The rich do it too – Los Angeles County and million dollar distressed properties. 1,947 homes in L.A. County valued at $1 million or more are three payments behind or in foreclosure. Beverly Hills prices down 31 percent from one year ago. 14 out 100 homes on the MLS are priced at $1 million and up.

Foreclosures are characterized by the media as a financial downfall that only hits the poor in our society. Recent media stories have focused on the higher end market and it shouldn’t come as a shock that many who appeared to be living in the new gilded age were merely mortgaged to the hilt with toxic loans. In fact, the data reveals that those with higher mortgages are all the more willing to walk away from their underwater properties than those with lesser means. Here you have the government berating people for strategically defaulting while the wealthiest among us run from their mortgage commitments as soon as their best rendition of Dallas fails. Instead of taking it at face value, what better place to examine the million dollar foreclosure market than here in Southern California?

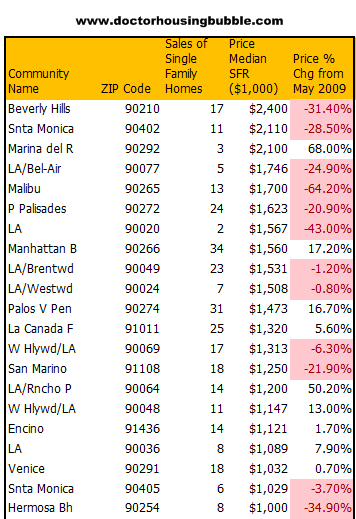

I wanted to closely examine the Los Angeles County market and see what is going on with high level distressed property. Let us first look at zip codes with median sales prices of $1 million or more:

309 homes were sold in the above zip codes. This doesn’t mean 309 homes sold with a price tag of more than a million. Take for example Hermosa Beach. The median is $1 million meaning half of the homes sold above that price and half sold below it. The above however gives us a good sense of what is happening out in the market. We know at the very lower end, that at least 154 homes sold in L.A. County for $1 million or more last month. But look at the price changes listed above. Many of the cities have seen drastic cuts in their median price. For example, the famous 90210 zip code has seen a median price drop of 31 percent. The most dramatic is Malibu with a 64 percent price drop. These markets are highly volatile (look at Marina Del Rey with a 68 percent year over year price increase).

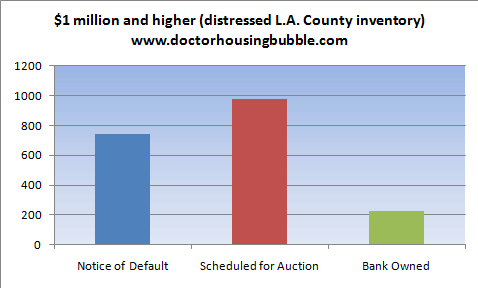

The idea that there is little trouble in the high priced market is absolutely incorrect. In fact, we are seeing a lot of properties entering into problems. The wealthy have more money by definition but many also bought into the housing propaganda and over paid for homes:

In total there are 1,947 homes in L.A. County valued at one million dollars or more with at least 3 missed payments all the way up to being bank owned. If these homes were valued at higher prices, you would expect that the owner would simply sell the home and take whatever equity remains and move on with their life. Yet that is where the conflict arises because many of these homes are massively underwater like millions of other Americans. Unlike most Americans facing housing trouble, these homes can be underwater in the millions of dollars. It would appear that many of the rich were only rich in their ability to access debt to purchase the property and lease the European make of car. A large number of them really lived a life of all hat and no cattle.

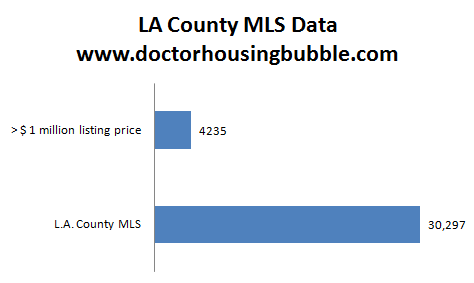

1 in 7 homeowners with a loan in excess of one million dollars is now seriously delinquent. This is compared to 1 in 12 for mortgage values of fewer than one million dollars. The assumption would be that those working class and middle class Americans would have a harder time paying their mortgage in these economically challenging times. Yet as it turns out the zip code rich on a per capita basis have more trouble paying their mortgage than the majority of Americans (or better put, have more means to selectively not pay their mortgage). In L.A. County appearances can be absolutely deceptive. Let us look at total MLS inventory and compare it to million dollar listings:

