Lessons from a housing bubble city, Thousand Oaks California. 74 percent owner occupied housing units with a median home price of $615,000. Median household income of $100,000 cannot support current prices. Million dollar foreclosure going for $712,000.

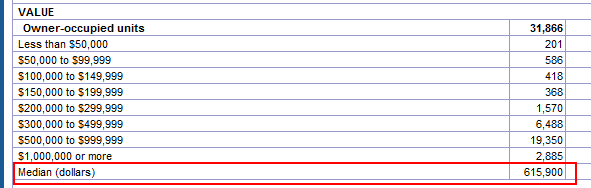

Part of the challenge in getting a bigger picture with certain cities is the mix between renter and owner occupied housing. California has a large renting population and it is only growing due to the current state economy and issues embedded in the housing market. Pasadena for example has a majority of its residents classified as renters. Yet one bubble city in Ventura County gives us a good place to dig deep into the data because 74 percent of households are owner occupied. In other words, we have a good data set for examining the housing bubble in real time here with owner occupied units. This is a city where the housing bubble is still going strong. In the detailed Census data going out to the end of 2009, the median home price was listed at $615,000 while the median household income was $100,000. We have a good amount of data here so let us dig deep into it.

Thousand Oaks

Source:Â Census

This is good information because this focuses on owner occupied housing units. Data going through the end of 2009 shows a median home price of $615,000. Of course, given the median household income of $100,000 we know that this is an inflated price. We already see that current homeowners are stretching their wallets to pay their mortgage:

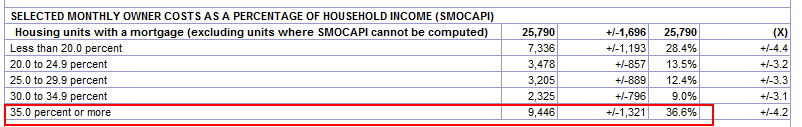

Over 36 percent of owner occupied households allocate more than 35 percent of their household income to paying their mortgage. This is a large number. It is too bad that the Census doesn’t add categories for 45, 55, and 65 percent to give us a better sense of housing costs. Then again, these Census categories were built at a time where 35 percent and higher was a small fraction of the market. As you can see for Thousand Oaks, it is the biggest category. And it isn’t like people are paying $5,000 a month either:

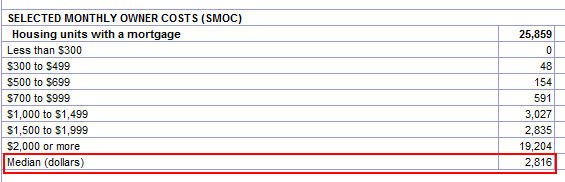

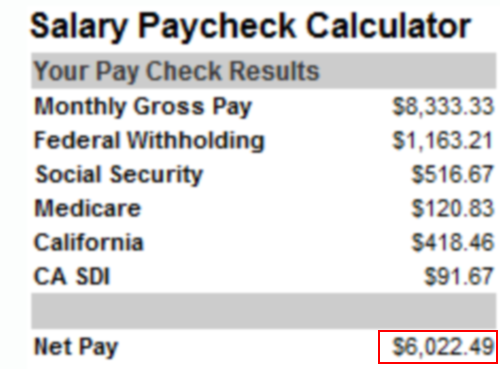

The median monthly home payment is $2,816. So of course this is going to eat up a large portion of income. Let us run the numbers for a married household making the median $100,000 in Thousand Oaks:

Even with the median home payment, 46 percent of net pay is going to paying for owning a home. This is a large amount of income. According to Census data we can compare the growth in household income versus home prices:

Thousand Oaks – 1999

Household income:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $76,815Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â (1999 data)

Median home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $324,800Â Â Â Â Â Â Â Â Â Â Â Â Â (2000 data)

Thousand Oaks – 2009

Household income:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $100,933Â Â Â Â Â Â Â Â Â Â Â Â Â (increase of 31 percent)

Median home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $615,900Â Â Â Â Â Â Â Â Â Â Â Â Â (increase of 89 percent)

Here is the clear picture of the housing bubble. Inflation over the decade for the state was roughly 33 percent so the increase in wages for Thousand Oaks kept pace with the overall cost of living. Yet home prices went up by 89 percent. If we use 2000 as a base measure home prices in Thousand Oaks should be around $425,000 (a drop of 30 percent from current values). You can see that in many areas of California, a large number of cities are still clearly in housing bubbles.

