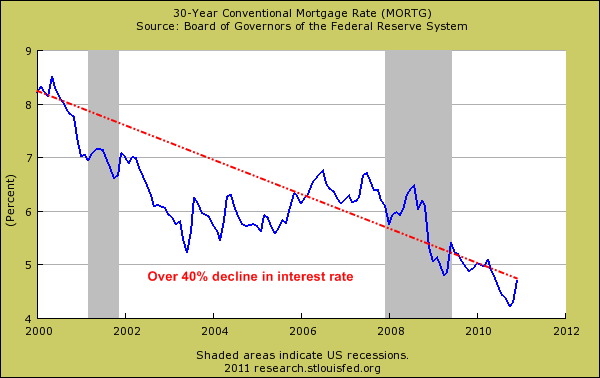

A world guided by low interest rates – Why a lower priced home with a higher interest rate is more valuable than a high priced home with a low interest rate. 30 year fixed mortgage has fallen by over 40 percent since January of 2000.

Give me a high interest rate and a low priced home over a record low interest rate and a home with an inflated price. It is hard to say how many understand this concept and why this is so important. When I bring this up to potential buyers they just do not understand why this would make financial sense. It seems counterintuitive in a world driven by interest rates. For these potential buyers the interest rate is merely a method of squeezing out the maximum monthly payment from their strained income. This mentality is very common in California housing but I would imagine is also popular across the country. People forget that in 1981 the 30 year fixed mortgage rate peaked at over 18 percent. Today while many talk about “rising†interest rates the 30 year fixed is still hovering around 5 percent. The four decade average is closer to 9 percent but the Federal Reserve has meddled to keep the lid on interest rates low for the time being. The only reason the Federal Reserve is following this path is because it needs to keep home values inflated or face another deep banking correction. So keeping rates low allows Americans to purchase as much home as possible with maximum face value but also allows banks to keep the pretend game going regarding real estate values. Yet this is a bad move for potential buyers and we will examine why.

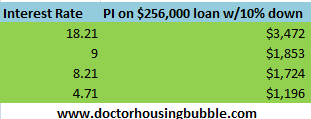

Over the last 10 years interest rates have gone from 8.21 percent on January of 2000 to the current 4.71 percent. Of course this if for the vanilla 30 year fixed mortgage and during this time creative and alternative financing dominated California. The 30 year fixed mortgage was like trying to bring a Beach Boys CD to a swank Hollywood club. However today the 30 year fixed mortgage does matter because it is biggest game in town. To demonstrate how big of a difference these various rates are let us run four scenarios: the peak 1981 rate, the historical average 9 percent, the January 2000 rate of 8.21, and the current rate. We’ll run the numbers for the median priced California home of $256,000:

Keep in mind the above does not include insurance and taxes. Why is the above important? First, it highlights how stretched many home buyers have become merely to purchase a home even after the substantial correction. A large reason for this has been the lost wages for many and stagnant income growth for most middle class families. A lowering of the interest rate gives a perceived feeling that people have more buying power because in a way they do. Yet this is Federal Reserve alchemy. It comes at a large cost of bailouts, Quantitative Easing, and a general bubble environment where hot money chases whatever is the flavor of the day. Ultimately a low interest rate gives the potential buyer a very expensive asset that seems inexpensive merely because of an artificially low interest rate. Just look at the historical average of 9 percent. If the 30 year fixed mortgage reaches this level a typical California buyer will need to pay a stunning 54 percent more each month on principal and interest. Is this even doable in this economy with virtually no wage growth? Of course this is not a sustainable path and that is why we are seeing home prices come down since mortgage rates are scraping the bottom of the barrel.

