How to get a $1 million home for $1,900 a month: The leverage provided by the resurgence of interest only loans. Leveraging up in expensive neighborhoods.

The interest only loan is back but in a very specific way. There are a few people with relatively high incomes that are using these to their advantage. I decided to run a quick test trial on this to see what it would cost to go with an interest only loan on a $1,000,000 home purchase. The answer might surprise many but it highlights the incredible leverage that low rates are providing to buyers. It also highlights how low rates favor large financial firms (i.e., hedge funds, etc) and those with high incomes. While the regular family might save a few hundred dollars a month they are still paying tens of thousands more on the sticker price. Combine that with the flood of big money into the market and you get the current housing market. What if I told you that you can get a $1,000,000 home for a $1,900 monthly payment? Not possible? Then we have the loan product for you.

The interest only loan

Interest only loans are pretty much what they say they are. You essentially pay interest for a set amount of time (no principal). The balance doesn’t change and you simply pay the interest of the money borrowed. While the NINJA products are gone, these are open to those with large down payments (take a look at the all-cash crowd).

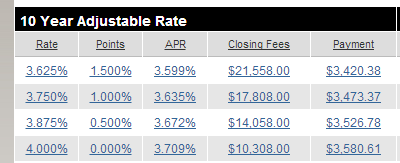

Let us say we are in the market to buy a $1,000,000 home and have a 25 percent down payment ($250,000). This means we will be opting for a $750,000 mortgage. What products are available to us? You can go with a 10-year ARM:

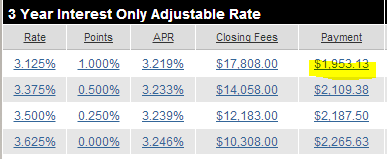

The benefit here is that you are paying down principal during this timeframe but the monthly payment will work out to be $3,420 (only for P + I). I thought you said you could get this down to the $1,900 range? Well take a look at a more aggressive option (a 3-year interest only product):

This is incredible if you think about it. You can get your hands on a $750,000 loan and simply pay $1,953 per month for 3-years. Keep in mind for higher income households the mortgage interest deduction is a major method of minimizing a tax burden. This is really a subsidy to wealthier households given that married couples already get an $11,900 standard deduction. According to an IRS study 63.3 percent of taxpayers claim the standard deduction.

For most families, the math on the mortgage interest deduction is non-consequential and less than they think they are getting (unless you live in inflated states where this simply becomes a subsidy for higher income households). And this example of the interest only loan gives you a perfect glimpse as to why.

For the household going with the 3-year interest only loan, they are going to take the MID of $23,436 a year plus, they are likely paying much lower monthly payments versus renting a similar home (a double-subsidy). Depending on what neighborhood, we are probably looking at $4,000 or $5,000 in rent. Also, you can write-off other items like taxes (around $12,000 per year).

Why use hypotheticals. Let us go shopping and see what we can find:

694 S Oak Knoll Ave, Pasadena, CA 91106

Bedrooms:Â Â 3

Baths:Â Â Â Â Â Â Â Â Â Â 3.5

Square feet:Â 2,200

This place just sold for $1,000,000 on 7/12/2013. Someone wanted to get more here:

Not a bad gain even though they wanted $1,399,000 back in March. How you drop $400,000 (40 percent) in four months just demonstrates the manic pricing we are currently seeing. Yet someone bought this for $1,000,000 just a few days ago. So our above numbers will pan out on this place.

It actually makes total sense to pay $1,953 and leverage the heck out of the low interest environment we are in especially for high income households. Yet you can see how this becomes a maximum subsidy for those that least need it (instead of the arguments you hear about helping working families purchase a modest home). The shell game is to inflate prices and provide massive subsidies in the form of mortgage interest to large income households. As previously mentioned, over 63 percent of households in the US go with the standard deduction (while many others get a tiny benefit when itemizing). This is the tiny sliver of how you can use taxpayer incentives to leverage out easy access to debt. Member banks can borrow at virtually zero. Banks then make massive margin on credit cards, loans, and other items. If it all goes bad, they will get bailed out. Wealthier households can use this interest only loans to maximize their after-tax savings.

