Housing Perception Foreclosing on Reality: The Fundamental Housing Attribution Error.

Much to my surprise as I was watching the Olympics this weekend, guess who appeared at the events in China? Our own Treasury Secretary Hank Paulson was out on a vacation in China. He was on Meet the Press with Tom Brokaw discussing the economic situation back home in the United States. Everyone is entitled to a vacation so that isn’t the problem. Yet what he said tells us a lot about how our current economy is being managed. Mr. Brokaw brought out a quote from April of 2007 which had Paulson saying that the subprime problem wasn’t going to cause many issues. Paulson’s response was one in which he mentioned it was hard to predict what was going to occur before the August 2007 credit crunch. Welcome to our new fiscal policy. Problems don’t exist until they do. This is the look one-step ahead of you economic philosophy.

Of course, many of you saw this coming years before. In fact, many high level officials and economist saw this coming and made warning signs but no seemed to care. The current narrative from the administration is that no one saw this coming but hey, everything is all good now. Haven’t you heard, we aren’t in a recession? I’m not sure if Paulson was in Beijing to also receive the gold medal in lack of foresight but that seems to be common with others as well.

How can it be that things in reality are pointing to a sluggish economy while so many people think things are improving? Call it the fundamental attribution error. That is, when we observe “others” we like to attribute their problems to personality traits or factors in their control. Yet when we are asked to talk about our own situation, we tend to include environmental and also social influences in how we observe ourselves. This error in logic helps us to understand the logic of many of the Pollyanna views out there. The “mental recession” comment tells us a lot because it tends to blame the “other” as being ultimately responsible for his economic demise. It couldn’t be that the economic infrastructure around him is collapsing because no society can trade houses like baseball cards and go into incredible debt without producing actual products and expect to have sustainable growth.

The perfect example of this is highlighted with a recent Zilliow survey that found 62% of American homeowners believed their home went up or remained the same in value over the past year. The only problem is in reality, 77% of U.S. homes actually declined in value. How can people be so wrong? In areas like California where the median price is now down by 38% on a year over year basis, it is very likely that 90%+ of all homes have declined in value. Yet what does the survey tell us about those in the west? Let us take a look and see:

West

My Home’s Value Has Increased:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 28%

My Home’s Value Has Decreased:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 56%

My Home’s Value Has Stayed the Same:Â Â Â Â Â Â 16%

Actual Percent of Homes that Increased:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 9%

Actual Percent of Homes that Decreased:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 88%

Actual Percent of Homes that Stayed the Same:Â Â Â Â Â Â 3%

Now this is for the entire west region. I’m sure if we broke out California on its own, the actual percent of homes that decreased would be higher. Either way, delusion runs rampant in this country and that is the only reason I can see how certain economists and politicians have the ability to say that there are no problems. The fact that 62% of people believed their homes either went up or stayed the same in value while 77% of home prices declined gives us a sneak peak into the psychology which fueled the housing bubble.

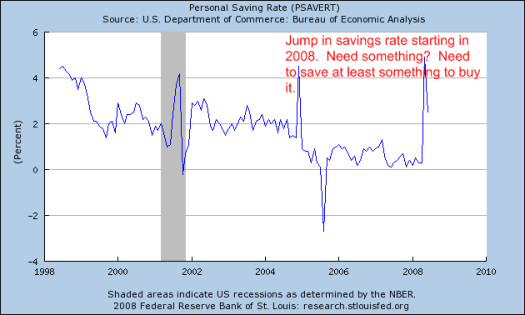

Another interesting tidbit in the survey tells us that 56% of respondents are planning on major or minor home improvements. Homeowners who thought their homes went up in value were more likely to respond that they would be doing improvements to their home. This may be a bit difficult since many of these home improvements depend on borrowing from the home and lenders and banks, which now have to operate in reality are shutting down home equity lines of credit. Yet ironically, the personal savings rate has actually jumped up a bit since all this credit crisis started:

You’ll notice that at the height of the housing bubble in 2005 and 2006 the actual savings rate went negative. Why would you save when credit was easily accessible and everything was soaring in price? In 2008 the savings rate spiked up to the highest point in over a decade. Can it be that the credit crisis is actually forcing some people to save? This is bad in a society where consumption is the pinnacle of success and saving is shunned since saving means you are not out there spending and being a good consumer.