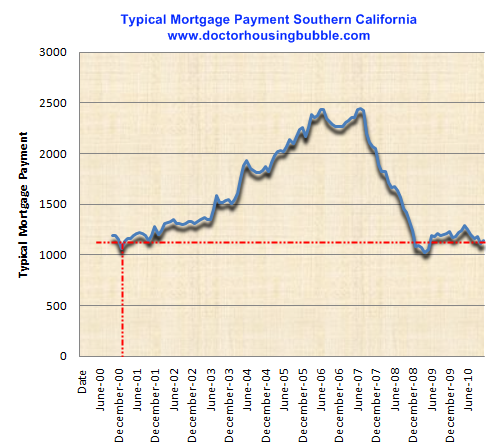

A lost decade is already seen in Southern California mortgage payments:

Source:Â DataQuick

For all the talk about hot money flowing into Southern California and giant bank accounts the typical mortgage payment stood at $1,136 for the latest month. This is where the “hot†money is since families now have to document income and go with 30 year fixed mortgage products. When the bubble burst it exposed of course the inflated asset values but it also unraveled an entire decade of lost income covered with the trappings of a debt lifestyle. Keep in mind that we had for the large part of the decade an entire mortgage market that cared not about documented income but about a willingness to buy into the cult-like mentality that somehow real estate values never went down. It was a hot money bubble. Incomes did not matter before but they do now so all these metrics matter and some have a hard time imagining a mortgage rate of 18 percent but we had that in 1981.

A lower priced home is much more valuable than a low interest rate because it provides you a variety of options:

-You can pay down the debt quicker with extra payments. Since you paid less, each extra dollar you send will eat away the principal quicker. Believe it or not mortgage burning parties did exist.

–Flexibility. If rates are high, it is likely they will stay that way or move lower. If they move lower, future potential buyers have more flexibility in buying your home so the pool of buyers increases. Today is as low as we go.

–Price. People seem to have forgotten that value comes from price, not the interest rate. The banking industry has made a living off economic rents and interest rates have become so crucial that our central bank is now obsessed with keeping rates low only to keep housing values inflated.

The market is demanding a higher interest rate but only artificial intervention is keeping the rate low. But how long can this go on? We’ve already passed the $14 trillion mark with national debt and it is likely our Congress will need to raise the debt ceiling yet again. And for what? To keep housing values inflated while Americans struggle to find work? To keep rates low so banks can chase easy money around the globe and inflate the stock market? The entire economy is being held together with the duct tape that is known as Federal Reserve sponsored low interest.

It is amazing that some people simply do not have within their vernacular the ability to see higher interest rates. Yet look at Iceland, Greece, Portugal, Spain, and other countries that saw interest rates rise by 100 basis points over a matter of months or weeks. The paradigm can shift once market sentiment changes. After all, does anyone even remotely believe that we’ll ever get around to making a dent in that $14 trillion national debt?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

50 Responses to “A world guided by low interest rates – Why a lower priced home with a higher interest rate is more valuable than a high priced home with a low interest rate. 30 year fixed mortgage has fallen by over 40 percent since January of 2000.”

It must have been with great amusement when they named themselves ‘the Fed’.

Like Federal Express…nothing Fedral about it.

There’s another advantage to lower house prices: lower property taxes.

That’s not true, the property owners still split up the budget of the township you live in. If you’re property value depreciates faster than everyone else’s, then you might pay less in taxes.

If house prices go down, banks will take a greater loss on their balance sheet, which means less profits and their stock will go down. The bankers have great influence over the government, so interest rates are down in an effort to support the inflated house prices(keep the bubble going). This is really a political situation, not an economic situation. Who rules us?

The Federal Reserve sets interest rates – not the US Government. The Federal Reserve is owned by a group of US for profit banks. So this is not a political issue since the US government cannot control what the Federal Reserve does at all.

The Feds DO NOT set interest rates. They only set the overnight rate they charge banks. The Fed is not owned by banks. It is the Federal Reserve.

Home financing may go the route of automobiles and have a zero interest component

for a significant period of time. The current financing mix of low down payments combined with low interest rates could easily morph into no interest loans directed act specific market segments that are not moving namely mid to higher tier housing for instance. The market is moving away from ownership in the historic sense and towards a leasing mentality created by overpriced property and lower wages.

0% would cause a markup in home values. Assuming people can qualify for it, that would bump up the cure rate for delinquent/foreclosed homes as people sell their no-longer-underwater homes, which will in turn make the banks balance sheets very happy.

