Olympic Gold Medal: Greenspan Tells us Housing will Bottom in 2009. Meantime Foreclosure Filings hit Historical Record.

What may be more amazing than one Olympian swimming for 8 gold medals is the continued revisionist delusion of our former Federal Reserve chairman Alan Greenspan. Greenspan in typical revisionist fashion, is now stating publicly that the government should have allowed Fannie Mae and Freddie Mac shareholders to be wiped out while breaking up the GSEs into 5 or 10 different units. Thanks for raising your voice now after the fact! He is a master of covering his tracks and you need to remember that he was a champion in pushing and cheerleading adjustable rate mortgages which have now become the step child and shame of the housing market.

Amazingly Greenspan is saying the right things in certain respects yet this is only to cover his silence during the actual bailing out of Bear Stearns and also, Fannie Mae and Freddie Mac through the Housing and Economic Recovery Act of 2008 otherwise known as the Crony Capitalism Bill. Â Here is what he had to say this week:

“(Reuters) They should have wiped out the shareholders, nationalized the institutions with legislation that they are to be reconstituted… as five or 10 individual privately held units,” which the government would eventually auction off to private investors, Greenspan said in an interview with the Journal.”

Maybe he should have said something during the public hearings. This is what he had to say about Bear Stearns:

“There’s no credible argument for bailing out Bear Stearns and not the GSEs,” Greenspan told the Journal in an interview, which was reported on Thursday.”

Baloney. This guy is on a legacy tour trying to revise history. He is saying the right things but his action speak otherwise. Here is his prediction on the housing market:

“Home prices in the U.S. are likely to start to stabilize or touch bottom sometime in the first half of 2009,” he said.

But Greenspan cautioned that even at a bottom “prices could continue to drift lower through 2009 and beyond.”

To a certain extent I am starting to understand the interworking of the Fed. Obviously as a lay person like most of you, much of what goes on behind closed doors is a mystery to most. In fact, that is part of the mystique of the Federal Reserve that when they speak, a fleet of economist are sent out trying to decode the hidden meaning in the talks. These economist and analyst then try to bring the conversation to the public with a more down to Earth language. It is ultimately a sham. The Federal Reserve as we now all know is rather impotent in this credit crisis. The one thing Alan Greenspan did have was the ability to speak in a way that moved markets drastically. As you may have noticed, Federal Reserve meetings don’t carry that power anymore. The history of the Fed is unknown to most of the public not because the information isn’t there, but most simply do not care.

It is becoming rather apparent that many saw this market imploding yet did nothing. The logic is rather simple and not necessarily conspiratorial. The boom of the housing market brought untold riches to many people. The solution was simple. Stop the massive and rampant fraud and speculation. Hike rates up. Yet these acts would assuredly pop the bubble and blame would be placed on whatever agency or person that took these actions. The politics got in the way of good policy. Even during the Great Depression, the Fed was voicing concern in 1928 and 1929 wanting to raise rates and attempt a reigning in of speculation but Wall Street vilified the Fed and they backed off. No one wants the punchbowl to be taken away and the public got drunk off easy credit.

Sadly this bubble at least on a human nature level is no different from Dutchmen buying tulips, or people investing in Florida real estate in the 1920s, or those trying to get rich quick on any company with a dotcom during the 1990s. People in speculative manias want to get rich as quickly as possible with the least amount of work. This idea is appealing to the dark green matter in our psyche that fuels those that buy lottery tickets. There is an easy meal ticket and all it takes is a little bit of faith and a small payment.

Just like those that saw the oncoming collapse during the late 1920s, many saw it this time around too but realized they did not want to be the one to take the flak for bursting the bubble. So what happens? The bubble infects the psyche of the populace and runs to a point where it is simply unsupportable and implodes on itself. Many are too blame. Some more than others. Yet at this point no single organization takes the entire blame. The games then begin and the mess is much larger than say someone stepping in during 2004, causing a pullback and correcting the ship before it hit a massive iceberg. At this point, the ship has careened into shore and now it is only a matter of who is to blame for this? Certainly Greenspan is politically savvy and realizes he needs to get out in front of this ball. He is a reed in the wind. During the height of the bubble he fed into the public speculative fervor and championed adjustable rate mortgages and made credit much cheaper through lowering the Fed funds rate. Now, it is time to spank Bear Stearns on their Fannie Mae.

