Housing’s Bitter Jagged Economic Pill: You can even get Granite. Oh, how you can get Granite. Spending Money into an Economic and Housing Sink Hole.

Our nation is slowly waking up from a housing binge and finding out that we are going to have a horrible economic hangover that won’t be cured with a glass of water and a pill. For the last decade, a larger and larger portion of our economy hinged on the silly notion that housing prices would increase at a torrid pace forever. Historically, we know that housing typically follows the inflation rate. And as we all know, currently it looks like we are battling with deflation with the seeds of a Japanese style recession looking more likely. Last year U.S. millionaires lost an average of 30 percent of their assets with 17 percent losing more than 40 percent. The global stock markets have seen $28.7 trillion in wealth evaporate.

It shouldn’t come as a surprise that two-thirds of U.S. millionaires felt their financial advisers failed them, especially if you were invested with uber Ponzi expert Bernard Madoff. But here is the thing, these same people were loving those high flying REITs or other stocks in the finance and real estate industry earlier in the decade while their home values went up disconnecting from all economic fundamental rules. In fact, how many of this millionaire class wouldn’t be millionaires without this credit and housing bubble? They bought into this perpetual perma-growth model and expected it to never end. If you walk into a Wal-Mart you are entering a shopping world the size of multiple football fields. We are a long way from having a model T and only one choice of color.

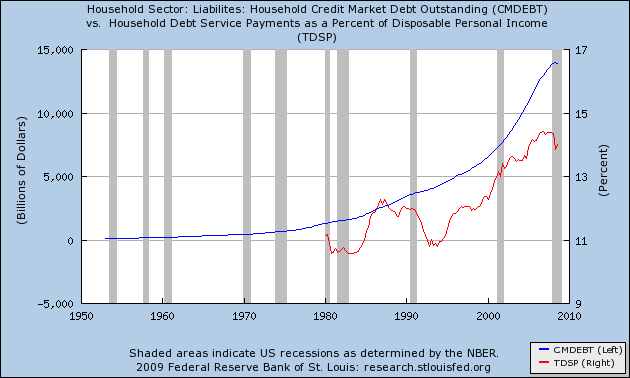

Some people want to think that our debt situation has improved given all the wealth destruction but it has actually gotten worse:

Americans are still carrying nearly $14 trillion in various forms of debt with the bulk being in mortgages. The red line above represents the steady growth of this debt. This is something probably most people already know. But I also graphed the year over year change on the graph (represented by the blue line) and you’ll noticed that this is the first time since the 1950s that actual household debt has gone below zero. Meaning, Americans are taking on less debt.

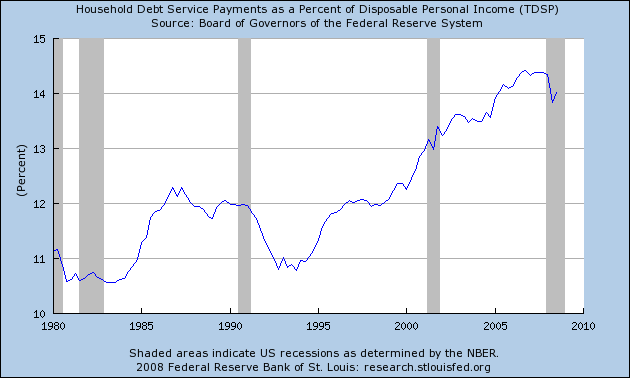

This is happening for a variety of reasons. The credit markets are frozen. Debt is harder to come by for the average American family but seems abundant for the crony capitalist on Wall Street.  Another important reason is that many consumers are already tapped out and have more and more of their disposable income going to service current debt:

I went ahead and took the average quarterly information above and found that the average household debt service payment as a percent of disposable income has hovered around 12.15 percent since 1980. We are currently at 14.01 percent. So this is still very high.

The reason Americans took on more and more debt is because they were fed a gigantic lie that somehow housing was the answer to all our wealth building fantasies. Earlier in the decade best sellers included books that championed real estate as your quick way to millions. Books about flipping, rehabbing, and leveraging your way to heaven were all the rage. In fact, there was a pilgrimage to the Ivy League schools for lucrative jobs at Lehman Brothers, Merrill Lynch, Morgan Stanley, Goldman Sachs, and Bear Stearns. This obsession for a decade has made us fall back globally in the sciences, engineering, and production capacity in a weak trade for flipping houses to one another and pretending that is the symbol of a healthy economy.