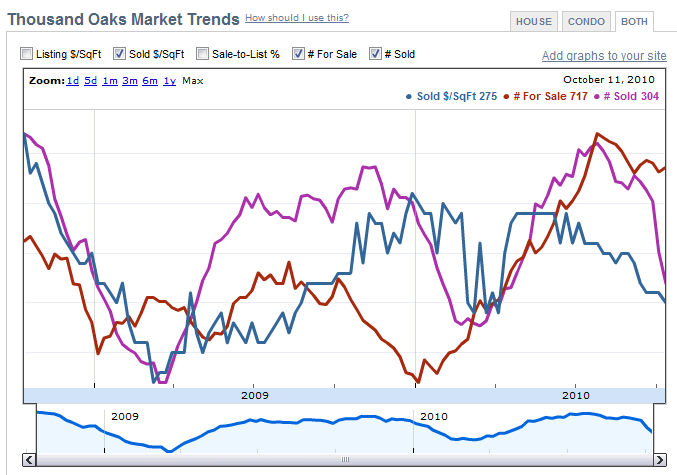

Thousand Oaks provides us a unique data set because of the large number of owner occupied units. We have a better sense of the dynamics taking place in a bubble city. Let us see how the current market is doing:

Source:Â Redfin

This is an interesting chart. What we see is the number of homes available for sale is staying high and the number of homes sold quickly declining (keep in mind this is occurring during the typically good summer months). The price per square foot is also moderating out. The more important items are the number of homes listed for sale and the number actually sold. More importantly is the number of homes on the MLS versus shadow inventory:

MLS listed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 307

MLS + shadow inventory:Â Â Â Â Â Â Â Â Â Â Â Â 829

In other words, you have a lot of people in Thousand Oaks unable to pay their mortgage. The reasons for this are clear given that many people are facing stagnant wages and have high levels of debt service merely to keep up their housing payment. You want to see an example? I’ll give you a million dollar foreclosure:

2792 HILARY COURT, Thousand Oaks, CA 91362

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 4

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1987

Square feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2,981

List date:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 09/09/10

Let us first look at the sales history:

02/09/1995:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $377,000

02/20/2007:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,000,000

The home is currently listed for sale at $712,405 in the more expensive zip code in Thousand Oaks. You think a paperwork mix up is going to save a place like this? Shadow inventory is enormous in Thousand Oaks and incomes simply do not justify current prices. The correction is already hitting and big price cuts are already common in prime locations.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

58 Responses to “Lessons from a housing bubble city, Thousand Oaks California. 74 percent owner occupied housing units with a median home price of $615,000. Median household income of $100,000 cannot support current prices. Million dollar foreclosure going for $712,000.”

Is there consensus that in 2010 or 2011 the median income should decrease? It did in 2009.

Nationally, the median income of $50,221 is down about 4 percent from its peak since the recession began in December of 2007. That year, median household income was $52,384. Last year alone was responsible for about $1,500 of that loss.

http://www.washingtonpost.com/wp-dyn/content/article/2010/09/28/AR2010092800465.html?hpid%3Dtopnews

Thousand Oaks = Road Runner, having run off the cliff, suspended there in mid-air, dare not looking down, as to expose the fact that he’s about to take a giant fall.

Actually, I mean Wiley Coyote. The road runner always makes out fine…

Good to see I am not the only one who watches cartoons…

and his rocket pack and roller skate contraption, which just sputtered out, suddenly explodes and he pauses in mid-air ….

Calif. has a very high percentage of govt. workers( teachers, landscapers, janitors, road workers, etc.) Unless people are willing to pay more in taxes, some of these people will be losing their jobs in the next 3 to 4 years.

This does not bode well for the economy or housing sales. We need to raise income taxes, and property taxes, NOW, in order to avoid layoffs of essential personell.

Well, come on. Do you believe that all state workers are essential?

Or do you believe that they’ll never lay off the ones who aren’t essential?

Raising income taxes in a recession is a prescription for making things much much worse. It’s what Roosevelt did in 1937 and a recovering U.S. economy went completely into the toilet to the extent that unemployment was nearly as bad as it had been in 1932.