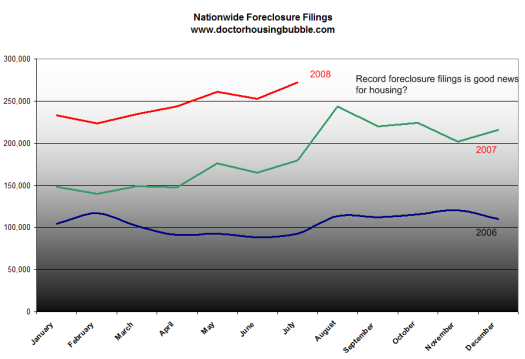

Look at the current rally today in stocks. This is a perfect example of delusion. Today the nationwide foreclosure filings were released and guess what? They are the highest ever! Take a look at this chart:

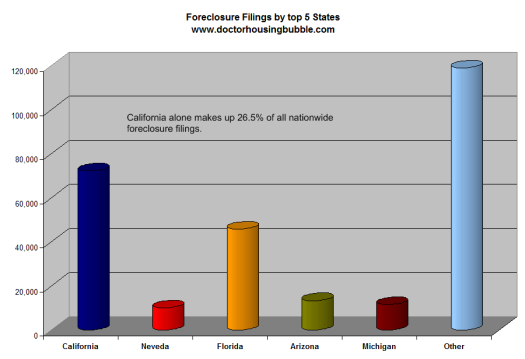

This was the largest number of foreclosure filings ever recorded yet if you look at some of the financial and housing stocks, they rallied because sales increased a bit. Again, you should read this article to give you an idea of how these numbers are being massaged and you’ll quickly realize that things are not improving. And you’ll also notice how Greenspan talks about national housing prices bottoming in 2009. Which is a nice way of covering yourself since 5 states make up 57% of all foreclosure filings. Places like California won’t be hitting a bottom until May of 2011 and the data points to this.

Here is a breakdown of foreclosure filings from the top 5 states:

Â

Clearly states like California with $300 billion in pay option ARMs set to hit their anniversary dates is in a much more precarious situation than say states that have homes priced within the $100,000 to $200,000 price range. Even with the massive 38% drop, California home prices are still $368,250 while the median household income is $53,770. This ratio is simply unsupportable even at current levels.

I’ve noticed a few mainstream articles cover the so-called shadow inventory issue. We talked about this in the previous article but I’ve raised this issue for months on end. Call it what you want but this is shady manipulation of the market and toying with nuisances of the MLS. Want some proof? Take a look at the July 2008 foreclosure filings for California:

July 2008 Data

REO:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 23,406

NTS:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 12,506

NOD:Â Â Â Â Â Â Â Â Â Â Â Â Â 36,373

Approximate California Inventory:Â Â Â 310,000

Total Southern California Foreclosure inventory today:Â Â Â 8,548

Â

June 2008 sales California:Â Â Â Â 35,202

June 2008 SoCal sales:Â Â Â Â Â Â Â Â Â Â Â 17,424

Â

Think about that for a second. Southern California made up 49.4% of all California sales in the month of June. We had 23,406 homes go back to lenders in July and 12,506 trustee sales yet the MLS foreclosure sales are only at 8,548 for Southern California? Let us assume that out of 35,912 homes that were foreclosed in July half are in SoCal. That would push up the inventory numbers by 17,956 just in one month! Keep in mind that we are using multiple sources to look at information from Realtytrac, DataQuick, ZipRealty, and yet from most places that do track foreclosures, the numbers are steadily rising yet somehow, the MLS data doesn’t reflect this. In fact according to their data months of inventory is actually getting healthier.

