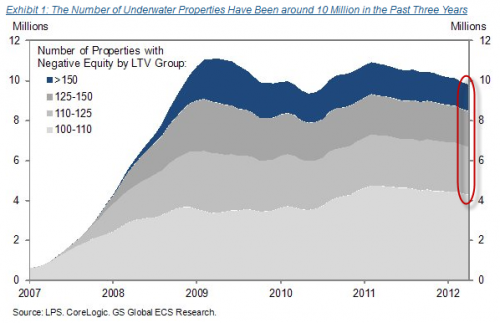

The lingering problems of negative equity – Over 10 million Americans are underwater with 1 million having loan-to-value ratios of 150 percent or higher.

The recent Federal Reserve report is troubling for a variety of reasons but a large factor contributing to the decline in net worth of Americans is the over reliance on real estate. You simply do not lose 40 percent of your net worth in three years and expect minimal impacts to the economy. It was also enlightening to see that the bottom 90 percent of American households actually saw their income fall in this period. So again the question remains, why would housing prices move up when incomes are falling for the vast majority? It also may answer why prime markets, those targeting the 10 percent that did see incomes rise are in fact stable or moving up. Yet overall the negative equity situation is one in which a large number of American families are impacted and will have long lasting effects on housing moving forward.

The overall picture of negative equity

According to a variety of reports, it is estimate that between 10 and 12 million Americans are in a negative equity situation:

Some are on the cusp of negative equity but over half of these mortgage holders have loan-to-value ratios of 110 percent or higher. Nearly one million homeowners have loan-to-value ratios above 150 percent! This is now becoming a battle of attrition. Those with negative equity levels that high are likely to remain in a negative equity position for probably a decade or more. In many of these cases it is likely better to cut losses and move on either to rent or repair your balance sheet to buy a lower priced home in the future if possible. This is common in places like Las Vegas or Florida where homes are selling for extremely low prices while some continue to pay on homes sold near or at the peak. The negative equity position is reflected in the below chart:

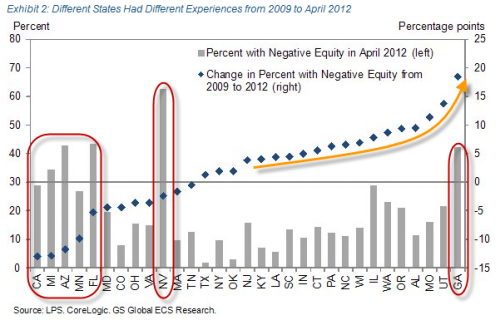

Over 60 percent of mortgage holders in Nevada are in a position of negative equity. California is close to 30 percent. Georgia is a state that we rarely talk about but over 40 percent of mortgage holders in the state are in a negative equity position. Yet you look at places like Texas for example and there is nearly no negative equity holders. In other words, this housing crisis was dispersed and impacted sparse parts of the nation. Some areas had minimal impacts while others are still engulfed in the remnants of the bubble. What impacted everyone is the crushing blow to the financial system and how banking is structured in the United States.

The situation in Greece is an interesting one because it is a situation of unsustainable debt. To sum up the issue, Greece in reality cannot adequately service their debts. On the surface this would appear to only hurt Greece but large European banks have their bets on Greece and the contagion would also spread to them. This is why the subprime problems were a tiny aspect of the housing problem. The issue and financial crisis came from banks having bets many times the size of the underlying assets that needed to be unwound. The problems with CDOs, CDSs, and other securitized debt is at the core of the problem that remain to this day. Today the banking system is largely a ward of the state living off bailouts, easy access to Fed Funds, and pumping out government secured mortgages.

What has been solved?

It should be obvious that with over 10,000,000 Americans in a negative equity position that housing is still in tough shape. Keep in mind the Fed report only ran up to 2010. What has happened from that point on?

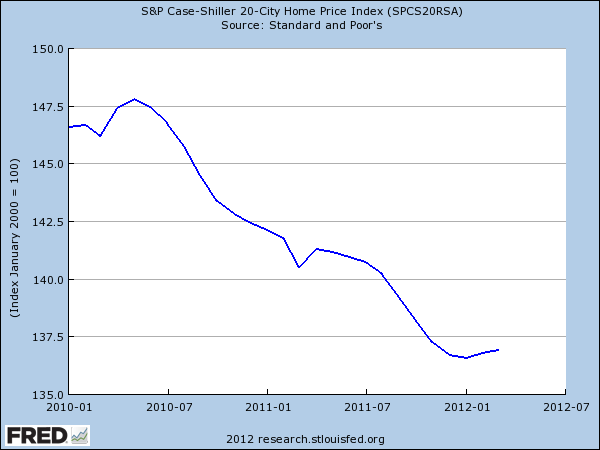

Housing has continued to move lower therefore pushing the net worth of Americans lower. Negative equity is a transfer to bailout the banks by those still living in overvalued homes. Since 9 out of 10 still pay their mortgage even when they are in a near or negative equity position, you realize that people are more resistant to making a calculated business decision when it comes to housing. Banks have pushed much of the toxic loans to the Fed balance sheet and essentially are only lending out government backed loans. To say housing is in good shape with over 10,000,000 negative equity homeowners is hard to grasp.

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

83 Responses to “The lingering problems of negative equity – Over 10 million Americans are underwater with 1 million having loan-to-value ratios of 150 percent or higher.”

This article and problem is huge! DHB you touch on so much, where to start?

Let us not forget that some 33% of American homes are paid in full, that’s always a good thing.

