Laundering real estate – How dirty loans have made data on distressed inventory look better. 1 out of 5 US mortgages impaired. Jumbo loan market has completely evaporated.

The elaborate gold plated fairytale for 2010 is that somehow housing recovered. Sure data was fudged and we swept a few million dubious loan modifications under the Ikea rug but this is certainly not a recovery. Zillow announced that in 2010 US homeowners lost $1.7 trillion in housing value. This brings the grand total of US residential real estate wealth to evaporate into the ether to $9 trillion. There are many pressing issues that remain with the housing market but one that stuck out to me was how modified loans are being laundered into the system as “re-performing loans†even if borrowers haven’t made a payment on the loan or deeply examining their debt-to-loan ratios. The reason this is an issue is that for most of the year, media sources have been quoting the “non-performing†percent figure and in fact this has gone down. Yet this is a blatant deception because of course this will drop when you take millions of loans and suddenly “mod†them and they are miraculously performing as if Houdini reappeared through a puff of smoke. Yet the vast majority re-default only a short while later for obvious reasons (i.e., lack of income, loan balance still too high, etc). Let us look at this daunting phenomenon.

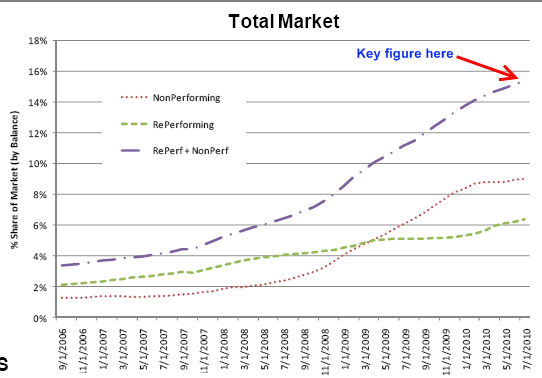

The most important thing is to combine the non-performing loans (foreclosures and those 60+ days late with no payment) with the recycled inventory:

Source:Â Amherst Securities

When we examine this figure we see that over 14 percent of all loans (55 million in total) are either non-performing or part of this recycled figure. Why haven’t we seen massive stories in the media about people that have had their loans modified through say HAMP early on and are now thriving? Why you may ask? Because these are diamonds in the rough and the bulk of these loans end up back in the foreclosure sewage pipeline process a few months later. Loan modifications have helped in some cases but it is naïve to assume that this has significantly helped the market like current quoted data reveals. The fact that another $1.7 trillion was shed in residential real estate values should tell you something.

Keep in mind this $1.7 trillion collapse (essentially the size of California’s annual GDP) in housing values for 2010 happened virtually unnoticed by many. I think folks are psychologically getting numb to these figures. When the crisis started a few billion dollar loss was enough to rock the markets. Today, an announcement that home values fell by $1.7 trillion doesn’t even get noticed by financial markets. Keep in mind that most Americans that own any wealth have it stored in real estate. This is going to be yet another hit to the net worth bottom line of most and mentally a roundhouse kick via the wealth effect.

The report by Amherst Securities even brought out Nouriel Roubini saying that US banks will face another $1 trillion in losses. According to the report the current mortgage market looks like this. 20 first mortgages out of 100 are impaired because of:

-9 are behind on their payments at a serious level (60+ days, foreclosure)

-6 of the loans are what they call “dirty current†meaning they were modified but re-default at rates above 50% per annum.

-5 are underwater with negative equity by more than 20% of current market value and these are defaulting at a 20% annum pace (I would imagine this is a large pool of the strategic defaulters).