It is absurd. REOs are being understated to the point of being criminal. Yet in manias people want to believe fudged data just like they saw nothing wrong with subprime lending. When you look at various sources, isn’t apparent what is going on? Greenspan should win a medal for revising history. Clearly people are now trying to underplay the actual market data and want to believe that housing is at a bottom. Anyone with an ounce of logic can see the numbers above and see something is clearly wrong.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

23 Responses to “Olympic Gold Medal: Greenspan Tells us Housing will Bottom in 2009. Meantime Foreclosure Filings hit Historical Record.”

Insofar as Greenspan’s comments toward hitting a bottom with prices, I’ve been predicting a similar timeline for months now. If you are to take a look at housing price indices through the mid-to-late 1990’s, after the prices recovered from the slide in the early 90’s, and trace that trend forward through time, it would generally follow inflation and cross the current downward trend in February or March of next year. Logically speaking, that should provide a lower support for prices. As long as nothing drastic happens in the credit market — that is as long as money is available to borrow — such prices would allow median-to-upper-quartile incomes to afford to buy houses in accordance with traditional lending standards. If they continue the downward trend past that point, by summer prices will likely have fallen to a point where investors would be able to purchase properties and immediately profit from rent revenue (well, as immediately as they can find a tenant, anyway). Another way to look at it is that if rents don’t recede in the next 6-12 months, it might become cheaper to buy.

Now there are some caveats. Credit is currently drying up. The Alt-A loans mentioned on this website before that are set to recast are a very dangerous situation that may severely damage the financial sector, to an extent that can really only be regarded as speculation at this point. Another mystery factor is exactly where interest rates go. Not just the fed rates but the nominal APR’s on loans being written, too. Energy prices are another factor. Here in the LA area, outlying cities like Palmdale, Lancaster, Corona, etc., look much less attractive now than they did 5 years ago with $2 gas. If people from LA and OC want to move there now, wages and housing costs will have to accomodate a staggering gas bill.

I have to respectfully disagree with the previous post’s conclusion (and Greenspan’s as well). The current housing situation bears very little resemblance to that of the early 1990s and therefore can’t be used as a good comparison. The global financial metdown combined with accelerating global inflation will make it very difficult to reach equilibrium in the housing market much less returning to a seller’s market anytime soon. I do agree with Greenspan that we should be taking out the Fannie and Freddie investors. They took on the risk, not the American taxpayer directly. As demonstrated by Bear Stearns, we now have a form of capitalism where the upside of risk goes to the investor but the downside of risk is socialized by passing it off to the public. In my opinion, this will further delay any recovery in the market.

Well, as it’s been said, history doesn’t repeat, though it does rhyme. I think there is a fundamental flaw in trying to compare the 1990’s slide with the current price decline, and then trying to draw the conclusion that ‘the end is near’ because of some coincidental shapes of the data curve.

There are substantive difference between the time periods, including reason for the decline (general economic vs. finance bubble), loan types and qualifications (‘normal’ underwriting vs. ‘NINJA’ etc.), savings rates, speed of data availability (that is, the interweb thingy). Consequently there is a lack of matching input variable points between the two time frames.

But even more than the technical reasons – the psychology is different now. Look back at many of Doc’s posts about the psychology of this market and it begins to become evident that the prospect for quick riches that underpinned the runup differed substantially from any other recent real estate valuation run-up. And consequently, IMO, the repudiation of the debt – and houses that symbolized the now evident false wealth – will result in a longer downturn and flatter bottom than Mr. Greenspan espouses.

dangermike-

I agree. “As long as nothing drastic happens in the credit market”

From what I’ve gathered, the subprime blew up in investors’ faces. This is giving banks less clientelle to sell loans off to. So thats one avenue of credit dried up.