How do California public employee payrolls look compared to how they did in, say, 2000? I suspect the situation was quite far from anarchy back then. Why couldn’t the public sector take a bit of the same hit as the private sector has. To be quite frank, a lot of state workers don’t add productive value to the economy. They simply divvy up spoils taken from the private sector. This is not to imply that every worker in the private sector adds value, but across the nation when advances in computers allowed for greater efficiency in office work, a lot of private industries saw significant paring of jobs. Virtually no state governments let people go when computers allowed 2 office workers to do what had previously taken, say, 3.

And, finally, I’ll try and dig up a link to a story in a magazine called the Washington Monthly. It is/was put out by a guy named Charles Peters who’s a very serious, conscientious sort of liberal willing to admit unpleasant truths about the working of government. The Washington Monthly had an article in which it asked federal workers how many of their co-workers could be let go without imparing the functioning of their office or agency. The consensus of responses, from federal gov’t workers was . . . 33%. This was a statement against interest. Mere partisan hacks would never print an article saying something like that. But Charles Peters is a serious, sober guy whose follow up to this shocking stat was that payrolls should be pared and the money saved devoted to new programs that Peters favored.

It might be the case that California state gov’t is organized along much more thrifty lines than the federal gov’t. Make that case if you wish.

If ya believe everything you read….. this could well be robbing Paul to pay Peter.

Absolutely brother. Already an 10.3% top rate in Cali! Need to cut taxes, like cap gains, not raise them.

And yeah, I taught for a decade PT at the JC level. Walk across a JC campus and 1 of like 20 employees is a professor. WTF? One guy to change the toilet paper, another to change a light bulb, still another to adjust the AC (they actually have a guy for that), like 7 people in the office that sells partaking permits, 2 of them standing around doing nothing. It’s unbelievable. And no matter how bad the employees are, it is *impossible* to fire them. Union protected.

Raise taxes and you’ll flush yet more rich people out of state like New Jersey learned.

Want to help the middle class in Cali? Let the foreclosures begin en masse! Price drop and maybe a teacher could buy a house.

What is essential personnel? Most of the budget goes to transfer payments. We pay a much larger percentage for Medi-Cal than what the federal law requires. This is an example of the spendthrift habits of California’s various governmental entities. We currently give free meals to the school children. Isn’t this the responsiblity of the parents? This are just examples of where we can cut the budget of the beast, an ever increasing monster. If the poor folk don’t like living in the new downsized governments, they are more than welcomed to leave the state.

I’m very skeptical of the notion that any state’s budget does not include a significant portion of money being given to citizens who are fairly well off, which money could be minimized before one truly poor person would have to be affected by a reduced or frozen state budget.

We need to raise income taxes, and property taxes, NOW, in order to avoid layoffs of essential personell.

10% sales tax and high income taxes in this state and you want to RAISE taxes. It’s goin’ the other way, fella.

Example: drugstore.com; purchase all household items online, find sale items for things you need; free shipping; NO CA SALES TAX

Not saying that I do this, but some others might.

More like another Prop 13 tax revolt! Just wait until the Baby Boomers see how Cali taxes their cap gains after a dead decade in the stock market. They’ll be pissed.

Time for public employees to take it on the chin!

Not agreeing with you, Ricky. My brother-in-law works as a mechanic for one of the transportation authority in Southern Ca. In his own admission, he spends his 1 hr in the morning working out, then he does some routine maintenance, spends another 2 – 3 hours reading books and playing games, have lunch, does his walk through, nap, then goes home. Plus he works overtime during the weekends sometimes. He loves his job (who could blame him) and will get pension in about another 8 years or so. So please don’t tell me we need to raise taxes so more of this waste can continue.

So

Statements like this makes me lean towards moving my small business outside of California.

Ricky, Ricky, Ricky…come now. “Essential personnel”?!? The public sector is so bloated with dead weight, we could easily cut the bottom half of workers and be fine. Hell 90% of them are useful only for leeching off society and providing no value or a net drain/negative value/return.

Ricky was funny with pulling out the ole “fear factor” card of laying off essential personnel.

I have watched with quite bemusement as almost every level of governement has played this card during the depression.

Wont raise taxes? Fine , we’ll lay off copys and you’re wife will probably be raped now.

Won’t raise taxes? Fine, we’ll lay off fireman and your house will burn down becasue it will lengthen the response time to put out a pile of burning 2×4’s from 6 minutes to 8 minutes.

Won’t raise taxes? Fine, we’ll lay off teachers and make your kid stand in class, sicne there wil lbe 50 kids in there now and not enough desks..