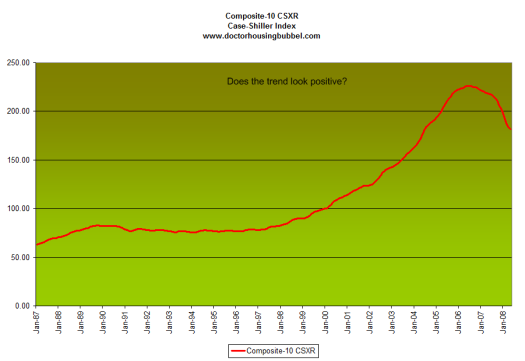

Morgan Stanley told clients last week that they would be freezing home-equity lines of credit. Again, reality is not coinciding with the perception of many. This short-term bear market rally is simply a reflection of this perception. Even Paulson hinted at the fact that much of the economy hinges on the overall health of the housing market. Let us take a look at the Case-Shiller Index for the United States:

Clearly the trend is heading lower and you can see from the graph, how high things got since 2000 so even our “major” correction is nothing compared to the decade long ascent in housing prices. With record high foreclosures and $500 billion Pay Option ARMs still waiting to recast, there will be a drag on the housing market for at least a couple of years. In areas like California I don’t see a bottom until May of 2011 and I’ll give you 10 reasons why.

Recently we talked about Ed McMahon lowering the price on his home by a stunning $1.9 million in one day but there is more to the story. Back in June when the price tag on the home was still $6.5 million, Ed and his wife went on Larry King for an interview. This is what Ed had to say:

King: Ed, why have you gone public?

Ed McMahon: Well, I figured I wanted to, in a sense, speak for the million people you mentioned [facing foreclosure]. I heard that figure today and I just couldn’t believe it. Anyway, the million people that now have foreclosure signs on their house, or nearby. And I just want to give them hope, give them optimism, give them some kind of guidance. Get the best corrective people you need around you. Keep working on it. Don’t stop. There’s a lot of people that are hard workers, did everything right, didn’t do anything wrong, and all of a sudden, they’re in this boat. And I speak for all of them, as far as I’m concerned.

First, one-third of people own their homes outright. These people have been prudent and methodical in making their payments. Next, the vast majority of people are current on their home payments.  These people didn’t take out $300,000 second mortgages on multi-million dollar homes. The problems occur at the margins as we’ve always said. Since June, Bank of America has taken over Countrywide which had a $4.8 million first and $300,000 second on Ed’s home. The fact that they slashed the price by $1.9 million last week tells us Bank of America is serious about moving distressed homes. Maybe Ed has shown us something and that is slashing the price of your home by 29% in one move may actually bring you a buyer.

Yet what is clearer in the comment is how he “heard” of the foreclosure figure recently and was stunned. His response simply reinforces the fundamental attribution error we are talking about. When problems happen to you it is based on the economy, family situations, jobs, or other circumstantial factors. When it happens to “others” they are simply unable to manage their own finances. 77% of “your homes” went down in value but 62% of “our homes” went up in price. With that kind of math, is it any wonder why we find ourselves in this current predicament?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

16 Responses to “Housing Perception Foreclosing on Reality: The Fundamental Housing Attribution Error.”

The term for this is known as COGNITIVE DISIDENCE. Holding two different views on the same subject at the same time. A common example of this is. someone who is PRO LIFE, then has NO problem with the unlimited use of the DEATH PENELTY.

Dissonance: http://en.wikipedia.org/wiki/Cognitive_dissonance

Well it’s like people who are shopping for a home while at the same time trying sell their home. They believe your home isn’t worth what your asking but believe their home is.

It happens for the same reason parents think their children are better than their neighbors children.

Pro Life, the unborn child is innocent, while pro death penalty, the person is guilty of taking away a life. Two totally different subjects.

Denial of reality is at the heart of all addictive complexes. If you’ve ever participated in, read about, or supported anyone through a “twelve step” program, then you’ll have seen how “recovery” from addiction means coming to terms with one’s own denial of the truth (i.e., being an addict, and its impact on self and others).

The housing bubble had a huge addictive component. When addicts are faced with the costs of their addiction it is common for them to blame others or perceive that they are right while others are wrong.