When AltA blows up, those are mostly on the banks’ portfolios – they wont have any money (those that survive, anyways) and the *other* avenue of credit will dry up. I believe there will be a severe lack of ability to get loans, a severe need for 20% (or more?!) down payments, rates through the roof cause the banks wont trust anyone, and a verification of income that makes the worst background check look like a walk in the park!

Any one of these causes prices to drop more. All of them will guarantee an overshoot at the bottom.

Don’t know what dangermike is smoking, but I would agree with everyone else refute of him.

My input is this, its the size and scale of this issue is unlike anything we have ever seen. Think about FEMA reaction to Katrina, and then take a look at what is going on here… its the almost the same thing. When looking at all this information it is easy to get lost in the charts, graphs, and the #’s, we can’t see the news tape of the destruction this is all wrecking. But this “foreclosure Tsunami” is having the same effect as Katrina, etc.,

The banks have so many foreclosures that they are having trouble processing them, and some of them have almost 300+ day waiting list. Can you even fathom this…, doesn’t it sound similiar to New Orleans post Katrina…

Greenspan since the beginning of time has been in love with pure capitalism – the essence of that feeling is brought out magnificently in Ayn Rand’s Atlas Shrugged. Greenspan, like a modern day Hank Rearden figured he could literally and figuratively put the US economy on his back (it takes a huge ego) and through sheer force of will he could steer us through these uncharted waters of low interest rates and free credit. Now we’re cleaning up that mess with the credit fiasco we’re stuck in.

The problem is that Greenspan with this love of capitalism and the economist in him assumed that people always act rationally. Unfortunately there was very little rational about buying homes w/ no money down ARM’s in cities like Phoenix that had 50% year over year appreciation. So the irrational exuberance created this mess and now we’re going to suffer through the aftermath.

I won’t just blame Greenspan for this credit trauma, there’s too much blame to go around, especially starting with individuals who didn’t take responsibility for their own actions. It’s a tricky tightrope act to walk, legislate the huddled masses to death or be cruelly kind and let them fend for themself – maybe John Galt has the answer.

Dr. I have been a reader for about a year great work as always.Sorry but I have to chime in on this one. I have been in the industry for 18 years and I can tell you I am at ground 0 in the O.C. and it is not pretty. missedthebubble is right on this is a nightmare of biblical proportion. You other guys can bath youself in all the data you want, compare this to 1990 what a joke. You are saying as long as there is no major change in credit we will be O.K. wake up. I do loans and guess what there are no loans to be had. Every investor I deal with looks for a reason not to do a deal. FHA is the only thing that can be done. Look at it this way to qualify for a 500k FHA loan you need to make about 125k per year to debt service the loan and be approved(that is if you have no credit cards or car loans to debt service) how many in SOCAL are in that situation? Credit has siezed up and that will be the nail in the coffin for a very long time. God help us all!!!!!

Greenspan has no credibility.

He’s the one who claimed you can’t recognize a bubble until after the fact.

He left interest rates way too low after the tech bubble popped, so he doesn’t recognize a bottom either.

Entire books have been written about his incompetence, grrr, I don’t want to get started…

dafox- Thanks. I agree with you, too, that the overwhelming likelihood is that something drastic not only will happen in the financial sector, but already *is* happening.

Anyone else who wants to disagree, I welcome it. Differences of opinion are what drives interesting discourse. However, if you can find the strength of character to express a difference of opinion in a way that is more meaningful than throwing around pejoratives, you may find that the resulting discourse is much more rewarding. At the very least, I ask that we all offer that much as a token of respect and gratitude toward the amount of time, effort, and money that goes into this site from our gracious host.

That said, I stand by my previous post, and here is why: The median income in LA and OC is around 50-60 thousand/year. Going by the traditional lending standard of 30-40 percent of gross income going toward housing costs, that’s 1500-2000/month for housing in the median household. Let’s assume mortgage APR’s jump to 10% next year. That would mean a median income could borrow 170000-225000, roughly. Factoring in a 20% down payment, that would put the expected prices around 215000-280000. Current median housing prices are sitting in the low 400000’s. Another 20-30% drop, and they’ll be within reach.

