Lifestyles of the Los Angeles flippers: Big money being invested in flips. Boyle Heights and other interesting market observations.

It is no secret that investors are pouring money into the real estate game. What is interesting is the kinds of investments being taken on are highlighting a bolder more aggressive approach. For example we are seeing more money flowing into flips in Southern California since rentals are unlikely to cash flow in many prime areas of Los Angeles and Orange County. The appreciation trade is back on. With supply at record lows and sentiment near a point of giddiness, money is being made in many different ways. Early on many of the flips we were seeing involved very minor cosmetic work and most of the gains were made on the low purchase price. Today, some flippers are doing some major work and are going for giant gains. Let us take a look at a potential flip in Boyle Heights.

The Boyle Heights Flip

One of the great things about Google Maps is that you can take a look at a property prior to any work being done. Google Maps only updates at longer intervals so you can see older pictures. Let us first take a look at this Boyle Heights flip:

Not exactly a home that will pop up on Lifestyles of the Rich and Famous but someone was able to snag a deal on this place last year for $94,000. Nice touch with the three stacked tires in the front sidewalk. Some major work was done on this place:

748 South MOTT St

Los Angeles, CA 90023

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 4

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Square feet:Â Â Â Â Â Â 1,281

Clearly some investor put in a lot of work here since the place is not even recognizable anymore. Let us take a look at the current listing for the place:

“Completely remodeled house – the entire property was down to the studs. This home is 95%+ new. Completely new plumbing (including water main from the street), new electrical, new flooring, walls, windows, cabinetry, even a car port – everything! An additional 499 sq ft was legally added with permits to bring the sq ft to almost 1300. Master bed has a large walk in closet that is approximately 6 x 10. Close to transportation, downtown and schools. Must see to appreciate.â€

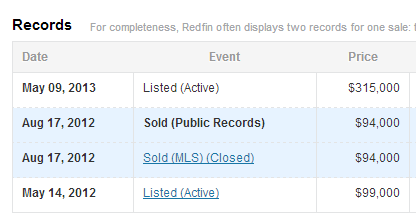

The original place was built in 1917 and from the first picture, it doesn’t look like much work had been done prior to the purchase last year. If they legally added 499 square feet the original place only had 782 square feet. What is interesting is the big gamble being taken on this place since clearly a good amount of money went into this investment. Let us take a look at the sales history here:

The current list price is $315,000. Do you think $221,000 in value was added over the last few months? Hard to say but the fact that this kind of investment is being made in Boyle Heights is showing that investor money is flowing to all areas of Los Angeles.

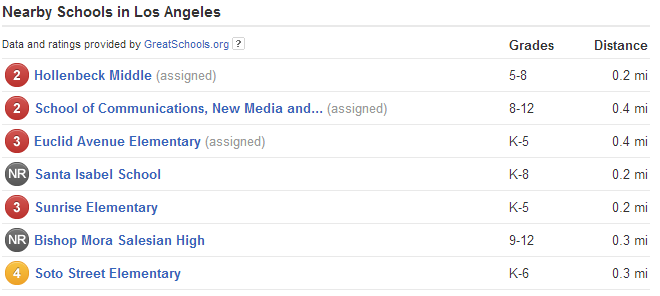

It’ll be interesting to see what the eventual sales price on this place ends up being. $315,000 is nothing to sneeze at here. Local area 2 bedroom rentals go for $1,000 to $1,200 in this market. The nearby schools are not exactly the best in Southern California:

What I do find fascinating is the willingness for many flippers to go after these kinds of deals. Only the investors really know how much money was sunk into this deal and how much of a buffer they have to play with here. At $315,000 there is definitely a lot of profit to be had. The question is, will someone bite at this price point? The reemergence of the flip for appreciation was a hallmark of all the SoCal flipping shows where buying and flipping was done into a momentum of manic euphoria. If you read many of the housing forums people seem to think that they missed the boat on the true and final bottom and now must capitulate and do whatever it takes to buy in this current market. Having lived through the booms and busts of California, it appears that short-term memories are abundant and real estate reaches deep into our emotional core. I’ve started seeing ads connecting family “wellness†with purchasing a home. I was wondering how long it would take to start seeing these. Yet these are still rare given that sales volume is still low in comparison to the former boom days.

