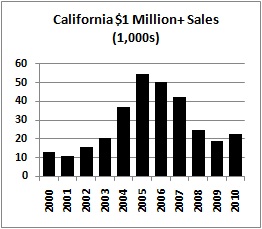

Malibu housing correction – 2005 saw 50,000+ million dollar home sales in California. In 2010 it was roughly 20,000. Malibu REOs listed at 15 but shadow inventory above 100+ in a prime SoCal beachfront city.

The recent housing data seems to come as a monstrous shock to most reporters. What in the world is happening with lower home prices if mortgage rates are at all-time lows? Contrary to the fact that for the past decade mortgage rates were already at comically low levels thanks to an activist Federal Reserve, demand for home buying is muted if people are not seeing their household income rise. Even if they want to buy, household incomes are weak and long gone are the banana republic mortgages and nothing down Monopoly products that use pretend money and Herculean leverage. Five years after the housing bubble burst the media is still largely absent when it comes to making the crucial connection between home prices and household incomes. Even in prime Southern California communities the bust is hitting. People tend to think that the housing bottom is already set but the data is showing a very different picture and some locations are showing another story. Today we take a trip to the beautiful beachfront city of Malibu.

Who foreclosed on Barbie?

The upper-tier in California has been massively hit because of the limited supply in the jumbo loan market. Long gone are the days when a $150,000 income was leverage enough for a million dollar mortgage. Million dollar home sales have been crushed in California:

Source:Â DataQuick

The peak year was in 2005 when over 50,000 million dollar homes sold. In 2010 we had just above 20,000 million dollar home sales. These prime communities had a large number of easy-debt posers jumping in with exotic Alt-A and option ARM products and shadow inventory is immense in these locations. Let us take a look at one of those 50,000 million dollar home sales back in 2005:

31869 SEA LEVEL DR Malibu, CA 90265

3 bedroom, 3 bathroom, 0 partial bath, 1,891 square feet, SFR

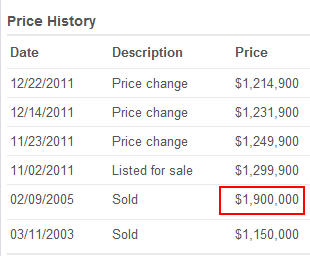

Nothing special about this home. This home sold for $1,900,000 back in 2005 when California had a peak in million dollar home sales. Apparently even property in Malibu got ahead of itself. Let us look at the pricing history on this REO:

The going price today is now $1,214,900 (a 36 percent price cut from the peak). Not bad when you can “save†$685,000 just by waiting a couple of years. Even in the crème de la crème communities you have massive REO discounts. What is more troubling is the reality that the MLS only lists 15 REOs in the Malibu area while the shadow inventory is up to 102 properties. Keep in mind that the million dollar home market has few sales by the nature that very few people make this much money to support a giant mortgage. And those that buy with all cash are likely looking for more flashy nests. The anomaly years of being lax with income documentation and using maximum leverage are now long gone. So it is revealed that even with low mortgage rates people have a hard time mustering large down payments for these moderate homes in prime locations. These seem to be taking the front hit of the correction.

Another pattern I’m seeing is high-end quality properties selling for cheaper but real money is jumping in on these prime locations AND prime properties. I just don’t see it for places like this one so you start seeing massive price cuts in prime locations.

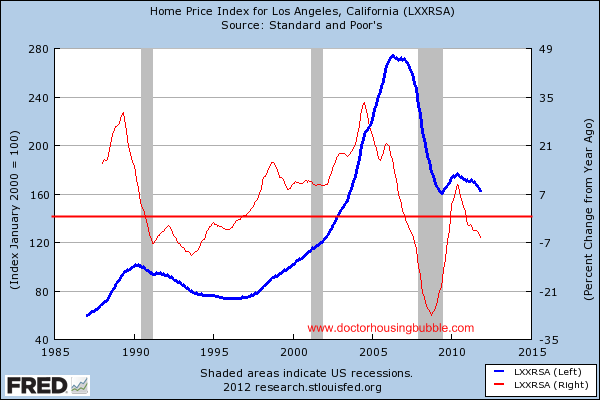

Contrary to bottom talks, the LA region is still moving lower:

A 36 percent discount on a Malibu REO in 2012? Welcome to the upper-tier correction. Who would like to guess when California will breach 50,000+ sales in the million dollar home market in one year?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

32 Responses to “Malibu housing correction – 2005 saw 50,000+ million dollar home sales in California. In 2010 it was roughly 20,000. Malibu REOs listed at 15 but shadow inventory above 100+ in a prime SoCal beachfront city.”

Put this in the pot.

http://www.zerohedge.com/news/california-run-out-cash-one-month-controller-warns

That chart says it all. We are headed back to 1990 prices in LA.

nothing left to say except… “We all live in a housing submarine, a housing submarine, a housing submarine…”

I don’t think Malibu is on the radar of most of your readers

With the way prices are going, they will be soon!

Both Illinois and California have the same problem: Their largest city – Chicago and LA – are both “Sanctuary Cities”. Need emergency health care? You better show up in an ambulance!