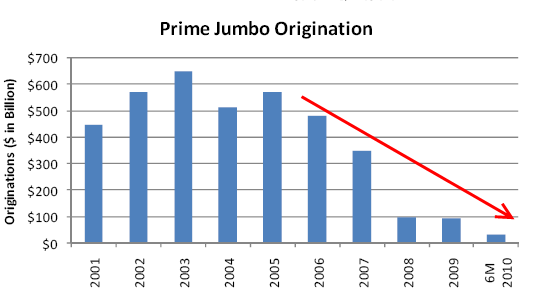

In other words, 1 out of every 5 first mortgages in the US are in seriously bad shape today. As in right now. Many toxic mortgages still permeate the market especially in places like sunny California. This report is for nationwide data so you can imagine what it looks like for a state like California where home prices are still in a bubble. And for all those California inflated price home owners that think the jumbo loan market is going to make a roaring come back, think again:

Source:Â Amherst Securities

The jumbo loan market is virtually non-existent showing that many homeowners in these “prime†areas used subprime tactics in buying their homes by over leveraging and buying something they could not afford. As we have shown, many million dollar home buyers in key areas like Beverly Hills or Newport Coast were only able to buy because of the mania of the housing bubble and debt fuel that allowed people to over spend and leverage. Since these loans can’t be funneled to the government, banks are not putting their money on the line in these markets. After all, you would think that if banks had faith in their “wealthy†customers they would be making large numbers of jumbo loans. Does the above chart look like that?

The vast majority of Americans never even have to contemplate a jumbo mortgage. The conforming loan limits are already high enough as they are. Plus, the median price of a US home now stands at $170,500 and this is down from $172,000 from last year. In other words, we have gone negative year over year yet again. Keep in mind this happened even in the face of tax gimmicks, the Federal Reserve artificially pushing mortgage rates lower through their actions, giant Wall Street bailouts, and banks basically stalling on foreclosing on homes. With a mixed Congress next year, it is hard to bet what exactly is going to happen. But one thing is clear; common sense minded Independents, Republicans, and Democrats now realize that their representatives do not listen or vote for items that are significantly meaningful to them. The 435 House members and 100 Senators answer to their larger interests.

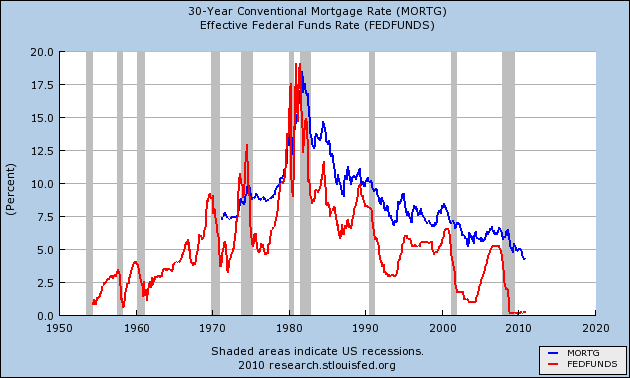

The troubling thing about all this is that mortgage rates are at all-time historical lows:

The Fed must be scratching its head wondering why people aren’t borrowing more money. After all, they were so willing to do it for the past three decades! Last night I was looking at comments from various blogs and mainstream media sources regarding the across the board tax deal in D.C. A large number of comments centered around, “that is great that everyone is getting a cut but it would be nice if I had a paycheck to cut in the first place.â€Â For those that will get a cut many reflected on the $15, $20, or $25 per week they would be getting and how the cost of other items like energy and healthcare have gone up. In the end it is peanuts and is merely a Band-Aid just like the loan modification issue.

Years ago, I tossed out the notion of nationalizing the US banking system. Why? The system was so rife with corruption and fraud that it would take only a true internal assessment to get us out of the mess. Many objected about the cost and believed what the banking industry fed them (or politicized the entire event). Well guess what? We are now entering the fourth year of the crisis, $9 trillion in housing wealth gone, and banks now back to their speculative ways again so what has really changed? We now back Fannie Mae and Freddie Mac completely and banks are the gatekeepers in terms of what mortgages they shuffle off to these agencies. What we have now is the worst part of nationalization (the cost) without the major benefit (complete control to reform). The battle isn’t between Democrats or Republicans. The battle right now is between the people and Wall Street investment banks. The media doesn’t frame it this way but most Americans now finally get it. Not all, but definitely a larger number.