14 homes out of 100 are priced at $1 million or more in the county. This is really where you still see evidence that California in many areas is still showing signs of a housing bubble. In order to purchase a $1 million dollar home, you would need a substantial income. Let us assume you buy at this price range with 20 percent down:

Home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1 million

Down payment: Â Â Â Â Â Â Â Â Â Â Â Â Â $200,000

Mortgage:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $800,000

PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $6,097 (30 year fixed 6.5% jumbo loan)

As a good rule, you should not take a loan out that exceeds 3 times your annual gross household income. So for this purchase, a household would need to bring in at least $266,500 a year. This is the lower end. Here is where the bubble is evident. Only 7 percent of L.A. County households make $200,000 a year or more (so those that make $266,000 or more is less). Yet current MLS listings show 14 percent of all inventory priced over $1 million! And you wonder why housing is still in a funk.

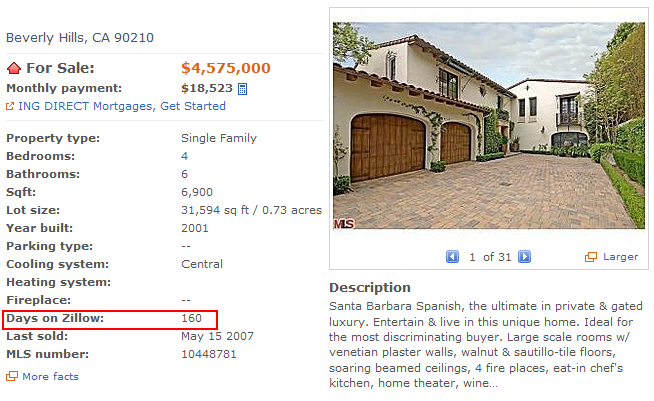

Let us look at a direct example in the glitzy 90210 Beverly Hills zip code:

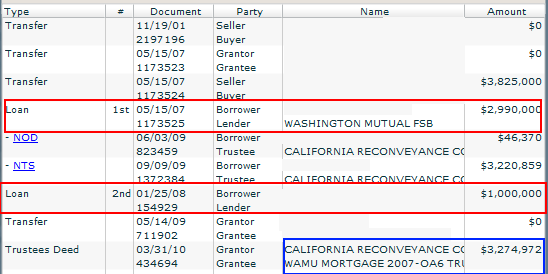

The above is a bank owned home that is currently listed for sale for $4,575,000. It is a 6 bedrooms and 4 baths home in a very exclusive neighborhood. That by itself does not seclude this home from jumping into the toxic mortgage world that engulfed the region for years. The home was taken over in late March but has been listed for 160 days. Let us look at the actual note history:

Washington Mutual made a loan back in 2007 for close to $3 million on this place. Not even a year later, a second mortgage was secured on the property for $1 million. All it took was another year and in 2009 the notice of default was filed in June. Three months later it was scheduled for auction. Even though it is listed as bank owned it is showing up as being postponed due to mutual agreement. This is probably why the home is up for sale for the current price. How many people do you think are ready to shell out $4.5 million in this market? Whoever is selling this home is trying to have a safe exit in the worst housing market since the Great Depression.

When I look at the data it is amazing how many of these homes are secured with Alt-A and option ARM products. Banks are hoping and praying the market will turn around but they are fooling each other. Many of the people that bought these places never were wealthy enough to own the home. Sure, their incomes were higher than the average but it is another level to afford a million dollar loan. Apparently the “rich†strategically default as well and have deep housing problems like millions of Americans. Still think it is a wise idea to push home buying for everyone before we patch up these massive kinds of loopholes? Keep in mind tax dollars are going to bailing out these owners indirectly by funneling money to the banks that made these absurd loans. After all, even the rich need a bailout to keep the Jacuzzi running.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

27 Responses to “The rich do it too – Los Angeles County and million dollar distressed properties. 1,947 homes in L.A. County valued at $1 million or more are three payments behind or in foreclosure. Beverly Hills prices down 31 percent from one year ago. 14 out 100 homes on the MLS are priced at $1 million and up.”