O yeah sure, illegal immigrants are to blame for falling house prices in Malibu and the housing bubble here in CA and around the globe. Not banks that made the loans or wall street for buying and bundling such loans. And you’re not an ignorant hateful bigot for suggesting such.

Illegal aliens are a big part of the problem along with the people who encourage them. Its a whole system based on greed and power that have fermented the decline of our nation. I will be a bigot or a racist or what ever it takes to keep our nation from becoming a banana republic. The US trying to be Mr. nice guy has not worked for us as of to date. Have you got anything more substantial than your mouth to put forward?

Of course only hateful bigots are against illegal immigration. The rule of law HAS been suspended in Los Angeles, and three million dirt-poor farmers who are here without papers, education, or English-language skills are struggling to survive in this sanctuary city. I’ll tell you, as well as the amnesty-supporting Obama and Gingrich: it isn’t racism, and it is unfair to argue that. If thirty penniless street-people from Ireland moved into your back yard, demanding that you pay for their education, hospitalization, and housing – you’d be demanding the rule of law in your little corner of the world!

Gael: I was only referring to the respective state budget crises.

I hear you! A person has to wonder had Ronald Regan NEVER set the precedent by granting amnesty to over 6 million law breakers, we wouldn’t be in this situation.

By granting amnesty once, you give hope to millions more that they too can be “forgiven” for jumping the fence.

We will never know. We have Regan Republicans, Regan Democrats and some 25 million and counting Regan illegals!

If you’re going to talk about him, at least spell his name right.

Sigh-logic and rational thought is always a good thing. Illegal immigrants were here, during the housing boom. So by your logic, they were responsible for the housing markets going up almost 300% or more??

Chicago has been dumping their black folks just as fast as they can by shipping them out as Section 8’ers to Milwaukee, Madison, Peoria, Springfield, Quad Cities, etc.

Chicago shut down Cabrini Green and sent ’em all away to bleeding heart social workers and county welfare departments all over the Midwest.

After spawning multi-generational welfare caseloads, they decided they were too expensinve and dumped them on everybody else to feed, clothe, medicate, educate and jail.

The person that was looking in the Santa Clarita Valley has got to be happy, prices are in free fall, and even in the better areas up there. I sold there in 2005, the same model as my old house is now nearly 50% below my selling price, or put it another way, you can now buy twice the square footage of my old house for less than my selling price…

The bubble is still strong in many areas. I sold in 92104, a nice part of San Diego but lots of multi family units mixed in with many cultures, so not exactly “prime”.

My house was one street down from a “barrio” street. I sold in May 2004 for 659K and if that same house was on the market today it would fetch 740 to 800K and my tax basis would be much much higher if I were to buy back. I paid a ridiculously high 289K (at least it was high at the time) in june of 1999.

I know this will not stand but I am beginning to think the only thing that will flush the bubble completely is normal interest rates and that won’t happen at least til 2016. Unless of course something happens in the financial markets that puts the unbelievable control that the fed has on world markets, to bed, once and for all.

Here in Bubble Zone Dos (So-Fla), Duh Banks seem to have increased confidence that they will be able to pick YOUR pocket, i.e. looking at courthouse auctions, more and more REO listings are just going through the motions, i.e. unwilling to accept bids less than what is owed on the note… WTF? Duh Banks are SUPPOSED to take a loss on these auctions, yes/no???

Oh, wait, we must have hit the market “bottom”… [roll]

[i]… the unbelievable control that the fed has on world markets…[/i]

And THAT is really the hard-to-quantify/imponderable nut. Even the most level-headed, non-alarmist pundits have underestimated this global leverage power.

Now remains the question: will it be worse if The FED does “pull it off” (de facto Third-Way One-World Gov), or if they don’t (Greatest Depression)????

What “culture” would you consider as “prime” ?

Vince……I don’t think any culture gets to claim itself as “prime”.

Prime areas when it comes to real estate generally refer to areas that are upper class and mostly single family rather than multi family. If you want to inject race, yes there are prime Black areas in many cities these days, as well as prime Asian areas although as a percentage, just as whites are the majority of the upper class, whites tend to dominate the “prime areas”.

Culturally diverse areas can sometimes be the most desirable areas for many but when you have lots of lower income multifamily residents mixed in, well then it probably won’t hold its value as well as upper income “prime areas”.

Why would you suggest that any culture is superior to another in the first place?

Nice try, Martin. You were the one who suggested that a certain area was not “prime”

because it was “mixed in with many cultures”. Your words, not mine. I just wanted to know what areas you would consider as prime when taken in the context of your version of mixed cultures.

Great article as always! I only want to add that aside from the incomes not rising. Proportionately, there is also the problem of ruined credit scores from the many previously well to do buyers left without a chair when the music stopped playing. Either because of unemployment, under employment, or simply having to do a strategic default because they are stuck with an underwater mortgage that they will never recover the fake previous value in their home, because the only reason it had the previous fake value was due to the banksters gambling on the equity that was not really there to begin with. When the banksters win they collect, if they lose they pass the losses on to the taxpayers. People better learn about how this all works quickly because there is only one candidate acknowledging the mountain of fraud in our monetary policies and banking system and that is Ron Paul. Ron Paul 2012!!!