Welcome back interest only loans!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

58 Responses to “How to get a $1 million home for $1,900 a month: The leverage provided by the resurgence of interest only loans. Leveraging up in expensive neighborhoods.”

Another financial instrument for the wealthy. You’ll probably need at least 30 percent down and have the income to pay off the amortized payment anyway.

If you qualify, it can be a powerful tool, especially when compared to renting.

Right off the bat, you’re probably saving a load of money vs. renting. Money you can either invest or pay down your mortgage. If you pay down your mortgage, your monthly payment ALSO decreases at the same time.

If you’re in a sector where bonuses come into play (iBanker) you can just pay down your mortgage with the year-end bonus.

The real danger comes in when someone uses the I/O loan as a affordability tool instead of a financial tool. Hopefully after the last bubble and the tightening of lending standards this won’t be possible, but who know.

It doesn’t make sense to save money now, since a savings account at the bank pays maybe .1% (1/1000) while inflation is ~15-20x higher (1.5 to 2% this year). So, saving actually causes one to lose money. And the banks can’t provide higher interest rates if they are only charging 3-5% on mortgages.

can this be done of commercial property 10 yrs interest only

If you give people more money they will spend it. I know a few people who said if I just sell my car for a cheaper payment or move to a smaller place for cheaper rent I can save all kinds of money. The problem is that most people when they have access or make more money they simply do not budget or put way for a rainy day. They just find other crap to spend it on. It’s the old story of the grasshopper and the ant. Problem is that the grasshoppers are being given more and more and all the ants can do is watch. Eventually there won’t be anything to eat but the ants

Spot ON bro! I’ve thought the same for a while. Saving no longer means stacking up dolla bills, it means spending a little less here so you can blow some more somewhere else.

This is not a coincidence, its a planned part of a debt based and reliant economy.

Anyone see the article as of late that Amerikka is $70 Trillion in debt?

I troll the L.A. dating websites pretty good, and I can tell you there is a large part of the population of 20 and 30 something women (sorry, I don’t look at the guy’s profiles) throwing their money away on over seas travel on a yearly basis.

Conversely, from my years on the east coast, dispensing meds to welfare recipients out in the country, I can tell you that when a person gets something for free, they put little or no value on it and have little or no respect for it.

You can get Jumbo 7/1 IO for 3.25%, zero point for that property above, if you’re interested to stay longer than the 3yrs the Doc was illustrating.

At that rate (assuming 30% all-in taxes the net rate is like 2.4%), and 750k loan you get to pay net $1,800.

Throw in insurance $100 and net taxes $600, you are looking to pay net $2,500 – for a house that would rent for $3,500 – $4,000, at the very least.

That rent goes up approximately $100-200/yr and I’d be willing to hear any “forecast” of rent deflation in that area, should anybody have one to share.

I think you and Doc are being disingenuous not emphasizing that they put down $250k. That’s the big ticket. They are putting a big bet down that if housing depreciates, they will lose some of that amount. That’s how life SHOULD be and thus capitalism. Risk taking should pay off well when you’ve invested a large amount of your money you should be able to reap the rewards if it pays off. And in the case that your bet doesn’t pay off, you will lose some of your invested stake. I don’t get what the gripe is about this makes perfect fiscal sense and I’m glad it’s an instrument available to those who have saved enough money to play that game and smart enough to take advantage of it. If you want to gripe about freeloaders, let’s talk about the asshats that borrowed too much foreclosed on their homes and sat (squatted) pretty without paying a dime for years upon years.

The mortgage interest tax deduction benefit goes overwhelmingly to the wealthy. Why are we subsidizing that lifestyle? Currently the benefit covers mortgages up to $1.1 million. Let’s be honest about helping the middle class. Let’s lower it to $500,000.