Take a look at the sectors of our economy:

Finance and insurance although employing roughly 6 percent of all workers brought in over 13 percent of all revenues. The only other place you see such a wide divergence is also with wholesale trade. This is why we are faltering and our economy is so poorly prepared for the next decade. Do you think that those ex-lenders, brokers, agents, and financiers are ready both mentally and physically to do the work of installing solar panels or retrofitting buildings? These people still believe the no money down mantra preached in many over the counter get rich quick books. If you look at the chart above, you see how disproportionate their income has been. They’ll now be put into the construction side of the equation which isn’t so lucrative (at least in relation to the FIRE economy).

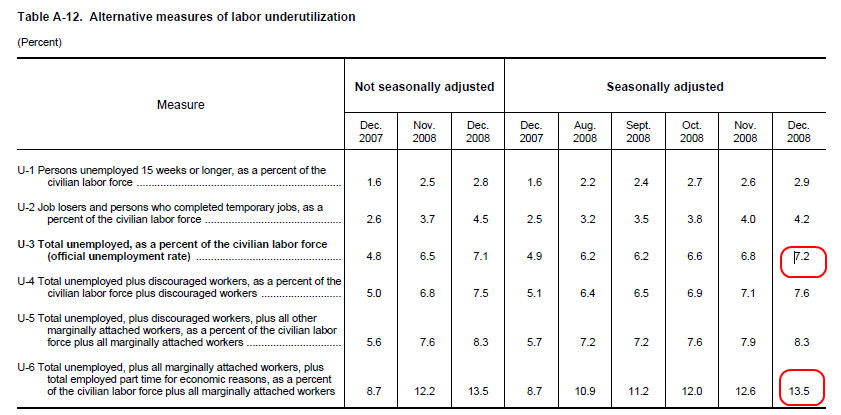

This is going to be an equally difficult challenge for reviving our economy. Are people psychologically ready for the end of the real estate economy? They may have no choice. We currently have 8 million people working part time but want full-time employment. This is a stunning 73 percent jump from one year ago! The current unemployment rate is much worse than the 7.2 percent being quoted:

Source:Â ShadowStats.com

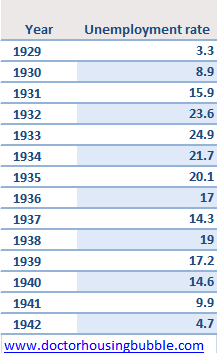

The true unemployment rate is already running at 13.5 percent. This includes many of those workers who are working part time but want full-time work and also workers who have simply given up looking for work. That 13.5 percent has gone up from the 8.7 percent of December of 2007. So if we are to believe that 2009 will be similar to 2008 in terms of job losses, then we can expect to see the true unemployment rate reach close to 20 percent by the end of the year. The mainstream number will get closer to 10 percent. How big is that? We are now talking Great Depression numbers here:

So at 13.5 percent, we are already getting close to Great Depression levels. That is why for most average Americans this already feels a lot worse than a 7.2 percent rate. The reason it feels worse is because the number is much higher than the mainstream quoted rate.