I would love to see them actually follow through with it for once.

Since, miraculously, it never seems to come to pass.

I know Team Obama continues to play this card, and shovel their shovel ready stimulus money to the states to repair their budget potholes, but I hope one day this charade will end and we’ll see if any of these fear mongerers have the guts to actually try some of these stunts.

Ricky, we could privatize virtualy every state worker here in California and the tax payers would save tons of money. No more unions, no more egrigious pensions or benefits. Trust me…there are plenty of people who would do the work of a typical government worker for less pay or benefits.

Yep, we could just take a leaf out of China’s book and make our workers work 12 hours days for 45 cents an hour.

No more unions, no more child labour laws, no more healthcare – they cut into the megacorps almighty profit margin and we can’t be blocking the bottom line, can we?

Seriously, your parents and grandparents fought hard to give you a better life than they had. So go right ahead and voluntarily put yourself back into Victorian Era servitude, because you can’t bring yourself to pay a fraction of a percent more in taxes to keep your society going.

I’d love to see you all when basic services actually do break down – or we end up like that guy in TN watching his house burn down because he forgot to pay a $75 ‘subscription’ – you’ll all be wailing like banshees about how your ‘freedoms’ are being impinged.

Seriously. Can we have a break from the idiotic Teaparty dogma here and talk about housing?

Seriously speedingpullet. I agree that people should earn a decent wage for a decent day’s work. However, things have gotten so off kilter that many of the public sector workers are getting WAY OVERCOMPENSATED for what they do. And if you don’t think this will be a problem in the future regarding pension, benefits and the ever growing government worker union population…you better take your rose colored glasses off. If you think this is tea extemism you have another thing coming.

However, things have gotten so off kilter that many of the public sector workers are getting WAY OVERCOMPENSATED for what they do.

And of course, you’re judge and jury on this one aren’t you?

You start off protesting that everyone deserves to work under humane labour laws, then go off on one about people who do work under humane labour laws…..

Why aren’t you as incensed by the CEO’s raking in millions a year for contributing less to your well-being?

Your taxes are on the hook for their pensions and healthcare too, but the target’s not quite as soft as the much-envied Unions, is it?

Again, I have to ask, how much of your society are you willing to dismantle in order to pay a few dollars less tax a year?

Regarding WAY OVERCOMPENSATED, anybody with an IQ greater than 50 will agree that people who make more in retirement than they did while working is just plain flat out wrong. That’s pretty common with safety workers with their 3@50 retirement plan, factor in cost of living increases and free healthcare and it’s not even an argument anymore.

Regarding CEO pensions, these PRIVATE entities whose compensation packages are agreed upon by board of directors and shareholders. How the hell is my tax money paying for CEO pensions? You’ll have to explain that one to me.

Us taxpayers just love how Calpers inflated current pensions and gave retroactive pension increases starting back in 1999. The premise of paying these pensions pigs out was expecting a 7.75% return FOREVER…how’s that working out? And somehow Calpers forgot to mention that it will be highly likely that taxpayers will be on the hook to make up any differences. This is a Ponzi scheme if you haven’t figured it out yet.

I argue with you union people all the time. We’re sick and tired of hearing your scare tactics…you won’t have services, rapists will break into your house, your house will burn down, etc, etc. All this is irrelevant anyway, this state is going belly up financially and YOUR unions will be a major contributor. Like I said, you deserve a decent wage for a day’s work, no pension (just 401K) and other decent benefits. Is that so wrong to ask for?

We could put them in big job banks like the UAW, there they can play poker and drink 40’s all day, and get paid…

You’re just jealous, that’s all 😉

Are you insane or a CA public employee?

The state has massively more people than it needs. It went on a hiring spree under Gray Davis operating under the insane belief that the dot.bomb bubble would never burst. A very large portion of those state employees’ jobs simply didn’t exist in 1998. The state was not desperately short of personnel then, so what do we need all these people on the public payroll?

“Million dollar foreclosure going for $712,000”

$300,000 house going for more than double what it’s worth.