This is very important point. $250K down is not trivial in almost anyone’s world. We’re starting to see loans like these popping up again, BUT with a fair amount of risk hedging to go with them. 25% down in order to get this loan! How many people have this type of cash laying around?

You’re absolutely right YoBlah.

I’m going to play devils advocate for a second though, there has been a seachange in the American mentality as of late. The taxpayer got hosed by the Gov and the banks. Yes people are squatting for years on end. It creates a downward spiral of “Everybody wants some” in that sense as well! If your neighbor is living free for years, and maybe that’s their way of “getting some of that money back” from the system, then I can see why it is happening.

Advocation over.

I know I play by the rules and bust my butt to do things right, and my 800 FICO is testament. But alas, I too have fell victim to the financial hubris in a sense. Let’s say something DOES happen to me down the line, the difference now is I no longer care. I’ll play the BK game and get my share too, as paying people back is so pre-2005.

For the sake of a bit more reality. Do you really think that any more than the very smallest percentage of people who can write a check for $250K want to live in a $1m home regardless of good financial optionality?

Most people I know with that liquidity are looking further up the scale and this is what ties into the whole interest rate vs. down payment game. No one has 20% down anymore because housing prices have vastly outpaced incomes/savings rates due to cheap debt and a culture unafraid to max that cheap debt out. People who want to live in $100K houses don’t have $25K liquid and the guy with $250K liquid is probably eyeballing neighborhoods populated by his peers who have $1.75-$2m homes.

For an interest only jumbo loan, you need 20% down. So on, 750k-1mil, you are looking at 150-200k, not sure where the 250k is coming from.

@slim: A lot more people have 250k in liquidity, than you think. Just because you don’t have it doesn’t mean it doesn’t exist.

Precisely.

Large down and tougher qualifying rules make this a non-starter for indicating a looser lending policy in the funding world.

your under estimating taxes, monthly would be 1080, also insurance would be 200

And yet this:

Bank of America hit with government lawsuits over mortgages

http://money.cnn.com/2013/08/06/investing/bank-of-america-lawsuits/index.html?iid=HP_LN

Did we not learn from RE Bubble 2.0?

The left hand gives, whilst the right one takes.

JPMorgan in the cross hairs also:

http://finance.fortune.cnn.com/2013/08/07/feds-say-jpmorgan-broke-securities-laws-in-mortgage-deals/

Interesting stuff! BTW the price reduction on that house from 1.4M to 1M is actually a 29% drop, not 40%…a 40% drop would have dropped the price to $840K

Well put Dr Housing bubble. In today’s America, leverage wins on paper every time. The welfare for the well off is so blatant. It is unbelievably evil.

And you’re so right, when the market goes bad again, they will walk and get to start over again in three years.

The three branches of government regularly commit treason against the “non crony” citizens and get away with it. How many senators and and congressman get huge loans and benefit from this while voting themselves raises in the mean time. Not one of them lives among the “people.” It amazes me how they live off of the big perks and side lobby deals and then declare some huge loan on their financial records. The President got his crony real estate deal before he was president from an actual crook who went to jail. No biggie

We have no power to fight this FIRE economy business cronyism. The President was in Arizona today touting the real estate recovery. It is laughable, the words they put in his speech to utter, without embarrassment.

I even think the lawsuit against Bank of America is for show. They probably agreed, up front, to take a little heat in exchange for the deal they got in the bailout. I’m sure they all golf together and laugh about it. The judgment will end up being a fraction of the money they got, just watch

“How many senators and and congressman get huge loans and benefit from this while voting themselves raises in the mean time.”

…and did you know that 50% of Senators and 40% of Congresspeople become lobbyists (er, “consultants”) after their term of “public service”?