Are you seeing more flips in certain neighborhoods? Do you think this place will fetch the asking price?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

62 Responses to “Lifestyles of the Los Angeles flippers: Big money being invested in flips. Boyle Heights and other interesting market observations.”

Again, with out a real economic recovery, this is all temporary rallies based on new ways to get cheap money into the real estate market. Not sustainable.

I have to think that folks (buyers living in the residence) eventually have to wake up–especially if job prospects remain dim–and move somewhere else. This is what the same budget will buy you in Florida–equivalent climate, better schools, lower taxes, arguably better job prospects in a service economy: http://www.trulia.com/property/3113393590-3584-Windjammer-Cir-Naples-FL-34112

You aren’t seriously comparing the climate of Naples Floriduh to Los Angeles, especially the Westside or coastal areas, are you? Haha, you made a funny!

Florida may have lower taxes, but… it’s also Florida. If I want to send my kids to school in a dumb, wacked out red state, yeah, Floriduh is the place! How are the cockroaches, gators and other non human vermin?

Having moved back to Orange County CA from South West Florida (Sarasota, just north of Naples) I want to call bullsh!t on your false equivalency. Southwest Florida has terrible weather (hot n humid with hurricanes), high unemployment, low wages, high crime and their state government is a disaster. Those service jobs you tout are only full time in winter as business drops off when the “snowbirds” head back north for summer. If you hate CA so much, by all means move to Florida! But don’t falsely bash our state… we have dramatically better employment prospects than Florida and our state is running a surplus.

CaliChris:

It looked like he was bashing Florida, not California….

–AL

CaliChris:

Saying CA is running a surplus is a bad joke. The combination of preofit taking from the stock market (which is WAAYYYY in bubble territory) and the initial flipping profits of House Bubble 2.0 made for a one time upswing in revenue. It won’t last…

@ Bora

Obviously, you know nothing about Napes, Florida. The titans of America commerce have homes there, including Trump. Southern California, on the other hand, has over a 150,000 gang members and a totally bankrupt state government with absolutely no way of paying its pension obligations, much less current state employees. Naples has excellent schools. Give me a call when the big one hits.

Yes, quite shocking. From the photos it looks like an alley runs along the property. houses in a rough neighborhood like that, with alleys usually generate lots of noise and riff raff at night (drug dealers, drunks pissing on the walls, etc). So quality of life in Boyle Heights AND a house with an alley side will be problematic, but for the family that would buy in Boyle Heights it could be a dream come true, compared to eternal renting from a greedy landlord. Doc, honestly, there are other aspects of this that to me are more shocking than the $315K list price. 1) I am surprised that the winning bid was $94K (with a new list price of $315K you would think the winning bid would be a lot higher than $94K) 2) it be interesting to know if this was a ‘courtroom steps deal or was this a deal where a bankster simply sold this out the bank back door to a friend? Anyway, this house was in terrible shape and not suitable for a first time home buyer. What saddens me the most is the millions of homes that were suitable for first time home buyers that The Powers That Be did nothing to ensure first time home buyers could have a chance at purchasing these foreclosures. I think it is called ‘viral capitalism’.

I tell my 30+ years appraiser friend that he should scratch out “estimate of market value” and put “Bernank Value” on his appraisal estimates.

Everything about this market is Bernank’d. I see people all over the net exclaiming how low rates make it a great time to buy. Wrong. Low rates (especially artificially low rates) portend a drop in prices when market rates return as a simple function of debt ratio qualification. If wages aren’t increasing and rates go up then prices go down as a direct consequence of full income doc underwriting. This isn’t rocket surgery. It’s math.

Increasing rates of return will also send the investors who have raided the single family real estate market back to their normal lairs of CDs and T-Bonds removing 30+ percent of the demand side from the market while simultaneously opening the exit doors.