I would say that anyone living in inland America who is more than $10k in the hole, needs to re-evaluate their position. $10k is a lot in Vegas, Denver, etc….and with no appreciation, the amortization will take a while to whittle that hole away. In coastal areas anything over $25k needs to be looked at. I am positive that there will be eventually be something of a recovery, but time needs to be factored in.

Right now, with all the debt like you say in Greece, only time will solve this. The pension recipients and inflated public wages need to be worked out of the system. This is only accomplished by people quitting, or dying, therefore it will take time to work out of the system. As we speak, lower wage counterparts are slowly replacing the ranks of older, skilled workers. The rest of the economy needs to deflate so they can “catch up” having their lower salary (lower prices).

The Europe, and Americas, problems are just beginning. Papering over the debt is only buying time and creating a bigger mess down the line. Europe consumes more from China than the US. China is slowing, that will slow down Brazil, Canada, and Australia. These are generational slowdowns that are and will continue to change the psyche of those living through it.

It goes much deeper than this, and we can go on all day…it’s just so much. I never bought a bubble home, called the DOW at 14k and pulled out, and bought gold since the days of $480. My wise financial decisions have keep me sleeping well at night. Not enough risk may be a regret, but I can live with that.

I call 10 more years of painful bouncing around before we even have an idea of what “emergence” looks like, let alone recovery. I’m beginning to agree with many that for some, this is a good time. For many, maybe not so much. If I had 100% cash, I’d buy a home and hold it forever, that’s smart. If I was young and highly leveraged, I would not, there is too much uncertainty in the labor market and wages yet to be worked out. If I was old and highly leveraged, and didn’t have much family or much to pass down, I’d buy and enjoy it until I croaked. Being a normal middle class worker is the hard part, only you can look at your individual achievements and outlook and decide if loan owning is a smart gamble right now.

“Let us not forget that some 33% of American homes are paid in full, that’s always a good thing.”

But, are they? The data relating to HELOCs is always sketchy. How many of these people borrowed on that asset?

Exactly. Very few people that I know bought homes out of a desire for a permanent residence — at least that wasn’t the primary reason. There was always at least a tacit understanding that a home was dividend paying asset; an asset you cold borrow against to fill any gaps.

As for a recovery in the sense that prices start to not only stabilize but ascend their dizzying heights from the bubble…most studies suggest not in your natural lifetime.

I think the home as an ATM mentality was more prevailent in CA, FL, and NY than most conservative interior states. I never heard of the mentality until I moved here.

That’s because there wasn’t much of a bubble there.

Does anyone know what the going mortgage rate is for a Greek citizen to purchase a home? Or what the average down payment must be?

Depending on what Interior state you’re talking about, the “there wasn’t much of a bubble there” really depends. If you are talking about Texas — which, for some weird reason, most Californians usually are — there is all kinds of small print. Lots of interior states had their house prices go up by thirds, halves and even double thanks to the Californian diaspora who moved away to enjoy wealth effect in a lower priced area and bought houses there without any regard for price histories or rental parity, etc.

This dynamic continues to distort the market in places like Austin in an upwardly fashion.

$25K? I don’t think you can give a ballpark figure like that. I’d say something like: “if the amount you’re underwater today is more than the amount you can save in 2-3 years, then you should consider strategic default.” This takes into account how large the gulf is relative to your ability to cure the issue.

Unlike your other responders I am a bit taken aback by your comment that public sector wages need to fall. It has been reported here and many other places that the wages of the lower and middle classes have been stagnant to negative for a decade while the upper crust have amassed great wealth. Your comment leaves the impression that such movement is good for the US economy. I would think that healthy wages for both public and private sector workers would be the best tonic for our difficulties barring the increase in spending that would go toward increasing carbon emissions.

I’m with you Wyde. We’re training the scope on the wrong guys when we start whacking at working stiffs.

Higher wages would be good, but global competetion stifles that. When the US rose to superpower status after WW2, we never factored cheap foreign labor into the equation of our system. Now it is biting us hard. I feel deflation on all fronts is the answer, although getting there is painful.

Are you stuck in the ’80s? Public sector have for at least the past decade outpace private sector wages, not even counting benefits.

http://www.usatoday.com/news/nation/2010-03-04-federal-pay_N.htm

I agree with you, but also agree that publicly funded pensions need to be revised. I worked with a (wonderful) teacher who retired this year after 35 years, he said he will make more on his pension than he would if he continued to work – something is wrong with that picture.

Amazing to see how willing folks are to hold out on their properties, my wife and I are looking to buy a house in San Diego and we’re running into the issue of prices creeping up due to the lack of supply, realtors tell us to expect to pay list price or 10k more. I suppose this is partially due to our budget maxing out at 300k, as absurd as that sounds, I really for the life of me can’t see the market sustaining it current momentum for much longer given the unemployment rates, the lack of substantial increases in income etc, San Diego median income is ~59k and the average price of a detached sfh is what 350k + , hmmmm well only time will tell I suppose, but I personally refuse to pay more than 30-35% of my monthly income on a house, it’s just not smart IMHO. With the rental market being so large you would think we’d reach a saturation point, something has to give between higher housing costs and higher rental prices with incomes pegged at a certain point.

I sometimes think these politicians n bankers are up to something. My friends bought a condo in Irvine in 2010. A similar condo sold in march 2012 60k below what they paid in 2010. They recently refinanced their house. To everyone’s surprise the appraisal came 25k above what they paid in 2010…how is that possible? The same floor plan sold for 60k less few mnths back. They have not done any upgrades. There is a difference of 60+25=85k…..