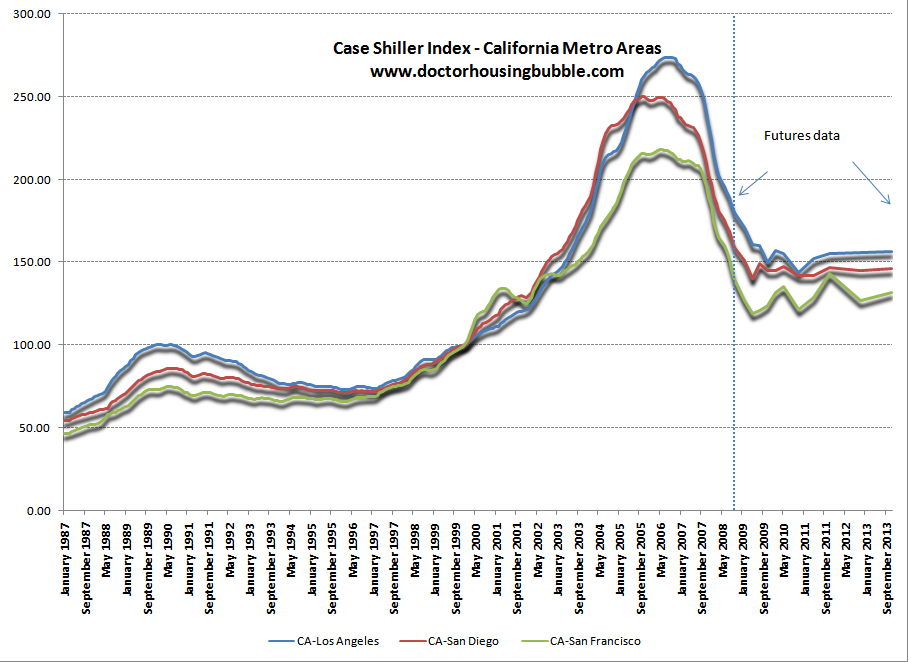

Mentally, people need to gear up. Debt levels are still extremely high so we can expect more deleveraging in 2009. Home prices will still fall lower. In fact, prices are still too high if you can believe it, especially in states like California where the futures market is pricing in lower prices:

And no other state had a bigger obsession and bubble than California. The state is contending with a $14.8 billion budget deficit for 2008-09 but is staring at a $41.6 billion deficit for 2009-10. That is unbelievable and no major actions have been taken yet. California and the nation will be a very different world as we reach the end of 2009. Those expecting the second half of 2009 to see a recovery probably still believe in the granite countertop worldview. You can even get granite. Oh, how you can get granite.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

19 Responses to “Housing’s Bitter Jagged Economic Pill: You can even get Granite. Oh, how you can get Granite. Spending Money into an Economic and Housing Sink Hole.”

Forgive me if this is an ignorant question, but were the unemployment figures you gave for the Great Depression years computed like U-3 above, like U-6, or by some other method? Your post implies U-6, but doesn’t say for sure. Thanks.

It’s amazing that the Doctor still needs to preach sound health practices after so much pain and suffering. Yet, the public and media continue to claim every day that it’s a bottom or that the worst is over. The dislocations are still massive and forspeak of more pain to come.

Is the American Dream really just about being rich? Owning three homes, five cars, and yacht or two? Is this what our society has evolved into? Consumption is a right, a duty, and the defining role of an American. The system is designed from birth to make us want and always new and more. Satisfaction lasts until the new model comes out, often before we even buy the old one!

I am not all that old, but my greatest consumer satisfaction comes from a pair of Timberland boots I bought about twenty five years ago. They are obviously still in fashion and going strong, never have seen the inside of a shoe repair shop.

Love the site..

What’s the “Granite countertop worldview”?

I’m glad to see the reference to shadowstats.com John Williams is doing great work. One of the keys to getting back on track is widespread use of the corrected stats. The average man on the street won’t have much understanding of what’s going on until the media and the government start making valid comparisons to 20 and 30 years ago.

“California and the nation will be a very different world as we reach the end of 2009.”

Indeed.

P.S. I love the posts that touch on the California budget, can we get some more of those? Is anyone doing a dedicated blog?

so what happens when CA goes BK? And what about when they start paying with IOUs next month? http://www.youtube.com/watch?v=7GSXbgfKFWg

Dr. HB: The U. S. ecomomy actually may be a version of the Ponzi scheme. Start with the mother of all Ponzi’s social security. In order for the SS to remain viable the U. S. must continue a significant increase in population. Then reduce the recipients payouts by means testing. I pay the max amount to SS each year and sometimes double if I work via 1099 income, however since I was born at the bottom of the ponzi, I likely will receive nothing. Your PhD economist contributer states it is our social contract to contribute, ok, then lets call it what it is, a tax to fund the retirement of others.

Ponzi argument number two, San Diego for instance, our population must increase and business expand for ever, if either contracts then the system fails.

Please explain Dr. HB. The US population now exceeds 300 million, great for SS but in order to survive as a nation will we need to become 600 million? What would be the result if our population remains at 300 Million? Why is it not possible to have a stable population and business environment without a continual expansion? It seems like a Madoff situation, people, business, and govt must keep expanding and bringing in new money to support a pyramid economy.

Spaceeba

Right on on the part about people from the FIRE industry doing manual labor. Imagine going from working every day in a climate controlled office to construction in the hot sun or cold winters. Gonna be a hell of a lot of pissed off people.

meanwhile, the NAR is running full-page ads in Politico’s hard-copy version demanding that Congress take action to “spur home buying” — that is a quote.