Case in point, I have a bank repo on my street (L.A. County). It was put up for sale a couple months ago and the feeding frenzy of lookers invaded one weekend. The place went pending immediately and I waited to see what happened. It listed for $450k and sold all cash for $440k. The comps were in the $370-$380k range. Purchased by Chinese buyers. Since closing they’ve put up signs all over the tract for 5 weekends in a row “House for Rent” asking $2,050 per mo. Taxes alone are $450 per mo. and it’s still available for rent. How the heck does this make any sense for an investor? Plus, the owner doesn’t seem to know what he’s doing. He has a sprinkler system yet he let the front grass completely die – WTH? So best case scenario he get’s $1,500 per mo. after property taxes, maybe nets $1,200 after insurance, management, replacement reserves etc. That’s $14k per year return on $440k invested. That’s 3.1% return with an 8% cost of sale to exit and total exposure to another downside collapse. Completely nuts.

I smell a top.

You forgot that as a rental, you’ll have to pay taxes on your income!

no fewer than 4 properties on my street exact same scenario. Cash foregin buyers seeking returns on their US dollars…..low returns yes, but higher thanthe bank pays!!!!

Very anecdotal, but talking to a Taiwanese friend, foreign all-cash buyers are looking to park their dollars in a “safe” asset. Basically it’s a warranted/non-warranted fear that the Chinese gov’t will take all their money. I don’t know if they are concerned so much with an investment return than a safe place to hide money. So it may be a choice between looking to lose all their money or some of their money. I don’t know where this house you speak of is, but it doesn’t sound like a prime area. Which surprises me because most of what I hear of foreign buyers are sticking to areas with good schools such as Irvine.

The Chinese Gov’t can, and most likely will eventually take their money. So, if they buy a property in the States, specifically CA where many other Chinese already do, then they can earn a little $$$ on the “safe investment” which is way better than having absolutely $0 in the end.

This is the main reason why we keep seeing more and more lucrative “birthing hotels” for Asian women. Plus, the American born child can eventually sponsor their wealthy parents to come to the States when they turn 21, which is exactly why this is a so-called “safe investment”. They can easily rent out the property until their “American” child turns 18, then add them to the “Title”, then attend a US college, where the entire extended family can stay with them for a very lengthy visit too!

Also, Irvine has UCI which happens to be one of the best public colleges in the U.S. As well as, all of Irvine’s public high schools made it on “The Top 1000 High Schools in the U.S.A. List”, and their elementary & middle schools are all high-performing “Distinguished CA Schools”, or “CA Blue Ribbon Schools” as well. So, the high concentration of Asians (i.e. mostly Chinese or Korean) in Irvine is inevitable b/c of the Irvine School District reputation, prevalent Feng Shui designed new homes (& hospital as well!), much higher paying tech jobs, and the City’s extremely low-crime rate. All of those factors solidify their “safe investment” which now can easily be sold to another wealthy Asian “investor”, or an established American-Asian move-up buyer from the OC whenever they feel like it.

How is buying into a housing bubble a “safe” asset??? Asians have historically been very herd minded when it comes to investing. I’m renting a house in the San Gabriel Valley area of Socal for 2K a month. The guy bought if for 600K in 2006 with 50% down. Even after refi’ng he’s clearing a few hundred from me at best per month. The place needs work and I doubt he could sell it for more than 400K and that would take a good appraisal and an over eager retail buyer. I’m sure he’s feeling great about the return on his 300K “investment”. But those smart Chinese are going to take us over soon 😉

Ask the Japanese, I think they are considered Asian as well, what happened to their “safe” investments in California and Hawaii during their bubble. Look up what the Pebble Beach golf deal to see how it worked out. At one the imperial grounds in Tokyo were worth more than the entire state of California. How is that working out now?

Central Bank bubbles always end up in a collapse because that is what the wealthy elite want to happen. Do you think people sitting a tons of cash want hyperinflation? No, they want a deflationary spirals, and they will get them again but even more severe than 2008. There is an oversupply of everything except the two most important things you need, energy and food. Labor, forget it. The new immigration bill will allow thousands of more tech people in the US. Do you think there is a shortage of tech people in the US, of course not. But there is a shortage of tech people willing to work for 50 grand a year. Wake up Muppets.