No conspiracy: Ben Bernanke has explicitly expressed that one of the goals of both Fed and Treasury policy is to restore wealth effect to the American middle class.

thinking that there are on average 38 debt dollars created for every dollar borrowed that competed equally with aevery dollar of savings not counting the mean revision of 1965 before fractional reserve bank printing when 8700 dollars were the average house price and the average individual yearly wage….todays average households have an average yearly income of 44 thousand dollars ……to save some to bid against someone holding 38 dollars for every one of their dollars continuing by government bailout.. to profiteers bidding prices higher

Rinse and repeat.

unfortunately the local coastal Ca market : Sheeple are still obsessed and enamored with owning over priced real estate for some odd reason?

Change to common thinking does happen but these changes are not usually overnight.

There will have to be some kind of major trigger or Event that we are not yet aware of .

It could be in the form of the San Andreas “waking up.” We are long overdue for a substantial quake of any kind. Tic, tic, tic….

A giant earthquake would definitely shakeup coastal CA real estate values. No pun intended. 🙂

Every natural disaster has the end result of making the remaining good housing inventory to rise in value, I have noticed every single time.

You have two houses, one survives undamaged, the other ends up with 200K damage. The house in good shape is now “special” while the house that has 200K in damage may sell for 200K less but you have to spend 200K to fix it.

Mix the above with hundreds of billions of dollars in insurance money and Federal Disaster Relief along with all the jobs that money creates and you have the recipe for a housing bonanza. It happens every time.

That last example was New Orlenes. The housing that was not flooded was up 33% 1 year out http://reversemortgagedaily.com/2010/09/29/cost-of-housing-in-new-orleans-increases-33-after-katrina-says-hud/

If you say so Martin. Just be sure to own the house that doesn’t get damaged when the big one rolls through. I personally think a big earthquake would significantly lower the value of RE here in overpriced LA/OC.

The FED new report says the “middle class” homeowner group lost 40% of their net worth from 2007-10. The information for 2011 was omitted (on a pretext) as it showed even further losses to the middle and upper middle class AND showed the rich SURGED in net worth. The trend lines were purposely omitted to avoid further showing what will happen in 2012-13 with middle class net worth and incomes. Now, to top it off, the RICH were defined in the FED report only as the top 10% by wealth and income and how well that ten percent did (really, really, well); but in fact, there are huge jumps in net worth of the 90% to the 95% to the 1%. By lumping the utterly rich and becoming richer one percent in with the ten percent, it looked like the ten percenters as a class barely improved their net worth in the last four years. Nicely deceptive, isn’t it? In fact, the top 1% received almost the entire gain and most of the other top ten percent suffered losses in household incomes/wealth. Thus the FED report is purposely warped to try to hide the obvious conclusion: the 1% IS the problem. How did you folks do, I did great! Note: also, all you retired seniors, who received half a percent interest on your savings and watched your home value collapse in so many cities…the FED is going to shove that pitiful yield down further and soon, it appears (QEIII or twist). Don’t like this set of facts? too bad! Your (non) choice is the same exact politician guys we have now, OR the same guys and ONE new guy, a bank-loving multimillionaire with known, now disclosed, Swiss and Grand Cayman overseas tax avoidance accounts, isn’t that cozy?

Normally I might label this sort of talk as alarmist but I’m inclined to believe this. For the longest time I’ve tried to understand why LA has not corrected to fundamentals. It’s been touched on a couple of times in these comments but I’m thinking there are just a lot more folks in SoCal with too much money.

It’s as if the definition of middle class that fits in 90% of the country just doesn’t apply here. We keep talking about prices being out of line with the median income but does that metric even mean anything in SoCal? As I venture around the city I see extreme displays of wealth and poverty. It feels like the middle class is just shrinking. If it is, then what good does median income do as a metric?

In lockstep with all of the aforementioned, it seems like money is moving around much faster in LA than it ever used to. There’s now a burgeoning tech industry that’s being pumped full of VC. Maybe I’ve got it all wrong. I don’t know what to think about this place anymore. Once 2000 hit, all prudence left and it doesn’t look to be coming back anytime soon.

Totally agree Joe. Bidding wars on half million dollar homes, starting well over list. No end in sight. Plenty of high rollers to keep nice middle class cities like Burbank where I live afloat. Prices haven’t budged much in the last 3 years on decent properties. If you pulled out the condo market I bet prices are flat. They tripled during the bubble, then dropped a quarter and stuck.

Rock and Roll, sun and sand, skii and be, Cali for me

Quake may come, devil may care, I got mine, ain’t gonna share

Movie stars, hip hop scene, in the desert my grass is green

Half a mill for a 2 and 1, I am such a lucky one!

Right you are, Lew. To use a political science term, there are so many cross-cutting cleavages in this crisis that it has proved impossible to address the problem in an effective manner. Some states got slammed hard, and some have lingering problems elsewhere (taxes and state pensions) that guarantee continued pain for homeowners long into the future. On top of that, there was a huge generational discrepancy. The Fed report points out that Gen X took it on the chin, with 60% loss of wealth! So if you are Gen X living in a high-underwater state you are much more likely to have been slammed.

The WSJ has a piece today on how uneven access to credit is and how this is now the biggest elephant in the room. Well, sort of. It is absurd at this late date that banks, regulators, Frannie, and the financial journalists could pretend to be “shocked, shocked” that cutting off 10 million current and former loan owners with impaired credit could be hard on the system (to say nothing of the people involved). There has been more concern on their part with preventing strategic default than with giving this huge demographic a path back to solvency. Honestly, it feels like a game of whack-a-mole. Here comes the hammer again!