That organization needs to be shut down and prosecuted.

I agree that the NAR should be shut down by the RICO Act; they are organized criminals pure and simple.

Congress “needs to take action to spur home buying?” What a bunch of ignorant asses.

I have an awful feeling that Peter Schiff is correct, that before this is over the dollar is going to implode. They can’t print their way out of this, though they are determined to try.

When I finally die of starvation, and those in the tents all around me are wondering what to do with my body: all I ask is to be buried in a coffin, with a lid made from granite. And the handles be made of stainless steel: and the pad I lie on, be made of travertine. And plant me in a plot with a view. And then I can rest in peace..

Another great post! I agree with those who feel NAR is a criminal organization. Its amazing what white collar criminals have gotten away with in our country. Today’s WSJ (01/12/2009) has an article, on the front page, about David Lereah the NAR mouthpiece during the housing bubble. He now claims that he was only doing what his bosses at NAR wanted, basically admitting that he was a shill. Now the poor SOB can’t hardly make his country club dues. His many condos have lost value as has his own home. Some bloggers referred to him as “Bagdad Dave” for his pro real estate press briefings. One can only hope this guy gets what he well deserves…………

Comment by Smasher

Forgive me if this is an ignorant question, but were the unemployment figures you gave for the Great Depression years computed like U-3 above, like U-6, or by some other method? Your post implies U-6, but doesn’t say for sure. Thanks.

____________________

Answer is NEITHER. (My one degree is a specialization in the political social and economic history of the 1930s.) The estimates – and they are rough estimates – of the unemployment in the 1930s was based on the data from several sources:

>>>>>

(1) Applications for relief – what we now call welfare. Difference is that there were no central records and programs where run by cities, counties, states and private groups with no co-ordination or exchange of information

(2) Applications to work for the WPA or CCC

(3) Large employer estimates of how many they laid off

(4) The few states that had unemployment programs (and it was only a tiny handful like NY)

>>>>>No distinctions were drawn between “unemployed and looking for employment in the past 4 weeks” (the U-3); and “discouraged workers” and “marginally attached workers” (U-6 which includes U-3) and the “want fulltime but can only get part-time due to economic reasons” (the 8,000,000 cited in the article”

>>>>>In the 30s, thye counted everyone who needed work or more work.

>>>Additionally, the ’30s numbers have to be placed in context. Back then there was NO RETIREMENT except for those in the upper 5-10%. Everyone else worked until they died, ended up in the county poorhouse or were supported all or in part by their younger family members. The elderly stayed in the workforce and Social Security was designed to remove these people from the labor pool. Ergo, to get a comparable number you have to do 1 of 2 things:

>>> (1) Take the current number retireees (45,000,000) and assume that maybe 1/2 would re-enter the workforce without Soc Sec. That would be another 22,500,000 looking for work which would boost the current unemployment rate to 28% (U-6 + 1/2 retirees)

>>> (2) Pull up the Census data for 1930 and deduct a.1/2 or so of those over 55-60 from the labor pool. Keep in mind that no everyone is in the labor market – exclude those under 16, exclude 90% of women in the 1930s, exclude those too ill or elderly to work, etc etc. Little tougher to try to adjust the 1940s data to a comparable base to now but can be done – and a rough approximationn of the maximum 1930s unemployment after excluding the elderly is around 15-18%.

>>>>

>>>>

BTW dr. skibum – Soc Sec IS NOT a “Ponzi Scheme”. You completely misapprehend the nature of either if you think that.

>>> A Ponzi scheme involves the operator getting money from the suckers for the purpose of investing it and earning returns. The sucker thinks they ahve an amount on deposit with the operator who does pay out money to them and claim that it is the “earnings.” In fact there are no earnings and the false earnings are being paid out of their own money and, if they stay in long enough , the money of other suckers. The operator skims money for his own use. Sooner or later it runs out of money because some will try to take out their principal and toomuch has been paid out of the principal.

>>>> Social Security is an intergenerational contract which mimicks the functioning of society in caring for the elderly since the beginning of recorded history but spreads the burden across all that are working. Before Soc Sec YOU PERSONALLY would have had to pay all the expenses and costs of your elderly relatives who were too old or too ill to work – parents, inlaws, grandparents. aunts, uncles…….