I know a 440k or so sales price area in the SGV. The rents in the area for a 3br are around 1300 to 2000, depending on the specific house size. This is in a pretty good area with access to a school that gets 7 to 9 on “greatschools.” 1700+ gets you into another nearby district where the schools feed into a high school that gets a 9 or 10 (I forget, but it’s high). So… yeah I don’t see being a landlord as a good business there.

But damn, if you know how to live in a ‘hood or barrio area in the SGV, you can get access to academically oriented schools by renting a house or condo for 2000 or less per month. Hell, if you’re moderate income, you can get into Alhambra for $1300 a month or less.

I guess it depends on who you are, and what your goals are.

I heard from a friend in China that within the next year, the government there will be cracking down on corruption on gov’t officials and money laundering. So there is a mass influx of Chinese money into the U.S. They’re not primarily concerned about returns in their investment but more so the security of their dollars.

The ugly house was listed for over 100k, and I guess they got it for a bit less. I live near this house, and don’t think this neighborhood is worth 300k. Rents for houses like this range from 1200 to 1500, but you could always accept section 8 to make up the difference or allow two families to rent. The median household income in this zip is around 30k. 75% of the residents are renters. Per capita rent is quite low due to overcrowding.

I don’t think there’s open drug selling in the area (not enough drive-by traffic) but there’s a lot of cops driving by due to whatever. Probably gang activity, fugitives, etc. Also, drug selling is usually not done in the alleys in LA – it’s done in the street in a parked car, or by a person coming out to drop drugs as they “talk” to you, or in homes.

I think the reason for this speculation inflation are related to the alleged gentrification of Boyle Heights. You hear the name of BH on public radio a lot, due in large part to KPCC. Years ago, they would just call the area “East LA,” but nowadays you hear “Boyle Heights” on both public radio stations. It’s also become some kind of academic focus for Jewish and Asian American academics rhapsodizing over the BH of the 30s or so. Also, there’s something going on at the city level to push for the idea of expanding downtown gentrification into the BH flats and also around Mariachi Plaza on 1st. I’m not sure why, but a lot of “things” are happening around that zone. There’s also the proposed Wyvernwood project south of the 5 freeway. Look it up.

The gentrification thing started with the tear-down of the Aliso Pico village projects in the 90s, and has been pushed by the city with charter schools. It started under Villaraigosa and has continued to be pushed by Huizar. Not sure what Cedillo will do.

I just sold my house in OC. A year ago, I could’ve got around $400,000. Now I got $567,000. What baffles me is how the new owners are going to pay for it. They are both teachers, got an FHA loan because they didn’t have a large down payment, so they got a jumbo loan & a higher interest rate. The house still needs plenty of work, there’s property taxes & HOA & insurance plus PMI because of the low down payment. To me, it’s an endless money pit. I’m so glad I got out with some cash. That house in Boyle Heights is WAY over priced, but some fool will buy it thinking real estate can only go up.

Same here – If we’d sold our Tustin townhouse in early 2012, we’d probably have sold in the low-$400s. We’ll be listing in a couple weeks and asking $550k, which is a reasonable price compared to the comps. Therefore we expect/hope for multiple quick offers. It’s insane. All of the detached homes in our neighborhood are selling at or above their peak 2007 prices. The condos and townhouses are still lagging peak pricing a bit, but they’re also rising rapidly.

Two teachers? Only one of two things will happen to teachers in California, their salary will drop or they will be laid off, period.