A smart way to address the crisis without creating any new debt, any moral hazard, or any angered stakeholders would be to create a clear path back to credit-worthiness for those who have lost or damaged theirs. Provide incentives for giving up on loans that cannot be repaid. Provide credit counselors who can help plan the next step back to solvency. Don’t ding people for checking to see if their credit is healing. Give them credit for paying their rent on time. Consider letting them take out smaller mortgages earlier: say, after one year, you can borrow one year’s salary. After two, two-years’ worth, etc. That way people can think about whether they want to buy a modest fixer-upper they know they can afford, or would rather wait and buy a bigger/better house.

Punishing and healing are incompatible. We have to choose which we want.

Extend MORE credit, that is your solution? You are as smart as BHO.

Why not change the mortgage interest to simple interest, or a repayment rate where by the interest paid on the money borrowed is amortized out over the full 30 year term? Now for the first 10 years or so we basically pay all interest, and no principle, so that if you sell your home before 8-10 years, the principle loan balance has really not gone down much at all-and we all then wonder why so many are still under water! How much would principle loan balance been reduced nationwide if the rate of repayment would have been increased in the first 10 years? Why should banks be due interest in advance on money that has been paid back? In this day and age of job career change in a world wide economy, how many actually stay in their home for the full 30 year term of their loan? With each relocation, and move into new home/location, the I interest game starts all over again, so the the person will never really get ahead by building equity in a home. The banks on the other hand are entitled to endless interest payments on money created out of thin air, guaranteed by the above person who signs the note!!! Now 4-5 years after the great financial crisis it seems that virtually no one broaches this topic!!!

Chris, I’m sorry but “simple interest” is not going to happen. From a mathematical, logical, and financial perspective, it just makes no sense. Compounding interest is natural and correct for loans and savings. The banks are not getting interest “in advance”. It’s the interest on the outstanding principle balance *today*. As the principle is reduced through amortization, the corresponding interest is less. If you want to pay down the principle sooner, chose a higher payment and a shorter repayment schedule (20yr, 15yr, 10yr, etc).

Chris, BobSki is right, this is not some kind of conspiracy by the lenders – it’s simply the fact that you have to pay interest on the amount you CURRENTLY owe. If you initially owe $100k at 5% then you will be paying close to $5k in interest in that first year. If you didn’t then the lender would allow you to essentially get a lower effective interest rate initially and then increase the rate over time. That would be great for the borrower, but in that case I’d love to take out 30year mortgages and refi every 5 years, effectively never paying any real interest…

If you wanted to pay off the same amount of principal every year of your mortgage then you’d have to pay a higher amount in the first years, and a much lower amount in the last year.

But because people want their payments to be as low as possible, they are stuck with paying mainly interest initially and very slowly start paying off principal. That’s why a 30-year mortgage is such a stupid instrument. If you really could afford that house, you’d take out a 15 or 20 year mortgage so you skip the first 10 years of barely paying any prinicipal…

I vote for punishing.

That way all you fools who made dumb decisions and drove bubbles that kept sensible people in cramped rentals for 10 years can move into cardboard boxes and eat dogfood, and those of us who made wise decisions can finally reap the rewards for being self-disciplined and using our heads.

Besides which, I just hate whining and blaming everyone but the guy in the mirror when your choices don’t work out. That isn’t American. That’s not how this country got built. I’d just as soon see y’all deported to Greece or Russia, where you can join whole nations of whiners and have the world’s biggest pity party.

10M? That’s maybe 20% of all mortgages. Not that much really.

The next impact will be state finances where the income is derived from property taxes. As the time comes for the apprasails that occure every 2-4 years and home values have dropped, states will be forced to lower values and either accept less revenue or risk public outrage by raising the tax rates to compensate.

In my area the county was doing re-apprasail every 3 years, starting in 2009 they completed a cycle (my house went UP!) then changed the law to every 4 years.

I am sure they were hoping that housing values would recover by the time the next apprasail wave was occuring………

those start late this year and into 2013, and take affect in 2014

if they hold values or raise them again in our area there will be protests at the county revenue building .

This will happen in othr states as well

The Federal Reserve study and the Census study are badly flawed. The two studies should only include cash equivalents. Including equity, especially real estate equity gained during one of the biggest bubbles in history, is structurally flawed. Unless one bought real estate low and sold when prices were peaking, the real estate equity was nothing more than a figment of their imagination and simply existed on paper only.

If you take that point of view, underwater homeowners don’t have any losses until they sell right?

You betcha. That’s exactly the thinking the govt has handed to the banks.

Exactly. If you’ve been in the same house for the last 10+ years, you didn’t “lose” anything – except on paper (with relation to real estate).

There are still a lot of people out there who believe we are simply in severe cyclical recession versus a balance sheet depression. Of course, this notion is heavily promoted by the Keynesians. To announce otherwise would contradict their failed monetarist remedies for the past 5 years and undo their central planning for the next 5 years.

Values will continue grinding down in bubble markets for the next decade, some years more slowly than others. It’s the anticipation of deflated asset value that stalls the pricing stabilization of assets, even when/if incomes begin to recover. So I expect a long slow Japan-like dilemma, and just hope I’m dead wrong.

In the meantime, I value my greatest asset as being debt free and a commitment to staying there.

Historically speaking, it’s a depression, and there is about 10 years to go.

This whole mess was really about the search for return on investment and avoiding paying US wages. We let our fearless leaders put a noose around the ankle of billions of slaves in Asia only to find out that it wound up around our own necks. How fitting. Maybe more accountability from all sides is in order here. You can’t flaunt your own environmental and labor laws by moving your productivity overseas without dire consequences.