The reason I chose to compare the prices to the mid-to-late 90’s is that, historically, housing will follow inflation (or more technically correct, housing follows wages which follow inflation) and through the stable period after the early 90’s bust, prices reflected similar metrics to what I have used here as well as other ages between periods of boom and bust. It’s a little more technical than just looking at shapes on a graph.

And it is worth repeating that expecting to see a bottom does require the assumption that the availability of credit will not change drastically between now and then. That is not a safe assumption for reasons that that have been well documented in this very blog (specifically the looming raincloud of Alt-A recasts). It also requires that there will be enough qualified buyers to provide a stable floor to pricing, which is a bad bet on two fronts: (a) the current cultural trend of zero and negative savings rates and (2) the possibility that market psychology will be damaged by the current downtrend.

Further, even if the market conditions provide the price support I’d expect to see, it doesn’t necessarily provide an inflection point for prices, or even a bottom for that matter. All I’ve meant to say through all of this is that I expect that the median house prices to find a center in the mid 200000’s to mid-300000’s since that is the price point that matches traditional spending criteria. I’m honestly surprised that such a statement would find so much opposition here. If any of my facts, premises, supposition, or reasoning are glaringly flawed, please do bring it to my attention. Because I’m honestly getting ready to go knife catching in the next few months.

In stating that the current California median house prices are $368,250 and median household incomes are $53,770 – this indicates that California housing is still a whopping 6.8 times household earnings.

Thats still way above 3 times household earnings – where it should be. You will note in reading the Annual Demographia International Housing Affordability Survey ( http://www.demographia.com ) that States like Texas and most of middle North America have housing at around 2.5 times annual household earnings.

What is Texas doing right – that California is doing wrong?

On Planetizen ( http://www.planetizen.com ) within an Op Ed I spell the problems out clearly and suggest solutions.

One can understand why Mark (above) as a California Mortgage Broker is doing virtually bo business – and that he is having difficulty moving $500,000 mortgages on $125,000 household income – still a grossly excessive four times household income. He can be sure that his Mortgage Broker friends in Texas are writing considerably more business with mortgages at 2.5 times household income and 20% deposits.

If California doesnt sort its urban planning fiasco out – its going to lose out big time to more competitive affordable States going forward. Mark can be sure too – that the Banks will be in no hurry to provide the financial fuel for another California bubble – when the survivors total their losses from the last bubble.

Hugh Pavletich

Co author – Demographia Internation Housing Affordability Survey

http://www.demographia.com

Saw somewhere on Bloomberg that 1 in 400+ houses are in trouble in the US. Assuming this is half-way right ( I get so confused with all the statistics out there), that means only about 1/4 of 1% are defaulting. This is bringing down Freddie, Fannie and our entire banking system????

>

Just goes to show how leveraged the banking industry is (was) and how greedily they work to squeeze out a profit. Funny thing is, the people that did this… the VP’s, lobyists, and corporate banking executives will walk away with golden parashutes. Why fund something productive when you can loan money and trade leveraged paper for the big bucks. Then have your buddies in the fed come to the rescue!

I believe this all started when house prices were dropped out of the general inflation figures and replaced with “rental equivalent”, along with other tweaks.

If house prices and other inflationary items had been in the figures, then inflation would have forced an interest rate hike, naturally cooling off the market.

As a renter, I look forward to houses becoming affordable again, but there’s going to be a lot of pain first….

Yeah old Al is a real capitalist – as long as the GOP is bouyed up in the process.

May 2000 – a Dem VP is running for Pres, the tech bubble bursts. Al and the Fed raise the fed funds rate by a 1/2 point to 6.5 (a number we have not come close to in the last 8 years) Keeps it there until Bush assumes office and slashes the rate over and over (long before 9/11) and keeps slashing to the point the the rate is *below* 2.00 for all of 2002, 2003 and 2004 (staying at a 40 year low rate of 1.00 for nearly all of 2003 and 2004 (until, you guessed it, the election is over).

