The manic real estate pricing in Huntington Beach – When dropping prices by $2,950,000 and rising prices by $1,950,000 on the same home is a tactic to sell. The disconnect between household incomes and home values.

There is something darkly comical about the way some aspiring sellers price their properties in California. They reduce the price of their property by $50,000 in one single action as if they failed to realize that this was the median household income across the United States as families struggle to adapt to a lost decade in wages. Many in California have lost complete perspective and even with the bubble popping in surround sound some still seem delightfully stuck in the mentality of the mania. Foreclosures and short sales still dominate the market roaming aimlessly like zombies. The pricing action on some properties tells you how out of sync some people are with true economic reality. I can understand adjusting your price by say a percent or two over a few months if no buyers are biting. Yet some are pricing homes as if all they needed was some delusional sucker and a Countrywide mortgage broker to get the deal going and a $2,950,000 price reduction was somehow ordinary. In today’s market you actually need some cash and resources to buy and not made up paperwork by some mortgage garbage pusher. Today we’ll look at a couple of Huntington Beach homes that highlight this manic pricing behavior.

Million dollar rollercoaster by the beach

3341 BOUNTY CIR, Huntington Beach, CA 92649

Listed   05/01/10

Beds     4

Full Baths            3

Partial Baths      2

Property Type  SFR

Sq. Ft.  5,303

Lot Size 6,952 Sq. Ft.

Year Built            1965

The above is a very nice home in Huntington Harbour with two boat docks. This place has 4 bedrooms and 3 bathrooms and is listed at 5,303 square feet. Certainly a nice home in Huntington Beach. Yet when we look at the pricing history we have to wonder what in the world is going on?

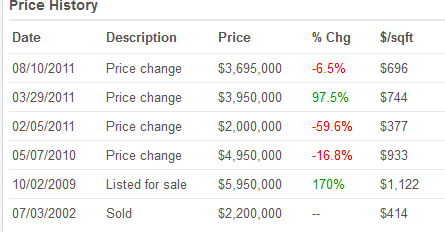

So going back to 2002 this home sold for $2,200,000. Seven years later the place was listed for $5,950,000! What in the world? We’re talking about in the height of the economic crisis this place was listed at nearly $4,000,000 more from the 2002 price. Of course no one bit. So seven months later it is listed for $4,950,000. Dropping by $1,000,000 as if this was par for the course. Then, I suppose to generate interest, they list the home for $2,000,000 seven months later. They dropped the price of the home by $2,950,000 in the matter of seven months (a 59% price decrease and a price lower than the 2002 sale price). Of course this must have generated some interest. Only one month later they nearly double the price to $3,950,000. In August of this year they reduced the price to the current listing of $3,695,000. Bwahahaha! What in the world is going on in Huntington Beach?

This is one of those pricing behaviors that only appear in some sort of mania. We are talking about millions of dollars in price changes only over short periods of time. So what does this tell us? Some people are flat out just wishing a price and using no sort of economic model to base this behavior. This worked during the bubble when you could be flaky on your income and we had a plethora of shady mortgage operations and loans to support your whimsical desires. Today the market is dominated by government backed loans and you have to document income. The game is very different now.

Just imagine if this was a car. You go to a dealer one day and the car is listed at $10,000. You come back a few months later and it is listed at $50,000. Then it is listed at $20,000, back down to $10,000, up to $30,000. Wouldn’t you conclude at this point that the dealer has absolutely no idea what he was doing and was only hoping for one eager sucker to bite? If this is our new model of selling, I might have a bridge to sell you.

No one is going to argue that this is a nice home:

Yet this kind of listing behavior is fascinating and entertaining. What are your thoughts on what is going on here?

Contrary to what people are saying and are artificially low rates, home sales are not even close to the bubble days:

Source:Â DataQuick

So why would anyone pay bubble prices?

Reduce the price by the median household income in the U.S. until someone buys

6962 CARLA CIR, Huntington Beach, CA 92647

Listed   07/05/11

Beds     4

Full Baths            2

Partial Baths      0

Property Type  SFR

Sq. Ft.  1,617

Lot Size 7,120 Sq. Ft.