I’ve made the “calculated business decision” to walk away from my condo, which is now 60% underwater. I’m not even 30 yet and don’t plan on investing more time and energy into a cramped money pit that will not even break even for another 10 years (if I’m lucky). There is no such thing as a starter home any longer as far as I’m concerned. I’d rather save up a hefty down payment for a house I’ll stay in forever. Bad timing for some of us, unfortunately.

I love how you state it as if it was everyone else’s fault that you were an idiot to pay too much for a condo. Deadbeat.

I don’t recall placing the blame on any specific entity. Everything is relative; at the time, when I was 23 years old, with a great job, I bought within my means and that was what I could afford. As for the name calling, I suppose everyone who purchased a property between 2006-2008 are idiots. All I had ever heard is that housing is the best investment and will always appreciate; a naive notion that many, many people believed and still believe. I’d rather be called a “deadbeat” than owe 200k more than my property is worth.

So what’s your answer, debtor’s prisons, indentured servitude? When debts are unsustainable, we need to face that fact and it doesnt matter if it’s the under-employed owner of a $60K condo or Wells Fargo Bank. The real solution to our current sorry state is not more extend-n-pretend accounting games or more debt to make interest payments on the existing loans. No, the answer is to clear the bad debt from the system, write it down to the true market value and take the losses.

Can’t do too much about an underwater condo. OTOH, my house was way underwater, even with 20% down, but I finished the basement. (had been completely unfinished at time of my purchase). For $12k I got two bedrooms, a 3/4 bath, and family room.

Now I’m a little above water, plus just refinanced (harp 2.0) into a 15 year fixed at 3.75%. I should be making a lot of headway paying down principal with a 3.75% interest rate and 15 year term. And my credit score wasn’t that great. Don’t really see the point in walking away, unless you’re unemployed.

Moral obligation to yourself and your family instead of moral obligation to banker. Pick one, idiot.

You must be a big bank representative that took trillions of taxpayer money and is afraid that the rest might do the same to them. After all, where will your bonus come from??

Is that you Jamie?

Defense spending is going to be cut. SC is much more affected by this than any bubble in high tech.

Unless you are going to stay in a house for decades, buying at the bottom of the interest rate cycle is the worst possible think you can do.

When you buy is more affected by your strategy than the interest rate. Buying for a long term hold on an asset you will use and benefit by through that term is well purchased if the $$ cost of that asset is within your means whether or not it sinks in value in the short to medium term.

If you study Case/Shiller back to the beginning of the 20th century – yes, more than a century ago – you will find that buying a home as a good long term investment is a myth. Over the long haul, homes have done about as good as T-bills, which about matches the CPI. And even if you think that the market has bottomed out in your neck of the woods, think twice. The moment you close you have just burdened the value of your happy little bungalow with 6-10% of costs you will have to pay when it comes time to sell it.

We are six years into what will probably be at least a 12-20 year process. Maybe prices have rebounded in a few places, I have my doubts about how robust these spot markets are. There are no national indicators that are looking positive for at least a year or two. I think anyone looking to buy a house or condo should have their head examined.

We had some bad timing with our home purchase. Closed late last spring right before Zillow re-adjusted their home prices down and the whole debt ceiling crisis shaved as much as 10% from $400K and up homes.

I’ll admit the first year was 6 months were stressful last summer. I’m preparing for another late summer / early fall drop again this year .. But so far the market is holding up FAR better this spring/summer than last year at this time. We bought a home that Zillow estimated to be worth $440K… that by the time we closed and had been living there for a few months was revised down nearly $40K. Our purchase price was $400K, and appraisal came in at $435K just a few months prior.. interest rates fell nearly a full percent and home prices collapsed along with them. Lots of regret until we were able to refi in the fall for a full percent less and got our PMI lowered for a total savings of $300 a month.

Now we are at better than rental parity with our payments… so while further declines will suck… The stress of the first year won’t be rearing it’s ugly head. We are back to saving money again, and feel financially prepared for the inevitable new roof / new a/c unit repairs coming in the next few years.

Enjoying the pool, yard and owning a home… We bought just a tad over 3x my income though… but couldn’t imagine stretching to 4-5x… If we lose some money it isn’t going to devastate us because we didn’t over-leverage.

At this point, even if we lose money on the sale… our next house will be an equal amount cheaper.. so it’s a wash since we are at rental parity anyway.

I thought nobody actually took “zestimates” seriously.

As for rental parity, does that factor in maintenance and repair costs? Renters aren’t paying for that outside of their monthly rent. You probably can’t reliably factor repair cost since one rarely ever knows when the HVAC is going to die or the roof needs an emergency repair. So, I’m guessing you didn’t.

I do assume you’ve included taxes and insurance into the rental parity equation.

It is exactly this type of delusional rationalization that got people in trouble in the first place. You did not buy at a bad time; you bought because you don’t understand money and economics while simultaneously drinking all of the Kool-Aid given to you (and eating the cups and pitcher too.)

And yet here you stand rationalizing your bad “investment†as you are “at rental parity anyway.†Sober up. You have to learn the difference between REAL prices/returns and NOMINAL prices/returns. The important one is the real price/return. Price your house using a numeraire of oil or gold and you will see how you are doing in real terms. Also, the value of something is completely determined by markets, not by “Zilloâ€. Want to know the value of your house, try selling it and see what kinds of bids you get. Admittedly, the markets are centrally planned (e.g. Operation Twist), so the price will be higher that what you would get in a truly free market, but that is a different story.

