new apps each week then I guess all is well.

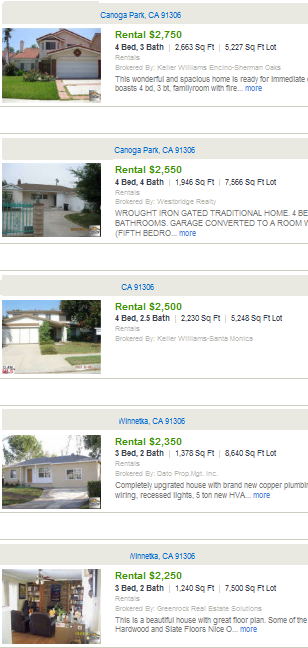

If you look at market rents in this area, it actually turns out that this borrower is making out big time:

Hard to tell the size of the home but assuming the basic 3 beds and 2 baths home, rents can range from $2,300 to $2,400. Keep in mind that the borrower can write-off on their taxes the interest portion of the note (100% for the next few years) plus taxes.   Ultimately, banks and borrowers are being rewarded for bad behavior. And this hurts everyone especially the prudent majority. Keep in mind that if this home was added to the market even as a rental, overall rent prices would go down. So by funneling money into the banking sector, what is occurring is we are favoring one group over another. In this case, the vast majority of the reward goes to the bank while the borrower shares in their dirty little secret.

This is only one example of many of the option ARM reworks that are currently happening. Make no mistake, the vast majority are failing and going into default but there are also many loans like the above that are being reworked through hocus pocus and subsidizing another group that made a very bad bet. And enough with the keeping people in homes argument. There have been modifications of toxic loans in million dollar neighborhoods! These people will be renting in top of the line areas if they lose their home so don’t go sobbing about that especially here in California. We’ve already analyzed top priced areas and you see that the stats show a very peculiar trend. Why not say that we won’t allow modifications that go above the median nationwide home price of $170,000? I think most can live with that. But that isn’t exactly what is happening.

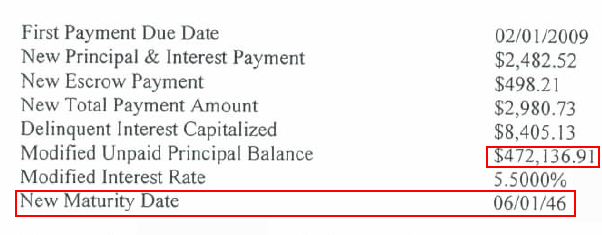

Shocked yet? Well how about a 40 year IndyMac loan modification? A reader sent over this interesting example:

Remember IndyMac? They were the bank that fell flat on their face and had a large number of people here in Southern California doing bank runs that looked similar to the Great Depression. Keep in mind that this is a giant loan amount. The national median home price is close to $170,000 as we just mentioned. In California, the median price is $278,000. Who are we really helping here and how do banks have the money to make these kinds of deals? That’s right, we’re in a crony banking system that basically operates to funnel money into the completely unregulated (actually, regulations are there but no enforcement) and wild west banking industry.

This absurd behavior goes on because both Democrats and Republicans (especially in the Senate) are owned by corporate lobbyist and Wall Street. Until people demand real change, the same beat will go on and banks will continue to suck every ounce of real wealth from our economy. The fact that it is cheaper to live in an option ARM financed home today than to rent responsibly tells you a lot of where things are.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

39 Responses to “Where did the option ARMs go? Cheaper to pay modified loan than paying market rents. Subsidizing the housing market through shadow finance. Interest only payment 10 percent cheaper than market rents.”

Another great example why everybody should be irresponsible.

The vast majority of people in the U.S. are functionally illiterate when it comes to economics. Most people would rather watch America Idol or Dancing with the Stars, than spend any time reading about finances or planning their future.

Actual comments I have heard over the years:

“I don’t know anything about stocks, so I do not invest in the stock market. I have mutual funds, instead.”

“Buying a house is cheaper than renting, because of the tax write off.”

“I am going for a 30 year mortgage, rather than a 15 year. It’s a cheaper way to buy a house.”

“I don’t know what the new car costs. I just know the monthly payment for the different models that I am considering.”

H.L. Menkein said” No one ever went broke under estimating the American public.”