Year Built            1963

Here we have a starter home in Huntington Beach. The place has 4 bedrooms and 2 bathrooms. This place is very different from the previous home but you also see some fascinating pricing history as well:

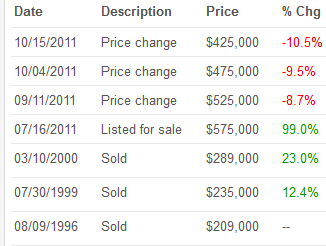

You’ll notice that the 1996, 1999, and 2000 sales prices were much more within a sane world of pricing. Then in July of this year they list the place for $575,000! This is a 99 percent increase from the price in 2000 while over the decade the inflation rate overall has been 30 percent. Of course no one bit so they shaved off $50,000 which coincidently is the median household income of a family in the U.S. Still no buyers? How about another $50,000. Still no one? How about another $50,000. This is the state of California housing in bubble markets. People are still wildly making prices up like throwing darts while blindfolded assuming that we still have no-doc loans and unscrupulous mortgage brokers and eventually the bull’s-eye will be hit. Even at the current price of $425,000 some sucker is going to have to jump in with some down payment.

Are you seeing any other whacky pricing history like this in other markets?

[rent trap]

Low rate today but how about those that buy in future?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

47 Responses to “The manic real estate pricing in Huntington Beach – When dropping prices by $2,950,000 and rising prices by $1,950,000 on the same home is a tactic to sell. The disconnect between household incomes and home values.”

Looks like they’re trying to catch a bid in a market that basically does’nt want the product for the price they’d like to sell it at. And one tactic is to bring the price way down and see how many people bite. You don’t have to sell it, and you get an idea of who’s really out there looking. I believe this is called “price discovery”.

3341 BOUNTY CIR HUNTINGTON BEACH CA 92649 – This home was purchased at a trustee Sale on 01/19/2007 for $1,010,000.

On 09/28/2007 the buyer put a new loan on home for $2,400,00. The owner does not live in this home they live in CLAREMONT CA

It is the same real estate agent at First Team Real Estate that has listed the home for $3,695,000 and $5,950,000

It appears the owner has no money at risk and is letting the home hopefully attack a buyer above $2,400,000 – Hal

“Are you seeing any other whacky pricing history like this in other markets?”

I’m seeing nothing but whacky pricing.. Once they gov declares that they will stop messing with the market, no more visas if you buy a 250k home etc. and the dart throwing has ended with prices going so low that there is some traction will the show start to make sense.

99%!

Excellent post Doc. Whenever I get any delusions about buying again, I read your blog and this serves as a giant wake up call to hold on and wait. If anything, prices will be moving lower in the few years. Housing appreciation is not even remotely on the radar. Add to the fact that our economy has never been tested like this before in most of our lifetimes…it will be a slow grind at best to turn things around.

Regarding the second house featured. It sold in 2000 for 289K, you mentioned inflation was 30% for the decade…that would put this baby at 376K today. The asking is 425K, so we are definitely getting there.

“Regarding the second house featured. It sold in 2000 for 289K, you mentioned inflation was 30% for the decade…that would put this baby at 376K today. The asking is 425K, so we are definitely getting there.”

That was when we didn’t live in an economic disaster era and things were still rosy from the dot.com market.

99%!

RE: infaltion, etc. in 2000, mortgage was 7%. FHA not available above 200K back then. Person had to put down 20% down or 58K, payment would be 1,538.18.

Today a borrower can do 3% down, finance 415K @ 3.75 +mi or 4% and have payment of 1950a/mo. Amazingly, thats is about 30% higher than 2000 prices.

Also not a bad deal considering a person did not have to save any money up to purchse the home.

Sacramento Realtor,

You forgot to include Wages and Unemployment figures for 2000 compared to today. Not to mention higher rates for property taxes and home owner’s insurance.

Yeah, and insurance, and energy, and food, and stuff.

We’re the FHA! We’re going to keep yall in your houses no matter how badly we have to let you screw yourself!

Sacto Realturd – How much should we factor in each month for depreciation? Although not in your best interest, it should be factored into your client’s decision. Additionally your clients, with 3.5% down, are underwater as soon as you hand them the keys to their new home since they have to pay you 6% to unload it for them. Great deal for you!

Thanks Lord “B”. Interesting post.