Another concept you have to learn is one of opportunity cost. With most of your capital tied up with your consumer durable (aka house), you loose the opportunity of investing in something that has a 0% or slightly positive real rate of return, unlike the real negative rates of return on most assets we see in the world today. That is how the rich get richer – by having liquid capital that generates positive real returns.

As long as we’re here, the number one determinate of housing prices is interest rates (the price of credit, not money!) Rates are at an all time low and cannot go much lower. They will go up. When the cheap credit (low interest rates) runs out, real estate prices will collapse far more (in real and nominal terms.)

Wake up.

Would you please more specific about when rate will go up? Next year? 2-3 years from now? 10 years from now? 20 years from now? That will make your statement more sense that just “Rate will go up”. Of course, it will go up but when?

Just an observation and a couple of questions Variance. The word loose means that something is not tight. My reading of your sentence tells me you wanted to use the word lose as in no longer in possession of. It always catches me up when I read that misuse and makes me question the sense of the comment.

I am confused about your market comments. When you say that the price of a house should be tacked to gold or oil are you saying that oil is an exemplar of a totally free market? I also wonder what you mean by saying that the markets are centrally planned is a different story. I am not saying I am opposed to that view just thinking that some form of regulation is a reality and even a necessity for a realistic market. My thought would be what that regulation looks like picture 20% down and debt to income as well as things like Glass Steagal.

@Sky

Nobody can foretell the future. You’ll have to ask the bearded clown running the circus for further details. Basically, the Fed cannot manage (centrally plan) the (almost) entire yield curve forever. The Fed is not the market and there will come a point when the market overwhelms the Fed and you will see rates rise. Just look at The PIIGS.

@wydeeyed

Yes, that was a typo. I meant lose as in losing an opportunity.

When you change the numeraire, you are changing the units of the asset in terms of a price. For example, if the S&P 500 is priced in oil or gold, you see a steady decline in the value of the index. That is telling you the real returns of the index are decreasing (negative real rates of return!!!). See this: http://econintersect.com/b2evolution/blog3.php/2011/05/25/oil-confirms-the-saamp-p-500-lost-decade.

Of course there is a separate market for oil, but it’s the historical trend that matters, not the local fluctuations. Think mean, not variance. Thus, pricing real estate in oil (for example), you will see approximately the price in real terms, not nominal terms and a much steeper decline from the peak.

What I meant by truly free markets, is the definition of capitalism – an economic system that is based on private ownership of the means of production and the creation of goods or services for profit coupled with the degree of government intervention (regulation) AND property rights.

Of course there has to be regulation, but it actually has to be enforced. Clearly, enforcement side is a big problem. See the MF Global cabal for instance.

One has to be willfully blind or galactically stupid (like the original poster) not to see that many markets are manipulated, e.g. interest rates and precious metals. See this for an example of manipulation in the muni bond market: http://www.zerohedge.com/news/taibbi-back-scam-wall-street-learned-mafia

Be safe out there.

Forget about Zillow. The only thing that matters is comparable sales in your hood, that is what will set the appraisal.

What your house is REALLY worthy gets broken into two categories. Cash money buyers is one. Or if buyer is getting a loan, what the lender will ultimately lend will determine the value of your house (this is the more likely case).

As a “legendary” real estate broker of 4 decades seeing the down payments falling between 2 and 5% no wonder the portfolios of real estaye homes have fallen. In order to have a stable real estate market the old fashion 20 and 25%.down payment should be restored. You can’t have an asset without an investment. Mariilyn Harra Kaye, Broker “legendary”

We should also limit mortgages to 20 years max. It is laughable when I see 50 year old couples buying with 30 year mortgages… if you can’t pay off your mortgage before you reach retirement age then that’s a clear sign that you’re supposed to remain a renter…

That is in my opinion simplistic thinking. It is possible to pay off a 30 year mortgage in 16 years with a very simple formula. And if the costs of loan origination are calculated it is possible to pay less over that time than you would with a 15 year mortgage.

wydeeyed, could you please explain this theory in more detail? Are you saying you could pay off a 30-year mortgage over 16 years for less than it would cost to pay off a 15-year over 15 years??? How would that work? I’m not following you. Please also consider that mortgage rates for 15 year mortgages are about 0.5 points lower.

But even if you could get the exact same interest rate on either type of loan – how exactly would your plan cost less?

I have about 10% saved for a down on what would be a long-term family home in L.A. I’d appreciate input from the faithful readers here…

How do I do the honest comparison:

1. Save for several more years while renting. Do not purchase until I have 20% down, and hopefully, prices continue to fall (as rates perhaps rise)

2. Buy soonish with 10% down. Take advantage of post-bubble prices, and 3.8% 30-year fixed rates.

Thoughts:

a. This is a long-term buy, so I’m not trying to time the market precisely…

b. If I take the view that this is a 20+ year Japanesque downturn, and wait for rates to rise and prices to really fall in Santa Monica, Ill be ready to retire by the time I am ready to buy a home. (Maybe that’s not such a bad thing, come to think of it..)

c. Every year I wait is one year longer that I will be mortgaged… I want to eventually start down the path…

d. Some financial advisers say holding a mortgage is “good debt”, its better than buying the house outright even if I had the cash to do so…

e. OTOH, seems the truly wealthy don’t mortgage, they buy with cash….

The tax dodge you get with the mortgage interest is only a fraction of the interest you pay on the mortgage. Pay as much as you can as fast as you can. You’ll still have property taxes but that is a fight we can still win in the future.

torabora

You’re 100% on the MID (mortgage interest deduction), yet most people don’t know that or care to know that fact.

Hey everyone.