I do subcontract work on REO properties. We call them ‘dumpers’. Because they are often dumps. We have to get a ten/twenty yard dumpster. It’s kind of the boom construction industry in reverse. We didn’t used to be, but now are specialized. We used to do it all, but now the subs are cheaper. First is the clean out crews. Animals. Sometimes a Bobcat for the back yard full of trash/crap. The guys get to scrap the metal( beds, grills, weights, even keels of sailboats that are busted up and put into the dumpster. Then the paint crews. Flat white, near everything, even the cabinets if really grungy. The the now paint mucked carpet that probably stunk of dog, cat… whatever gets ripped by a carpet company. A quick, poorly done roof is often called for. Just make it last a few years. A down and out plumber with a license gets the heat and fixes the pipes and then it’s on the market to the new owners. A once quickly, poorly built, poorly maintained, ghetto rehabbed ‘bargain’.

Anyhow. The bloom is off the rose. A lot of people got burned, lost decades of savings and will never look at houses the same. Kind of like your grandparents/depression generation. So, they’re out.

The boomers are getting old and downsizing and there are less asses to fill their chairs in the housing musical chairs.

Someone, directly or indirectly via the Fed Reserve has to pay these debts. Young people aren’t gong to have the bodies, families, kids or money to pay. And, that will be the critical price setting factor. Fewer buyers with less money.

Big supply with declining demand with less money.

With near zero return on savings, and rising medical, food, fuel costs…..more elders are going to pressed to keep their homes.

( did I mention tax increases at the Fedgov, State, town ? )

How about nearly 55% off peak selling price in the ‘BU:

http://www.zillow.com/homedetails/31341-Birdella-Rd-Malibu-CA-90265/20555362_zpid/

It’s more inland than coastal ‘BU—but no denying banks getting agressive

Not to flog a dead horse, but please don’t forget the greedy consumer who purchased all this overpriced housing. Yes, banks that made the loans, wall street for buying and bundling such loans, mortgage companies, the NAR, etc. are all guilty; but there was lots of stupidity and greed at the consumer level. This is not 20-20 hindsight as there were many people who did not participate. Unfortunately, there’s plenty of pain to go around. How will one know when to really buy? The current job market will NOT support today’s prices………. something is going to have to give.

The current political approach is NOT working. Something HAS to change.

Curt, I think that horse was beat to death years ago. Remember, it wasn’t all greed at the homebuyer level. Here’s something I recall hearing way more: “You’d better buy NOW, or you’ll be priced out of the market.” In other words it seemed that every day could be your last chance to realize the American Dream.

Not JUST the American dream either. This “don’t miss your last chance” thiing was a global phenomena. Back in 2007 and early 2008 I used to regularly harrassed to get a mortgage every time i went into my UK Building Society to deposit a cheque. This was a relativelly staid, boring financial institution, continuing in the year after the US market had started it’s decline.The tellers would cheerfully encourage me not to miss the bus, or I would reget it.

Some of my friends did get persuaded, and boy do they regret it.

The joke is, I’m far better off financially now than I was then, but they just turned down my overdraught application.

I have some favorite words to live by. Affordable. Sustainable. Accountable. Workable. Doable. Realistic. Rational. Reasonable. Legal. And I only enjoy what I can easily afford. I’ve been saving to buy a house for over a decade. When I do I’ll pay cash and it will cut my monthly expenses, not increase them.

FWIW I am seeing flipping alive and well in Palm Springs. A house that sold at or near the peak for 500, sells in 2011 for 500 and then is flipped for 730K in 2012. I can post links.

There are plenty of credulous and willing fools who need only the facility for making terrible financial decisions. I wouldn’t mind if it didn’t F-up my decision to live within my means when trying to buy a place.

taxxee-“When I do I’ll pay cash and it will cut my monthly expenses, not increase them.”

You might surprised about the great quantity of hidden costs associated with owning a house, compared to renting. The bottom line is that the best reason to buy, rather than rent, is that you can have a big dog on the premisses on your own private property, lmao.

Every tiny little repair that doesn’t get done, or is done by the landlord, becomes your responsibility. Also, with respect to apartments, there is a sort of ‘economy of scale’. For example, high speed internet, garbage collection, etc. are much cheaper on a grand scale. And of course, a pool is standard at a decent apartment complex, but but rare in an average backyard.

So if you have 100 pound dog, or other solid reasons for buying rather than renting, than go ahead and buy. But look for your expenses to go way up. You can mitigate this somewhat by hiring illegals to do repairs. (just poking fun at the above, off topic, discussion, lol)

The biggest advantage of all to owning is never having to move again. That will probably suck me back into home ownership again, but will wait until I can pay all cash.

God help me! Jim Crammer was humping home builder stocks this morning on CNBC because the unemployment rate (what ever that means) is down to 8.3… The good news is that he is, in an off hand manner, admitting that income has some connection with housing. How can someone be so wrong so much and still get paid? I would have lost my job a long time ago…

Cramerica!

Leave a Reply to spartan117