So what is next for us? Expect home values to drop even lower. Keep in mind that if mortgage rates go up (a very likely scenario given global market debt concerns) home prices will become much more unaffordable. The only thing keeping home prices affordable right now is an artificially low mortgage rate manufactured by the Federal Reserve. This is not a normal market by any stretch of the imagination and the longer home problems drag out, the more people of a new generation will think twice about buying a home. This was another important reason to confront the issue head on and deal with it squarely by breaking up banks into commercial and investing units and clearing out the inventory in a steady and predictable way. Now, it is a patch work of insanity and the price tag is up in the trillions of dollars even though we keep hearing about the few billions of dollars being paid back to TARP as some sort of win.

$1.7 trillion lost in residential real estate values, unemployment edging back up to peak levels, and banking profits back to record levels. Guess which group is benefitting the most because of the bailouts?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

47 Responses to “Laundering real estate – How dirty loans have made data on distressed inventory look better. 1 out of 5 US mortgages impaired. Jumbo loan market has completely evaporated.”

Unfortunately for those with an interest in the housing market, the critical public policy issue internationally is the financial system. Our big banks are truly too big to fail. Perhaps we could cut them down to size over time but a collapse of Citigroup or Morgan would screw the Western civilization.

So expect a slow squeeze of American citizens with real estate equity (or just debt if underwater.)

And yes, Bunkie, you ARE being lied to, over and over again.

Can you please explain how a collapse of a too big to fail bank if not rescued can result in the end of Western civilization?

It always troubles me when people say “oh the banks had to be bailed out or the world was going to end”. Really? Please explain.

The so called wealth that these banks, investment banks, hedge funds, etc… have is basically numbers in a hard drive followed by a whole lot of zeros. The amount of derivatives valued is probably 300 to 900 trillion dollars. An amount that is unfathomable to most of us. However, in the end, it’s nothing more than numbers (the bankers would want you to believe it’s wealth) in a banks secured hard drive. The world won’t end if people around the world tell the too big to fail banks they can’t cash in their chips.

Patel, you are an idiot.

Could you imagine the Feds not helping the big banks and letting them fail and then watching millions of depositors running to get money out of the banks? There is some $10 trillion in deposits at these big banks in 2008. The insurance was only $100,000. The amount of economic and social catastrophe would have been severe.

The Fed’s quickly raised the insurance to $250,000 and created money out of thin air and loaned the money to the banks to save them.

Hi Nimesh. Although I don’t think you’re an idiot, I agree with Matt; the big worry in 2008 was that because of the re-sale of toxic mortgages to the securities market the extent of the banks’ debt was unknowable, and that if people called in their deposits all the banks could go bust. Not the end of civilization, but certainly the end of the banks, and of the assets that individuals held in those banks.

I thought that at the time I read the figure of 9 trillion as a potential total of bad mortgage debt. – does anyone else remember that figure? Maybe it was a minimum – anyway, we’re beginning to overtake it and find out exactly how much the banks actually created.

Americans may get it but so what? We must stop planting our fat asses on the couch drooling over idiotic TV shows like American Idol. The system won’t change until we make it change.

Maybe we should stop over generalizing first.

Overgeneralizing?

We’re the 3rd most obese country (Behind teeny tiny countries of Samoa and Kiribati)

http://www.expatify.com/news/the-worlds-top-10-fattest-countries.html

And we watch the most Television by far.

http://www.economist.com/node/9527126?story_id=9527126

We’re #1! We’re #1.

BUUUUUUUUURP.

My guess is that there is a hidden element to American “obesity.” The same one that makes Samoans so fat: an increasing gene pool of people not adapted to foodstuffs out of the Mediterranean agricultures (wheat and dairy particularly, and then the industrial commodities made of them, such as sugar and hydrogenated fats).

So snark all you will, but this is only a symptom of the larger corporate imposition of a one-size (XXXXL) fits all consumerist lifestyle on diverse people. Plus mega-corporate agriculture has long sought to deliver profits, in the form of cheap addictive calories, not health, wherever it goes.

I believe that show is now called “Idle American”…

The latest International Monetary Fund (IMF) staff paper projects that federal debt could equal total GDP as soon as 2015. These levels approximate the relative indebtedness of Greece and Italy today. Leaving aside the period during and immediately after World War II, the United States has not been so indebted since recordkeeping began, in 1792 (p. 25).