Owes $542k in a $355k neighborhood. Sounds typical. Going from the homeownership society to a society composed of people living in Plywood Prisons. Did you hear that? Listen harder… I think I can hear the theme to “The Sting.” da da da da da da da da daaaa….. “we been boned”

Of course we all know what happens in a few years from now: the homedebtor either mods again or goes “all in” with a foreclosure. Appreciation won’t wipe out this balance, since payments made are clearly not going to either. Only a walk away with a re-sale will clear this mess up.

I often think how if I could only fire up the DeLorean and go back to 2000, buy at a low price, lever up to a high balance, squat, mod, and get a deal like this homedebtor got, I’d have moved to Santa Monica and lived La Vida Loca. Then again, I have a consciense.

so this is a very frightening anecdote, but just one example…. how prevalent a problem are we talking here?

What will be the affect on existing home prices with this type of Option Arm Morph? This will result in less foreclosures, which will mean that prices will not go down like forecasted. This will give the banks enough of a breather, until inflation and kick in and make the existing homes viable again.

Thanks for laying this out there for all to see. Of course no one will look. We are only pushing the rock up the hill.

So what is the end game? Double dip, recovery, inflation, deflation, collapse?

2012 can’t get here soon enough!

Aimlow Joe was here.

http://www.aimlow.com

Fool me once – shame on you. Fool me twice – shame on me. Fool me one thousand times – shame on the crony capitalists. But they feel no shame – it’s just a business model.

Constant refinancing – we essentially are creating mortgages with terms way beyond 30 years, it’s just not called that.

I know some have proposed allowing underwater homeowners to rent the home from the bank to prevent foreclosure. Making only interest payments for 5 years is essentially just that. Gotta make sure the banks can keep making money!!!!!!

I’m going to go vomit now.

This buys time and avoids taking the costly hit right now. It’s just more extending with the hopes that things will gradually get better and right themselves, given enough time. But, with 14% of all mortgages not being paid, how soon until more rentals are on the market, pushing down rental prices? This just makes the grind even slower, but still going down.

2 Social classes that exist today:

1) Prudent

2) Irresponsible

We have seen the governement side with the irresponsible for a long time now.

The lack of accountability is astonoshing. We are well on our way down the path

to destruction. Vote out all incubments who are responsible for the current corpocracy.

I used to say it’s cheaper to rent than to buy.

But now, with this new paradigm, I must say:

“It’s cheaper to scam, than it is to rent”

Scammers: The New Post-Bubble Rich.

These are all HAMP mods. Got any examples of mods for Option ARM loans over the $729k HAMP limit? I’m dying to know what they’re doing on these. Especially curious about Aurora.

Sure, he’s making out now. But when his job changes and he has to move, how is he going to make up the $200K deficit so he can sell the place?

Is it safe to say that the deadbeat will rent the house out for $2500, take the $800 differential between the modified payment and rent collected and go rent an apartment. Basically living for free?

Will these homeowners make the necessary maintenance? New roof, New heating

etc, bet not! As other posters have noted this is just another stop gap most if not all these folks will be the coming foreclosure wave.

Since these people cant refi being massively upside down and conforming arms sitting around 3.25% today I dont know if this is a massive handout. The banks are of course still covering their losses by keeping the balance high instead of shortselling and righting off the difference(since they long ago reported negative amortized balances as profit). With the high likelyhood of walking away for people at 125% or more of the value it actually sounds pretty reasonable. I’d rather they foreclose and get on with cleaning up this mess, but its clear that isnt going to happen with the whole shadow banking structure.

This reminded me of the Dean Baker right-to-rent concept. I guess it’s similar, except, this one is soaking the taxpayers, while the Baker concept soaked the bankers and speculators.

In the future, if we go through another crisis, and people see this comment, remember: do what the commies say, do not follow the advice of the capitalists.

Click my link to view the old blog post.

Dutch123 … Brilliant!

I am sure in next 1-2 years, rents in that neighborhood will fall to the same level as his mortgage payment. With 20 million vacant homes, and 10,000 homes a day going into foreclosure, and so many people moving in with their parents, grandparents, friends, relatives..The continued downward spiral of house prices and rents will continue unabated until the biggest asset bubble completely deflates to no air.