Greenspan is a political hack. Now he’s just trying to cover his ancient behind.

I support Dengermike. Many people pointed out the 30% rule for lending and the 3x income price level, but 3x has never been the case in California . I read article that in the height of the bubble in LA metro it was 10x income and at the bottom of the last cycle – for LA 1996 it was at minimum of 5x. It has never been easy owning in CA and that is why Nevada and Arizona are full of californians. Bottom line my guess is that prices will go down some 20% more and it will be mostly over. When I say mostly I mean, the price may continue leaking further , but the decrease in price will be less than the money lost for renting. if you are renting for $2000 it is $24 000/year. if you purchse a home of 400 000 and it decrease a whole 4%/year ( $16 000) + aditional $5 000 taxes + $4 000 maitenance and others. you are the same $24 000 back. You are not gaining any equity, but you have the intrinsic value of home ownership. Yuo may use purple paint. It is not worthed renting anymore when we are at the late stages of the down slope.

My plan is to start shoping in the spring of 2009. It will be mostly over till then with -20% after this winter of desilusionment.

Just dont buy on the steepest part of the rollercoaster drop, which is now. If you need to buy or want to buy, like me, wait till after the tapering off begins. Get a 15 or 10 year fixed and you’ll be looking good, not perfect, but good.

Yours is the best comment here.

4X income is and always will be excessive. The industry moved to this ration in the early 80s, and foreclosures immediately increased. There is no way you can borrow 4X your income and still have sufficient coverage for your food, health care, and other necessities, let alone for savings.

If the industry had retained the 2.5X income standard, we would never have experienced the house inflation of the past 25 years, and our population would be in much better financial health, as would our financial markets.

I don’t consider a down payment nearly so important as the debt:income ratio. I know many people who have bought successfully with no down payment, and are paying their bills with no problems and accumulating equity in their homes.

However, everyone I hear of who assumed a mortgage 3x his income or more is struggling with debt, saving nothing, and is in danger of being wiped out by the smallest personal disaster.

Using the 2.5X income yardstick, I figure that property in most major metros, including all of CA, as well as metro Chicago, St. Louis, Atlanta, Miami, Seattle, Portland, Boston, and NYC, are grossly overpriced.

When Schumer gave 4 Gold Medals of “Bad Policy” to Bush, He Should Give Himself the 5th One. http://activerain.com/blogsview/643024/When-Schumer-gave-4

@dangermike and Dan:

Like you, Jim Cramer is getting ready to buy, also. And the Inland Empire is one of 3 specific areas he’s looking at. Here’s his rational:

http://www.mainstreet.com/buying-home/jim-cramers-rules-real-estate-investing?puc=msgoogle&cm_ven=MSGoogle

Why do you rant and rave against adjustable rate mortgages per se, as in

> (Greenspan) was a champion in pushing and cheerleading adjustable rate mortgages which have now become the step child and shame of the housing market.

As long as adjustable rate mortgages are fully amortizing, they have their legitimate place in the US as well as in the other democratic countries where they are the predominant form of mortgages. The quote I know from Greenspan about adjustable rate mortgages points correctly top their benefits in the 80s (he also said stupid things, of course, about financial sophisticated borrowers). I, too, consider option mortgages a public danger, with their possible negative amortization, but we should also call them option mortgages and not blame all adjustable rate mortgages. Or would you like congress to step in and order everyone who want to buy to get a fixed-rate mortgage, regardless of interest environment?

I consider not the arrival of adjustable rate mortgages the main culprit of the easy lending in the housing bubble but the disappearance of downpayments. If congress would take measures that discourage buying without downpayments, I would welcome that. And if they really want to mess with adjustable rate mortgages, they should go and forbid all prepayment penalties on future adjustable rate mortgages, which would weed out those loans that force big future payments on the borrower. If the rate is adjustable, the lenders already have a tool against interest risk, and there is no need to secure themselves double (if they don’t want to prey on ignorant borrowers).