U.S. Facing Federal Debt Cataclysm

Federal debt is the dollar-for-dollar result of deficits, and it has essentially tripled over this past decade, from $3.5 trillion in 2000 (35 percent of GDP) to $9 trillion in 2010 (62 percent of GDP). The Congressional Budget Office now sees it reaching 90 percent by 2020.

These are staggering numbers. Of course, the unfunded Medicare and Social Security obligations dwarf the on-budget debt.

Interest rates will rise. The authors say that interest expenses will equal the entire Defense Department budget by 2020.

In 2020, the Treasury will have to borrow $5 trillion a year to roll over the debt. Don’t forget the Treasury’s obligation to Fannie Mae and Freddie Mac.

The debt of government-sponsored enterprises is already $8 trillion.

State and local debt totals $3 trillion. They say that Washington indirectly stands behind all of this. (They mean politically, not legally.)

Add to this unfunded state and municipal pension obligations of $1 trillion.

It is clear that the deficit will not be reduced. The Fed will flood the world with dollars to bring down the dollar so we can create more jobs in exporting. The Chinese and others will get paid back in devalued dollars and home prices, in dollar terms will stay up, so the banks will not take a write off. The consumer will get hurt. But the Wall Street investment bankers, who gave so much political contributions to Obama, will be happy.

“Years ago, I tossed out the notion of nationalizing the US banking system.”

How about reinstalling the regulation taken off during the 80’s? For example you could be a bank within one state. And banks could have brokerages they could only have banks.

Housing is on a collision course with Hell. Housing is going to get slaughtered. The fact that housing has been defying gravity so far, matters not. Before too long, the laws of economics will kick in, and housing will fall off a cliff.

Oh, by the way! Check this out! Check out little Bennie (Bernanke) in his interview on 60 minutes. LOOK AT HOW NERVOUS THE GUY IS. I noticed it the first time, but after reading an article about it and watching it again, I was absolutely amazed at how anxious and scared he looks. He looks like a mass murderer being questioned about his innocence (or lack thereof). Check out how his upper lip quivers, and how he studders at times. You see, Bennie knows the ecomomy (and therefore, HOUSING) is in big trouble. They whole interview is good, but for a quick peek, check out his facial expressions from 6:58 to 7:53.

http://www.youtube.com/watch?v=QPmmWe5iulQ

HA HA HA………Ben is a JOKE!

So the reason there is a giant disparity in incomes between the rich and poor is because of “educational levels”?

Yep, that is why the richest 5% owns 98% of all assets,…………….. education.

What Bernanke is saying is if a person goes to college and increases their marketability, they will increase their earning power and he is correct in that statement. Any one individual or group of individuals could do that but……does he really think that if all of the low paid services workers (the fastest growing sector) went out and got college degrees that would be the answer?

He is saying if everyone was highly educated Walmart would suddenly pay their staff 20 or 30 an hour, your local Safeway would pay their clerks 100K a year if only they got that college degree.

Sorry Idiot Brenanke, our economy has grown tremendously in the last 20 years, most of the jobs low paying service sector and no amount of education will change that for our nation but yes it would change it for a particular individual.

When Americas middle class was at its peak the educational levels were much lower than today. Yes, we must keep up with the world but when our primary business is selling the worlds production in big box stores, education can only go so far.

I notice Bernanke’s nervous ticks as well. Never noticed them before. I thought as I was watching him he was on the edge. He is an historian and obviously knows how he will come across as history judges him. Sad.

There is a very good reason “bennie” looks like a pencil necked quivering little weasel… he is!:

http://www.youtube.com/watch?v=Tw2ClOJuQII

For once this John Stewart idiot makes sense. 🙂

No, what are you talking about. It was the Republicans/Regan/Bushes and Greenspan at the helm while banks’ and financial institutions’ employees lined their pockets. Then he dumped it into Bernanke’s lap when Greenspan retired.