However, < 10% qualify for auto loans, and for loans like this, payment periods are shorter and tend to come with a few caveats that include fees and changes in the rate if certain events occur. Because of the increased risk (due to higher loan amounts), this could not only make qualifying for the loan very difficult, but also difficult to pay.

Furthermore, banks would have to figure out how to securitize those loans and sell them off without taking a hit, as I'm sure banks don't want to be stuck with a loan with 0 return. Although… nothing has stopped government, the fed or the banks from kicking the problem down the road. Maybe they will take a we-will-address-it-when-it-comes approach with this… heh

Ed: you make good sense! I will offer these additional thoughts: They are getting extra auto sales by creating these easy buy options even though the buyers need decent credit/jobs, folks in quantity are hitting the buy button which pushes up the GDP numbers!

Our current home financing system with FHA up to 729K with 3 1/2 percent down creates instant underwater homeowners but folks are still drinking the kool aid in fact they think they are getting a deal! Hell offer them zero financing for 5/10 years and they might go nuts for these houses.

Anyway when I consider how far the government has gone with excessive credit creation to push forward demand it gets me thinking we haven’t seen the worst yet!

I believe that’s called rent.

If the US tries to keep the borrowing rate too low too long it will trigger high levels of inflation, basically there is no free ride. Our currency will devalue.

“If the US tries to keep the borrowing rate too low too long it will trigger high levels of inflation, basically there is no free ride. ”

I’d doubt that: inflation means that there’s more purchasing power than things to buy and it’s obvious that people in US in general have less purchasing power than 10 years ago, not more. More probable outcome is deflation because citizens can’t afford anything beyond absolutely necessary because mortgage payments are taking all of ther money.

Of course dumping trillions into banks goes to somewhere: Banks and their owners are happy and dump it into foreign countries as fast as they can, buying property and gambling in stock exchanges as long as dollar has any value. Not a cent of it is going to help US internal economy.

“Our currency will devalue.”

It doesn’t matter as long you can pay anything you need with dollars: You can always print more. Real problems start when you can’t and then you are essentially bankrupt. Not that US isn’t already bankrupt so not a big difference.

FED knows this painfully well so they don’t care at all.

Not that situation would be much different here in EU, either, except that we pay our oil with foreign currency, dollars: exchange rate is significant.

According to http://www.housingtracker.net/ asking prices for houses in Los Angeles dropped over 17% in the last year. The asking prices dropped even more for houses in the top quarter (most expensive). They dropped from $734,000 to $540,000, or about 27%. I believe that asking prices are a leading indicator of actual sales prices.

When the interest rates drop – you can refinance at a lower rate.

When the price drops – you can’t take advantage of the lower price.

Oh wait – now we now have loan/mortgage modifications. Another STUPID idea to give those who don’t deserve a home a plan to say in a home they couldn’t afford.

PRUDENT BUYERS BEWARE – THE SYSTEM IS NOT SET UP FOR YOU.

The real winners are those who bought a home either at a high or low price, either they get a lower price (modification), free rent until foreclosure, or they profit on a sale.

Yup, You can take advantage of a drop in your houses price. Just be sure to refinance every year and take out 100% of the equity. When the value drops you have in essence sold your house to the bank at the peak price! Move the money over seas and live rent free until the bank gets around to kicking you out.

It blows my mind when I see the documents for foreclosed houses. People bought houses for $300K and owe $700K on them…. geniuses!

Anyone who refied and took out equity in cash owes that cash + interest….unless they put it under a mattress and bankrupt they will have to cough it up. Or am I wrong about that?

torabora – sure they owe the money – but they spent it. So they just declare bankruptcy and game over. Can’t get to the money if it’s spent (on gold) or moved over seas. They don’t put you in jail for owning money in the US, all you get is a bad credit score.

Great, now we can lease (RENT !) houses like cars. That will eliminate any private investors or homeowners and the banks can enslave everyone. What a concept. Now, you can really pretend to own an overpriced car and an overpriced house, while living your 3 months of fame on the Westside. What a joke.

Get ready for a big drop on the Westside of Los Angeles as in other overpriced markets.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Ron,

You make a great point about a “leasing-mentality” future for our society. This is a scary thought. I realize that through property tax, other assorted fees, and HOAs no one really has allodial title to anything anymore.