Po widdle rich kids…down to their last few million.

I would think that people that bought in this catagory would be more likely to strategically default than most other price catagories. First, because they probably have legal and financial councel that would recommend it , and second, they probably just lied more than others with smaller Alt A loans,

“Strategic” defaults simply should not be allowed. Unless there are serious ramifications for bad bets, people will continue to make them. Right now it looks like gambling big in our country is all upside potential, minimal or no downside. Gamblers get the gains, we all share the losses…. pathetic situation.

It will be interesting to see what happens in Australia if (when?) their property bubble bursts….once you sign on the dotted line there, you are on the hook for the loan no matter if you are underwater and must take the loss. Didn’t keep a gigantic bubble from forming but the brsting of the bubble is sure to look different…

The rich got rich by understanding money more than the average person, or being able to afford a financial advisor. Of course strategic default can be a part of antibody’s financial planning. More and more average people are waking up to the benefits of strategic default as part of a person’s financial plan. I expect soon that it will become the latest fashion, just like the old BMW, before the loan company came a knocking. Do a strategic default and keep the BMW. Continute to stay in your castle(for up to a year or more) and enjoy the good life as long as you can. Then rent for half the cost and still enjoy the good life!

These people didn’t just walk. They walked with 1 million dollars. Talk about working the corrupt system. The bank is responsible for this and the bank alone. They made a leveraged loan on a depreciating asset. The “owner” merely stuck to the contract and gave back the leverage (the home) when they defaulted. The banks are responsible…period.

Back in the Clinton years it was the leftard mantra that an income of $250000/yr made you a millionaire…because that’s what that level earns in 4 years. Of course, millionaires have to pay more taxes….as if they don’t already pay WAAAAY more taxes. The looney socialists haven’t given that song up because B+rry said he wasn’t raising taxes (not one dime) on people making less than….you guessed it….$250000/yr. That’s because when you do lefty math $250000 X 4 = 1 million $

Now with those $250000/yr millionaires losing their jobs, they’re scrambling to not get hung out to dry. It will be interesting to see how low a $4 million buck house will fall to. I bid $50.00. Sight unseen.

@Patrick

The banks made a deal – pay the loan or we take your house. End of story. They get the money or the asset, in this case the house, in event of a foreclosure. In normal times, this is all upside for the banks. Strategic defaults are just the consumer playing by the same rules as the banks. They are not breaking any contracts because the contracts state the penalty, losing the house, if borrowers don’t pay.

I agree that the government bailing out the banks is complete BS and the bailing out, to some degree, of “homeowners” is crap too. We live in an undereducated society where large corporate interests have captured the government. Our politicians try to please everybody but especially their campaign contributors. Unless regular, aware citizens make coherent protests, not this Tea Party nonsense, we will continue to have this state of affairs.

Australia will be something to see. There will be a dearth of investment in new businesses and industry for more than a generation when defaults start there. I don’t think their government is large enough to bail out their banks. It’s a pity, Australians are great people. I have worked with many over the years, and they are like Americans but without many of the neuroses that make us Americans a pain in the butt. They are a little naive and innocent though about the slash and burn economics that exist in the US. They are about to get a quick introduction to it.

Basically, lot of people, rich or middle class was being greedy, everyone was behaving like drunken sailor while loan officer and bankers were giving everyone the toxic loan that contains bad apple to begin with. It will take years and years to fix the problem so mean while everyone, grab some pop corn and enjoy your favorite movies ……

Well, if we are going to have to pay for these strategic defaults, then I guess I don’t want them either – but the point is we shouldn’t be bailing out these people or the banks that lent to them.

Just wondering why in your example you use a 6.5% mortgage, aren’t rates close r to 4.25% right now?

“The rich got rich by understanding money more than the average person”.