1) u make it sound like the $221 spread is pure profit u always go into great amount of analysis of the true cost of housing but when it comes to making “flippers” /real estate investors look bad u simply discuss buy cost vs sales price as if the greedy con artist is pocketing entire differinterest eatingy there are buying holding sales cost +construction architect permit fees waiting tjat goes into these projects

2) what does this example have to do with inflation If a remodeled 2br/1ba goes for $315k in boyle heights you somehow imply that evil greedy flippers r pushing the market higher when obviously the givt intervention has more to do with recent price gains than anyhing else

3) the cynicism from the comments on this blog is almost too much…

3) this blog was intetest

Hard to read your gibberish. What is intetest? But seriously why not just come out and admit that you own the house? I’m not in the business but I can’t imagine that working on the foundation and frame you can’t rebuild and add a room for 100K easy. Especially with all the low wage labor in that hood. Great profit if you get it.

Seriously. 100k feels right – you can get a lot done if you don’t tear down and don’t need a bunch of new permits. If you strip the walls, reinforce and repair, replace pipes and wires, and then cover it up, it can be kind of cheap. My old landlord redid a casita around half this house’s size (that is, the original house’s size) for under 20k. It’s not as nice, but it’s still solid, and the transformation was on the same level.

Dear ‘annoyed’,

Let me explain where the cynicism is coming from on this blog. An entire generation of Angelenos has been denied the opportunity to buy a home, even in the worst neighborhoods of the city. It doesn’t make us happy. To see the low/moderately priced properties going to people with money in order for them to make money … however much or little … it’s like adding insult to injury. That’s why there’s a lot of hate for the ‘flippers’ here.

But they don’t want owner occupants. Most of these loans had a government hand on them (Fannie Mae, Freddie Mac, etc). The government can impose a 30 day rule on most of these sales to allow bidding by only owner occupants in the first 30 days. The game is called keep away. Don’t participate to keep from getting hurt.

Hot money has left the building. Nothing but dumb money left holding the bag. Real estate is all about perception and that perception is now changing. Once the hedge funds, Wall Street and private equity groups get a sniff of the top (which they already have) , that giant sucking sound you here will be another massive real estate decline.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdown.blogspot.com

Interest rates on 30 year mortgages went from 3.25% at the beginning of May to 4% today. Nothing pops a bubble faster than rapidly rising interest rates.

…and Zero Hedge just posted an article which more or less confirms that interest rate going from 3.25% to 4% in a month has essentially done a great deal of harm to the REIT market. Profit margins must be super thin in the REO-to-rental arena.

http://www.zerohedge.com/news/2013-06-04/housing-bubble-pop-alert-colony-pulls-ipo-market-conditions-blue-mountain-rushes-cas

There’s a sucker born every minute! And to buy without looking at the background is a fools errand.

I posted this in the last topic, but it seems to have disappeared. Trying it again…

Finally someone gets it. Peter Schiff’s doomsday scenario seems to be spot on with most of the other posters on this website:

http://blogs.marketwatch.com/election/2013/05/30/peter-schiff-doubles-down-on-doomsday-views/

Stopped clocks are sometimes right but Peter Shiff was the guy who during the last bubble predicted a crash (so far, so good) and told everyone to invest ttheir money in Europe to avoid the crash that would be a crash of the U.S. dollar. In Europe …

Shifff may have his profiteering gig but as a financial forecaster he should be ENTIRELY discredited by now.

“since rentals are unlikely to cash flow in many prime areas of Los Angeles and Orange County.” Why would this be true? What kind of monthly rent would this lovely example generate?

Read the article and search craigslist for “boyle heights”. Around 1200 to 1500 for a 2br or 3br.

Doc, I wouldn’t be so quick to judge this as a flip with big profit in it. As a guy who has flipped many properties over the last 11 years I can tell you that this buyer likely and easily could have 150K or more in improvements to property. If you factor in transactional costs when selling, not a lot left in profit. I’m a fan of your analysis but perhaps a different example would have more clearly illustrated your point.

With all due respect, please DIAF.

Thanks

Ok add 50,000 to the cost in my above example then just how much will the transaction fees take out of the remaining 71,000? I think there is a good deal of profit to be had in this one deal. If it’s the only one he does in the year it’s a decent living. If he can do a handful he’s pushing up on the 3%.