However, the thought of paying $2-3 grand/month for a place to live for the rest of my life is frightening to me and I currently rent (disclaimer: would like to buy again when the numbers make sense!!!!).

I don’t worry so much about myself, but what kind of world are leaving to my children, our children?

If only 1 % of the world owns everything, there will be some serious blowback, unless the 1% has enough armed police and resources to hold on to the world.

Anyway, if that’s the case, I don’t think I would be long for living in a 5th-world hovel fighting for some daily ration of rotten fishead soup with maggots in it!!

Don’t get me wrong, leasing (just a pretty word for renting, anyway) has its merits and timing. However, if my life is no more than just a lease to the banksters and TPTB, well, what can I say to that!!!!!!!!!????

I don’t understand how it is so frightening. The home “ownership” rates have gone from around 62% of households in 1960 to about 64% in the 80’s and peaked at 69% in 2004. Last I saw, the rate is still over 67%. I don’t see it as a shift to a rental mentality so much as a return to the equilibrium established before the speculative bubble pushed the market all out of whack.

The important thing is perspective. A significant portion of those who were granted mortgages in the past 7-8 years were, by most measures, incapable of supporting the amount of debt they and the banks agreed to finance. The sooner that is realized and dealt with, the sooner we’ll all be able to move on from this mess.

No, the home ownership rate is not 67%. The last I checked, if you owe a bankster, THEY own the house, you are making payments on it.

Do you own your car while the banksters have title? Pretty silly question isn’t it?

Home ownership is around 20-30%. Free and clear, paid in full, etc.

I would love to hear you discuss how long the fed can keep interest rates as low as they are now. What is your prediction on that? They have to realize what impending explosion is at hand as interest rates creep up. What do they have up their sleeve next?

Wages are NOT stagnant for govt. workers. 4 to 8 percent a year.

O baloney.

I remember working at a bank in New York City back when interest rates were around 18%. My job was to borrow money at the end of every day to make sure our Reserve Requirement was covered. One day I had to pay 25% to borrow money overnight. The Fed Funds rate now is .25%. Too many people today are counting on eternally low interest rates to afford their homes. Imagine a 20% rate. There’d be panic in the streets.

Gosh, now I sound like my mother talking about the depression and how it could happen again.

~0% is the end game and that is where we are. They are out of options. It’s either a slow burn or catastrophic panic. Neither a borrower nor a lender be…wise men figured this out many centuries ago.

Its a fair bet there would never have been a housing bubble had the Fed not used interest rates to ‘stimulate’ the economy and the government through the GSE’s pushed

homeownership ever further down the economic ladder. In fact, the greater social good

would have been to encourage saving and kept rates moderate by eliminating income tax on interest income. Housing is an illiquid asset as millions have found out. Cash is not. High savings rates also allow governments to finance their debt at low interest rates without debasing the currency. Unfortunately we allowed the FIRE industry and the US government to wreck the economy and there is really no way out so we extend

and pretend until we collapse.

Elimination of savings interest taxes is a brilliant idea…it would encourage ‘investment’ in banks and displace the printed money bailout with its attendent draw on tax revenues as interest on treasuries. But to get that cash banks would need to offer rates higher than the public’s debt loads…and that would increase their mortgage interest take as people would save in banks rather than ‘save’ by paying down mortgages. I pay off my mortgage and ‘save’ at a 5.95% rate.

And let’s not forget the mortgage interest deduction–this also makes a higher interest rate worthwhile.

+1

A couple years ago I would laugh when my parents mentioned the MID, forgetting that they purchased in an era where this deduction could go way further than just covering property taxes.

Assuming absolute inelasticity on the actual price of a home, an 8% rate could double one’s writeoff.

I wonder what the grand total effect of the reduced writeoff has been to government tax revenues over the last ten years.

The mortgage interest deduction is widely misunderstood. Purposely paying interest in order to “write it off” for tax purposes is a bad decision. Why pay $10,000 in interest in order to get back $3500 in taxes?

If you have to borrow money because you don’t have it yet, or because you want to make some speculative investment, so be it. But borrowing just to get a “deduction” is silly.