We were using 2002/$276K to put a fair market price on a home we were interested in 6 months ago (in retrospect wrong home anyway), for a 1900 sq ft pool/spa rancher in Ventura County. The home of interest was $425K coming down from $440K. We would have paid $390K in cash and be done with it. (We are dealing with a medical issue.) We couldn’t pull the buy trigger, because it was still too pricey for us. We understand reality and where is market is headed.

I looked up the dude & dudett that bought it. Paid full list $425K, 3.5% down and financed their closing costs. (Looked up the property title post sale.) Another walk-away awaiting to happen.

We have noticed more activity in Oct. We need a home, and paying cash, we are in the driver’s seat. Our realturd tells us cash means nothing, other than a $10K discount right off the top. He feeds us so much BS, I just ignore him these days.

we have experienced the same thing, realturd pump monkeys. We have been all cash and have no contingencies (save clean title). With the 3.5% we compete with people that will walk if the going gets tough. Our all cash offers have not even given us any advantage, as three houses sold for less than our all cash offers, and the others less than 7k more. I haven’t been able to figure out what the hell is going on.

The reason cash is not helping you is because the banks can make a lot of money of a government backed Note they can securitize vs recieving cash and the bank is no longer in the game. The economic collapse was caused by the derivatives scheme. The real property had nothing to with it. All the banks wanted/needed was the borrowers signature on a NOte. That is how money is created. Now the banks have all these so called assets on the books supposedly backing the 600 trillion dollars worth of securities they sold. The banks already took their 30% off the top before even aquireing the Notes. It’s smoke and mirrors folks and if the banks actually sold off all these homes at the CMV they would have to write down the assets to what they are really worth and guess what? They would be insolvent. THEY ARE INSOLVENT! If the banks had their way they would just bulldoze all the non perforning house down and collect the insurnace at the previous market value. We were robbed don’t you know? Now this useless new plan to refinance people with underwater mortgages but with no credit check or new appraisal (and you haver to be current on your mortgage so it won’t even help the people damaged by unemployment etc.) so more suckers can sign up for debt slavery for life! Ypu won’t be able to sell your underwtaer home, so you can’t move or ever make any life changing plans and if you do decide to walk away after Dec 31st of 2012 tou will also have to pay tax to the IRS if you needed to move and give the house back and they sell it for less than you owe ( probably) Even if by some miricle the house does go back up to what you owe in 10 or 20 years, THE MONEY WON’T BE WORTH HALF WHAT IT IS TODAY SO IT IS GONE!! Who in their right mind would sign up for that bad deal?? Thanks Obummer! Great plan. It’s BS and it’s all bad for ya.

Fellow Cash Buyer Be Aware:

The R E Game is an Agent & Broker relationship game. Part of the deal most folks don’t understand that if one realturd has burned the bridge or screwed up a deal with another realturd, it can come back to haunt the buyer the realturd has as a client. (The one who stiffed the other). It could also be a dual agency thing. Those should be illegal, period.

I’m Ca licensed for my former career, and did the residential thing to learn about the business for our purchase. It was amazing that the chit they get away with doesn’t consitute an illegal practice, imho.

6962 CARLA CIR, Huntington Beach, CA 92647 Zillow is $538,000(393-640K) Zillow says that the rental is close to $2,600 month. At $425,000, it should move. We can follow it on Zillow to see what it actually sells for. The seller is motivated with all these price cuts.

It’s a risk to assume the $2.6k rental rate is a good figure into the future. The housing market manipulation is also manipulating the rental market with all the empty/vacant/unused housing units in the shadow inventory. I don’t know how cable/satelite providers are faring in SoCal, but in the Bay Area cable/satelite subscriptions are down for all providers due to households doubling/tripling/quadrupling/etc. When the empty housing units come out of the shadow inventory, the rental market could change significantly. I wouldn’t want to place a $425k bet on it.

This place has a nice pool in back… SMACK UP AGAINST A MAJOR BLVD! ASS-uming the $2.6k/mo. rental figure survives due-diligence, $425k means a GRM of 163–YOWza!

Are REITs/holding cos./landlords in Cali-Dreamland really working with yields that low, just due to interest rates, Treasury yields, etc? After PITI+overhead, not much risk cushion there at all.

With all the REOs here in So-Fla, I can get either turn-key condos, or SFRs (which after repairs) net out to GRM = 105… after dip in 2009, rents back up and holding… so far.