From 1999 (choosing that versus the 1996 sale), that’s annual appreciation of 8.77%, which is pretty typical for desirable So Cal over the past 15 years or so. But, median HH income has been flat (not adjusting for inflation) over the past 15 years, and inflation has been around 2-3%. What gives?

a) Although median wage growth has been stagnant, there are around a million more people in LA, boosting the raw numbers of wealthy people.

b) Mortgage rates were around 7.5% in 1999 versus the 4.0% that the buyer of this home could have gotten. That’s a big difference.

median income doesn’t seem that detailed to me. You can have nine people making {$10,20,30,40,50,60,70,80,90k} and the median is $50k. Then, 10 years later, you could have {$10,20,30,40,50,80,100,120,140k} and the median is still $50k. (and the 10,20,30,40,50 group are all renters). Certainly, in reality the law of large numbers would allow the median to track closer to the mean than in my example. But it would be nice to see some studies that are a little more detailed than just looking at median incomes for a neighborhood. Maybe use average net worth as a metric. Or examine the mean income of the top 50 percentile. Then correct everything regarding the interest rate time series, population to total inventory, etc.

The riddle wrapped in an enigma doesn’t end there. It’s more about “wealth” than “income” anyway:

* underground economy of small business owners (high wealth/low income)

* Chinese “anchor students” (high wealth/low income)

* Prop 65 lottery winners skewing the income numbers low (low income)

* Undocumented families (high wealth [when they cram 10 in a home]/low income)

* Jet-set millionaires who might “live” in Nevada but spend most of their time in LA (high wealth/no income)

Banksters steal millions from TAXPAYERS, and the government fines them for LESS than they STOLE, yet the people don’t get a friggin’ dime, the terrorist government of the U.S. gets it. Yet another reason to get your a$$ out of America if you can.

Obama calls for winding down Fannie and Freddie:

http://blogs.marketwatch.com/capitolreport/2013/08/06/obama-housing-speech-live-blog-and-video/

Aint Amerikka grand? Give audacious fake loans, get bailed out, use bailout money to again screw over the taxpayer.

Eat shit Government

I apologize for my ignorance, but why would they want to reel in Fannie or Freddie? I thought those are conventional loans? Are conventional loans causing the problem or is it FHA?

Maybe ’cause Fred/Fanny are making a profit and the masters of mankind want that profit?

Amazing that the righties are beating Obama up over trying to get rid of Fannie/Freddie while they’ve been trying the same for years. The lefties are shocked that he is a centrist for the most part. Obama really is quite a centrist, despite what the extreme right wants you to believe. The hard left doesn’t like him as much either for the same reason. Nothing wrong with being in the middle.

More on his rather candid talk today:

http://money.cnn.com/2013/08/07/real_estate/obama-housing-zillow/index.html

Janum thinks Obummer is a centratist??? HA! HA!

No doubt some people thought that Stalin, Mao, Hitler, Pol Pot, Fidel Castro, Hugo Chavez and other corrupt dictators were also centratists.

Geez stop spouting FAUX News tired old hate filled lines. No one bought this crap back then and we certainly don’t want to hear the venom filled BS again. The tea bags pushed the Republicans so far to the right that they’ve lost all credibility with the MIDDLE where most of us reside.

Janum is definitely not in the MIDDLE if he thinks Obama is a “centrist.” Janus needs to stop trying to make Obama into something he is not. Obama associated with far left radicals like Bill Ayers, Bernadine Dohrn, Rev. Jeremiah Wright, Frank Marshall Davis, Valerie Jarrett, and many others–Obama is definitely NOT a centrist. The Obama Administration is filled with radical leftists. His black attorney general refused to prosecute New Black Panther members who were intimidating voters in Philadelphia.

Obama once said during the 2008 election that “you can put lipstick on a pig, but it’s still a pig.” Well, you can put lipstick on a communist pig, but it’s still a communist pig.

Obama is a leftie socialist? The Republicans bankrupted the country between 2000 and 2008. Republicans hate big government except when it saves their butt (and mortgage deduction and big energy subsidies and low interest rates, etc., etc., etc.).

Obama is a radical far left social fascist commie scumbag. Worst thing to happen to Amerikka.

Wait til that 1st Obamacare fine, er, “required payment” comes due for you all.