In a simple one to one anaylsis yes. However if you are giving that $3500.00 to the govt as income tax you are losing it anyhow. So in the scenario of a tax deduction, the full amount of $10,000.00 you spend on the home is reduced by $3500.00 compared to an equivalent rent. In effect you can spend the money on buying the home instead of taxes. Managing your money well (not living on credit and paying down principal on the loan can result in a net increase in your worth over paying it to a landlord. Anyone doing this transaction needs to compare the math to see the benefit (or not of it). You are going to be paying for housing so it makes sense to make your dollars work for you in the long term. I believe the prudent concept behind it is ultimately owning the home free and clear. That I believe if done prudently is cheaper then renting till death. Sadly in our culture we have been led to the spend now payment (debt) paradigm. It works well for the bankers. Heck they have the government protecting them in this usury.

Wydeeyed- Be careful not to confuse the topic. A rent vs. buy decision is wholly different than borrow or don’t borrow. There are many reasons one might want to take on debt, getting a “deduction” shouldn’t be one of them.

The mortgage interest deduction is an illusion, and has done no small damage to the housing market. First of all, pretty much every single person I spoke to about ridiculous house prices during the crazy years would say, “but you get to deduct the interest!!!” Neverminding the fact that to avoid those taxes you have to take on a crushing 30 year obligation. Because it is a deduction and not a credit, you have to first pay enough in interest every year (to the bank, mind you) to beat the standard deduction – $6,500. Granted, you might have enough other valid expenses to make it worthwhile, but most people don’t – and it is still used as a justification, the thinking being that the gov’t would just pay all of your interest or something.

The real problem, though, is that it is just another way the gov’t attempts to keep house prices moving up-up-up, keep bank profits moving up-up-up, and mis-aligns investment into unproductive uses, which other actually useful expenses don’t benefit from. Have a student loan? It’s deductible! (but only up to $2,500, and only if you make less than $60k) Have a child and need to work? You can deduct the expense! ( but only up to $3000, scarcely enough for two or three months care).

End of story, the MID might be useful for some, but it’s for a small class of people. The market pays for this privilege through higher property prices for every strata of the RE market – not just the ones which would benefit. Everyone else pays, as the money has to come from somewhere, so the government taxes more or borrows.

Yay, but I get to deduct my interest expense!

Is it necessarily better to buy when interest rates are high? Isn’t it possible for prices and interest rates to rise as the economy improves?

Technically, it’s a possibility. For all practical purposes, it’s not very likely, and if it does, it’ll be short lived. You could potentially see a direct relationship between rates and home prices when the economy supports salaries to surpass the cost of homes and the debt associated in buying those homes.

The Bank of International Settlements has a plan known as UN Agenda 21 which seeks to remove private property rights from individuals, worldwide. The housing bubble was intentional because of this. They want us to become renters and at the same time destroy the backbone of the US Constitution — protected private property rights.

Destroy that and they get what they are after… world communism under a one world government, with unelected bankers as our world leaders.

As bad as state communism has been in practice, unelected bankers as world leaders is not communism under any possible definition. Fascism maybe, crony capitalism maybe, oligarchy perhaps, kleptocracy maybe.

What if everyone filed BK, what would happen? Many including myself talk about the Fed and the tax gimics and what we all don’t like that is going on… We have bailed out home, auto and whatever else needed bailing out, where was my bailout? So, again, if we all filed bk 7 or 13 would this as a general public census that if all big business receives debt relieve then we should to by doing a collective debt destruction?

There seems to be a lot of focus on interest rates over the past 20-40 years which is largely dominated by Volker’s massively high rates gradually working down to the near zero rates today. This gradual decline in interest rates, demographics, globalization etc.. is what precipitated the 1982 forward bull run and bubble in basically all risk assets including housing.

If you go back and look at interest rates over 100 years you find much much lower average rates. Specifically I’d point to the time right after the last major credit crisis (Great Depression) where we saw very low levels of interest rates for decades. Even during the booming times mortgages were 3% range in the 1950s. This went on for a very long time. Granted, this credit crisis has a very different map but over the longer-term I’m not really convinced at higher rates are the norm or that we need to go back to 7-8%. Granted the market may try to force it but eventually it may find that equilibrium is lower and settle back down.