1145 North CORTEZ Rd Arcadia, CA 91007. Dropping $60K each price change. Four more iterations, and it might be worthwhile to look at.

And on Michillinda to boot! Nice homes and everything, but I would hate to have to deal with the traffic there, which is constant throughout the day. Drivers going 50+ on a 35mph zone slowing only for the peacocks. You wonder why there is always a motorcycle cop present during peak hours.

We were priced out when the bubble inflated and resisted our friends/family/co-workers telling us we couldnt go wrong with real estate. we found DrHB and you folks several years ago. I’ve been a frequent visitor, love this blog and will continue to do so. Thank you all so very much. We are buying a house in Fullerton for 480k fha. Originally wanted Huntington Beach, but 450-525k still only buys a 1200sq ft house on a 6k lot with not much yard. We waited as long as we felt we could, our sons are 7 and 4. I’m 41 and my wife 38. We have been looking at various parts of OC and LB for 5 years and have been waiting for the bubble to deflate. It has to some degree but I believe it has much more to go. I fully expect to be underwater within a few months but am ok as its a nice house in a neighborhood we really like, hope to pay it off before retirement, will raise our family and someday leave for our sons. Can easily see the $480k we paid devaluing to $300k if interest rates tick back up someday. Ah well so be it… It will provide some

property tax relief. The majority of houses in SoCal are still crappy for the money being asked. If you can wait a few more years, houses will probably drop another 100k….and that still may not be the bottom. I wish we could have waited longer, but we are satisfied with the house we selected. Good luck to you all and thank you again DrHB 🙂

fatherpain

I could relate to your post. Life clicks away for all of just waiting for a home to live and grow older in. In our wildest dreams, we never thought this was a Japanese controlled collapse. In the S&L crisis, our home’s value fell fast and we got it over with. We sold with equity because we didn’t use our home as a credit card (ATM’s usually mean the money is there). Like you, and the rest of the DHB posters, we aren’t real estate flippers or infestors, we’re just looking for a home as the roots of a life with branches.

We paid $400K for a new construction view home in 1998 boasting 4,000 sq ft, with all the ammenities you could wish for. Now we are looking at paying the same for an average home. That’s way out of whack. So Ca is still way to high, but time is marching on, and life has no reset button. (We’re older.)

“I fully expect to be underwater within a few months”…

“Can easily see the $480k we paid devaluing to $300k if interest rates tick back up someday. Ah well so be it…”

Wow…just wow. I can’t believe someone buying and being okay with this.

We began looking for a house to buy back in 2002 when our kids were in little ones in elementary school. Advised we “had to buy” or the kids would be traumatized, American dream, picket fence, less of a family, blah blah blah. Made several offers, all “bidding wars” we never won (thank God). Finally threw in the towel in 2005; the housing market had become a joke. Never bought the SoCal house, raised the kids in rentals, they’re in high school now, daughter graduating next year, heading off to college and beginning her life as an adult, charting her own course. The kids are happy; lots of friends, involved in sports, school clubs…normal, well adjusted teenagers. Doesn’t appear to be any psychological trauma from not being raised in a SFR. If anything, I find them to be adventurous, enjoy living in different places, meeting new people; life outside the comforting womb of a cul de sac or tract worked out just fine for us. Different strokes for different folks, best of luck to all.

I agree, I would be royally pissed if I bought today and the home lost another 35% of its value. Timing the bottom will be impossible; however, it’s almost guaranteed that prices won’t shoot straight up. If you are patient, time is definitely on your side here.

I personally know several people who bought in the 04-08 time period and they are hurting BAD. That inflated mortgage is a giant boat anchor around their neck, they literally have very little money left over for anything else other than services house debt. Awful!

Yes, the kids will be fine! They are quite adaptable! Having to have a house for kids is just part of the American Dream propaganda…

What will you do when you are $180k underwater and you need to relocate to China to find work?