This is an off the cuff extrapolation of the 33% inflation increase applied backwards to that million dollar homes value from 1995. That value according DRHB was $377,000.00. Dividing ten years of inflation by half to equal the 5 years from 1995 till 2000 we get 16% (average) bringing the value of the home to $437,320.00. Next we apply the 33% inflation rate to arrive at a value of $581,636.00 in current dollars. A mortgage calculator returns a payment of $2,690.00 including taxes after applying 20% down. That’s roughly 3 times gross income. I would think it is affordable at that if it is in move in condition. Obviously it requires following traditional real estate purchase guidelines not the current FHA 3.5% down. Unfortunately the market is way over the top running this tract home up to a million dollars. $714,000.00 just does not cut mustard for financially prudent buyers. I suspect if the government would “manipulate the market” to bring the cost of this home into this range real estate would correct in half the time it will take on the current course. How do they do that? Remove the inflated California FHA loan value from it’s $729,750 limit. Make these homes sell with trad loans with 20% down. They also only have to reinstate mark to market and require banks to follow the correct accounting principals. The blood bath will only be painful at that point to all the scammers and cheaters. Well, actually a lot of the fools who got sucked in will hurt too but the good news is new jobs may be created to help them recover.

Inflation means nothing to me. I don’t follow any prescribed upward trajectory to come to a “value”. I don’t care that somebody paid $377,000 for it in 1997.

Mind you, this isn’t sour grapes as I really don’t care. I know that there are plenty of people out there that have alot more money than me. That’s fine. Perhaps those people deserve a much nicer place for their money, or perhaps enough money left over to buy a condo at (insert vacation resort here).

Maybe it’s really only worth $200,000.

Excellent post @wydeeyed. If the FHA 3.5% limit was lowered, we’d certainly see that drop.

I’ve noticed that here in San Diego. The housing market has extremely strong demand up to the FHA cap… then it just stops. $900k+ homes sit there for months or years, unless they’re priced really aggressively or truly “one of a kind”.

Ignore E’s ludicrous comments about “inflation meaning nothing” – he obviously doesn’t understand the basics of a debt/inflation-based economy like the US (like it or not, that’s where we live).

E. Maybe it is only worth $200,000.00. I love my idealism too but it seems that ignoring something that is happening right in front of you because you choose to is akin to playing touch football in an NFL game – it ain’t gonna work. I would bet that you take any pay increases that come your way. I think those are a result or action of inflation. Permabear is right. Inflation I believe comes from three things; population growth, supply and demand (see population) and compound interest. That last according to Einstein is the smartest guy in the room who would snatch up that house at 200 G’s at a 2x multiple of local incomes. In fact he may well be doing that with banksters as an institutional investor.

Permabear, I’m in San Diego too, North county. We are currently looking at houses around that $900,000 range trying to fill unique living needs. There do seem to be a goodly number. They sell homes around here in the $800’s. I suppose people go in with down payments to bring them to the FHA loan guidelines. That would support a lack of 20% down money or a lack of willingness to tie that much cash up in this market.

Unfortunately the FHA jumbo conforming max cap of $729,750 for areas such as ours (LA/OC, San Fran, Washington D.C., NY Metro) and the lower cap of $625K for other hot spots like San Diego/SoCal etc. isn’t going anywhere until at least September 30, 2011, since Congress just approved the extension and Obama is all but certain to sign it. So “prime” areas should continue to see that artificial floor in prices around the $700-$800K minimum, as you stated and which I have also noted in the good parts of LA County.

I agree with you though that we should cut them across the country to the $429K cap limit…boy would that speed the inevitable value collapse up in so called “prime” areas.

Dear Dr. Housing Bubble,

Can you please do the same analysis you did for Thousand Oaks for the areas of La Canada and La Crescenta?

Thanks

Not allowed to post pictures in this commentbox, but you can look it up yourself here:

http://www.redfin.com/city/9895/CA/La-Canada-Flintridge

http://www.redfin.com/city/23645/CA/La-Crescenta-Montrose

Dear Dr. Housing Bubble,

Will you please do the same analysis for San Luis Obispo/Shell Beach/Grover Beach/Arroyo Grande/Pismo Beach?

Also, I’m thinking of buying a 1250 square foot, 4 bedroom, 2 bath, house in a moderately safe area of Sacramento for $90K to rent out. I think I could get $1200/month rent. Any thoughts?

Depends on taxes/fees (and your personal income), but overall, if you can consistently rent the place for 1200/month, I think 90K is a good price.

As for the analytics part, you could look up the census for some of the data, but redfin doesn’t cover that part of california. They only cover southern/northern california. SLO/pismo/etc unfortunately cover the small deadzone on redfin’s coverage map.