I’ll just state that I don’t have a particular opinion on what’s going to happen aside from rates aren’t going below 0% so there is more upside risk than down, but it’s useful to look at the longer series as our lifetimes have largely been dominated by the setup in the late-1960s/early 1970s and then gradual post-Volker rolloff.

I n order to compare apples to apples and oranges to oranges you must only consider rates under the current monetary system.

Our current system began when Nixon took us off the Gold standard. I am not arguing we ought to return, I am just pointing out that the systems are different.

One system, the Gold standard allowed for limited monetary inflation, which by definition led to moderate to low interest rates.

The new system which allows endless monetary printing or also known as the more palatable “Quantitative Easing”, which has allowed annual monetary growth in excess of 20% in some years, results in much much wider gyrations in interest rates.

Put more simply, a 1906 dollar was worth about 70 cents in 1970, while a 1970 dollar only buys about 22 cents today, when using the pre Clinton era CPI index. Using the highly manipulated current CPI a 1970 dollar still will only by about 30 cents.

A dollar that erodes in value faster calls for higher interest rates. Since 1970 we have had a FIAT monetary system that allows for faster erosion. Sadly for the saver, the very system that causes higher “erosion” rates allows for the manipulation of interest rates more easily.

Obviously interest rates are manipulated either up or down which ever is best suited at the time to best screw the American public.

Buyer beware!

It’s an excellent point. Very hard to compare regime periods. One thing I will say is that Volker’s massive rate increase was largely done to squash inflation caused during Nixon/Vietnam etc.. during late 1960s through 1970s. I would point to today’s monster fiscal/monetary meddling although we may or may not get the same kind of inflation we had back then (profligate increases in wages). This is the real crux here and it needs to be viewed globally.

While some worry about inflation caused by commodity prices eventually this goes back to supply/demand – there’s a lot of demand coming from financial participants, just like $140 oil in 2008 when final end user demand was going deep south. If the global growth story slows (and it’s all Chinese/US stimulus based at this point with little endogenous demand) the financial flows will back up and you’ll get a fast retreat in commodity prices while the financial participants take a beating.

I don’t know how it works out but we live in interesting times. Or shall I say, I’m happy that I’ve been renting in these interesting times.

Robert,

Or as the currency inflates! In a stagflation, interest rises and prices of every real asset around do also (e.g. commodities, real estate, manufactured goods, collectibles, etc.).

If the House of Representatives really does slam the brakes on raising the debt ceiling, what bubble will tank first? Gold? Bonds? Stocks? Real Estate?

Interest rates are already rising. Witness the performance over the last two months of TBT (the ultrashort 20 yr treasury bill ETF).

The one joker in the deck is another foreign economic crisis that has overseas investors flooding into t-bills and driving rates down. Rising interest rates in other countries that aren’t in a crisis might mitigate that effect; e.g. if the British pay 4% and the US 2%, some might choose the pound over the dollar denominated treasury debt.

Joe R

Your Friend and partner, the bank:

Op-Ed: Home Team

The president of a real estate franchise organization writes on how owners and lenders can solve the mortgage mess together.

In an equity-sharing arrangement, the lender would write a new loan for $150,000, retire the original $300,000 loan and, to make up for that loss, take a 50 percent deeded ownership interest in the property.

The homeowner would also agree to split 50 percent of the net proceeds of any future sale of the property with the lender.

The new arrangement would also include a buyout provision, so that if the homeowner ever wanted to take over the lender’s share, he would simply pay the lender a predetermined amount of cash.

The Great Debate: Will Housing Be A Drag On The Economy In 2011 (Part 2)

There is one final thing that reinforces the degree to which homes are overpriced on a national scale. The graph below shows the bubble in the ratio of home prices to income. The average ratio was about 5.5 for the years 1975-2001. To get back to that ratio from the current level requires a decline in price of 19% at constant household median income.