463 Richmond Rd, La Canada Flintridge, CA 91011

Date New Status New PriceÂ

10/10/11 Pending 1,795,000Â

07/26/11 Pending 1,195,000Â

07/26/11 Active 1,195,000Â

12/06/09 Expired 2,395,000Â

07/02/09 Withdrawn 2,395,000Â

06/05/09 Active 2,395,000Â

07/24/08 Expired 2,695,000Â

05/03/08 Active 2,695,000Â

04/25/08 Cancelled 2,695,000Â

04/24/08 Withdrawn 2,695,000Â

02/25/08 Active 2,695,000Â

01/30/08 Active 2,995,000Â

10/26/04 Sold 1,850,000Â

07/01/04 Pending 1,895,000Â

06/19/04 Active 1,895,000Â

Here is wacky…this in a hood we like, down the street from where we are renting. I’d pay max of 400k for this place…it may never get there, but wtf are they thinking asking more than 100k more than a few months ago??

http://www.redfin.com/CA/Orange/6002-E-Bluebonnet-Ct-92869/home/4387554

Spike-TV debuts “Flip It” a real estate spinoff of “Auction Hunters” on Tuesday Oct. 25th @ 10:30pm ET. Here comes another one of those shows like selling NY or L.A. but on the auction side.

A couple of Saturdays ago one of those cable channels – Spike/DIY/HGTV – was running re-runs of Property Ladder from 2006-2007. It was like a watching a train wreck & you just couldn’t look away. Flippers paying huge sums for dilapidated houses, spending huge sums to fix them up & hoping to score a huge profit. The 2 episodes I saw ended with the flippers unable to sell the properties at the end. They were trying to re-sell into a free-falling market. All those real estate shows from 2006-2007 should be required viewing for everyone thinking about getting into the housing market.

“Are you seeing any other whacky pricing history like this in other markets?”

Yep, we’ve seen the same thing in San Diego county. We’ve been looking for over two years, but it does seem that only recently that we’ve observed the wild swings in asking prices.

We have an offer in on a short sale at the moment. Was listed at $850K for several months but no takers. The sellers abruptly slashed the price to $700K and we bit (as did several others, supposedly). Of course, the actual sale price is not up to the sellers at this point, so all we can do is wait to hear from the bank.

This isn’t the first time we’ve seen drastic price cuts. Oftentimes it seems they cut the price dramatically just to bring in prospective buyers. Then they use their favorite tactic: “give us your highest and best offer” (ironically, the same tactic that we used to sell my house back in 2004…for a significantly higher price than what we were initially asking). For sure, that seems to be a good selling strategy when you have NO IDEA what the house is really worth.

Yes, it’s a strange phenomenon. Reminds me of the stock market back in 2008-2009 (although in slower motion)…when a stock could be trading for 20% lower in a week’s time for no apparent reason (other than an obvious desperate need on someone’s part to unload certain assets).

Seems to me that when you’re talking about properties with unusual attributes (like waterfront lots, with a boat dock), it’ll inevitably be tougher to determine what the actual “value” of the house is. I don’t think you can use the traditional valuation metrics (based on median household incomes and such), because there ARE people with money out there looking for unique properties…and those unique attributes are almost impossible to accurately factor into “calculations” of what should be a “proper” valuation.

“Seems to me that when you’re talking about properties with unusual attributes (like waterfront lots, with a boat dock)”

Huntington Harbour is infested with gold digging residential/commerical realtards that play all sorts of games to jack UP RE prices to maximize their vig…

This is a multi-generational con, created to extract wealth from the nouveau riche and trust fund babies, whose season begins after the xmas Cruise of Lights has set the trap for new victims.

Gonna be a LOT of knife catchers in Huntington Harbour/Seal Beach, once the .gov underpinning for the economy runs out of steam…

Here’s one in San Gabriel. Sold back in 2010 for $438k, now listed at $598k.

http://www.redfin.com/CA/San-Gabriel/329-W-Saxon-Ave-91776/home/7031909

Wow. Worst area of a 3rd-class town. Genius.

Here’s another one going the opposite direction. Sold at $545k back in June 2011, listed and resold (pending) at $370k in August. Pending for nearly three months?!?

Appraised value at over $700k. Strange.

http://www.redfin.com/CA/San-Gabriel/5316-Acacia-St-91776/home/7049159

Oh I take it back, an even worse area exists, but as an income property this one is actually workable.

For “meat and potato” type of neighborhood yeah the income and employment are the determining factors in pricing whereas for many SoCal neighborhoods there are plenty of buyers with means to purchase (either cash or high downpayment or no problem getting a loan) and pricing depends more on availability of desirable houses and on how many buyers are circling the same houses. That could explain why stubborn high prices in some desirable areas.