Realistically real estate is about location location location and then property. This property is no where near worth throwing that kind of money to own. Buyer can probably find a similar blue collar job in Corona and live a short easier commute in triple the quality of home and neighborhood.

Honestly, this example isn’t the worst of it.. at least they took it down to the studs and managed to add to the sq footage. I think we’ve all run across sub 200k homes that received paint, flooring and the usual cheap granite/faux stainless steel BS only to be turned back onto the market two months later.. for 200k more.

I’m with QE though, the saddest part of this whole ordeal is that first-time buyers have been locked out–or taken for all their worth– in this process.

CaliChris

June 3, 2013 at 2:23 pm

Having moved back to Orange County CA from South West Florida (Sarasota, just north of Naples) I want to call bullsh!t on your false equivalency. Southwest Florida has terrible weather (hot n humid with hurricanes), high unemployment, low wages, high crime and their state government is a disaster.

One out of five – CA has better weather. But Boyle Heights is exactly everything else you describe plus…. Se Habla Espanol? Like the sound of helicoptors? At one in the morning when your trying to sleep? Is graffiti your idea of art? How about being jammed between industrial funk and several freeways? Yaaaa Let’s plunk down three large for a cramped dump in Boyle, it’ll be great…..

Don’t knock Boyle Heights, or E/NE LA in general. I don’t live in those areas but the latimes crime maps ranks those areas safer than a lot of places. You’d be surprised.

http://projects.latimes.com/mapping-la/neighborhoods/violent-crime/neighborhood/list/

http://projects.latimes.com/mapping-la/neighborhoods/property-crime/neighborhood/list/

Anyways I have noticed many flips in Faircrest Heights, PicFair and down to Mid-City. The first two areas are now 650k+ areas, mostly at 750k for anything bigger than a 2×1. I have been priced out of Mid-city in terms of flipped/turnkey houses. I looked at Baldwin Hills/Vista but lost out on a 450k list- good sized house but had outdated kitchen and bathrooms. A perfectly equal comp that closed 2 months out at 470k so I offered 473k. That house just closed this week at 525k…nuts I tell you… I’ve moved over to Leimert Park, but holy-hell crime is bad. I like it’s proximity to central LA and the Expo line. It’s also picking up flipper activity.

http://www.redfin.com/CA/Los-Angeles/4001-Cherrywood-Ave-90008/home/6881041

http://www.redfin.com/CA/Los-Angeles/3961-Dublin-Ave-90008/home/6881745

I don’t think comps are going to support these asking prices. But they look nice. I’m feeling pretty defeated these days.

@ forever_sidelined I think that house you refer to was the one I purchased that closed for $470K. It was listed for $475 and offers (including my own) ran it up to $505K but I ended up securing the property in escrow (my offer was not highest) but through appraisal and repairs the final price was $470K. I dont want to name the address but it was near the intersection of Clyde Av and Bowesfield St in Baldwin Vista. I have kept a close eye on the neighborhood and most of the recent new owners in the area of Baldwin Hills and Baldwin Vista tend to indicate a younger, more professional influx of homeowners.

Ha, you just described a large part of SoCal. Yet for some reason they still come….

Ha ha, I agree. However, you have to factor in that some of those negatives also exist for the Arts District across the LA River, where condos go for 300k to 600k. They also apply to areas like Koreatown or Hollywood. Want to inhale airborne lead? You can do it in Boyle Heights, or you can do it for 200k more over in the Arts District.

I have to say, though, having grown up in the SGV, and lived in other areas, the climate in central LA is so much nicer. There are only around 20 yucky days a year. Even the hot days aren’t that unpleasant compared. 85F hot? 40F cold? LOLZ.

El centro and the environs has also always had a lot more arts and culture than the suburbs, too.

It is still better than FL, where you can get your face eaten!

The original picture screams crack house all the way. They should have kept the tire “art” as is.

As was said above, Bernanke has his greasy finger prints all over this one. I remember in the late 1990s (just 15 short years ago) one could buy a nice house in some really nice areas in Socal. I lived in Turtle Rock (probably the nicest part of Irvine) and 3/2 ranchers could be had all day long for the low to mid 300s. For anybody who remembers the late 90s in OC or LA, those were truly some good times…houses were affordable, jobs were plentiful, the stock market was roaring and nobody seemed to have a care in the world.