Redfin doesn’t cover the central coast, unfortunately, but you can check out some stats on zillow: http://www.zillow.com/local-info/CA-Pismo-Beach-home-value/r_26526/

The link will cover pismo beach, and there will be links that point you to the neighboring cities. Good luck!

1,250 sq ft with 4 beds and 2 baths?!? What sort of clownhouse has 4 bedrooms/2 baths and only 1,250 sq ft?!?

Foolio, my old place in Huntington Beach was 4 bedroom and 2 bath at 1500 sq ft. There was a nice large kitchen, attached dining room, great room, 4 decent sized bedrooms and 2 decent bathrooms. Everybody who ever came over to that house loved the layout and commented how efficient it was. Doing the same in 1250 sq ft. might be difficult, but you definitely don’t need 2000+ sq ft for a decent 4 bedroom house.

Hi SloTaiChi,

I am a real estate agent in the Central Coast (SLO, AG, Grover, Pismo, Shell areas and more). If you tell me exactly what info you would like to know, I’d be happy to provide a real estate analysis for you for this area. Feel free to also look at two of my Facebook Pages about the area: “365 Things to Do in Pismo Beach” and “Pismo Heights Neighborhood by Kristen Crabtree.”

Best,

Kristen

The foreclosure crisis is bigger than you know. “Paperwork” is only the tip of the iceberg. Title companies are scared to death of any foreclosure or short sale, which is what’s keeping the housing market barely alive. I wouldn’t touch a foreclosure right now.

Phase 2 of the financial crisis is here.

http://www.westsideremeltdown.blogspot.com

We currently rent a beautiful house in Thousand Oaks. They tried to sell last year for $800,000 or so and couldn’t get anyone to buy it, even after 200 or so people looked at it. The owner will not lower the price, says that it will go back up again, always does. We are looking to buy, but after reading this blog, we are not going to buy until prices come down. Thanks again for this blog.

Also, one thing we have noticed in the neighborhoods in Thousand Oaks, is that they are mostly older generation of folks. Not too many young families can afford 1960 built homes over 800,000.00. So, you don’t see many strollers or neighborhoods with children. I have heard the schools are worried about declining student population.

That typifies what I hate in the local T.O. homeowner mentality. We have money, we can wait the market out, go to hell (or worse, Simi) if you want a bargain. The worst part is, they may be right. There’s so much money in this town that many folks could wait out a decade until nominal prices recover.

Yup, these are the same people who benefited greatly from the stock market bubble, real estate bubble, have had good consistent jobs, pensions, etc. All things the next generation won’t see. Yes, the older generation can wait this mess out if they didn’t do anything stupid regarding equity withdrawal.

HAHAHA…”or worse, Simi”. We’re about to close on a short sale in Simi Valley. I knew it’s not the most desirable place in Ventura County, but I didn’t realize it was the butt of jokes.

That’s kind of what our landlord said to us, that they push out the riff raff, by making the prices stay high, that way they won’t ruin our neighborhoods. Really selfish. We make great $, and could easily afford a home here, but were not going to buy one and make someone else rich, while we get ripped off. Renting is the best in Thousand Oaks, even if it takes years, don’t buy those rip off prices that these older people want to sell these homes for to others. It’s just still in a bubble, and they will not admit it.

Asking for feedback: What if you already own? We bought a 1BR condo in the SF Bay Area in 2004 for $315k. No money down, in fact, 103% financing. We’ve learned a lot since then and worked hard to pay it down to $235k, about what we could sell it for.

We now have an 8 month old and need to move out and rent a place with more space. If we rented out our current home, the rent would cover most of the expenses (interest, taxes, hoa, modest maintenance, etc.) but not the full principal payment of about $500. We’d be a couple hundred short.

Sell? Rent it out? Any thoughts from the gallery?

In previous “pre-internet” housing recessions, prospective out-of-state buyers had to rely upon realtors for the “essentials”. With 67 million boomers coming on line at 2 million, or so, each year, they can do their own searching while comparing Texas’ no state income tax, Florida’s abundance of non-ocean front lakes, Arizona’s fairly new inventory vs. California’s older inventory (from what I seen on this site). Given all of this and more, any California recovery must be virtually dependent on wage-earners and loan qualifying standards. I can’t see any retiree picking California over these other states.