If this weren’t such a sad piece, it would be hilarious. Used to be rollercoasters by the sea charged you a dime, and anybody could get in. Then you had a hot dog or lime rickey.

Maybe what we’re dealing with here is the establishment of a new SoCal bubble currency: the AMIU.

That is, the American Median Income Unit. $50K here, $50K there.

You know you’re rich, or pretending to be, when you use those, rather than Benjamins or dollars, like the rest of us.

I liked the part about the two boat docks. Because what says “arrived” better than two oilslick-leaking rumble-hulls blocking your view from every window!

LOL… sailor myself, so I share the disdain. Given the similar size and config, I’d say one or both boats belong to dock-renters, or VERY good friends.

In FL this is called a “point” lot–i.e. extra water-frontage, extra $$. Also it’s very close to the ocean-inlet, more $$. Really despise the pursuit of “raw square footage”, and near-zero setbacks on ALL sides of premium lots. Same as in Flori-DUH.

Do public records in CA allow you to see the liens/mortgages on this place? Bet that’s a tragicomedy in itself. 🙄

Seems to me that the realturds (love that word!) and the banks are either shortsighted or just plain stupid or both.

We’ve been waiting to buy with cash too, and we’re frustrated that cash seems to make no difference to sellers. Who turns away an eager buyer with the means to purchase?

All I can figure is that they’re way too stupid to realize that more transactions = more commission, or they’re trying to sucker people into borrowing money, whether they need to or not–for what reason I don’t know. Doesn’t seem that that kind of manipulation helps the sellers at all. Dr. HB, would love your thoughts on what’s going on here.

Too bad that the only logical conclusions are that the agents and the banks are stupid, corrupt, or both. How embarrassing for them.

For a long time care dealerships have preferred NOT to have cash buyers. They want to give out loans. Pretty funny if this now applies to houses as well.

*CAR* dealerships

Why doesn’t the bank want your cash ?

I’m not a banker. I’ll take a wild stab at an answer:

Banks don’t sell homes. Banks are not in the business of selling homes. Banks are in the business of taking risks. Banks make money loaning money, taking risk.

With todays market the bank will loose money selling the house for cash. No question about that.

My guess is the banker would rather “Transform relatively illiquid ( that could read WORTHLESS), individual financial assets into liquid and tradable capital market instruments.”

I lifted that quote from Wikipedia. Go read about Mortgage Backed Securities.

They did it once, they’ve done it twice, and they will do it again because it pencils out best for the banks and it’s one of many of the tricks of the trade the Old Dogs know how to do.

I’d imagine that just because it seems the game is over , the game isn’t over.

That is my best guess as far as I understand it.

I still have the picture of buyers seared into my mind from 2004 when I was selling and they were flippers. With a house not much bigger than a one bedroom, there were people literally drooling over the property. Greed makes people very unnattractive!

Looks like things are slowly coming back down to earth here in So. Pasadena…slowly.

http://www.redfin.com/CA/South-Pasadena/1928-Fletcher-Ave-91030/home/7009350

Wait, let me get this straight. I bought my house in 2000 for 200k. Sure it was a fixer-upper and I haven’t done a whole lot with it, but it’s in a good neighborhood, with good schools, in upstanding Stockton and it has a hot tub.

So if I list it at $2,000,000, which I believe is a fair appreciation value (let’s not forget it’s in a good neighborhood and it has a hot tub!!!), it won’t sell, but if I relist it six months later for $1,950,000, someone will bite? That’s genius!

If califonia home owners are selling their houses at a reduced priced, there is nothing wrong with that. It just depends on how they get the house. May be they are selling uit as an inheritted property. THey do not really know the current market price for it.

That first home in Huntington beach is worth about 2.0 right now using the california dreamin value indicator (pricing on 01/01/2000 +1/3 of the renovations since)

value on 01/01/2000 – 1900000

renovations since -300000 (1/3 =100k)

current value = 2.0

2nd home – 289k on 03/2000 +1/3 renovations (30k)

value is 299k right now

http://www.caliscreaming.com

Still seeing outrageous pricing in Hawaii… some cash buyers still showing up.

Leave a Reply to Rhiannon