DR HB please show a graph of mortgage rates from 1900 to 1960, including the Roaring 20’s and Depressions. I think 3-5% is average over 100 years excluding 1970s-80s.

Thanks

I am sure he could do that but don’t you think it would be smarter to compare apples to apples.

The monetary system of the world was based upon GOLD for thousands of years until, 1972. Basically the receipts for money on deposit (GOLD) became the money by the stroke of a pen.

In 1972 the FED was given the power to do “Quantitative Easing” ( by going off the gold standard) yet did not exercise it til recently. The FED was also given power to go out onto the open market and buy stocks, houses, cars or whatever it feels it needs to do to manipulate markets.

Comparing rates from 1972 til now would be the smart thing to do. Going back further would be fooling yourself and why you would ever wish to do that I dont know. Perhaps you are a Real Estate Agent?

Well Ben is nervous because Ron Paul will be in charge of the committee to bring him up on charges, no I mean to question him about things that Ben will not talk about, hence the contempt of Congress charge, and the cold jail. Ben is also nervous because he knows the book that Ron wrote about the death of Ben’s gang. Ben is also nervous, like a crew man on the sinking Titanic. Poor Ben. Our prayers are with him.

Also, in the above video, see his facial expressions and anxiety from 6:00 to 6:58. Amazing! Very Telling! All this VERY VERY VERY much relates to housing. A weak economy cannot support insane housing prices.

A strong economy couldn’t support the housing prices we have. That’s why we’re in the mess we’re in. And I’m not just talking about the stratospheric highs of the bubble prices. Even if our economy were immediately fully recovered with no more than 6% unemployment and a stable financial bloc, expecting people who make $50,000-$60,000 per year to buy $300,000-$400,000 homes is completely ludicrous.

People making $50k-$60k a year cannot afford a house that costs $300k, but when both parents work and pull in household income of $120k a year, that $300k is within range of the 3x gross income multiplier.

It’s pretty much a given now that if you want a house in a decent area (low crime, good schools) outside of the midwest, you’re in tech, law, medicine, finance, with a dual income household.

Traditional middle class, union supported, manufacturing careers are out of the running entirely.

Danger Mike – I completely agree with you! Housing in many areas, is still way too high. I live on the California coast (Santa Cruz), and housing is still priced in the stratosphere. The other day, I saw a small house (2 bed, 1 bath) for $439,000. Insane! And that is cheap compared to most houses in the area. Housing will come down! I guarantee it! It’s just a matter of time and circumstance. Imagine when all the foreign creditors wake up, and demand decent compensation for buying U.S. Treasury bonds. Or, they may just refuse to buy Treasury bonds, period! Interest rates will skyrocket, and housing prices will CRASH.

Eric, very true. However, that removes them from the median range and puts them well into the upper quartile of household incomes. If it takes an upper quartile income to afford the median house price, prices are still too high.

The only reason for the value of real property to increase was do to financing vechicals that allowed IO payments, neg am paymnts, high Debt to income ratio’s, than capp it all off with fudged income. Now with higher down payments, 30y fixed full amortised payment, full income documented, the goverment in turn has pressed interest rates down to prop-up (bubble) the real estate market once more. Research what some are saying about the QE2 600 billion in bond purchases. Do investors want our bonds at low yeilds? umm NO! when rates go up to international market levels either banks open new programs with lower standards (IE 2002 all over agian); The other options is housing values will react and move lower based on the purchasing power of the home buyer at 5-20% vs 4.5% supressed IR’s.

I am more concerned with the QE’s and US dollar than housing values. we have all ready seen other G20’s (Russia and China) agree to trade in other currency than the US dollar. Another nail in the coffin for the US dollar.

just maybe??? those “printed in error” new 100.00 notes stored in Texas are the new gold standard notes for 2011 or 2012. you would think printed in error notes would be destoryed? hmmmmm.