No, not really. It’s pretty much luck. Read:

Your Money and Your Brain: How the New Science of Neuroeconomics Can Help Make You Rich by Jason Zweig

You will learn that the Forbes 400, with average assets of $33 million and who make an average of $500K per year are only 14% happier than the average person making $40K per year and JUST AS HAPPY as the Inuit, the Amish and the Maasai, who live in huts made of cow dung.

After reading this book, you will learn how the FIRE industry played your brain and made the wannabee rich think they had to “move up” to a bigger, better house in order to be “successful”.

It’s a pathetic situation that so many people don’t feel any obligation or responsibility to uphold their end of a contract that they willingly signed. But it points to the real unfortunate part of the situation: “rich” people who are mortgaged to the hilt and and can’t afford to make payments aren’t really rich — they’re simply putting up a front. There are probably a lot of $30,000 “millionaires” living in these homes. Shame on the banks for making loans to these people, but shame on the people for taking a loan they knew they couldn’t repay. And most of all, shame on all the government programs that promoted home ownership for everyone — regardless of whether or not they could afford it.

I just read in the paper that there’s legislation being presented at the state level here in CA to allow non-purchase money mortgages to become nonrecourse as well. So it wont just be purchase money loans that are nonrecourse by law here in CA. This should make strategic default easier, if this becomes law. All the HELOC’s and refinances will become nonrecourse as well. Going forward.

Nonrecourse was made law in CA during the 1930’s as a reaction to all the people that were unemployed and could not pay their mortgage and were dead broke. So it had good intentions.

He used the higher rate because that is what you will be charged for loans over I think $600,000.

Why don’t the banks go after people like this for their second. In California you are exempted from the original loan if you walk. But banks can go after you personally for the second or if you refinanced.

Don’t understand why a new industry of lawyers are not suing these walkaway for the second or if they refinanced.

“Just wondering why in your example you use a 6.5% mortgage, aren’t rates close r to 4.25% right now?”

Rates are around 4.5% if I’m not mistaken, and that doesn’t count points. He’s using 6.5% because at $800K, it would be a jumbo loan. There’s quite a spread for jumbo loans versus conventional conforming and even jumbo conforming (up to $729K in Cali) loans.

Funny, I was going to say what cambridge02140 said!

~

Doc, is it possible to sort out what portion of the “million dollar home” prices is still due to bubble values? I’d think that for houses listing at around a million now, a good 30-40% of that would be inflation over the past 10 years. The five-million-plus houses, I’d think might be less inflated (totally guessing there).

~

It would be fascinating to see a distribution curve or scattergram of the over-million properties, by price, then compare that to curves showing the same properties’ original sale values, their LTV, and also their property taxes.

~

It would be interesting to sort through this. People who have to earn an income to keep their houses/pay their mortgages will be more directly affected by the magnitude of property taxes in the monthly nut.

~

Also there is a tax element here: how much people can write off as mortgage interest. They don’t have to give back those prior years’ tax deductions if they default. That alone provides incentive for inflating house, mortgaging to the hilt, and taking as toxic a mortgage as possible with the lowest monthly payment.

~

rose

I don’t know either why banks don’t go after second borrowers. Maybe it’s because the banks realize it would be like drawing blood from a stone. I have spoken with realtors and bankruptcy lawyers and they have told me that banks rarely go after seconds, but they do go after them in some cases, which cases they did not know. Couldn’t these second loan defaults alone break the banks since they were quite large by historical standards? Add that to purchase money loans and CRE defaults and you have a completely insolvent banking sector. Scary.

Jonathan Capehart of the Washington Post was all over this last week on MSNBC.

Turns out its even more egregious than it looks at first glance: the govt is trying very hard to bring in legislation to basically deny anyone a loan via the FHA again if they jingle mail.

So, anyone who’s mortgage falls above the FHA’s $725K limit here in CA can do a strategic defualt with almost no consequences.

Woe betide you if your mortgage is less than that, though.

My brother, who married an Aussie girl and moved Down Under, just bought a second home as an investment there. They lose over $1,000 per month (mortgage costs versus rental income), but the deal absolutely makes sense for them economically because although they cannot deduct interest and taxes on their “own” home, they can make such deductions in Australia for investment properties, which lessons their annual income taxes greatly. Makes our RE world seem rational by comparison.