Yes interest rates have been low and that increases home affordability. However, in the years 1975-2001 mortgage rates ranged from around 5% up to 12-14% and the ratio of prices to income fluctuated very little. We are now back at the low end of that earlier range with mortgage rates near 5%. It just isn’t reasonable to justify the high ratio based on an interest rate argument.

When one looks at the 120 year history of home prices adjusted for inflation, as done by Robert Shiller, there is a long historical norm established. The following Shiller data, graphed and annotated By David Rosenberg, tells the story:

We are currently one standard deviation above the 120-year average. And the irrelevance of interest rates to home prices during a housing market depression is obvious when one looks at the ultra-low interest rates of the 1920s and 1930s accompanied by home prices one standard deviation below the historical average.

There is no way that a thorough look at the data can lead one to rationalize that the housing market is poised for recovery. Sorry Mr. Reynolds and Prof. Perry – I’m not buying what you’re selling.

Lots of people talking bout real estate purchases at low rates in the 20’s. If I am remembering my history correctly, back then people may have mortgaged homes but they paid like 50% down. They had a lot of skin in the game so this may have affected rates somewhat as there was far less risk of default.

What I keep pondering is this. Banks are holding vast amounts of real estate(either REO or in the process of foreclosure or serious delinquency). These assets are losing value until sold. In trying to minimize their losses, they’ve managed to bamboozle our government to finance purchases of these asset through gov owned GSEs. At some point, banks will have unloaded enough to begin unloading and financing these by raising interest rates. This has to be the way the bank intend to solve the problem they’re faced with. This is because the securitization mechanism will not work now and certainly not at today’s interest rates. I’m sure banks have graphs showing them how fast homes will sell at their desired price at a given interest rate. This is their game. The fed and their influence on the gov is essential to their success in pulling this off. But there are tons of pitfalls in this plan. People don’t have to buy at current prices. People may not qualify if interest rates rise too high. We could easily enter a depression and very few could buy. More people might decide to sell while they can flooding the market and severely depressing prices. Gov could pull support for the GSEs because budget constraints. We’ve almost reached our self-imposed 14T debt limit. How much more can we tack on till our gov can’t finance and starts the printing presses? All this to support our treasured fantasy of ever increasing real estate values. All this to support a crony criminal enterprise(our banking system). Who knows how this will turn out. Maybe civil unrest? Rising crime?

The wildcard factor is government desire to soften the recession. They are led by banks that would be destroyed by normal market forces. They also believe that they can not only soften the recession, save their donors, but also that they can avoid the long term slow growth that Japan experienced. Of course they are full of it, but this is what they believe. Therefore, it is my belief that they will continue to do whatever it takes to prop up the foolish banks that have tons of overvalued property on their books.

–

Now given this situation, one of several scenarios may play out. First, the banks (supported by taxpayer bailout money) will hold properties for as long as it takes for them to dole out one at a time so that prices remain relatively constant. Second, the Fed may continue to buy bad debt from the banks at full value. If this happens, will the Fed eventually dump properties en mass? Maybe faster than the banks, but I think they will fear an additional market crash too much to dump en mass. Therefore, it is likely that the Fed would play the same pretend & extend game.

–

The next question then is, “Will the Fed let interest rates climb?” I don’t see how they can. Given that they don’t want another precipitous market drop in housing due to fears of further recession, and they still want to protect their banking buddies, substantial interest rate increases are unlikely for the next 5 – 10 years. (If I recall correctly, Japan’s rates stayed near zero for about ten years.)

–

Given this situation, besides stagnant growth, we will likely see relatively high inflation. The Fed likes this as well, as it reduces the real value of the massive Dollar reserves held by foreign countries.

–

I predict low interest rates for 5 – 10 years. I believe that if you would like to buy a home in that period, you might as well start looking now. Protect yourself (at least partially) from increasing rates by ensuring that your loan is fully assumable. (FHA & VA Loans are).

–

Unless you are willing to wait ten years, now is as good a time to buy as any. Just make sure you are getting a good deal relative to the current market.

Finally found a common-sense webpage that explains why lower prices and higher rates are better for home owners!!!

Have always loved and will always visit DoctorHousingBubble.com

Leave a Reply to Doug N