Please. Obama is just barely center left, and not nearly a full on liberal. Obamacare is hardly single payer health care, which is the real liberal health care system. That’s one of the reasons I voted for Hillary over him in the primaries.

The only reason anyone would consider Obama leftist is if they’re SO far right that anyone this side of George W. Bush is considered a liberal. That’s why the Democrats are winning elections. Liberals and Tea Partiers are on the outskirts (except were gerrymandering works,) and the Dems are centrist, these days. Most of my liberal friends are as annoyed with Obama being a centrist as the right is about him being “leftist.”

Bond market selloff looks a lot like 1994 and 2003: NY Fed

http://blogs.marketwatch.com/thetell/2013/08/06/bond-market-selloff-looks-a-lot-like-1994-and-2003-ny-fed/

Suppose a devaluation of the dollar was to happen soon – would it be safer to hold an asset like real estate through that “transition” or keep the money in say a savings account?

Are these big investment groups that buy up all of the property trying to flip – or possibly hold for a while to “insure” themselves with an asset rather than paper?

is cash trash?

The devaluation has been an ongoing trend. The question is how long does the FED and banksters want it to run for or at what rate? The new home conglomerates have to hold properties for 5 years. I think they may very well hold on to these homes for a decade at this point if FNF are released. In addition, with Obama’s plan to get immigrants into homes with these specialized mortgages it sounds like all the cards are falling into place now.

Give people no options except to play the game and that is essentially what is going on here. The question then is how many homes have to be sold to justify increases in mortgage rates to normal levels again of say 6-8%? I bet that we will see gradual growth with some reversals or flatlining due to the sheer amount of properties that need to sold to the next victimm…new owner.

Welcome to the new normal.

The USD is gaining strength against most other currencies. Only friends of govt and the Fed are getting cheap USD. The rest of us are left twisting in the wind. And that’s the way they like it.W

When and if real devaluation hits the USD, interest rates will climb with a vengeance and that will hit real estate prices as it’s a highly leveraged asset for almost everyone. Try mortgage payments on a $750K loan at 7%…..Almost $5K/month.

As David Lee Roth said.”Everybody wants some, I want some too.”

This is the sign of a last gasp blow off top.

These people are late to the party and think they might miss the boat.

They already have and this type of move will lead to more underwater home “owners” and foreclosures.

Without rising full time employment and wage numbers, housing prices cant continue to rise

Correct.

#1, anyone who thinks insider trading doesn’t happen is in denial. There is NO way money can be made on Wall St without all those guys calling each other up and giving the scoop on the future.

#2, these guys have been working this since the homes crashed in 2008/09. They were already getting the capital together to buy all these homes at low levels, to “invest in”.

#3, four years later, now it’s mainstream. The classic last stage of an investment strategy, when it makes the paper and the local barber is talking about it. The general public goes manic to push it to it’s end, while the insiders are selling and profit taking. That’s how it works.

You gotta be on the inside of something long before it happens to make the massive profits. Although I doubt it, homes may even go up a little more but we won’t know until Sept/Oct when increased mortgage rate data starts to come out. But the end no matter what, now or later, will be a decrease in home values in most areas.

Really? You think with $250k down payment that this house has any risk of being underwater in the next 3 years? I would bet money against your statement.

Yes, someone paying $250k as downpayment could still become underwater. underwater in the true psychological sense means how much you paid in already plus how much you owe your lender, minus what you can sell the house for. If the person knows they can’t sell for a price that lets them replace the $250k they had originally invested, and pay off their lender, they may be unwilling to consider selling.

If you had meant “in the psychological sense”, you should’ve said that to begin with. I can say the Earth is flat and then I would be right because I meant “in the next dimension sense”.