We are renting in Newbury Park. As of late we have noted homes decreasing in value. Still nothing we would purchase. Example: Homes built in the 1960′ for 570,000. Since the end of summer we have noticed a token drop in home prices $10K. DRHB: Do you think the Fall/Winter will see a significant decrease in home prices. Perhaps 20%.

Pickle.

What kind of double speak was that?

“the rent would cover most of the expenses (interest, taxes, hoa, modest maintenance, etc.) but not the full principal payment of about $500. We’d be a couple hundred short.”

Most normal people would want the rent to cover the PITI + HOA – PERIOD.

That’s what we call a …payment.

You might be able to fudge the maintenance thing a little since, hell, it is a condo.

It was funny the way you broke it down, backwards no less, putting the principal last as if that was somehow negotiable.

A couple hundred short, I assume you mean per MONTH, which by the way, is a couple THOUSAND per year.

Remember, as my folks always say, 30 days cmes fast.

Sell?

If you like selling at the bottom have at it.

And don’t forget about your friendly realtor / broker / banker’s 10% transaction cost.

Plus the closing costs that every owner just must pay these days.

Or so they say.

Given the lmited amout of data, I would chose Option “C”: Place the child up for adoption and continue living in the 1BR condo as if nothing happened.

Or in leiu of that, perhaps try renting the place out for a year or two or a five, since selling would gurantee you of a REAL and immediate (and non-deductible) loss of $85K (give or take), and renting might gurantee you of only a loss of 4-5K per year.

Sort of like how do you want it? – In the head or in the gut.

Let me re-phrase for you BoyWonder. Is it worth it to cover negative cash flow if the principal portion of the payment is more than the difference?

Pickle,

Learn to live with it.

My parents, albeit wealthy now with a nice home on the OC Coast, grew up in far different circumstances.

My mom grew up in a 2 bed 1 bath 875 sq ft home in a lower middle class neighborhood. She walked 2 miles to school every day. Little caucasian blonde haired blue eyed 8 year old.

My dad grew up in an area best described as “the wrong side of the tracks”. Him, his parents, his brother, and two sisters lived in a 2 bed/1ba 950sq ft house. They did ok, with him and both sisters getting 4 year degrees and holding professional level jobs. The older brother got a govt job after serving in the Korean War.

Its how people lived. There was no notion of “oh, I need this much space cause were a growing family”. People did with what they could afford. No notion of I deserve or I need X,Y, and Z.

Bob,

I wonder why I had to read all the way down to the current bottom of the comments to get the wisest advice (in this case for Pickle). “Deserve” “Need” without any consideration for “Afford” is the root of the problem. The “Jones” are still alive and well, but we don’t have to live beyond our means to try to live like them.

Pickle,

Funny all the negative responses. From my perspective, its nice to see someone doing the right thing. These days, its always someone else’s fault, and people just look for reasons to walk away. All the best. BTW, I’d sell, lick your wounds and move on.

See those:

-Federal

-SS

-California

Perhaps such things should not exist. They have for so long yet the states and countries are still in the red. Proof they are the things that should not be.

I live in the most expensive (91361) Westlake Village area of Thousand Oaks where 4+2s are moving into the low fives and high fours. I was looking around in the less upscale 91362 area recently and noticed a lot of stuff priced in the 5s that was just sitting there. I think within a year, TO proper will be in the 3s for 4+2 SFRs in good areas and Westlake Village will be in the mid 4s. Whenever I say this to people around here they either laugh or become incensed. The reality is that the almost the entire increase from 2001-2006 was based on hokey unsustainable financing schemes and none of it was based on fundamentals. Now that the schemes have imploded, prices must return to a sustainable level, probably closer to 2001 prices than 2003 prices.

It only takes enough people willing to overpay to prop higher prices. We had 7 overpriced homes in our area and 4 of them sold and 2 are under contract.

It would be different if you were trying to sell the whole area and needed the median to support prices, but in some cases you only need a few willing buyers for support.

On the flip, I suspect very few people in my surrounding area could afford to buy their own house based on our median.

“It only takes enough people willing to overpay to prop higher prices. We had 7 overpriced homes in our area and 4 of them sold and 2 are under contract.”

I suspect people dumb enough to overpay are starting to be in short supply, as many have lost their jobs or can no longer qualify for the loan. I would be surprised if most of the 7 are not back on the market within two years as these buyers become upside down.

Leave a Reply