>>>> What Social Security does is spread the burden out across all younger workers so you aren’t caring for 8 relatives, your neighbor for 4 and your other neighbor for 0 (having come from a short-lived family and his older relatives are all dead.)

>>>>It is an inter-generational contract. The current retirees paid into to Soc Sec and the money went to support their parents and grandparents. Those currently working pay into to support the current retirees. When those currently working retire, the next generations pay in to support them. It will never run out of new people paying in unless an entire generation stops breeding.

>>>>Calling Soc Sec a “Ponzi Scheme” is a far right-wing Rush-Limbaugh falsity that is done by people who think all but the upper 5% should work until they die or die in ditch if they are unabale to work and are not among the wealthy who historically have always been to retire.

I am curious why Dr. H beleives that the market will bottom in 2011 with the CS index at around 145-50? According to past historical Case-Schiller data, bubbles have usually fallen to prebubble levels and is some cases have over corrected to below pre bubble numbers, especially in areas where speculation was greatest. I think CA qualifies, right?

According to my checks of the LA and San Diego Case Schiller numbers for 1996-98, these appear to be the lowest points prior to the ascent of the bubble. Given historical corrections, why wouldn’t the market fall back to these Case-Schiller numbers recorded in say 1997? Those numbers were between 90-100 on the index.

Is Social Security the equivalent of a Ponzi Scheme? If it looks like a duck, and quacks like a duck and flies like a duck…. well it must be an “intergenerational contract”. Of course that fine distinction won’t matter much to those who have contributed but collect nothing when the whole system collapses, as it seems destined to do.

Graeat Post Doctor… thanks. Good to see so many people stirred up too!

Expat, yes we are willing to sacrifice our personal freedoms for material comforts. America has come full circle. Maybe New Hampshire should change their motto to “ Flip houses or dieâ€, or how about “Give me cheap Chinese stuff from Walmart or give me deathâ€.

Homeland security is 50 billion dollars of pork to make you take your shoes off at the airport. I lived along the Arizona/Mexico borders for years; the waste in vehicles/tax dollars/manpower is pathetic. All this for jobs Americans are above doing.

Now we have a president elect that will spend us to prosperity. I am not faulting Obama; he is doing only what America has asked of him. It shows our unwillingness to sacrifice our standard of living for the future of our nation.

China has already made noises they want to stop supporting our currency. Our forefathers built a great nation, all we presently do is consume the fruits of others.

@AnnS

Thanks. Very informative. It’s all complex and it’s enough for most of us to keep a handle on our own specialties.

It does not seem that we are going down a sustainable path to prosperity for our society, but until it touches us directly, it is more or less business as usual.

Seems that indeed collective consciousness regarding debt has made a massive change, but the young folks still think this will pass quickly. I’m not convinced and feel the doc has a lot of data to support why he feels things will get much worse, while the bullish pundits just say they feel the economy will improve at some ridiculously near time for no other reason than that they are brilliant men with knowledge we could not hope to know and this is what they feel. I’d be more comfortable if they would try to explain why the feel that way…

AnnS – while Social Security doesn’t actually fit the definition of a Ponzi scheme, the Social Security Act fails to establish any contractual rights. Hence, your assertion that “Social Security is an intergenerational contract” is false.

Refer to FLEMMING v. NESTOR, 363 U.S. 603 (1960), at

caselaw.lp.findlaw.com/scripts/getcase.pl?court=US&vol=363&invol=603

For a brief summary, see

en.wikipedia.org/wiki/Flemming_v._Nestor

or the commentary at the Social Security Administration website,

http://www.ssa.gov/history/nestor.html

to wit:

“In its ruling, the Court rejected this argument and established the principle that entitlement to Social Security benefits is not contractual right.”

http://activerain.com/blogsview/880598/Obama-is-another-Pres-Carter

At this moment after observing Obama’s plans, I am sorry to say our economy is not going to revitalize overnight and Obama is almost for sure another president on the far right side in the picture in Martin’s article. Yes, I am saying that Obama is another Pres. Jimmy Carter.

when housing prices,currency rates ,oil,gold ,commodities and prices of every other thing on earth is decided by the market why should interest rates be set by the govt.? it should also be decided by the market then only money will have value.please reply

Leave a Reply