I was watching an interview with the CEO of CoreLogic, and he made a statement that we will not see the peak prices of yesteryear (bubblicious peak) for 5-10 yrs. He lost all his credibility with me.

I see rising prices as we speak, but it’s too early to call it a trend. I would hate to see someone buy on a knee-jerk reaction. Smart move says to wait 1 more year, see what happens this winter and next spring. Then a clearer trend will form. Being as you are in it for the long haul, that is a good thing. I don’t know how much more prices will fall but they seem to be bottoming in the cheapest areas, so the more expensive areas can’t be too far behind. 10 to 20%? And probably closer to 10 than 20…

Papa To Be & CAE

Unless we see salary inflation, even with these engineered interest rates, how can prices rise back to the bubblicious years without imploding? I just don’t see it. Even if we have a Hyperinflationary Depression, who can afford these prices, with everything else rising. I agree with you two. I hope to God we find a home soon. If we wanted a two-story pos, with no rebar in the slab, we’d be in already. Problem is, we do our due diligence. Our realturd is getting tired of us as we are of his BS.

Even before he opens the door to a home, he let’s us know we’re going to pay list. Even if it’s a fixer with $80K with of repairs needed. No wonder we’ve always bought new. Inventory is in pathetic shape.

Something to remember is that inflation will probably eventually return with a vengence because its the most tempting answer to our debt burden, for spineless polititians. In that case your mortgage will increasingly be paid off with monopoly money and with any luck you’ll have mortgage interest tax benefits. Dan Amerman (google)does a great job of extolling the virtues of real estate as an inflation hedge. Of course picking a real bottom sweetens the deal. If you don’t buy hard assets at the end of a deflation cycle you might miss the boat.

Real estate is not a good inflation hedge. Most real estate is purchased using debt and as inflation increases so do interest rates, which keep a lid on appreciation. If you study real estate you will see that the examples where real estate has increased in value beyond inflation, for example NYC and SF, it has to do with location and economic growth, income growth. That is why a house in Nebraska will never appreciate like Santa Monica has. I use the past tense for a very good reason. I do notthink economic growth, much less income growth, in California or anywhere else for that matter, is going to grow like it has over the last 25 years (income in real terms actually stopped about ten years ago for most people). It is not in the cards. We have hit a debt wall and it is going to take a very long time to recover. Just look at Japan. Why are there more illegal Mexican immigrants going back to Mexico now than coming to the US? This is the first time this has ever happened in the history of the border. Growth will come in the BRICS as well as places like Mexico and Indonesia.

If anyone is interested, Octomom’s house is going into foreclosure… 😉

http://www.pasadenastarnews.com/ci_20894678/no-bids-octomoms-house

The US has been abdicating productive capability to other countries since the late 1980’s. When the dot bomb happened in 2001, the only thing left to do was make borrowing money and leveraging everything up a way of life in order to mask the loss of actually producing tangible assets.

This is why the markets have gone almost nowhere, purchasing power has receded and employment has fallen…All in the last 10 years. So we’ve now had our first “lost decade”. And we’re well on our way through our second one. I see nothing in the future except the continuation of this pattern until it implodes.

CAE

I use to follow the deflation vs. inflation camps until I got burn out.

The housing supply side is masking a mild demand side in my opinion.

Not many buyers looking at a smaller pool of homes. I don’t care what our

realturd tells us. They lie when they move their lips, imho.

Anderson School UCLA says that around 2014 housing should start to improve. The Fed Chief is not so upbeat, down right negative, especially with the problems of Europe. Apparently, borrowed money is expected to be repaid.This will come as a shock for some people(e.g. southern Europeans and others).

Regardless, I am buying so I can start raising a family(my parents say that they will babysit if we buy now.) The old biological clock is ticking away. A woman only has so many reproductive years. My mother says that I better start producing at 25.

Maria

Firstly, screw your mother’s wishes. She wants grandchildren. Do it when you’re ready my dear.

Secondly, UCLA Anderson has a huge base of REIC contributors. Learn how the world works, and you’ll see a clearer picture. My background is Accounting and I have been in the REIC in Commercial R E . University information isn’t objective anymore. USC ether.None of them are. Bought and Paid For! Corruption. Collusion. Criminal.

I’m with Mad as Hell and and CAE – the fundamental determinant of housing prices for non-flippers will be the wages that go to the buyers that the economy will allow. Yet the economy has been so hollowed out since the early 1980s, and especially since the year 2000! 1/3 of manufacturing jobs left the country; in fact, the only change in the housing market from the bubble years was that 2-5% down from brokers has been replaced with 3.5% down FHA government guaranteed.

As a result, it is foolish, given real unemployment of 22% in CA to pay more than 1-1.5X income. Really anyone who thinks of doing otherwise is punch drunk from Kool-Aid- we do not have an economy – we have FIRE industries looters – “job offshorers” in Republican parlance – who are coddled and who game the system regardless of elections or political parties. The average salary for males has not budged since 1970 in inflation adjusted terms; subtract the top 10% of males (or even the top 1%) and there will be decline. It is simply better to rent for most people most of the time, unless they will go under 1X income AND they plan to stay there medium term or more.

I can’t believe people would actually buy into the idea of purchasing in SoCal for 3X income in an inflated area with shadow inventory bulging at the seams! And this is after the 2008 bubble burst!

Why don’t consumer behave like corporations and banks and hoard cash? No spending sprees for them – just debt repayment and balance sheets rich in cash to take advantage of any opportunities that might arise. If a US corporation won’t invest in plant and equipment in the US, why should the consumer? Oh, I see, this is the only way the FIRE industry can generate fake GDP numbers for the economy to mask the fact that 33% or more of real production has been off-shored.