Secret Rendevous- thanks for the encouragement. I grew up in northern coastal orange county and am currently watching real estate like a hawk on the happy side of the orange curtain. Ideally I want to find something close enough to the LA border to for employment opportunities yet still on the OC side for tax and political reasons. But when houses in Buena Park and Fullerton are being priced at $350,000+ it is just impossible to rationalize a purchase. Looking toward Cerritos, Los Alamitos, and the nice side of Garden Grove and seeing prices between 400 and 600 g’s is almost laughable. People making enough to live in these areas probably wouldn’t want to.

Per Zillow: home prices have dropped $1.05 trillion last year (2009) and

$1.7 trillion this year (estimated). Can you say ‘disaster’? How much more will they fall in 2011? Here’s the link to the Zillow article. “It’s definitely going to continue into 2011,†Stan Humphries, Zillow’s chief economist.

http://www.bloomberg.com/news/2010-12-09/homes-in-u-s-poised-to-lose-1-7-trillion-in-value-this-year-zillow-says.html?t=TOP-OK&pos=1

Using Orange County, California data, in 2006 the median wage was around $60,000 while the median house was over $600,000. Running the numbers with a 20% down payment and 6.5% interest rate, the anticipated payment (PITI) would be $3,600 for a traditional 30 year mortgage. The after-tax take-home pay from that $60,000 job would be around $3,500. The 30% monthly gross for the rule of thumb maximum wise debt level would be about $1,500. Working from the payment on the $600,000 purchase, the minimum wage to support the payment would have to be about $140,000 per year. So we had a situation where 50% of the houses were priced well out of the reasonable reach of all but 2-3% of the population. To the question of how much houses must drop, just look at wages. Either $60K/$140K or 1500/3500 says that housing should have been closer to about 40% of the peak price. Until house prices have fallen 60+% off their bubble highs, they are too high. Factoring in the current mess of our economy, we might more reasonably expect 65-70%. Being that I don’t want to try to time the market bottom and that I want to buy while prices are still declining rather than increasing, my plan is drop the hammer when the OC median is between $250,000 and $275,000. I anticipate it might get as low as 200-225 but I’d be willing to accept that much loss for the advantage of participating in a buyer’s market to maximize the quality of what I can get.

If the banks are making all the money then buy bank stocks…they are publicly traded companies. Guess what, house prices have stabilized, people are shopping again, the sky is not falling. The next few years will be slow and rocky but everything will be okay…this is how it always happens in this country. Could you imagine if there were internet message boards during the depression, or WWII, or WWI, or Gettesburg and Vicksburg, or the burning of the White House, or 1970’s gas lines…hey, let’s not forget the Alamo.

It’s kinda of scary to say ‘lost billions or a trillion dollars’, but truthfully what is the value of the United States. I’d venture to say many, many times more than the economic output of the entire world (not to mention absolute military might). Don’t have stats and charts to back it up, just if I had to bet.

The sky’s not falling, but home prices are not stabilizing (except in low income areas). It took great effort by the Fed to keep interest rates low, and help from the FHA to allow an accessible entry point (for your down payment) to minimize the slide in home prices. Furthermore, banks are controlling supply by holding onto its inventory, further distorting the fundamentals. Add the high unemployment rate as well as stricter lending by the banks, and it all amounts to pretty strong downward pressure on home prices.

Recently, the Fed’s attempt to manipulate rates have failed as the 10 year t-bond hit a 6 month high (resulting in a bump in mortgage rates). Furthermore, whatever momentum the tax credit program gained last year into this spring has been lost. You can see the trend in the Case-Shiller report here: http://www.standardandpoors.com/indices/sp-case-shiller-home-price-indices/en/us/?indexId=spusa-cashpidff–p-us—-

I’m not part of the other extreme camp that thinks we’ll see another 30%+ correction, but I think prices won’t start stabilizing until we see another 10~20% drop. If the current downward trend continues, we may see a bottom as soon as early 2012, where most of the losses have occurred, and further losses are marginal. However, this speculation will always be subject to whatever the Fed/congress decides to do next to address the mess we’re in.

Only stabilization we will see (if any) will come down to any policy changes by the Fed/government. Another round of tax credits may stabilize home prices enough to prevent further big declines while the economy tries to recover and create the next batch of financially capable home owners.