Here’s the thing about Boyle Heights that some of you are missing, it’s the last affordable area adjacent to DTLA. I’ll use myself as an example as I purchased a home here 4 years ago. I make about $80k and my typical peers make about 50-90k on average. We work and play in DTLA. I used to rent a loft for $1600/mo in downtown and it was great but eventually I realized I needed a house, a garage and a yard for my dog. I’m single and for a single income I couldn’t afford echo park, silver lake, Angelina heights or highland park, and south LA, west lake were too crazy (worse crime/gang/drugs than boyle hieghts). boyle heights being directly across the bridge allowed me to own a home 3 miles away and still be able to work and play in DTLA with out having more than a 5 minute commute. Now my mortgage is less than my rent. Homes in this area are the last remaining affordable homes for the DTLA workers making 50-90k. Sure someone making $80-90k can afford a bit more house but bang for your buck buying a home like the one featured above is a great deal because its turn key and the price is reasonable. The arts district and every other area in DTLA are 300-400k+ and with HOA’s and paying for parking owning is really for someone making over $100k. With new developments in the arts district going for over $400k, my buddies who used to live there are coming to BH because its just across the bridge, they’d being priced out of DTLA. like I said I moved here 4 years ago and everyone asked why’d you do that? now all I hear from DTLA residents is that boyle heights is going to be the next echo park, and I know multiple people searching for affordable homes in the area right now. I’ve seen lots of college educated, non-Hispanics moving in, this is just something you didn’t see 10 years ago.

The price isn’t reasonable. Maybe if one is so desperate to “buy” that they don’t mind putting leverage on the line in a shitty neighborhood, they could talk themselves into it. Granted, it’s one of the least shittiest options out of the shitty LA neighborhoods.

We all know the gentrification story that has unfolded over the years in many cities across the country. The real issue is for those early adopters, just how much is one willing to put up with to live in a shitty neighborhood waiting for it to get better.

There are plenty of canned justifications people stock up on for settling on a shitty neighborhood. What’s hilarious in this case is that one of those talking points is about how it’s adjacent to another shitty area known as DTLA.

You obviously haven’t been downtown lately…

I was downtown just the other weekend. I’m well aware of what it is like down there. There’s going to need to be a lot more than some trendy drinking spots, hipster hangouts, and fad restaurants to make it a nice place to live and visit. Unless vagrants and blight is to be considered a nice attribute for a living space.

Also look at 680 Euclid ave. 90023. this BH property was purchased for $148k in 2/12, I watched them gut it and remodel it extensively and in 10/12 it sold for $282.5k. These types of flips have been going on and they are selling. The around $300k price point seems to be about the average price for a flip of this type.

Other example of this type of flip and around $300 selling price.

3423 Garnet St. Bought for$150k sold $285 3/13

3434 opal st bought for$175 sold on$305k 3/13

3417 garnet st bought for $184.8k sold $310 on 4/13

Interesting article on Wall Street, Blackstone and wholesale purchases of houses

http://dealbook.nytimes.com/2013/06/03/behind-the-rise-in-house-prices-wall-street-buyers/?smid=tw-share

Boyle Heights/similar neighborhood prices are rising because Hipsters that aren’t “LA Bohemian Bourgeois”, don’t have high paying jobs or wealthy parents, etc, are being priced out of Silver Lake, Los Feliz, etc. Perhaps soon the front door of this creampuff will be adorned with an artsy wreath fashioned out of empty Pabst Blue Ribbon cans.

I’ll always have a soft spot for Boyle Heights, as my brother’s beloved black cat once called those streets his home; he’s one hell of a colorful personality (cat, not brother).