Thanks for taking up this thread which appears to have been sparked by a poorly researched piece in last week’s New York Times.

Lots of things wrong with that piece: 1, it conflates strategic defaults with those caused by economic hardship (caused by a collapse in assets and steep loss of income among many, many once highly paid professionals). 2. it doesn’t bother to mention that the jumbo market remains frozen, with few investors willing to buy MBS, few banks willing to make loans and few highly paid professionals willing to bet that THIS is the bottom of the market (because it ain’t). 3. Non-conforming loans were deliberately left out of all HAFA and other crap Obama programs because we could not be seen to be helping “rich” people save their homes–so now that “rich” people are defaulting at twice the rate of non-rich people, the problem is, what, that they don’t care about their neighborhoods??!! C’mon.

You don’t have to ooze sympathy for those stuck with million dollar mortgages (Not, I might add, the truly rich, who would never have such a big mortgage) to wonder how else rational people can extricate themselves from an unwinnable situation.

Oh, and taxpayers are NOT subsidizing these defaults because they are not guaranteed by Fan/Fred. Many losses have already worked through the system, as jumbo MBS trade at 60-80 cents on the dollar and anyone buying these securities absolutely knows the risks they are taking.

Find some other whipping boy, would you?

I think that if a mortgage is a non purchase money loan, the lender can go after the borrower for restitution of the balance owed. But it’s much more costlier and time consuming in general to pursue this course of action for the lender vs. using the trustee route to get back the collateral (house) and just move forward with business. Plus the borrow may have ways to go BK if needed.

“Only 7 percent of L.A. County households make $200,000 a year or more (so those that make $266,000 or more is less). Yet current MLS listings show 14 percent of all inventory priced over $1 million!”

Two points:

First, more expensive houses are experiencing longer dwell times on the MLS, so they make up 14% of MLS, but what % of sales are they?

Second, what percent of LA County housing stock is over $1 million, and what percentage of LA County families own their homes?

Reality is this people, when people walks away, banks don’t really lose the money…its just the numbers and digit on the paper and they always win….. Anyhow screw the banks and corrupted Gov…… When US defaults dollar on 2012, welcome to the world of new era…….. unless feds give us a chance to pay back, which we never will…but 100 years celebration for NWO will come. (1913-2013)

Strategic default is only a good option in a no-recourse state where the only note on the house was the original purchase money loan and/or the borrower doesn’t have significant assets or income. Cash-out refis are full recourse notes everywhere.I think we’ll see firms buy up these notes for pennies on the dollar and then begin to aggressively collect when the economy rebounds a bit.

But … They *are* indeed upholding their end of the contract, they buy a house, take a million dollars more out and then hand the “asset” back to the bank instead of paying the loan, which is *exactly* the procedure the contract states.

This is the final fantasy. When you got a hot potato you try to give it to someone else. You can try to feed your ego at the Golden Corral but it will never be full. Still, when you lust after a fabulous chick, you will do ANYTHING to try to keep her in sight. It’s only irrational to the outside observer. When you are in the maelstrom, you will understand.

Still, the PTB think that they can fend of the depression by eating the entire crap buffet by cleaning out the treasury to store all the commercial toiletpaper and backstop the entire mafia, aka wall street.

Where we go from here I doublt we’ll be surprised. Could be the collapse of the free world to be supplanted by Chinese-style capitalism, or this preverse model of rewarding crime, clinging on for another 20 years.

My local bank bought a basketful (300 mil) of 2009 Re-Remics (repackaged toxic waste). Non-Agency (Jumbos) ALT-A and Option ARMs pre-2005 paying 7% and rated last fall as AAA! Nothing has changed, bankers are stupid and greedy. I think they used TARP for some of the money. An investment bank simply dumped on them.

This is my banking prediction. Smaller banks will originate gimmick ARMs for securitization, especially if F&F go away. The little banks will (forced) buy back high interest but mis-rated securities. The entire banking system will collapse and be bailed out again because it will be 10,000 banks all at once, easily overwhelming the FDIC.

Leave a Reply to Edy