Unless what you buy with the trillions of dollars you print in your basement fosters sensible, sustainable living for future generations you are nothing but a fool.

The Fed must be scratching its head wondering why people aren’t borrowing more money … the answer is that the current lending system is broken… Big banks are not lending in earnest. Getting a mortgage today is not quite but very similar to getting an audit from the IRS. Mortgage lending has gone from one extreme ( too easy) to another ( too restrictive). Unfortunatley both extremes lacked common sense.

I see the real estate problem becoming a lot worse as this article does not address the empty homes out there that have already foreclosed or have been abandoned. Nor the future amount that may strategically default if values continue to drop. I am aware of many people that have not paid thier mortgage for up to 3 years and the Big banks are not foreclosing. I know of some that B of A has told do not pay, just stay and maintain the house. The banks do not want the properties. When they foreclose they become liable for taxes, insurance , maintenance and any association fees as well as taking a hit on thier books. If values continue to decline (which it appears they will) then we could become a nation of squatters as more realize not paying your underwater mortgage does not result in eviction, but does result in monthly cashflow savings. Combining this with the uncertainty of health care and its repurcussions, the unfavorable environment for small business and future growth there is a big hill still to climb to get out of this.

Real estate/mortgaging is the very definition of racketeering. With the Fed at the wheel of this massive fraud machine, the future of this country is not bleak, it’s black.

“This brings the grand total of US residential real estate wealth to evaporate into the ether to $9 trillion. ”

This isn’t actual money, it’s just a “wealth number”. But no physical transaction was made. But if you put them all on the market at once the number would likely drop substantially. So what does that number really mean? Just more political rhetoric.

However, part of that 9 trillion banks made loans on. That is the true financial losses. But it happens all the time: stocks, homes, gold, they are all just an elaborate pyramid scheme that relies on someone else to buy the next higher price.

Of course you can live in some, wear some, and get some dividends on some. But in all actuality they are all gambles.

The question is how well call you bet? And how do you determine who is a winner? The “Broke Baller” who bought a 2MM home he can’t afford in 2005 and will be evicted in 2011 got to live a ballar life for 6 years with nothing down. He will walk away with cash in hand since he hasn’t paid towards the home in 3 years. And yet the “Smart Renter” lived in a crap apartment and had to pay the rent. And the smart renter will get to pick up the financial tab for broke ballar.

Seems to me the financially prudent got duped! Sure, now we have some extra cash but the last time I checked the prices in SoCal are still not cheap. We are still renting and the broke guy is living in a free home. So who won again?

Well, I don’t know.

I wouldn’t say that any “Broke Baller” is going to top out the average debt-free renter who lives within their means.

News has a way of leveling the playing field, particularly when the “Baller’s” financials are at the mercy of the U.S. Trustee:

http://www.irs.gov/businesses/small/article/0,,id=104627,00.html

Real life example:

http://lansner.ocregister.com/2010/12/08/o-c-housewife-tries-to-beat-foreclosure/91628

~Misstrial

OC housewife story, now read this

http://deathby1000papercuts.com/2010/01/alexis-bellinos-husband-jim-bellino-involved-in-fbi-fake-sports-memorabilia-sting/

You nailed it with this post.

The measures taken by The Fed so far haven’t surpassed the amount of de-leveraging across all credit markets. Housing still has a few more legs down to go.

The 1 in 5 impaired mortgages may increase to 2 in 5 by early 2012, as the entire Option ARM market will be fully re-cast, re-defaulted mods will work their way through the foreclosure timelines, and 2nd mtgs may finally be marked-to-market and charged off.

Unfortunately, all money creating, controlling, and distributing branches of government have favored the bankers over the citizens. At this point, there’s no reason to expect them to change their tune. Thus, more legs down to go for housing and a potential surge to that 2 in 5 impaired mortgages.

What is being debated in Congress in NOT a TAX CUT! Does anybody actually beleive their taxes will go down if the Bush cut is EXTENED? Ok a meger 2% reduction in payroll tax, this is not a cut it’s a scratch. If the Bush tax cuts are extended our taxes will remain the same as last year

What’s your take on Mortgage Interest Deduction?