Again, I don’t see any reason to buy save for the exceptions I notes – 1-1.5X income, long term purchase, rental possibilities, 25-40% down.

for more info, check out theeconomiccollapseblog.com, this site and the one I just mentioned are quite excellent.

In other words, let’s downsize to the living standards of our creditors, and not live in this MSM induced debt bubble –

http://www.forbes.com/sites/moneybuilder/2010/06/24/one-big-difference-between-chinese-and-american-households-debt/

75% of Chinese households own their home outright; in the US, it is 21%. Who will win in even the medium run?

I think we have been seeing a lot of consumer deleveraging.

whole string of houses came to market last friday after business hours and were listed pending before saturday morning business hours, seemingly listed to front running brokers and politically “correct” insiders or bribe payers of the one percent at prices a tenth the last highest sale sold prices…. “free market crapitalism”…….

Bidders Get Feisty Over Foreclosed Homes

http://www.npr.org/2012/06/21/155359393/bidders-get-feisty-over-foreclosed-homes

Paul

Thanks for the link. I bet it is a NAR “plant”, you never know. I read a long time ago they were using REOs to reset prices in the neighborhood. “AS IS”, and they are fighting over it (if it’s true?) means they a effing idiots.

I read the caption of the link and will read the rest this evening. Thank you again, Paul.The caption says she is making offers without viewing or walking the house. If she is a sample of the idiots, then my bra size is bigger than her and her husband’s IQ. (Disclosure: I had “modifications” and a lift.)

Does anyone see that renting is throwing money out the window? Even if you lose 50% of the purchase price on a 60K condo that’s 30k you will still have after 5 years as opposed to renting a roach infested, high crime area, apartment for 5 years @ 1k a month.

Some will bash the HOA fees in a condo/townhouse complex. But, the HOA fees cover the pool maintenance, my roof, my water, my cable, my landscaping, trash pick-up, and the gates in this beautiful gated community, etc… Due to reassessment of my property tax, I only pay $567.00 a year. Full coverage on the home inc. is $221.00 a year. And, in the end, I’m a home-owner. I plan on staying here for at least 10 years so I know I will have equity in a few more years and not be at the 50% loss I described earlier. I bought this condo for $43.5 K cash (REO). It was listed and sold for $240K in 2005.

The banks have time on their hands along with billions in stimulus money. They don’t have to do a thing but wait, smoke cigars, and hold onto all the shadow inventory until prices climb which we’re seeing now. They control and manipulate the market in their favor with corrupt politicians behind them etc… Prices are lower today than ever before in history. But, in many places we’re close to the bottom and prices are climbing in other places. In places like LA and OC the bubble simply hasn’t popped and it looks like it’s going to stay that way.

Being a home-owner is a great feeling. It’s a place to live and not really an investment for me. I can now move forward and focus on other things in life like saving more for retirement, eating better food, and buying a nice used car. The thought of where I’m going to live the rest of my life is a stressful nightmare that has vanished.

For all you people who think renting is a great idea keep working hard to have nothing in the end while I focus on other things in life. I may even buy another condo and rent it out to you. Have fun with paying your overpriced rent every 30 days to have nothing in return. I decided to jump into home-ownership when it was the best time for me to do so. You gotta play the game that your not in control of and this is the best time for any person looking to buy to go ahead and do so. I will now wait for the bitter and jealous comments that try to rationalize away simple common sense. High 5 to those who see my point of view.

Condo Mike, congrats, you got a good deal!

“Again, I don’t see any reason to buy save for the exceptions I noted – 1-1.5X income, long term purchase, rental possibilities, 25-40% down.”

Cash purchases make a lot of sense in many areas, especially lower end areas. I agree that the bubble may never burst in LA and OC. You played the game and won; not everyone has $43K in cash, but even with less than that amount it is possible to still make sensible purchases in lower end areas in this market.

Condo Mike,

If the monthly rental payment and associated fees was signifcantly lower than a compararable mortgage payment, one might be tempted to say renting might be best.

But:

1.) Folks would likely not scrupulously save that monthly differential, and piss it away. And so the mortgage payment may force you to live frugally, and give you no choice but pony up the money that might have gone to a flash car, clothes, entertainment, or thin white lines.

2.) If home prices continue their slide, you as a buyer are stashing money in a leaky savings account, your home. But at least it is stashed there for when you are incontenent and needing institutionalization. Plus, nothwithstanding maintenance and taxes, not inconsiderable in parts of the country, you don’t have to keep coming up with rent money every month. How will that feel when you are 75?

So like we will al be wearing if we live long enough, Depends.

In reply to:

Law Prof

June 20, 2012 at 5:38 pm

It all depends on how you define investment. If what you say were actually bottom line truth in the reality of living a life no one would buy a house. But funny thing people do. If I had bought the first property ever offered to me in San Francisco I could have lived rent or mortgage free out of pocket through today. We are talking 42 years and that property today would be worth $1,343,700 according to Zillow. That’s close to 45 times more than I would have paid for it. I am fully aware that the current value is still by our economy today a bubble amount. But I could in realty cash out. I could also have built a pension in a 401K or invested the mortgage amount at a rate of 25% of my earnings for all those years and be a multimillionaire today. Ain’t hindsight grand.

In my present circumstances in life I do have cash that if invested in a house will give me more money in my pocket vs a vs paying rental or mortgage parity. If I pay a down payment and use my capital plus earnings for a mortgage I will just give up a lot of dough to pay for the privilege of borrowing money. So again there is nothing inherently bad about buying a right house for the right price at the right time in the right place.

Leave a Reply to mike