I’ve been following this house for several years as a Redfin “favorite.” It sold in July 2012 for $985k after being for sale for the better part of 6 years, with a listing price not much higher. It was a nice updated house, and it doesn’t look like anything has been done to it since the sale. The listing doesn’t claim any remodel, either. But now it’s for sale for $1,749,000! Even Zillow thinks it’s worth $1,991,543! What do you think this bubbler is worth? http://www.redfin.com/CA/Dana-Point/35122-Camino-Capistrano-92624/home/5001284?utm_campaign=listings_update&utm_content=address&utm_medium=email&utm_source=myredfin#property-history

Colony had to pull its IPO yesterday because investors don’t believe they can deliver the spreads promised in the buy to rent game. Uh oh spaghettio.

http://www.zerohedge.com/news/2013-06-04/housing-bubble-pop-alert-colony-pulls-ipo-market-conditions-blue-mountain-rushes-cas

Gee.. with home prices at their peak, and in the middle of a summer sales season, I wonder what a company would do to end up in the black before their IPO?

“American Homes 4 Rent” has been transferring their titles to that exact name; if you haven’t already set up a Google Alert for it I highly suggest you do. They haven’t purchased anything in at least a month, and I suspect we’ll see a few sales in the next couple of weeks.

It’s going to be ugly by Nov-Dec, maybe sooner.

Ut-oh, is this the first crack in the REIT IPO foundation?

http://blogs.wsj.com/moneybeat/2013/06/04/colony-single-family-reit-ipo-his-speedbump/

On a more local note, how about this amazing June gloom weather? Looking forward to the fire smoke and Santa Ana wind cocktail later this summer. Being able to see the mountains or breathe clean air is overrated anyway. Too bad for those morons that live in the other 99% of the world that aren’t here living the dream. Better lever up to a ghetto shack before getting priced out of heaven forever!

That is an awful area. I used to work there. We called Hollenbeck “Hellandback.”

300K for a small house in that area? California is TOTALLY NUTS.

Just had to laugh outloud at the fool crapping on Florida’s schools, when Los Angeles schools are some of the WORST in the entire nation. The LA schools are 70% latino, and the dropout rate is over 50% because they can’t pass algebra. They have lockdowns and fights and violence fairly regularly. I seriously doubt that Florida could be anywhere near as bad, and in fact, my guess is that the Florida schools probably have much better discipline and control. Los Angeles schools are filled with thugs who have to wear trackers on their ankles. California is now mexifornia and it’s a dead zone. The CA. deficit is out of control, illegals are welcomed and given the entire welfare colonist treatment to free everything at the taxpayers expense. Only problem is, there are too few taxpayers to sustain the system.

Seems you or KR don’t know much about schools, especially California schools. My buddy lives near Boca Raton, which is one of, if not the nicest, towns in all of Florida. He was telling me he has to send his kid to private schools because the public schools suck in Florida. Compare that to the entire South Bay, La Canada/Flintridge, Calabasas, Saratoga, etc.

Six of the top 50 universities in the country are UC schools, not including Stanford, Cal Tech, or USC. Including them, it is 9 of the top 50. Florida has the Univ of Miami.

http://colleges.usnews.rankingsandreviews.com/best-colleges/rankings/national-universities/spp+50

Sure, lots of LAUSD schools blow. So do Miami-Dade schools.

You need to compare apples to apples. Florida’s public schools are atrocious compared to California’s.

Pending as of this morning.. I guess someone decided it was worth what they were asking!

What would be interesting to know is if the purchaser decided it was worth levering cheap bank credit with 3.5% out of pocket on a government (public) guarantee, or if it was worth more of their own money and less cheap leverage on only the bank’s risk.

A lot of casino gamblers probably think their bets are worth what the house demands. That doesn’t automatically mean that the bet makes sense.

I definitely think they justified the increase in value. When you take apart a property to the studs, it’s usually up to $50-70/sqft (approximately $50-60k) worth of renovation to rebuild. Ontop of it, you can easily count on at least $100/sqft (approximately $50k) in cost to add a permitted structure. Taking into account the time it took to do the project, and the risk of taking on such a long term project, they definitely deserve the price increase. They saw a diamond in the rough.

Leave a Reply to Joe