I agree with the above comments. Dr. HB has said that many times, it was much better to rent than to own. However, it is not much better to scam than to rent. And to scam you have to own. I unfortunately do not own, and rent and will postpone owning anything for what appears to be another decade. I understand why americans feel that they things are unfair in this country…moral hazard, corrupt banks, and my underwriting this system so that I can prop up a system that I can’t afford to get into. Let us keep propping up those property values.

Regarding the new frankenstein loans the banks are pushing to keep chaos in a bottle…Like John CPA says: “This will give the banks enough of a breather, until inflation and kick in and make the existing homes viable again”.

Yes, what if inflation takes hold — lay that over housing — isn’t that what would keep housing prices high ?? It would fill in that empty air pocket that the banks/real estate industry keep trying to hide. That’s been my thought for awhile — as much as the more prudent home looker would hope to swoop in when these houses are finally reduced (bank says: Oh, okay, fine then, we’ll mark to market the home, darn it all–NO WAY!) I just do not see this happening.

why? that requires the result to be the more prudent peasant the winner. The winner is the financial sector – banks – always. Like we’ve witnessed over and over again in the financial/banking sector – they extend/pretend and simply pass the mess to taxpayers. Privatize profits socialize risk.

Hopefully people out there now realize that the big scam was a big plan, with people’s penchant for greed the grease to keep it going… but no doubt, we’re in the middle of it still. The conclusion of this is certainly not going to be “great housing deals now for those who sat out of the chaos”

I think inflation is going to fill in that empty air and keep the sticker price of the home high overall — so while we’ve seen dips – it won’t crater. Because it cratering would kill banks and help Mr. and Mrs. Smith who saved to buy a home? No way! impossible. Right up there with taxpayers will make money off of bailing out banks via TARP….

Of course, the nominal price of the home will have dropped considerably, but think about it: people in general have NO idea how much the purchasing power of their dollar has been reduced, as said by others, they don’t understand any of this — just the numbers on the price tag… The government does their best to hide inflation and under report it anyway they can, again, we all know this.

somebody jumped on me before about this — but doesn’t that sound more probable – Bernanke and the boys “fixing” this touchy “home value” problems — think empty swimming pools – as they keep their fire houses spewing fed notes filling those empty pools and keeping with “quantitative easing” going, and going…

We already know the stories ends with the dollar tanking – the Fed is gonna print it into obscurity

Remember, they’re getting ready to celebrate their coup centennial! (1913-2013)

http://news.yahoo.com/s/ap/20100715/ap_on_bi_ge/us_foreclosure_rates

I’m pretty sure there’s also a huge balloon payment at the end of the mortgage too. Something along the lines of tens of thousands to even a hundred thousand depending on the size of the mortgage. There is no way banks really forgive anything. Principal, interest, back payments, deferred interest – it all gets tacked on to the end of the loan. You could make your payments for 30 years to find out that you owe another $50K and still get foreclosed on. No wonder people are walking.

quote: So the bank can assert that they have a $542,000 asset in a market where the median home price is closer to $355,000.

This also means that the home buyer is still really screwed. This loan modification simply cements the fact that they are almost $200,000 under water on their house. The interest payments are lower than rent for a while, to get them to sign the mortgage, but they are still on the hook for $542,000 should they ever want to sell. They can never sell with a mortgage like that.

Excellent post and graphs over at: http://www.ritholtz.com/blog/

A bit:

“For many years, total mortgage debt consistently and reliably equalled 0.4 times the value of the US housing stock. Intuitively, this average of 0.4 makes perfect sense as every property usually has a mortgage ranging from 0 to 0.9 times its value. So in 1990, $6 trillion of housing collateral could support $2.5 trillion of mortgages, and by 2006, $23 trillion of housing collateral could support $10 trillion of mortgages. But since then, the US housing stock’s value has slumped to $16 trillion which means the amount of mortgage lending supportable by the collateral has plunged to $6 trillion. However, actual mortgage debt has remained at $10 trillion – $4 trillion too high.

The fact that mortgage debt has barely declined suggests that relatively few homeowners have defaulted on their mortgages or paid off debt yet. Instead, a quarter of all borrowers are sitting on negative equity. That’s just as well – because were mortgage debt to shrink by even half of $4 trillion, the US economy would slump.”