Jail is too good for these Central Bankers and their co-conspirator politicians who have destroyed America’s credit, and currency via their unconstitutional semi-private cartel banking system. They have succeeded in eliminating free markets, basic constitutional tenets and freedoms, all so they could profit at the expense and to detriment of the American citizenry.

Homes for Sale in my zip code:232

Foreclosure listings from notice of default to REO 293

Listings for “New Homes” for Sale 10

(These are “new developments” with multiple houses for each of the 10.

P.S. There are REO’s listed as “Homes For Sale”

and “Foreclosure Sales” (double entries)

I am estimating that at least 1/3 of the “homes for Sale” are actually

REO’s of the “higher value kind” (when the bank is still desperately trying to get their money’s worth and the house hasn’t been trashed yet.

And this is a sleepy little town in Northern California.

Whom are we kidding? I have been watching the entries for a month now…

The Foreclosures go up and up and up

It went from 18 pages to now 32 pages…

The condo’s in the “undesirable” part of town are now listed for as little

as 80 000 in the REO section and 129K to 145K in the “home for sale”

section.

Average price for a decent 3 bdrm. 2 bath – 350K to 400K

Of course the same size house may already be listed as an REO

for as little as 250K.

So… are we done yet? – has the bottom been found?

No! – Even a layman can tell you that this isn’t over yet.

Oh by the way… the heating costs for this winter are going to be way up.

Let’s see how these vaulted ceilings and wood panel flooring 3000 sq. ft.

mansion will eat up any remaining discretionary Dollars.

Which leads me to my usual gripe. CREDIT CARDS….

Oh yeah… it is absolutely amazing…. how often they are being declined

at the Register.

I don’t think the Retail Sector will see any “Christmas Sales” this year.

The cards are being maxed out right now and with everybody stretching their budget and using their cards to compensate… Good Luck America.

Pray that this winter will be mild… there is at least that chance for California.

Hugh: are you really suggested in your article that the problem with Los Angeles is that it does not have enough sprawl, and needs more? Because that’s what I interpret “expanding into urban peripheries” to mean. Do we need more Inland Empires and how is that area doing now anyway? I know the Inland Empire has returned into sand, vanished from my hand …

Where was I? I don’t think more sprawl is at all a feasible plan for the future. I see nothing but higher fuel costs in the future. If gas prices are such that few people want to live in the “urban peripheries” due to fuel cost, then it really won’t bring housing costs down in the truly desirable (city and nearby suburb areas) will it? Yes if everyone telecommuted, or if we suddenly had a wonderful public transportation system that even served the peripheries etc … but we’re veering very far from actual reality here.

When we heard about the $1 sale in this household, our first reaction was, “Great, a realtor finally got an appropriate commission.” Apologies to any honest members of the profession who may be within earshot (eyeshot?) of that spew of Weltschmerz and cynicism….

Greenspan’s Ancient Behind would be a great name for a Japanese taiko punk group. It has a koan-esque quality.

One of my favorite little publications over the past 20 years is /Elysian Fields Quarterly/, a journal of baseball that is about baseball as cultural epic, not “sport” or industry. In a discussion of the then-emerging hyper-corporate economics of baseball in the late ’80s one of its writers referred to “Visigoths in pinstripes.” He was writing about the team owners who hold cities hostage for new stadia with all the luxury accoutrements.

But the phrase stuck in my mind.

I will note that where the Roman Empire was concerned, it was lucky it was overrun by Visigoths rather than, say, the NAR. But let me not digress into ancient and ecclesiastical history; this isn’t the place.

Thanks, Doc.

rose

PS–I note that in our household the biggest inflationary ratio is on EVFCP olive oil. Even the cheaper stuff has gone up over 300 percent in the past 5 years. Yikes.

Leave a Reply