Doc is thus being a good observer when he points out that the bubble may have burst, but people are still in full addictive mode around their belief that housing can allow them to transcend their mundane situation.

rose

Doc – see this post over at Calculated Risk?

http://calculatedrisk.blogspot.com/2008/08/subprime-and-alt-the-end-of-one-crisis.html

Like when people are against the death penalty until their kid gets raped and killed.

SEAN wrote (in part):

>> A common example of this is. someone who is PRO LIFE, then has NO >>problem with the unlimited use of the DEATH PENELTY.

Since we are discussing logic, implied in this example, is the fallacy of reasoning – “Ipso facto”. In other words if somone is anti-abortion then it follows that they are “PRO LIFE”. When many people are anti-abortion, anti-infanticide and yet support the death penalty with no claim to a label.

It goes a step further with the issues Dr. HB points out. It is always “pro-America, pro-Bubble” slanted blindness (for now). This is why we think Iraq and Iran are evil while our military commits genocide that would make Hitler proud, “liberating” a people who never asked to be liberated and “striking back” against imaginary terrorists in Iraq. You post an anti-war comment on a blog and three goons reply pack that you are a sissy, anti-American freak who supports terrorism, as if it is normal to wage a conventional war against a military TACTIC (not an actual enemy, improving the buy-in for perpetual war against imagined enemies).

Being against the bling-bling, overindulgence, debt, rat-racing, and striving for more than you can afford is being against the American way and not being into these things makes you weird or un-American. Running counter to the herd psychology before or at market turning points creates SEVERE cognitive headaches.

Once we are in the middle of the second leg down in housing and critical mass is reached in terms of market psychology, everyone will turn on “those other bad people” who were overindulgent, blaming more people like Mozillo who were simply drug dealers supplying a fix to the poor huddled addicted masses trying to fight against inflation and loose monetary policies without realizing it to avoid falling further behind. I’m guessing Dr. HB will soon be elevated to talk-show host status and fighting off agents who want to represent him in his book deal.

The point is (as if I have one since I’m hammered right now hoping the bank will hurry up and foreclose on me so I get to walk away before the gov’t changes the rules to benefit bankers) simple: listen to that cognitive dissonance and always question the herd before they take you off a cliff. You might be recognized as leader once the herd takes their head out of their asses (though I suppose you might just as easily be lynched – oh well, at least you’ll get to say “I told you so…”).

Got gold?

Another good post Doctor… thanks. Paulson saw this coming as did Greenspan. They are not dopes. Question is, why didn’t they try do something about it? Someone once said the job of the fed is to take away the punch bowl as the party is getting started or some such. What happened?

>

>Obama has worked for organizations promoting lowering standards for minority lending; McCain did his fair share too (remember Keating?). Bush touted greater home ownership as well. All want to take the credit when times are good and at the peak.

Oil usage is another example.

>Rational people know it is a non-renewable resource but collectively, we treat it as though cheap energy will never end.

Sean — that’s a very poor example that has at least three falacies: abortion and dealth penalty are not equiveants; most death penalty supports don’t favor “unlimited use”; groups like the Catholic Church have a long standing of being pro life and anti death penalty.

Why don’t you stick with the topics of this forum instead of bringing your anti dealth penalty agenda into it.

Hey SEAN,

The term for what the good Dr is describing is the Fundamental Attribution Error (as he identifies himself in the third paragraph). Cognitive Dissonance is similar and related, but not quite the same.

http://en.wikipedia.org/wiki/Fundamental_attribution_error

Thank you Jack Rogers. It was NOT about abortion, it was about holding two aposing points of view that when they are put to the logic test, does it stand up to examonation?

Doc, I just wanted to say to you that I refer to you as “he” while maintaining every expectation that you might be a “she.” It doesn’t matter to me either way, but I’m aware that the gender of an online persona can affect perceived source credibility. I don’t care, nor need to know, either way; I respect your thinking and viewpoints, as well as this blog, and that’s all that matters to me. But if in referring to you as “he” I’ve offended that respect, please know that I do this with tactical intent. My respect is for your ideas, irrespective of the fundamental attribution errors that relate to gender. 🙂 Thanks! Your blog is such a harbor of clear thinking in all the bling-honking.

rose

Sean is clearly illiterate.

Leave a Reply