There is one very important aspect that is not mentioned, the baby boomers. In California, there are many of them sitting on very large “equity” positions. The first boomers are retiring now. However, their cash savings are returning no money to live on. There has been over 30 months of continous net retail withdrawls from the stock market, indicating the ingrained fear of these investors. With the cost of carrying their equity rising, real estate taxes, repairs, electric, water, etc. bills at the same time their income will drop after retirement, they will be required to cash in on this equity and downsize, period. However, who is going to buy this equity? Run the numbers by zip code and see how many owners of high priced homes are boomers. I think you will find it very interesting. And, there is no growth in high paying jobs that would pay the salaries for the next generations to buy these homes. We have not seen anything yet.

Matt-

There’s no reason to call Patel an “idiot”. I agree with Patel, this panic of the administration to bail out the banks was nothing more than “the sky is falling”. It’s time to either give up on the capitalist model or re-form the shit out of it. The government could have taken over the banks like they did GM and “nationalized” them. These were bad bets that were then reimbursed by the government. Every home assessor that valued 1300 sg ft homes in Reseda at 650K should be put in jail. The ratings agencies, mortgage brokers, banks, et al. deserve to go belly up for being so greedy. This country is in such a mess right now. 42 million on food stamps. Yeah- we’re #1 alright.

When a person can not validate or invalidate an argument, they always turn to their last resort; “Patel you are an idiot”, “you are stupid”, etc…. Please, do read my argument and then come up with a better counter point.

The banks, investment banks, hedge funds, etc…. have all made investments in which a counter party can not make good on. So now they want the taxpayer to pay up. The banks and Wall Street argue that if they don’t get paid then the world will end, the sky would fall, etc…

Let me provide another example. Let’s say, I start my own hedge fund and I speculate on foreign currencies, commodities, etc… Through sheer luck I am able to turn $100,000 to $1000000000000 (one trillion dollars) but the counter party tells me “sorry, we can’t pay up”. What will happen now? Will the world end? Will the sky fall? Will civilization as we know it collapse?

Please, refrain from personal attacks. Doing so would only show you don’t have a reasonable argument to begin with. I would appreciate a healthy argument.

TPTB were afraid of a complete unwinding of the quadrillion dollar derivatives scam. We would have had hyperdeflation of an extreme magnitude. If the derivatives that the uber-rich unwound to such low values, they would be insolvent themselves and the poor debt free renters with cash in their mattresses would all of the sudden become the wealthy. Kind of a “meek shall inherit the earth thing”.

You think the big boys are gonna let that happen *yet*?

Let them get their bonuses, pay off their $40,000,000 mortgages and then, let the games begin.

Just remember the golden rule. He who has the gold makes the rules. Before you knock me for mentioning gold, ask yourself this. Why do central banks hoarde the stuff.

Taking over GM was as bad an idea as taking over banks would have been had that come to pass. Let the destroyed entities assets be sold on the courthouse steps for the market clearing price. Don’t prop up a phony asset price with tax payer money.

torabora,

No can do:

The purpose of taking over GM was to ensure that taxpayers would make good on UAW pensions, letting Obama play God by firing and hiring CEO’s from the Oval Office, and screwing the bondholders.

Bankruptcy would serve none of these purposes as well, and, as such, was quickly ruled out as not a viable option.

People ARE getting numb. Everywhere I turn, all I hear about is Loss. They know that a global plutocracy is bent on taking everyone’s hard-earned wealth, and stealing whatever pools of still-existing capital (like pension funds) exist. Because the process is automated and remote, they don’t know who to go after. And because those with the bling control even the communications media and categories of thought and speech, what can be done but slumping and slogging along?

Europe’s decadent culture of monarchs and feudal overlords seems to be erasing the American Revolution after all. And many Americans go along. Some come from monarchist cultures themselves (particularly religious ones); others saw in Reaganismo the overlord culture they secretly always worshipped.

And everyone seems to agree that if we whack anybody, it should be the workers.

Leave a Reply to João P. Bragança