There is a big problem with the Dutch123 post before you fire up the lynch mob. What about taxes on the house of at least $500 and insurance $100, maintenance certainly not $0 and then through in a one month vacancy and OOOOPPPSSS there goes the $800 differential and its a loss. Oh yeah there is also the problem of telling the Mrs. that they are moving out of the 4BR/3BA 2300 suburban tract home and squeezing the family of 4 into a 600 sq ft urban studio apratment for the $800 rent.

That post is nonsense….

The monthly payments are now being thrown away, just like rents are.

This is a smaller total loss for the homeowner who will have 0 equity ever,

but still a total loss…basically a rental. Nice rental deal, I guess.

Another angle is that property taxes must remain high to feed the

local public sectors, so they have an interest in propping up values as well.

In the 1930’s banks were so hated (in those days many shut down and kept your money) that infamous criminals like Bonnie & Clyde were cheered on after they robbed a bank. It is unfortunate that banks are bringing on that similar sentiment today.

The biggest problem I see with this mod is that the loan (assuming purchase money with no HELOC or refi prior to the mod) now becomes a full recourse loan. If in fact the “owner” loses his/her job or is forced to relocate, they no longer have the ability to walk away from this property without a deficeincy judgement of tens or hundreds of thousands of dollars. This is a short-term benefit with very dire long-term consequences. I’d take the credit hit now and have the peace of mind that the bank can never come after the foreclosure if it ever comes to that. Pay now or pay later.

Very prevalent. Our firm handles bankruptcies, and many of our clients had already received loan mods, and are now eliminating their 2nd mortgage (and all other debt) through a Ch.13. I’m very impressed by how aggressive some of these loan mod terms are. YES, they are definitely below market rent and these consumers have definitely “won”.

Not only do they get to live at a reduced cost of living in California, but have been forgiven of almost all their outstanding debts, including the elimination of their 2nd mortgage/line of credit. Crazy.

Actually, if the foreclosure is a “non judicial” foreclosure, which 99.9% of them are in SoCal, then automatically, by law, it is non-recourse as to the foreclosing lender.

Well, here’s another anecdote (mine). Not an Option Arm, but a prime jumbo ARM (5 year) taken out in 06 (so up next year). House is underwater by around 200K; loan is now just shy of 1mil. We were offered one year at a greatly reduced interest rate (from 6.2 to about 3.5–try taking out a jumbo today for that amount and see what the rate is) if we paid up our arrears (7 months’ worth). We are not, by the way, strategic defaulters or no-doc borrowers–put down and lost 25% down payment, then suffered big loss in income. The implication was “this is for one year, but if you’re good little house slaves there’s plenty more where that came from.”

If it makes you feel any better, we are walking (trying to work out a deed in lieu) and renting a place nearby rather than get on a magic carpet ride that goes nowhere.

But yes, this story and analysis (even better than your usual fare, Dr.!) ring true with our experience. Extend and pretend is the law of the land.

I agree with Partyboy. The modified loan illustrated above is not a good deal for the home purchaser. Better to declare bankruptcy, walk away, and live in a bad apartment than to sign a “modified” mortgage on a house that is worth $200,000 less than the amount of principal owed on the mortgage.

But there is a difference between renting and this situation. Its more like a lease with the leasee assuming repairs and the like. I.E. if the house needs a new roof the owner pays for it. There is also no 3.5% per year depreciation on the house for the land lord. So to really compare the situation take an average repair budget for the house and subtract from the rent, and how do these compare?

995,000 balance….reduced to 829,000

Interest only loan for 5 years. Ramped up interest rate starting at 5.25…ending at 6.5 after 7 years

The new city manager (John Nachbar) for Culver City comes from Overland Park Ks. As a resident of Overland Park I can testify that it was impossible to get him on the phone. Under his stewardship, ordinances were not for the whole city but to protect the favored few. Violations were swept under the carpet and the complainer told not to complain anymore–they didn’t want to hear it. Good luck with him, Culver City!

This seems like it’s just going to clobber the demand side by keeping prices artificially high when there are falling wages and structurally high unemployment. I don’t see it fixing anything.

Japan redux.

Leave a Reply