Perhaps in 10 years SoCal demographic will consist of wealthy pockets of inherited and foreign money; old school LA bourgeois bohemian liberals scooping up houses in trendy areas for their sub$50k/annual income kids so adult kids stay close to Mom/Dad and can continue pursuing careers in entertainment, fashion, RE, lackey at family business, etc; middle class increasingly move to urban core/high density housing to be close to job (cost of gas, car too high, commute long/painful), working poor packed into dense high crime neighborhoods, higher taxes/fees mount to pay for services for swelling low income population, retiring state worker pensions, etc; more toll lanes, road/freeway closures extending for months/years for “improvements”, increased fees for services, etc. Good news…likely more bike lanes, see a celebrity at the Grove, great weather!

Drinks, sure you didn’t dig this up from a 2000 time capsule?

You’ve got a point! However, in 2000, SoCal median house price was approx $211K. In 2013, it’s $385K. SoCal UE rate in 2000, 5%; SoCal UE now, 8.5%. In 2000, most jobs were FT career jobs w/benefits; most jobs generated now are low pay PT or contract gigs w/no benefits/little security. It will be curious to see all SoCal stats in 2023, if I’m still breathing…

In 2000 middle class folks in SoCal w/ decent jobs, good credit and a reasonable down payment could buy a nice property in a safe neighborhood. I wonder if in 2023 renting a plain 900sq/ft plain boxy mid rise apartment in a dense urban core near the workplace will be the new SoCal middle class “dream”. Property ownership? Perhaps only for inheritors, foreign investors, rich kids w/ generous parents, 6 people group together to buy a little house for 15 people to share, etc…everybody else rents, lives w/family…

What a bleak future for the middle class Drinks. Perhaps all middle class jobs should leave and build new Utopia’s in other parts of the states to avoid that limited lifestyle.

Blade Runner future looks possible.

Drinks, a lot of good points there. When you start crunching the numbers, today’s 385K isn’t completely out of line. If housing was reasonable in 2000 with a median of 211K and we assume 3% inflation (that seems to be the number everybody is fixed on), that would put it at 310K today. Rates were around 8% back in 2000, they are 4% today. These low rates allow you to borrow about 50% more money for the same monthly payment. That easily accounts for the rest.

Everybody keeps spouting off that incomes are the same or went down. Anybody who is making the exact same amount (in nominal dollars) really needs to find a new career or a new employer. I highly doubt people buying in the desirable areas (careers in medical, law, engineering, finance, tech, etc) fall into this category.

I have 250,000 to put down if someone has the credit to borrow a million dollars on a second mortgage for 1 million dollars.. I have 250,000 and want to borrow it so I can purchase a poducing U.S oil well for $750,000. I can afford the monthly payment but what i want to do is buy an oil well and repay the loan off using the 3 year loan. After the three years the loan can be paid out its remaining balance in cash so it won’t require another loan. In exchange I will offer you a 50/50 partnership in the wells income after the loan is paid off completely.

This is an interesting article…”HUD Proposes Plan to Racially, Economically Integrate Neighborhoods” “Move would allow Obama administration to institute policies that would better integrate communities”.

http://www.usnews.com/news/articles/2013/08/09/hud-proposes-plan-to-racially-economically-integrate-neighborhoods

Wonder what the long term consequences of this could be? Is low income housing mandated by the govt be coming to the “desirable” neighborhoods? Hmmm…

HUD estimates that compliance costs would range from $3 to $9 million each year.

You could literally hand $10,000 to 900,000 people. Hmmm, that’s too radical and too direct a benefit to actual people.

Anyway, who wants to guess that costs > $9b and real benefits to the intended target group is minimal while hard-working, middle-class Americans get “subsidized” further out of the American dream?

This sounds like an extension of the 1960s policy of Spatial Deconcentration (though spatial is more of a euphemism).

I’M interest in borrowing $ 5,000,000 self liquidating loan. collateralized by stocks and bonds. $ 3,000,000 will be invested in an income producing fund with a 20% annual return. Over a period of 7yrs to 10yrs will payoff the $ 5,000,000 loan plus interest and fees.

$ 2,000,000 will be invested in income producing real estate properties.

Leave a Reply to DFresh